- USD 3 bn in from China for new admin capital business district. (Speed Round)

- FinMin revises growth forecast to 5.6% for current fiscal year; Reuters poll of economists predicts 5.5%. (Speed Round)

- US investment fund doing DD on United Bank acquisition -Amer. (Speed Round)

- CIB eyes expansion into Kenya, also likes Ethiopia, Tanzania and Uganda. (Speed Round)

- Strategic investor could take a stake in Heliopolis Housing. (Speed Round)

- Orascom Construction JV signs USD 739 wastewater treatment contract. (Speed Round)

- Former Abraaj exec Abdel Wadood granted bail in New York. (Speed Round)

- Glovo exiting Egypt, Chile following EUR 150 mn funding round. (Speed Round)

- The Market Yesterday

Thursday, 2 May 2019

Did you miss us?

TL;DR

What We’re Tracking Today

…And we’re back, ladies and gentlemen. Bright eyed and fresh faced from a wonderful extended weekend. What did we do over the break? Exactly nothing — and we have the New York Times on our side on that front.

Lest you need a reminder: Ramadan looks set to begin on Monday. Banks and the EGX will move to shorter hours.

Owe the government money? If it’s more than EGP 500, you need to pay it electronically. A Finance Ministry decision that makes it mandatory for all government transactions exceeding EGP 500 to be electronic officially came into effect yesterday, according to a ministry statement out last week. The ministry also issued a set of guidelines (pdf) on how to correctly make electronic payments. The move to e-payment for government services, which was mandated by the National Payments Council, is meant to help regulate public spending and drive financial inclusion.

Tourism Minister Rania Al Mashat is in Switzerland today for the start of the two-day World Tourism Forum.

A new opening for Egyptian natural gas? Jordan’s King Abdullah II is coming under political pressure to scrap a USD 10 bn natural gas agreement with Israel, Asharq Al-Awsat reported on Tuesday. The king is reportedly looking to renegotiate the terms of the agreement under public pressure to which some in parliament are playing. Senior government officials told the newspaper that the pressure comes as part of a movement to curtail economic cooperation with Israel. Egypt could look to capitalize on the situation by increasing its exports to the kingdom should Jordan reduce its imports of Israeli gas.

Gabriel Makhlouf is the new governor of Ireland’s central bank. Born in Egypt and “of British and Greek parentage,” Bloomberg writes, Makhlouf, 52, is chief economic and financial advisor to New Zealand’s government.

Key news triggers on the horizon:

- Monthly inflation figures are due out at the end of next week. Annual headline urban inflation eased slightly in March to 14.2%, down from 14.4% the previous month.

- The CBE should announce Egypt’s net foreign reserves figure for the end of April within the next few days.

- It’s PMI week: The purchasing managers’ index for Egypt, Saudi Arabia, and the UAE is due out on Sunday, 5 May.

- An IMF delegation will be in town to conduct its final review of the reform program ahead of the disbursement of the sixth and final tranche of Egypt’s USD 12 bn loan.

- Interest rates: The central bank’s Monetary Policy Committee will meet to review interest rates on 23 May.

The US Federal Reserve left interest rates on hold yesterday, it said in a statement (pdf), citing slowed inflation, rising economic activity, low unemployment as well as slowdowns in both household spending and investment by businesses. The WSJ, the Financial Times and Reuters have more on the not-so-surprising decision.

Amazon has rebranded its Souq subsidiary to become Amazon.ae in the UAE, but continues to operate under Souq.com in its remaining Middle Eastern markets, reports The Wall Street Journal. Amazon said it would offer Arabic functionality on its app and online website while boosting product offerings amidst heightened competition in the regions’ e-commerce market from local startups.

Food for thought: Millennials tried to kill the American mall, but Gen Z might save it. It seems shoppers in Amreeka aged 7-22 “still appreciate brick and mortar,” Bloomberg writes, “Today’s teens interact differently with stores than their older siblings and Gen X parents before them.”

El Face is redesigning its app to focus more on events and groups, which are apparently the two most popular features on the social media platform, according to the Verge.

Japan has a new emperor: Crown Prince Naruhito is now Emperor Naruhito after his father, Akihito, was given permission to abdicate. The NYT’s Motoko Rich has a fantastic five “episode” series looking at the post-Second World War history of Japan’s imperial family.

PSA- The heat wave continues today with our favorite weather app suggesting we’re looking at a high today of 37°C. The mercury is then set to ease to 30-31°C Friday and Saturday before climbing back to 38°C on Sunday and 37°C on Monday, which looks set to be the first day of Ramadan. Expect some relief the second half of next week.

Enterprise+: Last Night’s Talk Shows

The World Bank extending its country partnership framework (CPF) with Egypt to 2021 stole the show on the airwaves last night. Al Hayah Al Youm’s Lobna Assal pointed out the significance of the move in light of Egypt’s economic reform program (watch, runtime: 03:05). The decision to extend followed an official review by the group and will focus on efforts towards inclusive growth, job creation and support for the private sector.

Economist Fakhry El Fiky praised the decision to extend the CPF, explaining that the group’s funding will be focused on infrastructure and social projects (watch, runtime: 6:33). We have more on the decision in this morning’s Diplomacy + Foreign Trade section, below.

Speed Round

Speed Round is presented in association with

USD 3 bn in fresh financing for Egypt as El Sisi deepens ties with China at Belt and Road Forum in Beijing: A series of new financing, manufacturing, and communications agreements were signed last week between Egyptian and Chinese companies as President Abdel Fattah El Sisi joined the three-day Belt and Road Forum in Beijing. El Sisi used the forum to draw international attention to the country’s economic reform program and highlighted Egypt’s drive to become a regional energy hub, according to an Ittihadiya statement. He also called on participating countries and investors to provide favorable funding terms to African countries. You can read the president’s speech in full here.

Egypt has closed some USD 3 bn in Chinese financing for the new capital’s central business district, Housing Minister Assem El Gazar announced during the event, according to Youm7. The New Urban Communities Authority (NUCA) lined up the facility from a group of lenders led by state-owned Industrial and Commercial Bank of China. The first USD 834 mn tranche will be used to finance construction during the initial 600k sqm phase of the district, which includes two administrative and five residential skyscrapers. Our friends at Arab Legal Consultants were counsel to NUCA on the transaction. China State Construction Engineering Company (CSCEC), the main contractor NUCA hired to develop the district, was previously reported to have budgeted USD 3 bn to complete the site. We noted last year that 85% of CSCEC’s expenditure will be financed by Chinese banks, with the balance set to be local finance.

Electric bus and clothing manufacturing agreements: The Military Production Ministry inked an agreement with Beijing-based automotive company Foton Motor to manufacture 2,000 electric buses in Egypt over the next four years, according to a ministry statement. The vehicles will be assembled by a production plant owned by the Egyptian military; 45% of the components will be sourced in Egypt. The Trade Ministry also announced that Hong Kong-based global clothing manufacturer Handa is planning to set up a readymade garment and fabric dye factory in Egypt.

Telecom Egypt signed two MoUs with Chinese tech giant Huawei to develop Egypt’s mobile internet infrastructure, Al Mal reported. One agreement will see the two companies experiment with high-speed fiber optic internet while the second confirms Huawei’s plans to equip Cairo International Stadium with 5G connectivity during this year’s African Cup of Nations. TE also signed a USD 45 mn landing agreement for the 12k km Pakistan, East Africa and Europe for Connecting International Networks internet cable cross Egypt, the company said in a statement.

Meetings with world leaders: The three-day forum saw El Sisi meet with Chinese Premier Xi Jinping, Russian President Vladimir Putin, Italian Prime Minister Giuseppe Conte, UAE Crown Prince Mohamed bin Zayed as well as Portuguese President Marcelo de Souza and Swiss President Ueli Maurer.

EXCLUSIVE- FinMin revises FY2018-2019 growth forecast to 5.6%: The Finance Ministry has revised downwards its growth forecast for FY2018-2019 to 5.6%, down from 5.8% previously, according to an official document seen by Enterprise. The budget deficit declined during the first nine months of the fiscal year to 5.3%, compared to 6.2% during the same period last year, while the primary budget surplus also increased to 0.74% of GDP during the period, compared to 0.2% in the previous fiscal year, the document shows.

A Reuters poll of economists last week predicted 5.5% growth in the current fiscal year. “Structural constraints are keeping the growth forecast slightly subdued,” Nadene Johnson, an economist at NKC African Economics, told the newswire. Economists expect Egypt to grow 5.6% in the coming fiscal year — short of the 6% government target in the FY2019-2020 draft budget — and 5.7% in FY2020-2021. Growth will be supported mostly by government investment in infrastructure projects, Naeem Brokerage economist Yara Elkahky said. “Household consumption growth however, is expected to remain muted as purchasing power still remains tight,” she said.

Egypt’s GDP grew at a 5.6% clip during the first half of the current fiscal year, driven largely by the gas, ICT, and construction sectors, Finance Minister Mohamed Maait had announced earlier this month. Projections for GDP growth in FY2018-19 from HSBC, the European Bank for Reconstruction and Development, Capital Economics, Fitch Group’s BMI Research, and economists polled by Reuters have ranged between 3.8% and 5.5%.

M&A WATCH- The acquisition of United Bank by a US-based investment fund should be complete within three months’ time, CBE Governor Tarek Amer said last week, according to Masrawy. Amer did not disclose any further details of the transaction. The governor said in February that a US financial institution had made an offer to acquire the bank and was currently conducting due diligence. The CBE governor said the due diligence process will be complete in three months. Amer separately told the domestic press that it is also possible that a non-controlling stake in United Bank could be offered on the EGX. The central bank owns 99.9% of the bank’s shares, having created the institution through the merger of a number of smaller institutions. It announced back in 2017 its intention to sell United Bank to a strategic investor.

CIB eyes expansion into Kenya: CIB intends to enter the Kenyan market when it finds the right opportunity as part of its strategy for expansion in east Africa, our friend Mohamed Sultan told Euromoney. Sultan, chief operating officer at the bank, cited the bns of USD that flow in annual trade between Egypt and Kenya, as well as Kenya’s role as a major regional trade hub as driving CIB’s interest in the country. The bank has not yet finalized an acquisition, he said. Sultan’s comments come a week after the bank’s announcement that it has established a representative office in Ethiopia. CIB has also identified Tanzania and Uganda as being potential markets for expansion.

Broader growth in east Africa: The bank is not alone in targeting east African countries: Banque Misr and Beltone Financial have also expressed interest in developing their operations further down the African coast. EFG Hermes entered Kenya through acquisition in 2018.

IPO WATCH- Stake in Heliopolis Housing could be sold to a strategic investor: The Public Enterprises Ministry is working with the government’s IPO committee to decide the fate of Heliopolis Company for Housing and Development (HHD) after it was dropped from the lineup of companies in the first wave of the state privatization program, the local press reported. While the sale of an additional stake on the EGX in 4Q2019 is a possibility, so is “developing” HHD in partnership with a strategic investor, Public Enterprises Minister Hisham Tawfik hinted last week on the sidelines of an AmCham event in Cairo.

What other transactions could go to market soon? Abu Qir Fertilizers and Alexandria Containers and Cargo Handling Company could make secondary offerings before the Eid El Fitr break, but the sale program will definitely be on hold during the summer, when liquidity and trading volumes are typically low, Tawfik told Enterprise last week.

Background: The government kicked off the first wave of the program in March with Eastern Tobacco’s secondary offering of a 4.5% stake. The first phase of the program was delayed last year as a global emerging markets selloff hit the EGX.

Orascom, Arab Contractors sign USD 739 water treatment contract: A joint venture of Orascom Construction and Arab Contractors signed yesterday a USD 739 mn agreement with the Armed Forces Engineering Authority to set up a water treatment plant in Sharqia’s Bahr El Baqar, OC said in a statement (pdf). The facility — set to be the biggest in Egypt — will treat around 5 mn cbm/d of water, which then will be used to irrigate agricultural land in Sinai. The OC-Arab Contractors JV will also be responsible for operating and maintaining the facility for five years.

Separately, Orascom Construction announced it has added USD 475 mn to its consolidated backlog in 1Q2019, bringing its value to USD 4.2 bn as of 31 March, according to a company statement (pdf). Egypt accounted for around 75% of new awards — with projects across the infrastructure, marine, and roads market segments and in the new capital and New Alamein, the company noted. The company, which has listings on Nasdaq Dubai and the EGX, is focused on infrastructure, industrial, and high-end commercial projects and has operations in the MENA region, the US and the Pacific Rim.

Correction: 4 May, 2019

An earlier version of this article incorrectly said the facility will treat wastewater.

INVESTMENT WATCH- Accor Hotels is planning to open more than 30 hotels in Egypt over the next two years as the country’s tourism industry recovers, MENA CEO Mark Willis told Bloomberg. “Egypt is resurrecting after 10 years of a tough situation,” Willis said. Egypt has passed Kenya to become the top choice for European tourists and investors with revenue per available Accor room having risen 20% y-o-y, he said. Accor aims to open 60 new hotels in 14 African countries over the next four years, with Nigeria, Ethiopia and South Africa also at the top of the company’s investment list.

Former Abraaj exec Abdel Wadood granted bail in New York: Former Abraaj managing partner Mustafa Abdel-Wadood has been released on bail, the Wall Street Journal reported. Abdel-Wadood will be under house arrest in a Manhattan studio apartment under the USD 10 mn bail package secured by four cosigners. He could face trial as early as November on fraud and other charges related to the meltdown of Abraaj, once the flag bearer for private equity in emerging markets. Abraaj founder Aref Naqvi and another managing partner, Sev Vettivetpillai, were also arrested in London in the same case, and US prosecutors are seeking their extradition. Abdel-Wadood has denied any wrongdoing in the case. A judge in the UK denied bail for Naqvi last weekend.

Abdel Wadood loses his seat on Orascom’s board: Local press reported that Orascom Construction has let go of Abdel Wadood as an independent non-executive member. He will be replaced by Wiktor Słowiński.

STARTUP WATCH- Glovo exiting Egypt, Chile following EUR 150 mn funding round: Spanish on-demand delivery startup Glovo has “indefinitely” suspended operations in Egypt and Chile as of Tuesday, Menabytes reports. The move came as the startup secured a EUR 150 mn series D funding round led by Lakestar. According to Contxto, the decision to exit the Chilean market “due to some hefty financial losses” in 2018, which Glovo apparently attributed to a lack of funding. It remains unclear whether the company recorded the same scale of losses in Egypt. Glovo, which is partially owned by Germany’s Delivery Hero and delivery market player Otlob, apparently sent messages to its employees and couriers in Egypt last week informing them of the decision to shut down. The company was active in Egypt for less than a year but managed to acquire a double digit market share. Glovo has yet to issue an official statement on the matter.

Egypt outperforms regional oil importers on GDP, export growth; lags behind in containing inflation and debt: Egypt’s projected GDP growth rate is expected to outstrip the average among oil importing countries in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) over the next two years, the IMF said in its April 2018 Regional Economic Outlook (pdf). According to the report, GDP growth across MENAP oil importers is expected to average at 3.6% and 3.2% in 2019 and 2020, respectively. Egypt, meanwhile, is expected to see its GDP grow 5.5% and 5.9% during this period, according to IMF figures.

Export growth in Egypt “is expected to remain strong” on the back of new natural gas discoveries and recovering tourism (with the aid of a low base effect), despite regional export growth being projected to slow to 7% and 6.5% in 2019 and 2020, respectively. Jordan is also expected to see its export growth picking up over the coming period, but the regional trend will be driven downwards “due to weaker demand in key trading partners.”

Inflation remains an issue: An expected spike in inflation figures in Egypt as a result of the next wave of fuel subsidy reform in the summer is projected to accelerate regional inflation to 11.3% this year. Pakistan’s weakening exchange rate is also anticipated to contribute to higher inflation levels across the region. Pharos Holdings has previously said it anticipates inflation averaging 14-14.5% for the rest of the year, before falling slightly to 13.3% by the end of December. EFG Hermes expects inflation to sit at 14% in May and cool gradually to c. 10% by the end of the year.

Debt is also still weighing on Egypt’s economic wellbeing — but it’s the same across oil importers. According to the report, public debt in most oil importers across the MENAP region is “well above the emerging market threshold,” including Egypt, Jordan, Lebanon, and Sudan, all of which have public debt levels north of 80% of GDP. Egypt will also have a little more than USD 12 bn (the equivalent of around 5% of GDP) of external debt maturing in FY2019-20, the IMF notes. “This presents an increasingly difficult choice for policymakers as they weigh rebuilding buffers to strengthen resilience to near-term risks against addressing challenges to growth. High public debt limits options for fiscal policy to help offset the impact of weaker external demand on near-term growth,” and leaves governments with inadequate breathing room to invest in key areas such as health, education, and a “sustainable safety net.”

This all comes in the midst of significant regional and global headwinds, including volatile global financial conditions, continued trade tensions between the US and China, and increased uncertainty as a result of volatile oil prices. These factors, the IMF notes, “amplify the challenges faced by policymakers in their efforts to support growth.” Unrest across the region is also creating economic uncertainty, with protests reaching “an all-time record in Sudan.” On the flipside, Morocco, Egypt, and Lebanon have seen “for different reasons, fewer reported expressions of social discontent than in the recent past.”

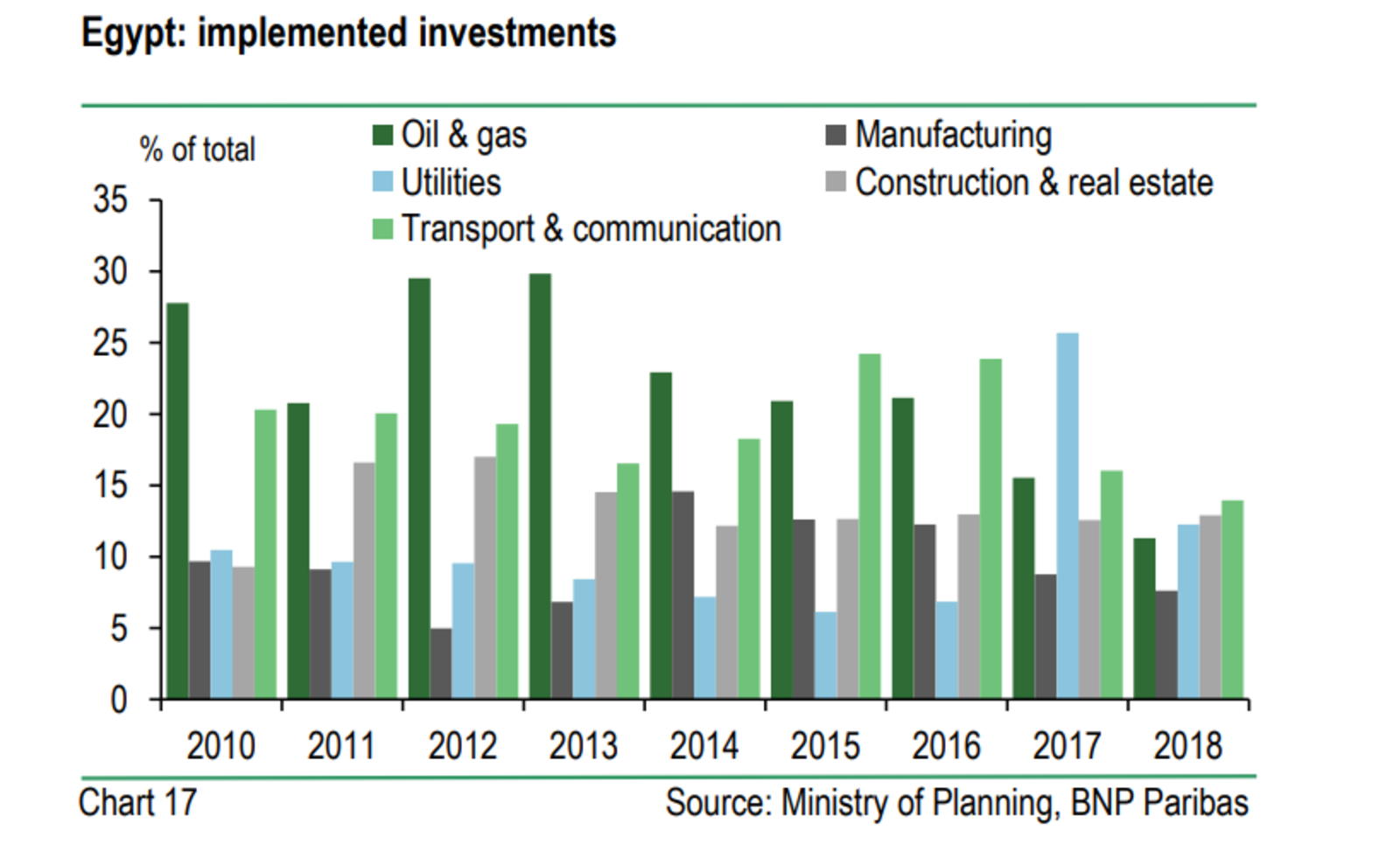

Egypt needs to deepen structural reforms if it wants to spur private-sector investment and job creation, BNP Paribas said in a recent report (pdf). While macroeconomic imbalances have largely been corrected, structural issues such as the informal economy have not yet been fixed, BNP says. High government debt, insufficient job creation, and capacity constraints to absorb a high-growth population were also listed as potential growth impediments.

We’re going to become a net gas importer again by fiscal year 2020-21, the report suggests. That will put some pressure on the current account deficit, the bank suggests, noting that “only the start-up of new gas fields would enable the country to cover its domestic consumption needs, which are growing rapidly (+14% in 2017).” (The ramp up in imports, we note, will come as Egypt locks in imports not just for domestic consumption, but for processing and onward sale.)

The current account improvement is the “most significant outcome” of the reform program. This improvement was primarily driven by a sustained growth in expat remittances, tourism revenues, and Suez Canal returns since the government initiated the program in 2016. The current account balance should continue to improve over the next two years, although remaining in negative territory, the report says.

EXCLUSIVE- The finance and planning ministries have agreed to set a USD 110 bn cap on foreign debt, a figure the government expects to reach within two to three years, a senior government official told Enterprise. Once we reach that mark, the government will move to cut its foreign borrowing as the financing gap shrinks and economic indicators improve, the official said. Studies have shown that exceeding this limit could result in borrowing costs becoming unsustainable, according to the official.

Background: The Finance Ministry began implementing a comprehensive debt reduction strategy in March, which aims to reduce debt to 80% of GDP by 2022. The strategy involves extending maturities on government debt and speeding up inclusion of informal businesses into the formal economy. The financing gap is expected to reach EGP 820 bn in FY2019-20, up from EGP 715 bn in the current fiscal year.

Money supply growth slows again: The pace of M2 money supply growth continued to slow in March, falling slightly to 11.38% y-o-y from 11.55% in February, Reuters reported. The M2 gauge stood at EGP 3.72 tn at the end of March, up from EGP 3.67 tn a month earlier. M2 growth has consistently slowed over the past year, having fallen from 21.36% growth in April 2018. M2 measures liquid assets such as cash, savings deposits and money market securities.

EARNINGS WATCH- CI Capital Holding reported a 41% y-o-y increase in net profit after tax to EGP 115.5 mn in 1Q2019, according to the company’s earnings release (pdf). Revenues for the period came in at EGP 728.6 mn, up 34% y-o-y.

Juhayna Food Industries’ net profits dropped 11% y-o-y in 1Q2019 to EGP 72 mn, the company said in an EGX disclosure (pdf). Quarterly revenues rose 12% y-o-y to EGP 1.73 bn.

MOVES- The European Bank for Reconstruction and Development (EBRD) has appointed veteran banker Khalid Hamza (LinkedIn) as deputy director of its Egypt office, the lender said in a statement (pdf). Hamza, who assumed the role yesterday, joined the institution in 2012 as a principal banker. He was most recently a senior VP at Rasmala, and formerly a risk officer at CIB and an investment officer at the International Finance Corporation.

The Macro Picture

“Made in Africa” could be the new “Made in China” in 50 years if enough focus is given to investing in manufacturing across the continent, our friend Carbon Holdings CEO Basil El-Baz writes for the Financial Times’ Beyond Brics blog. Many economies in Africa have already been flourishing over the past several years, propped up by a “blossoming” services sector, but Africa could become an economic powerhouse once manufacturing becomes the core source of growth. “Sustainable transformation requires a radical new approach. It is not a services economy that will lift half a bn people out of poverty or create 100m jobs, but an industrial one. Export-led manufacturing will be the key to Africa’s success, just as it transformed the fortunes of Asian countries, particularly China, in past decades.”

Cross-border expansion is already happening, thanks to freetrade agreement: El Baz also argues that the African Continental Freetrade Zone, which was launched last year, will also spur investments in cross-border infrastructure and help lay the groundwork for further expansions in the customer bases of African-owned companies. With that infrastructure in place, Africa will be well-placed to edge out China as the world’s leading manufacturer and exporter of goods, particularly since Africa is already at a geographical advantage.

Egypt in the News

Topping coverage of Egypt in the foreign press is the White House’s announcement that it could formally designate the Ikhwan a terrorist organization. This comes weeks after a meeting between The Donald and President Abdel Fattah El Sisi in Washington DC. Bloomberg, the Wall Street Journal and The Guardian all emphasize the potential negative fallout from such a move, which they say could complicate US relations with allies (including Tunisia, Morocco and Kuwait) where Islamists serve in the government. Reuters, meanwhile, reports that the Ikhwan’s response was to issue a statement that it would continue to work in line with its “moderate and peaceful thinking.”

On the same topic: Former NYT Cairo bureau chief David Kirkpatrick wades in with a Q&A that argues the Ikhwan doesn’t meet the US definition of a terror group. The news came as Hassan Malek, the Ikhwan business leader who suddenly became very popular from 2011 through early 2013, was handed a life sentence on charges that included helping lead a terror group.

Also making headlines this week was news that “an infectious biological agent or toxic chemicals” were behind the death of a British couple at a Hurghada resort last year, according to the Guardian. John and Susan Cooper died in August after falling ill at the Steigenberger Aqua Magic hotel. The BBC, Sky News and the Sun had the story.

Also making the international press this morning:

- Referendum turnout: The Carnegie Middle East Center is casting doubt on the veracity of the turnout figures for the recent referendum on constitutional reform, something that exiled opposition leader Ayman Nour is eager to point out in the Washington Post.

- Sectarianism in Egypt: Increased assaults on Egypt’s Copts has led to an increased “exodus” of the Christian population out of the country, the Wall Street Journal reports (paywall).

- Egypt’s security and prosperity are crucial for regional stability, but it must work to regain its regional leadership position, argues Republican Congressman Jeff Fortenberry in an opinion piece for The Hill.

- Egypt’s small steel producers are coming under financial pressure due to the recently imposed tariffs on iron billet and steel imports, Arab Weekly reports.

ODDITIES: The Economist talked up fiseekh on the occasion of Sham El Neseem, while Bloomberg got into Ancient Egyptian cat statues.

On The Front Pages

Government efforts to support workers was the main story on state-owned Al Ahram, in honor of Labor Day. Meanwhile, the World Bank Group’s decision to extend its Country Partnership Framework with Egypt until 2021 topped the front pages of Al Gomhuria and Al Akhbar.

Diplomacy + Foreign Trade

The World Bank Group (WBG) has decided to extend its Country Partnership Framework (CPF) with Egypt for an additional two years to end in 2021, according to an Investment and International Cooperation Ministry statement (pdf). The CPF, which originally covered 2015-2019, includes a total of USD 8 bn of WBG financing — USD 6 bn of which was allocated from the International Bank for Reconstruction and Development, and the rest from the International Finance Corporation. The extension will see the CPF focus on creating jobs for women and the youth, in addition to investing in human resources in the health and education sectors, the statement says.

Chile will begin talks with Egypt to launch a freetrade zone later this year, Director of Economic Relations at the Chilean Foreign Affairs Ministry Philippe Lubieda told Al Ahram. A feasibility study on the zone is currently being conducted, according to Lubieda.

Egypt seeks additional USD 2.35 bn facility from Kuwait-based fund for 17 new projects: Egypt is holding talks with the Kuwait-based Arab Fund for Economic and Social Development (AFESD) to obtain a USD 2.35 bn facility to fund 17 new projects, according to an Investment Ministry statement (pdf). In 2018, Egypt received AFESD funding to the tune of USD 352 mn for water, transportation, agriculture, social services, and energy projects.

Basic Materials + Commodities

Al Ghurair signs EGP 5 bn-worth of agreements for sugar beet processing facility

Al Ghurair Group signed three agreements worth a combined EGP 5 bn for its USD 1 bn sugar factory in Minya last week, according to an Investment Ministry statement (pdf). The agreements include a contract with China’s Sinoma CDI to construct the facility by 2021, a contract with Elsewedy Electric to provide high-pressure water lines for the plant. The agreements also include three separate contracts with Saudi’s Al Khorayef Group for the cultivation of the land and to provide and maintain irrigation infrastructure. The sugar production project will see Al Ghurair develop 181k feddans of reclaimed desert land west of Minya to grow 1 mn tonnes of beets per year, as well as develop a USD 400 mn sugar production facility.

Manufacturing

IFC to finance USD 2.3 mn project to boost manufacturing efficiency in Egypt

The International Finance Corporation (IFC) will finance a USD 2.3 mn project to improve the efficiency of electric motors used in Egyptian factories, according to a Trade Ministry statement (pdf). Trade Minister Amr Nassar and an IFC delegation led by Walid Labadi, IFC’s regional manager for Egypt, Yemen and Libya, discussed cooperating to support the competitiveness of Egyptian products, including projects to supply cement factories with alternative fuel produced from waste.

Health + Education

Egypt to set up container classrooms supplied by Chinese company

Egypt is planning to set up 265k “container-like smart classrooms” developed by a Chinese company over the next three years, reports People’s Daily. The classrooms take a few hours to set up and, at GBP 22,900 apiece, cost a fraction of typical educational infrastructure.

Tourism

Grand Egyptian Museum inauguration set for 4Q2020

The Grand Egyptian Museum will be inaugurated in 4Q2020, Tourism Minister Rania Al Mashat announced on Tuesday during the Arabian Travel Market (ATM) in Dubai, Egypt Today reports. Construction of the museum began in May 2005.

Automotive + Transportation

Egypt’s NRA signs EUR 157 mn contract with Spain’s Talgo to purchase six trains

The National Railways Authority (NRA) has signed a EUR 157 mn contract with Spanish manufacturer Talgo to purchase six passenger trains, according to a Transport Ministry statement. The agreement is financed by the European Bank for Reconstruction and Development. The ministry is set to receive the first rolling stock in 21 months.

Other Business News of Note

Global Telecom’s Banglalink agrees on USD 300 mn loan

Global Telecom’s Bangladeshi subsidiary Banglalink has reached an agreement on a USD 300 mn syndicated loan with several international banks, the company said in a bourse filing. The loan will be used to refinance the principal amount of a USD 300 mn bond that matures on 6 May and will be guaranteed by GTH’s mother company Veon Holdings.

Sports

Farag, El Welily win 2019 El Gouna International Squash Open Championships

Raneem El Welily and Ali Farag won the 2019 El Gouna International Squash Open women’s and men’s titles, respectively, on Friday, after defeating Egyptian compatriots at the CI Capital Arena, according to a press release (pdf). CI Capital Group Co-CEO Hazem Badran presented El Welily with her trophy and prize money following the championship finals. CI Capital were core sponsors of the championship for the third year running.

AfCON ticket prices generate controversy, prices to be reviewed

Sports Minister Ashraf Sobhy announced the prices of tickets for the 2019 Africa Cup of Nations (AFCON) will be reviewed after sparking backlash for being too expensive for the average football fan to afford, Ahram Online reports. A host of public figures and athletes took to social media to criticize the tickets originally being priced between EGP 100 and 2,500.

Nestle tips

On Your Way Out

Egypt’s Rod Al Farag Axis Bridge will be listed in the Guinness Book of World Records as the widest suspension bridge in the world, Egypt Independent reports. At 64.8 meters, it just has the edge over Canada’s 64.2 meter suspension bridge, according to Al-Shorouk. Comprising five connected bridges, Rod Al Farag, which is due to be inaugurated any day now, has a total length of 16.7 km.

The Market Yesterday

EGP / USD CBE market average: Buy 17.12 | Sell 17.22

EGP / USD at CIB: Buy 17.10 | Sell 17.20

EGP / USD at NBE: Buy 17.12 | Sell 17.22

EGX30 (Tuesday): 14,920 (+1.0%)

Turnover: EGP 668 mn (21% below the 90-day average)

EGX 30 year-to-date: +14.5%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.0%. CIB, the index heaviest constituent ended up 2.4%. EGX30’s top performing constituents were Orascom Development Egypt up 3.9% and SODIC up 3.1%. Tuesday’s worst performing stocks were Palm Hills down 2.0%, Emaar Misr down 1.7% and Eastern Co down 1.6%. The market turnover was EGP 668 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +230.0 mn

Regional: Net Short | EGP -16.6 mn

Domestic: Net Short | EGP -213.4 mn

Retail: 21.0% of total trades | 17.3% of buyers | 24.8% of sellers

Institutions: 79.0% of total trades | 82.7% of buyers | 75.2% of sellers

WTI: USD 63.58 (-0.03%)

Brent: USD 72.11 (-0.10%)

Natural Gas (Nymex, futures prices) USD 2.61 MMBtu, (-0.34%, June 2019 contract)

Gold: USD 1,278.50 / troy ounce (-0.44%)

TASI: 9,361.96 (+0.62%) (YTD: +19.62%)

ADX: 5,258.32 (+0.01%) (YTD: +6.98%)

DFM: 2,751.51 (-0.56%) (YTD: +8.77%)

KSE Premier Market: 6,043.80 (-0.06%)

QE: 10,400.29 (+0.23%) (YTD: +0.98%)

MSM: 3,965.96 (+0.51%) (YTD: -8.27%)

BB: 1,433.92 (-0.17%) (YTD: +7.23%)

Calendar

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program ahead of the disbursement of the sixth and final tranche of Egypt’s USD 12 bn IMF loan.

04 May (Saturday): An administrative court will look into an appeal by Emirati business figure Mohamed Alabbar’s Adeptio AD Investments against a Financial Regulatory Authority order to submit a mandatory tender offer (MTO) for Americana.

05 May (Sunday): Egypt’s Emirates NBD PMI for April released.

06 May (Monday): First day of Ramadan (TBC).

14 May (Tuesday): Egyptian Private Equity Association annual sohour. Four Seasons Hotel, Nile Plaza, Garden City, Cairo.

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Meditteranean (UfM) countries to promote trade and investment in the 43 member states.

June: President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.