- Things are getting increasingly nutty as the world tries to respond to covid-19. (What We’re Tracking Today)

- As the cabinet approves its strategy to stimulate Egypt’s auto sector… (Speed Round)

- …Investors want more subsidies to produce electric vehicles. (Speed Round)

- FX brokers now need to follow bank-style KYC rules when selling foreign currency. (Speed Round)

- The collapse in oil prices is forcing energy companies in Egypt onto the defensive. (Speed Round)

- FRA may file lawsuit against Adeptio Chairman Mohamed Alabbar. (Speed Round)

- Madinet Nasr is looking to offload its utilities arm. (Speed Round)

- My Morning Routine: Mai Abaza, CEO and co-founder of Publicist Inc.

- The Market Yesterday

Thursday, 12 March 2020

US bans flights to Europe as covid-19 is declared a pandemic

TL;DR

What We’re Tracking Today

What, you thought a little bit of rain (or the whiff of the apocalypse in the air) would keep us out of your inboxes?

Businesses, government, banks and the EGX are all closed today thanks to fears of inclement weather, according to statements by the central bank, the EGX and the cabinet. Thursday had been declared a school holiday earlier this week after the national weather service said that sandstorms and heavy rains would hit the country today. With the press and policymakers invoking the specter of the , the government has declared an emergency and set up operation rooms in every governorate nationwide, Local Development Minister Mahmoud Shaarawy said at a press conference picked up by Youm 7.

Rain began in the capital city a little after midnight and is intermittent in the People’s Democratic Republic of Maadi as we hurtle toward our dispatch deadline this morning. Twitter tells us the rain near dispatch time is heavy in El Wahat, moderate in Sheikh Zayed and light in Cairo.

The weather service says we could still see heavy rainfall: We could see total rainfall of more than 45 mm in Cairo (more than last October), and 70 mm in Matrouh and other points on the North Coast.

While you were sleeping, things got more than a little nutty on the covid-19 front: Flights between Europe and the US are suspended, shops across Italy are closed and Asian stocks and US futures are tanking: We may have found a new winner for the worst day of covid-19 yet.

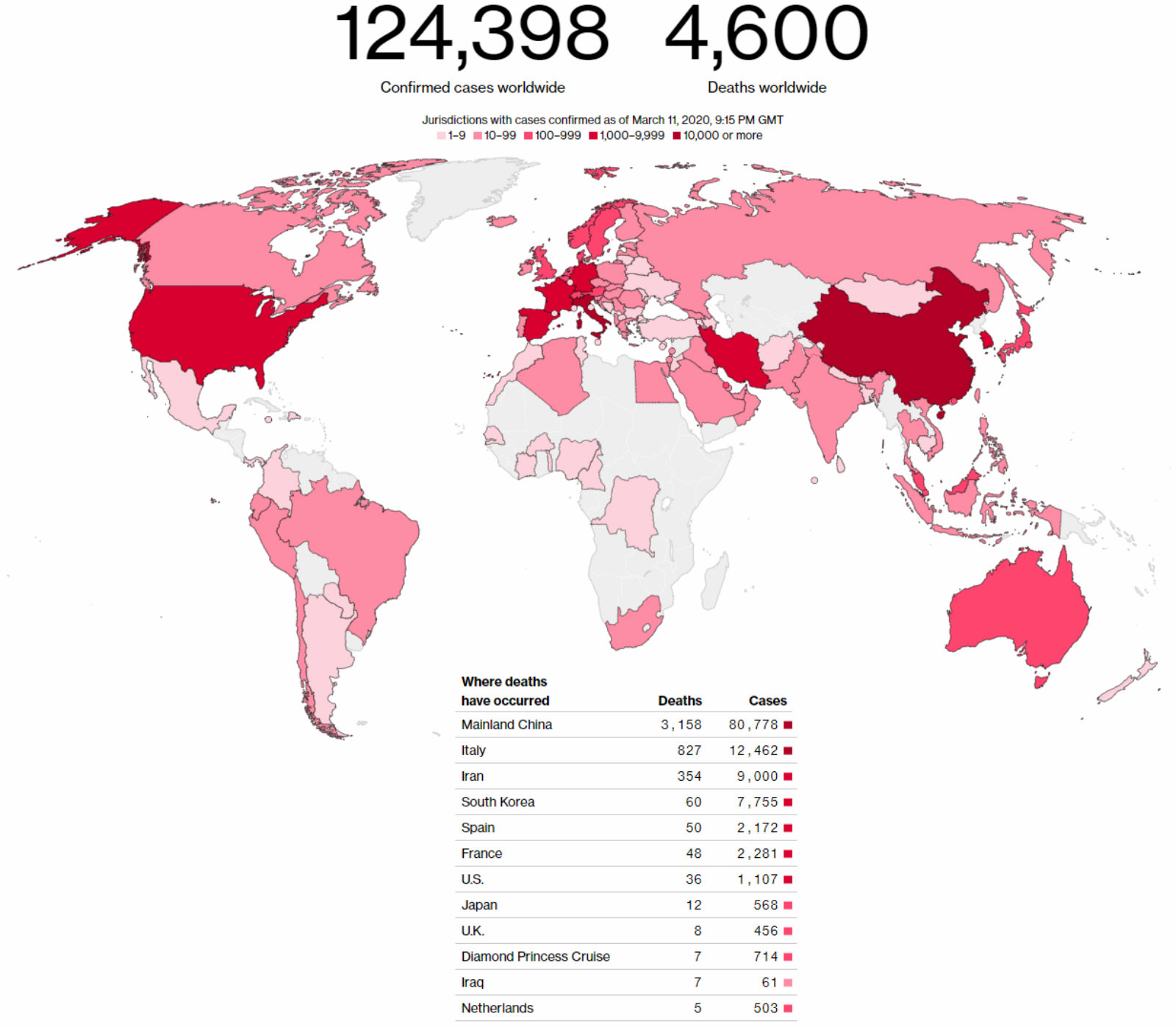

The World Health Organization (WHO) has officially declared the covid-19 outbreak a global pandemic. “In the days and weeks ahead, we expect to see the number of cases, the number of deaths and the number of affected countries to climb even higher,” WHO Director-General Tedros Adhanom Ghebreyesus said. More than 126k people worldwide have now tested positive for the virus, with 4.6k having died as a result and 67k having recovered. You can read the WHO’s statement here.

The United States has banned flights to Europe for a 30-day period starting on Friday at 11:59pm, with only aircraft heading to the UK exempted. Oil prices plunged nearly 6% in the minutes after the announcement. There’s more:

- The US has issued a travel warning urging its citizens not to leave the country;

- The NBA has cancelled its season;

- Italy has ordered all shops and restaurants across the country to close;

- Germany’s Angela Merkel said up to 70% of Germany could become infected;

- The actor Tom Hanks announced that he and his wife have tested positive for covid-19 in Australia.

The flight ban leads the front pages of news sites the world over this morning.

Markets are tanking in the wake of the flight ban. Asian markets including Japan, Hong Kong and China are down anywhere 2-4% at the moment and futures point to a heavy sell-off when markets open in Europe and the United States today. This comes after the Dow entered bear territory yesterday, defined as 20% down from its record high in February. US markets all closed deeply in the red yesterday, while the EGX was down 0.1% as it erased at the close the gains it had made earlier in the day

HERE AT HOME: We now have 67 total recorded cases in Egypt, after another eight patients tested positive, including seven Egyptians and one foreigner, the Health Ministry said in a statement. Each is apparently a case of community transmission. Meanwhile, Egypt reported one patient has officially recovered after receiving medical care, joining 26 others who did the same earlier this week.

The Education Ministry has suspended some extracurricular activities at schools as a precaution, a cabinet statement said without elaborating. In a clarification to Masrawy, Education Minister Tarek Shawky said the ministry was referring to after school physical education, music and computer science programs, which are on hold as part of the ban on large gatherings. Friday prayers are still expected to take place tomorrow.

Face masks are being distributed to Cairo metro workers and passengers at peak times, and authorities are undertaking extra cleaning efforts, Ahram Online reports.

Cityscape Egypt announced it is pushing back its 18 March real estate exhibition and will reschedule for a date later this year.

Health insurance providers in Egypt may not pay out in case of infection or death if covid-19 is declared a pandemic, Misr Life Insurance Chairman Ahmed Abdel Aziz told Al Mal. The story was filed just before the WHO declared that the virus is, indeed, now pandemic.

We are seeing a spate of new cases abroad that have connections to Egypt. Nine travelers from a Hong Kong tour group that recently visited Egypt and their guide have either been infected or tested preliminarily positive for the virus. And in Iowa, five new cases of the illness were identified on Tuesday evening, with all of those affected having been together on a cruise in Egypt. Seven existing covid-19 cases in Iowa were individuals who had been on the same cruise, local media reports.

Egypt is now the sixth-largest connection to covid-19 cases in the US, according to data from the New York Times.

We’re need to start asking ourselves whether (and when) we can start working from home as “flattening the curve” through extreme “social distancing” (no hugs, no work from the office, no shops and malls) may be the only thing that prevents the widespread transmission of covid-19. Check out this piece from Stat’s excellent Helen Branswell.

Across Africa, fears of a rapid spread of the virus abound. The continent is home to 16% of the world’s population but only 1% of global healthcare spending, and resources to tackle an outbreak are scarce, according to Bloomberg. The IMF has pledged to make USD 10 bn available at zero interest to help poor countries fight the illness, and the WHO has supplied testing equipment and training across the continent. Crowded urban areas, a low doctor-patient ratio and a lack of resources are reasons to be concerned.

A rare note of positivity: In Wuhan — the Chinese city that was the epicenter of the pandemic — workers in critical sectors are being allowed to return to work following President Xi Jinping’s visit on Tuesday, Reuters reports. Other regions in the country have since also lowered emergency response levels and eased travel restrictions.

Policymakers around the world are sounding the rallying cry to avert a global recession: The UK government and Bank of England yesterday announced coordinated stimulus measures in a bid to mitigate the effects of covid-19 on the UK economy. The BOE followed the US Federal Reserve in making an emergency 50 bps rate cut, and announced cheap funding for the banking sector, a freeze on bank dividends and lowered capital requirements. In the government’s annual budget statement, UK Chancellor Rishi Sunak announced a GBP 30 bn (c. USD 39 bn) fiscal stimulus package, GBP 12 bn of which will be allocated to fighting covid-19 and at least GBP 5 bn for the National Health Service.

A model for other central banks to follow -El Erian: The always-on-point Mohamed El Erian writes for Bloomberg that the UK’s twin responses of monetary and fiscal stimulus “set an important example for other central banks” for how to manage the crisis. The large fiscal stimulus package, the decision to increase coordination between the Bank of England and the Treasury and new central bank measures to support small businesses “are part of the necessary comprehensive response” that should be replicated around the world, he writes.

The ECB is very likely to follow suit this afternoon when it meets to decide rates: ECB boss Christine Lagarde signaled that the central bank will be taking steps that would take into account all possible tools to shore up the bloc’s economy, especially measures to support liquidity and access to credit — including providing “super-cheap” funding, according to Bloomberg. Lagarde warned that the world facesa crisis not unlike the 2008 financial crash if policymakers don’t start working on a coordinated response.

Bank of Japan to take easing to new extremes: The BOJ will likely greenlight further stimulus measures when it meets next week, taking its hyper-easing strategy to new levels. Interest rates are at negative 0.1% and the bank already holds USD 279 bn in stocks on its books, but sources told Reuters that one of the measures the bank could take is ramping purchases of ETFs.

All eyes on the Fed next Wednesday: Traders expect the Fed to cut rates by another 75 bps to just 0.25-0.5% when it meets on 17-18 March.

Where does Egypt stand? Analysts are split on what the CBE would do when it meets on 2 April after inflation slowed down in February, beating most expectations. Those in favor of a rate cut argue that policymakers will make protecting economic activity a priority, considering moves being taken by other central banks.

Others forecast that the Central Bank of Egypt will maintain rates, citing pressure on Egypt’s three key sources of foreign currency — tourism income, remittances from Egyptians abroad, and foreign inflows into government debt. “We expect the CBE to pause the easing cycle as it waits to assess the new threats to both the Egyptian and the global economic performance,” Pharos Holding said in a research note yesterday. Pharos believes the CBE can’t afford to cut rates, despite global monetary easing — high rates will keep the carry trade here and ease pressure on the EGP.

Saudi ratchets up oil price war: Saudi Aramco announced yesterday that it would raise its output capacity to 13 mn bbl/day, up from the record 12.3 mn bbl/d it already announced this week, striking another blow in the country’s ongoing oil price war with Russia. Aramco didn’t say when the capacity increase would take place, but analysts have said it may take years and require bns in investment.

The news sent the price of Brent crude plummeting 3.2% to USD 36.04 bbl. Aramco’s share price was also down 0.32% yesterday, having dropped 4.8% since last week.

Putin pushes legislation to keep himself in power until 2036: Russia’s lower house of parliament approved on Wednesday a constitutional amendment that would allow President Vladimir Putin to stay in power until 2036, according to The Wall Street Journal, giving him a 36-year run in the position. The proposal was put forth by MP Valentina Tereshkova and quickly embraced by Putin who says that Russia “has had enough revolutions” and his prolonged rule would guarantee internal stability.

Egyptian couple get Guinness World Record as married squash world champions: Tarek Momen, 32, and Raneem El Welily, 31, have been recognized as the ‘first married couple to become squash world champions’ bagging a Guiness World Record for Egypt, according to Gulf News. Momen won the 2019-20 Professional Squash Association men’s world champion trophy last November while El Welily won the 2017 women’s World Open winner and topped the world rankings in September 2015.

Enterprise+: Last Night’s Talk Shows

The working week has ended a day early as fear of bad weather shuts down public and private sectors alike: Al Hayah Al Youm’s Hossam Hadad covered the cabinet’s decision to grant give both private and public sector employees paid leave today due to adverse weather conditions, with the exception of employees at vital facilities (watch, runtime: 4:13). Masaa DMC’s Ramy Radwan (watch, runtime: 3:41) also covered the story.

Covid-19 safety measures: Yahduth Fi Misr’s Sherif Amer spoke by phone with former health minister and World Health Organization envoy Maha Al Rabat, who discussed steps you can take to lower your chances of coming down with the covid-19 virus. She also noted that there is currently no vaccine and that scientists are still in the “experimental stages” of formulating one (watch, runtime: 3:10).

New covid-19 cases: Amer also spoke by phone with Health Ministry spokesperson Khaled Megahed who discussed the seven cases of covid-19 that recovered and were discharged from hospitals upon recovery in addition to the first case discovered in Egypt. Megahed also spoke about the eight newly confirmed cases of covid-19 patients — seven Egyptians and one foreigner — who contracted the virus by coming into contact with infected people. This brings the total number of cases in Egypt to 67 (watch, runtime: 2:51).

Ethiopia’s GERD agenda: Amer spoke by phone with political analyst and the head of the Alexandria Library Moustafa Al Fiqi, who said that Ethiopian Prime Minister Abi Ahmed is taking advantage of the Grand Ethiopian Renaissance Dam crisis to promote himself ahead of this year’s elections, which he said shouldn’t come at the expense of Egypt’s interests (watch, runtime: 2:36). Al Fiqi said that Egypt’s patience has its limits and that “dying in war may be better than dying of thirst” (watch, runtime: 2:09). He also added that he would not rule out Israel stepping in as a mediator in the negotiations (watch, runtime: 2:28).

Speed Round

Speed Round is presented in association with

Gov’t greenlights automotive strategy: The Madbouly Cabinet approved in its weekly meeting the long-awaited automotive strategy to encourage car assemblers and feeder industries. While the statement falls short on discussion of the finer details, it notes that the strategy will comprise legislative provisions, incentives, infrastructure improvements, and trade agreements with countries in the region and elsewhere.

What we already know: We reported last summer that a cornerstone of the new plan would be to provide customs discounts to manufacturers on a sliding scale linked to the percentage of locally-produced content they use. A ‘value-added rule’ will reportedly be used to calculate the percentage of domestic content used when deciding whether a car qualifies as locally-made.

Background: The so-called automotive directive — a package of incentives that would have allowed local assemblers, who industry backers argue support tens of thousands of skilled direct and indirect jobs, to better compete with European Union, Moroccan and Turkish imports — was scrapped in 2018 after it drew criticism from the EU for breaching trade terms. German Chancellor Angel Merkel, in particular, was said to have discussed the issue directly with President Abdel Fattah El Sisi. Talks of a new program, which was cleared with the EU and is expected not to violate any of Egypt’s trade agreements, then emerged.

The new strategy still needs to make its way past the House of Representatives, whether through legislative amendments to the Customs Act or other bills that will require House approval. And remember: The devil is in the details, and those are more likely to be spelled out in full in the executive regulations than they are in the bills themselves.

Auto industry wants more subsidies to produce first batch of electric vehicles: Auto industry figures lobbying the government to increase the subsidies it is planning to offer companies to produce an initial batch of electric vehicles in Egypt, according to Al Mal. Public Enterprises Minister Hisham Tawfik previously said that the government would offer EGP 50k in average subsidies per car for the first 100k produced, but industry insiders want something closer to EGP 95k per unit for sticker prices to be “competitive,” according to Holding Company for Metallurgical Industries Chairman Medhat Nafea.

Public transport is going green: Besides the planned subsidies, public authorities, economic bodies, and public sector companies will be required to replace 5% of their fleet every year with electric cars as part of a national strategy for EVs, Tawfik said at the time. Ongoing negotiations with prospective investors are expected to move forward as soon as both the EVs and the general automotive strategy approved by the cabinet yesterday are implemented, Nafea said.

Dongfeng is currently the front runner to become the country’s first EV manufacturer. Talks between the Chinese manufacturer and El Nasr Automotive are still ongoing, despite the covid-19 outbreak, Nafea said. We noted late last year that El Nasr Automotive was conducting a feasibility study to manufacture 25k electric cars in partnership with Dongfeng, and expects to sign an agreement by 2Q2020.

EXCLUSIVE- FX brokers now need to follow bank-style KYC rules when selling foreign currency: The Central Bank of Egypt (CBE) imposed new restrictions on foreign exchange companies, requiring them to follow know-your-client procedures similar to those used by banks when changing currencies for clients, secretary-general of the foreign exchange bureau division at the Federation of Egyptian Chambers of Commerce Ali Al Hariri told Enterprise. The new measures, put in place three months ago, require foreign exchange companies to verify the identity of the customers and the reason for the transaction.

Individuals, companies, expats, and diplomats are subject to the new rules: Individuals seeking to exchange EGP for foreign currency have to provide justification for the exchange, including the national ID, workplace information, passport with a valid visa, and airline tickets. Companies also have to provide the commercial registry information, while foreigners living in Egypt have to show a valid residence visa, and diplomats have to provide verification of the workplace before obtaining foreign currency. Data on the transactions and copies of the paperwork for each are sent on a daily basis to the CBE.

The move comes as part of the CBE’s ongoing bid to clean up the exchange bureau industry, which it believes was not a constructive actor in the period running up to the devaluation of the EGP. “We can now act like banks and turn down the customers that we think may be suspicious, which we were unable to do in the past,” Al Hariri added.

The new restrictions are contributing to a slowdown in business at exchange offices caused by the recent volatility in the currency markets. “The appreciation of the EGP pushed many customers to sell part of their holdings, but then when it started to depreciate, customers started holding onto their funds,” Al Hariri said. “With lower liquidity at hand and more strict rules on granting FX, our business has been slowing down."

The collapse in oil prices is forcing energy companies in Egypt onto the defensive: Energy companies operating in Egypt, including Pharos Energy and TransGlobe Energy, are responding to oil market volatility by slashing spending and adjusting production metrics in 2020, Energy Voice reports.

Pharos plans to spend USD 45 mn, which could include “discretionary” USD 10 mn in Egypt: Pharos has set out plans to spend around USD 45 mn in 2020, and has said there is a discretionary amount of USD 10 mn in Egypt that might be spent this year. It has suspended the forecast announced in January that it would raise production from the 5,055 bpd seen in 2019 to a projected 6,500-7,500 bpd in 2020. Despite confirming its interest earlier this week in purchasing Shell’s onshore oil and gas assets in Egypt’s Western Desert as part of a consortium, no further mention of this prospective acquisition has been made in Pharos’ most recent statement.

TransGlobe will spend USD 7.1 mn, including USD 5 mn in Egypt: TransGlobe has cut its overall spending for 2020 from USD 37.1 mn to USD 7.1 mn, with USD 5 mn allocated to development work in Egypt. It has slightly reduced its planned production in Egypt and Canada, which in Egypt means a reduction from a projected 11,900-12,700 bpd to 11,700 bpd for the year. The company was planning to drill 16 wells in Egypt this year before the price crash, and it is unclear whether these plans will go ahead.

Dividends are being suspended for now: Pharos has stated it does intend to pay a dividend this year, but this has been suspended pending more clarity on the macroeconomic environment. TransGlobe meanwhile is suspending the payment of a dividend in 1Q 2020.

DISPUTE WATCH- Market regulator mulls moving a lawsuit against Adeptio chairman: The Financial Regulatory Authority (FRA) is considering filing charges against Emaar chairman and Adeptio Investments head Mohamed Alabbar for failing to submit a mandatory tender offer (MTO) for the minority stake in the Egyptian International Tourism Projects Company (Americana), according to Youm7, which does not cite a source for the story. Last month, the FRA’s grievance committee rejected Adeptio’s appeal against the market regulator’s decision to reject the previous MTO it made in November arguing that the financial advisor that conducted the company’s fair value assessment had been in violation of fair evaluation practices. The committee also upheld a previous FRA decision requiring Adeptio to hire a new financial advisor to conduct a new valuation and make a new MTO, which Adeptio has since failed to do.

Background: Adeptio acquired a 67% stake in Americana Egypt’s parent company, Kuwait Food Company (Americana) in 2016, handing them indirect ownership of more than 90% of the subsidiary’s shares, which triggered an MTO clause for the remaining 9.563% shares. Adeptio had initially claimed it should not be required to submit an MTO, but after a few denied appeals, the company submitted an initial offer price of EGP 3.9 per share, based on Fincorp’s study. Americana’s minority shareholders were dissatisfied and asked for an offer worth EGP 24 per share. Fincorp was then suspended from carrying out valuation studies for a period of three months by the FRA.

M&A WATCH- MNHD looks to offload its utilities arm: Madinet Nasr Housing and Development (MNHD) appears to be exploring the possibility of selling its utilities arm El Nasr Utilities and Installations to an as of yet unnamed potential buyer. The company approved allowing the potential buyer to conduct a due diligence on its facilities and equipment arm, as a prelude to the sale, according to a regulatory filing (pdf). The potential buyer had submitted a non-binding purchase offer to buy 100% of El Nasr Utilities.

CABINET WATCH- Madbouly cabinet approves plan for five-year tourist visas: The cabinet has approved plans to introduce a new five-year tourist visa that will come into effect from June. With the new visa tourists would be able to enter the country for multiple 90-day periods for a USD 100 fee. Citizens of 27 countries can obtain visas at arrival ports, and countries offering Egyptians free entry at their ports of arrival will see the same service reciprocated in Egypt. There will be no restrictions on nationality or age for visitors whose tourist visas have expired to apply for a residency visa for one year, renewable. A USD 10 discount will be offered to tourists entering the country from Luxor or Aswan, from June to August every year, as part of the “Summer in Upper Egypt” initiative.

In addition, the cabinet:

- Ratified an agreement between Egypt and 23 other African countries signed in 2013 to set up the Community of Sahel–Saharan States;

- Approved proposed amendments to a law regulating government-commissioned dispute resolution bodies; and

- Approved a EUR 1.5 mn grant from the European Investment Bank to fund railway upgrades to the Tanta-Mansoura-Damietta line.

- Approved extending Tourism Ministry's charter flight incentive program till the end of October, crediting it with drawing 13.6 mn tourists to the country in 2019, compared to the 11.3 mn visitors in the previous year.

Image of the Day

Bloomberg charts the latest on the spread of covid-19 around the world in this interactive graphic: 124,398 people infected, 4,600 dead.

Egypt in the News

Covid-19 and its impact on Egypt as well as cases that trace their origins there continue to dominate the conversation on Egypt in the foreign press.

Worth Watching

CNN profiles Sherif El Magrabi, the owner of Magrabi Agriculture, one of the lead Egyptian exporters of fruits and vegetables, about how he grew his farms, where he exports to, and the secret to growing great agriculture products (watch, runtime: 02:41). Magrabi believes that Egypt has surpassed Spain as the world's number one exporter of oranges. His farms are on an area of 50k acres and the citrus farm alone is the size of greater Beirut. Magrabi Agriculture exports to 57 countries worldwide including all of the EU, a few African countries, China, Australia, New Zealand, “and everything in between.”

But even El Maghrabi isn’t immune from corona: Supply disruptions due to covid-19 have been slowing the export of Egyptian oranges to China. The good news coming out today is that shipments are gradually resuming, Fresh Plaza reports.

Diplomacy + Foreign Trade

Ethiopia working on new GERD proposal: Ethiopian officials are working on a new proposal for filling and operating the Grand Ethiopian Renaissance Dam and will present it soon to Egypt and Sudan, a source in Ethiopia’s Irrigation Ministry told local media. The dispute between Egypt and Ethiopia over access to the Nile’s water has escalated this month after Ethiopia abandoned talks in Washington, accusing the US of being biased in its mediation. “The new proposal is prepared in a way that will protect Ethiopia’s natural right on the use of the Nile waters and in line with international laws and ensures the benefits of the downstream countries,” the source said.

Foreign Minister Sameh Shoukry arrived in Brussels yesterday and will head afterwards to France after finishing his Middle East tour to shore up support for Egypt in its dispute with Ethiopia, the ministry said in a statement. Shoukry will discuss the ongoing dispute with French and Belgian officials, as well as the crisis in Libya, the situation in Palestine, terrorism and illegal migration, the statment said.

Real Estate + Housing

Al Ahly Sabbour signs EGP 5 bn agreement with the Urban Communities Authority to develop 6th of October’s Keeva

Real estate developer Al Ahly Sabbour has signed an agreement with the New Urban Communities Authority worth an estimated EGP 5 bn to develop the Keeva compound in Sixth of October, Al Mal reports. Company chairman, Hussein Sabbour, said that the compound will be built across 144 acres in four stages to deliver 1,138 housing units by the second half of 2023. Only 18% of the compound will be allocated for two-storey residences, and the remaining 82% for green spaces, lakes, entertainment venues and roads.

Legislation + Policy

House to extend discussion period over bill regulating use of plastic bags

The House of Representatives’ Industry Committee has agreed to extend the period of deliberations over a draft law regulating the use of plastic bags, the local press reports. The committee’s deputy chairman Mohamed Moustafa El Sallab said that the Environment Ministry had requested that the committee postpone discussion of the draft bill submitted in June of last year. The ministry said it needs to conduct a comprehensive study of the situation on the ground and submit another proposal in April that allows relevant industries an appropriate adjustment period. Chairman of the Export Council for Chemical Industries and Fertilizers Khaled Abul Makarem rejected the idea of an outright ban on the production of plastic bags, saying it would result in the closure of around 3k plastic factories.

My Morning Routine

Mai Abaza CEO and co-founder of Publicist Inc.: My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Mai Abaza, CEO and co-founder of Publicist Inc.

I’m Mai Abaza, the CEO and co-founder of Publicist Inc. and a proud mom of twins. I was born and raised in Dubai, and I’ve been in the PR industry since 2002. I studied at AUC, but moved back to Dubai after graduation, working in the Gulf and Levant, before moving to Cairo at the end of 2009 and founding the company in 2011.

Once I'm up in the morning I like to take action, so I get dressed and immediately start my day. Everything begins at 6:00 am, getting the kids ready with lunchboxes packed and onto the school bus. Then, if I’m feeling energetic I do some stretching, grab a coffee and start reading Enterprise before making it into the office by 9:00 am. Some days, crawling back into bed for another hour before heading out is necessary, though.

Two years ago, I made a conscious decision to limit my work day to when my kids are at school, so I try to pack the day to make sure I'm getting the most out of it. Mornings are when I’m most alert so I dedicate this time to catching up on emails and any tasks to do with numbers and finance. Starting around midday, I have an open door policy for anyone who wants to sort through problems, work-related or otherwise. As my partner Allaa and I plan our next steps for the company, we’re thankful for our fantastic 20-person team of young and driven people.

I recently discovered an interesting e-book called the Silent Meeting Manifesto, which is designed to help focus meetings and make them more useful by encouraging participants to silently read a prepared memo and make notes ahead of actually speaking. I’m looking to apply the concept here as best as I can. In light of International Women’s Day I’ve also been reading some short stories by Virginia Woolf. It's fascinating that the challenges she identified for women in the early 20th century still exist today.

I’m hooked on Money Heist, aka La Casa de Papel, and I’ve been binge watching it ahead of its Season 4 release in April. I also like The Family, which is about the influence of a Christian conservative group on American politics. I’m generally fascinated by the history of religion and politics and how they often mix when they shouldn't. One of my favorite books of all time is Umberto Eco’s The Name of the Rose.

At Publicist Inc. our goal has always been to place PR at the top of an organization's priority list, not as a sub-function of marketing. In 2010, after a couple of years working at a multinational agency, I could see there was a real opening in Egypt to start a PR firm where we could bring on board global best practices. A series of conversations and after-work meetings with Rania Helmy, one of our initial founders, saw our ideas grow into more concrete plans. Everything was momentarily suspended in January 2011, but later that year Rania really pushed for it and without hesitation I agreed.

No PR strategy can be duplicated, because to approach a problem, you need to do a significant amount of in-depth research and analysis to ensure the messaging is just right. This process is what we love to do with our clients, because it helps us build the communications strategy on solid ground.

Digital marketing is changing public relations strategies in many ways but as is the case with any industry, you expect technology to drive change in the way that you practice what you do. It does not pose a challenge as much as it has become a core pillar of communications.

Among my greatest sources of pride are campaigns we have run for social causes and our partnership with RiseUp. In 2013, we worked with a company that manufactures cochlear implants for children with hearing problems and last year, with the Wataneya Society for the Development of Orphanages. We launched awareness campaigns on hearing loss and what happens to youth who are forced to leave orphanages after the age of 18. With RiseUp, we spent a lot of time raising awareness in the local press of what the startup sector means for the economy and the support it requires. So we've basically become the go-to agency for the entrepreneurship sector and innovation.

We’re all human and fallible, and it’s important to keep the ego in check. There’s a great Rumi quote that I feel expresses this idea well: “Out beyond ideas of wrongdoing and right doing there is a field. I’ll meet you there.”

The Market Yesterday

EGP / USD CBE market average: Buy 15.66 | Sell 15.78

EGP / USD at CIB: Buy 15.66 | Sell 15.76

EGP / USD at NBE: Buy 15.65 | Sell 15.75

EGX30 (Wednesday): 11,194 (-0.1%)

Turnover: EGP 717 mn (20% above the 90-day average)

EGX 30 year-to-date: -19.8%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.1%. CIB, the index’s heaviest constituent, ended down 0.2%. EGX30’s top performing constituents were Dice up 8.5%, GB Auto up 3.2%, and Elsewedy Electric up 2.5%. Yesterday’s worst performing stocks were CIRA down 6.5%, Qalaa Holding down 2.9% and AMOC down 2.2%. The market turnover was EGP 717 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -80.2 mn

Regional: Net long | EGP +1.8 mn

Domestic: Net long | EGP +78.3 mn

Retail: 53.5% of total trades | 50.5% of buyers | 56.5% of sellers

Institutions: 46.5% of total trades | 49.5% of buyers | 43.5% of sellers

WTI: USD 32.87 (-4.34%)

Brent: USD 35.76 (-3.92%)

Natural Gas (Nymex, futures prices) USD 1.88 MMBtu, (-1.13%, April contract)

Gold: USD 1,636.00 / troy ounce (-1.46%)

TASI: 6,552 (-3.10%) (YTD: -21.89%)

ADX: 4,235 (-0.64%) (YTD: -16.55%)

DFM: 2,207 (-1.04%) (YTD: -20.14%)

KSE Premier Market: 5,246 (+1.39%)

QE: 8,613 (+2.14%) (YTD: -17.38%)

MSM: 3,832 (+0.90%) (YTD: -3.75%)

BB: 1,439 (-0.27%) (YTD: -7.51%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit.

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 March (Tuesday): The Annual Export Summit, Nile Ritz Carlton, Cairo, Egypt.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action”, new administrative capital, Egypt.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

17-19 April (Friday-Sunday): IMF, World Bank hold Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.