- Egypt will earmark more funding for covid-19 fight if necessary –Maait. (Speed Round)

- Total covid-19 cases in Egypt rise to 1,939. (What We’re Tracking Today)

- Inflation dips slightly in March to 5.1%. (Speed Round)

- Fuel pricing committee cuts all fuel grade prices EGP 0.25 / liter. (Speed Round)

- Cheiron consortium moves to the second round of bidding for Shell Egypt’s onshore assets. (Speed Round)

- Pharma chain 19011 acquires 100% of Roshdy Pharma. (Speed Round)

- Ebtikar becomes sole shareholder of Vitas Egypt after acquiring remaining 50% stake. (Speed Round0

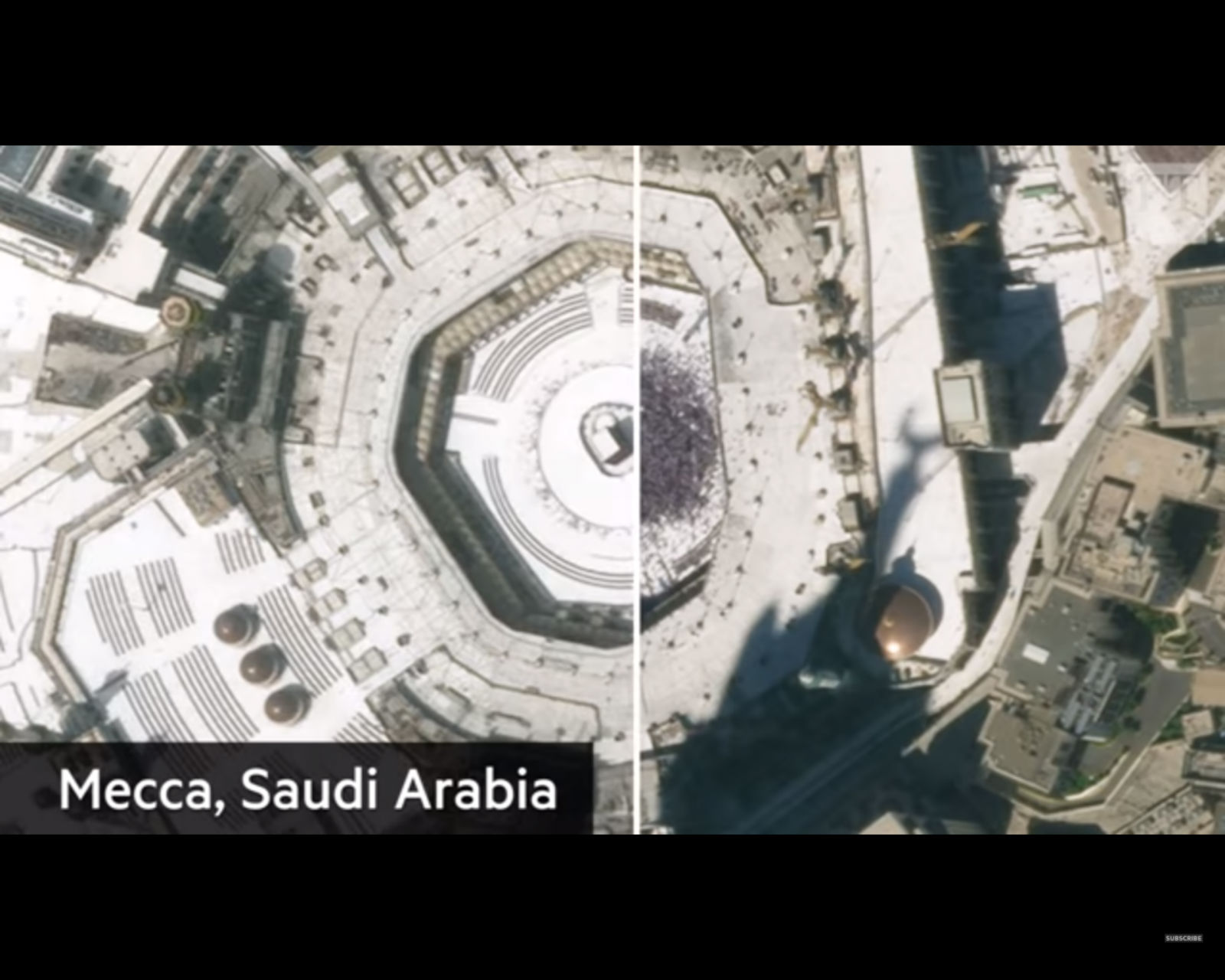

- Satellite images from around the world: Before and after covid. (Worth Watching)

- The Market Yesterday

Sunday, 12 April 2020

Egypt will earmark more stimulus for covid-19 fight if necessary, Maait says

TL;DR

What We’re Tracking Today

We’re headed into a four-day long weekend, friends, and we cannot ever recall having been more profoundly grateful for a holiday. Banks and the EGX are off on Sunday, 19 April in observance of Coptic Easter, while Monday is a national holiday for Sham El Nessim.

Happy (western) Easter to all of our readers who celebrate today.

Food for thought as we start the week:

Global trade sputters, leaving too much here, too little there: As the pandemic stretches on, businesses and consumers alike could run short of some products in months to come, the New York Times worries. The Wall Street Journal adds that on the food front in particular, the US, Europe and “other wealthy regions are unlikely to experience serious problems … but poorer countries … could struggle.”

Coronavirus may ‘reactivate’ in cured patients, Bloomberg quotes Korea’s CDC as saying. The notion underscores the MIT Technology Review’s contention that “coronavirus antibody testing needs to get a lot better, and so does our understanding of immunity, before people can start circulating freely.” Wired’s UK edition, with characteristic understatement, notes, that immunity passports that “split society along the lines of immune and not-immune people might not be a good idea.” At least 70 companies in the US are said to be developing antibody tests for the virus that causes covid-19.

MUST READ- The key going forward isn’t asking “How soon can we return to normal life,” the New York Times writes after looking at how European nations are starting to life controls on daily lives. It’s learning to live with corona until a vaccine is found as epidemiologists worry about a second wave of infections.

Among the countries planning to test the waters: “Austria is allowing small shops to resume business after Easter. Denmark is reopening nurseries and primary schools. The Czech Republic is planning to lift a travel ban.” Denmark’s PM said it best: “It’s like walking a tightrope. If we stand still, we may fall. If we go too fast, it may soon go wrong. We don’t know when we’ll be on firm ground again.”

COVID-19 IN EGYPT-

Egypt now has 1939 confirmed cases of covid-19 after the Health Ministry reported 145 new infections yesterday. The ministry also said that another 11 people had died of the infection, taking the death toll to 146. We now have a total of 542 cases that have since tested negative for the virus after being hospitalized, of whom 426 have fully recovered.

At least three doctors have died of covid-19, including one who contracted the virus on duty, the Medical Syndicate said in a statement. Forty-three doctors have also tested positive so far, but the syndicate expects the figure to rise as it continues tallying cases.

Police dispersed a demonstration of Dakahlia residents who were trying to stop the burial of one of the infected doctors, according to Al Masry Al Youm. Twenty-three people were arrested. Dar Al Ifta, which issues opinions on issues of religious law and practice for the observant, later issued a statement that trying to prevent burials is simply wrong.

The Health Ministry has launched a covid-19 hotline on WhatsApp with a bot developed to address frequently asked questions, the ministry said in a statement. The Health Ministry had received more than 477k inquiries about the virus through its telephone hotlines last month, most of which were about prevention methods, common symptoms, complications, and what callers should do if they had symptoms.

Museums and archaeological sites will remain closed until further notice, the Tourism and Antiquities Ministry said after Prime Minister Moustafa Madbouly announced last week the nighttime curfew will be extended for two weeks.

Factories have received the greenlight to use a staggering shift system to distribute their workers across three shifts to maintain productivity as long as they follow protection and safety procedures, Trade and Industry Minister Nevine Gamea said (watch, runtime: 5:33).

Freezone companies will now be able to sell 50% of their products in local markets for a six-month period, GAFI boss Mohamed Abdel Awahab said. Industrial manufacturers will also be permitted to sell 20% of their raw materials in the domestic market and businesses will have another six months to meet the mandatory financial reserves and update their insurance policies. Commercial license renewals are also getting a three-month break, allowing manufacturers to continue operations — on the proviso that companies confirm their intent to renew.

An unnamed Red Sea hotel will have its license revoked after failing to pay employee salaries, according to a Tourism Ministry statement. This comes amid government efforts to support the tourism sector to prevent covid-19 layoffs, with directives issued to businesses to avoid salary deductions and layoffs where possible.

Bibliotheca Alexandrina is going digital: The library will launch virtual tours from tomorrow until 22 April to encourage people to stay home, according to Ahram Online.

DONATIONS-

State-owned Misr Cement-Qena donated EGP 2 mn to the Tahya Misr Fund to support irregular laborers and buy respirators for hospitals, according to the local press.

The Federation of Egyptian Industries’ chemical industries division has earmarked EGP 1 mn to finance new hospital equipment or respirators, division head Sherif El-Gabaly said, according to the local press.

ON THE GLOBAL FRONT-

The US now has the world’s highest covid-19 death toll, surpassing Italy yesterday with more than 20k deaths and counting. New York Governor Andrew Cuomo suggested the curve is beginning to flatten out in the state as the virus “hit its apex.” The story is front-page news around the world this morning: WSJ | NYT | Reuters | Financial Times.

Saudi Arabia’s King Salman has indefinitely extended the kingdom’s nighttime curfew, the Saudi Press Agency said. The curfew was first imposed on 23 March for a three-week period after Saudi saw more than 4k cases.

Sub-Saharan African is heading into its first recession in 25 years, according to the World Bank: The region will contract by 2.1-5.1% in 2020 after posting 2.4% growth last year, the bank predicts in its latest Africa Pulse report. The virus will cause the region to lose anywhere between USD 37 bn and USD 79 bn in output this year due to the breakdown of trade and supply chain disruption, falling inflows, and disruption caused by emergency measures to quell the outbreak.

The EGX 30 was up 2.4% on Thursday, dragged up by index heavyweight CIB, which was up 5% at the closing bell. The exchange saw active trading, with shares worth EGP 800 mn changing hands, about 40% above the trailing 90-day average. The EGX30 is now down 26.1% since the start of the year, but gained 9.2% last week (its best week since covid-19 hit) as it turned in gains in four sessions back-to-back, propped up by domestic investors.

US stocks, meanwhile, had their best one-week showing since 1974, ending the week up 12% on news of a series of new “sweeping” measures announced by the Fed after weekly data showed that unemployment claims surged for three weeks straight. European markets were also up on Thursday. US and European markets were closed on Friday for western Easter and will be closed again tomorrow in observance of Easter Monday.

The US Fed said on Thursday that it will open USD 2.3 tn in credit lines to SMEs and local state governments and purchase bonds and collateralized debt. This comes on top of the historic USD 2.3 tn stimulus package that passed the House last month, as well as other economic prop-up measures.

Opec+ reaches initial agreement on production cuts but Mexico isn’t playing ball: Opec and its Russian-led allies (Opec+) reached an initial agreement to cut production by 10 mn barrels a day following a meeting on Thursday, but Mexico is looking to negotiate smaller production cuts, according to Bloomberg. The group’s virtual meetings ran from Thursday to Saturday and it still remains unclear whether they will reach a compromise, delegates said. G20 energy ministers also talked on Friday about taking “the necessary measures” to stop oil prices from tumbling further but didn’t discuss specific production numbers.

Enterprise+: Last Night’s Talk Shows

Health Ministry spox on covid-19 testing procedures: The government has been relying more heavily on isolating suspected cases of covid-19 than on PCR testing, which does not necessarily always yield accurate results, Health Ministry spokesman Khaled Megahed told El Hekaya’s Amr Adib. Megahed explained that the ministry has a set of diagnostic criteria in place for cases to be tested, saying that the system has so far allowed the outbreak to remain contained in Egypt (watch, runtime: 5:29). Masaa DMC’s Eman El Hosary (watch, runtime: 0:51) and Min Masr’s Amr Khalil (watch, runtime: 0:35) also ran down the ministry’s daily case tally.

Balancing health and economic concerns is key, says Bahaa Eldin: Adib also had a chat with former International Cooperation Minister Ziad Bahaa Eldin, who pointed out that Egypt is not exempt from the turmoil that is hitting the global economy and that it’s currently impossible to determine how long the current situation will last. The former minister stressed that the government must continue to strike a balance between policies safeguarding public health and measures to prevent a total economic meltdown (watch, runtime: 2:54 and runtime: 3:54).

Samih Sawiris was of the same mind, telling Al Kahera Alaan’s Lamees El Hadidi that the government should start thinking of ways to gradually return some of the country’s labor force to work with the necessary precautions in place. Sawiris noted that irregular laborers are the most affected by social distancing policies and the nighttime curfew, and that the state can’t afford to pay out stipends for the foreseeable future. The businessman separately told Lamees that he has recovered from a case of pneumonia (watch, runtime: 7:55).

Madbouly checks up on health measures at factories: Prime Minister Moustafa Madbouly’s media coordinator Hany Younis debriefed Lamees and Al Hayah Al Youm’s Lobna Assal on Madbouly’s tour of factories in Ismailia and 10th Ramadan City to assess their health policies for workers (watch, runtime: 1:39) and (watch, runtime: 5:53).

Speed Round

Speed Round is presented in association with

Egypt’s commitment to insulating the economy from the impact of covid-19 is “open-ended” and could go above the EGP 100 bn in stimulus and bailout funding the Sisi administration has already committed, Finance Minister Mohamed Maait said in an interview with Al Arabiya on Thursday (watch, runtime: 14:38).

The administration has about EGP 70 bn in dry powder from the original round, having so far deployed about EGP 30 bn in funding — including some EGP 5 bn to the Health Ministry, EGP 3 bn to the Export Subsidy Fund, EGP 3 bn to seasonal workers, and expedited payments to state contractors and suppliers, Maait said. That figure suggests the state has more room to maneuver — and that it has even more freedom to act after last month’s surprise 300 bps interest rate cut.

Maait specifically noted tourism and aviation as industries likely to be allocated more funding as part of the bailout program.

The minister is effectively writing off the final quarter of the current fiscal year (2019-2020) from a revenue perspective, saying he expects state revenues could fall 25% or more in FY2019-2020. He cautioned that the ultimate impact on macro indicators will be entirely dependent on how long the covid-19 crisis lasts — and how severe it is.

Foreign holdings of Egyptian sovereign debt are down about 40% by our math as Maait noted the figure now stands at USD 13.5-14 bn, down from USD 24 bn last month. The outflows come as investors pulled a record USD 83 bn from emerging markets in March in a global risk-off.

Inflation dips slightly in March to 5.1%: Annual urban inflation cooled to 5.1% in March from 5.3% in February, according to Capmas data out on Thursday. Price growth increased 0.6% on a monthly basis compared to 0.8% during the same month last year, and zero in February. This is the second consecutive month that inflation has slowed after three months of acceleration.

Food and transport prices were primarily responsible: The prices for food and beverages rose 0.8 percentage points in March to register an overall drop of 3% on an annual basis. Transport costs dropped by 1.3% to reach an annual rate of 13.4%. The uptick in food and beverage prices is likely a combination of increased demand from consumers stocking up on food since the outbreak of covid-19 and the usual increase that precedes Ramadan, says Sigma Capital’s Abu Bakr Imam.

Core inflation falls slightly: Annual core inflation remained effectively flat at 1.9% in March, while monthly core prices rose 0.2% from the month before, according to figures released by the Central Bank of Egypt (pdf).

What’s the outlook for inflation? The analyst jury is still out. HC Securities anticipates inflation accelerating 1% every month to reach 11.45% by December, which is above the government’s projection of 9.8%. Beltone’s Alia Mamdouh sees relatively tame inflation figures over the course of the year that she expects will be within the CBE’s target range.

Expect the CBE to hold rates next month: With inflation relatively contained and expected to remain within the CBE’s 9% (+/-3%) target range, the central bank is expected to keep rates on hold when its Monetary Policy Committee meets on 14 May, says Beltone’s Mamdouh. The MPC left rates unchanged at its meeting last week after its exceptional 300 bps rate cut last month in a “preemptive decision” that was made to provide “appropriate support” to the economy amid the covid-19 outbreak.

The government’s fuel pricing committee has cut the price of all fuel grades by EGP 0.25 per liter and has also cut the price of mazut (heavy fuel oil) for factories, according to an official statement (pdf). The price of 95-octane is now EGP 8.50 per liter, 92-octane is EGP 7.50 per liter, and 80-octane is EGP 6.25 per liter.

Mazut price cut a form of stimulus? The price of mazut was cut a much sharper 8.2% to EGP 3.9k per ton, suggesting the committee views that as a form of stimulus for the economy.

The committee didn’t get overzealous with its price cuts to account for a potential recovery in oil markets, Oil Ministry spokesman Hamdy Abd El Aziz said on Sada El Balad on Friday (watch, runtime: 06:31), suggesting that we are now seeing a reversal of the the sharp decline in global oil prices over the past few months. The price of US crude crashed 68% to USD 20/bbl during 1Q2020 on depressed demand due to covid-19 and the Saudi-Russia price war, but staged a mini-recovery at the beginning of April, rising to USD 29/bbl.

Diesel prices remain unchanged, prompting questions from parliament: Rep. Mohamed Abdel Ghany has called on the government to adjust diesel prices, saying that they should be adjusted according to the 60% drop in global prices, according to Al Shorouk. The fuel pricing committee can only revise prices up or down 10% every quarter.

Background: The fuel pricing committee was formed early last year and meets every quarter to review fuel prices. Fuel prices were left unchanged when it last met in January after it made a 25p cut to the prices of all fuel grades in October.

Cheiron consortium moves to second round of bidding for Shell Egypt onshore assets: A consortium of Cheiron, Pharos Energy and Cairn Energy has moved to a second round of bidding to acquire Shell’s onshore assets in Egypt, Bloomberg reports, citing unnamed sources. Egypt’s East Gas has also been invited to the next round of bidding, according to the sources, who said that other companies can still come forward and bid.

Oil price war throws uncertainty into proceedings: Shell is moving forward with the sale for now, but recent oil price volatility could impact what buyers are willing to pay, the business information service says. The Dutch oil giant had been expecting to net as much as USD 1 bn for the assets, a target that now could be under threat due to the lowest price of oil, the sources said, emphasizing that discussions will not necessarily lead to a sale.

Background: Shell announced last year its intention to exit its onshore upstream assets in the Western Desert and focus on expanding its Egyptian offshore gas exploration efforts, appointing Citigroup to manage the estimated USD 1 bn sale. Cheiron and Pharos Energy submitted bids for the assets in February, as did Egypt’s Apex Energy, US oil and gas producer Apache, and other undisclosed Asian and Middle Eastern companies. Shell’s portfolio in the Western Desert includes stakes in 19 oil and gas assets including the Badr El Din and Obaiyed area, as well as the North East Abu El Gharadig, West Sitra, Bed 1 gas, and West Alam El Shawish concessions.

M&A WATCH- Pharma chain 19011 has acquired 100% of Roshdy Group in a transaction worth EGP 362 mn, according to the local press. This is the second chain 19011 has acquired after buying Al Image Group’s 17 outlets last year in a transaction worth c. EGP 80 mn. 19011 is a market newcomer, having launched only three years ago. The chain has come under scrutiny by the Pharmacists’ Syndicate, which launched an investigation for a suspected breach of a law stipulating that pharmacists should own no more than two retail branches. A Health Ministry body permanently suspended Roshdy Group’s Hatem Roshdy from its registry last year over licensing-related breaches.

Naeem Securities brokered the transaction between 19011 and Roshdy.

M&A WATCH- Ebtikar becomes sole shareholder of Vitas Egypt after acquiring remaining 50% stake: Ebtikar Financial Investments has purchased the remaining 50% stake of microfinance company Vitas Egypt, according to an EGX disclosure (pdf). Ebtikar, which is jointly owned by B Investments (50.1%) and MM Group (49.9%), bought Vitas Group’s entire stake and will now have sole ownership of the firm. MM Group said last month it is looking to take Ebtikar public on the EGX sometime in 2021.

State banks sell EGP 70 bn of high-interest savings certificates in three weeks: Around EGP 70 bn has been invested in the National Bank of Egypt (NBE) and Banque Misr’s new high-interest savings certificates since they were made available three weeks ago, Al Mal reports. NBE has sold EGP 47 bn of the 15% one-year certificates to 245k customers, and Banque Misr has sold around EGP 23 bn to 93k customers.

Background: The two state-owned banks began offering the certificates on 22 March to discourage people from putting their savings into USD in response to the recent market turmoil. The NBE also cut the interest rate on its USD certificates to deter people from holding the greenback.

Ethiopia to maintain GERD construction, filling timetables despite covid-19: Ethiopia intends to continue work on the Grand Ethiopian Renaissance Dam (GERD) and is sticking to its timeline for filling the dam despite the impact of covid-19, Bloomberg reports, quoting Ethiopia’s State Minister for Finance Eyob Tekalign. Ethiopia declared a state of emergency over covid-19 last week, but while it might reprioritize some projects because of the virus, the GERD is not among them, said Tekalign, who spoke with Bloomberg last week.

Egypt, Sudan reiterate calls for Washington timetable: Egypt and Sudan agreed to stick to the draft agreement approved by Washington for the dam’s filling timetable, following a Thursday meeting between Sudanese Prime Minister Abdullah Hamdok and Egyptian Irrigation Minister Mohamed Abdel Aty in Khartoum on Thursday, a cabinet statement said. The timeline for filling the dam’s reservoir has been a key point of contention in GERD negotiations between Ethiopia and countries downstream of the Nile. Ethiopia has long said it will begin filling it in July but Egypt has demanded that there be a formal agreement in place deciding the filling and operating timetable before this goes ahead.

MOVES- The Amer Group board has nominated Mansour Amer to become its new chairman after Hisham Arafat resigned from the position to focus on managing his engineering consultancy firm, according to Al Mal.

Egypt in the News

Leading the conversation on Egypt in the foreign press this morning is the death of three doctors after contracting covid-19. The Associated Press highlights the story of pathologist Ahmed El Lawah as part of an ongoing series on victims of the virus.

Worth Watching

Satellite images from around the world depict life before and after the covid-19: This Financial Times video (watch, runtime: 3:34) shows satellite and drone imagery from cities across the world and compares pollution levels pre- and post-lockdown.

Infrastructure

Larsen & Toubro subsidiary contracted for 220 kV substation in Egypt

Egypt has awarded Power Transmission & Distribution, a subsidiary of Indian energy company Larsen & Toubro, a contract to construction and commission of a 220 kV gas insulated substation, the company said in a statement (pdf) without providing further details.

Basic Materials + Commodities

Egypt to import 800k tonnes of wheat to increase reserves

Egypt is planning to import 800k tonnes of wheat during the upcoming season as part of government efforts to boost reserves of strategic commodities, Supply Minister Ali Moselhy said, according to a statement. Egypt also expects to harvest 3.6 mn tonnes locally, potentially giving the country enough wheat to cover 7-8 months — more than the amount being targeted by the government.

Health + Education

CIRA resumes construction of Regent British School in Egypt’s Mansoura

Private sector education company CIRA has resumed construction of its Regent British School in Mansoura after Prime Minister Moustafa Madbouly gave the go-ahead for construction works to continue, and is operating at 60% capacity, the company said in a statement (pdf). The company’s adoption and engagement metrics for its online learning system have reached 82% in the four weeks since the government shuttered schools across the country, and so far all students completing online exams have had a “smooth experience,” CIRA said.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Thursday): 10,322 (+2.2%)

Turnover: EGP 874 mn (40% above the 90-day average)

EGX 30 year-to-date: -26.1%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 2.2%. CIB, the index’s heaviest constituent, ended up 5.0%. EGX30’s top performing constituents were CIB up 5.0%, Dice up 4.0%, and EFG Hermes up 3.6%. Thursday’s worst performing stocks were Ibnsina Pharma down 3.2%, Kima down 3.1% and Madinet Nasr Housing down 2.7%. The market turnover was EGP 874 mn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -135.6 mn

Regional: Net Short | EGP -17.9 mn

Domestic: Net Long | EGP +153.5 mn

Retail: 46.3% of total trades | 46.8% of buyers | 45.9% of sellers

Institutions: 53.7% of total trades | 53.2% of buyers | 54.1% of sellers

WTI: USD 22.76 (-9.29%)

Brent: USD 31.48 (-4.14%)

Natural Gas (Nymex, futures prices) USD 1.73 MMBtu, (-2.80%, May 2020 contract)

Gold: USD 1,752.80 / troy ounce (+4.80%)

TASI: 7,006.24 (+0.10%) (YTD: -16.49%)

ADX: 4,113.86 (+6.38%) (YTD: -18.95%)

DFM: 1,830.02 (+3.56%) (YTD: -33.81%)

KSE Premier Market: 4,910.98 (-3.39%)

QE: 8,989.70 (-0.45%) (YTD: -13.77%)

MSM: 3,472.43 (+0.50%) (YTD: -12.78%)

BB: 1,300.37 (-0.22%) (YTD: -19.24%)

Calendar

12 April (Sunday): Western Easter Sunday.

16 April (Thursday): New deadline for individuals to file their tax returns to the Egyptian Tax Authority.

17-19 April (Friday-Sunday): IMF, World Bank will hold virtual Spring Meetings.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

23 April (Thursday): Earliest date on which suspension K-12 and university instruction is set to be lifted.

23 April (Thursday): Suspension of international flights to / from Egypt expires.

23 April (Thursday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29 April (Sunday): House of Representatives covid-19 recess ends.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.