What we’re tracking on 01 October 2019

Today’s the day, ladies and gents: The House of Representatives reconvenes at 10am CLT today for its fifth and final legislative session before we’ll elect not just MPs to the House, but also a new Senate, which was reconstituted under the new constitution. What’s on the House’s agenda as MPs get back to business? We had a preview yesterday of what you might expect.

(Incidentally, we’re not the only ones who want to tax global internet giants: Canada’s governing Liberals announced yesterday as part of their re-election platform that they plan to impose a 3% tax on revenue that “digital companies that make at least USD 1 bn in annual global revenues and at least USD 40 mn in Canadian revenues … generate through the sale of online advertising and user data.”)

Gov’t to announce fuel prices today: The government will likely leave fuel prices unchanged for 3Q2019 under its newly implemented automatic fuel pricing mechanism, analysts expected, citing a strong EGP and expectation of relatively stable global oil prices. The mechanism was mandated by the IMF as a condition for the disbursement of the fifth tranche of its USD 12 bn facility to Egypt. An unnamed government source also told Al Shorouk the prices would be kept on hold.

Moody’s is the latest with something to say on last week’s 100 bps interest rate cut, saying that lower interest rates and slowing inflation will provide an extra shot in the arm for the economy. The ratings agency expects capex and consumer spending to pick up in the coming months and government finances to continue stabilizing as its interest bill falls (we have more on this last point in this morning’s Speed Round, below). Moody’s also expects lower rates to stimulate credit growth by more than 15% next year.

Indicators we’re keeping our eye on as we step into October:

- PMI: The purchasing managers’ index for Egypt, the UAE, and Saudi Arabia will be released on Thursday, 3 October at 6:15 CLT.

- Foreign reserves: The Central Bank of Egypt is due to release net foreign reserves figures for August this week or next.

- Monthly inflation figures for September are due at the end of next week. Inflation cooled for the second consecutive month in August to 7.5%, marking the lowest reading in six-and-a-half years.

Among the conferences taking place in the coming days:

- Beltone is running an investor conference in Dubai this week.

- The annual International Federation of Technical Analysts (IFTA) conference takes in Cairo place this Saturday and Sunday.

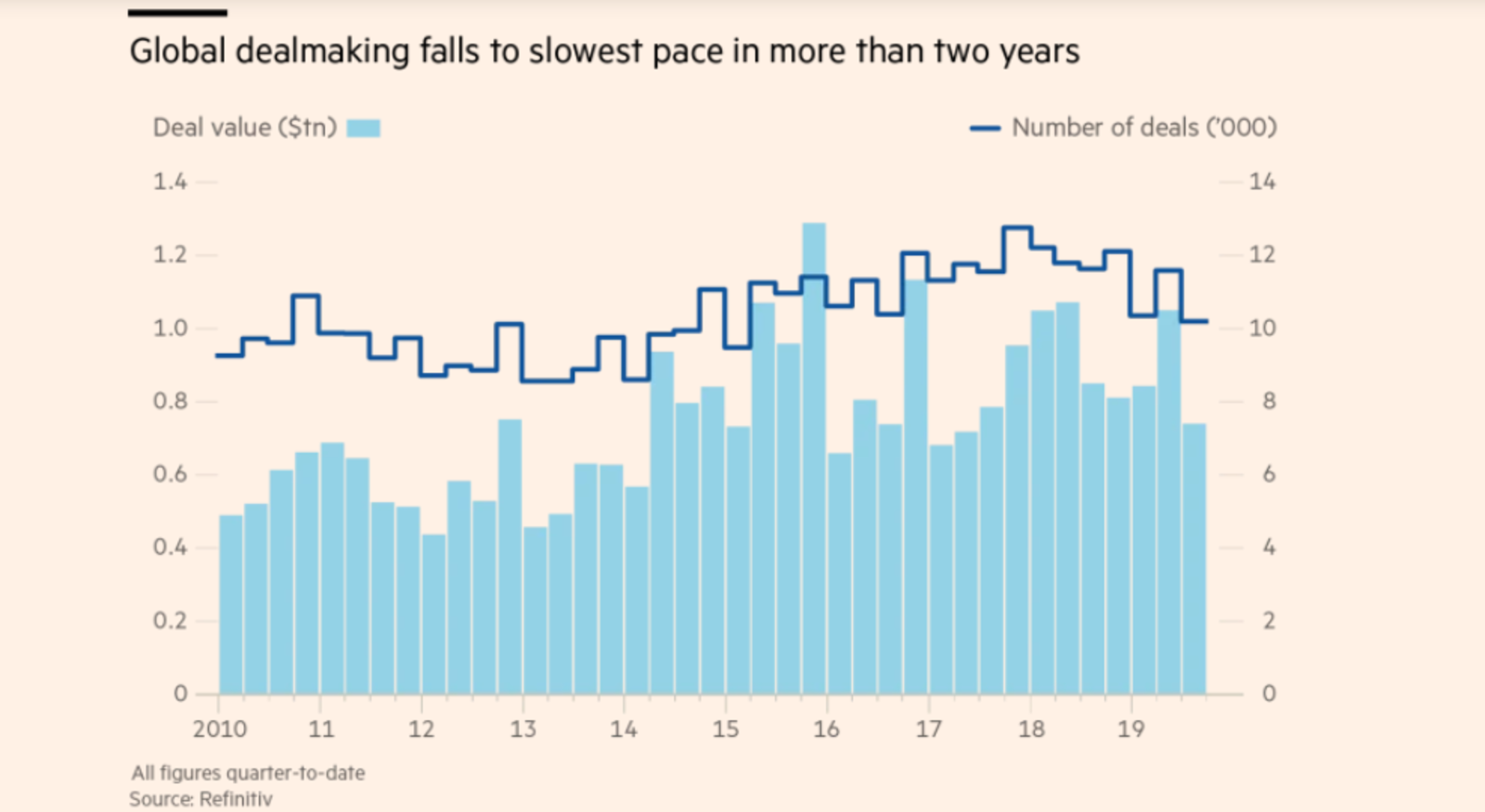

Global M&A in 9M2019 dropped 11% to USD 2.8 tn “as fears of an economic slowdown sap corporate confidence” and a USD 200 bn merger between Altria and Philip Morris International failed to materialize, according to Refinitiv data picked up by the Financial Times. M&A activity during 3Q2019 — around USD 740 bn-worth of transactions — was the slowest in two years. “M&A markets thrive when CEOs and directors have confidence in the future, and it’s hard to have confidence in the future when the world around you is in turmoil both economically and politically,” said Scott Barshay, partner at Paul Weiss law firm.

Fund managers the world over are cutting their exposure to equities and are recommending bonds as a better alternative amid volatility in financial markets, according to a Reuters poll. “Overall equity exposure in the global balanced model portfolio has fallen to the lowest since November 2016,” declining more than four percentage points since the beginning of 2019 to reach 44.3% in September. On the flipside, recommended bond holdings have reached a six-year peak, rising 3 percentage points this year to 42.1%. The poll didn’t take into account the shift in sentiment after the Trump administration said it’s mulling barring Chinese companies from listing on US exchanges, “which broke the wave of optimism” that a detente in the US-China trade war was imminent.

Further escalation in Saudi-Iranian tensions could bring down the global economy, Saudi Crown Prince Mohammed bin Salman said in an interview with CBS’ 60 Minutes (watch, runtime: 12:55). MbS called the attacks on Saudi Aramco’s oil facilities earlier this month — which Saudi and its western allies all pinned on Iran — “an act of war,” and cautioned that a military response would impact the rest of the world. The crown prince also denied his involvement in the murder of Washington Post journalist Jamal Khashoggi during the interview. Both the Financial Times and Bloomberg have more.

Citing geopolitical tensions and the kingdom’s vulnerable economy, Fitch downgraded Saudi yesterday, bringing its long-term foreign-currency issuer default rating to ‘A’ ’from ‘A+’, according to a press release. Pointing to the Aramco attacks, the ratings agency said it believes “that there is a risk of further attacks on Saudi Arabia, which could result in economic damage.”

Nobody’s quite sure why, but diverse companies perform better than their more homogeneous counterparts. Diversity in gender and overall board composition together create a statistical likelihood for a company’s financial success, Morgan Stanley’s global head of sustainability research Jessica Alford writes for the Financial Times. The investment bank analysed company data over the past eight years and found that gender-diverse companies outperform less diverse companies. “Globally, the most gender-diverse companies outperformed their regional benchmarks by 1.7 percentage points on average each year, while the least gender-diverse firms underperformed by 1.4 percentage points,” Alford writes. The trend still held up even when controlling for company size, dividend yield, profitability, and risk.

We’re not in Hawkins anymore: Stranger Things dropped a teaser trailer for the upcoming fourth season on its Instagram page yesterday. The widely expected fourth season had previously not been announced by the streamer. Now, if they’d just say when that season might actually start, the resident 12-year-old would be happy.

PSA- Mercury levels in the capital this afternoon are expected to peak at a balmy 32°C, before cooling off to 22°C, according to Meteorological Authority forecasts (pdf). Those in Alexandria will be seeing slightly cooler weather with highs of 29°C and a chance of rainfall.