- Our 2020 Enterprise Reader Poll found you’re a rather optimistic bunch. (Speed Round)

- The coronavirus outbreak is sending markets on a downward spiral. (What We’re Tracking Today)

- The Sovereign Fund of Egypt is looking for an investor to acquire NIB's stake in e-Finance. (Speed Round)

- Analysts think Telecom Egypt would do well to sell its Vodafone Egypt stake. (Speed Round)

- Cairo 3A bids for Americana's stake in Egyptian Starch and Glucose. (Speed Round)

- Iowa Caucus convenes today, signaling the official start of the race for Democratic nomination in US presidential vote. (What We’re Tracking Today)

- Egypt risks missing out on economic opportunities from inclusive education. (Blackboard)

- The Market Yesterday

Monday, 3 February 2020

Our 2020 Enterprise Reader Poll found you’re a rather optimistic bunch

TL;DR

What We’re Tracking Today

The results of the 2020 Enterprise Reader Survey are in. Altogether, businesses in Egypt say they fared relatively well in 2019 and optimism is making a comeback for 2020. Other key takeaways from the poll, which we carry in full in this morning’s Speed Round:

- Investment began picking up in 2019 as the CBE kicked off its easing cycle…

- …but the majority of you still want more rate cuts to fully unlock capex spending;

- You’re looking to hire new staff, but say you’re struggling to find and retain talent;

- With inflation cooling substantially, you’re being less generous with raises than in recent years;

- More of you expect to beat your competition in the next six months than did when asked the same question a year ago;

- The IPO outlook seems mixed, but a lot of you are expecting healthy M&A activity in the pipeline.

As a token of our gratitude, 50 respondents to the poll will be getting their very own Enterprise mug and a bag of our special coffee blend, produced in association with our friends at 30 North (website | Facebook). Deliveries start tomorrow morning.

STORY OF THE DAY- Markets are slumping amid worries about the global economy as the Wuhan coronavirus is “increasingly looking like a pandemic.” Chinese markets tumbled this morning, with benchmark Shanghai Composite off more than 8% and the Shenzhen Composite plunging nearly 9% as the world’s second-largest economy is effectively shut off from the rest of the world.

It’s unprecedented: “China’s health crisis is testing the entire global economic system and placing unexpected and additional strain on the fragility of an extended boom,” the Wall Street Journal notes. Countries are closing their borders and airliners are scrapping routes to China. Factories could be shut for weeks. Oil is down 20% since China identified the virus (its own demand is off 20%), and market watchers are now predicting that Beijing’s injection of USD 22 bn into markets today won’t stave off further pressure on the country’s stock markets, but might “ease a global sell-off.”

It’s squeezing emerging markets: “A sense of foreboding is spreading through emerging markets on concern that the fast-spreading virus … could crimp global growth,” Bloomberg flatly suggests.

What it means for Egypt (so far):

- Egypt received coronavirus diagnostic kits yesterday, the World Health Organization (WHO) bureau in Cairo said in a press conference, according to Egypt Today.

- An evacuation flight from Wuhan will deliver Egyptian nationals to Matrouh later today. All those on the flight will be subject to a 14-day quarantine.

- It could constrain tourism growth this year: Egypt was looking to attract 600k tourists from the Far East in 2020, half of whom would have been Chinese.

- And it’s going to slow the pace at which Chinese companies invest in Egypt. Case in point: El Nasr Automotive and China’s Dongfeng were expected to ink an agreement in 2Q2020 that will see them manufacture 25k electric cars using the state-owned company’s facilities. Talks could now be delayed for “months,” Public Enterprise Hisham Tawfik said yesterday.

- The EGX has so far proven fairly resilient, with the benchmark EGX30 edging down just 0.2% yesterday in fairly heavy trading as EGP 794 mn worth of shares changed hands, or about 26% more than the trailed 90-day average.

How deadly is it? Wuhan coronavirus appears to kill about 2% of those it infects, and it’s not as contagious as measles. To keep that in perspective, SARS killed one of every 10 people it infected. Those at particular risk appear to include folks with a history of smoking, bacterial coinfection and high blood pressure as well as those who are above the age of 65.

The coronavirus has sickened 17,384 people and killed 362 people worldwide, according to a Bloomberg virus tracker.

If you read nothing else on the subject this morning, make it this: Coronavirus closes China to the world, straining the global economy in the WSJ.

SWF, Defense Ministry to ink restructuring pact: The Sovereign Fund of Egypt will sign an agreement today with the Defense Ministry’s National Service Products Organization (NSPO) to restructure some of its companies, the Planning Ministry said in a statement (pdf). The agreement aims to “maximize the value of these assets and develop them,” the statement reads. NSPO is a manufacturer and contractor, with companies working in industry, mining, agriculture, food, and services.

Swiss business delegation arrives in Egypt: A delegation of Swiss business leaders led by the country’s head of economic affairs Guy Parmelin is in town until Wednesday. Parmelin will join a Swiss-Egyptian business forum before meeting tomorrow with Prime Minister Moustafa Madbouly and Trade and Industry Minister Nevine Gamea to discuss the EU-Egypt trade agreement.

Eight Irish companies will accompany a trade mission this week looking to establish partnerships with Egyptian dairy firms, reports the local press.

Cabinet will discuss amendments to the Public Enterprises Act on Wednesday, Public Enterprises Minister Hisham Tawfik said on the sidelines of a financial inclusion conference in Cairo.

News triggers to keep your eye on over the coming weeks:

- The purchasing managers’ index for Egypt, Saudi Arabia and the UAE is due out tomorrow at 6:15am CLT;

- Foreign reserves figures for January will be released tomorrow;

- Inflation figures are due out next Monday, 10 February;

- The Egypt Petroleum Show runs 11-13 February;

- The CBE will meet on Thursday, 20 February to discuss interest rates.

EFG Hermes’ annual One on One conference runs 2-5 March. The largest frontier and emerging markets conference of the year, the 1×1 takes place once again at Atlantis, The Palm in Dubai. Check out the conference website here.

The race for the Democratic nomination to challenge The Donald in this fall’s election officially begins today as the Iowa Caucus convenes: Bernie Sanders has been leading the nomination charts in Iowa and is inching up even faster in New Hampshire, which will vote on 11 February, but Joe Biden is still in the lead across the nation. Democrats are concerned that Sanders will claim victory after the first vote and before the caucuses are concluded, thus impacting the final count, Politico reported.

Not quite sure how the caucus works (or what it means)? Reuters has you covered with this explainer.

For those who enjoy American football: The Kansas City Chiefs rallied to come from behind and win the Super Bowl, downing the San Francisco 49ers 31-20. It’s the Chiefs’ first title in 50 years.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: We look at the state of education for people with disabilities and people with special educational needs, and the economic opportunities Egypt stands to lose by not focusing on them.

Enterprise+: Last Night’s Talk Shows

The Grand Ethiopian Renaissance Dam (GERD) was a major talking point on the airwaves again last night. Al Kahera Al Aan’s Lamees El Hadidi gave a rundown on sticking points Egypt, Sudan, and Ethiopia finally agreed on over the weekend following four days of meetings in Washington (watch, runtime: 4:00). We had the full story in yesterday's issue.

Ethiopia’s “intransigence” prevented a final agreement from materializing last week, but the preliminary points of agreement are in line with what Egypt has been calling for, Al-Ahram Center for Political and Strategic Studies advisor Hani Raslan told El Hadidi (watch, runtime: 9:12).

The IMF is happy with Egypt’s macroeconomic indicators thanks to the government’s reform program, Al Hadath TV’s Washington correspondent, Pierre Ghanem, told El Hadidi (watch, runtime: 2:24).

Bringing home Egyptians from Wuhan: Al Hayah Al Youm’s Lobna Assal (watch, runtime: 6:17), Masaa DMC’s Eman El Hosary (watch, runtime: 6:01), and El Hadidi (watch, runtime: 8:29) all phoned Cabinet spokesman Nader Saad for a follow up on the ongoing evacuation of Egyptian expats in China’s Wuhan to protect them from the coronavirus outbreak. The plane carrying the Egyptians has taken off from the Chinese city, and was on its way back to Matrouh as of dispatch time.

Commodity prices are falling: The sustained EGP appreciation against the greenback have caused commodity prices to lose up to 20%, reaching a point where consumers are actually starting to feel it, the supply minister’s assistant for internal trade affairs, Ayman Hossam, tells Assal (watch, runtime: 5:13).

Speed Round

Speed Round is presented in association with

For all of the complaining, 2019 was a pretty good year in which to do business in Egypt, you told us in our fourth annual Enterprise Reader Poll — and you expect 2020 to be even better. Around 48% of poll respondents said last year was good for business. This is a slight increase from the 46% of you who said that 2018 was a good year for business. But it also falls short of the 63% of you who were happy with business conditions in 2017, the high water mark for business sentiment after the float of the EGP in late 2016.

(You can also tap or click here to see the poll results on our website if that would be easier.)

Three quarters of all respondents think business conditions will improve in 2020, while only 8% think they will deteriorate. This year’s respondents appear to be more optimistic than last year, when around half said they expected improvements in the 12 months ahead and 16% foresaw worsening conditions. 31% of you either think conditions will remain unchanged in 2020 or haven’t yet made up your minds about where you see the year heading.

More of you were also more optimistic about foreign investment coming into your industry: A whopping 60% see 2020 bringing with it FDI inflows, compared to 44% who expected the same in 2019. Again, while this number is an improvement from last year, it’s not quite as high as your hopes for 2018, when 65% of you expected foreigners to commit new investments.

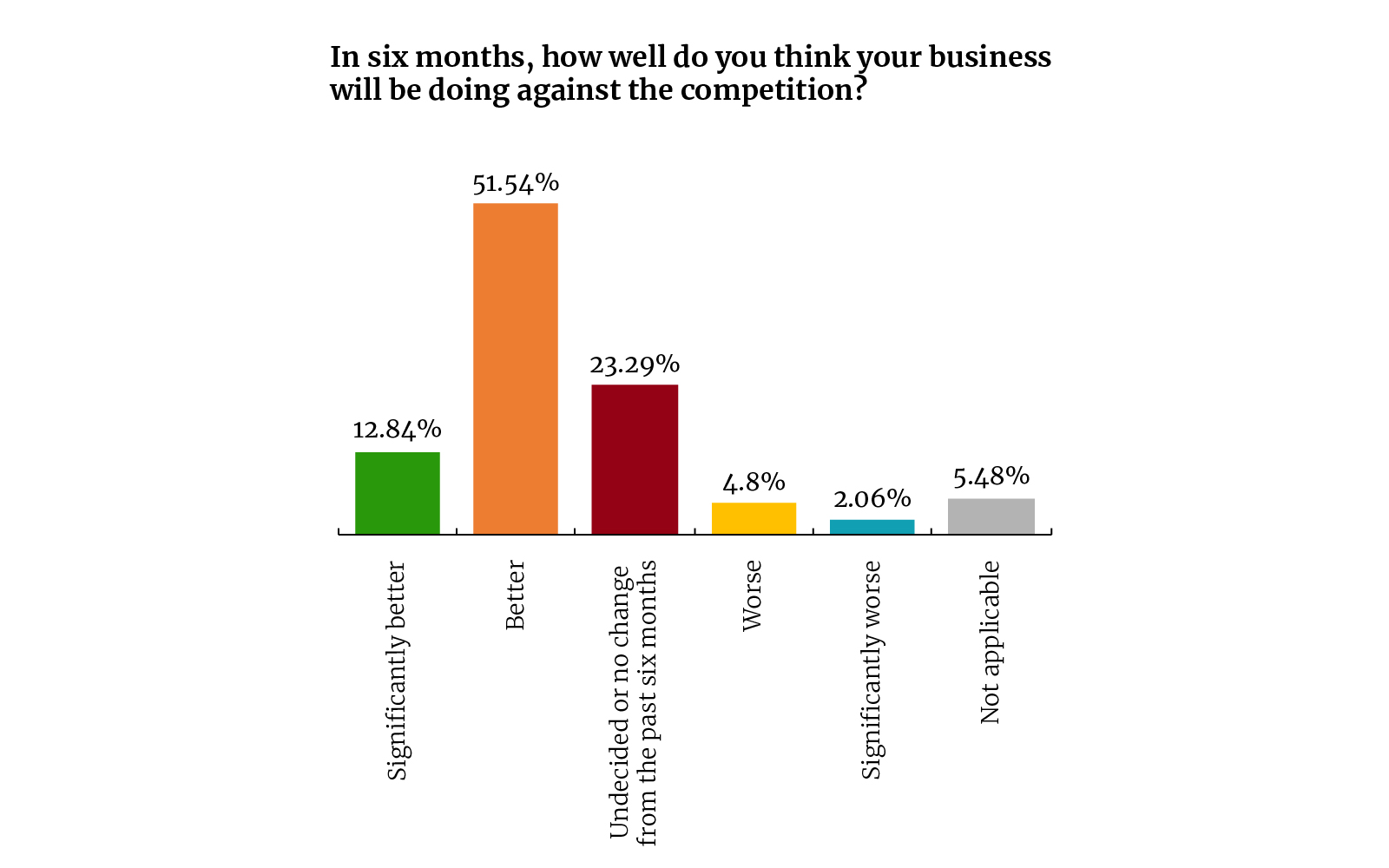

Nearly two-thirds of you expect to be ahead of your competition in six months’ time — and only 7% of you think you will be outperformed by your industry peers. At the beginning of last year, just 54% of respondents saw their businesses doing better than the competition.

The challenges facing businesses today are largely unchanged year-on-year, albeit with a bit of a shuffle in the rankings. Inflation, high interest rates, and government regulation were all listed as top concerns for our readers. The most pressing challenge today for 26% of our respondents is finding and retaining talented employees. By comparison, it was just the fourth-biggest concern for businesses heading into 2019. Inflation and high interest rates were the two biggest issues for poll respondents last year.

Many of you are also uneasy about the legal and regulatory environment in Egypt. Some 23% of respondents said bureaucracy and government regulation are their biggest hurdles right now, and another 15% pointed to a general sense of uncertainty as to where legal and regulatory policies are headed.

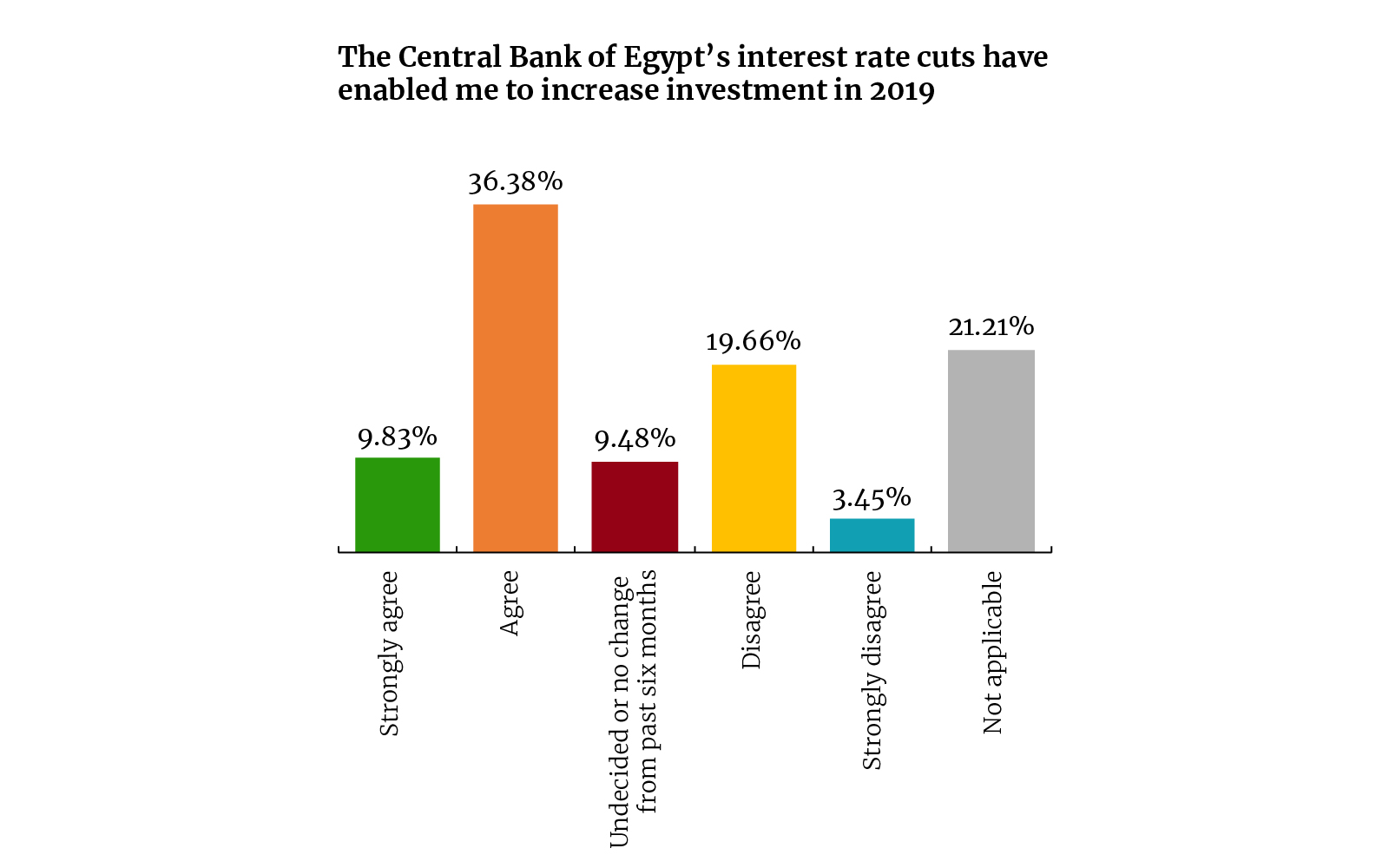

Inflation is taking a backseat as a top concern because 46% of you jumped on the 450 bps rate cuts delivered in 2019 to ramp up investment throughout the year.

That wasn’t enough for everyone, though: 33% of you still held off on fresh investments in 2019, and 46% still want to see interest rates go down by an additional 100-300 bps to unlock CAPEX spending in 2020 and beyond.

You seem to be optimistic that the CBE will resume its monetary easing cycle this year, as 58% of you plan to increase your investments in Egypt over the next six months. A little less than a third of you are undecided or intend to freeze investments for the time being.

The IPO outlook is a little mixed this year. Just 33% of you think 2020 will see an uptick in IPO activity for your industry, while the majority of respondents seem uncertain of what to expect on that front. 20% of respondents don’t see this year being a good one for IPOs in their industries.

The outlook for M&A is more decidedly positive: 41% of respondents said they think the M&A outlook their industry is positive, compared to 17% who are pessimistic in this regard.

Even with a little bit of volatility in recent months, FX seems to be less and less of an issue for business in Egypt. Around 4% of you pointed to FX pricing and availability as a challenge for operating in Egypt, compared to 5% last year and 10% the year before that.

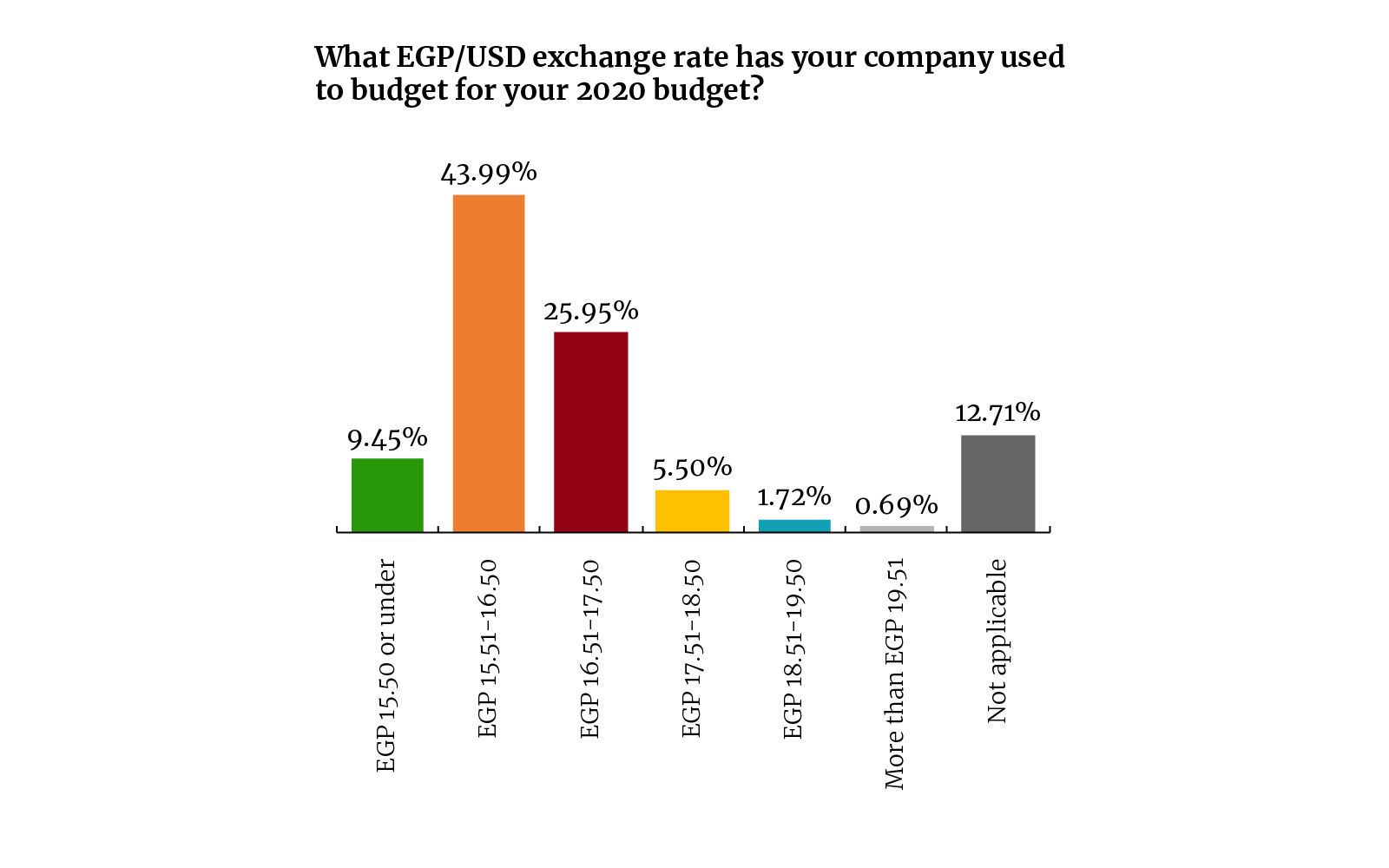

The majority (44%) of you have set your 2020 budget expecting that the EGP will remain where it is now or erase its recent gains as 2020 wears on. 10% of you think the EGP rally will find a second wind against the greenback to bring the FX rate to EGP 15.50 or under, and very few of you expect the rate to broach the EGP 18.50 / USD 1 barrier again. Around a quarter of you have planned for the exchange rate to sit between EGP 16.51 and 17.50 this year.

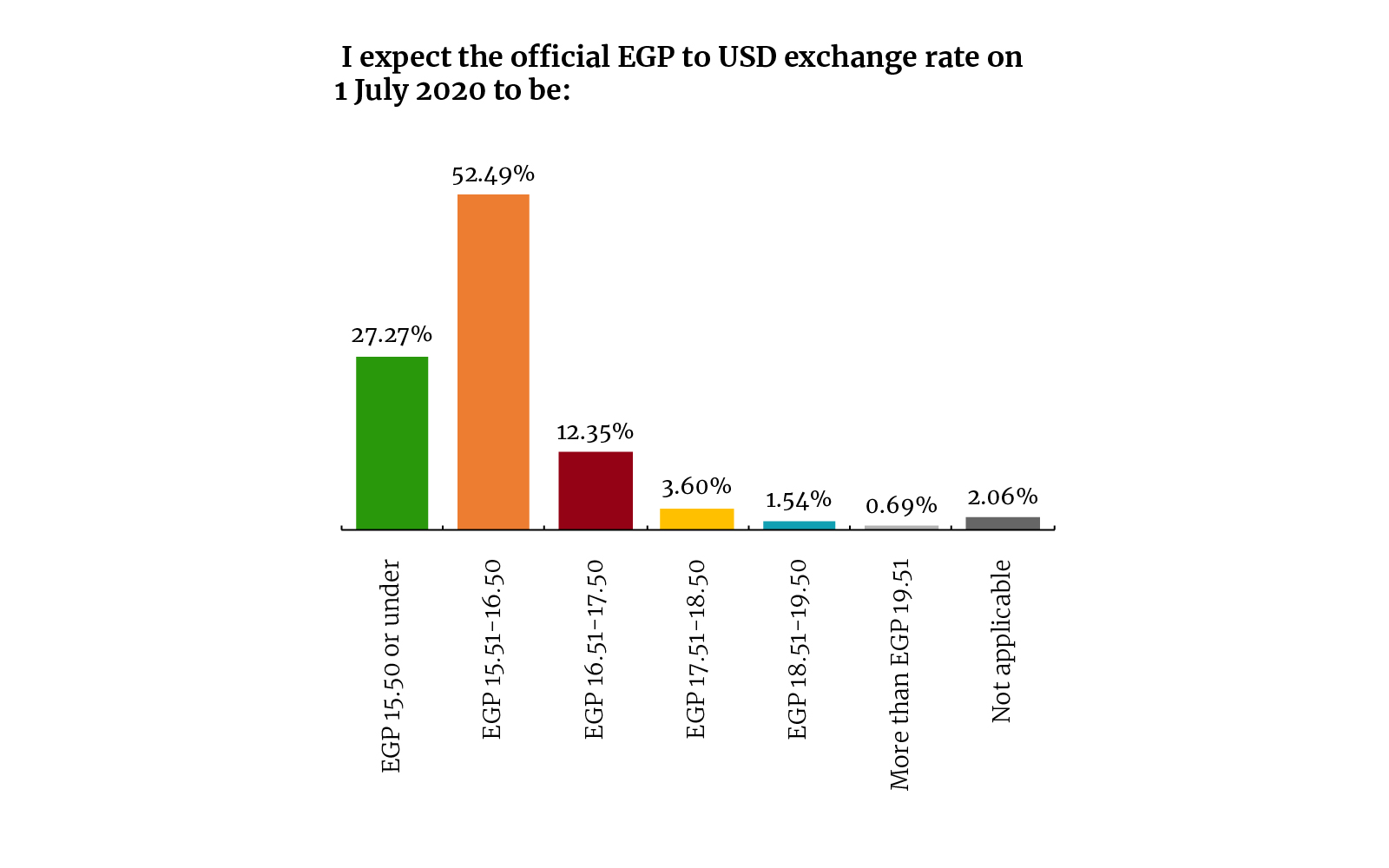

You have planned for a higher FX rate than you actually anticipate: 53% expect the official EGP to USD exchange rate at the beginning of the new fiscal year on 1 July to be between EGP 15.51 and 16.50. That’s a full 9% more of you than those who set that range in your 2020 budget. And while one-tenth budgeted for an FX rate at or below EGP 15.50, 27% of you actually expect that could be the official rate in July.

Hiring activity is expected to be at its highest level since the EGP float this year, with 66% of you saying you’ll be adding to your payrolls in 2020. That’s one metric of optimism that is higher than it was in 2017, when 58% of you said you would be hiring new staff. Meanwhile, 18% of you either haven’t decided or expect no change in your staff size.

If you were the one signing payroll checks, you would most likely give out a 6-15% annual salary increase in 2020. A handful of you don’t seem to think your colleagues are deserving of any salary bump. All in all, it suggests that business leaders thing the substantial raises of the past few years have helped staff catch up to inflation — and with the cost of living now rising at a slower pace than before, you’re being moderate in your outlook.

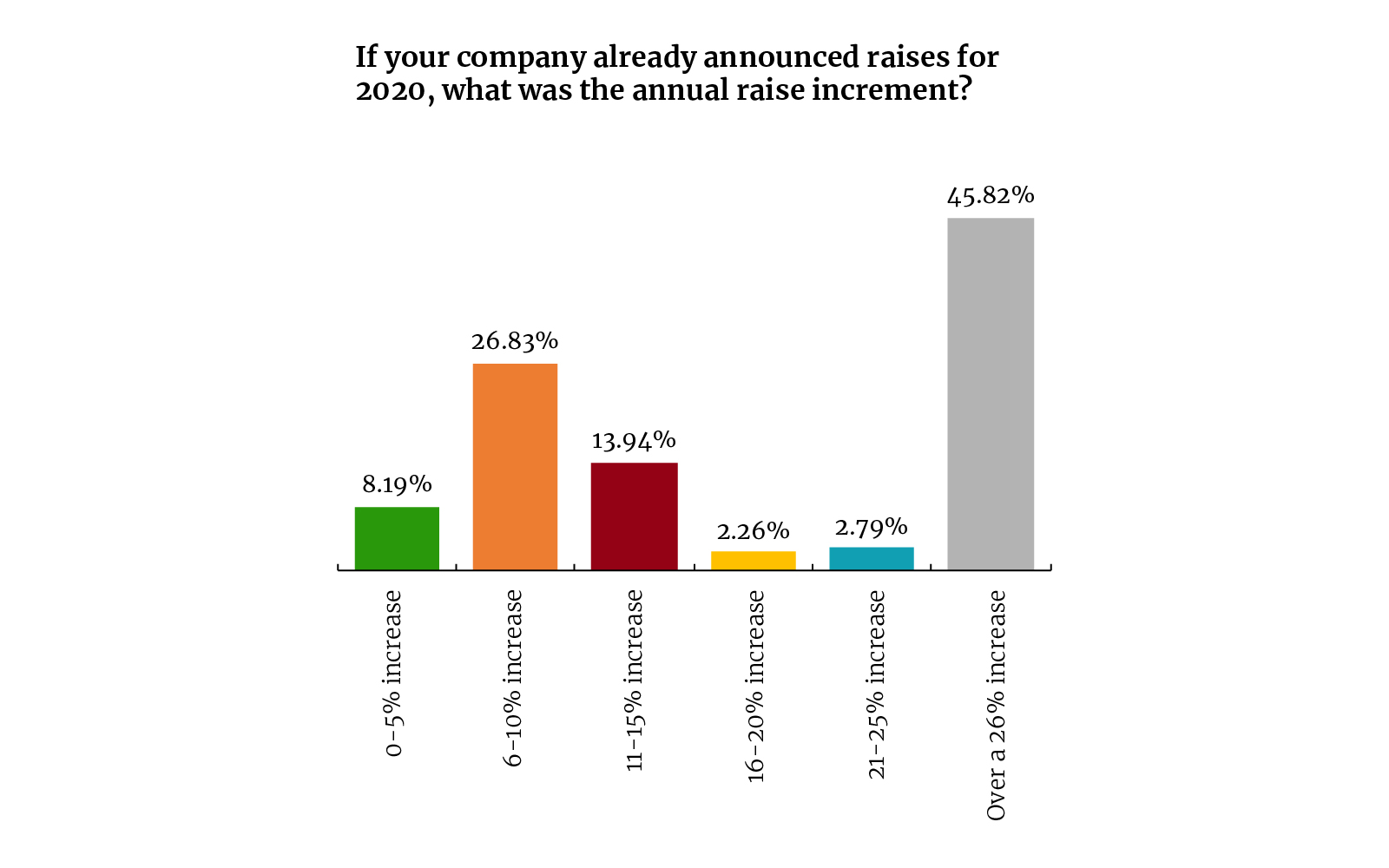

Let’s talk raises for the staff you already have: Most of you who have announced raises for this year are doling out a 6-10% annual salary increase, which is also the same range most of you would give out if you had the power to set your company’s budget. 29% of you would raise salaries by 11-15% if you were the ones signing off on the cheques. Only a few of you (7%) would want to see your staff salaries rise 21-15%, and the 2% of you that wear rose-colored glasses would hike salaries by more than 26% this year.

The cabinet economic group is making its way back into business’ good graces: Some 38% of respondents disagree with the idea that the economic group is understanding of the needs of business. That’s a marked improvement from the 46% of respondents who felt that way last year. Around 34% of you also either agree or strongly agree that the cabinet economic group is sympathetic to your needs as a business, up from 23% last year.

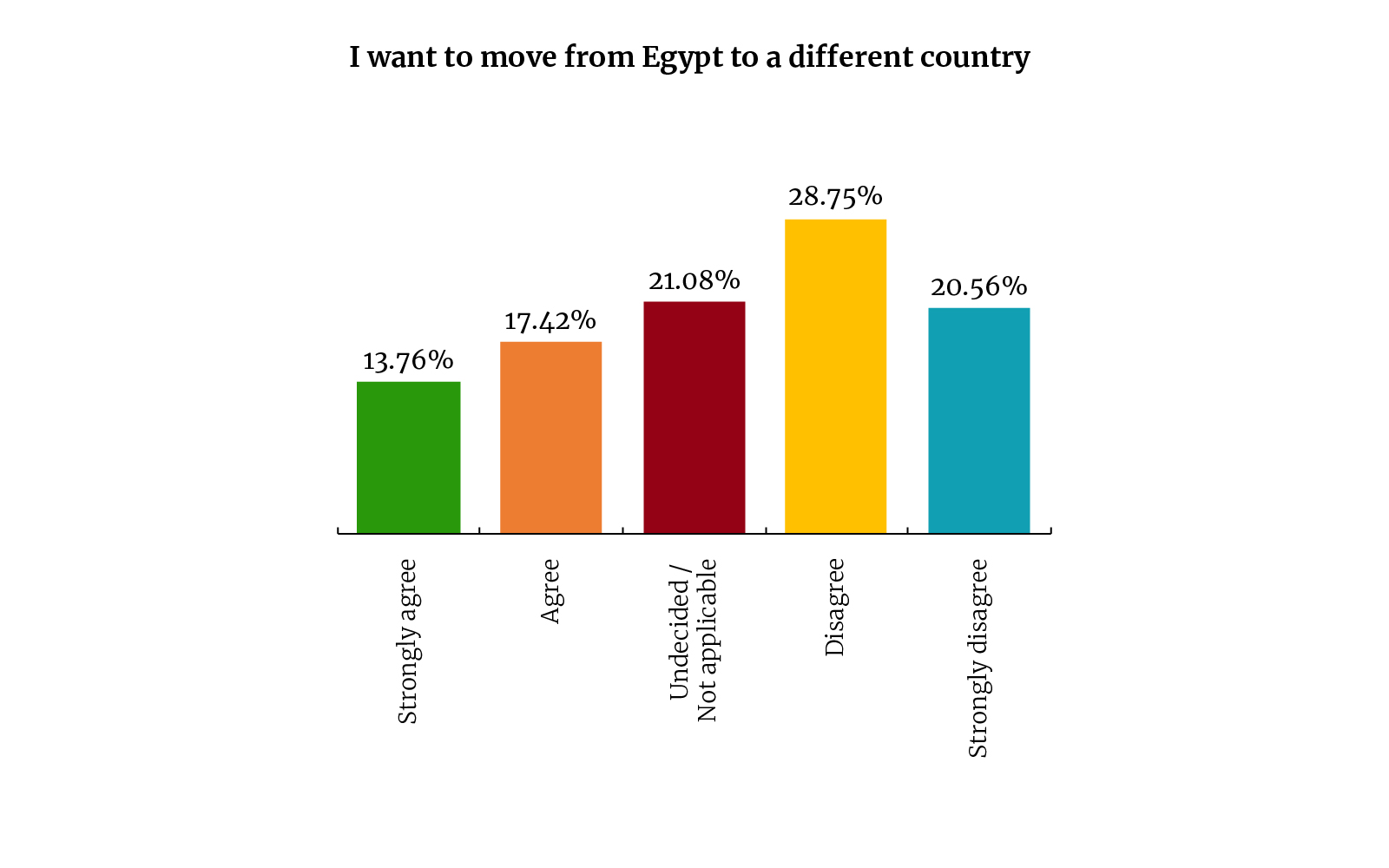

The government’s improving report card is reflected in how you all feel about leaving Egypt behind: Half of you do not want to move out of the country, and a solid 61% of you say you are not considering moving your wealth abroad. By way of comparison, 37% of respondents last year said they’re planning to stick around in Egypt and 41% said they don’t want to move their wealth and possessions out of the country.

Food appears to still be the most obvious choice for you if you were to start a new business this year, but tech is catching up. A number of you said you would likely want to set up a business related to data science, artificial intelligence, the internet of things, or just general tech infrastructure. Fintech was also a popular choice, but munchies still reign supreme.

The Sovereign Fund of Egypt could be looking sell the National Investment Bank’s stake in e-payments platform e-Finance, according to a report in Hapi Journal. The potential transaction would have no impact on the planned springtime IPO of e-Finance, the newspaper adds. The National Investment Bank owns 63.64% of e-Finance, with the remainder divided equally between the National Bank of Egypt, Banque Misr, the Egyptian Banks Company, and the Egyptian Company for Investment Projects, according to its website.

E-Finance is gearing up for a possible IPO in April: The legal procedures and fair value report were slated for completion at the end of January, paving the way for the results to be put to the company’s general assembly in March. Recent domestic press reports had suggested the IPO could go to market by April, while Sarhan said that it could happen during the first three months of the year.

Advisors: Pharos Holding and Renaissance Capital are joint global coordinators. Zaki Hashem & Partners were previously reported to have been retained as legal advisors, while Baker Tilly was tapped to prepare the fair value report. Inktank is investor relations advisor.

M&A WATCH- Could Telecom Egypt sell its stake in Vodafone Egypt? Telecom Egypt (TE) is more likely to offload its 45% stake in Vodafone Egypt than it is to call on its right of first refusal to bid for Vodafone Group's 55% holding, say analysts and experts speaking to Reuters and the local press. Saudi Telecom Company (STC) signed last week a non-binding agreement to acquire the 55% stake for USD 2.39 bn, pricing the entire business at USD 4.4 bn. Vodafone said it expects the transaction to close in June of this year, pending the green light from regulators.

TE would be better off selling: The state-owned company’s debt burden currently stands at EGP 15 bn, meaning it lacks the liquidity to finance the purchase of Vodafone Group’s 55%, Pharos Holdings’ Radwa Elswaify and Shuaa Securities’ head of research Amr Elalfy tell Reuters. Offloading its stake would help the company finance its operations, but the question is whether STC would buy it. TE had said that it will “consider all the possible ways” to handle its investment in the company, and that it will make a decision after Vodafone and STC reach a final agreement.

On the other hand, buying the rest of Vodafone Egypt would make TE the country’s top mobile network operator and would give its own network, We, a chance to survive, former National Telecommunications Regulatory Authority (NTRA) head Hesham El Alaily says.

But the state-owned company has so far expressed no intention of buying. Vodafone Egypt CEO Alexandre Froment-Curtil told us last week that STC’s buyout offer was unsolicited, and TE had earlier said that it had no intention of exiting Vodafone Egypt. TE said after the STC announcement that it would “consider all the possible ways” (pdf) to handle its investment in VFE once Vodafone Group and STC wrap up their transaction.

The government is looking at the possibility of requiring STC to make a mandatory tender offer for 100% of Vodafone Egypt’s shares, an unnamed analyst at an investment bank told Reuters. This would only be legally possible if Vodafone Egypt is treated as a listed company, even though it delisted in 2006.

TE shares have soared since the STC announcement, rising 12.48% on Sunday to EGP 13.80, according to EGX data. Analysts told the local press they see the company's stock reaching EGP 18.

Banks will be required to call off any legal action they’re taking against factories that are unable to pay off their debts as part of a Central Bank of Egypt (CBE) debt relief initiative, CBE Governor Tarek Amer said in a circular to local banks carried by Youm7. The banks also have to hand back cheques written by the factory owners, and require only promissory notes in the future, according to the circular.

Background: The government and the CBE launched a two-part initiative in December aimed at boosting local manufacturing. The first part gave medium-sized factories with annual sales revenues of less than EGP 1 bn access to subsidized loans. The second, meanwhile, required banks to write-off bad loans made to financially-strained factories — starting with loans of up to EGP 10 mn, as a first phase that is in place until the end of the year, and extending to loans exceeding this amount later.

M&A WATCH- Cairo 3A bids for 91.5% stake in Egyptian Starch and Glucose: Cairo 3A has made an offer to buy 45.8 mn shares held by three major shareholders in the Egyptian Starch and Glucose Company, according to a bourse disclosure (pdf). The poultry and commidities trader offered to buy a all of Egyptian International Tourism Projects Company’s (Americana Egypt) 23.2% stake, all of Americana Egypt’s parent company Americana Group’s 41% stake, and all of Cairo Poultry’s 27.3% share for EGP 8.98-10.18 per share, valuing the 91.5% stake at EGP 450-510 mn. The final price will be determined by due diligence which will conclude by 9 April. Cairo 3A has suggested filling a mandatory tender offer application by 12 April. The current shareholders will convene on 6 February to review the initial bid and the price range proposed by Cairo 3A.

Cairo 3A is reportedly preparing to IPO on the EGX this year, with CI Capital the frontrunner to quarterback the transaction. Information on the size of the offering and an exact date have not yet been released.

M&A WATCH- Adeptio appeals FRA’s rejection of Americana Egypt MTO: Adeptio has reportedly scheduled a court date in March with Cairo’s Administrative Court to appeal the Financial Regulatory Authority’s (FRA) decision to block the company’s mandatory tender offer (MTO) for a minority stake in the Egyptian International Tourism Projects Company (Americana Egypt), legal sources told Al Mal. Adeptio had initially argued it should not be required to submit an MTO, but the company’s appeal and a separate suit filed with an economic court were both rejected. The FRA then rejected the MTO Adeptio had submitted, saying the offer was too low.

Adeptio threatened legal action last November over the FRA’s rejection of the company’s MTO, citing a media smear campaign against the company that influenced the regulator’s decision.

M&A WATCH- The UAE’s Mashreq Bank is considering acquiring a controlling stake in Egypt’s Arab Investment Bank (AIB), sources familiar with the matter told Al Shorouk. The bank is currently 91.4% held by the National Investment Bank (NIB), with the government holding the remaining 8.58%. NIB recently held talks with investors about purchasing stakes in seven state-owned companies.

Egypt in the News

It’s a blessedly quiet Monday morning for Egypt in the foreign press.

Inclusive education brings substantial economic and social benefits. But despite gov’t support, Egypt risks missing out. Inclusion of people with disabilities (PWD) and people with special educational needs (SEN) in the mainstream education system is key to Egypt’s workforce tapping into a gravely underused talent pool, with sizable economic results. But the estimated 12 mn people living with a sensory or intellectual disability in Egypt — according to UN data cited by global business disability inclusion nonprofit organization Disability:IN — still face discrimination and widespread exclusion from education and professional training. This forms a major barrier to recruitment and employment, according to the International Labor Organization.

Just what kind of financial benefits does inclusion bring? The Federation of Egyptian Industries (FEI) is attempting to quantify this for Egypt, says Senior Advisor El Sayed Torky. But as the process is nascent, a look at other economies is highly revealing. The US could see a USD 25 bn boost in GDP with the inclusion of just a further 1% of PWD in the labor force, according to a 2018 Accenture report (pdf).

There is a pervasive stigma in Egypt, and it severely impacts service provision. It is estimated that only 2% of PWD in Egypt have access to any kind of service. This is partly due to a lack of information and issues of affordability, but is compounded by stigmatization. Often the diagnosis of a hidden disability (such as autism or dyslexia) is delayed because families fear the stigma of their children having any form of disability, says consultant and advocate Maha Helali. This is in spite of the fact that early intervention could reduce developmental gaps.

There are around 900 institutions for SEN in Egypt, estimates Helali. These include Caritas SETI and Advance, which focuses on supporting people with autism and other disabilities. These services range from vocational training to working directly with caregivers.

So the bulk of specialist care falls to a small group of institutions. These include private schools such as the Continental School of Cairo (CSC). They provide tailored academic and pre-academic services — the latter comprising areas such as hand-eye coordination, auditory skills, verbal and non-verbal communication, and socialization — to some 40-50 students with learning difficulties and SEN between the ages of 2.5 and 18. Hope Academy, founded in 2018, currently has 26 students with SEN who follow tailored programs comprising workshops in six areas: Clerical, graphic design, cooking, woodwork, gardening and jewelry-making. The Learning Resource Center, of which Helali is a founding partner, offers diagnosis and consultation in a range of areas, including neuro-developmental therapy, speech and language therapy, behavioral analysis, and sensory motor services such as occupational therapy. It also supports integration into nurseries for children under four and offers educational support to students in mainstream schools.

But specialist care comes at a price, and financial sustainability remains a thorny issue. Many of these institutions were started by parents of children with SEN and are registered as nonprofit entities, despite often having high attendance costs. CSC’s regular 2019-2020 school fees were listed as ranging from EGP 51k – 85k per year. Collectively, all three branches (Continental Language School (CLS), Continental International School (CIS), and the Continental School of Cairo (CSC) which is the dedicated SEN school) serve approximately 1,500 students, with CSC serving 40-50. CSC stresses on its website that it is “not a commercial venture,” with Deputy Principal Maey Elnimer describing it as a “self-sufficient” school. Fees for Hope Academy are in the range of EGP 55k per year, says Principal Nagla Ahmed, although they can increase if the student in question needs extensive one-on-one attention. This income is supplemented as needed by capital put in by the organization’s founders. Ahmed notes that roughly 50% of Hope Academy’s operational costs go towards employing teachers, while the other 50% is used for activities, tools, equipment, and different kinds of therapeutic care.

A shift towards greater inclusivity and accessibility would benefit everyone: Quality inclusive education brings better behavioral and academic outcomes for all children, at a lower cost than segregated education, studies have shown (pdf). Helali estimates the cost of teaching one child with SEN in a specialist school as being equal to the cost of teaching four typically developing children in a mainstream school. So the best and most cost-effective solution would be to support inclusive education and have all schools focus on including children with disabilities or SEN, she argues. And when it comes to both SEN provision and the inclusion of PWD in the workforce, prioritizing accessibility often means developing a product or service that is better for everyone, argues consultant Peter Fremlin. “Sometimes people argue that text messaging was invented for the deaf. I don’t know if that’s technically true, but the pattern is quite believable. And it’s an example of diversity leading to more creative solutions that benefit everyone.”

Government efforts to promote inclusivity have been fueled by the 2018 law on the rights of persons with disabilities. The Education Ministry has long sought to integrate students with disabilities and SEN into mainstream schools (pdf). The new law has boosted this drive, mandating that PWD comprise 5% of the positions at schools and universities and 5% of the workforce of public and private companies that have more than 50 employees. The law emphasizes inclusiveness based on principles of equal citizenship ― marking a shift away from the idea of PWD as being a group in need of charitable support. Being the first of its kind, the law is an important step for Egypt, says Helali.

And for-profit models work when it comes to training and workplace integration. Helm, a social enterprise comprising a for-profit and a nonprofit arm which work in tandem, has given over 5k corporate training sessions to some 900 institutions in the region on inclusive hiring, organizational accessibility, and training needs for employees with disabilities. It also provides regular training sessions for PWD to help them develop their skills to meet the needs of the labor market. There is a substantial market need to provide companies with the tools to overcome their accessibility issues, opening up huge space for for-profit organizations to grow and scale, says Helm’s CEO Amena Elsaie.

Businesses need to look at this beyond CSR: The FEI and the ILO are restarting the Egypt branch of the Global Business and Disability Network. Among the most insidious challenges they face is the complete misuse of the 5% quota by some companies, says Torky. Many Egyptian companies have yet to recognize the economic value of their employees with disabilities. As this UNPRPD-funded document (pdf) notes, “one relatively common practice is for companies to fill the quota in a superficial way, with people receiving an allowance or salary while not being expected to work.” However, companies including Americana, El Araby, and Vodafone Egypt are integrating employees with disabilities into their workforce in a real way ― often through public-private partnerships. This direct demonstration of applicability is the most effective argument they can make use of, say both Elsaie and Torky.

So how could this knowledge be applied to the education sector? If Egypt is to reap the economic benefits of inclusion, greater access to education and skills development for PWD and people with SEN is a must. Cooperation between civil society, the private sector and government has proven the most constructive way of doing this, says Fremlin. For-profit organizations might be able to help complement and scale the work of nonprofit entities offering education services, he speculates.

Big business is also stepping up: Meanwhile, several big companies (including El Araby, Elsewedy, Americana, and Siemens) are working with the Education Ministry to set up specialized technical schools providing vocational training based on new methodologies, says Torky. One of these institutions alone was established with an investment of EGP 50 mn. If schools of this kind could allocate a certain number of places to people with disabilities, it would be a great step towards inclusion and create a pipeline of very employable students, he adds.

Your top education stories in a week of slim pickings for education news in Egypt:

- CI Capital said it has 4 EGX IPOs in the works for this year, one of which will be an education firm, which we expect will be Taaleem for Consulting and Educational Services.

- The Supreme Administrative Court upheld Cairo University’s Niqab ban last week.

- CORONA WATCH (education edition): The Higher Education Ministry pressed pause on Chinese university scholarships, while schools received preventative hygiene protocols from the Education Ministry amid the coronavirus scare.

- The Islamic World Organization for Education, Science and Culture (ISESCO) established a USD 500 mn endowment that will contribute to supporting educational, cultural, and scientific initiatives for its member states, including Egypt.

The Market Yesterday

EGP / USD CBE market average: Buy 15.75 | Sell 15.85

EGP / USD at CIB: Buy 15.74 | Sell 15.84

EGP / USD at NBE: Buy 15.75 | Sell 15.85

EGX30 (Sunday): 13,889 (0.2%)

Turnover: EGP 794 mn (26% above the 90-day average)

EGX 30 year-to-date: -0.5%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 0.2%. CIB, the index’s heaviest constituent, ended up 0.02%. EGX30’s top performing constituents were Telecom Egypt up 12.2%, SODIC up 1.8%, and Ibnsina Pharma up 1.6%. Yesterday’s worst performing stocks were Orascom Development Egypt down 4.2%, Sidi Kerir Petrochemicals down 3.5% and Juhana down 2.9%. The market turnover was EGP 794 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +106.7 mn

Regional: Net Short | EGP -63.3 mn

Domestic: Net Short | EGP -43.4 mn

Retail: 52.1% of total trades | 48.4% of buyers | 55.7% of sellers

Institutions: 47.9% of total trades | 51.6% of buyers | 44.3% of sellers

WTI: USD 51.32 (-0.47%)

Brent: USD 56.13 (-0.87%)

Natural Gas (Nymex, futures prices) USD 1.86 MMBtu, (+1.14%, March 2020 contract)

Gold: USD 1,588.00 / troy ounce (+0.01%)

TASI: 8,157.51 (-1.08%) (YTD: -2.76%)

ADX: 5,115.92 (-0.78%) (YTD: +0.79%)

DFM: 2,766.39 (-0.86%) (YTD: +0.06%)

KSE Premier Market: 7,001.95 (-0.45%)

QE: 10,362.04 (-0.77%) (YTD: -0.61%)

MSM: 4,092.72 (+0.33%) (YTD: +2.80%)

BB: 1,659.66 (+0.12%) (YTD: +3.07%)

Calendar

23 January-4 February: Cairo International Book Fair 2020, New Cairo International Exhibition and Convention Center, Egypt.

February: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

2-5 February (Sunday-Wednesday): A delegation of Swiss businesses will visit Egypt to discuss investment.

February: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

3-5 February: The Arab-African International Forum, Jeddah, Saudi Arabia.

4 February (Tuesday): Court hearing for PTT Energy Resources’ USD 1 bn lawsuit against Egyptian government.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

9-10 February (Sunday-Monday): The the 33rd ordinary African Union (AU) Summit where Egypt will hand over the African Union presidency to South Africa

11-13 February (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

12-13 February (Wednesday-Thursday) (TBC): Egypt, Ethiopia and Sudan to meet in Washington, DC, to review final GERD agreement.

14-16 February (Friday-Sunday): A Euro-Mediterranean Organization for Economic and Development Cooperation delegation will visit Egypt to discuss cooperating in the field of organic cotton and home textiles

23 February (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot. It was previously postponed to 24 November 2019 and then to 5 January 2020, and now 23 February.

23 February (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous

20 February (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

2-5 March (Monday-Thursday): EFG Hermes’ 16th annual One on One conference, Atlantis, The Palm, Dubai.

3 March (Tuesday): Business Today’s bt100 awards ceremony, Cairo.

4-5 March (Wednesday-Thursday): Women Economic Forum, Cairo.

7 March (Saturday): International Conference for Investment organized by Suez Canal Economic Authority, Al Galala City, Egypt

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

7 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April (Sunday): Easter Sunday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.