- Egypt’s non-oil private sector contracted in May for the 18th consecutive month. (The Big Story Tonight)

- POLL- What do manufacturers think will help grow local industry? (Inside Industry)

- Egypt looking to focus on broader policies and national strategies in the shift towards a green economy -IsDB annual meetings. (What We’re Tracking Tonight)

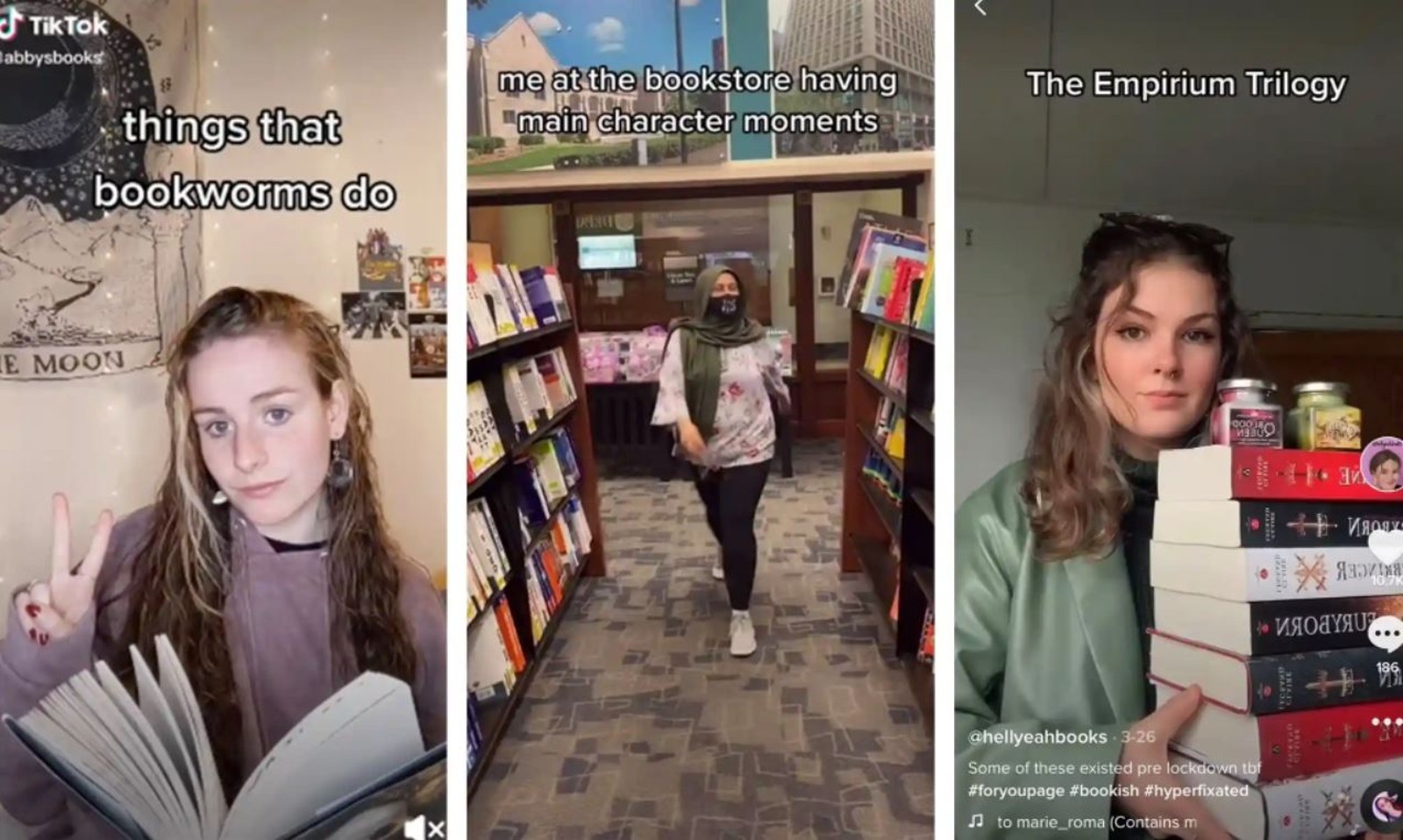

- BookTok, the literary branch of video-sharing app TikTok, is driving book sales at scale. (For Your Commute)

- The Perfect Mother is a bite-sized mystery that will keep you guessing till the very end. (On The Tube Tonight)

- Egyptian national team to face Guinea tonight in 2023 African Nations Cup qualifiers. (Sports)

- Collecting art on a budget: TAM Gallery is hosting its popular Summer Affordable Art Show. (Out And About)

- Jump a century back in time with Violeta, a historical fiction novel that begins in South America in 1920. (Under The Lamplight)

Sunday, 5 June 2022

PM — Tamagotchi for the digital-age parent

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, wonderful people. We’re off to a roaring start this first full workweek of the month — so much for that breather we had prophesied.

THE BIG STORY TODAY

Egypt’s non-oil private sector contracted in May for the 18th consecutive month as inflationary pressures continued to weigh on spending, according to the S&P Global purchasing managers’ index survey (pdf). Business activity contracted at a slightly slower pace during the month, with the index inching up to 47, up from 46.9 in April. Activity remained below the 50.0 mark that separates expansion from contraction.

^^We’ll have more details on this and other stories in tomorrow’s edition of EnterpriseAM.

Recapping the Islamic Development Bank’s (IsDB) annual meetings: The Islamic Development Bank’s annual meetings in Sharm El Sheikh wrapped up yesterday, bringing to a close the four-day event — which Enterprise attended — that saw policymakers and business leaders focus on climate change action. A key takeaway for us: The Madbouly government is looking to focus on broader policies and national strategies in the shift towards a green economy, said Planning Minister Hala El Said. The government is currently preparing strategies for hydrogen and water resources as part of its push to encourage the transition to a green economy. The government is also making sure that inclusive growth and the core principle of “leaving no one behind” are part and parcel of its policies, El Said said. Read our recap of a panel discussion on catalyzing growth through green finance for more details.

The meetings also saw the government and local private sector players sign a total of 13 agreements over the weekend, including six MoUs between the Islamic Corporation for the Development of the Private Sector and Sarwa Capital, FAB Egypt, and Faisal Islamic Bank to issue sukuk, on-lend to SMEs, and spur private sector involvement in the economy.

THE BIG STORY ABROAD

Russia launched airstrikes on Kyiv this morning for the first time in five weeks, ending the eerie sense of calm that had started taking shape in Ukraine’s capital, the Associated Press reported. Russia said it destroyed tanks donated from abroad, as President Vladimir Putin warned that more “targets” would be struck if Western deliveries of long-range rocket systems were to continue, without identifying what those targets could be. The renewed attack comes days after the US announced plans to deliver USD 700 mn in additional security assistance for Ukraine. The story is getting wide play in the international press this afternoon: Reuters | New York Times | CNBC.

HAPPENING NOW-

Trade and Industry Minister Nevine Gamea is at the House of Representatives to answer MPs’ questions on government plans to boost investment in industry, improve the business environment for manufacturers, and localize certain sectors including the automotive industry. Among the questions and topics MPs are broaching with the minister: The status of producing our first local-made EV; the government’s decision to raise the customs exchange rate and whether the move was designed to limit automotive imports; the industrial partnership between Egypt, Abu Dhabi, and Jordan — details on which are scant so far; and several issues pertaining to local industry such as land and license allocation and access to services.

Egypt is prepared to step up its health services cooperation with other African countries, President Abdel Fattah El Sisi said at the Africa Health ExCon, which kicked off earlier today and runs until this Tuesday. El Sisi stressed that “Africa is the future” thanks to its young population, but that providing adequate health services to the continent’s population requires financing and innovation (watch, runtime: 20:10).

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Egypt is finalizing some USD 3.5 bn in fresh financing from multilateral lenders to shore up food and energy security amid ongoing disruptions to global markets. Cairo is hoping to receive USD 3 bn from the ITFC and USD 500 mn from the World Bank.

- Food-for-fertilizer swap with India? Egypt is in talks to export fertilizer and other products to India in exchange for the 500k tons of Indian wheat we’ve been hoping to secure.

- Policymakers expressed disappointment about climate finance and pledges at IsDB annual meetings in Sharm El Sheikh last weekend, with officials condemning the lack of action and broken promises.

|

???? CIRCLE YOUR CALENDAR-

IN THE HOUSE THIS WEEK- Tackling pollution + mud tax. The House of Representatives is holding plenary sessions today through at least Tuesday. On the docket:

- Environment Minister Yasmine Fouad is in the House tomorrow to talk tackling pollution in our waterways, beaches, and natural reserves.

- Mud tax talks: Tuesday will see discussion of reports on potentially extending the suspension of a 14% tax on agricultural land for an additional year to July 2023.

ALSO THIS MONTH- Gas agreement with the EU this month? Egypt and Israel will sign an agreement with the EU this month to increase LNG exports as the bloc scrambles to find new suppliers and unwind its dependence on Russian gas, according to a draft document seen by Bloomberg. The two countries are expected to come to an agreement when European Commission President Ursula von der Leyen visits Egypt this month, the business newswire said. Bloomberg reported last month that the plan would see Israel increase natural gas exports to Egypt’s LNG facilities, from which the gas would be shipped to Europe.

NEWS TRIGGERS you’ll want to keep an eye on as the new month gets underway:

- Foreign reserves figures for May should be announced sometime this week;

- Inflation figures for May are due out on Saturday, 9 June (from state statistics agency Capmas) and Sunday, 12 June (central bank figures);

- The Central Bank of Egypt holds its policy meeting on Thursday, 23 June.

Technology conference Tech Invest 4 will take place this Tuesday, 7 June at the Grand Nile Hotel in Cairo.

LATER THIS MONTH- The Aswan Forum for Peace and Sustainable Development is scheduled (pdf) for Tuesday and Wednesday, 21-22 June under the theme Africa in an Era of Cascading Risks and Climate Vulnerability: Pathways for a Peaceful, Resilient and Sustainable Continent. You can register for the event here.

NEXT MONTH- Follow-up on the Egypt-UAE-Jordan industrial partnership: Egypt, the UAE and Jordan will meet in Cairo in July to follow up on the industrial partnership agreed last week in Abu Dhabi, the Egyptian Trade Ministry said in a statement Friday. Bolstered by USD 10 bn in investment from ADQ, the initiative will look to support sustainable economic growth and increase industrial production by channeling finance into industrial projects in the three countries.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Expect a daytime high of 37°C tomorrow and a nighttime low of 22°C, according to our favorite weather app.

???? FOR YOUR COMMUTE

You think TikTok is just for Crinjaat, lip synching, and the yoof? Its latest foray into books suggests otherwise. BookTok, the literary branch of video-sharing app TikTok, is driving book sales at scale, the Financial Times reports. BookTok videos — usually short videos where people talk about their favorite books — have clocked up some 56.6 bn views in the past four years, according to TikTok. And while BookTok’s appearance at established events in the global literary calendar — like the UK’s Hay Festival — offers festival goers fresh ways to engage with reading as a discipline, publishers say it’s also helping to spur the thing that matters most to them: An increased bottom line.

New-age Tamagotchi: Virtual parenting edition. Remember Tamagotchis, the widely-popular Japanese digital pets that were sold in small devices in the 90s? Just like actual pets, Tamagotchis needed to be cared for, loved and fed — digitally. Now, Tamagotchi kids are about to make a debut, according to artificial intelligence expert Catriona Campbell. Your computer-generated offspring will cuddle with you, play with you, grow with you, and even look like you, Campbell claims, adding that this could be the world’s remedy to overpopulation. As the financial burdens of bringing a child into the world continue to rise, virtual babies will cost next to nothing to bring up in the metaverse, she points out. “Virtual children may seem like a giant leap from where we are now, but within 50 years technology will have advanced to such an extent that babies which exist in the metaverse are indistinct from those in the real world,” she writes in her new book, AI by Design: A Plan For Living With Artificial Intelligence. “As the metaverse evolves, I can see virtual children becoming an accepted and fully embraced part of society in much of the developed world,” Campbell concludes.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

The Perfect Mother is a bite-sized mystery that will keep you guessing till the very end. Set in Paris and Berlin, the new Netflix thriller is mostly French, but also includes a bit of spoken German. The mini-series revolves around a mother, Helene, whose daughter is implicated in a murder, and it explores how the role of being a mother can sometimes overpower moral decisions. As Helene works hard to prove her daughter’s innocence, some harrowing truths begin to unravel, and she begins to question if her daughter is as innocent as she believed she was. You will likely change your perspective on who is guilty several times throughout the four episodes, which we believe may just be the perfect number — who has time for 10-12 episodes anymore? Each episode is less than an hour long, making this an easy, fast-paced show to binge.

⚽ Salah x Keita: Today, the Egyptian national team will play an important confrontation in the opening of its campaign in the 2023 African Nations Cup qualifiers against the Guinean team at 9pm. Egypt sits in a group that includes Ethiopia and Malawi, as well as Guinea, which is led by fellow Liverpool player Naby Keita. Two teams from each group qualify for the tournament that will take place in Côte d'Ivoire. This is the first official test for coach Ihab Galal with the Egyptian national team. The match between Malawi and Ethiopia kicked off at 3pm and continues as we dispatch.

The European play-off match to determine the World Cup qualifier between Wales and Ukraine starts today at 6pm. Wales qualified for the play-off final at the expense of Austria, while Ukraine overtook Scotland a few days ago.

The European Nations League continues: There are nine matches today. We recommend that you follow the matches of the Czech Republic v Spain and Portugal v Switzerland, both of which start at 8:45pm tonight.

???? EAT THIS TONIGHT-

One of our favorite Zamalek spots branches out to West Cairo: Crimson Bar & Grill brings its signature delectables to Arkan Extension. It may not have Zamalek’s stunning Nile views, but Crimson Arkan makes up for it with an elegant yet comfortable ambience, scrumptious dishes, and impeccable service. The new space boasts indoor and outdoor areas — we recommend reserving a table outside for a solid al fresco fine dining experience. With a wide selection of dishes, you really can’t go wrong with anything off their menu. We recommend the Chateaubriand if you’re sharing the meal with someone special, or their Pasta Ai Gamberetti, which is smothered in Crimson’s special rose sauce with seared shrimp.

???? OUT AND ABOUT-

(all times CLT)

Collecting art on a budget: TAM Gallery is hosting its popular Summer Affordable Art Show at their venue in Abu Rawash, featuring over 150 contemporary Egyptian artists. Hundreds of artwork of varying styles and sizes will be divided over different displays based on their prices, which range between EGP 2k-25k. In this round of the Summer Affordable Art Show, TAM Gallery has collaborated with the UNHCR and will be showcasing the works of refugee artists from Eritrea, South Sudan, Sudan, Syria and Yemen. The exhibition runs until the end of August.

???? UNDER THE LAMPLIGHT-

Jump a century back in time with Violeta, a historical fiction novel that begins in South America in 1920. The New York Times bestseller revolves around a woman who bears witness to the greatest upheavals of the twentieth century. Through the span of her 100-year life, Violeta del Valle experiences quite an eventful life, including living through not one, but two different pandemics, which makes this a timely, cathartic read. Violeta also lives through the fight for women’s rights, the rise and fall of Cold War-era tyrants, heartbreak and passionate affairs, poverty and wealth, and the tragic story of her drug-addled daughter who dies while giving birth. With determination and an unlikely sense of humor, author Isabel Allende brings to life an epic that is deeply emotional and fiercely inspiring.

???? GO WITH THE FLOW

EARNINGS WATCH-

Ezz Steel’s bottom line rose 2.4% y-o-y in 1Q2022 to reach EGP 1.22 bn, according to the company’s financials (pdf). The metal producer saw its revenues increase 38.1% y-o-y to EGP 18.64 bn.

Misr Fertilizers Production Company (Mopco)’s bottom line rose 163.5% y-o-y in 1Q2022 to EGP 2.09 bn, according to the company’s financials (pdf). Sales also rose 111.1% y-o-y during the quarter to record EGP 4.21 bn.

MARKET ROUNDUP-

The EGX30 fell 0.2% at today’s close on turnover of EGP 347 mn (58.8% below the 90-day average). Local investors were net buyers. The index is down 16.4% YTD.

In the green: Ezz Steel (+6.3%), MM Group (+6.1%) and Heliopolis Housing (+1.8%).

In the red: Orascom Construction (-2.6%), Orascom Development Egypt (-2.2%) and EFG Hermes (-2.2%).

POLL- What do manufacturers think will help grow local industry? The government has been stepping up its efforts to help grow local manufacturing and limit Egypt’s imports as of late. Last month, we reported on the Trade and Industry Ministry’s list of priority sectors in which to increase domestic manufacturing to address local consumption needs. Today, we look at the measures local manufacturers think are critical to expanding local industry.

REFRESHER- Why is the gov’t prioritizing local manufacturing now? Reducing imports is a cornerstone of narrowing the current account deficit, which stood at USD 3.8 bn in 2Q 2021-2022, narrowing from USD 4.8 bn during the same period the prior year on the back of rising tourism revenues and Suez Canal receipts. On the export side of the equation, Egypt is aiming to increase to USD 60 bn a year by 2025 as part of the government’s new structural reform program, Trade Minister Nevine Gamea had previously said. This also comes as supply chain issues continue to batter global trade amid pandemic-fueled shutdowns in China and the Russia-Ukraine war.

What will help us reach these targets, according to manufacturers?

#1- More industrial land provision: The government announced last month that local manufacturers will be getting usufruct land rights, and will be allowed to pay fees in installments, as part of a package of measures it plans to take to help expand local manufacturing. This will help manufacturers direct investments towards production lines, machinery and equipment, instead of draining their capital in paying land fees, several industry experts we spoke with said.

#2- Supportive banking policies and incentives from banks: More “supportive” banking policies — particularly for medium industries — from banks is the fastest solution for growing the local industry, Hani Kassis, chairman and managing director of Mintra, told Enterprise. Banks need to offer manufacturers the capital that would help them cover their operating costs, allowing them to increase their production capacity and subsequently, their exports, Kassis said. Interest rates for manufacturing loans must also be “reasonable,” in order for manufacturers to be able to get financing to expand and increase production, Sherif El Gibaly, chairman of the board of the Egyptian Chamber of Chemical Industries, told Enterprise.

That includes being open to providing capital to different sectors: Banks tend to consider some textile industries high-risk and, consequently, refuse to provide them with the necessary funding to upgrade their production lines, said Magdy Tolba, chairman of Cairo Cotton Center and former head of the Export Council of Spinning and Textiles.

#3- Continued public sector contribution is still important: The public sector will need to contribute to the development of local manufacturing, especially when it comes to newer industries that require large investments from the private sector, El Gibaly told us. The government has already said it is prepared to contribute to new sectors by purchasing non-majority stakes in manufacturing companies, El Gibaly added.

How will this work in light of the government’s new “hands-off” strategy? This comes as the government announced plans to exit as many as 79 industries over the next three years as part of plans to restructure the economy in favor of the private sector. But some industries — like food and beverages — will see the government only handing over management to the private sector, while retaining ownership of the assets, while others — including high-tech industries — will see public-private partnerships (PPPs).

The caveat: We still don’t know how much the government is planning to invest in developing these sectors, nor do we know the time frame for these targets.

#4- Upgrading production lines is essential for industry to stay competitive: Improving quality while keeping prices competitive is essential, but this can’t happen as long as production lines are outdated, Tolba explained, adding that this is the case for a large portion of Egyptian manufacturers. Upgrading production lines to enhance their efficiency will keep production costs low, which can help attract more investments, and boost exports, Tolba added.

Check out our Inside Industry automation series (Part I, II, and III) for more on where Egyptian manufacturers stand when it comes to production line efficiency and industrial automation.

#5- Some industries require a push from the state…: Industries like pharma and pharma component sectors need to be tied to preferential agreements for unified procurement contracts in order to grow, Ashraf El Kholy, CEO of HoldiPharma, told Enterprise, adding that several Gulf countries do the same to develop their own local industries.

#6- …while others require more attention: Some Egyptian products, like long-staple cotton, are very competitive, Tolba said, adding that this kind of cotton is produced by only seven countries in the world. We need to add value to the product by expanding the spinning cycle to include manufacturing fabrics and finished products, instead of exporting it as raw cotton, he added.

#7- On the export side, it’s important to open up new markets while simultaneously ramping up exports to existing ones, Gamal El Leithy, head of the Federation of Egyptian Industries’ pharma division, told us. It is important to review our trade agreements and begin to reconsider other markets in light of the recent changes to the global trade landscape, House Industry Committee deputy head Mohamed Mostafa El Sallab told Al Mal earlier this month.

The shift in the global order means new attractive export markets for us: Egypt has trade agreements with many foreign markets and it is necessary to review them to comply with the broader interest of the national economy in light of shifting global dynamics, El Sallab said, adding that the various crises affecting global trade present a window for us to increase exports to foreign markets. It’s also essential for Egypt’s industry to become self-sufficient, especially in light of the recent rise in freight costs and in the prices of basic materials and oil, Kassis said.

#8- Finally, manufacturers need skilled labor: Some industries, like textile, are struggling to find the skilled labor needed to operate high-tech equipment, Tolba said, adding that manufacturers are competing over a limited amount of talent in the market. Egypt was among six countries identified by McKinsey in a 2018 report (pdf) where more than half of the workforce holds a high school diploma or lower. It is important for both the public and private sectors to help upskill workers.

Your top industrial development stories for the week:

- A unified legislation on industry could be in the works: The Industrial Development Agency (IDA) is working with the EU and the OECD to assess the possibility of merging existing laws and regulations governing the industrial sector into a single piece of legislation. The study will be finalized within two months.

- Al Futtaim Group is looking to invest between USD 700 mn and USD 1 bn in Egypt over the next three years, including partnering with international firms in our industrial sector, CEO Omar Abdullah Al Futtaim said.

- A step closer to our first waste-to-hydrogen plant: The Suez Canal Economic Zone (SCZone) has signed an MoU with H2 Industries to establish Egypt’s first waste-to-hydrogen plant in East Port Said at a cost of USD 4 bn.

- Eastern will acquire a quarter of Egypt’s second tobacco manufacturer after the company’s general assembly approved the EGP 100 mn purchase of a 24% stake in Philip Morris’ United Tobacco.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

JUNE

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, new administrative capital.

5 June (Sunday): GB Auto is hosting an extraordinary general assembly meeting (pdf).

7 June (Tuesday): Technology conference Tech Invest 4, Grand Nile Hotel, in Cairo.

9 June (Thursday): European Central Bank monetary policy meeting.

9 June (Thursday): Digital Transformation Summit, The Nile Ritz-Carlton, Cairo

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): EU-Egypt Sustainable Food Value Chain conference, Grand Nile Tower Hotel, Cairo.

16 June (Thursday): End of 2021-2022 academic year for public schools.

21-22 June (Tuesday-Wednesday): Aswan Forum for Sustainable Peace and Development, Cairo.

21-23 June (Tuesday-Thursday): Commonwealth Business Forum, Kigali, Rwanda.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26 June (Sunday): The deadline for private companies to pre-register ahead of bidding for the second phase of the PPP national project to establish and operate 1k language schools.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

30 June (Thursday): Deadline for bids for National Democratic Party HQ redevelopment contract.

June: Egypt will launch a unified ticketing system for all means of transport at the Adly Mansour Interchange Station.

June: Egypt and Israel will sign an agreement with the EU to increase LNG exports.

JULY

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

1 July (Friday): Official rollout of e-receipt system begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

AUGUST

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 600 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

OCTOBER

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC, chaired by CBE Governor Tarek Amer

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

NOVEMBER

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): The Autotech auto exhibition kicks off at the Cairo International Exhibition and Convention Center.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

DECEMBER

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

JANUARY 2023

January EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

MAY 2023

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

EVENTS WITH NO SET DATE

2Q2022: The Sovereign Fund of Egypt will invest in two companies in the financial inclusion and non-banking financial services sectors.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 2Q2022: Door for bidding for the contract to redevelop the site of the former National Democratic Party HQ to close.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.