- Futures exchange and derivatives trading are coming to Egypt next year -Farid. (Speed Round)

- Gov’t reportedly scraps Al Nowais’ USD 4 bn ‘clean coal’ plant. (Speed Round)

- Pioneers looks to acquire stakes in listed subsidiaries, restructure in three focused companies. (Speed Round)

- What exactly is Egypt’s new Data Protection Act and what does it mean to your business? (Spotlight)

- Export subsidies payments in full swing? (Speed Round)

- 1.8 mn people restored to subsidy rolls after earlier purge of welfare cheats. (Speed Round)

- Should developing countries be exempted from emission reduction targets? (The Macro Picture)

- The Market Yesterday

Wednesday, 2 October 2019

A futures exchange and derivatives trading: Coming to Egypt in 2020

TL;DR

What We’re Tracking Today

We’re heading into a long weekend, with the Manpower Ministry declaring Sunday 6 October a vacation day for civil servants and private sector employees alike in observance of Armed Forces day. Enterprise will also be off, and we’ll be back in your inboxes at the appointed hour on Monday morning.

We’re still waiting on a decision on fuel prices for 4Q2019: A source told Masrawy yesterday that the committee in charge of setting prices under the automatic fuel pricing mechanism has recommendedthat prices remain unchanged, but we are yet to hear anything official. The committee will now send its report to the Prime Minister to announce the decision, which should come into effect one day later. The committee will next convene at the end of the fourth quarter to decide on the 1Q2020 rates. The mechanism, the implementation of which was attached to the IMF loan, allows the government to base fuel prices on global oil prices and the USD exchange rate.

Indicators we’re keeping our eye on as we step into October:

- PMI: The purchasing managers’ index for Egypt, the UAE, and Saudi Arabia will be released on Thursday, 3 October at 6:15 CLT.

- Monthly inflation figures for September are due at the end of next week. Inflation cooled for the second consecutive month in August to 7.5%, marking the lowest reading in six-and-a-half years.

Among the conferences taking place in the coming days:

- Beltone is running an investor conference in Dubai this week.

- The annual International Federation of Technical Analysts (IFTA) conference takes in Cairo place on 5-6 October.

- A Russian delegation will be in Cairo on 7-10 October for a joint forum to discuss cooperation in various fields, including trade, Al Shorouk reports.

On being in the delightful position to congratulate friends: Our friends at CIB and EK Holding came home with hardware from the 2019 Middle East Investor Relations Association’s annual gathering in Dubai. CIB once again brought home two Egypt awards and one Middle East award, while EK Holding’s Haitham Abdel Moneim and his team were named Most improved IR team (large cap). Congratulations from all of us and from the folks at Inktank. You can check out the details here.

If you’re in Zamalek today, go stop by our friends at 30 North Coffee, who are opening their second outlet at Iconia Zamalek (16 Mohamed Thakeb St., in front of Maraashli Church). Not sure what to order? We’re partial to their Tanzanian single origin — taken as a double shot of espresso. We wish the team all the best as they expand out of their base in Sheikh Zayed — and promise to try to forgive them for not having opened yet in the People’s Democratic Republic of Maadi.

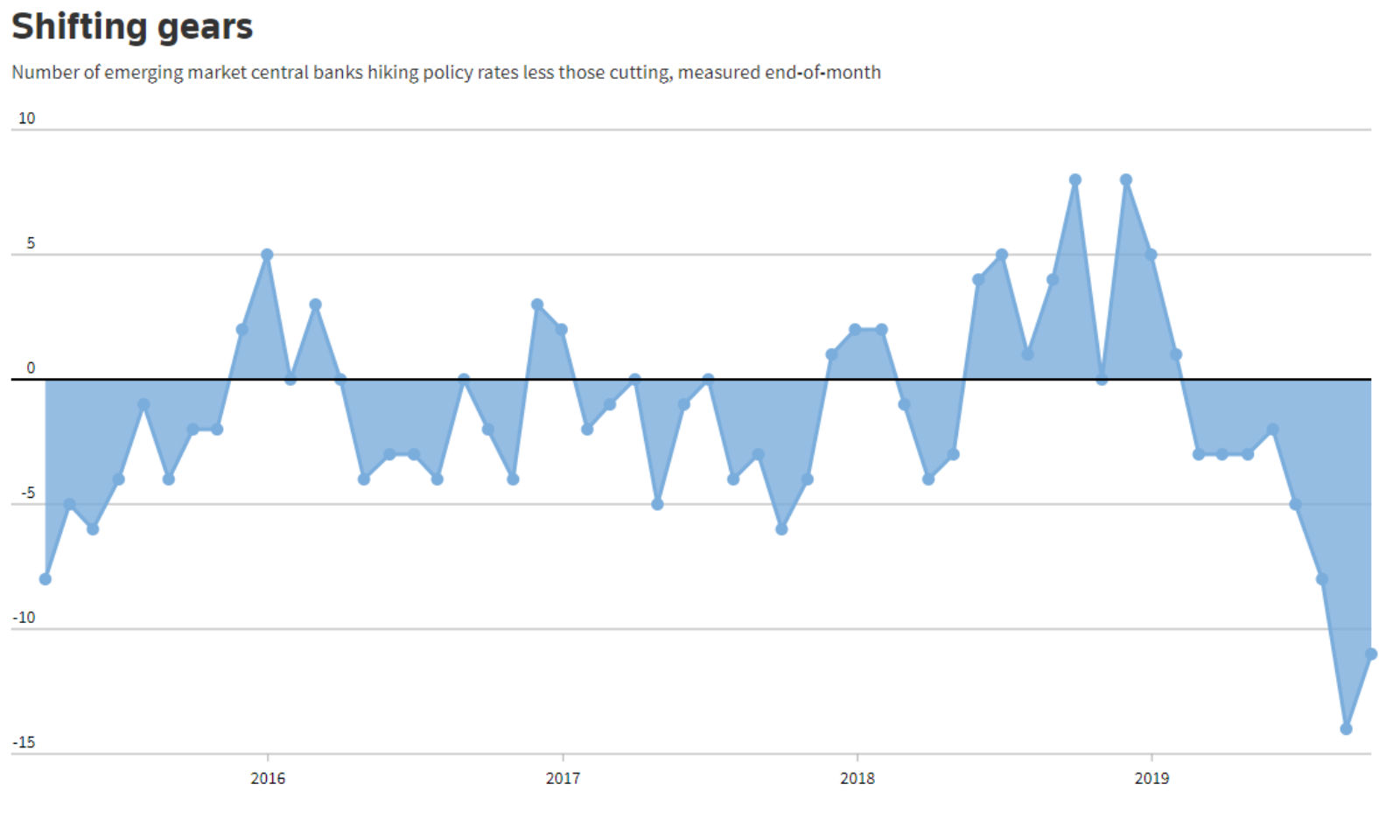

Monetary easing cycle continues across EMs: September marked the eighth consecutive month of interest rate cuts in emerging markets, with policymakers across 37 EMs delivering 11 net rate cuts, reports Reuters. Last month, however, saw fewer rate cuts than August, which saw the largest number of coordinated cuts in a decade. Egypt’s 100 bps cut last week was among the steepest, with the majority of EM central banks trimming rates by 25-50 bps. Recession-hit Turkey stood out as a startling exception with a 325 bps cut on 12 September. The sustained monetary easing cycle is following the US Fed’s lead, which cut its benchmark rate for the second time in a row last month.

Which EM currencies would get a lifeline from a trade war detente? The Brazilian real, Chilean peso and Russian ruble could top the list of strong emerging market currencies if the latest round of US-China trade talks go well, with the Thai baht and Israeli shekel coming in at the bottom, according to a recent Bloomberg analysis. The study looks at 19 EM currencies — not including the EGP — assessing their responsiveness to the yuan from mid-2017 onwards.

Global trade is set to grow at its weakest pace since the 2008 financial crisis. Global trade will expand just 1.2% this year, down from 3% in 2018, according to data from the World Trade Organization cited by the Wall Street Journal. Trade growth is expected to rebound to 2.7% in 2020, but this is contingent on the dissipation of US-China trade tensions.

Aramco is pulling out all the stops to get its target valuation. The Saudi government announced yesterday that Saudi Aramco will pay investors an annual dividend of USD 75 bn, in a bid to achieve its USD 2 tn target valuation, says the Financial Times (paywall). Authorities are also revising state royalty payments and taxes as Aramco gears up for its IPO. “The government is doing everything it can possibly do” to reach its target, a person familiar with the process said. The government has reportedly also been pressuring wealthy Saudis to take anchor positions.

Gulf states must turn on the money taps for SMEs if they are going to diversify their economies. Providing more liquidity to Gulf SMEs will be crucial if the region is going to create the mns of non-oil jobs that will be demanded by a growing workforce, Simone Tagliapietra writes in the Financial Times. She suggests that Gulf states can follow two approaches: building up the capitalization of their banking sectors and creating a well-regulated sector that incentivizes SME financing; and/or developing other sources of finance such as the capital markets instruments and fintech-based finance.

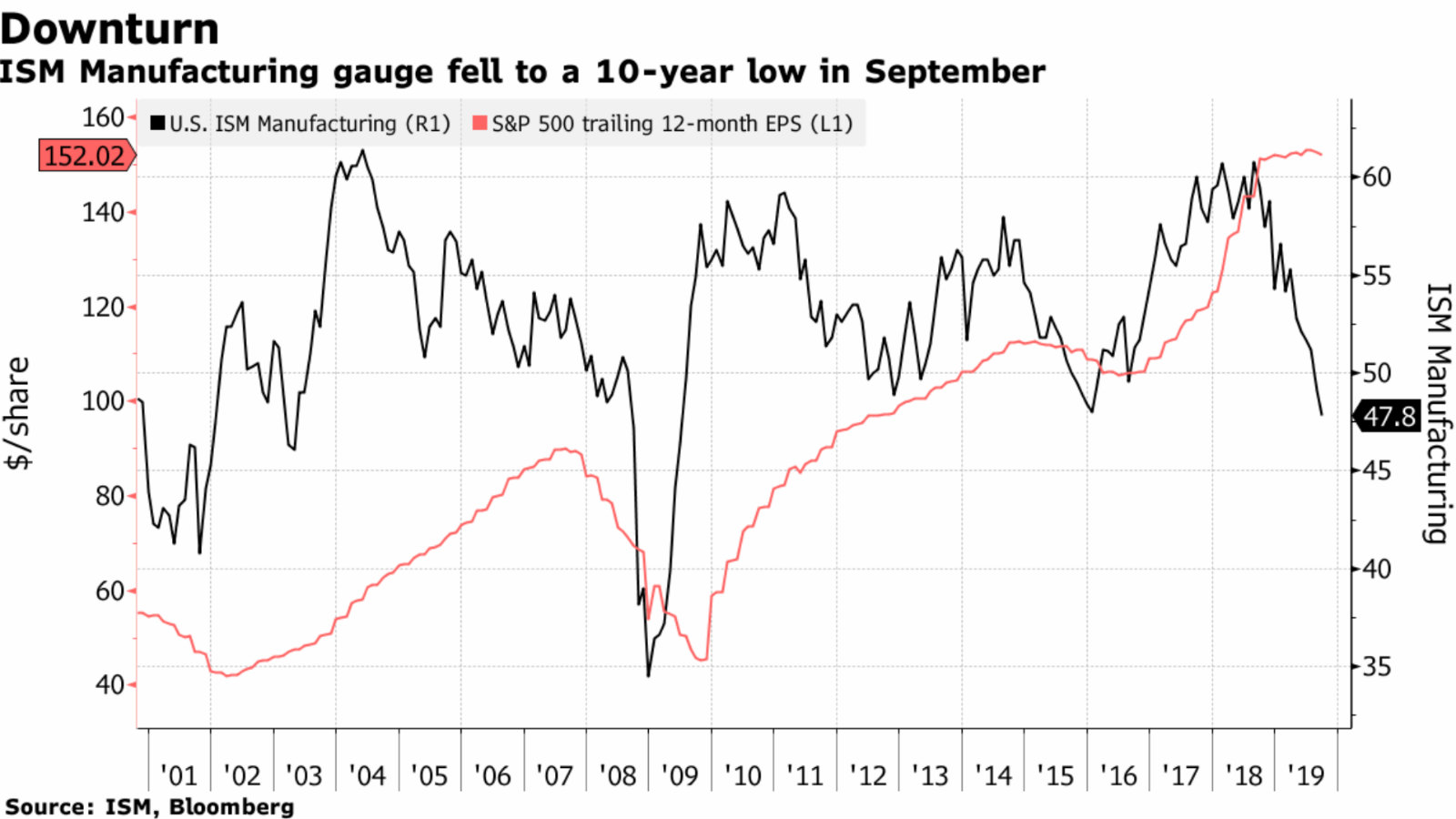

US manufacturing PMI gives worst reading in a decade: The US manufacturing purchasing managers index (PMI) slipped to 47.8% in September, indicating a contraction in the sector, according to data from the Institute for Supply Management. This is the lowest level since June 2009, according to CNBC. The new export orders index came in at only 41%, the lowest reading since March 2009. The S&P 500 dropped the most in five weeks on the news, which also sent yield on 10-year treasury bonds down. “We are clearly seeing a very weak backdrop for manufacturing. The concern is the contagion effect into the services economy, which is the driving force of the U.S. economy,” Katie Nixon, CIO at Northern Trust Wealth Management, told Bloomberg. “We cannot take this lightly and we think the Fed shouldn’t take it lightly either.”

Speaking of the Fed: The chances of a rate cut just went up a notch. Fed fund futures — a barometer for how traders see the direction of travel for Fed monetary policy — are now showing a 64.7% chance of a 25 bps cut when the central bank next meets on 29-30 October, CNBC reports, citing the CME FedWatch tool. The market gave a 40% chance of a cut prior to the release of the PMI data.

US Democrats have subpoenaed President Donald Trump’s personal lawyer, Rudy Giuliani, who was “at the heart” of Trump’s now-infamous call with Ukraine’s president, in which he tried to get the dirt on political rival Joe Biden. (Associated Press)

Enterprise+: Last Night’s Talk Shows

Egypt to go after Twitter, Facebook: The government will “within the coming few days begin procedures against social media platforms Twitter and Facebook” for allegedly allowing users to incite violence and cause harm to others, (watch, runtime: 10:08), Al Hayah Al Youm’s Khaled Abu Bakr said. Abu Bakr also took it upon himself to read to us Twitter and Facebook’s terms of service for almost 10 minutes. Abu Bakr did not specify what those “procedures” might be — we suggest (a) watching this space and (b) taking this with a grain of salt in the meantime.

El Sisi focused on national security, social welfare: President Abdel Fattah El Sisi discussed national security and the war on terrorism with officials from his government yesterday (watch, runtime: 03:15). El Sisi also urged officials to make sure vulnerable groups are protected against austerity measures through state-sponsored subsidy and other social welfare initiatives, Abu Bakr pointed out.

Subsidy rolls: 1.8 mn Egyptians who were wrongly removed from the subsidy program have been re-added, Masaa DMC’s Ramy Radwan said (watch, runtime: 04:48). We have more on this in our Speed Round, below.

Speed Round

Speed Round is presented in association with

Futures exchange, derivatives trading are coming next year: Egypt could launch derivatives trading and its first futures exchange in 1H2020, EGX boss Mohamed Farid said yesterday, according to the local press. No further details were provided on the plans to introduce the new financial instruments, which have been in the works for a while now.

Background: The creation of a futures market comes after amendments to the executive regulations of the Capital Markets Act issued last July opened the door to the introduction of new financial instruments, including short-selling, futures and commodities exchanges, sukuk, and green bonds. Last we heard, Misr for Central Clearing, Depository & Registry (MCDR) and the EGX were finalizing the regulations and infrastructure needed to launch derivatives trading, which would see derivatives trades settled through a new electronic platform.

INVESTMENT WATCH- Looks like the Al Nowais “clean coal” project may not happen after all: The Electricity Ministry has withdrawn a contract with the UAE’s Al Nowais to build a USD 4 bn, 2.65 GW “clean coal” power station in Oyoun Mousa, government sources told the local press. The sources said that the country’s current electricity surplus, the project’s high cost, and the ministry’s focus on renewable sources of energy were all reasons for the reported cancellation. A final agreement was expected to be signed in 1Q 2019, but ministry sources said in July that the project had been postponed, citing the country’s electricity surplus. The ministry signed the original MoU with Al Nowais back in 2014.

Other potential investments in the pipeline? The Emirati company will soon discuss with the Egyptian government offers it made to build renewable energy plants with a total capacity of 500 MW, the sources said. The Electricity Ministry is currently preparing a detailed report on the offers to present to the prime minister alongside the decision to end the Oyoun Mousa agreement.

Pioneers to make five MTOs: Pioneers Holdings’ board of directors has agreed to make non-cash mandatory tender offers to increase its share to 90% in five of its EGX-listed subsidiaries, Youm7 reported. Pioneers has yet to acquire approval from the regulator to make the MTOs, which would be executed via share swap, a relatively new mechanism in Egypt. The company will hire an independent financial advisor to decide on fair share values and identify shares of the targeted companies.

Pioneers to split into three companies: The company plans to restructure into three companies, one each focused on financial services, real estate, and the industrial sector after completing transactions. The company has hired UHY United as a financial advisor and Baker McKenzie as legal advisor to begin its studies. CEO Walid Zaki told Reuters that the company intends to complete the process by the end of the year.

Gov’t continues to disburse overdue export subsidies: Several unnamed manufacturers will receive this month part of their overdue export subsidies through cash payments from the government, head of the Export Council of Building, Refractory, and Metallurgy Industries Waleed Gamal El Din told the press. He did not disclose the number of companies that will receive the payouts. Some 15 manufacturers are also working with the Finance Ministry to receive their arrears by writing off any taxes or customs owed to the government, he added.

Background: Egypt has so far inked undisclosed settlement agreements with Schneider Electric and Sumitomo Tires under the new EGP 6 bn Export Subsidy Fund. The government has received 100 requests from companies to settle around EGP 900 mn worth of overdue subsidy payments through the new mechanism.

Gov’t restores 1.8 mn people to subsidy rolls: The Supply Ministry has added to the country’s subsidy rolls some 1.8 mn people who were wrongfully removed from the system under the ministry’s Great Subsidy Rolls Purge, the ministry said yesterday. The announcement came a day following President Abdel Fattah El Sisi’s tweet about measures to shore up the social safety nets and help “protect the rights” of low-income citizens affected by subsidy cuts. The purge of the welfare rolls as part of the ministry’s reforms to the subsidy program have recently entered their fourth phase, and saw the removal of 8 mn Kramers (our semi-fond term for welfare frauds), Supply Minister Ali El Moselhy previously said. Bloomberg also covered the story.

Foreign reserves crept up to USD 45.11 bn in September, up from USD 44.97 bn in August, the Central Bank of Egypt said yesterday.

Money supply growth slows in August: M2 money supply grew at 11.78% y-o-y in August, compared to 12.1% in July, central bank data showed yesterday. The M2 gauge stood at EGP 3.93 tn at the end of the month, up only marginally from EGP 3.88 tn at the end of the month prior. M2 measures liquid assets such as cash, savings deposits and money market securities.

EFG Hermes topped the EGX’s brokerage league table for September with a market share of 29%, according to figures released by the EGX (pdf). CI Capital came in second with a 12% market share, followed by Arqaam (4.5%), Pharos (4.1%) and Beltone (3.9%).

CORRECTION- Palm Hills’ Mazeej hotel is in Hacienda White and Le Sidi hotel is in Hacienda Bay. We incorrectly said yesterday that the North Coast hotels are in the opposite resorts. Mazeej is being developed in partnership with G’nK Hospitality, while the Lemon Tree and Co is partnering with Palm Hills on Le Sidi. The story has since been corrected on our website.

The Macro Picture

Exempting developing countries from climate change mitigation expectations would help them economically without significantly worsening the climate situation, Channing Ardt writes for the Financial Times. Developing countries currently seem to be stuck between a rock and a hard place when it comes to the environment: If no action is taken to curb emissions, they would be affected more than their developed counterparts, but they also are not economically developed enough to adopt mitigation plans without seeing their economies suffer. Alongside researchers at the MIT Joint Program on the Science and Policy of Global Change, Ardt found that low-income countries could see economic benefits from being temporarily exempted from fossil fuel cuts within 30 years. In Malawi, Mozambique, and Zambia, for example, “relatively modest efforts to cut emissions could increase the average GDP” by 2-6 percentage points versus a scenario where no action is taken worldwide to rein in temperature increases.

Developing countries contribute far less to the planet’s carbon footprint, but have far more to gain from climate action: The researchers argue that developed economies are already disproportionately larger contributors to emissions than developing nations, meaning they should take more action and climate change can still largely be mitigated even if developing countries do not contribute to emissions cuts. In turn, setting real restrictions on emissions would create a domino effect starting with lower demand for oil (and therefore lower prices). “If poorer countries are allowed a period of several years in which they are exempt from meeting emission-reduction targets (as our model assumes), the lower fuel prices could stimulate economic growth and development. Since nearly all low-income countries are net oil importers, these gains would be widespread,” Ardt says.

Spotlight

What exactly is the Data Protection Act and how is it going to affect business? Our friends at Sharkawy and Sarhan have outlined the main features of the draft legislation, which is currently on the House of Representatives’ docket for their fifth legislative session, and its repercussions for you and your business.

The draft Data Protection Act is concerned with the privacy and security of personal data, and would be applied to Egyptian citizens and foreign residents alike. It is essentially Egypt’s version of the EU’s General Data Protection Regulation (GDPR). The draft law would protect any personal data — your name, address, or photo, to name a few examples — if it leads to identifying an individual. The law would provide an additional layer of protection to sensitive data, such as an individual’s religion and his/her medical information. The act also enshrines your rights as they pertain to personal information, including right to ask that your data be deleted, and sets out obligations for organizations collecting or processing data.

The main features of the draft law that may affect you as a business:

- Limitations on organizations’ ability to collect, use, transfer, or retain personal data;

- Requirements to obtain a license and other fulfill other compliance stipulations, if data is controlled or processed (which is the case with all organizations);

- Regulations and stipulations for companies engaged in direct marketing.

Should you be worried about these regulations? The legislation covers any individual or business that collects, stores, processes, and/or transfers personal data for uses that are non-personal. The consequences for non-compliance are severe, ranging from imprisonment and fines, to revoking data-related licenses and publication of the criminal verdict in media outlets.

How can you get your house in order, and how much time do you have? The starting point is to track the data cycle from when your organization receives the data, through to it being processed and stored, and until the data is deleted. Next, make sure you comply with each of the data protection principles as they have been emptied into legal obligations (we delve into that more below). Document this in a policy and implement it — and don’t forget to train your people. Those included within the scope of the law will be expected to comply within 18 months from its issuance (assuming the executive regulations are issued on schedule).

Now that you have an idea of the main tenets, let’s look at the key data protection principles laid out in the act. We flesh out three of them below to give a clearer picture of what they entail. These are set in stone under the GDPR and mirrored in Egypt’s law:

- Lawfulness, fairness, and transparency;

- Purpose limitation;

- Data minimization;

- Accuracy;

- Storage limitation;

- Integrity and confidentiality (security);

- Accountability.

Lawfulness, fairness, and transparency: The principle stipulates that you must not collect or keep any personal data in electronic or physical form. The only exception is for lawful purposes, including if the person whose data is being collected has given their consent, the relevant document is anonymized, the company has a legitimate reason to keep the data, or there is a legal or contractual obligation. In all these cases, you must reveal the purpose of the data collection and processing.

How to comply: Ask yourself why you are collecting this data and if you are also processing it, and make sure your reasons are legitimate. For example, think of a financial institution storing personal data to comply with KYC regs under anti-money laundering laws. Wherever possible, obtain the subject’s consent.

Accuracy: This is a fairly straightforward concept that requires you to ensure the data collected is correct, and that you correct any inaccurate data.

How to comply: Map your data, review it to make sure it is correct, and put in place procedures that allow data subjects to review their data and correct it. A simple example of this is someone changing their address: Either update the information, or note that the information you have is their last known place of residence.

Integrity and confidentiality (security): You need to take the necessary technical and organizational data protection measures to guard against breach of confidentiality, hacking, destruction, alterations, or damage to the personal data. Technical measures here include more than addressing cybersecurity risks — they cover procedures such as securely disposing of documents containing personal data and securing access to any location with documents or devices that can access the data. Organizational measures, meanwhile, include coordinating on security processes between relevant members of the company.

How to comply? Draft and implement a data security policy, and train your people accordingly. A registered data protection officer should also be appointed to regularly check, evaluate, and document the protection systems. Report any data leaks, should they occur.

What needs to change in the current draft? Data protection is good and eventually leads to a better business environment for all of us. But, we are mostly worried about the imprisonment sanctions which, as currently drafted, are extraterritorial. This represents a personal threat to senior executives in Silicon Valley and Seattle. We see this as a disabling threat that may cause some companies to reconsider their investments in Egypt. The draft law is essentially borrowed from the GDPR. But on sanctions, we seem to have lost our sense of where the world is going and decided to go in the opposite direction.

Corrected on 2 October 2019

The link was updated.

Egypt in the News

The government’s response to last month’s protests is still getting coverage in the foreign press. Police have released dozens of people who had been arrested in response to protests that occurred in several Egyptian cities last month, officials said yesterday, according to the Associated Press. Authorities determined that they had no connection to the protests or the Ikhwan and were freed without charge. Human rights group the Egyptian Commission for Rights and Freedoms confirmed that dozens of detainees had been released. More than 2k people had been detained.

The roots of discontent: Discontent among some Egyptians is being driven by an economic policy that has “pushed people to their limits,” human rights activist Gamal Eid tells Deutsche Welle, which also carries a piece by novelist Alaa Al Aswany, who argues that the fact no protests took place last Friday doesn’t signal the end of discontent. Daanish Faruqi, a visiting scholar at Rutgers, in turn attacks Aswany in Foreign Policy, criticizing him for both writing passionately in favor of democracy, but supporting the overthrow of Mohamed Morsi.

Also getting attention in the international press:

- Do women have equal labor rights in Egypt? That’s the question asked by the Washington Report as it looks at women’s increasing contribution to Egypt’s labor force in the midst of gender-based wage disparity and a lack of maternity laws.

- Surprise: Ethiopia doesn’t like Egypt’s GERD proposal. Egypt’s proposal on the filling of the Grand Ethiopian Renaissance Dam (GERD) is “dangerous,” and puts Ethiopia in a losing position, Ethiopian water experts say, according to Ethiopian media.

Worth Listening

Can AI-produced art be genuinely creative? AI-produced art has the potential to show us how we as humans frequently limit our own creativity in a very machine-like way, and could force us to rediscover the creative abilities that make us human, argues mathematician Marcus du Sautoy in this Financial Times podcast (listen, runtime: 19:56). He cites jazz musician Bernard Lubat, who experimented with machine learning systems that ended up producing music that he felt was “unquestionably” him, but years ahead of what he was actually creating. The 2001 Lovelace test was created to assess creativity in machines, saying essentially that if a machine can originate a work of art using a repeatable (rather than a random) process, but the AI’s programmer cannot explain how the output was produced, it has attained human-like intelligence.

Diplomacy + Foreign Trade

Brazilian beef exporters pressuring Agriculture Ministry to scrap halal meat certificate decision: The recent Agriculture Ministry decision to limit the acceptance of halal meat certificates to only the Egyptian Islamic Company is being met with backlash from the Brazilian Beef Exporters Association (ABIEC), which expressed its refusal to the Brazilian embassy, according to a local press report. ABIEC is in talks with Brazil’s diplomatic mission here in Egypt to lobby against the decision, which took effect yesterday.

Basic Materials + Commodities

EGX to partner with Supply Ministry to operate commodities exchange

The EGX will partner with the Supply Ministry to operate the holding company that will be set up to manage the country’s first exchange market for industrial and agricultural commodities, ُEGX Chairman Mohamed Farid told reporters, according to Youm7.

Manufacturing

Holland’s GEMCO to build EUR 18.7 mn foundry for Egypt’s Delta Steel

Dutch engineering and contracting firm GEMCO has been awarded a EUR 18.7 mn to build a steel and cast iron foundry for state-owned Delta Steel on a turnkey basis, Al Mal reports.

Egypt signs MoU with Chinese companies to produce EV charging stations

The National Authority for Military Production signed an MoU with China’s SSE International and Marathon International Technology to establish a facility to produce EV charging stations, according to Hapi Journal. The agreement comes as Egypt is working on setting up the infrastructure for electric vehicles in the country.

Health + Education

GE signs agreement with Alpha Healthcare to distribute x-ray machines in Egypt

General Electric Healthcare signed a partnership agreement with Alfa Healthcare to provide x-ray machines that are currently unavailable in the market, according to the local press. The machines would be provided under a 12-month payment plan for healthcare providers.

Real Estate + Housing

IDA to launch website for industrial projects this month

The Industrial Development Authority (IDA) will this month launch an electronic platform for investors to buy industrial land, boss Magdy Ghazi said. The map has been completed and the government is now working to secure the website before it launches. The move was first announced by the government last month as part of efforts to promote transparency and fair competition in the sector.

Automotive + Transportation

Bahri Logistics to launch cargo shipping line from Egypt to Houston

Saudi Arabia’s Bahri Logistics will begin operating a cargo shipping line from Ain Sokhna Port to the Port of Houston today, according to Al Mal. This will be the first Ain Sokhna-Houston line to be operated. Bahri is in talks with Egyptian exporters and shipping companies to sign contracts to use the cargo line.

Banking + Finance

SAIB leading group of Egyptian banks to arrange EGP 1 bn loan for Dorra Real Estate

SAIB Bank is in talks with a number of unnamed local banks to arrange a EGP 1 bn syndicated loan for Dorra Real Estate Development Group to fund projects in the new administrative capital, banking sources told Al Shorouk.

Other Business News of Note

Egypt launches website to create database of foreign investment

The General Authority for Investment (GAFI) has asked public and private sector companies to provide information about direct and indirect foreign investment on a newly launched website (Arabic) (English) built for statistical and auditing purposes, the Investment Ministry said in a statement.

EgyptAir receives second A220-300 Airbus

Canada’s Bombardier has delivered a second Airbus A220-300 Airbus to EgyptAir under a supply contract that will see the flag carrier receive 12 of the aircraft as part of its fleet modernization plans, according to Al Shorouk.

Legislation + Policy

El Sisi approves amendments to medical profession law

President Abdel Fattah El Sisi ratified on Monday legislative amendments to the medical profession law, according to Ahram Online. Under the amendments, medical school graduates in Egypt will undergo mandatory training for one year to be eligible to join the Health Ministry's register of licensed medical professions. University graduates will also be required to pass a medical test as a requirement for licensing, which would need to be renewed every five years.

Sports

El Welily, El Shorbagy win Oracle NetSuite championship following all-Egyptian finals

Egyptian squash champions Raneem El Welily and Mohamed El Shorbagy won the women’s and men’s Oracle NetSuite championship in San Francisco, after defeating compatriots Nour El Tayeb and Tarek Momen in an all-Egyptian final, according to the championship’s website.

On Your Way Out

Calling all tech enthusiasts: Vodafone Egypt launched its annual four-day innovation hackathon, which brings competitors to develop new ICT solutions, including AI and virtual reality, to support Egypt’s digital transformation, according to the local press. The team that comes in first place will receive a prize of EGP 120k, while the second place winner will receive EGP 60k, and third-place team EGP 30k.

The Market Yesterday

EGP / USD CBE market average: Buy 16.20 | Sell 16.33

EGP / USD at CIB: Buy 16.21 | Sell 16.31

EGP / USD at NBE: Buy 16.23 | Sell 16.33

EGX30 (Tuesday): 14,496 (+1.7%)

Turnover: EGP 779 mn (15% above the 90-day average)

EGX 30 year-to-date: +11.2%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.7%. CIB, the index’s heaviest constituent, ended up 2.8%. EGX30’s top performing constituents were Ezz Steel up 7.8%, Pioneers Holding up 4.9%, and Egyptian Iron & Steel up 3.5%. Yesterday’s worst performing stocks were Cairo for Investment and Real Estate down 1.9%, Eastern Company down 0.9% and Egyptian Resorts down 0.7%. The market turnover was EGP 779 mn, and local investors were the sole net sellers.

Foreigners: Net long | EGP +32.0 mn

Regional: Net long | EGP +38.2 mn

Domestic: Net short | EGP -70.2 mn

Retail: 65.1% of total trades | 61.3% of buyers | 68.8% of sellers

Institutions: 34.9% of total trades | 38.7% of buyers | 31.2% of sellers

WTI: USD 53.97 (+0.7%)

Brent: USD 59.17 (+0.5%)

Natural Gas (Nymex, futures prices) USD 2.30 MMBtu, (+0.7%, November 2019 contract)

Gold: USD 1,487 / troy ounce (-0.11%)

TASI: 8,052 (-0.5%) (YTD: +2.9%)

ADX: 5,054 (-0.1%) (YTD: +2.8%)

DFM: 2,778 (-0.1%) (YTD: +9.8%)

KSE Premier Market: 6,161 (-0.2%)

QE: 10,434 (+0.7%) (YTD: +1.3%)

MSM: 4,036 (+0.5%) (YTD: -6.7%)

BB: 1,515 (-0.1%) (YTD: +13.3%)

Calendar

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

October: German businessman delegation will visit Egypt to discuss good projects in order to spend German funds into Egypt

October: A delegation of 40-50 Saudi companies will visit Egypt to discuss increasing exports of Egyptian furniture.

3 October (Thursday): Emirates NBD / Markit PMI for Egypt released.

5-6 October (Saturday-Sunday): Annual International Federation of Technical Analysts (IFTA) conference. Cairo Marriott Hotel.

6 October (Sunday): Armed Forces Day, national holiday.

7-10 October (Monday-Thursday): A Russian delegation will visit Cairo to attend a joint forum to discuss cooperation in various fields, including trade.

8-10 October (Tuesday-Thursday): A delegation of 20 Korean companies visits Egypt.

10-13 October (Thursday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

20-24 October (Sunday-Thursday): German-Arab Chamber of Industry and Commerce’s ROI Week with ROI Institute, JW Marriott Hotel, New Cairo

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23-24 October (Wednesday-Thursday): Russian-African Summit, Sochi City, Russia

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

13-15 November (Wednesday-Friday): Africa Early Stage Investor Summit, Cape Town, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.