- Three foreign companies are bidding to help manage Egypt’s railway network. (Speed Round: Transport)

- Elsewedy expands in South Asia + Nile Scan joins race for Alex Medical. (Speed Round: M&A Watch)

- Hotel occupancy outlook in Cairo + Sharm on the up. (Speed Round: Tourism)

- Egypt to manufacture 2 mn doses of Sinovac vaccine by end of June. (What We’re Tracking Tonight)

- New details on construction licenses announced. (What We’re Tracking Tonight)

- The global semiconductor shortage may be about to hit us where it hurts. (What We’re Tracking Tonight)

- DogeCoin loses its bark thanks to Musk + German, US regulators mull crypto rules. (What We’re Tracking Tonight)

- What do fake news and magic have in common? (Worth Reading)

- Can science slow down the impact of ageing? (What’s Next)

Sunday, 9 May 2021

EnterprisePM— Three foreign companies bid to manage Egypt’s rail network

TL;DR

WHAT WE’RE TRACKING TONIGHT

Good afternoon, wonderful people. Only two more days to go until we start Eid vacation. And the best part? The heat wave is going to die down overnight tonight.

THE BIG STORY this afternoon here at home: Details of the new system through which the government will hand out construction licenses were announced this morning, according to a cabinet statement. The licensing requirements include setting limits on building heights that vary with street width and standards for built-up areas depending on land size. A two-month pilot phase began on 1 May in districts including Heliopolis, South Giza, Montaza, Kowesna, Kafr El Dawar, Qaha, Marsa Matrouh, Tanta Second, and Sidi Salem. The full rollout is expected at the start of the new fiscal year in July. The government announced a six-month construction ban last year in a crackdown on building code violations after getting a sharper teeth to clamp down on illegal construction.

The measures are designed to curb unlicensed construction, a government campaign against which has resulted in bns on EGP in fines collected and settlements reached in the past year.

COVID WATCH- State-owned Vacsera will locally manufacture 2 mn doses of China's Sinovac vaccine by end of June, Health Minister Hala Zayed said at a presser (watch, runtime: 16:12). The first shipment of the vaccine’s raw materials will arrive on 18 May, Zayed noted. The vaccine, which is cleared for emergency use in Egypt, will be available without charge, she confirmed. The government plans to produce 5 mn doses of the vaccine within two months, before raising capacity to 40-60 mn per year. China is also expected to send 500k doses of the Sinovac vaccine this month.

We have steady increases in daily cases.The minister noted that daily covid-19 cases are rising at a steady pace that is likely to continue until Eid Al Fitr, noting that the past three week didn’t witness big increases. She added that hospitals still have enough capacity for new infections.

EU leaders are pushing back on the US-backed proposal to waive intellectual property rights on covid-19 vaccines, saying that the move is not the answer to increasing vaccine supply, according to the Financial Times. Allowing the export of raw materials required for jab manufacturing and sending more doses to developing countries would instead fill in the gap, German Chancellor Angela Merkel said following a two-day EU leaders’ summit in Portugal. This was echoed by French President Emmanuel Macron and European Council President Charles Michel.

The waiver: The US last week came out in favor of a proposal pushed by South Africa and India in October to temporarily suspend patents on vaccines, which they claim would allow manufacturers in other countries to produce shots and speed up the rollout in the developing world. The proposal has the backing of more than 100 countries and is being negotiated at the World Trade Organization. Pharma companies and a number of countries have come out against the idea.

THE BIG STORY INTERNATIONALLY #1: We’re happy to report that the Chinese rocket spared Enterprise World Headquarters when it re-entered the Earth’s atmosphere this morning. Most of the rocket burned up on re-entry and the remaining debris landed in the Indian Ocean. The US wasn’t happy (coz, China), with NASA accusing Beijing of “recklessness” and “failing to meet responsible standards” regarding their space debris. Most outlets have the story this afternoon, from the Associated Press and Reuters to Bloomberg.

(STILL) THE BIG STORY INTERNATIONALLY #2: Last night’s cyberattack on a US oil pipeline remains front page news across much of the international press. The White House has pledged to crackdown on hackers, who have stepped up attacks in recent weeks, according to Bloomberg.

** So, when do we eat? We sit down to eat at 6:38pm, and we’ll have until 3:27am to eat and hydrate.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- IDH going live this month on the EGX: IDH is expected to float 5% of its shares on the EGX on 20 May after receiving regulatory approval for the dual listing last week. It will be the first technical listing on the EGX.

- S&P affirms ‘B’ sovereign credit rating: S&P Global Ratings expects Egypt to have no trouble meeting upcoming debt payments but warned that lower foreign inflows would weigh on its fiscal position in the coming months.

- Private sector minimum wage coming? The National Council for Wages will draw up plans to introduce a national minimum wage for private sector workers this month.

|

FROM THE REGION- Plans for a Gulf mega-merger are afoot: Abu Dhabi wealth fund ADQ plans to form the UAE’s biggest steel and building materials company through a merger of Emirates Steel Industries and Arkan Building Materials Company, combining their assets for a total of USD 3.54 bn. This comes as part of the Emirate’s push to support the economy and diversify away from oil and gas production. Reuters and Bloomberg have the story.

Israel is refusing to stop the forced removal of Palestinians from East Jerusalem: Prime Minister Benjamin Netanyahu said he “firmly rejects the pressure to stop building” in the Sheikh Jarrah neighborhood, an area in which the government is planning to evict Palestinians and replace them with Israeli settlers, reports Reuters. There are growing international calls to half the evictions after hundreds of Palestinians were injured yesterday when Israeli forces attacked worshippers gathered in Al Aqsa Mosque for prayers.

THE BIG STORY IN THE MARKETS- Musk may have inadvertently just taken the Doge to the glue factory as regulators in the US and Germany mull crypto crackdown.

Dogecoin’s record rally reversed on Saturday after Elon Musk called the meme cryptocurrency “a hustle” while hosting an episode of Saturday Night Live last night, reports Bloomberg. The currency fell almost 30% during the airing of the show, dropping to USD 0.49 at one point from its previous high of USD 0.73, according to CNBC. The sell off was so rapid that popular trading app Robinhood experienced a blackout. Dogecoin has surged more than 26k% in the past six months amid rampant speculation in the crypto market. Dogecoin’s price is currently at USD 0.628 as of this afternoon.

Stonks and doges aren’t impressing the powers-that-be in Germany and the US, where regulators may be about to push for tighter control of the crypto market, the Financial Times reports. Crypto giant Binance is currently in a showdown with German regulators over whether its new stock tokens — a crypto derivative of publicly-traded shares — break European securities rules. And in the US, new head of the Securities and Exchange Commission Gary Gensler last week hinted at plans for new regulations over the market, telling a congressional hearing that investors would benefit from tighter controls.

???? CIRCLE YOUR CALENDAR-

It’s inflation day tomorrow: The long Eid break shouldn’t get in the way of Capmas and the CBE releasing inflation figures for April, which should land tomorrow.

Africa-based startups have until 26 May to sign up for the French government-sponsored AFD Digital Challenge, an annual startup competition (pdf) run by the French Development Agency (AFD). This year, the competition is targeting startups that work on environmental protection and tackle carbon emissions. The 10 startups chosen will receive a package of technical and financial support worth EUR 20k.

The IMF will conduct on 1 June a second review of targets set under Egypt’s USD 5.2 bn standby loan. The loan was approved in June 2020.

The El Gouna International Squash Open 2021 and the CIB PSA World Tour Finals will go ahead as planned, PSA World Tour announced. The El Gouna Open will take place on 20-28 May, while the CIB-sponsored World Tour Finals will run on 22-27 June in Cairo.

???? FOR YOUR COMMUTE-

The global semiconductor shortage may be about to hit us where it hurts: The severity of the chip shortage has increased in recent weeks and will likely start hurting consumers’ wallets as products dry up and prices increase, analysts tell CNBC. The supply crisis is beginning to be felt in a multitude of sectors — from cars and home appliances to games consoles and dog-washers — and consumers will soon start to feel the impact. “What it will mean is they can’t get something, or prices are slightly higher,” says a Gartner analyst.

Automakers are already raising their prices, as the twin shock of the chip shortage and surging commodity prices squeezes the sector, Bloomberg reports. Analysts at JPMorgan estimate the price of an auto’s raw materials have climbed 83% in the year through March, and although companies usually avoid passing on higher input costs to consumers, the surge in demand for vehicles is adding to inflationary pressures caused by supply issues.

The Egyptian auto sector is already beginning to feel the pinch: Local companies have been forced to reduce production amid a dearth of electronic components.

Need a refresher on the global chip shortage? Check out our in-depth explainer here.

Meanwhile, one staple food commodity is helping the world stave off a food crisis: While crop prices have been increasing across the board this year, the price of rice has bucked the trend by falling in recent months, according to Bloomberg. Why? Among other factors, rice is grown primarily for human consumption, and the recent surge in food prices has been driven by growing demand for livestock feed.

???? ON THE TUBE TONIGHT-

A recent Netflix release, The Sons Of Sam: A Descent Into Darkness, is a four-part docuseries that explores investigative journalist Maury Terry’s obsession with the case of David Berkowitz (aka The Son of Sam). The American serial killer pleaded guilty to eight separate shooting attacks that began in 1976 in New York City. However, the now-deceased Terry spent a large portion of his career trying to prove that Berkowitz didn’t act alone but instead was part of a cult. He even corresponded with Berkowitz (who is still in jail today) for tips on where to look. The NYPD denounced Terry’s findings, refusing to reopen a closed case, and his alternative solutions to the murders have yet to be proved correct. You can check out these reviews by The New Yorker and Roger Ebert.

⚽ It’s a busy day for football.

In the Premier League: Aston Villa and Man United have just finished the half at Villa Park, with West Ham and Everton’s match starting at 5:30pm followed by Arsenal and West Brom at 8pm and Fulham vs. Burnley at 9pm.

Juventus vs AC Milan is the match of the night. The two rivals are currently tied on 69 points and must battle it out to secure that top 4 spot and qualification to next season’s Champions League. The match kicks off in Turin at 8:45pm.

Meanwhile, Real Madrid are still in with a chance of being crowned La Liga champions, but will likely have to beat fourth-placed Sevilla tonight to do it. The two sides kick off in Madrid at 9pm.

????EAT THIS TONIGHT-

Our final Ramadan dessert recommendation of the season: After trying all the unique creations from several joints this holy month, we found ourselves going back to basics time and time again. Zanobia in El Rehab and Nasr City has given us some of the best classic Ramadan treats with their baklava, kunafa, and atayef. Definitely worth a try before the desserts stop blessing your dining room table every night. We’ve also loved Abdel Rahim Kouiedar’s basbousa, proving itself to be as soft and sweet as you could ever wish for. Finally, Voila’s balah el sham and halawet el jabn blew us away — without sending us into a sugar coma in the process.

???? UNDER THE LAMPLIGHT-

She Made It aims to be a guide for women to launch successful businesses during the digital age. The book is packed full with advice, inspiration and wisdom from author Angelica Malin and other successful female entrepreneurs. It’s also not afraid to delve into the nitty gritty of day-to-day operations of building a startup, such as the hiring process, investment, and presenting ideas, while also shedding light on the challenges that might face female entrepreneurs. Malin is the founder and editor-in-chief of About Time Magazine and is a commentator on business and entrepreneurship in the UK.

???? TOMORROW’S WEATHER- Expect daytime highs of 38°C and nighttime lows of 20°C tomorrow, with the rest of the week looking pretty much the same, our favorite weather app indicates.

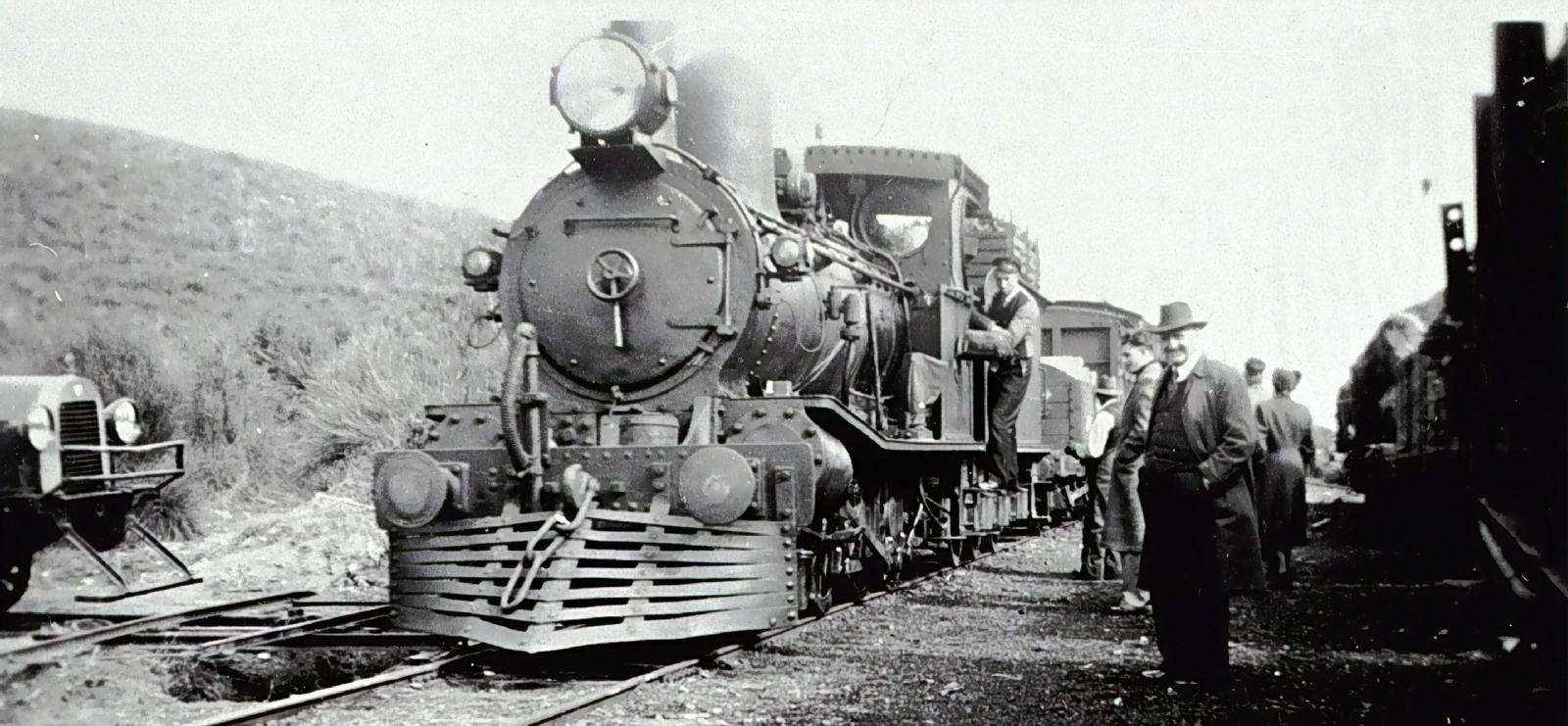

SPEED ROUND: TRANSPORT

Three foreign companies bidding to manage Egypt’s railways

Three foreign companies are bidding to help manage Egypt’s railways: The Transport Ministry is in talks with three unnamed international companies to help manage the country’s rail network, reports Al Mal, citing unnamed sources in the know.

Who’s in so far? Details are sketchy so far, but the sources say that French transport company RATP Dev, a German firm and a Russian company are all involved. RATP Dev, which operates the Paris metro, recently won a contract to operate the planned electric rail between Salam City and Tenth of Ramadan City, and is expected to run Cairo Metro Line 3.

And what are they bidding for? It’s still unclear exactly how the government plans to integrate private sector firms into management of the nation’s rail network. Sources recently outlined various models being considered by the government, which include allowing companies to manage different sections of the network, and handing full control over passenger trains to a single company.

The next step: The companies will each present a detailed long-term plan for improving the country’s railway system, which the government will then evaluate.

Whatever happens, nothing is going to change before 2022. Regardless of the time needed for the Transport Ministry to study the scenarios and make a choice, it is highly unlikely that any company would agree to assume responsibility for Egypt’s railway infrastructure as it currently stands. The wait time is necessary until the country’s railway signaling system is upgraded and the Egyptian National Railways (ENR) takes receipt of the remaining Transmashholding railcars next year, the sources said. Transmashholding has so far delivered 260 railcars under a EGP 22 bn contract signed with ENR back in 2018.

A long time coming: Plans to bring the private sector into the fold had originally been in the works back in 2018, when the Transport Ministry began procedures to establish private sector-run companies to manage each railway.

The past six weeks have brought a new sense of urgency: The need to improve the country’s ailing railway system has been amplified over the past six weeks following a string of deadly accidents. Hundreds were injured and tens killed in a succession of rail accidents in March and April, including a derailment in Qalyubia and a collision in Sohag. Transport Minister Kamel El Wazir came under fire last month in parliament as he was questioned about the recent accidents, which have perhaps contributed to the new momentum behind privatization.

SPEED ROUND: M&A WATCH

Elsewedy expands in South Asia

Elsewedy Electric has acquired two power transformer companies in Indonesia and Pakistan in transactions worth a combined USD 60 mn, the EGX-listed company said in a filing to the EGX (pdf) this morning.

Item 1: The company acquired 95% of PT CG Power Indonesia, a company that produces around 10k MW of electricity each year. It also builds electricity substations, manufactures transformers and provides maintenance services, and exports to at least five countries in the Asia-Pacific region.

Item 2: Elsewedy purchased 100% of Validus Engineering, a manufacturer of transformers based in Karachi, Pakistan.

Where the company stands now: The acquisitions will more than double Elsewedy’s annual production capacity to 30k MVA and increase its transformer factories to six.

The race for the hospital operator is heating up: Diagnostics outfit Nile Scan and the UAE’s Global One Healthcare Holding were the two latest bidders to join four others eyeing Abu Dhabi Commercial Bank’s (ADCB) 51.4% stake in medical firm Alexandria Medical Services, ADCB said in a filing to the EGX (pdf). Initial offers have valued the stake at between EGP 700-750 mn, and strong competition could increase the final price tag to closer to EGP 800 mn, Al Mal’s sources said, citing a PwC due diligence report. Final binding offers are expected to be submitted by the third week of May.

CATCH UP QUICK-

- Diagnostics and healthcare firm Speed Medical is planning to increase the number of beds in New Al Safwa Specialized Hospital to 150 from 67 at a cost of EGP 75 mn, the company said in an EGX filing (pdf) this morning. The company recently acquired (pdf) a controlling stake in the Sixth of October-based facility through subsidiary Speed Hospitals.

SPEED ROUND: TOURISM

Hotel occupancy outlook in Cairo + Sharm on the up

Colliers International has revised upwards its 2021 outlook for hotel occupancy in Cairo and Sharm El Sheikh in its latest monthly MENA hotel forecast (pdf). The real estate services company now sees occupancy in Cairo hitting 45% this year, up 66% from 2020, and hotels in Sharm seeing a 37% occupancy rate, up 58% from last year. This is up from its April forecast, which predicted a 40% occupancy rate in Cairo and 35% in Sharm.

Outlook for Hurghada, Alex unchanged: Colliers expects occupancy rates in Alexandria to hit 61% this year, up 35% in 2020, and rates in Hurghada to rise to 38%. These forecasts are unchanged from its April report.

The return of Russian tourists could give these figures a boost: Direct flights between Russia and Egypt are set to resume next month after a six-year hiatus, with 1 mn Russian tourist arrivals expected this year. This should prove a huge boon for hotels in places like Hurghada, which are popular with Russian tourists.

CAVEAT- Even with a huge influx of tourists, hotels still aren’t able to have occupancy rates over 50% due to government restrictions designed to curb the spread of covid.

2021 so far: Hotel occupancy nationwide averaged 40-45% during the first quarter of 2021, and rates have been gradually increasing.

A slow but steady recovery: Last year, occupancy rates in the four destinations dropped almost 60% as the covid-19 pandemic brought tourism to a halt. S&P Global Ratings said this month that tourism will rebound to pre-pandemic levels in 2023, while the government hopes that arrivals will recover to 2019 levels by fall 2022. The government currently expects to receive USD 6-7 bn in tourism revenues this year, which amounts to around 60% of 2019 revenues.

GO WITH THE FLOW

Earnings Watch: NBK Egypt

NBK Egypt recorded net income of EGP 404.1 mn in 1Q2021, up from EGP 402.8 mn in the same period last year, according to the bank’s quarterly financial statement (pdf) released this morning. This came despite revenue falling 10% to EGP 797.5 mn from EGP 882.5 mn last year.

The EGX30 rose 0.5% at today’s close on turnover of EGP 776 mn (38% below the 90-day average). Foreign investors were net sellers. The index is down 1.9% YTD.

In the green: Oriental Weavers (+4.4%), Ibnsina Pharma (+2.9%) and ElSewedy Electric (+2.6%).

In the red: Cleopatra Hospital (-2.0%), Orascom Investment (-1.8%) and GB Auto (-1.8%).

WORTH READING

The psychology behind magic and misinformation is often one and the same

What do fake news and magic have in common? We’ve all seen a magic show during a kid’s birthday party, and heard the “oohs” and “ahs” over an endless handkerchief. But the psychology behind magic has helped researchers explore the people’s everyday reasoning, writes Tim Harford for the Financial Times. Magicians play on misdirecting and manipulating the audience's attention and thoughts to lead them away from the truth. By applying the same concepts to explain general cognitive processes, we can better understand why misinformation and fake news run rampant in political and economical spheres.

Demonstrating the art of misdirection: Apollo Robbins, the world-famous theatrical pickpocket, explained the basic principle behind misdirection in a Ted talk. In a nutshell: We pay less attention than we think we do (watch, runtime: 08:34). To prove his point, he asked the audience to close their eyes and recall what he’s been wearing for the past few minutes on stage. After some struggle from the audience, he moves onto his next trick, picking a volunteer to come onstage and deftly takes his watch without anyone noticing. In a final hoorah, he asks the audience to once again take a look at his clothes, which are all different from when he first asked them to close their eyes. This practical approach to his explanation saw Robbins misdirect the attention to his performance with the volunteer and change his clothes in plain sight.

Politicians use this same approach to focus people’s attention away from scandals or other events: The approach has a name in political dialogue: The “dead cat strategy,” which metaphorically calls for throwing a dead cat on the dining room table if things get awkward. Yes, people will be outraged, but the attention will be led away from the topic. Former US President Donald Trump “had an unrivalled gift for producing a dead cat whenever he wanted to,” writes Harford for the FT ahead of the release of his book How To Make The World Add Up.

Controlling and deceiving human perception: Teller, who makes one half of magician duo Penn & Teller, told Smithsonian Magazine that magic has less to do with fancy machinery and more with understanding and manipulating how viewers digest sensory information. Among his suggestions for pulling off a believable magic trick are exploiting pattern recognition, so that audiences expect the same thing to happen every time — and missing if it doesn’t. The darkest of magic’s psychological secrets, in his opinion: “If you are given a choice, you believe you have acted freely.”

So, why are we prone to falling for the same tricks again and again? Some say it's that we are incapable of telling the difference between truth and lies in situations we’re not familiar with or in cases where we lack critical-thinking skills. However, we’ve all seen a knowledgeable person fall prey to misinformation, hence the second explanation: That we know the difference and just don’t care. In a study published in the Nature journal, participants were given 36 news headlines and asked to assess how accurate or inaccurate they are. Most did well at this stage, clearly distinguishing between the fake and real news items. However, once asked which they would be more likely to share on social media, participants quickly forgot the difference between truth and lies and chose news that was sympathetic to their political or religious beliefs, no matter how inaccurate it was.

We also fall for the ‘There’s nothing up my sleeve’ act: Another misdirection principle is that once people are introduced to a possible solution, it continues to affect their reasoning capacity — even if it is proven false. Even after the magician shows you there’s nothing up his sleeve, his pointing out the possibility will have you focused on whether it could be true, misdirecting you away from whatever could be in his pocket or in his hat. In a University of London study testing this hypothesis, researchers found that participants who were not offered a false solution to a card trick were more likely to find the correct answer. “It’s as if, having made the effort to construct a solution, people become stuck on it and less able to ‘think outside the box’ and come up with a new solution that abandons their original assumptions,” explained Gustav Kuhn, the co-author of the study who just released a new book titled Experiencing the Impossible.

How can you stop being deceived? Don’t be so overconfident. What makes magic tricks easier to perform is people’s intuitive overconfidence that they will notice what matters. We share misinformation because we don’t research it enough to determine its accuracy, we see one thing and assume it is another. Our own brains conspire in the illusion, filling any blind spots with plausible images or explanations, even when there are none. “Pay attention; get some context; ask questions; stop and think,” urges Harford. We can spot the tricks, but the problem is we don’t really try to, and then believe that we did.

WHAT’S NEXT

Can science slow down the impact of ageing?

How close is science to reversing age-related diseases? Our biology might be more malleable than originally thought. Recent research has scientists thinking that they may be able to slow the process of ageing and prevent age-related diseases, according to the BBC (watch, runtime 07:27).

Harvard biologists were recently able to reverse blindness in an old mouse: “The cells in our bodies have youthful information when they’re born,but over time they lose that information,” Harvard Medical’s Center for Biology of Ageing co-director David Sinclair said. “We’ve discovered there’s information in the cell to reboot the system, in the same way that you could reboot a computer with fresh software,” he adds. Sinclair’s team were able to regenerate vision in an old mouse simply by “reprogramming” the eye.

Young blood can rejuvenate old tissue and organs, and vice versa: As early as 2005, scientists were experimenting with diluting blood plasma to achieve rejuvenation. A different team from Harvard was involved in research that found infusing the blood of young mice into older mice created a regenerative effect across many tissues and organs, and surprisingly, that old blood could speed up deterioration as well. This effect was attributed to a lesser studied protein by the name of GDF11. The team co-founded biotech “anti-ageing” firm Elevian, and are using GDF11 in preclinical trials to treat dozens of age-related diseases including stroke recovery, Obesity, type II diabetes, and intracerebral hemorrhages.

Is anyone working on humans yet? Officially, not yet. Elevian don’t expect human clinical trials for at least another 18 months.

Don’t try this at home: There are “biohackers” that eye-diseases-info.com with gene therapy on themselves, says Sinclair, who cautions that introducing hormones through DNA is an irreversible process, and could potentially have carcinogenic effects.

There’s skepticism and ethical questions to be asked, but pundits would like to see a middle ground between “anti-ageing” and optimizing human efficiency. The self-proclaimed father of biohacking Dave Asprey is of the mindset that humans have autonomy over their bodies, and Elevian CEO Mark Allen would like to see more experimental therapy under informed consent, but Sinclair and Patridge warn of the experimental practice of biohacking that is not evidence-based.

CALENDAR

12-16 May (Wednesday-Sunday): Eid El Fitr.

16-19 May (Sunday-Wednesday): The Arabian Travel Market (ATM) takes place in Dubai.

20-28 May (Thursday-Friday): Gouna International Squash Open 2021.

26 May (Wednesday): Final day for Africa-based startups to apply for the French government-sponsored AFD Digital Challenge (pdf).

27-29 May (Thursday-Saturday): Informa Markets’ Nextmove real estate exhibition, Cairo International Convention Center, Nasr City.

30 May (Sunday): Al Mal GTM is organizing the fifth edition of the Portfolio Egypt conference under the theme ‘Growth under the weight of the pandemic.’

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

17-20 June (Thursday-Sunday) : The International Exhibition of Materials and Technologies for Finishing and Construction (Turnkey Expo), Cairo International Conference Center.

22-27 June (Tuesday-Sunday): The CIB PSA World Tour Finals for 2020-2021 will take place in Cairo.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: National Book Fair.

July + August: Thanaweya Amma exams take place.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

15 June (Saturday): EGX-listed will have to complete filing their financial disclosures for the period ended 31 March.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

17-20 August (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The 54th session of the Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday) Mediterranean Offshore Conference, Alexandria, Egypt

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.