- NBE’s Al Ahly Leasing Company takes EGP 700 mn securitization issuance to market. (The Big Story Today)

- Things are getting ugly in Ukraine as Russia accused of killing civilians + name calling begins. (The Big Story Abroad)

- MENA exchanges saw an “unprecedented surge” in stock market debuts in 2021, with a record 21 IPOs. (Macro Picture)

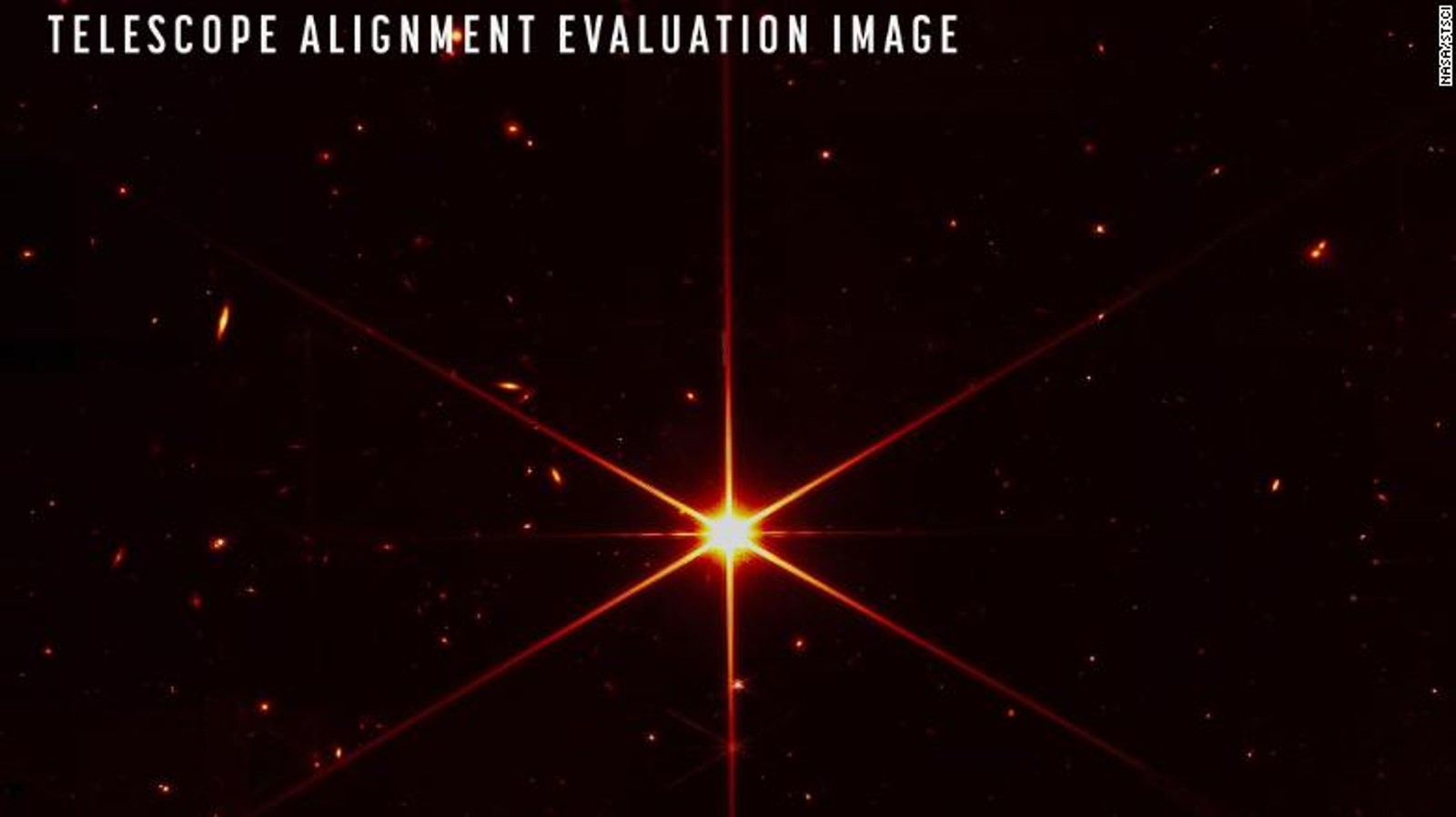

- The James Webb Space Telescope may exceed the goals it set out to achieve. (For Your Commute)

- Fan favorite comedy TV series El Le3ba (The Game) is back on Shahid for its third season. (On The Tube Tonight)

- WHAT’S NEXT- How to use marketing to make it to the top. (Under The Lamplight)

- Car shows, concerts, bazaars, book discussions, and anime meetups… There’s a lot to do this weekend. (Out And About)

Thursday, 17 March 2022

PM — Plenty to do this weekend

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, ladies and gentlemen, and a very happy THURSDAY to you all. This week has been quite a whirlwind, so we’re looking forward to a relaxing weekend to decompress.

Al Ahly Pharos closed a EGP 700 mn securitized bond issuance on behalf of the National Bank of Egypt’s Al Ahly Leasing Company, marking the company’s first securitized offering, Hapi Journal reports. Dreny and Partners acted as advisor for the issuance, KPMG Hazem Hassan was auditor.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Swvl to invest USD 15 mn in Argentina expansion: Mass transit firm Swvl is investing USD 15 mn in Argentina over the next three years to scale the company’s operations in the country, CFO Youssef Salem told Enterprise. The investments will target research and development, and supply and customer acquisition.

- Misr Life IPO could go ahead in October: State-owned Misr Ins. Holding (MIH) will float 25% of its life ins. subsidiary on the EGX in October, Public Enterprises Minister Hisham Tawfik said.

- El Nasr, NATCO to set up Egypt’s first EV dealership: State-owned firms El Nasr Automotive and the National Automotive Company will jointly set up Egypt’s first electric car distributor, the Public Enterprises Ministry said.

Russia accused of killing civilians in Ukraine + name calling begins: US and Ukrainian officials accused Russia of killing civilians taking shelter in a theater in the besieged city of Mariupol and others waiting for bread in Chernihiv today, Reuters reports. The shelling reportedly left many trapped and feared dead, although the exact death toll remains unclear. At least 500 people were using the theater as shelter, Human Rights Watch said.

US President Joe Biden described Vladimir Putin as a “war criminal,” leaving the Kremlin furious, describing Biden’s comments as “unacceptable and unforgivable rhetoric,” Russian news agency Tass reports. Moscow can use its power to “put all of our brash enemies in their place,” the deputy secretary of Russia’s security council said, according to Reuters.

On the ground, the Russian invasion is “largely stalled,” with “minimal progress on land, sea or air in recent days,” UK military intelligence said. Russian forces have still failed to take control of any major cities in Ukraine so far. Despite the wall Russia appears to be hitting, Moscow doesn’t appear to be taking any measures to de-escalate the aggression, White House spokesman Jen Psaki said, according to Reuters.

Meanwhile, Ukrainian President Volodymyr Zelensky is appealing to Germany to end the war in Ukraine, urging German Chancellor Olaf Scholz to tear down a (metaphorical) wall separating Europe. Speaking to the Bundestag through video conference, he invoked Holocaust survivors’ motto, “never again.”

No NATO intervention in Ukraine: The alliance will not intervene through military force in the Ukrainian war, Germany’s Scholz said at a joint news conference in Berlin with NATO Secretary General Jens Stoltenberg today, CNN reported.

|

FOR TOMORROW- Members of the public will be able to take a stroll along the Ahl Masr promenade for the first time tomorrow when the government opens the first, 1.8-km section running between Imbaba Bridge and the 15 May bridge. The two-level walkway will house restaurants, cafes and shops, as well as a theater and three parking lots.

???? CIRCLE YOUR CALENDAR-

The CBE will hold its policy meeting next Thursday, 24 March, and almost all the analysts we’ve heard from so far are expecting policymakers to hike interest rates. We’ll have more for you on this on Sunday when we publish our customary interest rate poll.

EV-charging bid deadline extended: The Public Enterprises Ministry has extended the deadline for sending in expressions of interest for experienced companies that would like to manage the soon-to-be-established EV charging stations company, the cabinet announced in a statement. Interested companies have until Thursday 24 March to send in their letters. Three companies have told the government they want to take part in the project so far, according to the statement.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- The weather over the weekend will reach 22-23°C during the day before falling to 10°C at night, our favorite weather app tells us.

???? FOR YOUR COMMUTE

The James Webb Space Telescope may exceed the goals it set out to achieve: The Webb Telescope — which is 100x more powerful than its predecessor, the Hubble telescope — was created to peer inside the atmospheres of exoplanets and observe some of the first galaxies created in the universe using infrared light, writes CNN. Last week, Webb completed the “fine phasing” process, which ensures that the telescope’s optical capabilities are working the way they should and that all 18 gold mirror segments are aligned. Scientists received results even better than they expected with the resolution of images showing distant stars and galaxies that are invisible to the human eye. Once Webb is fully operational, the telescope could pave the way for “a very demanding year of science operations,” said NASA’s Webb operations project scientist. The news has allowed scientists to take a breath of relief, as the success of the telescope had a lot riding on it after three decades of work and USD 10.6 bn spent.

Starbucks is looking to do away with single-use paper and plastic cups by 2025, replacing them with reusable ones by encouraging a shift in consumer behavior, Wall Street Journal reported. The coffee giant wants to see more people bringing their own cups or be a part of its “Borrow A Cup” program — which sees coffee lovers borrowing a reusable cup from one of the stores — within three years. The program is already being tested in several markets, trialing whether an incentive such as price reductions for using reusable cups would encourage customers to take part or if a surcharge for using a single-use cup would change their perceptions.

Africa’s largest bank wants to raise more for renewable energy projects: South Africa’s Standard Bank Group, Africa’s largest bank in terms of assets, is looking at raising approximately USD 20 bn by 2026 to help finance green projects, Bloomberg reported. The bank has promised working towards a net zero carbon emissions target from its operations by 2040 and from its portfolio of financed emissions by 2050, as part of its commitments to the 2015 Paris Agreement. The Johannesburg-based lender will only fund energy and mining projects under “certain tightly defined circumstances” to help Africa achieve a transition away from fossil fuels.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Fan favorite comedy TV series El Le3ba (The Game) is back on Shahid for its third season, as the competition between childhood friends Mazo (Hesham Maged) and Wassim (Chico) intensifies through new challenges and new players in their teams this season. The duo has been competing since childhood, but as the rivalry eases with age, they’re forced back into the competitiveness when a mysterious person provokes them to play against each other. This season begins with both players getting released from jail in turn of taking part again in “the game.” Catch the series on Shahid from Sunday to Thursday.

⚽ Liverpool continues to close in on Premier League leaders Manchester City after a 2-0 victory yesterday against Arsenal, narrowing the gap with the Citizens to one point. Manchester City is currently on top of the league at 70 points, followed by Liverpool at 69 points. Both teams have ten games left in the league, while London’s Chelsea comes third at 59 points with a delayed game, and Arsenal comes in fourth at 51 points with two postponed games.

This weekend has a rather limited number of games going into the weekend, with Everton v Newcastle tonight at 9:45pm, Wolverhampton vs Leeds United tomorrow at 10pm, and Aston Villa vs Arsenal on Saturday at 2:30pm.

For the Europa League today, we’ll be watching Galatasaray v Barcelona at 7:45pm with an aggregate of 0-0, and West Ham v Sevilla at 10pm (aggregate: 0-1 for the Spanish team).

We have some decisive games in the CAF Champions League, with Egypt’s Al Ahly clashing with Sudan’s Al Merrikh tomorrow at 6pm in hopes of qualifying through the group’s bottleneck. Al Ahly is in third place with four points, one spot behind Al Merrikh with the same number of points. Sudan’s Al Hilal ranks fourth currently. The group sees South African side Mamelodi Sundowns at the top of the group with 10points, with competition intensifying with each club set to play their two remaining games to determine the teams qualifying to the quarterfinals.

Zamalek will play against Angola’s Petro de Luanda on Saturday at 3pm, with a foregone conclusion that they will exit the tournament after the Angolese team and Morocco’s Wydad AC secured seats in the quarterfinals.

We have new gameweeks of European Leagues over the weekend, with La Liga seeing Athletic Club v Getafe at 10pm tomorrow. On Saturday, there’s Alavés vs Granada at 3pm, Elche v Valencia at 5:15pm, Osasuna v Levante at 7:30pm, and Rayo Vallecano v Atletico Madrid at 10pm.

In the Serie A, Sassuolo will play against Spezia at 7:45pm while Genoa will clash with Torino at 10pm tomorrow. On Saturday, we’ll be watching: Napoli v Udinese at 4pm, Inter v Fiorentina at 7pm, and Cagliari v Milan at 9:45pm.

Also on the field on Saturday, Chelsea v Middlesbrough in the FA Cup quarter-final at 7:15pm.

We’ll be waving goodbye to the Egyptian Premier League’s games for a while until 6 April, with the tournament on a break to allow our national team to gear up for decisive Fifa World Cup qualifiers against Senegal. But first: Eastern Company is playing against Tala’ae el Geish at 5:30pm today, while Pharco and National Bank are currently wrapping up the first half of their match as we dispatch.

IN OTHER FOOTBALL NEWS- 23 players are headed to the training camp ahead of the World Cup Qualifiers, Egyptian National Team Coach Carlos Queiroz decided, reports Al Ahram. The Pharaohs have two matches to play against Senegal set for 25 and 29 March. A preliminary list of nine players has been announced, with Liverpool’s Mohamed Salah, Arsenal’s Mohamed El Neny, and Stuttgart’s Omar Marmoush joining from Europe. Meanwhile, Egyptians footballers playing in Turkey who will be participating include Başakşehir’s Mahmoud Trezeguet, Galatasaray’s Mostafa Mohamed, Altay’s Ahmed Yasser Rayan, Quinaspor’s Ahmed Hassan Kouka, and Yeni Malatyaspor’s Karim Hafez. Finally, Mustafa Fathi will make his way to the camp from Saudi’s Al Taawoun.

???? EAT THIS TONIGHT-

Colorful eclairs, chocolates, and croissants at Heliopolis’ Bouchee: The new bakery shop offers a selection of pastries and chocolates that taste as good as they look. From red velvet croissants to fruit-topped danishes, their displays are a sight to behold. We really liked their selection of eclairs, especially the pistachio and caramel. Bouchee also lets you mix and match a box of their colorful chocolates and macaroons or you could pick up one of their cakes for a Friday family gathering. For the relatives who each like something different, go for their gateaux, which include specialties such as the pina colada and apricot confit mini-cakes that will give Tant Samah something to rave about.

???? OUT AND ABOUT-

(all times CLT)

The Stitches of Egypt Exhibition is kicking off today at Bayt Yakan Al Darb Al Ahmar and will run until Saturday. The exhibition will showcase fashion, clothing, and accessories created by local artists who drew inspiration from Egyptian heritage while also featuring talks and workshops.

Raphael Cormack is holding a book discussion for his work “Midnight in Cairo: The Female Stars of Egypt's Roaring '20s” which drew the attention of the foreign press upon its release. The discussion will take place in AUC Tahrir Bookstore and Garden today at 6pm.

Ahmad Ali El Haggar is performing at The Room Art Space in Garden City today at 8:30pm. El Haggar combines classical Egyptian songs with Jazz and Neo-soul. He has performed with artists such as Carole King and Jason Mraz.

Nesma Abdel Aziz and her band are performing today at the Cairo Opera House’s Open Air Theater at 8pm.

All Saints' Cathedral in Zamalek is hosting its annual Spring Bazaar tomorrow. There will be stalls selling crafts, home produce, jewelry, fashion accessories, and clothing — a perfect chance to grab something for Mother’s Day.

Bandmakers – Battle of The Bands will see school bands compete against each other on Friday and Saturday at Zed Park.

Calling all gamers, and anime and manga lovers: EgyCon 9 is taking place on Friday at Family Park. The event will include trivia games, competitions, karaoke, concerts, and of course, a lot of cosplay.

Abo El Anwar will be performing at Zamalek Theater on Friday at 7pm.

The Uptown Classic Car Show is taking place on Saturday from 12-5pm. The show will feature more than 80 of the finest classic cars of different eras, ranging from Rolls-Royce, Bentley, Cadillacs, Mercedes, Chevys, and more. You’ll need to send a message to their page to request an invite.

???? EARS TO THE GROUND-

American Radical: A five-episode podcast on how one woman became part of the Capitol Hill riots after years of being apolitical. MSNBC host Ayman Mohyeldin heads to his hometown, Georgia’s Kennesaw, to investigate the story of 34-year-old Rosanne Boyland, following her journey from being politically uninvolved to becoming among those who died in the insurrection at the US Capitol in January last year. Mohyeldin speaks to Boyland’s family to try to figure out how Rosanna became a devoted Trump supporter, egged on by conspiracy theories. The episodes include one on the investigation into the insurrection and Rosanne’s death as well as the debate over the autopsy report.

???? UNDER THE LAMPLIGHT-

WHAT’S NEXT- How to use marketing to make it to the top: In The Hawke Method, Erik Huberman, the Founder and CEO of Hawke Media, argues that there's a common framework behind every successful marketing strategy — one that over 3k brands used to soar to the top. Huberman delves into his holistic approach to marketing, stressing on the three core elements: Awareness, nurturing, and trust. Marketing can often be overwhelming, with new techniques and trends emerging very quickly. The book is a good way to get a bird’s eye view of the space and assess your business’ marketing endeavors from a new perspective. Huberman makes complicated concepts simple and utilizes a ton of examples that are applicable to every type of business, whether it’s B2B or B2C.

???? GO WITH THE FLOW

The EGX30 rose 0.2% at today’s close on turnover of EGP 1.4 bn (34% above the 90-day average). Foreign investors were net sellers. The index is down 10.2% YTD.

In the green: MNHD (+4.2%), Rameda (+2.7%) and Palm Hills Developments (+2.6%).

In the red: Orascom Development (-3.6%), Fawry (-3.2%) and GB Auto (-2.9%).

???? The Macro Picture

MENA exchanges saw an “unprecedented surge” in stock market debuts in 2021, with a record 21 companies completing IPOs in the region, EY says in its quarterly MENA IPO Eye report. Companies raised some USD 7.9 bn in debut share sales last year, more than quadruple that of 2020, it said.

Energy, financial services and utilities companies dominated last year: Saudi Arabia’s ACWA Power led the pack by raising some USD 1.2 bn in its listing on the Tadawul. ADNOC Drilling came in close behind with a USD 1.1 bn listing in 4Q2021 in Abu Dhabi. The bulk of IPO activity took place late in the year, with 13 issuances worth some USD 5.6 bn listed in 4Q2021 alone.

Abu Dhabi topped performance in the region with the ADX index up by 68% at the close of 2021. Saudi’s Tadawul came in second with its index up some 30% by the end of the year. Egypt caught some of the action but performed nowhere nearly as well as regional peers, with the EGX 30 index ending the year up only 10%.

IPO activity on the EGX wasn’t quite as hot: We saw two IPOs worth more than USD 500 mn last year, in addition to the EGX’s first ever technical listing and a stake sale as part of the state privatization program. Still, listings fell short of expectations that we would get five or six IPOs completed in 2021. State-owned tech company e-Finance came in with the EGX’s biggest IPO since 2015, raising some EGP 5.8 bn (USD 370 mn) in its listing, while higher education outfit Taaleem raised EGP 2.1 bn (USD 133.5 mn) in its EGX debut. Consumer healthcare provider Integrated Diagnostics Holding (IDH) completed the first technical listing in EGX history after it transferred 5% of the company’s existing 600 mn shares to become dual listed on the EGX and LSE. Abu Qir Fertilizers also completed a sale of some 10% of its shares for EGP 2.25 bn (USD 140 mn) late last year. We also had Emerald Real Estate’s mini-IPO on the Nilex in October.

Still, performance was way up from 2020: The EGX closed out the year up 10% YTD, a far cry from its performance in 2020 when it ended the year down over 23%.

EY’s take? 2022 looks “promising” for IPOs in Egypt: So far, the EGX has seen two listings this year: Al Khair River for Development and Investment’s (aka Nahr El Khair) shares began trading on the EGX in January, followed by Macro Group’s EGP 1.3 bn IPO the following month. The Planning Ministry announced that Egypt is still targeting to list state-owned companies every month or two. We could be seeing some more listings coming from the likes of Egyptian Chemical Industries (Kima), who might sell more shares on the EGX later this year when earnings pick up. Banque du Caire, Misr Ins. Holding’s Misr Life Ins, Heliopolis Housing and Development and Mopco could also be in the pipeline for secondary offerings at some point during 2022. On the private sector side of things, healthy food brand Abu Auf is targeting a 2Q2022 listing and non-bank financial services player Ebtikar is also reportedly planning to go to market in early 2022. Then there are the military companies Safi and Wataniya Petroleum which have been slated to float on the exchange for some time now.

You sure, EY? Although it was published around a week after Russia decided to invade Ukraine at the end of February, it appears that the report was written without taking into account the event which has sparked turmoil in global commodities markets and triggered serious concern about the direction of the global economy as it copes with surging inflation and intensifying shortages of key commodities. Add to that that we’re entering a period of rapidly rising interest rates and we’re expecting a few more bumps in the financial markets this year. We’re not saying these IPOs aren’t going to happen, but market conditions matter.

Regionally, the outlook is still shaky: Although a rebound from 2020 was underway rising interest rates, inflation and geopolitical tensions has kept “the mid-to-long-term outlook remains somewhat uncertain,” said Gregory Hughes, EY MENA IPO and transaction diligence head. State privatization initiatives and investor oversubscriptions, however, are indicative of “a period of high demand and strong investor sentiment,” Hughes added. What remains to be seen is “whether there is sufficient liquidity in the regional markets to cover the expected pipeline of large government backed IPOs in the near term,” Hughes said.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

15 February-15 June (Tuesday-Wednesday): ITIDA’s Technology Innovation and Entrepreneurship Center is organizing the first Metaverse Hackathon.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: Contracts for last two phases of Egypt’s USD 4.5 bn high-speed rail line to be signed.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

9-18 March (Wednesday-Friday): The annual Cairo International Fair.

Mid-March: Bidding for the construction of Anchorage Investments’ petrochemical complex in the Suez Canal Economic Zone starts.

14 March-30 June: The “Escape to Egypt” exhibition at the Coptic Museum, in celebration of its 112th anniversary.

20 March (Sunday): Applications close for Visa’s global startup competition, the Visa Everywhere Initiative.

20-22 March: International Maritime and Logistics conference Marlog kicks off.

22 March (Tuesday): Egyptian German Green Energy Forum, 5:30-9:30pm CLT, InterContinental Cairo Semiramis.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

24 March (Thursday): GB Auto Extraordinary General Assembly (pdf).

24 March-1 April: Ahlan Ramadan Supermarket Expo, Cairo International Convention Center.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal (TBC).

28 March (Monday): The court hearing for a case brought by Arabia Investments Holding (AIH) against Peugeot has been postponed until 28 March.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF Spring Meetings, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release first financing product.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 300 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

4-6 November: The Autotech auto exhibition kicks off at the Cairo International Exhibition and Convention Center.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.