- Current account deficit widens to USD 8.2 bn in FY 2018-2019. (Speed Round)

- Tourism sector could recover to pre-crisis levels this year -Mashat. (Speed Round)

- BdC and three other companies have six months to complete their IPOs, leaked FRA document suggests. (Speed Round)

- CBE easing to slash gov’t interest bill by 20% -Kouchouk. (Speed Round)

- Algebra, Glint invest EGP 20 mn in FilKhedma. (Speed Round)

- PrintX raises USD 150k from Saudi investor. (Speed Round)

- FEI lobbies ministry for income tax changes. (Speed Round)

- The new legislative season kicks off today. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 1 October 2019

The House of Representatives is back in session today.

TL;DR

What We’re Tracking Today

Today’s the day, ladies and gents: The House of Representatives reconvenes at 10am CLT today for its fifth and final legislative session before we’ll elect not just MPs to the House, but also a new Senate, which was reconstituted under the new constitution. What’s on the House’s agenda as MPs get back to business? We had a preview yesterday of what you might expect.

(Incidentally, we’re not the only ones who want to tax global internet giants: Canada’s governing Liberals announced yesterday as part of their re-election platform that they plan to impose a 3% tax on revenue that “digital companies that make at least USD 1 bn in annual global revenues and at least USD 40 mn in Canadian revenues … generate through the sale of online advertising and user data.”)

Gov’t to announce fuel prices today: The government will likely leave fuel prices unchanged for 3Q2019 under its newly implemented automatic fuel pricing mechanism, analysts expected, citing a strong EGP and expectation of relatively stable global oil prices. The mechanism was mandated by the IMF as a condition for the disbursement of the fifth tranche of its USD 12 bn facility to Egypt. An unnamed government source also told Al Shorouk the prices would be kept on hold.

Moody’s is the latest with something to say on last week’s 100 bps interest rate cut, saying that lower interest rates and slowing inflation will provide an extra shot in the arm for the economy. The ratings agency expects capex and consumer spending to pick up in the coming months and government finances to continue stabilizing as its interest bill falls (we have more on this last point in this morning’s Speed Round, below). Moody’s also expects lower rates to stimulate credit growth by more than 15% next year.

Indicators we’re keeping our eye on as we step into October:

- PMI: The purchasing managers’ index for Egypt, the UAE, and Saudi Arabia will be released on Thursday, 3 October at 6:15 CLT.

- Foreign reserves: The Central Bank of Egypt is due to release net foreign reserves figures for August this week or next.

- Monthly inflation figures for September are due at the end of next week. Inflation cooled for the second consecutive month in August to 7.5%, marking the lowest reading in six-and-a-half years.

Among the conferences taking place in the coming days:

- Beltone is running an investor conference in Dubai this week.

- The annual International Federation of Technical Analysts (IFTA) conference takes in Cairo place this Saturday and Sunday.

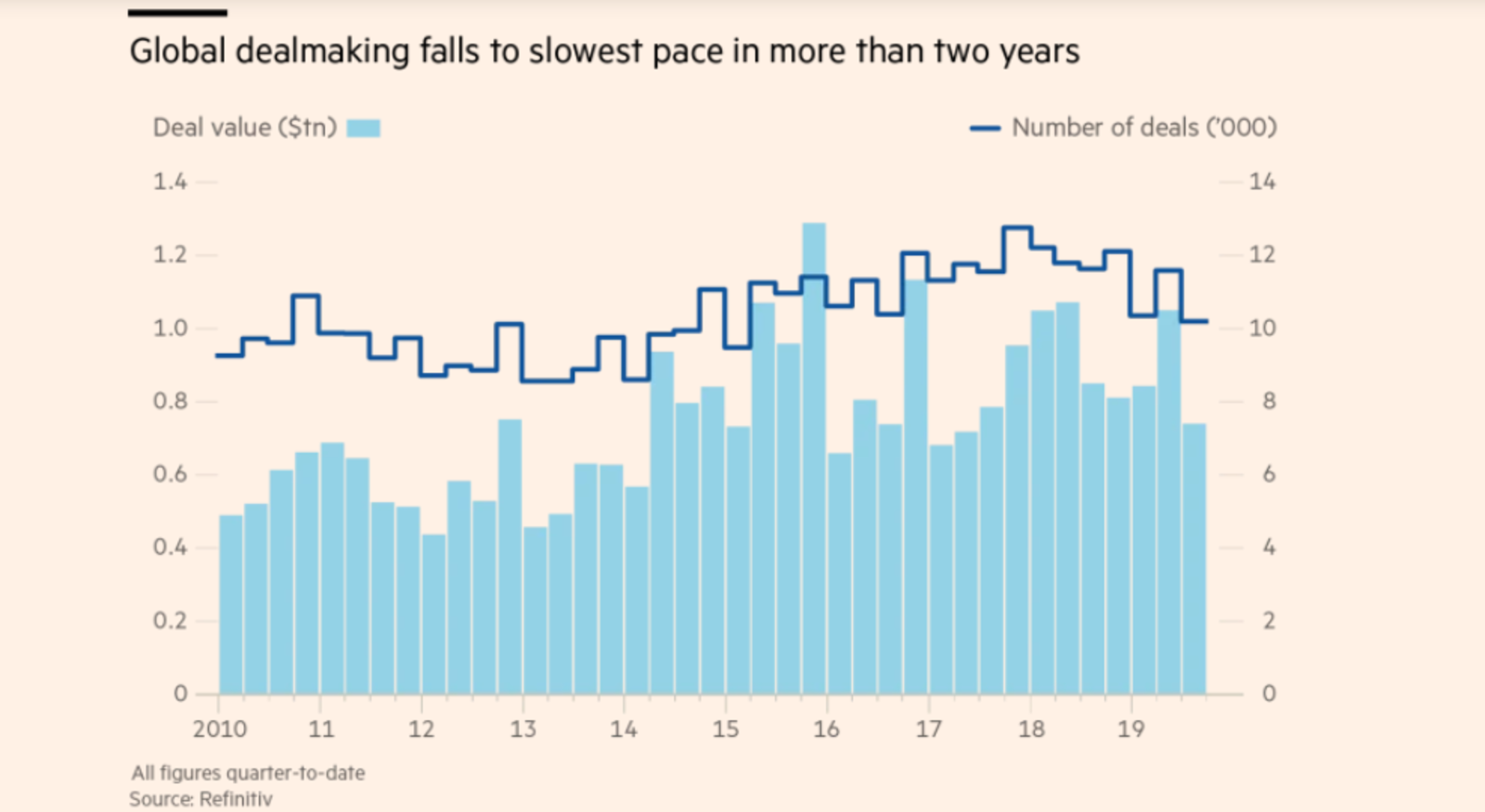

Global M&A in 9M2019 dropped 11% to USD 2.8 tn “as fears of an economic slowdown sap corporate confidence” and a USD 200 bn merger between Altria and Philip Morris International failed to materialize, according to Refinitiv data picked up by the Financial Times. M&A activity during 3Q2019 — around USD 740 bn-worth of transactions — was the slowest in two years. “M&A markets thrive when CEOs and directors have confidence in the future, and it’s hard to have confidence in the future when the world around you is in turmoil both economically and politically,” said Scott Barshay, partner at Paul Weiss law firm.

Fund managers the world over are cutting their exposure to equities and are recommending bonds as a better alternative amid volatility in financial markets, according to a Reuters poll. “Overall equity exposure in the global balanced model portfolio has fallen to the lowest since November 2016,” declining more than four percentage points since the beginning of 2019 to reach 44.3% in September. On the flipside, recommended bond holdings have reached a six-year peak, rising 3 percentage points this year to 42.1%. The poll didn’t take into account the shift in sentiment after the Trump administration said it’s mulling barring Chinese companies from listing on US exchanges, “which broke the wave of optimism” that a detente in the US-China trade war was imminent.

Further escalation in Saudi-Iranian tensions could bring down the global economy, Saudi Crown Prince Mohammed bin Salman said in an interview with CBS’ 60 Minutes (watch, runtime: 12:55). MbS called the attacks on Saudi Aramco’s oil facilities earlier this month — which Saudi and its western allies all pinned on Iran — “an act of war,” and cautioned that a military response would impact the rest of the world. The crown prince also denied his involvement in the murder of Washington Post journalist Jamal Khashoggi during the interview. Both the Financial Times and Bloomberg have more.

Citing geopolitical tensions and the kingdom’s vulnerable economy, Fitch downgraded Saudi yesterday, bringing its long-term foreign-currency issuer default rating to ‘A’ ’from ‘A+’, according to a press release. Pointing to the Aramco attacks, the ratings agency said it believes “that there is a risk of further attacks on Saudi Arabia, which could result in economic damage.”

Nobody’s quite sure why, but diverse companies perform better than their more homogeneous counterparts. Diversity in gender and overall board composition together create a statistical likelihood for a company’s financial success, Morgan Stanley’s global head of sustainability research Jessica Alford writes for the Financial Times. The investment bank analysed company data over the past eight years and found that gender-diverse companies outperform less diverse companies. “Globally, the most gender-diverse companies outperformed their regional benchmarks by 1.7 percentage points on average each year, while the least gender-diverse firms underperformed by 1.4 percentage points,” Alford writes. The trend still held up even when controlling for company size, dividend yield, profitability, and risk.

We’re not in Hawkins anymore: Stranger Things dropped a teaser trailer for the upcoming fourth season on its Instagram page yesterday. The widely expected fourth season had previously not been announced by the streamer. Now, if they’d just say when that season might actually start, the resident 12-year-old would be happy.

PSA- Mercury levels in the capital this afternoon are expected to peak at a balmy 32°C, before cooling off to 22°C, according to Meteorological Authority forecasts (pdf). Those in Alexandria will be seeing slightly cooler weather with highs of 29°C and a chance of rainfall.

Enterprise+: Last Night’s Talk Shows

It was a mixed bag on the airwaves last night. The State Information Service (SIS) struck back against Amnesty International accusations that the state restricted people’s right to freedom of movement on Friday, Al Hayah Al Youm’s Khaled Abu Bakr highlighted (watch, runtime: 10:52). The SIS accused the human rights organization of acting politically.

No need to panic over fuel prices: El Hekaya’s Amr Adib phoned the Oil Ministry spokesman Hamdi Abdel Aziz to have him reassure apparently panicking citizens that fuel prices won’t necessarily increase today (watch, runtime: 02:59). The government will announce fuel prices today under its new fuel pricing mechanism, which lets it decide fuel prices based on global oil prices and the exchange rate.

Gold prices declined in Egypt and abroad yesterday: Hona Al Asema’s Reham Ibrahim spoke to Nady Naguib, general secretary of the Gold Division at the Cairo Chamber of Commerce, who said that the price of a gram of 21-carat gold fell to 675 pounds from 677 pounds in morning trading. He recommended people buy gold now while the price is lower (watch, runtime: 07:40).

Speed Round

Speed Round is presented in association with

Egypt’s current account deficit widened to USD 8.2 bn in FY 2018-2019, up from USD 6 bn the previous year, according to central bank figures (pdf). Rising imports and a dip in remittances caused the current account to fall further into the red, despite the oil balance turning a surplus and a pick up in tourism revenues.

The balance of payments (BOP) recorded an overall deficit of USD 102 mn against a USD 12.8 bn surplus the year before. BOP figures have slowly recovered over the second half of the year after sinking to a USD 1.77 bn deficit during 1H 2018-2019. Reuters has the breakdown by quarter.

The good news first: The oil trade balance recorded a surplus of USD 8.1 mn compared to a deficit of USD 3.7 bn the year before as “a result of the leap in investments in the oil and gas sector,” the CBE said. Oil exports rose to USD 11.6 bn last fiscal year, up from USD 8.7 bn the year before, as imports fell by 7.6% to USD 11.5 bn from USD 12.5 bn. Egypt halted all imports of natural gas in the second quarter of FY 2018-2019 and gradually lowered reliance on imported oil products and crude.

The non-oil trade balance wasn’t as hot: The deficit widened by 13.4% to USD 38 bn, driven both by a fall in exports and a rise in imports, which the CBE said was partly due to a pick up in economic activity.

Tourism revenues surged to USD 12.6 bn from USD 9.8 bn in 2017-2018.

FDI and portfolio investment fell in FY 2018-2019: Net foreign direct investment fell to USD 5.9 bn from USD 7.7 bn the year before, while net inflows of portfolio investment declined to USD 4.2 bn from USD 12 bn.

Expat remittances slipped to USD 25 bn from USD 26 bn during the year, in a drop that Pharos Holding’s Radwa El Swaify described as “insignificant.”

CBE easing cuts gov’t interest bill by a fifth -Kouchouk: The Central Bank of Egypt’s (CBE) interest rate cuts in August and September will slash the government’s interest bill by a fifth, Vice Finance Minister Ahmed Kouchouk said yesterday, Reuters reported citing MENA. The government’s interest bill will fall by as much as 20% to EGP 20 bn from the EGP 25 bn it was paying before the latest round of monetary easing, he said.

“Every percentage point cut in interest saves the state budget between EGP 8 bn and EGP 10 bn a year,” Kouchouk was quoted as saying on the sidelines of “an investment conference” in Dubai (presumably the Beltone Access conference, but not specified in the original story). The CBE has cut key interest rates twice over the past two months, making a 150 bps cut in August and a 100 bps cut last Thursday. The overnight lending rate now stands at 14.25% and the deposit rate 13.25%.

Despite the cut, investors in a low-yield world are still hungry for Egyptian debt: Foreign holdings of Egyptian treasuries climbed to USD 18.3 bn in August, up from USD 16.7 bn in July, Kouchouk said. EGP treasuries will continue to be attractive for foreign investors because of the economic stability brought about by the government’s reform program, he added. Meanwhile, foreign holdings in treasury bills fell to USD 15.2 bn at the end of August from USD 16.9 bn at the end of the previous month, according to CBE data (pdf).

Egypt's tourism sector should claw its way back to its pre-crisis high-water mark by the end of this year, Tourism Minister Rania Al Mashat said during a Bloomberg TV interview yesterday (watch, runtime: 3:43). Al Mashat attributed the “quite steep” rebound in the industry to the legislative and administrative reforms implemented under Egypt’s Tourism Reform Program, her ministry’s long-term policy framework aimed at overhauling the sector. The program also helped to improve tourism infrastructure, and focused on branding and promotion for the country. Egyptian Travel Agencies Association boss and Blue Sky Chairman Hossam El Shaer this week said that tourist arrivals have increased some 30% y-o-y so far this year.

Thomas Cook’s bankruptcy is unlikely to have a lasting impact the industry. Al Mashat downplayed the potential losses of thousands of British tourists as a result of Thomas Cook’s recent liquidation. The country is facing the prospect of losing 100k tourists that were expected to book via Thomas Cook next year, while 25k reservations booked up to April 2020 have been cancelled. “The bankruptcy that happened in the British markets not only affects Egypt but other countries… we had invested time in the past few years to diversify the markets where tourism comes from. British tourists are not the main tourists to Egypt anymore,” she said. Former ministry undersecretary Magdi Selim said the loss of Thomas Cook was bound to a negtive, if short-lived, impact on the sector: “The collapse of a leading company like Thomas Cook will inevitably affect tourism in Egypt, but this will be temporary,” he told Al Monitor.

Companies are already bidding to fill Thomas Cook-shaped hole in Egypt’s tourism sector: A number of multinational companies have begun competing to fill the void in Egypt’s tourism market left behind by Thomas Cook, said Ahmed El Wassif, head of the Egyptian Tourism Federation. British package travel operators easyJet Holidays and Jet2holidays are among the candidates to pick up the slack, according to TTG. Bassem Halaka, president of the Travel Agents Trade Union, told Al Monitor that it may only take “up to two months” for new operators to come in and take Thomas Cook’s place.

The situation isn’t great for Blue Sky: Thomas Cook’s local operator Blue Sky Group is owed EGP 125 mn by the now defunct company, El Shaer said yesterday without providing further details, according to Reuters.

IPO WATCH- BdC and three other companies have six months to complete their IPOs: The Financial Regulatory Authority (FRA) has reportedly given four companies, including state-owned Banque du Caire, a six-month grace period to complete their initial public offerings, according to a copy of the decision picked up by the local press. BdC, City Trade Securities and Brokerage, Sky Light for Touristic Development, and New Castle for Sports Investment have all listed on the stock exchange, but trading of their shares has yet to begin. These four companies are now required to submit their plans and timeline to complete their IPOs to the EGX by 30 November.

Background: The Finance Ministry told us last week that a government committee is close to finalizing a fresh package of incentives to boost stock trading activities. The incentives would possibly include tax breaks, a capital gains tax exemption for non-residents, and a full stamp tax exemption for residents. Chairman Tarek Fayed told reporters in August that Banque du Caire is expected to IPO sometime around early 2020. The sale could see the bank raise between USD 300-400 mn, and is part of the IPO-phase of the state privatization program.

CIRA closes EUR 25 mn EBRD funding agreement: Cairo for Investment and Real Estate Development (CIRA) signed yesterday an agreement with the European Bank for Reconstruction and Development (EBRD) for a EGP-denominated facility worth EUR 25 mn to set up a university in Assiut’s Nasser City, CIRA said in a press release (pdf). The EBRD will also be providing the leading private-sector education outfit with a EUR 400k grant to acquire a green building certification by incorporating “innovative sustainable design features and technologies,” reads the statement. CIRA is aiming to position the university as a cultural and education hub in Upper Egypt. “Our partnership with EBRD will add an important dimension towards both accelerating and enhancing the establishment of a top model of impactful environmental friendly universities in Egypt,” CEO Mohamed El Kalla said.

INVESTMENT WATCH- Majid Al Futtaim opens EGP 6.8 bn Heliopolis mall: UAE-based real estate developer and retail giant Majid Al Futtaim (MAF) opened yesterday its EGP 6.8 bn City Center Almaza shopping mall in Heliopolis, Al Mal reported. The mall includes 260 retail shops, a cinema and a Carrefour hypermarket. “Egypt is today the fastest growing market so it is back and it is back well and hopefully for good…we are very happy with Egypt but there is much more to come,” CEO Alain Bejjani told Bloomberg last month.

Sodic reeled in EGP 1 bn in presales on the first day of the launch of its new compound, “The Estates,” according to a statement (pdf). Located in New Zayed, 5 km north of Sodic West, the 630k sqm all-villa compound will include a clubhouse and a spa. The Estates is the upscale developer’s first venture in New Zayed, where it plans to develop a series of projects “that represent a new generation of developments for Sodic in West Cairo.” Sodic has previously said it plans to invest EGP 34 bn in four new projects in New Zayed over the coming decade.

STARTUP WATCH- Algebra Ventures and Glint Consulting have invested EGP 20 mn in home services marketplace FilKhedma, founder Omar Ramadan announced at a press conference yesterday. The new investment will be used to develop the application, launch new marketing campaigns and hire employees, he said. In addition to Algebra and Glint, FilKhedma’s current shareholders include Ramadan and Khaled Ismail’s KiAngel.

STARTUP WATCH- PrintX raises USD 150k from Saudi investor: Cairo-based printing services startup PrintX has raised USD 150k from a Saudi-based angel investor, Menabytes reports. The company plans to use some of the capital to establish an online platform to provide on-demand printing services for individuals and businesses. The service will allow customers to preview designs on a range of products and track their orders, co-founder and CEO Abdelrahman Gaber said. It will also use part of the investment to expand its reach in Egypt, with a view to entering the Saudi market next year.

Beltone sees scope for growth in Egypt, looks to regional expansion: Egypt has become a hub for attracting investment, especially in fixed income, thanks to the attractiveness of its carry trade and the success of its economic reform program, Beltone Financial’s Executive Chairman Maged Shawky told Bloomberg TV (watch, runtime 04:11). With the region’s fastest growth rate and inflation now at its lowest point in six and a half years, Egypt remains a focus for Beltone even as the investment bank looks at regional expansion on the horizon, particularly as markets like Saudi Arabia and the UAE “can’t be ignored,” Shawky said.

Non-banking financial services will be a core engine of growth in Egypt and should attract inward investment over the next two to five years, along with consumer-related sectors and real estate, Shawky predicts. Beltone is increasingly orienting itself towards non-banking financial services in Egypt’s relatively un-banked population, he said. With declining interest rates opening up a lot of room for lending and enhancing purchasing power, these are the lines of business that will be flourishing in the coming period, he said.

Despite speculation, the finance industry is unlikely to see consolidation: Changes or difficulties in the industry have historically prompted discussions about potential M&A in the finance industry, but these ideas rarely materialize into actual plans, Shawky said. He stressed that Beltone is not looking at any potential mergers with other industry players.

Austerity has been tough, but financial easing is coming: The impact of declining inflation and interest rates will translate into lower prices in the coming period, Shawky said. He brushed off recent protests as being a natural response among the middle and lower class to the government’s economic reform program, but expects prices to continue falling as long as economic stability prevails.

LEGISLATION WATCH- FEI suggests changes to Income Tax Act: The Federation of Egyptian Industries (FEI) is lobbying the Finance Ministry for changes to the Income Tax Act, the local press reported. Among the amendments is a proposal to give a tax cut to low income earners by tripling the tax exemption threshold to EGP 24k from EGP 8k currently. The FEI wants to amend residency rules for corporate tax purposes and redefine what it means for individuals or entities to have a “close relationship” with a company. It also wants to ensure that all e-commerce companies are brought into the tax base.

Background: The government began drafting significant changes to the Income Tax Act in May, which are expected to impact how tax appeals are handled, the ministry’s internal tax committees, and the procedures for filing tax returns. The government said last month it had incorporated suggestions from the business community and finalized an initial draft of a new income tax law that it was ready to put up for public consultations before going to Cabinet for approval. Once approved, the draft will be handed over to the House of Representatives for a discussion and a final vote before getting signed into law by the president. Maait said in July that the new law would not make any changes to income tax rates.

LEGISLATION WATCH- New Tourism Act coming? The Egyptian Tourism Federation (ETF) is coordinating with the House of Representatives’ Tourism and Civil Aviation Committee to prepare draft legislation on tourism licensing, ETF head Ahmed El Wassif said. The legislation would simplify licensing procedures and name the entity that is to be in charge of issuing licenses as part of efforts to boost tourism and attract investment, El Wassif said. He expected the legislation to be discussed by the House during the current legislative session, which kicks off today.

Maait denies auto development tax: Finance Minister Mohamed Maait yesterday denied our report that his ministry is considering a new development tax on locally-produced and imported cars. Our report was based on interviews with two senior government officials who have historically proven accurate and trustworthy.

MOVES- Bupa Egypt has appointed Mohamed Bazzi (LinkedIn) as managing director, replacing Abeer Helmy, Al Mal reported.

Egypt in the News

El Sisi promises to support low-income citizens: The government is working on measures to shore up the social safety nets and help “protect the rights” of low-income citizens affected by subsidy cuts, President Abdel Fattah El Sisi wrote on Twitter yesterday. The foreign press, including the Associated Press, took note of the message in light of recent protests, which continue to lead the conversation on Egypt.

Turkish mouthpiece TRT World was out with a piece yesterday saying that rising economic inequality and perceived corruption were the main drivers of the demonstrations. An editorial in the Washington Post suggests that the huge security operation this past weekend revealed a sense of “panic” within the government about the possibility of the previous weekend’s outburses escalating. The Committee to Protect Journalists (CPJ), meanwhile, is calling on the government to release journalists Alaa Abdel Fattah, Nasser Abdel Hafez and Engi Abdel Wahab who are among almost 2k people swept up in a widespread campaign of arrests.

Worth Reading

Rajia Hassib’s ‘A Pure Heart’ explores complex ideas about identity in post-2011 Egypt: Egyptian novelist Rajia Hassib’s most recent work, A Pure Heart, unpacks the challenges of reconciling the multiple, often contradictory, facets of an individual’s personality through the stories of two sisters in the context of post-2011 Egypt. The novel has been met with wide critical acclaim, with the New York Times saying it “beautifully articulates the full-bodied chorus of Egypt’s voices,” while the Observer praises the compelling way it shows a multiplicity of viewpoints, highlighting the divisions among family and community members that are innately human.

Diplomacy + Foreign Trade

New round of EAEU trade agreement talks: Egypt and the Eurasian Economic Union (EAEU) will resume on Saturday talks over a trade agreement that would also see the creation of freetrade zones in Egypt, head of the Egyptian Commercial Service Authority Ahmed Antar tells Mubasher. Trade and Industry Minister Amr Nassar had said at the beginning of the year that the trade agreement will be signed by the end of 2019, and the two sides will meet once every three months to hammer out the final agreement. The initial framework was signed in November by Nassar and Eurasian Economic Commission Trade Minister Veronika Nikishina.

Energy

Eni to begin trial operations on 13th well at Egypt’s Zohr

Italy’s Eni will begin test operations on the Zohr natural gas field’s 13th well next week, industry sources tell the local press. The well is expected to produce an average of 150-250 mcf/d, and Eni will reduce output from other wells in the field to avoid a supply glut.

Waste-to-energy tariff to be ratified by gov’t within two weeks

The tariff for waste-to-energy tariff projects will be ratified by the cabinet within the next two weeks, Environment Minister Yasmin Fouad told the local press. The value of the tariff will be dependent on the USD exchange rate to attract domestic and foreign investment in the sector, Fouad said, without explaining how the tariff will be calculated or correlated with the USD. Sources told the local press in August that the tariff would be set at 140 piasters per kWh: the Electricity Ministry would pay 103 piasters per kWh and the Environment Ministry the remaining 37 piasters.

Manufacturing

Egyptian textiles producer MardiniTex to invest EUR 2 mn next year to up output

Textiles manufacturer MardiniTex is planning to invest EUR 2 mn in mid-2020 to increase its production capacity to 300k meters per year, owner Maamoun Mardini told the local press. The company’s investment plan involves upgrading machinery and expanding an existing production facility. MardiniTex earmarks some 75% of its output for exports to European and Asian countries, and is planning to increase this figure to 90%.

Egypt’s AOI in talks with Opel for domestic EV manufacturing

The Arab Organization for Industrialization is in talks with Opel to manufacture electric vehicles (EVs) in Egypt, Chairman Abdel Moneim Al Terras said. Al Terras previously announced talks with several other EV manufacturers, including Toyota, to set up shop here. The plan to manufacture EVs domestically comes alongside a government initiative to replace outdated state-operated buses with natural gas-powered vehicles manufactured domestically.

Real Estate + Housing

Polaris Parks signs contracts with three companies for Sadat City industrial zone

Polaris International Industrial Parks has signed contracts with three multinational and local companies to invest in the first phase of a new industrial zone in Sadat City, Assistant Manager Bassel Shoeira told Amwal Al Ghad. The company aims to begin developing the land plots within the coming three months, he said. Polaris is also in talks with a further five companies in the food sector, including two multinationals, that it expects to sign contracts before the end of the year.

Tourism

Archaeologists dig up temple ruins from Ptolemaic Egypt in Sohag

An Antiquities Ministry archaeological team has unearthed in Sohag the ruins of a temple that could have belonged to Ptolemy IV, the fourth pharaoh of Ptolemaic Egypt, according to a ministry statement. The ruins were discovered while drilling for a sewage drainage project, which has been suspended until the archaeological team completes the temple’s recovery.

Palm Hills completes two hotels in Egypt’s North Coast

Palm Hills has completed two boutique hotels in its Hacienda White and Hacienda Bay resorts in Sahel at a cost of EGP 300 mn, the real estate developer said in a press release (pdf). The Mazeej hotel in Hacienda White includes 34 rooms and four suites, while Hacienda Bay’s Le Sidi hotel offers 28 suites.

Corrected on 1 October 2019

A previous version of this article incorrectly flipped around the locations of the Mazeej and Le Sidi hotels.

Telecoms + ICT

Communications Ministry, French companies to launch entrepreneurship competition

The Communications Ministry is launching an entrepreneurship competition this month designed to create healthcare, fintech, and smart city systems and solutions, a ministry official told the local press. The competition, which runs until February, will be sponsored by unnamed French companies. The initiative comes a week after Communications Minister Amr Talaat visited France for talks with ministers and companies about working more closely on tech innovation.

Telecom Egypt to install fiber optic cables in Shorouk

The Shorouk City Authority signed a cooperation protocol with state-owned landline monopoly Telecom Egypt to install fiber optic cables, according to Mubasher. The project will be carried out in two phases, but it remains unclear how long the phases will take to complete.

Banking + Finance

Banque Misr joins responsible banking initiative, signs e-payment protocol with Alex Port

Banque Misr has signed on to join 130 banks worldwide to begin implementing the Principles of Responsible Banking launched under a United Nations Environment Program (UNEP) initiative, according to Al Shorouk. The initiative, which sets principles in accordance with Sustainable Development Goals, aims to develop economies and encourage financial institutions to “align [their] business strategy with society’s goals.” Separately, Banque Misr and the Alexandria Port Authority signed a cooperation protocol on Sunday to provide electronic payment options for the port’s services and activities, according to Al Shorouk.

Other Business News of Note

Raya’s BariQ to invest EGP 300 mn in Sixth of October facilities

Raya Holding’s recycled plastic producer BariQ aims to invest EGP 300 mn to expand its Sixth of October facilities, Sales Manager Ahmed Nabil told the local press. The company aims to establish new production lines to double its output capacity to 3.2 bn recyclable bottles per year. The company exports 100% of the raw material it produces from recyclable bottles, which amounts to 15k tonnes per year.

Egypt Politics + Economics

Egypt’s newly-established securities federation receives 90 membership requests

Egypt’s Federation for Securities has so far received over 90 membership requests since it was established by the Financial Regulatory Authority (FRA) in March, head of the federation’s establishing committee Soliman Nazmy said yesterday. The committee is waiting for more of the 550 FRA-licensed firms to request membership before organizing board elections. Each member company will be able to nominate one candidate for the federation’s board.

Sports

Mo Salah named captain of Egypt’s national football team

Mohamed Salah has been named the new captain of Egypt’s national football team, recently-appointed head coach Hossam El Badry announced on Saturday, according to the local press. Speculation was rife that Salah may leave the Pharaohs following tension with the Egyptian Football Association (EFA) for allegedly not voting for Salah to receive the Best Fifa Men’s Player Award. Fifa later explained that their votes were not counted because they were invalid.

On Your Way Out

US actor Steven Seagal made a whistlestop and (excuse us for this) action-packed visit to Egypt on Friday, attending the Gouna Film Festival and then touring the Giza Pyramids with his wife, Egypt Today says. Seagal is best known for starring in cheesy ‘90s action movies and fighting accusations of [redacted] assault.

The Market Yesterday

EGP / USD CBE market average: Buy 16.20 | Sell 16.33

EGP / USD at CIB: Buy 16.21 | Sell 16.31

EGP / USD at NBE: Buy 16.23 | Sell 16.33

EGX30 (Monday): 14,258 (-0.4%)

Turnover: EGP 688 mn (2% above the 90-day average)

EGX 30 year-to-date: +9.4%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.4%. CIB, the index’s heaviest constituent, ended down 1.5%. EGX30’s top performing constituents were CIRA up 6.0%, Qalaa Holdings up 5.2%, and Juhayna up 3.6%. Yesterday’s worst performing stocks were Oriental Weavers down 1.6%, CIB down 1.5% and Ibnsina Pharma down 1.5%. The market turnover was EGP 688 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -14.0 mn

Regional: Net short | EGP -23.1 mn

Domestic: Net long | EGP +37.1 mn

Retail: 56.7% of total trades | 56.7% of buyers | 56.7% of sellers

Institutions: 43.3% of total trades | 43.3% of buyers | 43.3% of sellers

WTI: USD 54.27 (+0.4%)

Brent: USD 60.78 (-1.8%)

Natural Gas (Nymex, futures prices) USD 2.33 MMBtu, (-0.2%, November 2019 contract)

Gold: USD 1,479 / troy ounce (+0.4%)

TASI: 8,091 (+0.5%) (YTD: +3.4%)

ADX: 5,057 (-0.3%) (YTD: +2.9%)

DFM: 2,781 (+0.0%) (YTD: +9.9%)

KSE Premier Market: 6,174 (-0.4%)

QE: 10,367 (-0.3%) (YTD: +0.7%)

MSM: 4,017 (-0.4%) (YTD: -7.0%)

BB: 1,516 (-0.1%) (YTD: +13.4%)

Calendar

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

October: German businessman delegation will visit Egypt to discuss good projects in order to spend German funds into Egypt

October: A delegation of 40-50 Saudi companies will visit Egypt to discuss increasing exports of Egyptian furniture.

1 October (Tuesday): The House of Representatives reconvenes for its fourth legislative session.

3 October (Thursday): Emirates NBD / Markit PMI for Egypt released.

5-6 October (Saturday-Sunday): Annual International Federation of Technical Analysts (IFTA) conference. Cairo Marriott Hotel.

6 October (Sunday): Armed Forces Day, national holiday.

8-10 October (Tuesday-Thursday): A delegation of 20 Korean companies visits Egypt.

10-13 October (Thursday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

20-24 October (Sunday-Thursday): German-Arab Chamber of Industry and Commerce’s ROI Week with ROI Institute, JW Marriott Hotel, New Cairo

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23-24 October (Wednesday-Thursday): Russian-African Summit, Sochi City, Russia

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.