- MNT-Halan’s record fintech raise solidifies our position as the fintech capital of the Arab world. (The Big Stories Today)

- Privatization program to resume before year’s end with as many as three IPOs by December – Planning Minister. (What We’re Tracking Tonight)

- Saudi opens travel to and from the UAE just in time for Expo2020. (What We’re Tracking Tonight)

- Apple confirms fall event — pundits expect new iPhone, AirPods, Watch. (What We’re Tracking Tonight)

- Can I get that change in BTC, please? El Salvador makes BTC legal tender. (Crypto)

- 80s’ anime at its best + Medfest Egypt takes place today. (Enterprise Recommends)

- Somewhere out there, George Costanza is crying as the WSJ joins the FT in declaring the physical wallet “dead.” (For Your Commute)

Wednesday, 8 September 2021

EnterprisePM — MNT-Halan’s record fintech raise solidifies our position as the fintech capital of the Arab world

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, everyone, and welcome to another busy newsday, with our top story being a blockbuster:

THE BIG STORIES TODAY SO FAR-

#1- Our friends at MNT-Halan have pulled off what we think is the biggest fintech round ever to take place in MENA, raising c. USD 120 mn from a who’s who of investors that includes financial services-focused PE house Apis, the UK’s Development Partners International (DPI) and Lorax Capital Partners.

Emirati fintech player Tabby previously held the crown as the “most-funded” fintech in the region, having raised a total of USD 132 mn after a USD 50 mn round. MNT-Halan has comfortably blown past that milestone with the region’s biggest-ever fintech raise. We’ll have more on the transaction tomorrow morning, including a quick look at what’s next for MNT-Halan.

Forgive us, then, if we declare Egypt the fintech capital of the Arab world. Add e-payments giant Fawry to the mix, throw in e-Finance’s upcoming IPO and we’re easily the most exciting market in the neighborhood — and that’s before you start talking about the dozen (or more) other compelling and credible players out there, from Khazna and Kashat to Thndr and Paymob. The list goes on and on.

#2- Colliers International maintained its optimistic forecast for Egypt’s hotel occupancy through 2021 in its September report on MENA hotels (pdf). Occupancy at Sharm El Sheikh hotels is forecast to reach 45% over the year, while 50% of Hurghada and 52% of Cairo’s hotel capacity is expected to be occupied, marking a y-o-y increase of 111% and 91% respectively.

#3- Speed Medical said that it had paid the shareholders of New Al Safwa Specialized Hospital EGP 4 mn in June as part of its compensation for the months delay on the transaction, the company said in a bourse filling (pdf). The company also confirmed that it will be upping its offer for the acquisition after sellers voiced complaints about the slowness of the regulatory approvals from the Health Ministry.

^^ We’ll have chapter and verse on all three stories in tomorrow’s edition of EnterpriseAM.

HAPPENING NOW- The two-day Egypt-International Cooperation Forum (ICF) kicked off today at the Nile Ritz-Carlton in Cairo, bringing together representatives from African and Arab governments, leading Egyptian and international businesses and banks, multilateral lenders, and international institutions including the UN, World Bank, OECD to discuss international development issues such as climate change and the pandemic.

Covid-19 has put sustainable growth at the forefront, International Cooperation Minister Rania Al Mashat said in her opening remarks, highlighting the role of the private sector, and the importance of leveraging agreements such as the African Continental Free Trade Agreement in promoting regional cooperation. President Abdel Fattah El Sisi also highlighted the need for a climate-friendly approach to development in light of global environmental threats. Bloomberg also took note of the forum, speaking to Al Mashat about Egypt’s bid to attract broader investment.

The state’s privatization program will resume before the end of the year, Planning Minister Hala El Said said at the forum, confirming that at least two, maybe three state-owned companies would IPO between now and December, Masrawy reports. State-owned e-finance is expected to be among the companies to offer stakes, with unnamed government sources telling El Borsa yesterday that 10% of the company could be offered as soon as next month.

You can check out the full agenda for the forum here (pdf).

THE BIG STORY ABROAD-

Good news for Dubai Expo 2020: Saudi Arabia has opened up travel to and from the UAE, according to a press release (pdf) from the Saudi Embassy in Cairo. This comes weeks before the Dubai Expo 2020 is set to launch on 1 October, “opening up a key market” for the large-scale event, writes Bloomberg. Saudi also resumed travel with Argentina and South Africa after assessing the countries’ epidemiological risks.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- E-Finance to IPO next month: E-Finance’s long awaited IPO could hit the market as soon as next month, and around 10% could be up for sale.

- Shell could sell Western Desert assets to Cairn Energy and Cheiron: The companies are expected to finalize their takeover of Shell Egypt’s onshore oil and gas assets by the end of September.

- BCI lands USD 30 mn loan from IFC: Plastics raw material manufacturer BCI Holding will expand its production facility in Egypt through a USD 30 mn loan from the International Finance Corporation, which will also be used to establish new facilities in Algeria and Nigeria.

|

WHAT’S HAPPENING TODAY-

The GlobalCapital Sustainable and Responsible Capital Markets Forum 2021 wraps today. The two-day virtual event yesterday hosted Vice Minister of Finance Ahmed Kouchouk for a panel session on green bonds.

Day two of the Egy Health Expo starts today at the Al Manara International Conference Center. The conference wraps up tomorrow.

It’s day four of the Arab Labor Conference, which is running through to 12 September at the InterContinental CityStars Hotel in Heliopolis. Government officials, ambassadors, trade union reps and business owners’ association delegates from 21 Arab countries are participating in the gathering.

FOR TOMORROW- Inflation data for August from state statistics agency CAPMAS is expected. Annual urban inflation accelerated to an all-year high in July — from 4.9% to 5.4% — on the back of rising energy and food prices. July’s inflation figures — which hit the CBE’s target range of 7% (±2%) for the first time — fell short of analysts expectations, and August’s figures are expected to show a continuation of the uptick in prices.

???? CIRCLE YOUR CALENDAR-

iSheep, take note: Apple is holding a virtual event on Tuesday, 14 September. You can expect a new iPhone, new AirPods and probably a new Watch. If the watch doesn’t make its appearance next week, it may come at one of the rumored follow-up events for the iPad, iPad Mini and hotly anticipated new MacBook Pros. Apple has scheduled the event for 7pm CLT and show’s it running for two hours. You can stream it here.

Need an Apple fix before then? Go watch this brief “marketing masterclass” by Steve Jobs.

EFG Hermes’ fourth Virtual Investor Conference runs 13-21 September with the theme of “After Reflation – FEMs in 2022.”

AmCham event: Environment Minister Yasmine Fouad will give a speech on strategies for generating green, private sector-led growth at AmCham’s virtual monthly event on Monday, 13 September. Register here.

ALSO:

- New school year: International schools begin the 2021-2022 academic year on Sunday, 12 September.

- Sahara Expo: The four-day agricultural conference, the Sahara Expo, will start on Sunday at the Egypt International Exhibition Center.

- Interest rates: The Central Bank of Egypt will meet to review interest rates on Thursday, 16 September.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Tomorrow seems to be the last warm day before the weather cools down for the weekend. Expect highs of 39°C during daytime and lows of 23°C at night.

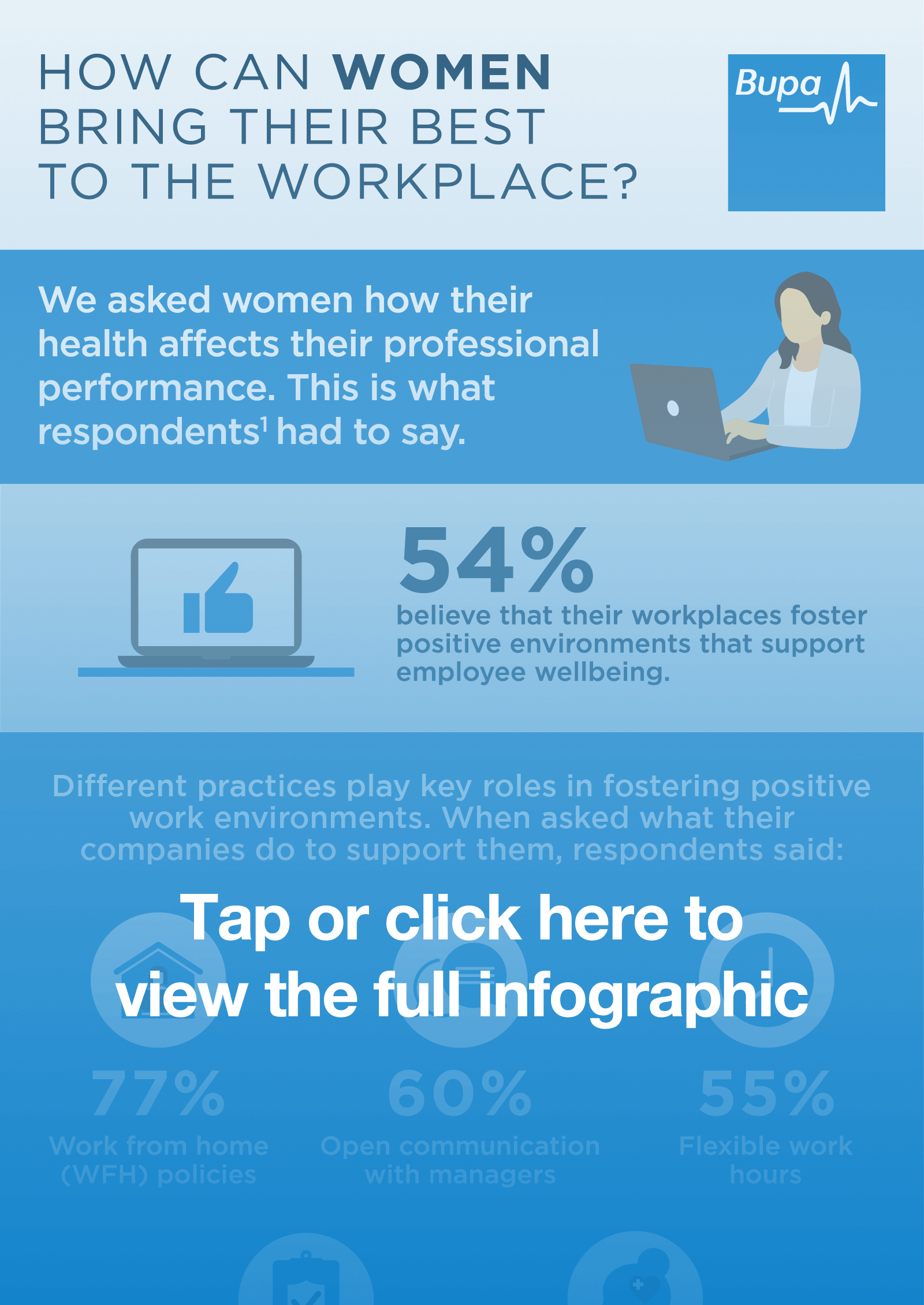

A MESSAGE FROM BUPA EGYPT INS.

???? FOR YOUR COMMUTE

Somewhere out there, George Costanza is crying, suggests the Wall Street Journal, drawing on the Seinfeld characters ridiculously overstuffed wallet for the lead to its piece on the death of the physical wallet. Personal tech columnist Joanna Stern looks at how everyone from Apple and Google to governments and hotels is looking to replace your ID, keys, and the other paraphernalia you carry around with an app on your phone. Stern doesn’t think we’re on the verge of entering Utopia — and looks at the security, privacy and practical concerns that come with trusting everything to your phone — but she’s … guardedly optimistic. The story was prompted by Apple’s recent announcement that a bunch of US states are rolling out iPhone-compatible versions of driver’s licenses and state IDs.

The Financial Times was banging on about the death of wallets back in January, suggesting that the fashion accessory faces competition from everything ranging from fanny packs and cross-body bags to clutches and … fingerprints.

Speaking of Seinfeld: We have less than one month to go before the show debuts on Netflix. The streamer is set to drop all nine seasons in October.

FINTECH FOUNDERS’ DREAM: PayPal will acquire Japanese buy now pay later platform, Paidy for c. USD 2.7 bn, the digital payments giant said in a press release. Paidy allows Japanese shoppers to make online purchases, then pay for them on a monthly basis in a consolidated bill. The acquisition, which is expected to be complete by 4Q2021, will allow PayPal to expand in the Japanese market, the third largest ecommerce market worldwide. Earlier this year, PayPal acquired Israeli cloud-based infrastructure for digital asset security, Curv. Tech Crunch and the Financial Times have the story.

YOUR MANDATORY COVID STORY- Dreaming of a “return to normal life?” Well, dream away: Covid-19 is “here to stay,” World Health Organization officials said, with the virus likely to mutate like the flu and stay a part of our future indefinitely, CNBC reports. WHO officials say that this fate could have been avoided if the world had intervened early to stop the spread and mutation of the virus during its initial discovery.

Job openings plateau as delta variant puts blue collar workers on shaky ground — in America: Job postings have increased during the summer due to a growing demand for remote working, rising by about 39% at the end of August from February 2020, according to the Wall Street Journal. But things took a different turn after that, with the delta variant curtailing previously strong demand for restaurant, salon and other in-person service positions. Beauty and wellness job openings dropped by 8.5% while child care jobs fell 3.3%,during August, after they had returned to a pre-pandemic level in the prior month.

???? ENTERPRISE RECOMMENDS

80s’ anime at its best + Medfest Egypt takes place today

???? ON THE TUBE TONIGHT-

(all times CLT)

It’s hard to believe that this animated masterpiece was made in 1984: Japanese director Hayao Miyazaki fascinates with his first hit Nausicaä of the Valley of the Wind as a glimpse of anime powerhouse Studio Ghibli’s then-developing style and storytelling. From the director who created Spirited Away and My Neighbor Totoro, this avant garde masterpiece is an eco-warning that shows heroine Nausicaä — lover of nature and the animal kingdom — grappling with warring nations and man’s relentless capacity to destroy the planet. Miyazaki’s nature-first, humanity-second approach to environmentalism began with this movie. You can binge-watch all of Studio Ghibli’s films on Netflix, but make sure to start with this hidden gem.

⚽The footie is back in action tonight: The international break finally ends today, and the big European leagues are coming back this Friday and Saturday. Until then, here are tonight’s highlights for the World Cup’s European qualifiers: Kosovo vs Spain; Italy vs Lithuania; Belarus vs Belgium; Poland vs England; and Iceland vs Germany, all of which will be played at 8:45pm.

???? Two Canadian teenagers have captured the attention of the tennis world as they storm to their first-ever slots in the semifinals of the US Open. Catch awesome match reports from the US Open website (Fernandez and Auger-Aliassime) and get ready to tune this weekend — both play on Friday.

???? OUT AND ABOUT-

(all times CLT)

Egyptian Project Acoustic takes to the stage at Cairo Jazz Club 610 tonight at 9pm with their captivating folkloric tunes. Meanwhile, 3al Intaج featuring AK will be playing the latest homegrown rap and trap music, as well as some hip hop beats at Cairo Jazz Club at 8pm.

Alongside Al Andalus Orchestra, Mona Burkhardt will be performing a round of classics from Spanish folklore at the Cairo Opera House today at 8:00pm.

The Egyptian Center for Culture and Arts is hosting an Italian-Egyptian music concert that fuses Mediterranean influences from both countries, performed by an ensemble of musicians from Italy and Egypt.

Medfest Egypt is taking place today at La Viennoise in Downtown at 7pm with the screening of four short films focusing on the intersection of medical and social issues, Sheffa; Ayny; I Don’t Care; and From Inside. The screenings will be followed by a panel discussion with the filmmakers.

???? UNDER THE LAMPLIGHT-

Drop your phone and pick up this book: No One is Talking About This: A Novel by Patricia Lockwood tells a genre-bending story about a nameless “influencer” who posts her life away into “the portal.” Lockwood’s writing style in this debut work seems a little bit odd on first read, but the story then unravels to hit close to home, especially for heavy social media users. The author’s debut novel shows the effects of social media and being “extremely online” in a bizarrely humorous — and at times piercing — way. As one of the most anticipated books of the year, it was longlisted for the 2021 Booker Prize and shortlisted for the 2021 Women’s Prize.

???? GO WITH THE FLOW

EGX30 up 2.7% YTD

The EGX30 rose 0.4% at today’s close on turnover of EGP 1.4 bn (81% below the 90-day average). Egyptian investors were net buyers. The index is up 2.7% YTD.

In the green: Speed Medical (+2.6%), Orascom Development Egypt (+2.6%) and Oriental Weavers (+2.5%).

In the red: Raya (-2.7%), Sidi Kerir Petrochemicals (-1.5%) and CIRA (-1.2%).

CRYPTO

El Salvador yesterday made BTC legal tender, ignoring the concerns of many, many officials and industry experts around the globe. The country has adopted the cryptocurrency in an effort to boost its low banking penetration rate and cut the cost of sending home remittances. But critics say El Salvador’s poorest stand to suffer if BTC’s value falls, and have warned against anchoring the country’s economy to the volatile cryptocurrency.

So, what exactly happened yesterday? Salvadorans were meant to receive USD 30 in BTC as an incentive — equivalent to 0.00058 BTC — after they downloaded a government digital wallet — Chivo — and entered their ID numbers, according to the country’s Finance Minister Alejandro Zelaya. The government has allocated some USD 120 mn to establish up to 4 mn Chivo accounts, almost enough for El Salvador’s entire adult population of 4.6 mn, though Zelaya has said that he is skeptical about the number of people who will take up the offer.

El Salvador’s congress had approved Bukele’s proposal to adopt BTC earlier this summer: As the law (pdf) comes into effect, the cryptocurrency will become an acceptable form of payment for goods and services, along with the USD, which will also continue to act as legal tender. “It will bring financial inclusion, investment, tourism, innovation and economic development for our country,” Bukele said in a tweet.

The plus side: Adopting BTC could save citizens an annual USD 400 mn in fees spent on receiving remittances, according to Salvadoran president Nayib Bukele, which comprise 16% of the country’s GDP. While less than 30% of the population have bank accounts, while the country has recorded over 10 mn mobile cellular subscriptions, meaning that a number of the country’s 6.5 mn population have more than one phone. With an underbanked, but highly connected population, the adoption of mobile BTC payments could make transactions easier for a large portion of El Salvador’s population.

BTC could also help the country plug its budget deficit, proponents argue, if it is able to take advantage of BTC’s fluctuating price and convert inflows when the price is high to finance its deficit, which stood at 10% of GDP in 2020.

But the IMF thinks the government should be cautious: A lack of effective regulatory measures means the mass adoption of crypto could present heightened risks for the country, an IMF spokesperson said after the plan was announced. An unregulated crypto market could become a hotbed for money laundering and other financial crime, analysts said. The move could also go south if people lose confidence in BTC, and a sudden rush to convert BTC holdings into USD could strain onshore liquidity. Moody’s also downgraded El Salvador’s credit rating after the announcement, saying the adoption could destabilize the financial system.

And so does JPMorgan: A sudden increase in the number of daily transactions using BTC could pose a challenge not only for the country, but for BTC’s blockchain itself, which could struggle to support a surge in transactions, according to a JP Morgan report. Almost 90% of the BTC in existence is locked up in illiquid holdings, and daily payments in El Salvador would be equivalent to 1% of the value of tokens that have been transferred over the past year.

How much will your morning coffee set you back in BTC? To put things into perspective, a cappuccino in El Salvador costs USD 2.76 on average, which is 0.000053 BTC. One BTC today is equivalent to USD 51,823.94 — about 13x the average annual income of a Salvadoran in 2019, which stood at USD 4k.

And BTC ATMs should make conversions easier: In efforts to prepare for the BTC rollout, the government has installed BTC ATMs that allow citizens to convert their cryptocurrency into USD and withdraw it. The government has said it will set up 200 commission-less machines that will serve the country’s citizens along with the government’s digital wallet, and 50 financial branches for cash withdrawals or deposits.

This isn’t El Salvador’s first experiment with BTC: So-called BTC beach, a moniker for El Salvador’s seaside town of El Zonte, has been using the currency since 2019 after an American expat introduced it to the unbanked town, transforming the local economy. The town was cited as an inspiration by President Bukele for his nationwide experiment.

Will other developing countries follow suit? Economies looking to decrease reliance on, and unpeg their currency from the USD could consider following in El Salvador’s footsteps, though BTC is not the obvious crypto of choice for many due to its volatility. Many countries have been exploring launching their own Central Bank Digital Currencies, with Venezuela in 2018 launching its own crypto tied to its oil reserves as an (unsuccessful) attempt to get around US sanctions. The Bahamas has also introduced its own government-issued digital currency in a bid for financial inclusion.

What about BTC in Egypt? We’re a far cry from adopting the currency into our financial system, with the Central Bank of Egypt issuing a warning earlier this year against cryptocurrencies after the recently-enacted Central Bank and Banking Act prohibited issuing, trading and promoting crypto in Egypt without special licensing. Egypt was said to be mulling the introduction of its own cryptocurrency, though that would be different from a cryptocurrency as it would be backed and regulated by the central bank.

We have an explainer here if you want to dive more into what a central bank digital currency is and how it works.

???? CALENDAR

5-12 September (Sunday-Sunday): Arab Labor Conference, the InterContinental CityStars Hotel, Cairo, Egypt.

7-8 September (Tuesday-Wednesday): Euromoney Conferences will host the GlobalCapital Sustainable and Responsible Capital Markets Forum 2021, featuring Vice Minister of Finance Minister Ahmed Kouchouk.

7-8 September (Tuesday-Wednesday): Egypt, Turkey hold diplomatic talks in Ankara.

7-9 September (Tuesday-Thursday): Egy Health Expo, Al Manara International Conference, Cairo, Egypt.

8-9 September (Wednesday-Thursday): Egypt-International Cooperation Forum (ICF), Cairo

11-12 September (Saturday-Sunday): International Conferences on Economics and Social Sciences, Cairo

12 September (Sunday): International schools begin 2021-2022 academic year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

13 September (Monday): Environment Minister Yasmine Fouad will give a guest speech at AmCham’s monthly virtual event,

13-21 September (Monday-Tuesday): EFG Hermes’ fourth Virtual Investor Conference.

14-30 September (Tuesday-Thursday): 76th session of the UN General Assembly, New York.

15 September (Wednesday): The CFO Leadership & Strategy Summit is taking place in Egypt.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 September (Saturday): Expiration of United Nations Investigative Team to Promote Accountability for Crimes Committed by Daesh/ISIL

21-22 September (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

22-25 September (Wednesday-Saturday): Cityscape Egypt, Egypt International Exhibition Center, Cairo, Egypt.

29 September (Wednesday): DevOpsDays Cairo 2021 is being organized by ITIDA and the Software Engineering Competence Center in cooperation with DXC Technology, IBM Egypt and Orange Labs.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

30 September: Closing of 2021’s first oil and gas tender in the Gulf of Suez, Western Desert, and the Mediterranean.

October: New legislative session begins — must be held by the first Thursday of October.

October: Romanian President Klaus Iohannis could visit Egypt in mid this month to discuss ways to boost tourism cooperation between the two countries.

1 October (Friday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 October (Friday): Expo 2020 Dubai opens.

1 October (Friday): State-owned companies and government service bodies selling goods and services to customers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

9 October (Saturday): Public schools begin 2021-2022 academic year

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.