- Egyptian stocks hold steady following Sunday’s rout… (Speed Round)

- …as global markets also held their ground in expectation of a G7 finance ministers and central bankers meeting today. (Speed Round)

- There are now six covid-19 patients abroad who have recent travel history in Egypt. (What We’re Tracking Today)

- Covid-19 continued to dominate proceedings on the airwaves last night. (Last Night’s Talk Shows)

- ECMA pushing for three-year exemption from taxes on stock market gains. (Speed Round)

- Telecom Egypt looks like it’s really thinking about buying Vodafone Egypt. (Speed Round)

- Gov’t considering complete customs exemption on imports of auto components. (Speed Round)

- Former GE CEO Jack Welch, who embodied the 1990s cult of the CEO, is dead at 84. (What We’re Tracking Today)

- The Market sodiYesterday

Tuesday, 3 March 2020

Global markets take a breather amid covid-19 rout

TL;DR

What We’re Tracking Today

Global markets including the EGX held their ground yesterday after the worst week of losses since the global financial crisis. Hammering on a big block of wood as we note this, today is looking reasonable, too: Markets in Hong Kong, South Korea and China are up this morning (only Japan is mixed) and futures suggest that European and US markets will also open in the green later today.

What’s with the sudden pause in the sell-off? Word that G7 finance ministers and central bank governors will meet today to discuss a coordinated response to the market meltdown and expectations that covid-19 will slash global growth this year. We have the full rundown in this morning’s Speed Round.

One thing to keep in mind: We’ve been collectively willing ourselves into (a) an end to the bull market for equities and (b) a global recession for more than year now. Just sayin’.

COVID-19 WATCH- There are now six covid-19 patients abroad who have recent travel history in Egypt: California’s Santa Clara county reported three new cases of covid-19, including a husband and wife who had recently traveled to Egypt have been confirmed with the virus, according to CBS SF. Four other people who were diagnosed with the virus over the weekend were also linked to Egypt. The current assumption seems to be that the patients traveled to Egypt while asymptomatic and developed symptoms after returning home.

Health Ministry gives details on Egypt’s second corona victim: The Canadian engineer was first diagnosed at the health clinic of his company — disclosed by the Oil Ministry as Khalda Petroleum Company (KPC) — before being transferred to a nearby quarantine center, according to a cabinet statement. Around 1,500 KPC workers have been held on-site for a 14-day testing period, and another 1,427 potential contacts that accessed the company over the past 10 days will be tested at their homes.

The government has launched a website — Care.gov.eg — to provide information on the virus, outline preventative measures, and respond to FAQs.

Kuwait has not suspended issuing visas to Egyptians, a diplomat at the Kuwaiti Embassy in Cairo told Youm7, adding that visas are being processed normally. The allegations came on Sunday from Kuwaiti outlet Al Qabas, citing unnamed security officials.

The Trade Ministry will facilitate the release of Chinese goods that have been held in Egyptian ports since the start of the outbreak, Al Mal reports, carrying a copy of a letter sent to the Customs Authority by the ministry.

El Molla plugs Egyptian mining investment at Canadian conference: Oil Minister Tarek El Molla is in Canada for PDAC 2020, a four-day mineral exploration and mining convention in Toronto, where he’s promoting investments in Egypt’s mining sector, according to a statement (pdf). El Molla is looking to pique investor interest in Egypt’s upcoming gold mining and exploration tender, which the ministry is set to launch on 15 March. The tender will be the first of its kind since amendments to the Mineral Resources Act designed to jump-start investment in the sector were passed last year.

It’s PMI day in Egypt as well as Saudi Arabia and the UAE. Look for them starting 6:15am. here.

Foreign reserves rose to USD 45.5 bn in February, up from USD 45.45 bn in January, according to CBE figures released yesterday.

Bahrain could be taking a leaf out of Saudi’s book with an oil asset stake sale: The Bahraini government may decide to transfer some of its oil and natural gas assets to a sovereign fund that would open the doors to private investors in a bid to balance the public budget, Oil Minister Mohammed bin Khalifa said, according to Bloomberg. “Nothing is not for sale anymore” after Saudi Arabia’s USD 30 bn Aramco IPO last December, bin Khalifa said. The small gulf country’s deficit widened to 13% of GDP in 2015 and narrowed to 4.7% in 2019.

Italy’s GKSD approaches Mubadala to team up for NMC Health bid: GKSD Investment, which is backed by an Italian hospitals group, has approached Abu Dhabi’s sovereign wealth fund, Mubadala, on becoming an equity partner in a bid for the troubled LSE-listed NMC Health, Bloomberg reports, citing people close to the matter. Mubadala had signaled earlier this week it is looking at potentially investing in the troubled company, which is currently under an investigation from the UK financial regulator over fraud allegations.

Jack Welch, former CEO of General Electric, died on Monday, Bloomberg reports. Welch, aged 84, was widely hailed as a “legendary” manager for his ruthless efficiency-driven ethos that saw GE become the world’s biggest company in 1999. Under Welch’s command, the company shut down hundreds of factories and trimmed the lowest performing 10% of workers annually, which allowed it to raise massive profits for company shareholders.

Nokia and Harley Davidson have replaced their CEOs after underperformance. Reuters has more on the shakeups at the mobile comms player and motorbike maker.

It looks like Benjamin Netanyahu “is within striking distance of forming Israel’s next government” according to exit polls cited by Bloomberg after yet another election.

It’s Super Tuesday in the US of A: Almost a third of the 1,991 delegates will be awarded to candidates running for the Democratic nomination as 14 states hold their primaries in what the US media has dubbed ‘Super Tuesday.’ Current frontrunner Bernie Sanders is currently leading in many of the state polls — including the crucial states of California and Texas which together account for almost 650 delegates.

The key questions in the hours before voting begins: How much of a bump will Joe Biden get from his decisive win in last weekend’s South Carolina primary? And what will be the impact of Michael Bloomberg — who has spent upwards of USD 500 mn on ads and campaign staff but hasn’t yet appeared on the ballot?

In a last-minute bid to slow Sanders’ momentum, former candidates Pete Buttigieg and Amy Klobuchar endorsed Biden. Klobuchar formally ended her campaign last night having won only seven delegates in the first four contests.

Want more? Vox is out with an in-depth guide to today’s proceedings.

Here’s how much you’re going to be paying for smokes: Tobacco companies in Egypt published their new official prices in the Official Gazette on Sunday following last week’s amendments to the VAT Tax Act which raised the sin tax on tobacco products. Merit’s Blue brand now costs EGP 46, Marlboro’s Red and Purple Mix EGP 42, and Cleopatra’s soft pack EGP 17. See the full price list on Masrawy here.

PSA- Spring has sprung. Look for a daytime high of 26°C in the capital city today, 21°C in Alexandria.

Enterprise+: Last Night’s Talk Shows

Covid-19 dominated proceedings on the airwaves last night: Al Hayah Al Youm's Lobna Assal provided the details on the Canadian resident who on Sunday tested positive for covid-19 (watch, runtime: 1:57), and spoke with cabinet spokesman Nader Saad, who said that some 1500 workers at the patient’s company (Khalda Petroleum Company) are being quarantined on-site for 14 days and are being inspected twice daily (watch, runtime: 5:40). Al Kahera Alaan’s Lamees El Hadidi also carried the same report, speaking by phone with Nancy El Gendi, the head of the Health Ministry’s central laboratories department, who added that another 1427 company workers that the patient could have come into contact with were also being quarantined in their homes for 14 days (watch, runtime: 7:14).

Qatar singling out Egypt? El Hadidi spoke by phone with Al Shorouk's Editor-in-Chief Emad El-Din Hussein, who questioned Qatar’s decision to place Egypt on a covid-19 watchlist, alongside China, Iran, Italy, and South Korea, among other countries (watch, runtime: 5:16).

Naeem chimes in on market performance: El Hadidi spoke by phone with Naeem Holding’s head of technical analysis Ibrahim Al Nimr, who said that the markets on Monday got off to a good start, but lost many of their gains by the end of the day due to covid-19 fears. (watch, runtime: 5:21). More on this in this morning’s Speed Round, below.

Will car prices spike? El Hadidi also spoke with the president of the Automobile Dealers Association, Osama Abu Al Magd, who said that the coming period will see a rise in the price of many cars in the local market because of the covid-19 outbreak. He added that not only Chinese cars will be impacted, but Korean and Japanese brands as well, in addition to the spare parts supply from the Chinese market. Abu Al Magd noted that several Asian brands have already suspended production of some of their assembly lines (watch, runtime: 15:49).

Speed Round

Speed Round is presented in association with

Egyptian stocks hold steady following Sunday’s rout: Egyptian equities stabilized yesterday as global markets rebounded from last week’s sell-off on hopes that central banks around the world will launch coordinated stimulus to mitigate against the economic fallout of the covid-19 virus. The EGX30 closed 0.55% in the green, led by a recovery in banking, healthcare and industrial stocks. CIB — which accounts for almost a third of the benchmark index — finished up 0.1%. The EGX30 suffered its worst day’s trading since 2012 on Sunday, falling more than 6% as investors reacted to the intensifying covid-19 crisis.

Trading was heavy with more than EGP 959 mn worth of shares changed hands, or around 63% more than the trailing 90-day average.

Foreign investors slowed the pace yesterday at which they were exiting EGP bonds, a domestic press report suggested. Investors offloaded EGP 4.1 bn worth of bonds on Sunday, but just EGP 297 mn worth yesterday, according to Mahmoud Naghlah, executive manager for fixed income at Al Ahly Financial Investment Management. Keeping this in perspective: That’s a rounding error in the context of the EGP 289 bn worth of total foreign bond holdings as of the end of January, the most recent period for which we have figures.

Amid the global risk-off, investors have been demanding higher yields at recent bond auctions: The CBE sold only half of the EGP 7.5 bn of three-year and seven-year treasury bonds in an auction yesterday amid investor pressure for higher yields. Investors bought just EGP 791 mn of the EGP 3.5 bn seven-year offering after the central bank accepted a yield of 13.979%, almost 300 bps beneath the rate targeted by investors. The EGP 4 bn three-year tranche was more than 2x oversubscribed, but the central bank sold EGP 3.189 bn at a 13.986% yield, more than 200 bps lower than investors’ target rate. This was the third consecutive auction the government has failed to sell its targeted amount after falling short in t-bill auctions on Thursday and Sunday.

EGP WATCH: The EGP eased one piaster against the USD yesterday to 15.59, off from a peak of 15.49 at the beginning of last week.

Global stocks rebound on stimulus hopes: US stocks surged yesterday on hopes that central banks around the world will launch coordinated monetary stimulus in response to the covid-19 outbreak. The Dow Jones jumped more than 5%, the S&P 500 rose 4.6% and the Nasdaq 4.5% as it emerged that G7 finance ministers and central bank governors would discuss on Tuesday how to respond to the crisis. The reaction in Europe was more muted, with the FTSE being the best performing major index rising 1.13%. Global stock markets suffered their worst week since the 2008 financial crisis last week as fears of the impact of the virus on corporate earnings and economic growth resulted in USD 7 tn being wiped from indices around the world.

Japan joins the US in signalling market intervention: The Bank of Japan yesterday hinted (pdf) that it may inject liquidity into markets and purchase assets to mitigate the economic impact of covid-19. The bank plans to “provide ample liquidity” to the markets and undertake “appropriate market operations and asset purchases,” it said. Federal Reserve Chairman Jerome Powell indicated last week that the central bank was prepared to act if the economy comes under pressure, saying in a statement that “we will use our tools and act as appropriate to support the economy.”

The markets may be happy, but it’s unclear what policymakers can do to defend against a supply shock: “The policy response is complicated by the fact that the economic shock caused by the virus affects both the supply- and the demand-side of the economy. There’s not much that monetary or fiscal policy stimulus can do to address the former,” Neil Shearing, chief economist at Capital Economics, wrote in a research note yesterday. “And it’s doubtful that it can do much to support demand in the very short term either, given the time it takes for looser policy to filter through to the real economy.”

Yields on US bonds continued to fall to new record lows, reflecting increasing investor confidence that central banks will embark on further monetary easing, according to the Wall Street Journal. The rate on the benchmark 10-year treasury fell to a record 1.085%, down from 1.127% on Friday.

Oil prices surged on hopes that the OPEC+ will agree new production cuts this week. Brent rose 6.34% to reach USD 52.82 per bbl and US crude gained 6.17% to USD 47.2. US crude fell 15% last week — its biggest weekly fall since 2008 — on fears that the outbreak would hit global demand. OPEC and its allies will meet in Vienna on 5-6 March to decide whether to deepen production cuts in an effort to support prices amid expectations that global demand will fall as economic growth stalls.

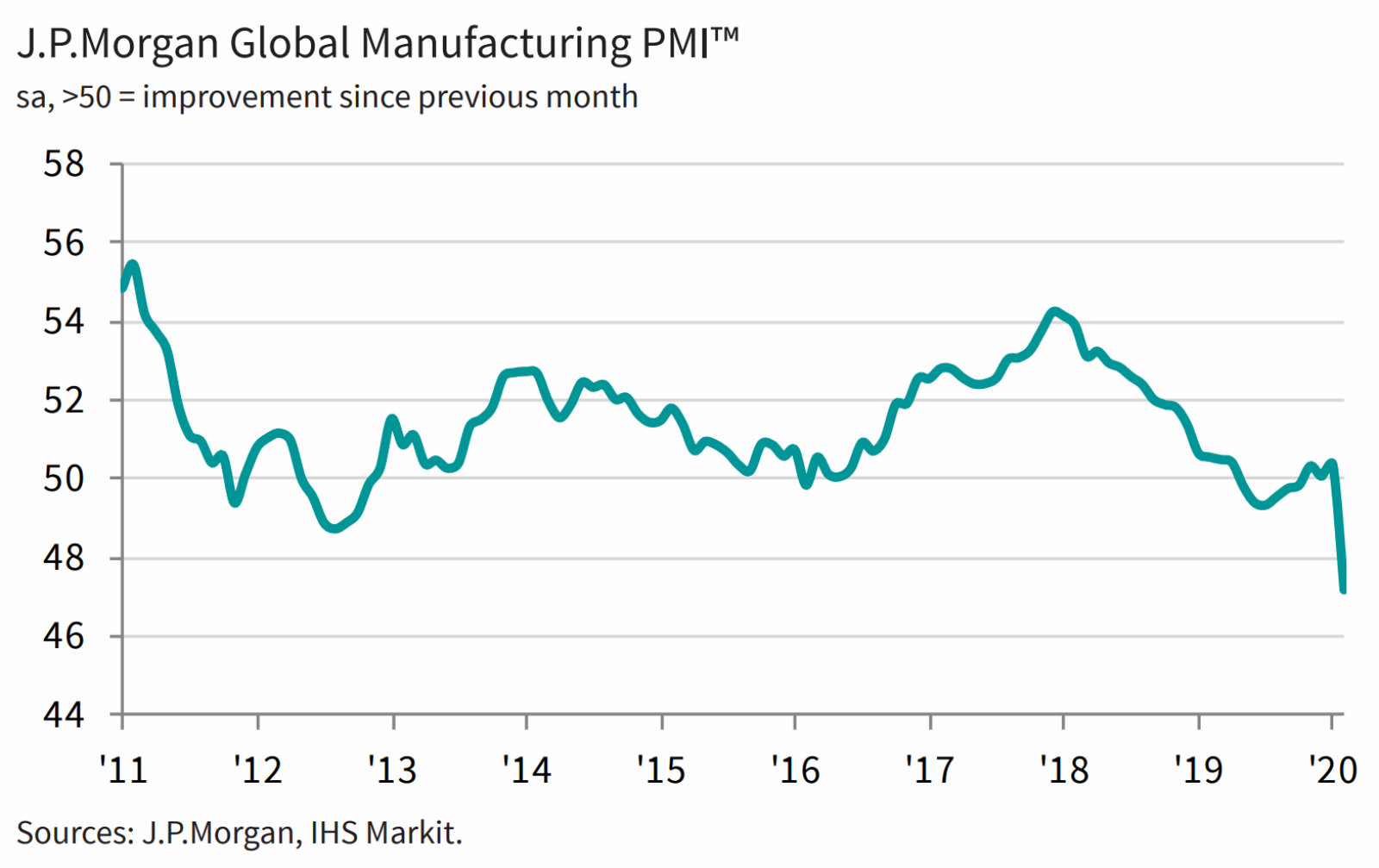

Global manufacturing PMI plummets at fastest pace since 2009: Falling demand and disruptions to global trade and supply chains caused global manufacturing activity to experience its sharpest monthly decline since 2009 in February, according to the JPMorgan Global Manufacturing PMI (pdf). The consumer, intermediate and investment goods sectors all saw output fall, while manufacturing production and new orders saw their steepest fall since April 2009.

OECD cuts global growth forecasts: Global GDP growth is likely to fall to 2.4% this year from 2.9% this year in the best case scenario that the outbreak peaks in China and is contained in the rest of the world, the Organisation for Economic Cooperation and Development (OECD) said in a report yesterday (pdf). In a “longer lasting and more intensive” outbreak, global growth could shrink to just 1.5%, just half of what the OECD had projected prior to the virus.

Capital inflows into emerging markets are suffering: Capital flows into EM securities fell to just USD 3.4 bn in February, down significantly from USD 29.5 bn in January, according to the Institute of International Finance’s (IIF) monthly capital flows tracker. Flows into EM debt fell 60% during the month to USD 13.2 bn while equities saw a net outflow of USD 9.8 bn, accelerating from USD -6.8 bn in January. “This is largely a result of the dramatic collapse of flows in the last one-and-a-half weeks, when the increasing spread of the coronavirus rattled global financial markets,” the IIF said.

Covid-19 has produced the biggest commodity demand shock since the 2009 global financial crisis, Goldman Sachs says, according to Bloomberg. The disruption of economic activity in China has resulted in an estimated 4 mn barrels of lost oil a day, compared to 5 mn barrels daily during the 2008 recession. Chinese activity is meant to ramp up in March, but even that might prove slow as companies restart supply chains.

EXCLUSIVE- A leading industry association is pushing for capital gains tax exemptions for stock market investors, according to proposals by the Egyptian Capital Markets Association (ECMA) seen by Enterprise. The ECMA is lobbying for both Egyptian and resident foreign investors to be exempted from capital gains taxes through May 2023, suggesting that the Finance Ministry postpone the introduction of the tax for another three years as part of a package of measures designed to attract investment and boost trading.

What is the ECMA proposing for capital gains? Egyptians and foreign residents would not become liable for capital gains tax until 1 May 2023, with the first period for the calculation of taxes due falling to tax season in April the following year. The starting point for the calculation of gains would be either price paid for the share or the share’s closing price on the day the law comes into effect, whichever is higher.

ECMA is recommending that foreign investors — as we heard last year — would be fully exempt from the capital gains tax. ECMA’s proposals would see foreign investors pay a reduced 0.1% stamp tax instead of 0.15% currently. Egyptians would be exempt entirely. Intraday transactions would also not be charged stamp tax.

Tax on dividends would be cut in half: A flat tax rate of 5% would be introduced on dividend income for both resident and non-resident shareholders, regardless of how much of the company they own. Shareholders currently pay a 10% withholding tax on dividend income, lowering to 5% for shareholders holding 25% or more of a company’s shares. If this applies equally to public and private companies, the community should cheer the proposal.

Background: A committee made up of the ministry, the Egyptian Tax Authority and the Egyptian Capital Market Association has been meeting for weeks to discuss the tax on stock market transactions. The ministry has also been closing in on finalizing draft amendments that will settle whether the capital gains tax will be making a comeback, after being shelved for three years in 2017 in favor of a provisional stamp tax.

Where’s this coming from? The proposals are likely the product of a meeting held last month between ECMA, the Federation of Egyptian Chambers of Commerce’s (FEDCOC) securities division and key stakeholders in the capital markets. Local press reported following the meeting that FEDCOC had invited capital market representatives to meet with the House Economic Committee within 45 days to discuss tax on stock market transactions.

The Finance Ministry is treading slowly given the impact of covid-19 on global markets. We had expected to hear something from the ministry last week after Minister Mohamed Maait said that he would publicise its EGX tax plans at the end of February. Government sources then told the press that the current turmoil in the markets may force the government to delay its plans.

M&A WATCH- Telecom Egypt looks like it’s really thinking about buying Vodafone Egypt: Telecom Egypt (TE) has asked its advisors, EFG Hermes and Citibank, to prepare a feasibility study and options to finance a transaction that would allow it to use its right of first refusal to acquire Vodafone Group's 55% stake in Vodafone Egypt, the local press reports, citing unnamed sources. The state-owned landline monopoly hasn’t made a final decision on the purchase, and offloading its 45% stake in Vodafone Egypt or maintaining its stake after Vodafone Group sells its stake to the Saudi Telecom Company (STC) are also still on the table, the sources noted.

Background: STC had signed a non-binding MoU to purchase Vodafone Group’s 55% stake in Vodafone Egypt in a USD 2.39 bn cash agreement in January. TE confirmed it has the right of first refusal to STC’s offer, giving it the right to make a counter offer. The Egyptian Competition Authority has also yet to rule whether TE exercising its right of first refusal would run afoul of the competition act, given it owns a mobile network operator in the form of We. TE was reportedly in the market for financing to make a bid for the majority stake, although the notion does seem a bit far-fetched given the company’s current debt burden and liquidity constraints.

Eni to export gas from Damietta LNG plant this year: Eni is looking to begin exporting natural gas from the Damietta LNG plant this year, the local press reports, citing an unnamed source at the Oil Ministry. The company is permitted to export production from its Zohr natural gas field after clearing with the Oil MInistry that it is not required for domestic consumption, the source said.

The Damietta plant is now expected to open in June following a seven-year hiatus: The Egyptian government last week reached a settlement with the facility’s majority shareholder Union Fenosa Gas (UFG), putting an end to a five-year legal dispute that arose after Egypt cut gas supplies in 2012. The agreement will see Spain’s Naturgy exit UFG — a joint venture with Eni that owned 80% of the facility — handing the Italian company an increased 50% stake and allowing it to begin exporting natural gas.

The Zohr field is on track to reach maximum production capacity this year after Eni begins operations at the field’s 15th well this month. Production at the field currently stands at 2.7 bcf/d after four wells in the field’s southern region were connected last November.

The government is considering a full customs exemption on imports of auto components: The Trade Ministry could grant a full customs exemption on imports of auto components as part of its strategy to incentivize local manufacturers, the local press reports, citing unnamed government sources. Nissan and Toyota requested earlier this year that the government exempt them from paying customs on imported parts, asking that they receive the same benefits provided to other companies from other countries covered by trade agreements.

This apparently is just one proposal on the table for the government’s long-gestating strategy to help local manufacturers, who have long complained that they are unable to compete with imported zero-customs European vehicles. The ministry is reportedly also considering reducing customs on all cars to 10% in addition to the 30-125% development fees. We were told last summer that the cabinet had settled on a plan that would have reduced customs for companies to 5.6-20%, depending on the percentage of local content used.

The ministry is planning to finalize the strategy within the coming weeks before sending to cabinet for review, the sources said.

LEGISLATION WATCH- House committee approves amendments to Anti-Money Laundering Act: The House Constitutional and Legislative Affairs Committee approved on Monday several amendments to the Anti-Money Laundering Act that widen the scope of money laundering to include selling and smuggling of oil, natural resources, securities and cryptocurrency, among others other assets, Ahram Online reports. They would also empower the Money Laundering and Terrorist Financing Combating Unit to expedite freezing assets, and require cooperation between relevant authorities and the publishing of up-to-date reports. A seven-year prison sentence and hefty fines will be imposed on those caught laundering any of these assets.

The amendments appear to be part of a wider effort to crack down on terror financing. The House last month approved proposed amendments to the Anti-Terrorism Act that expanded the definition of terrorist financing, coming at a time when Egypt’s legal framework against money laundering and funding terrorism was subject to a review by the the Middle East and North Africa Financial Action Task Force.

Gov’t mulls automating Egypt’s ports to streamline customs procedures: The Finance Ministry is looking at potentially using ACI pre-registration systems at Egypt’s ports in a bid to cut red tape and streamline customs procedures, according to a cabinet statement. The new system, which would reduce the time needed for customs procedures to a maximum of three days, would create an online portal allowing customers to follow the status of their shipments. The news comes as Chinese goods have been piling up at Egypt’s ports as a result of manual paperwork delays that exporters in China have left unfulfilled in the aftermath of the coronavirus outbreak that has stalled much economic and business activity globally.

Other customs updates: The ministry has set up a specialized committee to create a unified set of customs procedures, and has created a customs fast-track for pharma, industrial inputs, and transit ships. The government has also established a one-stop shop system for customs in several airports and seaports, according to the statement. This comes as the Customs Act — which would expedite clearance through a white list of importers, among other things — is currently with the House of Representatives and expected to come into effect in 1H2020.

Egypt’s universal health coverage suggests there’s plenty of untapped potential in the country’s healthcare and pharma sectors, Renaissance Capital said in a report yesterday (pdf). As it currently stands, Egypt’s healthcare spending per capita falls far below the majority of its emerging market peers, coming in at USD 106 in 2017. “This is 10x lower than the average spent in the UAE and Kuwait of USD 1,350 and c. USD 1,500, respectively, and well below the OECD average of USD 4k,” the report says. Per capita pharma sales in Egypt (USD 54 in 2018) also fall below the MENA regional average of USD 160, RenCap says.

The program is up and running (albeit not without expected kinks) in Port Said, where the government decided to pilot the new system in July, according to the report.

How the private sector plays into all this: Private service providers, including pharmacies, diagnostics service providers, and pharma manufacturers, are all open to register with the government to provide their services under the program’s umbrella in exchange for an enrolment fee. Diagnostics service providers — including Alfa Lab, Astra Lab, and Integrated Diagnostics’ Alborg and Al Mokhtabar — have already enrolled their Port Said branches, while private pharmacies appear to still be planning to register soon.

What’s unclear so far is what will happen to private sector insurance players once the new system is fully rolled out, the investment bank says. The system is “expected to shake up Egypt’s entire private health insurance system,” but it remains to be seen whether the private sector will still have a role to play once the system covers all governorates by 2032.

EARNINGS WATCH- Emaar Misr's profits halve in 2019: Emaar Misr profits fell by 49% to EGP 1.74 bn in 2019, down from EGP 3.42 bn in 2018, according to a regulatory filing. The company's revenues declined by 13.7% to EGP 5.57 bn in 2019 from EGP 6.3 bn in 2018.

Egypt in the News

Leading the conversation in the foreign press this morning: The Cairo Criminal Court confirmed terrorist and former military officer Hisham El Ashmawy’s death sentence for carrying out 54 assassinations of security personnel and citizens. Another 36 defendants were also sentenced to death. This is the second death sentence for Ashmawy, after a similar verdict in November last year. The special forces officer-turned-terrorist was captured in Derna in 2018 by troops commanded by Libyan National Army chief Gen. Khalifa Haftar, and was brought back to Egypt in May. Amnesty International is calling on the courts to reverse its decision to execute the defendants (AP | The National | Times of Israel | Asharq Alawsat).

Diplomacy + Foreign Trade

Deputy speaker accuses Ethiopia of GERD “conspiracies: Deputy House Speaker Soliman Wahdan condemned what he described as “Ethiopia’s conspiracies” after the country’s representatives did not attend the latest round of US-sponsored mediation talks in Washington, DC on 27-28 February, Ahram Online reports. He said the absence was a ploy to fill the reservoir of the Grand Ethiopian Renaissance Dam (GERD) before talks on the filing schedule were finalized, and showed Ethiopia’s “malicious intentions” toward the countries downstream of the Nile, Egypt and Sudan.

Energy

Schneider Electric signs agreement with gov’t to build power control centers

Schneider Electric has signed an agreement with the Electricity Ministry to build power control centers for Egypt’s electricity grid, an Ittihadiya statement said. President Abdel-Fattah El-Sisi met with SE’s Executive Vice President for International Operations Luc Remont on Sunday to discuss the agreement. The statement did not specify how many control centers would be built or a timeframe. The ministry launched at the end of January a tender for five power control centers in the Alexandria, Upper Egypt, Suez Canal and Greater Cairo areas. Competing companies at the time included General Electric, Siemens, ABB, Schneider Electric and China’s State Grid Corporation. The project will be financed by the Egyptian Electricity Holding Company using a portion of a EGP 19 bn loan it acquired in 2017 from a banking consortium led by the National Bank of Egypt and Banque Misr.

Infrastructure

IMF officials met with Port Authority to discuss public private partnerships

General Authority for Ports and Dry Land Chairman Amr Ismail met with an IMF delegation to discuss progress in public-private partnerships in port development projects, reports the local press. The authority is looking to issue new tenders for ports in Beni Suef, Tenth of Ramadan, Borg El Arab, Damietta, and Sadat City, Ismail said.

Basic Materials + Commodities

Egypt to produce 9.5 mn tonnes of wheat this season

Egypt is looking to produce 9.5 mn tonnes of wheat this season, with 3.5 mn allocated for subsidized bread, Agriculture Ministry official Abbas Al Shennawi told Reuters. The ministry said last week Egypt had planted 3.4 mn feddans of wheat this season, up from 3.18 mn in 2019-2020.

Tourism

Sawiris looks to participate in developing services at Egypt’s Pyramids plateau

Tourism Minister Khaled El Anany met with businessman Naguib Sawiris to discuss developing services at the Giza Pyramids Plateau, including providing electric vehicles for transport, mobile toilets, and fast food vendors to the area, according to Al Mal.

Automotive + Transportation

Uber may launch “Uber For Government” services for Egypt’s new capital

Uber is considering launching Uber for Government, a new service that would specifically serve civil servants looking for transportation to and from the new administrative capital, according to a statement (pdf). The ride-hailing giant is also looking to expand its services to the new capital, Uber Egypt Director Ahmed Khalil and North African Policies Director Ahmed Ali told Planning and Economic Development Minister Hala El Said at a meeting on Friday.

Banking + Finance

EFG Hermes’ ValU partners with PayFort to offer installment option for e-commerce

EFG Hermes’ installment payment solutions app ValU has partnered with Amazon’s PayFort to offer payment plans to e-commerce stores and Egyptian online shoppers, according to Startup Magazine. The new service provides valU customers with installment options of up to 60 months for their online purchases. The service will be rolled out for existing valU customers in the first phase, with these customers set to receive instant credit decisions once they deliver the required documents to valU. Unbanked customers will receive feedback within two days. The service will expand to cover non-valU customers in a later phase.

Other Business News of Note

Palm Hills Egypt board approves purchase of 62 mn treasury stocks

Palm Hills Development’s (PHD) board of directors approved the purchase of 62.351 mn treasury stocks to hedge against the "unjustified" drop in the company's stock price on the Egyptian Exchange (EGX), according to a regulatory filing (pdf). The decision comes one day after the Financial Regulatory Authority introduced a new temporary rule that enables listed companies to purchase treasury stocks without notifying the EGX three days in advance. PHD said it plans to issue EGP 1.2 bn of securitized bonds in 2020 to help finance its ongoing construction projects, according to the local press. The company had closed a EGP 776 mn securitized bond backed by a portfolio of 582 delivered units at 11 of the real estate company’s developments, last year, to bring its total issuances to EGP 2.4 bn.

Law

ALC is advising ITDA on company that will manage Egypt’s commodity exchange

Our friends at ALC Alieldean Weshahi & Partners are advising the Supply Ministry’s Internal Trade Development Authority (ITDA) on the establishment of the company that will manage the Egyptian Commodity Exchange, the local press reported. Company shareholders will include ITDA, the General Authority for Supply Commodities, the Holding Company for Silos and Storage, and the Egyptian Exchange. The exchange is expected to launch between August and November of this year, or by January 2021, ITDA head Ibrahim El Ashmawy had previously said.

On Your Way Out

Giza Zoo’s Eiffel Bridge is coming back to life: Egypt and France have signed an agreement to restore the 150-year-old Eiffel Bridge in the Giza Zoo, which was designed in the late 1800s by French architect Gustave Eiffel, Agriculture Ministry spokesman Mohamed El Karsh told Ahram Online. The bridge has been closed since the 1990s after requiring repairs, and will be open to the public again once the renovation works are completed. El Karsh did not provide an expected timeline.

The Market Yesterday

EGP / USD CBE market average: Buy 15.59 | Sell 15.69

EGP / USD at CIB: Buy 15.59 | Sell 15.69

EGP / USD at NBE: Buy 15.60 | Sell 15.70

EGX30 (Monday): 12,290 (+0.6%)

Turnover: EGP 959 mn (63% above the 90-day average)

EGX 30 year-to-date: -11.97%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.6%. CIB, the index’s heaviest constituent, ended up 0.1%. EGX30’s top performing constituents were Egypt Kuwait Holding up 7.1%, Cleopatra Hospital up 4.6%, and Porto Group up 3.4%. Yesterday’s worst performing stocks were Qalaa Holdings down 5.4%, Heliopolis Housing down 5.0% and Kima down 4.5%. The market turnover was EGP 959 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -8.4 mn

Regional: Net short | EGP -19.9 mn

Domestic: Net long | EGP +28.4 mn

Retail: 42.9% of total trades | 45.0% of buyers | 40.7% of sellers

Institutions: 57.1% of total trades | 55.0% of buyers | 59.3% of sellers

WTI: USD 47.52 (+6.17%)

Brent: USD 52.82 (+6.34%)

Natural Gas (Nymex, futures prices) USD 1.76 MMBtu, (+4.33%, April 2020 contract)

Gold: USD 1,590 / troy ounce (+1.50%)

TASI: 7,349 (+0.06%) (YTD: -12.40%)

ADX: 4,763 (+0.84%) (YTD: -6.15%)

DFM: 2,536 (+2.54%) (YTD: -8.25%)

KSE Premier Market: 6,370 (+6.34%)

QE: 9,215 (-2.89%) (YTD: -11.60%)

MSM: 4,081 (0.00%) (YTD: +2.51%)

BB: 1,640 (+2.27%) (YTD: +1.91%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit

3 March (Tuesday): Business Today’s bt100 awards ceremony, Cairo.

4-5 March (Wednesday-Thursday): Women Economic Forum, Cairo.

5-8 March (Wednesday-Saturday): 25 Egyptian companies will participate in a forum on investment in startups in Saudi’s King Abdullah Economic City.

6-8 March (Friday-Sunday): Arab Banking Forum, for heads of risk management in Arab banks, organized by the Union of Arab Banks,with the Central Bank of Egypt and the Federation of Egyptian Banks.

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21-22 March (Saturday-Sunday): An international conference to market investment prospects in the Suez Canal Economic Zone, Al Galala City, Egypt

24 March (Tuesday): The Annual Export Summit, Cairo, Egypt

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

9 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.