- EGX30 worst one-day drop since 2012 as covid-19 outbreak hits Middle East stocks. (Speed Round)

- There’s a second case of covid-19 in Egypt. (What We’re Tracking Today)

- FRA suspends three-day notice requirement for treasury stock purchases. (Speed Round)

- FinMin creates single budget for income tax, VAT arms of Tax Authority. (Speed Round)

- Delivery logistics company iMile to expand into Egypt following USD 10 mn pre-series A. (Speed Round)

- GERD talks hanging by a thread as Egypt, Ethiopia ratchet up the rhetoric. (Speed Round)

- Education is so far proving resistant to the corona-induced market meltdown. (Blackboard)

- The Market Yesterday

Monday, 2 March 2020

Egypt has second covid-19 case and the EGX has had its worst day since 2012

TL;DR

What We’re Tracking Today

Egypt has its second known case of covid-19 this morning, the Health Ministry and World Health Organization said in a joint statement in the early hours of this morning. The individual was taken to a quarantine centre after displaying “basic symptoms” but his condition was stable and being monitored, the statement said.

Health Ministry sources said the patient is a 54-year-old Canadian citizen working as an oil engineer at an undisclosed oil company in the country’s northwest, Al Shorouk reported. He came to Egypt from Canada two weeks ago, transiting at an undisclosed airport in Europe, the sources said. They added that he tested positive for covid-19 on Saturday, but his colleagues tested negative after inspection.

The only other known case of the virus in Egypt has made a full recovery and has been discharged from hospital, the ministry said over the weekend.

The EGX’s resistance in the face of the covid-19 selloff ended yesterday as the bourse suffered its worst one-day loss in almost eight years as markets across the region were hit by the waves of selling rippling through global markets. The benchmark EGX30 closed down 6% — its sharpest single-day decline since 2012 — as investors fled dumped equities on the back of plunging oil prices and a spate of new covid-19 cases across the region. We have chapter and verse in this morning’s Speed Round, below.

The question of the day: Will markets take a breather? Markets in China, Japan, Hong Kong and South Korea — all hammered by covid-19 so far — were up substantially in early trading this morning before our dispatch deadline. And futures suggest European and US shares could also open in the green, although somewhat more tepidly than Asian markets.

Egyptian pharma companies are looking at how to address looming supply chain shortages as they face import delays in raw materials from China used to manufacture meds, Al Shorouk reports. Around 40% of Egypt’s locally manufactured meds depend on materials shipped from China and the slowdown in trade has prompted manufacturers to scramble in search of alternatives. The head of the meds division at the Egyptian Chamber of Commerce, Ali Ouf, cautioned against panic, saying that the government has six months worth of raw materials in reserves but that private sector players are still working out plans to establish alternative supply chains.

Qatar has introduced new entry restrictions on visitors travelling from Egypt in a bid to insulate itself from the virus, Reuters reported, citing the country’s state news agency. Qatar confirmed another two cases yesterday, bringing its total to three.

It’s unclear whether Kuwait has done the same. The Gulf country has reportedly suspended issuance of new visas until further notice, Kuwaiti outlet Al Qabas reports, citing unnamed security officials. The decision includes all types of visas, including business visas, but allows Egyptians in Kuwait to return home freely, the newspaper reports. Egypt has been placed by Kuwait on a watchlist that includes Iraq, Iran, Thailand, the Koreas, Itay, China and Hong Kong, the sources said.

But Lamees El Hadidi reported last night that there have been no official reports of a visa suspension (watch, runtime: 4:35). The night-time talk show host spoke by phone with Abd El Mohsen Al Harby, Al-Hadth’s reporter in Kuwait, who did note that Kuwait’s Health Ministry was taking precautionary measures towards those arriving from Egypt and that anyone with a high temperature was being quarantined for 14 days.

Health Minister Hala Zayed is en route to China: The minister will travel with a consignment of medical supplies as a gesture of goodwill to the Chinese government, Al Masry Al Youm reported.

Covid-19 fears in the Middle East are slowing down regional travel. Tourist destinations and pilgrimage hubs have resorted to stringent precautionary measures to quell the spread of coronavirus, meaning less travel to some deeply revered religious sites, Bloomberg reports. Emirates airlines has encouraged employees to take time off in light of the slowdown in global travel and has stopped travel to most Chinese destinations and Iran, the center of the coronavirus outbreak in the Middle East. The company has also paused flights from 20 countries to Saudi Arabia, which has begun taking its own steps to reduce exposure to the virus by barring entrance of all umrah visa holders from countries where cases of coronavirus have been documented.

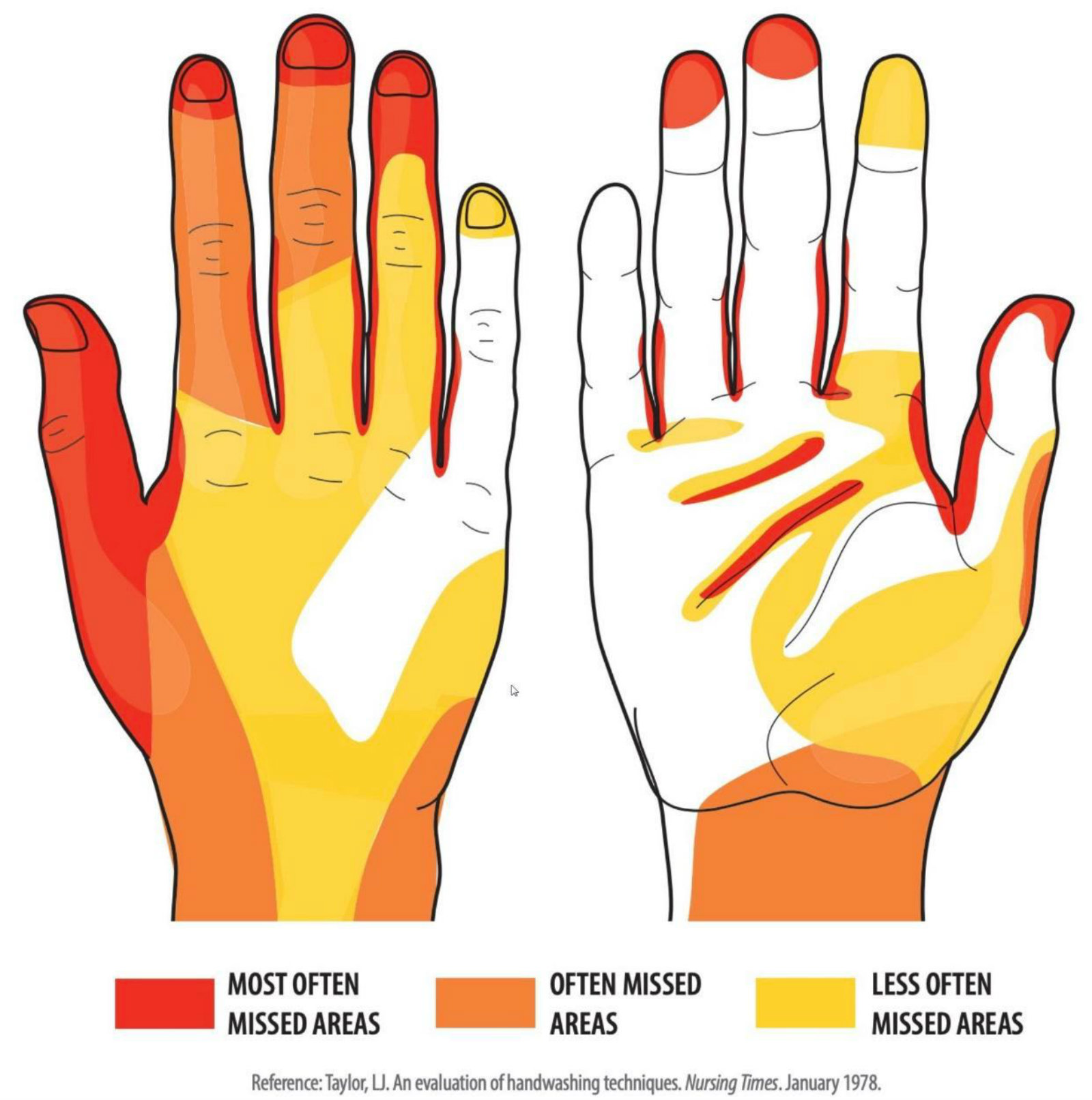

What’s the best thing you can do to keep yourself, your family and your business safe from covid-19? It’s not a mask — it’s washing your hands properly (take a look below to see where we all cut corners), particularly with soap, which nukes the membrane that holds coronaviruses together. Tap or click the image below for the US Center for Disease Control’s instructions.

Emerging markets have to pray for central bank action: Large-scale monetary and fiscal stimulus may be the only thing that can slow the declines in EM equities and bonds, which saw more than USD 1.1 tn in outflows last week as investors fled for safe haven assets. “The week will start horrible, but may improve on central-bank pivots, with a coordinated G-20 fiscal pump not out of the question,” Stephen Innes, chief market strategist at Axicorp, tells Bloomberg. “Given the tightening of financial conditions due to the stock-market meltdown, the US Federal Reserve will deliver to weaken the USD. If none of this works, just pray.”

News triggers to keep your eye on:

- PMI figures for Egypt, Saudi Arabia and the UAE will land tomorrow.

- Foreign reserves figures for February will be released on Wednesday, 4 March.

- Inflation figures for February are out next Tuesday, 10 March.

Coming up this week:

- Business Today’s bt100 awards ceremony (pdf) takes place tomorrow.

- The two-day Women Economic Forum (pdf) gets underway on Wednesday, 4 March in Cairo.

- The Union of Arab Banks will hold a three-day forum for risk officers on 6-8 March in Hurghada.

- A one-day investment conference for the Suez Canal Economic Zone will take place on Saturday, 21 March.

Mubadala eyes potential investment in NMC Health: Abu Dhabi’s sovereign wealth fund Mubadala is looking at potentially investing in troubled LSE-listed NMC Health as the company grapples with allegations of financial wrongdoing, Bloomberg reports. Short seller Muddy Waters alleged last year that the company’s “financial statements hint at potential overpayment for assets, inflated cash balances and understated debt.” NMC, the Middle East’s largest healthcare provider, has denied the allegations, but the company’s shares have been “on a freefall” since Muddy Waters’ report, Bloomberg notes. The UK’s Financial Conduct Authority has launched an official investigation into the claims, according to the Guardian.

After nearly two decades, US and Taliban agree to end Afghanistan war: The US and the Taliban signed a peace accord on Saturday that will see the US and its allies pull all their troops from Afghanistan within 14 months, according to AFP. The accord is contingent on the Taliban opening a dialogue with the Kabul government in the hope that the two can reach a power-sharing agreement, although the US-backed government was “conspicuously excluded” from Washington’s negotiations with the militant group, the New York Times notes.

List of contenders vying for US Democratic nomination shrinks to six ahead of crucial Super Tuesday vote: South Bend mayor Pete Buttigieg and bn’naire hedge fund manager Tom Steyer have withdrawn from the race for the Democratic nomination, two days before 14 states go to the polls on Super Tuesday. Buttigieg performed well in the early states — coming joint-first in Iowa and second in New Hampshire — but proved unable to build support among minorities, and came a distant fourth place in the majority African-American state of South Carolina in Saturday’s primary. Steyer — always a long-shot for the nomination — poured USD 191 mn into campaign ads across the country yet failed to win a single delegate in the first four states.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: Education has so far proven that it is, indeed, a defensive sector in the face of the covid-19 meltdown. Clear communication with investors and contingency planning now are key for that to continue, insiders say.

Enterprise+: Last Night’s Talk Shows

The fraught state of the GERD negotiations and the latest on covid-19 held the attention of the nation’s talking heads for the second night running.

Foreign Minister holds fast against Ethiopia: Al Kahera Alaan’s Lamees El Hadidi spoke by phone with Foreign Minister Sameh Shoukry, who discussed Ethiopia’s absence from the latest round of talks on the Grand Ethiopian Renaissance Dam (GERD) in Washington, DC (watch, runtime: 6:28). Shoukry said that if Ethiopia continued to fill the dam’s reservoir, — and it had signaled its intention to do so repeatedly this year — it would be in breach of the 2015 Declaration of Principles. He said that extensions are being discussed to allow for a final agreement on the dam’s filling.

Former irrigation minister lauds Egypt, berates Ethiopia: El Hadidi also spoke by phone with former Water Resources Minister Mohamed Nasr Eddin Allam, who said that Egypt had achieved “remarkable progress in internationalizing” the GERD talks (watch, runtime: 4:28). He added that “it showed the extent of Ethiopian intransigence that Egypt has suffered since 2011,” and that Ethiopia's absence from the latest round of talks showed a disrespect for their sponsors, the US and the World Bank. Allam said that Ethiopia was “wasting time” to leave Egypt with few options, but that wasn't in its favor as Egypt has “many tools” to pressure Ethiopia.

Ethiopia urged to sign draft pact: El Hekaya’s Amr Adib read out the Foreign Ministry's Sunday statement which voiced dissatisfaction with Ethiopia’s position. He then phoned Shoukry (watch, runtime: 2:09) who said that Egypt signed the draft agreement because it was “fair for all parties” and encouraged Ethiopia to sign on to it (watch, runtime: 2:05).

Call for punitive measures against Ethiopia: Masaa DMC's Eman El Hosary phoned Amany Al Tawil, director of the Al Ahram Center for Political and Strategic Studies, who said that Egypt's signing of the draft GERD agreement was a “professional measure” to indicate that Ethiopia had already previously agreed to its principles (watch, runtime: 9:56). Al Tawil said that Ethiopia is hoping to fill the dam’s reservoir before a final agreement is reached, “presenting Egypt with a fait accompli, which Cairo rejects.” She called for punitive measures against Ethiopia, which she said had shown “disrespect to the other parties” and “lost credibility.” We have more on GERD in this morning’s Speed Round, below.

Adib offers assurances on China, Kuwait: El Hekaya’s Amr Adib went over viewer’s criticisms of Health Ministry’s Hala Zayed visit to China and urged calm (watch, runtime: 3:15). He said it was “clearly a measure by the state to demonstrate solidarity” and showed images of the Chinese flag projected onto historical buildings such as the Citadel. (watch, runtime: 1:49). Adib also noted that his show had contacted the Kuwaiti embassy in Egypt and that they were assured that there were no instructions to stop issuing visas to Egyptians (watch, runtime: 4:07).

Qatar rebuked for banning Egyptians: Min Masr's Amr Khalil and Reham Ibrahim criticized Qatar for banning Egyptians from entering the country (watch, runtime: 6:35). Khalil noted that while Qatar had imposed the restrictions on Egyptians it was still welcoming flights from countries that have announced positive cases like France and Italy.

Speed Round

Speed Round is presented in association with

EGX30 suffers worst day’s trading since 2012 as covid-19 outbreak hits Middle East stocks: The benchmark EGX30 index tumbled a bit more than 6% yesterday in its worst showing since 2012 as the spread of the covid-19 virus drove down oil prices and investors caught up with the Friday selldown in other markets. CIB, the index heavyweight, dropped 5.3% during the day and the wider EGX100 closed down 5.4%. Trading was halted for half an hour at 12:35 CLT after the market dropped more than 5%, triggering circuit breakers for the first time since last September.

From bad to worse: The EGX is coming off a poor February which saw the index fall 6% over the month. Most sectors finished in the red at the end of last week, making the index the fifth worst performer in the region, according to a note from Shuaa.

The EGX wasn’t the only MENA market to take a beating: Plummeting oil prices spooked investors and caused them to dump stocks in the oil-rich Gulf states. Kuwait’s index was the hardest hit, falling 11% after a three-day holiday last week. The Dubai index shed 4.5%, the Saudi Tadawul fell 3.7%, and the Abu Dhabi and Bahraini indices both dropped by more than 3%. Saudi Aramco shares finished 2.1% in the red, bringing the oil giant’s share price to its lowest level since its December IPO. Bloomberg has more.

Oil markets suffered their worst week since 2008 last week, with US crude plunging more than 15% to USD 45.25 per bbl and Brent falling 14.3% to USD 50.

Yesterday’s market turmoil came after global stock markets turned in their worst week since the 2008 financial crisis. Around USD 7 tn was wiped from markets around the world last week, with US indices alone losing USD 4.3 tn.

A prolonged international crisis over covid-19 threatens more than just Egyptian stock prices: Trade and supply chain disruptions, market turbulence and building economic uncertainty threaten to hit vital sources of government revenue and put pressure on its current account position. “All sources of hard currency, including revenues from the Suez Canal and tourism, and inflows from portfolio investment, will be affected by the decline in global trade,” Radwa El Swaify, head of research at Pharos, told Enterprise. “Even transfers from abroad will be hit, especially from Gulf countries due to the decline in oil prices.”

EGP reverses recent gains: The EGP continued to ease against the greenback yesterday, all but erasing gains seen in the week leading up to last month’s MPC meeting. The currency fell another 2 piasters yesterday to EGP 15.58/USD, continuing a slide that has seen it fall from a peak of 15.49 on 23 February. The trend could continue if portfolio investors trim their holdings of Egyptian treasuries and flee to safe haven assets, El Swaify says.

Government bond auction receives lukewarm response from investors: The Central Bank of Egypt sold less than half of the EGP 14.5 bn of three-month and nine-month treasury bills offered in an auction yesterday, official data shows. Investors bought just EGP 45 mn of three-month t-bills from the EGP 4 bn on offer after the central bank accepted a yield of 12.98%, almost 150 bps lower than the rate targeted by investors. Appetite for the higher-yielding nine-month tranche more than doubled the EGP 10.5 bn on offer, but the central bank sold only EGP 7.2 bn after offering an average 14.44% yield, below the 14.61% rate requested by investors. This is the second consecutive auction the government has failed to sell the targeted amount after falling short in last Thursday’s auction of six-month and one-year bills.

Analysts are going to be rethinking their interest rate forecasts: Analysts who spoke to Enterprise all agreed that any plans the CBE might have had to cut interest rates at the next MPC meeting in April will likely be taken off the table. Portfolio outflows could gather pace if the global equity selloff continues this week, and a rate cut next month could push more bondholders to liquidate their positions, increasing pressure on the government’s fiscal position, El Swaify said. Indeed, the central bank could even look at a rate hike to leave Egypt as attractive as possible to the carry trade, said Hany Genena, head of research at Prime Holding.

The silver lining: Plummeting oil prices will help to ease the pressure on the state’s finances in the event of a shortfall in revenues.

Government stimulus on the way? “The Finance Ministry will resort to some financial policies to support the economy without putting pressure on the state budget, provided that the CBE will resume using its tools immediately after the situation stabilizes by reducing interest rates,” Genena said. Shuaa’s Amr El Alfy said the government should move to soften the blow for the industrial sector by reviewing gas prices.

Or maybe not? A government official told the local press yesterday that it is not yet considering a stimulus package and will wait to assess the effects of the CBE’s recent multi-bn EGP initiatives to support the manufacturing and tourism sectors. Sources said that the Planning Ministry is evaluating whether fears over covid-19 will impact its growth forecasts, which see the economy growing at a 6% clip during the current fiscal year.

Does our fate rest in the hands of the Fed? Genena said that the extent to which the virus impacts the Egyptian economy will in large part be determined by the trajectory of the US economy and the decisions made by monetary policymakers in Washington. “The Fed hinted at the possibility of cutting interest rates faster than expected to stimulate the economy, and if the US economy remains stable, global growth and the rate of growth in Egypt will be kept safe,” he told Enterprise. “If the US is affected, we will be facing a global economic crisis.”

REGULATION WATCH- Market regulator suspends three-day notice requirement for listed companies’ treasury stock purchases: The Financial Regulatory Authority (FRA) introduced a new temporary rule that will allow EGX-listed companies looking to purchase treasury stocks to notify the bourse on the same day they plan to buy the stocks, instead of three days in advance, according to an official statement. The new rule bars majority shareholders from engaging in the sale. The FRA said that the decision is meant to boost trading and hedge against turbulence in the equity markets (see above). The market regulator did not specify how long this measure will be in place.

What exactly are treasury stocks? These are shares that a company had sold on the open market and then bought back from stockholders. Companies usually buy back these shares to reduce their exposure on the open market, which also reduces the chances of a hostile takeover. Holders of treasury stocks do not have voting rights.

Egypt Kuwait Holding was the first to jump on the wagon, announcing in an EGX filing (pdf) yesterday that it will buy USD 20 mn of treasury stocks yesterday.

The Finance Ministry has started implementing a single budget for the Tax Authority’s departments for income tax and VAT as part of the new unified tax law, according to a ministry statement (pdf). Minister Mohamed Maait said the effort had begun in FY2019-2020 by merging some departments of the authorities for income tax and VAT, including those covering large and mid-tier investors. The unified tax law would create a single tax filing system for income tax, stamp tax and VAT, and is currently being discussed by the House Planning and Budgeting Committee.

STARTUPWATCH – UAE logistics company iMile raises USD 10 mn pre-series A, eyes Egypt expansion: Dubai-based cash-on-delivery logistics company iMile has raised USD 10 mn in a pre-series A funding round, which the company will use to finance regional expansion to Egypt, Kuwait, and Morocco, CEO Rita Huang told the National. The funding will also be allocated for a new research and development center. The round was led by a Chinese VC firm, Huang said, without disclosing the name of the firm or other investors. iMile currently operates in the UAE and Saudi Arabia.

GERD talks hanging by a thread as Egypt, Ethiopia ratchet up the rhetoric: The Egyptian foreign and irrigation ministries yesterday expressed “deep dissatisfaction and rejection” of Ethiopia’s position over the Grand Ethiopian Renaissance Dam (GERD), days after talks in Washington failed to find a breakthrough in negotiations. In a joint statement, the ministries accused a statement released by Ethiopia on Saturday of containing “many inaccuracies, distortions of fact and a clear disavowal of Ethiopia’s obligations under international law.” Ethiopia, which says it requires more time to consider its position and did not attend the talks on 27-28 February, rejected the US Treasury’s claims that an agreement had been finalized and said that it would begin filling the dam under the terms agreed in the 2015 Declaration of Principles. A final agreement was expected to be signed at the talks last weekend.

Ethiopia was responding to a statement put out by the US Treasury that claimed the four months’ of talks had produced an agreement that “addresses all issues in a balanced and equitable manner.”

Egypt’s Foreign Ministry said on Saturday that it would use “all available means” to defend its interests, and called Ethiopia’s absence from the talks “unjustified.” The statement called the pact “fair and balanced” and announced that it had initialled the agreement.

Questions over the US role in the talks: The US former ambassador to Ethiopia David Shinn on Saturday suggested that Washington had been biased in Egypt’s favor during the negotiations. “The statement by the Treasury secretary is strange in that it appreciates the readiness of Egypt to sign the US-brokered agreement, which is not part of the public record, but warns Ethiopia that ‘final testing and filling should not take place without an agreement,’” he wrote in a blog post. “The United States seems to be putting its thumb on the scale in favor of Egypt. Perhaps it is time to make the agreement public so that everyone can see what the United States is proposing.”

We’re still none the wiser about what is actually in the agreement: Leaks from the talks last month suggested that Egypt and Ethiopia remained at loggerheads over key aspects of filling and operating the dam, with the US pressuring both sides to make concessions on how much water will be released each year, how to monitor the flow, and even on the definition of “severe drought.”

Suez Canal revenues increased slightly y-o-y in February to reach USD 458.2 mn, up from USD 433.9 mn during the same month last year, according to Reuters. February’s revenues dipped m-o-m from USD 497.1 mn in January. The increase was driven by more ships transiting the channel from both sides and loads rising by 12.8% y-o-y, according to Al Mal.

EFG Hermes topped the EGX’s brokerage league table in February with a market share of 36.7%, according to EGX figures (pdf). CI Capital came in second, holding a market share of 9.8%, followed by Beltone Securities (6.8%), Pharos Securities (4.5%), and Arqaam Securities (3.4%).

MOVES- Uber Egypt has tapped Ahmed Khalil (LinkedIn) as its new general manager, succeeding Ahmad Hammouda, according to an emailed statement (pdf). Khalil was previously the head of Uber’s Middle East and North Africa operations.

Egypt in the News

It’s another quiet morning in the pages of the foreign press:

- Hurghada museum: The new museum opened in Hurghada over the weekend is getting coverage in Voice of America, which is out with a photo gallery of the inauguration and some of the antiquities housed within.

- Henna tattoos in Nubia: Xinhua looks at the popularity of henna tattoos among tourists visiting Nubian villages in Aswan.

- Misr El Maqassa football club has sacked its head coach, Nigerian Emmanuel Amuneke, after less than a month on the job, BBC Sport reported yesterday. It did not provide reasons for his removal, and said that he will take on the role of the club’s director of academies across Africa.

Worth Watching

Egyptian researchers develop canal to reduce water waste, generate energy: Researchers at Egypt’s Nile University have created a prototype solar canal, covered with photovoltaic cells, that reduces levels of evaporation to conserve water, allowing it to be used for agriculture or to produce energy, a Reuters video shows (watch, runtime 01:16). Climate change has accelerated the rate of water evaporation, and finding a way to decrease evaporation can save 2-3 bcm of water in the Nile River, according to the video.

Diplomacy + Foreign Trade

Russia and Bangladesh have begun importing Egyptian onions, Ahmed Al Attar, head of the Agriculture Ministry’s Quarantine Authority, tells Al Mal. Egyptian onions have been subjected to more stringent regulations from several countries, including Saudi Arabia, Kuwait, and Mauritius due to residual pesticides, soil remains, and mold.

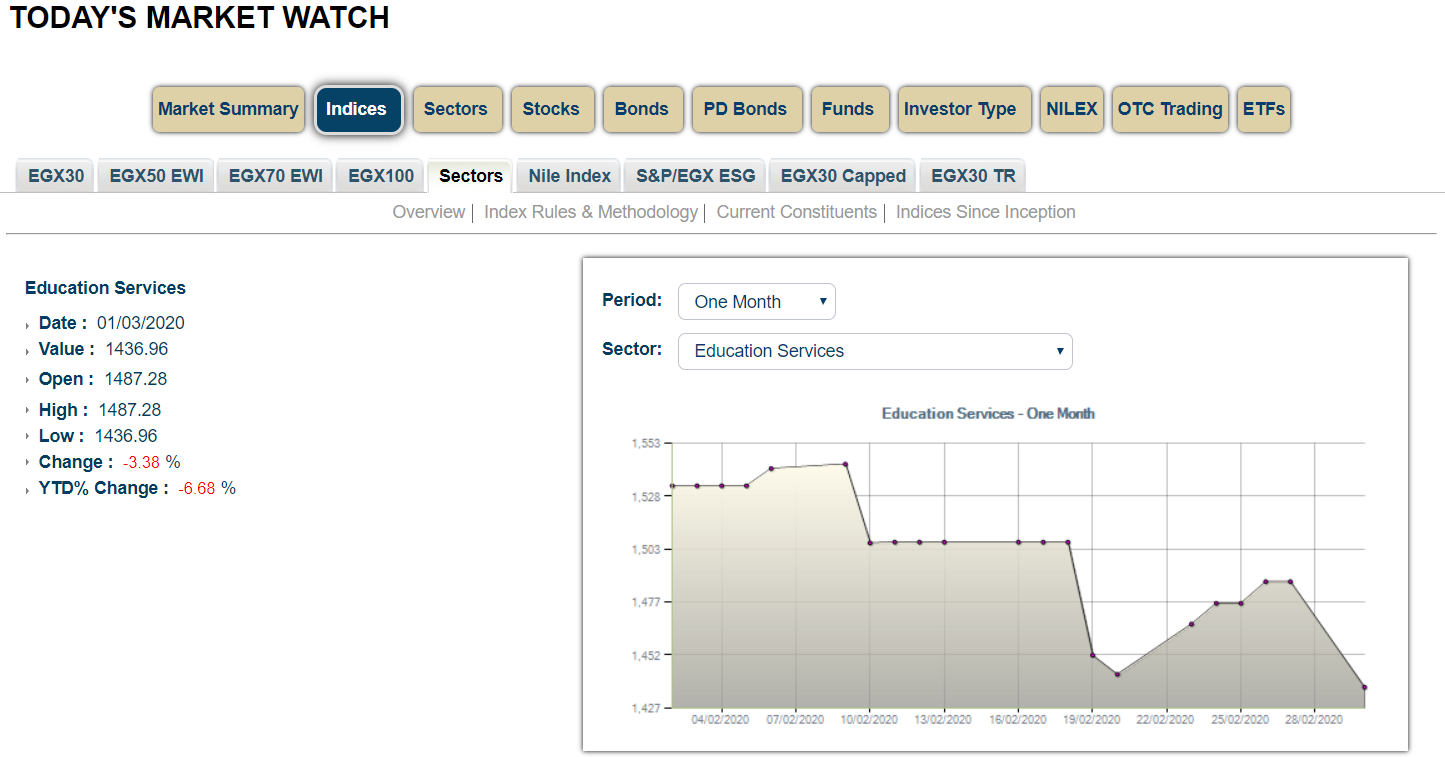

Education proves its strength as a defensive sector in the midst of corona market meltdown: The EGX30 closed down 6% on Sunday as investors reacted to the accelerating sell-off in global markets at the tail-end of last week and a spate of new covid-19 cases — including four people who had recently travelled to Egypt. (Speculation is that all four were carriers of the virus who tested positive after the visit, not that they contracted the infection here.)

Turnover dropped on Sunday to EGP 598 mn, 2% above the 90-day average, from EGP 988 mn on Thursday (or about 69% above the trailing 90-day average). All sectors were impacted, including traditional high performers banking and telecoms. Education was no different, but sector stocks fell only an aggregate 3.4% at the close of trading yesterday, or about half of the dip of the general market.

Education shares are doing well because the business itself is defensive, says Pharos Holding’s head of research Radwa El Swaify, noting, “We saw this in early 2011, when schools were shut down [after the events of 25 January]. Parents continued to pay tuition, even when schools were closed, and we expect it to happen here.”

A lesson from CIRA management: Open clear lines of communication with investors. CIRA shares have performed well despite the covid-19 selloff because the company has a history of “over delivering” to the market since its 2018 IPO, said CEO Mohamed El Kalla, noting that management has clearly communicated the company’s growth strategy and milestones to investors. Putting in the work during good times kept CIRA’s stock stable during tough market conditions, he suggested, adding that CIRA’s schools and colleges have enacted measures to guard against potential spreading of the covid-19 virus and that it has plans in place should the rate of infections get worse.

That contingency planning is key. GEMS Egypt CEO Ahmed Wahby, like El Kalla, noted that safety is the first priority for any schools operator. Schools shouldn’t take risks, he said, and need to create awareness among parents, students and faculty of their plans to handle any crisis. Wahby suggests that some schools will entrench their defensive position by having in place the tools they need to deliver education in the event schools are ordered to shut down. GEMS, he notes, has its own tech platform that it can use should the need arise.

So how defensive is education right now? Let’s look at EGX data from Sunday. Education stocks on the EGX, which include CIRA (Mavericks and Futures in K-12 and Badr University) and Suez Canal Company for Technology Settling (the owners of Sixth of October University) collectively saw a drop of 3.38%. CIRA, an EGX30 constituent, saw no drop in its EGP 13.50 share price while the lightly traded Suez Canal Company, which has been mired in legal disputes over ownership of Sixth of October University, saw its share price fall 24%. Education still beat traditional strong market performers, including banks (which fell 3.94%) and telecoms (which fell 4.37%). The only other sectors to have performed as well or better were food, beverages and tobacco (-3.37%) and trade and distribution stocks (-2.42%).

That’s consistent with education’s performance year-to-date and since the so-far only novel coronavirus case was reported in Egypt. Education is down 6.7% year-to-date, better than the EGX30 (-12.5%) and just behind telecoms, banking, and trade and distribution. And in the month of February, when covid-19 first hit our shores, education dipped only 3%, according to a research note by Shuaa Capital out yesterday. That put education in the same top-performers basket as healthcare (another defensive sector), banks, telecoms, trade and distribution, and textiles.

The question is whether education can hold its ground as a defensive play, and the answer lies in how the sector operates in the event that there is community-level transmission of covid-19 in Egypt, and that’s where the contingency plans El Kalla and Wahby discussed will ultimately pay off — or not.

Your top 5 education stories of the week:

- New technical schools: The Education Ministry is looking to develop 100 technical schools in Egypt by 2030 with domestic and international partners. 19 of the educational facilities are targeted to be constructed in the coming years, with at least one in every governorate.

- The Unified Technical Education Act: The Education Ministry is looking to get the Unified Technical Education Act passed by the House of Representatives by the end of the current legislative session in September, which would include forming an oversight committee composed of relevant trade and craftsmen.

- New foreign change program: The Higher Education Ministry is looking to get private universities on board a new ministry-backed foreign exchange program that would promote the pursuit of a college degree at one of Egypt’s institutes of higher learning.

- El Sewedy technical school receives Finnish accreditation: ُEl Sewedy Technical Education Academy signed an MoU with the Finnish International Foundation for Educational Solutions (FGES) to receive Finnish accreditation at a number of El Sewedy’s institutes in Egypt.

- Salah the face of Vodafone education initiative: Mohamed Salah was named the ambassador of the Vodafone International Foundation, the EUR 26 mn fund that seeks to provide internet and communications access for school students located in remote areas in Africa and and soon to expand to Egypt within the coming year.

The Market Yesterday

EGP / USD CBE market average: Buy 15.57 | Sell 15.70

EGP / USD at CIB: Buy 15.58 | Sell 15.68

EGP / USD at NBE: Buy 15.58 | Sell 15.68

EGX30 (Sunday): 12,223 (-6.0%)

Turnover: EGP 598 mn (2% above the 90-day average)

EGX 30 year-to-date: -12.46%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 6.0%. CIB, the index’s heaviest constituent, ended down 5.3%. Yesterday’s worst performing stocks were Orascom Development Egypt down 14.4%, Heliopolis Housing down 13.8% and Ezz Steel down 12.3%. The market turnover was EGP 598 mn, and regional investors were the sole net buyers.

Foreigners: Net short | EGP -9.5 mn

Regional: Net long | EGP +11.2 mn

Domestic: Net short | EGP -1.8 mn

Retail: 58.4% of total trades | 58.8% of buyers | 58.0% of sellers

Institutions: 41.6% of total trades | 41.2% of buyers | 42.0% of sellers

WTI: USD 44.76 (-4.95%)

Brent: USD 49.67 (-3.98%)

Natural Gas: (Nymex, futures prices) USD 1.68 MMBtu, (-3.88%, April 2020 contract)

Gold: USD 1,566.70 / troy ounce (-4.61%)

TASI: 7,345 (-3.71%) (YTD: -12.45%)

ADX: 4,723 (-3.62%) (YTD: -6.93%)

DFM: 2,473 (-4.49%) (YTD: -10.53%)

KSE Premier Market: 5,991 (-10.98%)

QE: 9,490 (-0.61%) (YTD: -6.15%)

MSM: 4,081 (-1.20%) (YTD: +2.52%)

BB: 1,604 (-3.37%) (YTD: -0.35%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit

3 March (Tuesday): Business Today’s bt100 awards ceremony, Cairo.

4-5 March (Wednesday-Thursday): Women Economic Forum, Cairo.

5-8 March (Wednesday-Saturday): 25 Egyptian companies will participate in a forum on investment in startups in Saudi’s King Abdullah Economic City.

6-8 March (Friday-Sunday): Arab Banking Forum, for heads of risk management in Arab banks, organized by the Union of Arab Banks,with the Central Bank of Egypt and the Federation of Egyptian Banks.

16 March (Monday): Circular Economy Summit, Cairo.

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21-22 March (Saturday-Sunday): An international conference to market investment prospects in the Suez Canal Economic Zone, Al Galala City, Egypt

24 March (Tuesday): The Annual Export Summit, Cairo, Egypt

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

9 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.