- Mohamed Farid sees three companies IPOing this year, and Fawry just got EGX approval to list. (Speed Round)

- Germany’s Wintershall DEA is looking to invest USD 800 mn in Egypt through 2020. (Speed Round)

- Eni is on a roll with new natgas and oil discoveries. (Speed Round)

- We need to talk about our debt levels and growth prospects. (What We’re Tracking Today)

- The IMF’s Executive Board is voting today on the disbursal of our last USD 2 bn loan tranche, and a World Bank delegation is in town. (What We’re Tracking Today)

- Brilliance Auto plans to invest USD 120 mn to return to assembling its cars in Egypt. (Speed Round)

- The IMF’s emerging markets outlook is looking sluggish amid expectations for “subdued” global growth. (The Macro Picture)

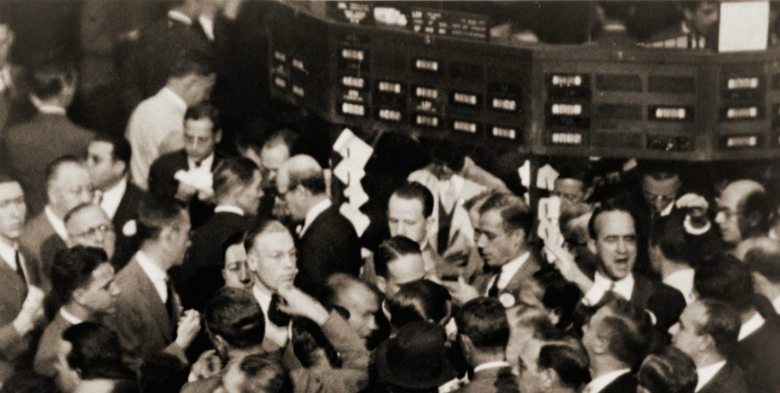

- The Market Yesterday

Wednesday, 24 July 2019

Three IPOs expected this year? Plus: Fawry offering gets EGX nod

TL;DR

What We’re Tracking Today

Good morning, folks, and welcome back to the second half of our shortened work week.

We should find out today whether the IMF’s executive board will sign off on disbursing the final USD 2 bn tranche of our USD 12 bn loan. Egypt reached a staff-level agreement with the IMF back in May after the fund completed its fifth review of the economic reform program. The board has delayed making a decision for more than two months, presumably waiting for Egypt to follow through on its pledges to cut energy subsidies.

After months of lavishing praise on our commitment to the reform program, we see no reason for an about face that would cause the IMF to withhold the funds. Assuming everything goes to plan and the board votes in favor today, it’s possible we will see the funds arrive either tomorrow or early next week.

The World Bank is back in town: A World Bank team is in Egypt to assess the business environment ahead of its 2020 Ease of Doing Business report to be published later this year. The delegation has already met PM Moustafa Madbouly, who discussed his cabinet’s effort to increase Egypt’s ranking in the cross-border trade and contract enforcement indices according to a cabinet statement. Egypt jumped eight spots in the 2019 report to rank 120th out of 190 countries.

East Med Gas Forum meeting tomorrow: A second meeting to discuss establishing a regional gas forum in the Eastern Mediterranean is taking place in our fair city tomorrow, reports Al Shorouk. Energy ministers from the US, Israel, Cyprus, Greece, Italy, Jordan, Palestine, and Egypt are set to attend, alongside a representative from the European Commission for Climate Action and Energy. A series of preparatory meetings are scheduled for today. The first gas forum meeting took place at the start of the year. The participants agreed to establish an intergovernmental regional gas market, and designated Cairo as the incipient organization’s headquarters.

Could Lebanon soon become the forum’s eighth member? Beirut is in talks with Cairo and Larnaca on oil and gas cooperation, Lebanese Energy and Water Minister Nada Boustani said, according to Lebanon’s Annahar newspaper. Talks with Egypt involve reopening idle sections of the Arab Gas Pipeline.

We were on the receiving end of some Trump love yesterday: The Donald sent us a message yesterday to mark the anniversary of the 23 July revolution. “The United States values our close cooperation on counterterrorism and security, and seeks to deepen our partnership on inclusive economic growth and greater educational and cultural ties,” the message reads.

We need to talk about our foreign debt levels: The rapid accumulation of foreign debt over the past decade threatens to hurt Egypt’s future growth prospects, Amr Adly writes for Bloomberg. Egypt’s ratio of foreign debt to gross national income (GNI) more than doubled to 36% from 17% between 2010 and 2017. Over the same time period, the ratio of debt to total exports surged to 190% from 75%, suggesting that the country will find it increasingly difficult to service its debt obligations. This “alarming” growth in external debt will further reduce foreign direct investment and impede growth if left unchecked, Adly says.

Global trade and the international capital markets aren’t in the best shape right now, so the best path to sustainable growth is local investment in sectors that can deliver real economic growth, boost exports and reduce dependency on imports, Adly argues. Deepening regional integration will not just increase the flow of goods and services, but Egypt could also stand to benefit from transfers of technology and skills from the Gulf, which would help the country to kick-start more high-value added industries.

Saudi Arabia is finally clocking the power of wind: Riyadh plans to build its first wind power plant and begin generating electricity within three years, Bloomberg reports. The planned 400-MW Dumat Al Jandal facility is expected to begin operations in 1Q 2022, and will be constructed by France’s EDF and Abu Dhabi’s Mubadala Investment (Masdar). The project is part of Saudi Arabia’s push to increase its renewable energy facilities and diversify its oil-reliant economy.

Boris Johnson has become the UK’s next prime minister, beating rival Jeremy Hunt to be elected as the new leader of the Conservative party. The former foreign minister and London mayor will step into Theresa May’s shoes today. He’s promising to both deliver Brexit by 31 October and “unite the country.” We’re not holding our breath.

Nassef Sawiris now the fourth richest person in Africa: The fortune of b’naire tycoon Nassef Sawiris has risen by a cool USD 1.5 bn in recent months to reach USD 7.9 bn, according to Forbes. This follows the conclusion of a partnership agreement between Orascom Construction Industries and Abu Dhabi National Oil Company (ADNOC), as well as Aston Villa — which he co-owns — qualifying for the Premier League. The OCI NV-ADN OC partnership will create the region’s largest producer and exporter of nitrogen fertilizer, in which OCI NV will hold a 58% stake.

Enterprise+: Last Night’s Talk Shows

Oil and gas updates from Eni and a cursory mention of the World Bank visit occupied the nation’s talking heads last night.

Eni ramps up production: News that Italy’s Eni has begun oil production from its West Meleiha concession in the Western Desert earned some airtime on Al Hayah Al Youm (watch, runtime: 1:34). We have the full story in this morning’s Speed Round, below.

A new natural gas well Eni discovered at its El Qar’a onshore concession (the details of which we have in this morning’s Speed Round) gave Yahduth fi Misr’s Sherif Amer and Al Hayah Al Youm’s Khaled Abu Bakr a strong sense of optimism that the discovery is a harbinger of more to come (watch, runtime: 2:14).

The arrival of a World Bank delegation assessing Egypt’s economy ahead of releasing the 2020 Ease of Doing Business also made it onto Abu Bakr’s radar (watch, runtime: 2:58).

Speed Round

Speed Round is presented in association with

IPO WATCH- Two private companies, one state-owned company expected to IPO this year -Farid: EGX boss Mohamed Farid expects one state-owned company and two private companies to complete their initial public offerings this year, he told the local press. Farid did not say which companies he sees making their EGX debuts or provide any further details on the expected IPO pipeline, but said that the bourse is working to attract fresh offerings. While Farid did not offer any further specifics, government officials previously told us that a number of proposals are currently on the table, including offering a 50% tax break for companies that list 35% or more of their shares.

We’re guessing Farid counted Fawry among the private IPOs, as the e-payments platform received EGX approval to move forward with the offering, according to a bourse statement. Fawry is also expecting to see its IPO prospectus greenlit by the Financial Regulatory Authority this week, CFO Abdel Meguid Afifi told Al Shorouk. The IPO will see an existing shareholder, BSI Netherlands BV fund, make a partial exit, Afifi added.

Meanwhile, the IPO roadshow is now in Dubai and will next move to London, Managing Director Mohamed Okasha told Hapi Journal. Fawry should begin receiving subscription requests for the 10% institutional portion at the start of next week. Tap / click here for more details on the offering, which we delved into earlier this week.

INVESTMENT WATCH- Germany’s Wintershall DEA is looking to invest USD 800 mn in Egypt through 2020, Oil Minister Tarek El Molla said on Monday at a joint press conference with the company’s Chairman and CEO Mario Mehren. Newly merged Wintershall DEA plans to increase production from its Desouk field to 100 mcf/d by the end of the year, up from 60 mcf/d currently, the ministry said in a separate statement.

The pipeline: The company is expecting to begin oil and gas exploration at its recently awarded northeastern Damanhur concession next year, Mehren said during the presser, according to Al Shorouk. Wintershall DEA is also planning to take part in the upcoming west Mediterranean gas exploration tender, which is expected to launch in 1Q2020. The Raven field at the North Alexandria concession, in which the company has a stake, is also slated to begin production at the end of the year. The field is expected to produce an amount four times that of its four neighboring fields, Mehren said.

When Wintershall and DEA became Wintershall DEA: Wintershall DEA completed the merger in May, and consolidated its Egyptian assets, giving it six onshore and offshore concessions, with the most significant being its 17.5% stake in the West Nile Delta concession. The company had previously said it would invest USD 500 mn through 2020 to develop the asset as well as its Desouk and Gulf of Suez fields.

M&A WATCH- United Oil & Gas wants to buy Rockhopper Egypt for USD 16 mn: Irish energy company United Oil & Gas has proposed to Rockhopper Exploration that it acquire Rockhopper’s Egypt business for USD 16 mn, the company said in a statement. Rockhopper Egypt owns a non-operating 22% interest in the onshore Abu Sennan oil concession, among other assets. BP has agreed to provide USD 8 mn to fund the acquisition after it entered an offtake agreement for United’s future oil and gas production.

The portfolio: The Abu Sennan concession is located in the Western Desert region and contains seven operational fields with seventeen producing wells. Current gross production has recently been reported by Rockhopper Egypt at over 5.1k boe/d, the company said. In addition to the seven fields in production, the Abu Sennan concession also contains a large exploration area with a significant prospect potential. Kuwait Energy holds a 25% operating interest in the concession, while Global Connect (25%) and Dover Investments (28%) are the other stakeholders.

Italian energy company Eni has begun oil production from its West Meleiha concession in the Western Desert at a rate of 5k bbl/d, it said in a statement. Production is expected to reach 7k bbl/d by September 2019. West Meleiha is 50%-owned by Eni’s IEOC and 50% by state-owned Egyptian General Petroleum Corporation (EGPC).

Eni also announced the discovery of natural gas in the new El Qar’a onshore exploration lease. The El Qar’a-NE1 well delivered 17 mn scf/d of natural gas and associated condensates during the cleanup, Eni said. The well will be linked to Petrobel’s Abu Madi gas facility. Eni, through its subsidiary IEOC, holds a 37.5% interest in El Qar’a exploration lease, while BP has a 12.5% interest and EGPC a 50% interest.

The company also made an oil discovery at the IEOC/EGPC Abu Rudeis development lease in the Gulf of Suez, which could hold up to 200 mn bbl of oil in place. The well has been completed and brought on stream through production facilities available in the area. Petrobel has a plan to develop the new discovery with about 10 wells that will be drilled in the near future.

EXCLUSIVE- Brilliance Auto to invest USD 120 mn to return to domestic assembly: Brilliance Bavarian Auto is planning to invest USD 120 mn to use the existing facilities of its parent company — BMW’s Bavarian Auto Group (BAG) — to begin assembling its China-origin cars by early 2020, Brilliance’s general manager and head of the Automotive Marketing Information Council (AMIC) Khaled Saad told Enterprise. The company will use BAG’s factory in 6 October temporarily while it works on acquiring a land plot in the Gulf of Suez for its own assembly facility. Brilliance will also launch its first electric car model this winter.

Brilliance’s planned return to domestic assembly is partially thanks to the Madbouly Cabinet’s proposed automotive incentives program for local assembly, which would see the finance and trade ministries provide custom breaks to local assemblers and manufacturers that use at least 45% local components. Saad tells us Brilliance sees this threshold as feasible, and intends to meet the requirement. We were told the local component requirement would be a sliding scale based on how much is actually used. This approach will effectively replace the now-scrapped automotive directive, which was sharply opposed by Egypt’s European trade partners — a key hurdle to the directive seeing the light of day.

Egypt’s first fintech fund to launch early 2020: The Central Bank of Egypt’s (CBE) EGP 1 bn fund to back fintech startups will be up and running at the start of next year, banking sources tell Al Mal. Several unnamed international and local institutions will invest alongside the CBE in the fund, which will focus its investment strategy on financing “both directly and indirectly” fintech venture capitalist funds and startup incubators and accelerators, the sources say. The fund will see its size increase within five years to c.USD 500 mn from an original USD 50-100 mn, the sources expect. The CBE is expected to announce soon types of businesses it will be looking to prioritize.

Background: CBE Governor TarekAmer first announced the fund during the 2018 Seamless North Africa digital and fintech conference, which saw former Prime Minister Sherif Ismail speak of plans to make Egypt a regional hub for fintech innovation. Advisory firm Ernst and Young has already finalized the fund’s bylaws and internal structure, according to sources with whom Al Mal spoke recently.

OFID to increase Egypt financing by USD 55 mn by year-end: The OPEC Fund for International Development (OFID) is planning to increase its financing for Egypt by USD 55 mn until the end of the year, private sector operations officer Saud Al Rajhi told the press. This will bring proceeds provided to Egypt by the fund up to USD 220 mn throughout the year. The fund has already doled out a total of USD 165 mn in 1H2019 — including USD 95 mn to SMEs, USD 30 mn to finance food commodity imports, and USD 40 mn to finance petroleum imports.

M&A WATCH- Ebtikar acquires additional 10% stake in Masary: Ebtikar for Financial Investment, a joint venture between BPE Partners and MM Group, acquired an additional 10% stake in e-payments firm Masary in a transaction worth EGP 42 mn, MM Group said in a statement to the bourse (pdf). The transaction brings Ebtikar’s stake in Masary to 45.8% from 35.7%, according to a B Payments statement (pdf). B Investments holds a 20% stake in Ebtikar, while MM Group holds 52.9%. The stake increase “confirms Ebtikar’s commitment to its investment in Masary as a leading E-Payment provider with considerable growth potential in the Egyptian market,” said Ebtikar Chairman Aladdin Saba.

Majid Al Futtaim will open its USD 437 mn City Centre Almaza in East Cairo in September, the company said in a statement (pdf). Owners will receive the keys to their shops at the beginning of September and the mall will be open to customers by the end of the month, the company said. The European Bank for Reconstruction & Development (EBRD) has provided up to USD 200 mn to Majid Al Futtaim to build the project, which is its third City Centre in Egypt.

LEGISLATION WATCH- Pensioners Union lobbying El Sisi to reject Pensions Act: The Pensioners Union has agreed to send an official memo to President Abdel Fattah El Sisi urging him against ratifying the Social Insurance and Pensions Act, which the union claims include unconstitutional articles, a union official told the local press. According to the official, the union will take legal action if the law is ratified. The law, which was approved by the House of Representatives earlier this month, will see 21% of public and private sector workers’ salaries going towards a newly-established pension fund, among other stipulations.

Separately, the Council of State (Maglis El Dawla) has completed its review of the Insurance Act and referred it to the Madbouly Cabinet for approval before it is referred to President Abdel Fattah El Sisi to be ratified, a source from the council told the press.

REGULATION WATCH- Madbouly issues executive regs for National Press Authority bill: Prime Minister Moustafa Madbouly issued on Monday the executive regulations for the law passed in 2018 that regulates the National Press Authority (NPA). The law — one of three born out of the process of dividing part two of the Press and Media Act — outlines the structure, responsibilities and legal authority of the NPA, which oversees the work of state-owned newspapers, appoints board members and editors-in-chief and sets minimum wages. Under the executive regulations:

- The NPA will create a committee to settle disputes between the newspapers, a development and support fund, and a committee to monitor their administrative and financial performance.

- The authority’s financial and legal committee will use reports from the Administrative Control Authority to evaluate performance.

- Boards are required to inform the NPA of their decisions within a week of issuing them. The NPA has the authority to freeze decisions until it has decided to either approve or reject them.

EARNINGS WATCH- Etisalat Misr reported revenues of EGP 7.14 bn in 1H2019, compared to EGP 6 bn during 2H2018, according to financial statements seen by Amwal Al Ghad. Mobile revenues during the quarter came at EGP 6.06 bn.

We incorrectly wrote on Monday that Abu Dhabi Capital Group has appointed Ahmed Fathallah (LinkedIn) as the chairman of Capital Group Properties and Imkan Misr. Fathallah will become the chief executive of the two portfolio companies, rather than the chairman. We have since updated the story on our website.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

The IMF’s emerging markets outlook is looking sluggish amid expectations for “subdued” global growth: The IMF has revised downwards its forecasts for emerging markets’ GDP growth in its July update of the World Economic Outlook, saying it sees EMs growing 4.1% and 4.7% in 2019 and 2020, respectively. The figures are 0.3% and 0.1% lower, respectively, from the fund’s last update in April. The EM growth forecast is “a decade low and the second-weakest figure since the dotcom bust of 2002, rather than the 4.4 per cent the IMF pencilled in as recently as April,” the Financial Times notes. Global growth, meanwhile, could pick up next year to 3.5% from an expected 3.2% this year. The expected acceleration in global growth remains “precarious” and is contingent on the resolution of trade conflicts, the recovery of struggling economies such as Turkey and Argentina, and warding off potentially more acute economic collapses in Iran and Venezuela, the fund says.

All major EM regions have seen downwards revisions to their growth forecasts on the back of factors such as rising trade tensions, a high dependence on debt, weak investor sentiment, and policy uncertainty, the fund says. Emerging markets had a weaker-than-expected second quarter, driving the fund to lower its expectations for the remainder of 2019. Latin America is perhaps struggling the most, with the region’s growth outlook bogged down by key players such as Brazil, Mexico, and Argentina, while the “economic implosion in Venezuela [continues] to have a devastating impact.”

What does this all mean for interest rates? “Across emerging market and developing economies, the recent softening of inflation gives central banks the option of becoming accommodative, especially where output is below potential and inflation expectations are anchored. Debt has increased rapidly across many economies. Fiscal policy should therefore focus on containing debt while prioritizing needed infrastructure and social spending over recurrent expenditure and poorly targeted subsidies.”

You can catch the landing page or the full report (pdf) here.

Egypt in the News

The British Airways decision to suspend flights to Cairo for a week continues to provide international media with a chance to rake Egypt’s security over the coals. Exhibit A: This Deutsche Welle article that, despite quoting a security analyst as saying, "You have to distinguish between Sinai and the rest of the country," does not hesitate to characterize the security situation throughout the country as “unstable” and “tense.” The suspension remains inexplicable, EgyptAir Holding Co Vice Chairman Sherif Ezzat Bardous said yesterday, according to Reuters.

The “increasingly lethal response” of Egyptian security forces to terrorist threats is prompting greater scrutiny of our human rights record, the Wall Street Journal reports. The number of people reportedly killed in raids spiked at 153 in the first half of 2019 alone, up from 33 in 2015. Many families of the deceased are alleging that they were killed in detention, rather than in clashes with security forces. Meanwhile, Amnesty International accuses police of keeping detainees in poor conditions during “arbitrary overnight probation” following release from prison, says Amnesty International.

Other headlines worth noting:

- Revolution Day is more than a celebration of Nasser’s overthrow of the monarchy; it is a reminder that the army is “in the midst of determining the destiny of the Arab world,” argues Ahmed Aboudouh in the Independent.

- Tomb raiders are in the money: In the most gruesome news of the day, tomb-raiding has reportedly become “increasingly widespread” in Egypt and medics and narcotics dealers getting rich, according to the African Exponent.

- New discovery: Underwater archaeologists have uncovered the remains of an ancient temple near the sunken city of Heracleion off the Nile Delta coast, reports Newsweek.

Worth Watching

This story of two young Egyptians hitchhiking across the country with only a token EGP 1 each is a reminder that the world isn’t always such a bad place. On day 1 of their trip (watch, runtime: 16:19) they journey from Cairo to Suez, meeting a host of characters who offer them food, money and a place to stay. It’s a little corny in places, but likely to give a warm fuzzy feeling to even the most cynical among us.

Diplomacy + Foreign Trade

The European Union is planning to provide EUR 110 mn to finance projects in Egypt next year, the Investment Ministry said in a statement. The projects will span water, renewable energy, trade and local development, the ministry said following a meeting between a number of Egyptian ministers and EU officials. The funding comes as part of the EUR 500 mn 2017-2020 Single Support Framework. The French Development Agency (FDA) will also provide an additional EUR 100 mn to finance the upgrading of the Al Raml tramline in Alexandria, the ministry said in a separate statement.

EGX, AfDB discuss cooperation to develop Africa’s capital markets: Officials from the EGX discussed cooperation plans to develop capital markets in Africa with an African Development Bank (AfDB) delegation led by Egypt country manager Malinne Blomberg, Youm7 reported.

Energy

Egypt’s natural gas imports from Idku plant rises to 750 mcf/day

Egyptian natural gas exports from Shell’s Idku terminal increased to 750 mcf/day this month from 500 mcf/day in June, an EGAS source told the local press. Egypt is currently running a natural gas surplus of 1.56 bcf/d

Basic Materials + Commodities

Sugar crop production rises 320k tonnes y-o-y to hit record levels

Egypt produces a record 2.48 mn tonnes of sugar crop this season, marking an increase of some 320,500 tonnes y-o-y, Agriculture Minister Ezz El-Din Abu Steit said in a statement on Monday. Around 248,200 feddans of sugar cane were cultivated, while 584,580 feddans of sugar beet were cultivated. The average output from each feddan of sugar cane also increased to 34.8 tonnes from 33.8, Ahram Online reports. This comes in the wake of news that the cultivated area of sugar beet could fall between 33-50% in 2020 as a result of fuel price hikes and challenging market conditions, we noted last week.

Health + Education

Egyptian vocational graduates struggle to find sustainable work

A lack of structural support is preventing vocational education graduates from entering or remaining in the workforce, with a recent study by the Population Council’s Egypt office showing that 49% of vocational education graduates in Egypt were unemployed in 2018, Al-Fanar Media reports. A 2017 Capmas study showed that every year some 450k students complete secondary level vocational programs in Egypt. But low wages, difficult working conditions, poorly-applied labor laws and a skills gap in the market make it more difficult for graduates to find sustainable work.

Telecoms + ICT

Egypt targets average internet speed of 20 MB/second next year

The CIT Ministry is looking to increase Egypt’s average internet speed to 20MB/second by the end of the year, Youm7 reported. The average internet speed in the country has now reached 10 MB/second, up from 5 MB/second in 2018. State-owned Telecom Egypt has invested USD 2 bn to upgrade internet infrastructure.

Automotive + Transportation

Total Egypt, Dynamics Distribution sign agreement for motor oil supply

Total Egypt has signed an agreement with Dynamics Distribution to supply motor oils for Fiat and Alfa Romeo cars, the company announced in a press release (pdf). Total Egypt will supply Dynamics with Total Quartz 0W-30 oils, which have been designed for Fiat engines.

Banking + Finance

Egypt to receive second tranche of USD 3 bn Chinese business district loan

The Housing Ministry will sign today an agreement to receive the second tranche of a USD 3 bn loan arranged by eight Chinese banks for the new capital’s business district, Housing Minister Assem El Gazzar said. Egypt secured the loan during President Abdel Fattah El Sisi’s participation in the Belt and Road Forum in Beijing last spring.

Other Business News of Note

PM establishes industrial zone for SMEs in Benha

Prime Minister Moustafa Madbouly issued a decree to create a specialized industrial zone in Benha, Qalyubia, dedicated to establishing SMEs, the cabinet said in a statement.

Egyptian Media Production City to inaugurate a “mega studio” by end of 2020

The Egyptian Media Production City (EMPC) is planning to inaugurate a new film studio at the end of next year, Chairman Osama Heikal said. The “mega studio” is expected to cost some EGP 55 mn.

National Security

Egypt, US, UAE hold joint military exercises in Red Sea

The Egyptian, US and UAE naval and air forces began a joint military exercise dubbed Eagle Response 2019 in the Red Sea on Monday, the Armed Forces said in a statement.

On Your Way Out

The government is planning to rebuild the historic Ataba vegetable market after a fire in June damaged almost half of its shops, the cabinet said in a statement. The government plans to restore damaged parts, replace the power system and install fire safety features to avoid similar incidents in the future.

The Market Yesterday

EGP / USD CBE market average: Buy 16.56 | Sell 16.68

EGP / USD at CIB: Buy 16.56 | Sell 16.66

EGP / USD at NBE: Buy 16.56 | Sell 16.66

EGX30 (Monday): 13,685 (+0.8%)

Turnover: EGP 397 mn (37% below the 90-day average)

EGX 30 year-to-date: +5.0%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.8%. CIB, the index heaviest constituent ended up 1.0%. EGX30’s top performing constituents were CIRA up 4.2%, Elsewedy Electric up 2.0%, and Sarwa Capital Holding up 1.7%. Monday’s worst performing stocks were Arabia Investments down 0.8%, Oriental Weavers down 0.3% and Orascom Investment Holding down 0.2%. The market turnover was EGP 397 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +14.7 mn

Regional: Net Short | EGP -21.9 mn

Domestic: Net Long | EGP +7.2 mn

Retail: 50.2% of total trades | 51.2% of buyers | 49.2% of sellers

Institutions: 49.8% of total trades | 48.8% of buyers | 50.8% of sellers

WTI: USD 57.11 (+0.60%)

Brent: USD 64.19 (+0.56%)

Natural Gas (Nymex, futures prices) USD 2.29 MMBtu, (-0.39%, Aug 2019 contract)

Gold: USD 1,417.40 / troy ounce (-0.30%)

TASI: 8,796.06 (-1.25%) (YTD: +12.38%)

ADX: 5,343.86 (+0.85%) (YTD: +8.72%)

DFM: 2,832.53 (+2.08%) (YTD: +11.97%)

KSE Premier Market: 6,640.23 (-0.32%)

QE: 10,511.25 (-0.29%) (YTD: +2.06%)

MSM: 3,763.59 (-0.18%) (YTD: -12.96%)

BB: 1,522.30 (-0.32%) (YTD: +13.84%)

Calendar

July: The National Railway Authority will launch a tender for the purchase of 100 new locomotives expected to be financed through an agreement with the European Bank for Reconstruction and Development (EBRD).

25 July (Thursday): US Secretary of Energy visiting Cairo.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

29 July (Monday): An administrative court will look into charges brought by the Financial Regulatory Authority (FRA) against Raya Holding founder Medhat Khalil in connection to a mandatory tender offer forced on him by the FRA.

30-31 July (Tuesday-Wednesday): Egypt will hold its seventh youth conference at the New Administrative Capital.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

3 August (Saturday): A Cairo Criminal Court postponed “stock market manipulation” trial of Gamal and Alaa Mubarak, along with seven others.

3-4 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

4 August (Sunday): The High Administrative Court will hear appeals filed by the State Lawsuits Authority and a number of iron and steel companies to bring back the Trade Ministry decision to impose 15% import duty on iron billets.

7-11 August (Wednesday-Sunday): Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

25-27 August (Sunday-Tuesday): G7 Summit, Biarritz, France.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 September (Sunday): A court hearing for a case brought by Arabia Investments Holding (AIH) against Peugeot suing the French automaker for EGP 150 mn-worth of damages, postponed from 21 July.

The court hearing for a case brought by Arabia Investments Holding (AIH) against Peugeot has been postponed until 9 June

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.