- Ukraine staves off Russian aggression in second-largest city as fighting intensifies. (War Watch)

- FinMin boosts PPP reporting + transparency to track risks, fiscal implications. (The Big Story Today)

- Another potential victim of the Russia-Ukraine crisis: Semiconductors. (For Your Commute)

- Could crypto be the loophole Russians use to circumvent sanctions? (For Your Commute)

- This incoming Apple TV series explores the chaotic love story behind the WeWork crash. (On The Tube Tonight)

- The case for investing in EM economies has “rarely been weaker,” argues the FT. (Macro Picture)

- A historical treasure hunt gives us an Indiana Jones-style memoir in the 21st Century. (Under The Lamplight)

Sunday, 27 February 2022

PM — Spillover from Russia-Ukraine war begins

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, ladies and gentlemen. It’s another somber news day, with few stories of note here at home as the focus remains on Ukraine’s efforts to stave off Russia’s invasion.

One piece of good news in the midst of it all: The EGX30 was a sea of green at the closing bell today, with 29 out of the benchmark index’s 30 constituents ending the trading day up. Western and Asian markets are closed today, so keep an eye out tomorrow for how they react to the developments in Ukraine.

THE BIG STORY TODAY

FinMin boosts PPP reporting + transparency to track risks, fiscal implications: The Finance Ministry has provided a template for a database of Egypt’s public-private partnership (PPP) projects with the IMF, according to a technical assistance report (pdf) from the global lender. The database includes detailed data on each PPP contract individually, including project status, sector, dates of signature, value, financing among others, and a consolidation table for reporting. The database will be used as an input source for the PPP Assessment Model, helping to increase transparency and “potentially [lowering] the risk premium and cost of financing” for the government in PPP contracts.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Fresh wheat tender on Monday after war breaks out between top suppliers Russia + Ukraine: State grain buyer GASC will look to buy 55-60k tonnes of wheat in an international tender tomorrow. The bid comes days after GASC called off a wheat tender due to a lack of offers as global grain markets face turmoil on the back of Russia’s invasion of Ukraine.

- Etisalat could push into Egypt’s fintech sector following rebrand to “e&”: The UAE’s largest telecoms operator has rebranded itself as e&, as the company looks to expand beyond telecoms. Etisalat will soon make an announcement about a transaction related to Egypt’s fintech sector as part of its expansion drive.

- Siemens-led consortium set to sign on second + third high-speed rail lines next month: The Transport Ministry and the consortium of Siemens Mobility, Orascom Construction and Arab Contractors tasked with building Egypt’s first high-speed rail line are next month set to sign final contracts for the second and third lines of the project.

WAR WATCH- Ukraine managed to push Russian forces out of Kharkiv, Ukraine’s second-largest city, Governor Oleh Sinegubov said, according to Reuters. Sinegubov had announced earlier in the day that Russian “light vehicles have broken into Kharkiv, including the city center,” but later claimed that Ukraine had regained control of Kharkiv. The initial advance into the city saw Russian troops blowing up a natural gas pipeline in the city, Reuters reports. Meanwhile, in Vasylkiv, southwest of the capital city of Kyiv, Russian missiles blew up an oil terminal. Despite the attacks, Ukraine has said that its pipeline carrying Russian gas to Europe continues to operate as normal, according to the newswire.

Kyiv’s status isn’t quite as certain, as Russian troops continue to encircle the Ukrainian capital, “bypassing other towns as columns of troops sent from Russia and Belarus race towards the city,” the Financial Times reports.

The Ukrainian military is getting some helping hands: Italy is working to supply Ukraine with about 500 Stinger surface-to-air missiles and 1k anti-tank weapons, while Portugal will provide the military with helmets, night vision goggles, grenades, various ammunition, portable radios and G3 automatic rifles, Bloomberg wrote. There’s also aid coming in from Czech Republic, Romania and Poland.

And Germany, which embarked on a significant policy shift by shipping arms to Kyiv, is now looking to more than double its own defense spending in 2022 to “protect our freedom and security,” Chancellor Olaf Scholz told Germany’s Bundestag today.

EU-wide no-fly zone coming? The EU could decide to impose a coordinated no-fly zone and close the entire bloc’s airspace to Russian flights, Reuters reports, citing an unnamed EU official.

The Bank of Russia assures Russian banks: Shortly after news broke that select Russian banks are about to be cut off from the global banking system, the Bank of Russia said it will provide “uninterrupted” supplies of RUB to banks.

Ukraine says it’s open to talking things out — just not in Belarus: Ukrainian President Volodymyr Zelenskiy rejected an offer of talks from Russia in Belarus’ Minsk, saying Belarus “was complicit in the Russian invasion.” Belarus has offered its own troops to help Russia and allowed Moscow to launch attacks into Ukraine from Belarus. Zelenskiy says he is open for negotiations in other locations.

Meanwhile: Egypt has called for an emergency meeting of the Arab League to discuss the situation in Ukraine, according to a Foreign Ministry statement.

|

FOR TOMORROW-

A call for tech startups: Tomorrow is your last day to apply for the Information Technology Industry Development Agency (ITIDA) and US-based VC firm Plug and Play’s incubator and accelerator program for digital transformation-focused startups. The program was launched in partnership with our friends at USAID. The “Smart Cities” innovation hub will select 20-30 Egypt-based companies for its inaugural three-month program, which starts in March.

???? CIRCLE YOUR CALENDAR-

The long-awaited tender for the Tenth of Ramadan dry port is kicking off today, Amr Ismail, head of the General Authority for Ports, told Al Borsa, adding that four consortiums — out of six that came forward with offers — are competing to build and operate the EGP 3.5 bn dry port and logistics hub. The four consortiums reportedly include Orascom Construction-Abu Dhabi Ports, Elsewedy Electric-CMA CGM, a consortium led by the Mediterranean Shipping Company, and another by Bollore Logistics.

Consoleya is holding its second Women Meet-up this Wednesday, 2 March to discuss topics including inclusivity in investment. The agenda includes a panel discussion on gender-lens funding here in Egypt.

ARE YOU BUILDING A FINTECH STARTUP? You might want to apply for Visa’s global startup competition, the Visa Everywhere Initiative, which is running in Egypt in partnership (pdf) with the Central Bank of Egypt. Learn more here. The deadline for applications in Egypt is 20 March.

The Diarna Handicrafts Fair kicked off on Thursday and runs through 7 March at Cairo Festival City from 10am until 10pm daily.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Expect a daytime high of 23°C tomorrow and a nighttime low of 12°C in the capital city, our favorite weather app tells us.

???? FOR YOUR COMMUTE

Another potential victim of the Russia-Ukraine crisis: Semiconductors (as if they weren’t having a bad enough year). Russia’s war on Ukraine could disrupt the supply of neon gas and metal palladium, both of which are used to manufacture conductors, according to analysts cited by the Wall Street Journal. The two countries together produce nearly 50% of semiconductor-grade neon, while 37% of the world’s palladium production comes from Russian mines. A prolonged war would drive up prices and lead to more shipping delays, potentially delivering a blow to an already fragile semiconductor industry, which was just beginning to show signs of hope. Hyundai had said last month that the company expects an increase in semiconductor supply in 2Q2022.

The war in Ukraine is also having spillover effects on the global aviation industry, as countries impose no-fly zones and airlines stop operating flights to Russia, among other measures, according to CNBC. Aside from the risks of venturing into active warzones like Ukraine, a handful of EU member states have banned Russian flights in response to the Ruskies’ invasion of Ukraine. Lufthansa Group and KLM have reportedly evacuated their crews from Ukrainian territories and announced a curb on flights to and from Russia. Russia, in turn, has vowed to implement similar restrictrictions in retaliation, and promised a swift response to the flight curbs enacted by EU countries and Western airlines, according to BBC. All of these measures are forcing airlines to take longer routes to avoid Russian airspace, and could undercut their earnings, industry sources say, according to the Wall Street Journal.

Could crypto be the loophole Russians use to circumvent sanctions? After Russia’s banking system was slapped with sanctions from a number of countries, the crypto market is still trying to figure out where it falls in all of this. While the West’s sanctions aim to limit Russia’s ability to do business in USD and include restrictions on elite citizens and their families, they didn’t specify restrictions on crypto transactions. Since some cryptocurrencies keep their customers anonymous, while others are based in jurisdictions beyond the scope of sanctions, wealthy Russians are left with a loophole allowing the crypto market to “serve as a tool wealthy Russians could use to circumvent those sanctions,” Bloomberg writes.

…which explains why Ukraine is trying to get a hold of Russian politicians’ crypto info: The Ukrainian government is offering rewards for intel on any information on the crypto wallets of Russian and Belarusian politicians, Vice Prime Minister Mykhailo Fedorov said in a tweet.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

The chaotic love story behind the WeWork crash: Anne Hathaway and Jared Leto bring to life the rise and fall of shared workspace startup WeWork in their portrayal of Adam and Rebekah Neumann in drama miniseries WeCrashed. The drama, which debuts on 18 March on AppleTV, is based on the podcast of the same name (which we loved). WeCrashed follows the story of how WeWork crashed following its IPO through the lens of Israeli-American entrepreneur Adam and his wife, Rebekah, “whose chaotic love” fueled “the greed-filled rise and inevitable fall” of one of the world’s once-most valuable startups. You can catch the trailer here (watch, runtime: 2:24)

⚽ It’s final day at Wembley Stadium, with Chelsea and Liverpool meeting in the Carabao Cup final at 6:30pm to decide on the first domestic trophy triumph this year.

The Premier League’s Week 27 fixtures also continue today, with West Ham United v Wolverhampton Wanderers kicking off at 4pm.

In La Liga, Villarreal is currently awaiting the first-half whistle in its game against Espanyol which began at 3pm, while Sevilla will play against Real Betis at 5:15pm. Real Sociedad goes head to head against Osasuna at 7:30pm, and Barcelona v Athletic Club begins at 10pm.

Moving to Italy’s Serie A, Roma will play against Spezia at 7:05pm, while Lazio will clash against Napoli at 9:50pm. Torino’s clash with Cagliari ended minutes ago with Cagliari on top with a 2-1 score. Hellas Verona will play against Venezia a few minutes after we send out this issue, at 4:05pm.

In Germany, Bochum v RB Leipzig is scheduled for 4:30 pm and Borussia Dortmund meets Augsburg at 6:30pm.

Moving to France, Ligue 1 has a stacked menu for football fans with seven games today, including Monaco v Reims, where the final whistle will be blown any minute now. Also kicking off at 4pm: Angers SCO v Lens, Brest v Lorient, Clermont v Bordeaux, and Metz v Nantes. Olympique Marseille will play against Troyes at 6:05pm, while Olympique Lyonnais will clash with Lille at 9:45pm.

In the CAF Confederation Cup, Pyramids will play against SC Sfaxien at 6pm, and Al Masry will clash against Otôho d’oho at 6pm. Other games to watch: TP Mazembe v Coton Sport, which is currently wrapping its first half, as well as ASEC v USGN and Al-Ittihad vs JS Saoura, both at 6pm. Royal Leopards and Orlando Pirates also hit the field at 9pm.

It was a bad day for Egyptian football leaders Al Ahly and Zamalek yesterday, with both teams losing their CAF Champions League’s Group stage games. Al Ahly lost 1-0 against Mamelodi Sundowns while Zamalek was defeated 3-1 against Wydad AC.

As for the Egyptian Premier League, Smouha will play against Ghazl El Mahalla at 5:30pm.

????EAT THIS TONIGHT-

Satisfy your cravings for wings with the spiciest wings in town at Wingmen at Cairo Festival City. The restaurant, which was originally at Waterway in east Cairo, offers giant buckets of crispy, juicy wings (both regular and boneless) and, of course, drumsticks. And where there are wings, there is sauce. We personally recommend the Sriracha, lemon pepper, honey garlic and the honey mustard teriyaki. The menu also includes sandwiches — we really enjoyed the Wingmen Sandwich, along with a side of fried mac & cheese.

???? OUT AND ABOUT-

(all times CLT)

The group exhibition Imagining A Landscape is ongoing at Arkan Plaza as part of an initiative by Bibliothek. The exhibit showcases the work of several emerging contemporary artists as they explore what it means to live in a city like Cairo.

Natik Awayez and Maurice Louca will be performing tomorrow at Rawabet Art Space. Awayez is an Iraqi lyricist, composer, and oud player whose contemporary folk album Manbarani is inspired by the polyrhythms of Iraq, Yemen, and the Gulf. Meanwhile, Louca is an Egyptian musician and composer who alternates between compositions and improvisation.

???? UNDER THE LAMPLIGHT-

A historical treasure hunt gives us an Indiana Jones-style memoir in the 21st Century: Pauline Baer de Perignon’s The Vanished Collection recounts the author’s mind-bending exploration into the past of her great-grandfather, Jules Strauss, a Parisian art collector who toiled to secure his treasured collection in a time when art was scavenged by the Nazis. In a truly exhilarating historical treasure hunt, Perignon sifts through Gestapo records and delves deep into the struggles of her Jewish ancestors during WW2. With the aid of researchers, and a Nobel Prize Laureate Patrick Modiano, Perignon pieces together her family’s collection, eventually leading her to the Louvre in Paris, where she discovered a trove of antique frames donated by her great-grandfather. In her exhilarating quest to discover her family’s past and track down her family’s heirlooms, Perignon emphasizes the idea of “ancestral love,” which she describes as having the “strange and marvelous power of uniting people who have little else in common.”

???? GO WITH THE FLOW

The EGX30 rose 2.6% at today’s close on turnover of EGP 541 mn (46.7% below the 90-day average). Foreign investors were net sellers. The index is down 6.5% YTD.

In the green: Cleopatra Hospital (+10.2%), GB Auto (+7.3%) and Qalaa Holding (+6.7%).

In the red: Credit Agricole (-0.1%).

???? MACRO PICTURE

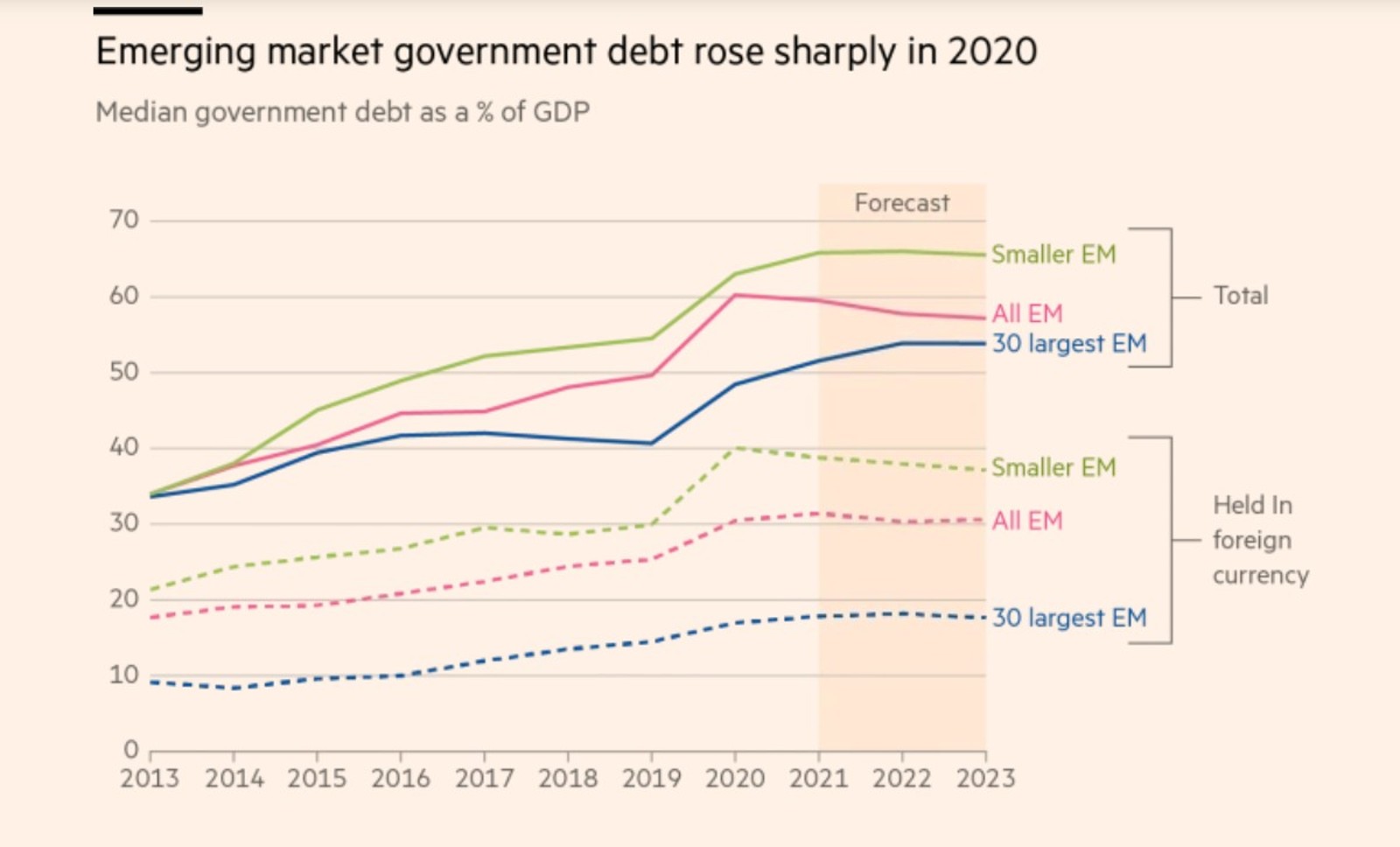

With EM economies facing slowing growth, soaring debt, and imminent US interest rate hikes, the case for investing in them has “rarely been weaker,” argues Jonathan Wheatley in the Financial Times. Amid the ongoing covid-19 pandemic, many EM economies have accrued high levels of debt, which they relied on to finance fiscal spending and support economic activity. Now faced with rising inflation and slowdowns in global trade, many are seeing sluggish GDP growth. Amid an already high-risk environment, the biggest risk of all is set to come from hikes in US interest rates. All of this undermines the key value proposition for EM investment: Without high growth, investors are left with many risks and few potential gains.

Rising US interest rates are expected to hit EMs hard: Major investment banks anticipate a cumulative hike in US interest rates of 125-175 bps in 2022, starting in March, Reuters reported recently. This tightening will reduce the appeal of investing in EM assets, Wheatley says. EM stocks and bonds saw outflows of some USD 7.7 bn in January, accompanying a sharp rise in 10-year US Treasury bond yields, representing “a pre-tightening of financial conditions well ahead of any official interest rate increases,” according to one analyst. With rate hikes likely to strengthen the USD, the cost of servicing existing USD-denominated debt will likely increase, dampening foreign investment and hindering trade, Wheatley adds.

While red-hot inflation and slowing global trade are curbing EM outputs: Inflation has become a global problem, with 15 of the 34 countries classified as advanced economies by the IMF’s World Economic Outlook, and 78 out of 109 countries classified as emerging or developing economies, seeing annual inflation rates above 5% through December 2021, according to a recent World Bank blog post. The global inflation shock has forced “abrupt” EM policy interest rate hikes, weighing on growth, Fitch notes. And global trade, traditionally a key source of output growth for EMs, is set to slow sharply in 2022 and 2023, as pent-up demand lessens, according to the World Bank.

As, of course, are high levels of debt: EM fiscal spending to mitigate the worst effects of the pandemic, by stimulating activity and supporting businesses, was largely financed by debt, Wheatley notes. The median level of government debt to GDP in 80 EMs rose to over 60% in 2020 to just under 50% in 2019, according to Fitch data. Though this is forecast to remain steady or even slightly decrease through 2023, it still represents “a huge increase for a single year,” he says.

It’s all weighing on EM GDP growth: EM growth is expected to fall to 4.6% in 2022 and 4.4% in 2023, from 6.3% in 2021, according to World Bank data. Though advanced economies will also see declining growth, they will all still have achieved full output recovery by 2023, the World Bank anticipates. But overall EM output will remain 4% below its pre-pandemic trend by 2023, with some of the most vulnerable economies seeing growth that’s 7.5-8.5% below pre-pandemic trends.

Higher US interest rates and a strengthening USD are particularly problematic for smaller EM economies: The 50 smaller economies rated by Fitch will be buffeted by these headwinds more than the 30 largest because their debt levels are higher and their share of foreign currency debt is much greater, Wheatley notes. These economies could face “a legacy of fiscal difficulties that take years to resolve.”

A host of “fragile” EMs are less able to withstand shocks, while several have already defaulted, since the pandemic began: Ghana, El Salvador, and Tunisia — along with Ukraine, particularly now with the Russian invasion underway — are much less likely to be able to manage shocks that could hit them this year, says Fitch’s head of global sovereign research. Argentina, Belize, Ecuador, Lebanon, Suriname and Zambia have already defaulted during the pandemic.

And many saw their credit conditions deteriorate in 2020: Fitch issued a record 45 sovereign downgrades in 2020, hitting 27 of the EMs it issues ratings for.

It all paints a bleak picture, but there are still reasons for optimism: In some important ways, EMs are better placed than they were in the past to withstand shocks like exchange rate volatility and see-sawing risk appetite from international investors. For one, EMs are as a whole running a current account surplus, with some large economies like Brazil, South Africa, and India having substantial FX reserves and deep local capital markets. And so many investors retreated from EM stocks and bonds that a further sell-off is unlikely, and prices have even decreased enough to entice some foreign investors back, Wheatley notes.

Fixed-income investors may also be drawn by EMs with rising interest rates and declining inflation: Some EMs, including Brazil, started raising their interest rates nearly a year ago, with Brazil’s policy rate currently standing at 10.75%, up from 2% in March 2021. It’s expecting to see inflation decline to 5.5% towards the end of the year, from over 10% currently. High interest rates and relatively low inflation can be a giant magnet for investors, with high yields available on hard currency bonds already offering “tempting annual returns in the high single digits.”

Higher EM interest rates could ultimately revive the carry trade, resulting in a boom in local-currency bonds, Wheatley concludes.

In a precarious EM landscape, Egypt has been bucking many of the downward risk trends: Egypt is seeing strong economic growth, expected to come in at 6.2-6.5% in FY2021-2022, up from 3.3% in FY2020-2021. Though inflation is high, with urban inflation rising to 7.3% last month from 5.9% in December, it remains within the Central Bank of Egypt’s target range of 7% (±2%) by 4Q2022. And our interest rate is currently the world’s highest after adjusting for inflation, we noted last month. Egypt’s local bonds were the world’s second-best performing worldwide last year, with returns reaching 13%, according to Bloomberg data. Local EM debt saw an average loss of 1.2%. Egypt’s carry trade has long been a draw for foreign investors.

Analysts and fund managers are bullish on Egyptian debt, expecting double-digit returns this year, bolstered by Egypt rejoining JPMorgan’s emerging bond index in January.

Ultimately, our position seems strong. But it looks like a rate hike may be necessary in 2022 for it to remain so: Though the CBE left interest rates on hold for the tenth consecutive meeting earlier this month, expectations for a 2022 rate hike are increasing, we noted. Several analysts are forecasting a 100bps hike through the year, as the central bank looks to protect the lucrative carry trade in the midst of rising global interest rates, which undermine EM inflows.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

24 February – 7 March (Thursday-Monday): The 72nd edition of the Diarna Handicrafts Fair. Cairo Festival City, Cairo.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

27 February (Sunday): British-Egyptian Business Association (BEBA) green finance event with Finance Minister Mohamed Maait, Semiramis Intercontinental, Cairo

27 February: Bidding for the construction and operation of the Tenth of Ramadan dry port kicks off.

28 February (Monday): Applications close for the incubator and accelerator program run by Information Technology Industry Development Agency (ITIDA), US-based VC firm Plug and Play, and USAID.

28 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

28 February-1 March (Monday-Tuesday): The Future of Data Centers Summit.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will

replace the existing “closed” financial management system.

March: Contracts for last two phases of Egypt’s USD 4.5 bn high-speed rail line to be signed.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

3 March (Thursday): Fawry’s extraordinary general assembly (pdf) to vote on EGP 800 mn capital increase.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

20 March (Sunday): Applications close for Visa’s global startup competition, the Visa Everywhere Initiative.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal (TBC).

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.