Global stocks rebound on stimulus hopes

Global stocks rebound on stimulus hopes: US stocks surged yesterday on hopes that central banks around the world will launch coordinated monetary stimulus in response to the covid-19 outbreak. The Dow Jones jumped more than 5%, the S&P 500 rose 4.6% and the Nasdaq 4.5% as it emerged that G7 finance ministers and central bank governors would discuss on Tuesday how to respond to the crisis. The reaction in Europe was more muted, with the FTSE being the best performing major index rising 1.13%. Global stock markets suffered their worst week since the 2008 financial crisis last week as fears of the impact of the virus on corporate earnings and economic growth resulted in USD 7 tn being wiped from indices around the world.

Japan joins the US in signalling market intervention: The Bank of Japan yesterday hinted (pdf) that it may inject liquidity into markets and purchase assets to mitigate the economic impact of covid-19. The bank plans to “provide ample liquidity” to the markets and undertake “appropriate market operations and asset purchases,” it said. Federal Reserve Chairman Jerome Powell indicated last week that the central bank was prepared to act if the economy comes under pressure, saying in a statement that “we will use our tools and act as appropriate to support the economy.”

The markets may be happy, but it’s unclear what policymakers can do to defend against a supply shock: “The policy response is complicated by the fact that the economic shock caused by the virus affects both the supply- and the demand-side of the economy. There’s not much that monetary or fiscal policy stimulus can do to address the former,” Neil Shearing, chief economist at Capital Economics, wrote in a research note yesterday. “And it’s doubtful that it can do much to support demand in the very short term either, given the time it takes for looser policy to filter through to the real economy.”

Yields on US bonds continued to fall to new record lows, reflecting increasing investor confidence that central banks will embark on further monetary easing, according to the Wall Street Journal. The rate on the benchmark 10-year treasury fell to a record 1.085%, down from 1.127% on Friday.

Oil prices surged on hopes that the OPEC+ will agree new production cuts this week. Brent rose 6.34% to reach USD 52.82 per bbl and US crude gained 6.17% to USD 47.2. US crude fell 15% last week — its biggest weekly fall since 2008 — on fears that the outbreak would hit global demand. OPEC and its allies will meet in Vienna on 5-6 March to decide whether to deepen production cuts in an effort to support prices amid expectations that global demand will fall as economic growth stalls.

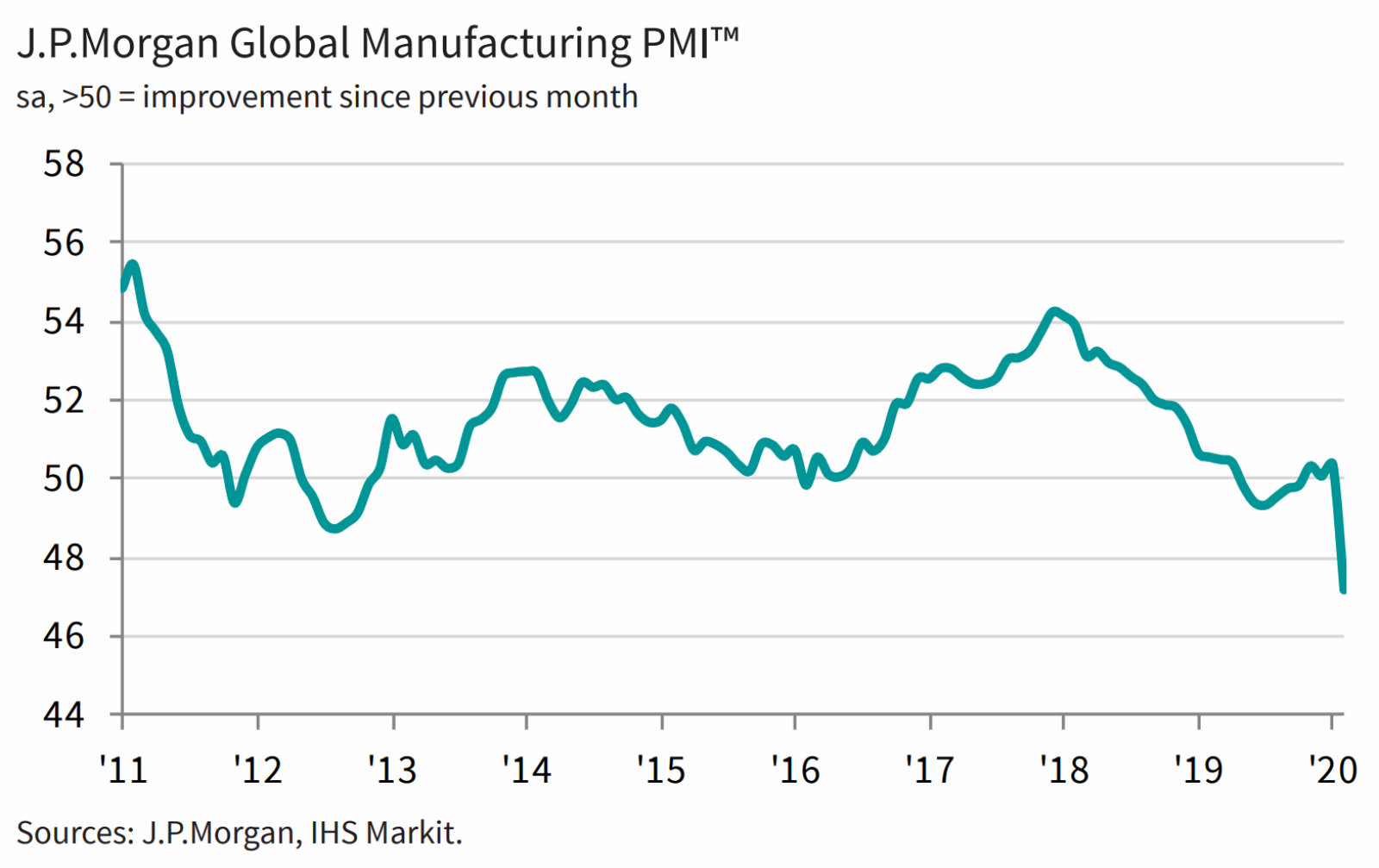

Global manufacturing PMI plummets at fastest pace since 2009: Falling demand and disruptions to global trade and supply chains caused global manufacturing activity to experience its sharpest monthly decline since 2009 in February, according to the JPMorgan Global Manufacturing PMI (pdf). The consumer, intermediate and investment goods sectors all saw output fall, while manufacturing production and new orders saw their steepest fall since April 2009.

OECD cuts global growth forecasts: Global GDP growth is likely to fall to 2.4% this year from 2.9% this year in the best case scenario that the outbreak peaks in China and is contained in the rest of the world, the Organisation for Economic Cooperation and Development (OECD) said in a report yesterday (pdf). In a “longer lasting and more intensive” outbreak, global growth could shrink to just 1.5%, just half of what the OECD had projected prior to the virus.

Capital inflows into emerging markets are suffering: Capital flows into EM securities fell to just USD 3.4 bn in February, down significantly from USD 29.5 bn in January, according to the Institute of International Finance’s (IIF) monthly capital flows tracker. Flows into EM debt fell 60% during the month to USD 13.2 bn while equities saw a net outflow of USD 9.8 bn, accelerating from USD -6.8 bn in January. “This is largely a result of the dramatic collapse of flows in the last one-and-a-half weeks, when the increasing spread of the coronavirus rattled global financial markets,” the IIF said.

Covid-19 has produced the biggest commodity demand shock since the 2009 global financial crisis, Goldman Sachs says, according to Bloomberg. The disruption of economic activity in China has resulted in an estimated 4 mn barrels of lost oil a day, compared to 5 mn barrels daily during the 2008 recession. Chinese activity is meant to ramp up in March, but even that might prove slow as companies restart supply chains.