- Will our balancing act on inflation endear us to foreign investors? (Speed Round: Macro)

- Oil hits 32-month high off of bolstered demand and delay to Iran nuclear agreement. (What We’re Tracking Tonight)

- Hong Kong’s Zeta to kick off MTO for brokerage house ANFI tomorrow. (Speed Round: M&A Watch)

- Sawiris’ Endeavour has listed on the LSE. (Speed Round: IPO Watch)

- Don’t miss part 2 of our exclusive interview with Bruno Le Maire in tomorrow’s EnterpriseAM. (What We’re Tracking Tonight)

- Sleep tracking gadgets are the latest trend in wellness optimisation. (Your Health)

- TONIGHT’S EURO GAMES: Poland v. Slovakia, Spain v. Sweden.

- An even darker Pinocchio? Keep this one away from your kids. (On The Tube Tonight)

Monday, 14 June 2021

EnterprisePM — Inflation dominates the conversation globally as central banks decide on interest rates this week

TL;DR

WHAT WE’RE TRACKING TONIGHT

It’s another macro-heavy issue this afternoon, friends, with both the US Fed and our own central bank meeting this week to decide on interest rates. Consequently, inflation is the big concern both domestically and internationally, thanks to the continued commodities price boom of 2021.

Not helping matters was oil hitting a 32-month high yesterday, with futures rising 0.9% in New York, reflecting bolstered demand in the US and Europe as vaccine rollouts continue, as well as the expected delay in reviving the 2015 Iran nuclear agreement, according to Bloomberg. Negotiations to reactivate the agreement were expected to be complete before Iran’s elections take place this Friday, a target which seems increasingly unlikely to be met. Increased road and air traffic in the West has also given investors a bullish outlook on crude, with some forecasting continued price increases over the coming weeks.

Inflation will be front and center when the Fed’s Open Market Committee kicks off its two-day meeting tomorrow, especially after a heated US consumer prices report out last week and May prices coming 5% higher than forecasts. Market watchers floated the idea that inflation will prove short-lived, and no policy action is to be expected. Investors will still, however, be on the lookout for clues on how and when the Fed will shift its policy stance.

The Fed is pushing the idea that “the current spike in inflation is transitory,” and this week’s meeting will be a test of this so-called “narrative,” market sage Mohamed El Erian writes for the Financial Times.

REMINDER- It’s interest rate day here on Thursday: The Central Bank of Egypt’s (CBE) own Monetary Policy Committee meets on Thursday to review rates here at home. All 11 analysts and economists surveyed in our poll are calling another hold as inflation hit its highest level all year in May as the global commodities boom began to hit the domestic economy.

Inflation will be something investors will be eyeing when looking at which emerging markets to invest in, according to a Bloomberg survey, with takers suggesting that the more an EM central bank promotes inflation control the more investors will likely jump in. What does that mean for us? Read today’s Speed Round to find out.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Egyptian Banks may face more pressure in the coming fiscal year: Banks could see their interest income squeezed during the coming state fiscal year due to lower interest rates and a potential dip in treasury yields, Fitch Ratings said in a report.

- Jumia flags Egypt as a top investment destination: Africa-focused e-commerce giant Jumia plans to invest over USD 590 mn in Egypt and other African countries over the upcoming years starting 2021.

- Four companies to IPO in 2H2021? EGX Chairman Mohamed Farid told Reuters as much, without revealing the companies. Likely contenders include Banque du Caire, State-owned e-payments company E-Finance, NBSF player Ebtikar, and

Cosmeceutical giant Macro Group.

The German-Arab Chamber of Industry and Commerce is offering to assist its members and clients with the procedures of registering on the Advanced Cargo Information (ACI) system Nafeza, according to a statement (pdf). Members who have not completed their registration on the system may submit their documents to the chamber, who will take over the process. The chamber will also offer long-term support with troubleshooting and problems that may arise at a later date. If you’re still unsure how you can prepare for Nafeza, check out our explainer on the topic. All businesses importing goods at seaports must be registered on the system by 1 July.

HAPPENING NOW- Foreign Minister Sameh Shoukry is meeting with his Qatari counterpart Mohammed bin Abdulrahman Al Thani in Doha, Foreign Ministry Spokesperson Ahmed Hafez tweeted. They are expected to discuss the latest developments in Egyptian-Qatari relations since the Al Ula declaration was inked earlier this year. In late May, Al Thani met with Shoukry for the first time in Cairo since the lifting of Egypt and the GCC’s 2017 blockade on Qatar. Their meeting today comes ahead of the Arab League’s meeting for “emergency” GERD talks in Doha tomorrow.

THE BIG STORY ABROAD #2- US urges G-7 allies to take bolder stance against China: President Joe Biden has called on democratic western allies to take a tougher stance on China and other “autocratic governments around the world” to curb their economic influence, the Financial Times reports. Countering China was a key theme throughout the G7 summit, with the summit’s final communique yesterday denouncing China over human rights abuses in Xinjiang, and asking for further probes into the origins of covid-19. In response, a spokesperson at the Chinese embassy in London criticized the summit, noting that it “exposed the sinister intentions of a few countries including the US.” The story is front-page news in Bloomberg and the Wall Street Journal.

The Nato summit taking place in Brussels today also appears to be focusing on freezing out China, with Nato countries agreeing that Beijing poses a security threat, according to The Guardian. The Nato summit will also see discussions on how to align on broader topics such as cyberattacks, resource scarcity, migration flows, climate change, global health security, and trade cooperation, USA Today reports.

…And taking the alliance to outer space (yes, you read correctly): The military organization has extended an article in Nato’s founding treaty that stipulates that an attack on any one of the 30 allies will be considered an attack on all of them to include attacks in space, according to the Associated Press.

YOUR MANDATORY COVID STORY- New vaccine entrant could boost supply to developing world: A covid-19 vaccine developed by US pharma firm Novavax was found to be 90% effective in a large-scale study in the US and Mexico, the company announced. The jab is expected to help fill in the global gap in vaccine availability, with the pharma firm pledging 1.1 bn doses to developing countries over the next year. Novavax will seek authorization for the shots in the US and Europe by the end of September, according to the Associated Press, and is currently working to expand capacity to produce up to 100 mn doses a month by 3Q2021.

|

FOR TOMORROW-

DON’T MISS PART 2 OF OUR EXCLUSIVE INTERVIEW WITH BRUNO LE MAIRE, France’s Finance Minister, in tomorrow’s EnterpriseAM. Le Maire was in Cairo this past week where he signed yesterday infrastructure funding agreements worth EUR 3.8 bn covering everything from the Cairo Metro to railway upgrades to wastewater, energy and food security.

Missed Part 1? In addition to revealing details of the agreements, Le Maire expanded on areas of cooperation Egypt and France could dive further into. These include supporting Egypt’s rollout of its universal healthcare system, renewables and clean energy (including green hydrogen), and urban development in the new cities. You can read the full interview here.

But France isn’t satisfied with just that: In the second part of our sitdown, Le Maire reveals his ambitions for France to be among Egypt’s top three contributors to FDI — up from its current position as eighth — and how the Macron administration hopes to take it there.

Other key highlights from tomorrow’s interview you don’t want to miss include:

- What Egypt’s been doing right to attract French investment.

- How we could become a regional export hub for French goods and services.

- How the French-Egypt partnership could be a model to link developed and developing nations.

- The global importance of the new G7 tax proposal, and what it means for us here.

???? CIRCLE YOUR CALENDAR-

EFG Hermes and the Saudi Exchange kicked off a joint conference today titled the EFG Hermes and Saudi Exchange Virtual Investor Conference, which will run until Thursday, 17 June, according to a press release (pdf). The virtual event aims to share and discuss insights on compelling prospects across the Saudi capital market, and brings together executives from 61 companies with more than 450 international investors from over 190 institutions.

The Egyptian Center for Economic Studies is holding a virtual seminar tomorrow exploring the extent to which SMEs benefit from Egypt’s financial services. The discussion will take place from 10-12 am and you can register to join the Zoom call using this link. The seminar will also be streamed live on their YouTube page.

Entrepreneurs in the tourism sector have until 20 June to apply for the six-month Tourism Recovery Program launched by Enpact and the TUI Care Foundation and supported by GIZ, according to a press release (pdf). Some 100 startups will be eligible for direct support to the tune of EUR 9k each. The program also aims to create an international network of tourism business to expand cooperation between Egypt, Germany, and other European countries. You can apply here.

???? FOR YOUR COMMUTE-

The threat of rising oceans could wipe out tns of USD from China’s economic activity this century — including USD 974 bn in Shanghai alone — if climate change is not kept in check, according to Financial Times analysis of unpublished data. Higher tides and annual flooding are expected to hit China’s most important commercial hubs on the east coast, chipping away at the country’s GDP and undermining economic growth. Panasonic’s new China headquarters and Tesla’s Shanghai gigafactory are expected to be among the facilities at risk. So far, China has given little attention to the literal tsunami coming its way, rejecting international projections. President Xi Jinping has put climate change on his radar by pledging to reach carbon neutrality by 2060, possibly shifting the attention towards the rising oceans dilemma in the world’s second largest economy.

???? ON THE TUBE TONIGHT-

A dark retelling of the puppet who wished he were a real boy is out on Amazon Prime. The 2020 Italian remake of a childhood favorite, Pinocchio, is unapologetically weird. With its psychedelic imagery and wild storyline, the film is giving us Pinocchio meets Alice in Wonderland vibes. The remake follows the boy puppet as he tries to fit in with the humans at school. When that fails, he decides to go off on his own and find his own crowd by joining a travelling puppet show. Pinocchio ends up meeting a cast of unsettlingly strange characters that all try to help him become a real boy.

⚽ Today in UEFA EURO 2020: Scotland and Czech Republic started a match less than an hour ago in Group D. Meanwhile, Poland and Slovakia are playing at 6pm in Group E and Spain and Sweden will hit the field at 9pm, also in Group E. Spain is expected to come out on top in the group, while Poland could come in second, fueled by striker Robert Lewandowski.

Last night’s score: England beat Croatia 1-0, Austria won against North Macedonia 3-1, while the final match of the day was a close one, with the Netherlands barely scraping past Ukraine with 3-2.

???? OUT AND ABOUT-

Contemporary poster exhibition Cairo Prints is ongoing until Thursday at Cairopolitan, the French Institute in Cairo, and Institut français d’archéologie orientale. The annual exhibit features a vast array of works from local and regional graphic designers and visual artists.

It’s karaoke night at The Cork in Heliopolis, a cozy Irish pub you should check out regardless of your singing abilities.

???? UNDER THE LAMPLIGHT-

The history of the city: Over half of the world’s population lives in urban areas, with cities getting bigger and bigger over the years. But how did these cities come to be? How do they affect us? And why do we still live in them? (We ask ourselves that last one every day). Cities by Monica L. Smith explores all of these questions by taking a look at the historical origins of our modern metropolises, from Pompeii, Ancient Rome, and Athens, to the lesser known Tell Brak in Syria and Teotihuacan in Mexico. From Mesopotamia to Manhattan, the book aims to show how the emergence of cities brought dominance and knowledge to homo sapiens.

???? TOMORROW’S WEATHER- Expect daytime highs of 35°C and nighttime lows of 20°C tomorrow, our favorite weather app tells us.

SPEED ROUND: MACRO

Will our balancing act on inflation endear us to foreign investors?

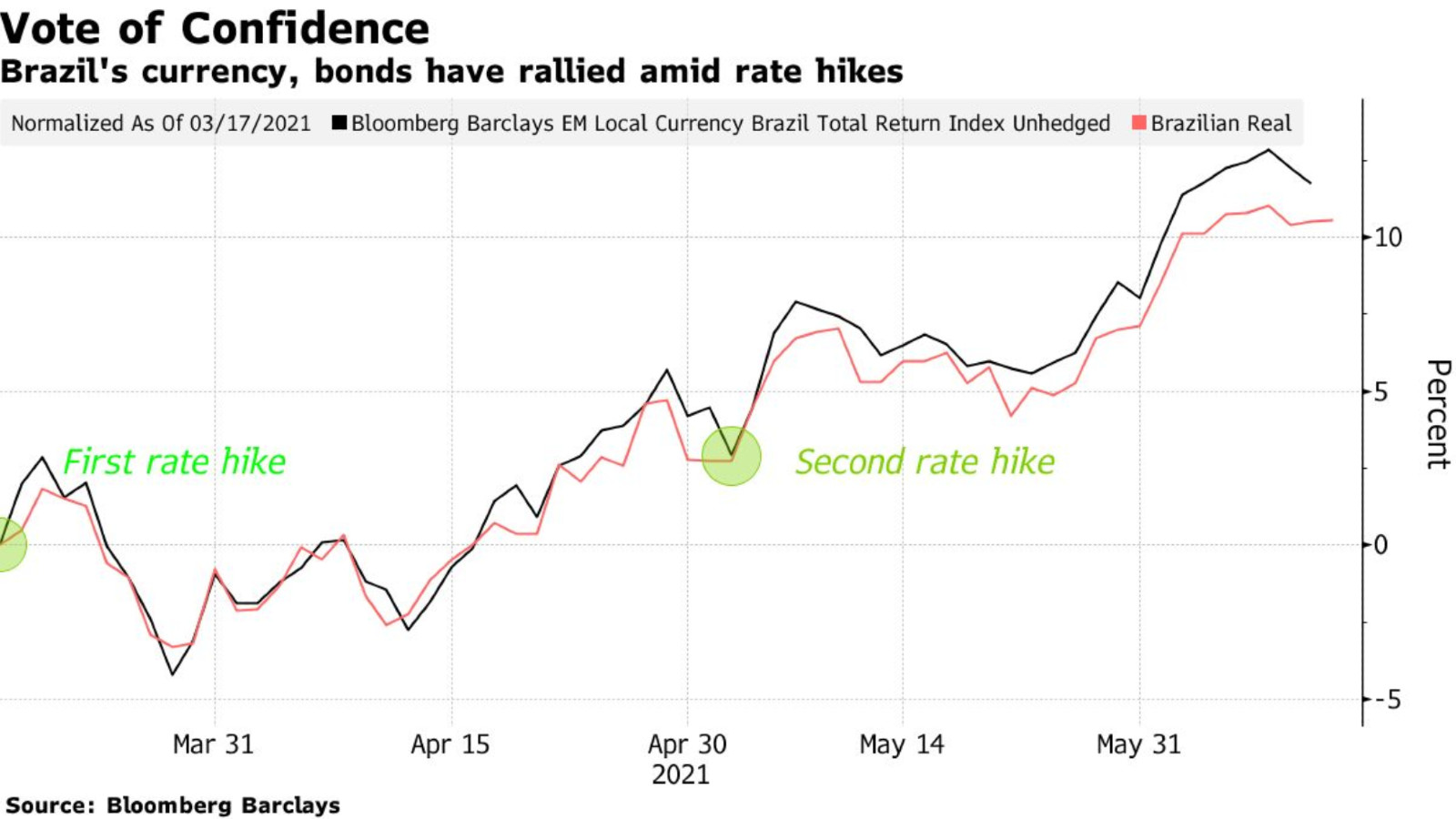

Emerging markets that are talking tough on inflation will be rewarded by foreign investors, who have one eye on the potential dangers ahead as price pressures grow, analysts tell Bloomberg. Central bankers in developing countries are having to perform a delicate balancing act between supporting their economies — many of which are still facing covid-19 outbreaks — and keeping a lid on inflation, which threatens to become a problem thanks to a strong economic rebound and huge stimulus in advanced economies. “Investors will ultimately favor those countries in which central banks are able to get ahead of inflation,” said an analyst at TS Lombard. “It’s essential that central banks react proactively.”

Exhibit A: Brazil. Brazil’s central bank chief Roberto Campos Neto has made how he feels about inflation explicit, communicating in no uncertain terms that he will do whatever it takes to fight off inflation, which rose to its highest rate in almost a quarter of a century in May. This has been backed up by actions: the Brazilian central bank has twice hiked rates aggressively since inflation began to tick upwards, with another increase expected later this week as prices continue to surge. Since the first hike, the Brazilian real has gained an EM-leading 9.2% and its bonds have returned 10%.

Exhibit B: Russia. Russia’s central bank has taken a similarly tough approach to inflation, raising rates three times, with another hike expected at their next meeting in July. This will help to support the ruble, which in turn could help the central bank contain inflation, said a fund manager at PineBridge Investments.

On the flipside, countries that are being lax on inflation aren’t in investors’ good books. Poland and Hungary are two examples of lower-yielding countries that have been happier to let prices rise. “We are cautious in the lower-yielding markets with high correlation to core rates and where risks of inflation becoming ‘un-anchored’ are most concerning,” said a bond analyst at Pictet Asset Management.

Fortunately, the Central Bank of Egypt isn’t facing the same dilemma, given the global inflationary trend is yet to make its mark in Egypt. Even after a slight increase in May, the annual urban rate is still beneath the lower bound of the central bank’s target range. Furthermore, inflation slowed down m-o-m, with urban prices rising 0.7% during the month, compared to an increase of 0.9% during April. This trend isn’t expected to change drastically, with analysts forecasting a pick up in price growth over the summer, but nothing that will overshoot the CBE’s 7% (+/- 2%) target range.

…But has to still balance inflation targets with our all-important carry trade: The CBE is trying to find a balance between maintaining its attractive real rates and stimulating the economy — a line that may become finer as inflation pushes other EM countries to raise rates and become more competitive with the EGP carry trade, an important source of foreign inflows.

Need a refresher on the carry trade? We’ve got you covered right here.

SPEED ROUND: M&A WATCH

Hong Kong’s Zeta tables formal bid for brokerage house ANFI

A mandatory tender offer by Hong Kong’s Zeta Investments targeting up to 90% of brokerage house ANFI kicks off tomorrow, the EGX said today in a bulletin. Shareholders of the Alexandria National Company for Financial Investments (ANFI), will get an option to sell at EGP 5.48 a share — a price which values the entire companies’ shares at EGP 28.6 mn, by our math. A subscription period for the MTO ends on Monday, 28 June.

Zeta isn’t the only suitor: Tycoon Holding had submitted an offer earlier this month to launch a separate MTO targeting EGP 5.55 a share, and a group of investors including Egyptian businessman Ahmed El Saba and Saudi Arabia’s Mostafa El Humeidan were also said to be conducting due diligence on the company a few months back, and had been planning a much more attractive offer of EGP 7.48 per share. Offers of EGP 5.30-5.48 per share have also been submitted by Kayan Sustainable Development, and Zaldi Capital.

SPEED ROUND: IPO WATCH

Sawiris’ Endeavour becomes an LSE-listed company

Naguib Sawiris-backed Endeavour Mining has listed today on the LSE after being admitted into the UK Listing Authority’s premium listing segment, the company said in a statement. Endeavour, which counts Sawiris’ La Mancha as its largest shareholder, set up a new holding company based in London that will also begin trading under its new corporate structure on the Toronto Stock Exchange starting Wednesday, according to Arab Finance. Its shares will be listed on both exchanges under the ticker EDV. The company expects to be added to the UK’s blue-chip index FTSE 100.

Background: Endeavour earlier this year finalized the takeover of West Africa-focused Teranga Gold — completed through a USD 1.86 bn share swap agreement that created one of West Africa’s 10 largest gold producers.

GO WITH THE FLOW

Pioneers, Arab Dairy report higher net income in 1Q2021, Kabo narrows losses

EARNINGS WATCH- Pioneers Holding net income inched up to EGP 299.6 mn in 1Q2020, up 10.4% y-o-y from EGP 271.3 mn in 1Q2021, according to the company’s earnings release (pdf). Revenues also climbed 18% over the first quarter of 2020 to reach EGP 2.04 bn.

Arab Dairy saw its net income jump to EGP 8.37 mn in 1Q2021, compared to EGP 831,647 in the same quarter of 2020, according to the company’s quarterly financials (pdf). Revenues also rose to EGP 383.13 mn in 1Q2021 from EGP 340.15 mn in 1Q2020.

El Nasr Clothing and Textiles (Kabo) has reported a net loss of EGP 7.4 mn in 1Q2021, up from a loss of EGP 16.2 mn in 1Q2020, according to its quarterly financials (pdf). Sales were down 16.7% y-o-y to EGP 73.7 mn.

IN MARKET NEWS-

Tobacco monopoly Eastern Company has officially denied it’s planning to issue securitized bonds, confirming in a statement to the EGX (pdf) that “it has not communicated with any party regarding this matter.” This came after Eastern CEO Hany Aman shot down a recent report by Al Shorouk claiming that his company was looking into executing a securitized bond sale worth some EGP 3 bn to expand its product line, telling Enterprise this week that securitized bonds aren't on the menu.

MARKET ROUNDUP-

The EGX30 rose 0.5% at today’s close on turnover of EGP 1.05 bn (18.6% below the 90-day average). Foreign investors were net sellers. The index is down 8.4% YTD.

In the green: Fawry (+1.5%), CIB (+1.5%) and Eastern Company (+1.4%).

In the red: CI Capital (-3.8%), Qalaa Holdings (-3.2%) and Emaar Misr (-1.8%).

YOUR HEALTH

You snooze, you lose — just don’t forget your sleep tracker

With the advent of wearable biometric tech like smartwatches, consumer-based sleep analysis technologies are gaining in popularity, as a bigger crowd moves to hack their bodies’ functions in our never-ending quest for wellness monitoring, the Wall Street Journal reports. Until recently, the only way to thoroughly assess your shut-eye was to be wired up and observed by doctors in a clinical setting. But along with the wearable activity-tracker revolution came a variety of sleep-monitoring products that promise to optimize your sleep cycle outside of a medical setting.

In a sign of the times, the sleep-tech business is now exploding: It’s projected to be worth about 3x what it was in 2018, and is expected to grow into a USD 27 bn industry by 2025, according to Global Market Insights.

Part of the hype is an increased awareness of the effect of sleep on wellbeing: Sleep disruptions or deprivations can cause a variety of problems, ranging from stress and irritability, to errors in judgement, to headaches and other physical pains. But it’s not just about how much sleep you’re getting, the quality matters too. One study that followed the sleeping patterns of more than 43k subjects for over six years found that those classified as “evening types” — those whose sleep cycles left them more or less constantly jet lagged — experienced a higher risk of cardiovascular disease, and had a 10% increased likelihood of dying.

And covid-19 is exacerbating the problem: While sleep problems are not new, a rising trend of what some sleep experts call “coronasomnia” — a portmanteau denoting the interference in sleep patterns caused by the pandemic — has manifested over the past year among around four in ten people. Routines went out the window, with many reporting “feeling perpetually in sleep debt” and experiencing increased anxiety.

Cue sleep trackers as a solution for those restless nights: These devices claim to help people make informed decisions about how to optimize their sleep cycles by determining bedtime behavioural changes and recording patterns throughout their sleep.

How do sleep trackers work? They collect data points throughout the night and translate this information into a sleep score. Many sleep-tracking technologies use accelerometers to track nocturnal movement and present sleep-stage data, with less movement equated to deeper sleep. They can also listen to your heart rate, trace your breathing patterns, and keep tabs on blood oxygen levels. Some of them even record sleep talking, while others monitor air quality.

CAVEAT- Sleep trackers are not medical devices: Sleep trackers often measure inactivity as a surrogate data point to guesstimate how much you’re actually sleeping. In other words, a wearer who is wide awake but also lying still could get an imprecise sleep summary the next day. Research has found that compared to polysomnography tests — which experts use to diagnose sleep disorders — these technologies are only accurate 78% of the time when identifying sleep versus wakefulness, with their accuracy dropping more than twofold when estimating how long it took participants to fall asleep. Still, sleep-monitoring tech can definitely be useful in helping recognize whether sleep disruptions are occurring, prompting users make environmental changes that could give them better rest.

In case you’re interested, here are the go-to options: Many are smart wearable trackers that users strap to their wrists like the Apple Watch, and Fitbit and Garmin Fēnix’s gadgets, which use the motion-sensing tech inside the watch to detect even minor movements. Wireless sleep-enhancing headbands are another type of wearable tracker that monitor brain activity and use advanced algorithms to detect sleep patterns, promising to boost periods of deep sleep with a meditative and calming soundscape — Muse S and Dreem are just a few of the options available. Other devices can clip on your pillow or sit on your nightstand, like Google’s next-generation Nest Hub — which measures nighttime movements and breathing through sensor strips — or sleep-tracking mats such as Withings Sleep Mat that slip easily under a mattress. Also on the contactless front: sleep-monitoring apps, including Sleep Cycle, SleepScore and Sleep++.

CALENDAR

11-14 June (Friday-Monday): Egypt is hosting the first forum of the heads of African investment promotion agencies from under the theme Integration for Growth.

14 June (Monday): Egypt hosts the third edition of the Green Economy Forum (pdf).

14 June-17 June (Monday-Thursday): The EFG Hermes and Saudi Exchange Virtual Investor Conference

15 June (Tuesday): Arab League meets to discuss the GERD in Doha.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

17-20 June (Thursday-Sunday): The International Exhibition of Materials and Technologies for Finishing and Construction (Turnkey Expo), Cairo International Conference Center.

20 June (Sunday): Ismailia Economic Court to hold hearing on Ever Given compensation case.

20 June (Sunday): Deadline for Enpact + Tui + GIZ tourism recovery program (pdf).

22-27 June (Tuesday-Sunday): The CIB PSA World Tour Finals for 2020-2021 will take place in Cairo.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt. The Big 5 Egypt Impact Awards will also be taking place at the event on 27 June.

30 June (Wednesday): The IMF will complete a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: The Cairo International Book Fair, Egypt International Exhibition Center.

July + August: Thanaweya Amma exams take place.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

1 July (Thursday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

15 June (Saturday): EGX-listed will have to complete filing their financial disclosures for the period ended 31 March.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday).

23 July (Friday): Revolution Day (national holiday).

2-4 August (Monday-Wednesday): Egypt is hosting the Africa Food Manufacturing exhibition at the Egypt International Exhibition Center.

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.