- Consumer healthcare giant IDH could list on the EGX within two months. (Speed Round)

- FinMin releases timeline for nationwide rollout of B2B e-invoicing system. (Speed Round)

- Nearly 5% of Egyptian adults may have had covid-19 last year, according to survey by state-owned polling firm. (What We’re Tracking Tonight)

- The ban on new construction permits has *not* been extended for another six months. (Happening Now)

- You can’t just say nice green things and call yourself an ESG investor. (Green Economy)

- From Le Marché to Cairo Photo Week, there’s a ton of cool stuff to do this weekend. (What We’re Tracking Tonight)

- Will the commodities supercycle weigh on the CBE when it meets a week from today to review rates? (Parting Shot)

Thursday, 11 March 2021

EnterprisePM — IDH could list on the EGX within two months.

TL;DR

WHAT WE’RE TRACKING TONIGHT

…and that’s another week in the books, wonderful people. We hope you all have plans to unwind and relax this weekend before we return on Sunday for week #11 of 2021 — and start the 30-day countdown to Ramadan. We hope you’ve enjoyed this M&A-heavy week as much as we have.

THE BIG STORY here at home: Nearly 5% of Egyptian adults may have been infected last year with the virus that causes covid-19. Baseera estimates 2.9 mn adults in Egypt were infected with covid-19 in 2020, according to a report (pdf) by the state-owned public opinion center. The conclusion is extrapolated from a telephone survey of just over 3k people. The highest incidence of cases occurred in November and December, Baseera says, with an estimated 864k people infected in those two months. Some 72% respondents said a physician had confirmed their diagnosis, 61% had blood tests, 56% underwent chest CTs, 23% took a PCR test, and 1.3% were diagnosed by other methods. Al Masry Al Youm has the story.

Officials have long said that the official case count under-represents the extent to which the virus has spread in Egypt. The Health Ministry’s official tally shows 188k cases reported through government labs as of yesterday. A similar Baseera poll in June 2020 found that 600k people had been infected with covid-19; the ministry’s official figure then stood at 57k. The June poll had put the number of people who had been hospitalized at roughly 74k individuals — a figure Baseera had said is within the same rough ballpark as the official case tally.

YOUR STATUTORILY REQUIRED COVID STORY for the afternoon: Trials of Russia’s Sputnik V covid-19 vaccine in the UAE have completed the inoculation phase after 1k volunteers received the second dose of the vaccine, the Abu Dhabi Media Office announced on Twitter. Bloomberg also has the story. Sputnik has been reported to have a 91.6% effectiveness.

GlaxoSmithKline (GSK) and Vir Biotechnology’s antibody therapy reduces the risk of death by 85% in severe covid-19 cases, studies revealed, GSK said in a press release. The therapy has also proven effective against variants from Brazil, the UK and South Africa. The two companies will immediately seek emergency use authorization in the US and other countries.

HAPPENING NOW- The ban on new construction permits has *not* been extended for another six months, according to a cabinet statement issued in response to unconfirmed news reports out this morning. The Madbouly government imposed in May 2020 a six-month ban on construction permits in urban centers in response to ongoing building code violations. The restrictions were relaxed in September to allow for work to resume on buildings of four storeys or less, but the ban has remained in place for other permits. An industry lobby group said earlier this week that as many as 5 mn casual laborers have been impacted by the ban.

*** Expect workplace safety to be a big theme next week amid news just at dispatch time this afternoon that at least 20 workers were killed and 24 injured in a fire that broke out today at a garment factory in Obour. Youm7 has the still-developing story.

Sudanese Prime Minister Abdalla Hamdok and a delegation of ministers arrived in Cairo today for a two-day visit, according to the Sudan News Agency. They’ll talk bilateral ties and the Grand Ethiopian Renaissance Dam (GERD) with their Egyptian counterparts, according to a cabinet statement. The visit comes after President Abdel Fattah El Sisi’s Saturday visit to Khartoum and has already seen Hamdok meet with El Sisi, and a joint press conference is likely in the cards. Also on tap: a series of meetings with Prime Minister Mostafa Madbouly, an unnamed Sudanese source told Al Shorouk. Hamdok also plans on meeting the Sudanese community in Egypt, the source added. Egypt and Sudan have previously agreed to cooperate in projects in fields such as electrical interconnection, infrastructure, water management, and transport.

The European Central Bank is expected to signal today at around 3:30 pm local time (1:30 pm GMT) whether it will act to slow or stop rising bond yields, which analysts fear could “harm the bloc’s economic outlook,” Reuters reports.

There’s no single news story dominating the news agenda in the global business press. The Financial Times is leading with what it says will likely be controversy over the European Union’s market access agreement with Beijing, while the Wall Street Journal reports that stock futures point to shares on Wall Street opening in the green a day after the Dow closed at another record high. Bloomberg, meanwhile, looks at who will benefit and who’s going to get squeezed by surging oil and commodity prices.

CATCH UP QUICK on the top stories from this morning’s edition of EnterpriseAM:

- We have enough vaccines to inoculate everyone who has (so far) registered with the Health Ministry — and more on the way

- Economic growth picked up in the second quarter of the state’s 2020-2021 fiscal year.

- Hassan Allam Utilities is looking to expand into transport through a reverse merger with Egytrans.

KUDOS- Members of the U.S.-Egypt Business Council contributed to the purchase of medical supplies for 300 hospitals, 1k primary health care units, and 50 quarantine hospitals across the country, according to a council report released yesterday. The report focuses on social impact projects of 14 US companies including Apache, Citi, and ExxonMobil, to alleviate economic, educational, health, social and environmental challenges.

|

STUFF TO DO THIS WEEKEND-

Le Marché, the anchor of the annual expo scene, is on today through Sunday at the Egypt International Convention Centre, with over 300 local and international brands set to showcase their wares. Full details and digital catalogue on the show’s website.

Photopia’s Cairo Photo Week 2021 is kicking off today and will run through 20 March. The photo festival will feature over 100 activities including workshops, panels, photo challenges, exhibitions, portfolio reviews and photo walks throughout the week, all led by more than 80 local and international photographers. Genres including fashion, food, portraits, documentary and photojournalism are all in the spotlight. You can check out the event program on Photopia’s website, there’s plenty to look at on the group’s Instagram feed @cairophotoweek, and both physical and virtual tickets are available here.

The Cairo Fashion & Textile Expo trade show opened its doors today at the Cairo International Convention Center tomorrow and runs until Saturday.

The handicraft and home decor show Al Bazaar kicks off at the Cairo International Conference Centre today and will run until 20 March.

The Marketers League runs this Saturday and Sunday, 13-14 March, at Kundalini Grand Pyramids Hotel in Giza. This year’s theme is Beyond the Pandemic with panelists and speakers including our friend Tarek Nour (founder of Tarek Nour Communications), Ayman Hegazi (CEO of Allianz), Sherine Zaklama (CEO, Rada Research and Public Relations), and Walid Hassouna (CEO, EFG Hermes Finance).

???? CIRCLE YOUR CALENDAR-

Life coach Arfeen Khan is giving a talk at a virtual AmCham event on Monday, 15 March.

Talking sustainable manufacturing with BEBA: The British-Egyptian Business Association (BEBA) will host a virtual conference on how Egyptian and UK firms can work together on sustainable manufacturing projects in Africa in the post-Brexit environment on Tuesday, 23 March. Check out the agenda here (pdf).

AUC Press’s Mad March book sale will be ongoing for the rest of the month. The sale is open to the general public every day from 10am–6pm CLT at AUC Tahrir Bookstore & Garden.

???? FOR YOUR COMMUTE-

Egyptologists are using Assassin’s Creed: Origins to teach history in a six-part Twitch series titled Playing in the Past that uses digitally recreated worlds to explore history, The Gamer reports. Set in Ptolemaic Egypt, the 10th installment of video game publisher Ubisoft’s franchise features a “Discovery Tour” mode that can be purchased separately, and lets visitors freely roam Ancient Egypt to learn more about its history and daily life with built in tours. Egyptologist Chris Naunton, who leads the show, touted the video game as “the best visualization of Ancient Egypt.” Also worth noting: the 11th installment of the franchise, Odyssey, features a discovery tour mode for Ancient Greece.

???? ON THE TUBE TONIGHT-

(All times in CLT)

Back to old school comfort TV: Dream Home Makeover on Netflix is a pause-able continuation of what many over-40s experienced staring at the TV set late at night — and if you’re younger, we’re thinking odds are good you sat through some of it with your parents. Drawing from ‘classics’ such as Extreme Home Makeover, the show takes on a new project every episode from kitchens to movie rooms to entire condos.

Singer Sherine has made it to Netflix, with her 2015 series My Way (Tareeky) recently added to the streaming platform’s roster. Set in the 1970s, Sherine plays Dalila, whose dream is to become a famous singer — to the dismay and fury of her aristocratic mother.

A film about an innocent man held at Guantánamo — The Mauritanian — is in cinemas nationwide. The flick is based on the experience of Mohamedou Ould Slahi, a Mauritanian man who was held without charge for 14 years at Guantánamo and repeatedly tortured. Slahi was arrested during the 9/11 attacks because of alleged connections to Al Qaeda. BBC hails the piece as shedding light on the realities of the US military prison, while The New York Times is too stressed to enjoy the film, saying “After weathering almost five years of rolling political scandals, American audiences could be less than eager to be reminded of one more.”

Zamalek is playing Ceramica Cleopatra tonight at 7:30pm in the Egyptian Premier League. Smouha will face off against Aswan tomorrow at 3pm, while Saturday will see Al Mokawloon play versus Ghazl El Mahalla at 3pm and Enppi taking on Al Masry at 7pm.

The Europa League is going strong with eight matches on tonight. Among the fixtures to look out for: Manchester United against Milan at 7:55pm. At 10pm we have three matches: Olympiacos versus Arsenal, Tottenham and Dinamo Zagreb, and Roma’s face off with Shakhtar Donetsk at 10pm.

Both The English Premier League and La Liga have one match on tomorrow and four on Saturday: Newcastle will go up against Aston Villa tomorrow at 10pm. Saturday will start off with Leeds United facing off with Chelsea at 2:30pm, while Crystal Palace and West Brom will play at 5pm, Everton and Burnley at 7:30pm, and Fulham and Manchester City at 10pm.

In La Liga, Levante will go head-to-head with Valencia tomorrow at 10pm, while Saturday will see Alaves play against Cadiz at 3pm, Real Madrid against Elche at 5:15pm, Osasuna against Valladolid at 7:30pm, and Getafe against Atletico Madrid at 10pm.

Finally, Serie A has two matches tomorrow and three on Saturday: Tomorrow, Lazio will play against Crotone at 4pm and Atalanta against Spezia at 9:45pm. Meanwhile on Saturday, Sassuolo will play against Verona at 4pm, Benevento will kick off against Fiorentina at 7pm, and Genoa will hit the field with Udinese at 9:45pm.

????EAT THIS OVER THE WEEKEND-

Artisanal food boutique Carmel has an open buffet brunch every Friday and Saturday boasting assorted sandwiches, salads, quiche, mini bagels, pizza, and desserts. The mouthwatering display of munchies is set out from 10am-4pm while breakfast is served all day at the New Cairo restaurant (Google Maps). Their dishes are all intricately put together such as their tarts, mille-feuille, and eclairs. We might be highlighting their breakfast dishes, but their all-day menu is also fantastic. We recommend their fish and chips and their salmon fillet. Not convinced yet? Check out their Instagram @carmel_egypt and thank us later.

???? OUT AND ABOUT-

(All times in CLT)

The Cairo Opera is celebrating iconic singer Mohamed Abdelwahab’s birthday with a concert led by Selim Sehab while Safwan Bahlawan and Mai Farouk will be performing today at 8pm. Abdelwahab would have been 120 this Saturday, with his birthday reported to be 13 March 1901.

Sheikh Zayed’s Walk of Cairo has a lot going on tomorrow: Red Bull is hosting its dance battle Dance Your Style tomorrow where dancers can hop on the dancefloor and improvise their choreography with random music. The audience will act as judges. Meanwhile, the Cairo Flea market will be having a Mother’s Day Festival on tomorrow from 11am-10pm featuring local art, handmade bags, vintage treasures, and upcycled items.

New Cairo’s Point90 also has a Mother’s Day Bazar this weekend. If, like us, you had forgotten about Mother’s Day and are now panicking, there’s still time to treat your mama right: Egyptian Mother’s Day isn’t until 21 March.

A BlaBla language exchange meetup is taking place tonight at 7pm at Dawar in Downtown Cairo (Google Maps). Attendees can practice Italian, German, or French while meeting new people.

Visual arts competition and exhibition Roznama 8 is opening today at Medrar. The competition was set up by the Contemporary Image Collective (CIC) who gathered a jury of artists who selected 34 artworks from over 500 applicants under the age of 35. The selected pieces range from photography, moving images, painting, graphic art, sculpture, to installations and mixed media creations by young Egyptian artists. From the 34 artworks, three will be named best of show on 25 March and the artists responsible for them will be able to pursue an art residency in the Netherlands, France, or Switzerland.

LIVE STREAMED- The Cairo Classical Ensemble will perform Spring Love Themes at 8pm in an event organized by the AUC Center for the Arts. The ensemble performs works by Mozart, Cimarosa and Piazzolla for oboe and string quartet. You can find the livestream link in the event details.

???? UNDER THE LAMPLIGHT-

The Hard Thing About Hard Things sees Andreessen Horowitz co-founder Ben Horowitz relating his personal experience to veteran entrepreneurs as well as those aspiring to create their own new ventures. The high-profile venture capitalist offers essential advice on building and running a startup — and the challenges you’ll face along the way. Bonus: He’s also an avid rap fan and he amplifies business lessons with lyrics from his favorite songs.

???? WEEKEND WEATHER- We’re in for another sunny day tomorrow, with daytime highs of 25°C and lows of 11°C, our favorite weather app tells us. Saturday will be the same, but the temperature will go up on Sunday to 28°C.

SPEED ROUND: IPO WATCH

IDH could list on the EGX within two months

Consumer healthcare giant IDH could go ahead with its dual listing on the EGX within two months, sources close to the matter told local media. Earlier reports in Al Mal had suggested that London-listed IDH could pull the trigger on its dual listing sometime in February, although the company has only guided on a timeline of 1H2021. IDH is the market leader in Egypt’s diagnostics sector with the Al Borg and Al Mokhtabar brands, has diversified into radiology and has a strong presence in Jordan, Sudan and Nigeria. The company declined to comment on the report when we reached out earlier today.

It’s unlikely the company will offer new equity for sale. IDH said in December that it would need to offer at least 5% of its shares on the EGX to retail or institutional investors to meet freefloat requirements. Shareholders also signed off on a 1 to 4 stock split. That doesn’t mean a stock split is in the cards, as the company and its bankers could convince some existing holders of LSE-listed shares to transfer their stakes to the EGX.

Advisors: EFG Hermes and Renaissance Capital are quarterbacking the transaction, while White & Case, Clifford Chance and Ogier are counsel. Inktank is IDH’s investor relations advisor.

SPEED ROUND: REGULATION WATCH

Timeline for all companies to join e-invoicing system announced

EXCLUSIVE- FinMin releases timeline for nationwide rollout of B2B e-invoicing system: The Finance Ministry is planning to gradually rollout the e-invoicing system for all B2B transactions across various governorates after all large taxpayers join the system on 1 July 2021, Mohsen El Gayar, director of taxpayer services at the Tax Authority, tells us.

Companies in Cairo, Alexandria and governorates west of the Nile Delta will need to log all of their business-to-business invoices in the system before the end of this year. Firms in the Suez Canal cities and in governorates east of the Nile Delta will be brought into the fold by 1H2022. Upper Egypt-based companies will join the system by the end of 2022, he added. The Finance Ministry hopes to see all companies issuing B2B invoices using the system by April 2023.

Wait, does that mean I don’t have to join in July? If you’re counted as a large taxpayer, then you must have signed up by 1 July 2021. The longer rollout period ending in 2023 is only for companies not on the roll of large taxpayers. Large taxpayers (which number at around 2.8k companies) who don’t join the system will face penalties that include inclusion in the Tax Authority’s black list and being denied basic government services.

What is this e-invoicing system, you ask? We have a primer on the system, its purpose, the timeline of implementation along with a list of phase one companies here.

CATCH UP QUICK-

- The Egyptian Credit Bureau (iScore) is launching an electronic system that would update banks on whether someone is deceased, iScore Chairman Mohamed Kafafi told Al Mal. The system, which is currently in the trial phase, will launch at the end of June, he adds.

GO WITH THE FLOW

The EGX30 fell for a third day in a row, shedding 0.2% at today’s close on turnover of EGP 1.2 bn (19.1% below the 90-day average). Local investors were net buyers. The index is up 3.8% YTD.

In the green: Orascom Investment (+5.4%), Orascom Financial (+3.1%) and Edita (+2.2%).

In the red: MM Group (-1.3%), Cleopatra (-1.0%) and Abu Qir Fertilizers (-1.0%).

EARNINGS WATCH- MM Group reported a 20.3% y-o-y decline in net income in FY20 to EGP 366 mn, down from EGP 459 mn in FY19, the consumer stalwart said in its annual earnings statement (pdf). The company’s consolidated revenues fell 11.7% y-o-y to EGP 8.7 bn, down from EGP 9.8 bn in the same period last year. The company’s consumer electronics division (accounting for more than 69% of consolidated revenues) came under pressure as mobile segment revenues fell just over 21%. Revenues at its telecoms business were down nearly 10% while revenues at its automotive business were flat due to timing differences on deliveries that pushed more than 100 units to 1Q2021.

M&A WATCH- Remco’s EGM has approved a bid from Bayt El Khebra’s Technolease to acquire 99.95% stake in Orient Tours, the company said in an EGX disclosure. Remco’s stake in Orient Tours is worth around EGP 1.09 bn according to a valuation by Solid Capital Financial Advisory.

GREEN ECONOMY

You can’t just say nice green things and call yourself an ESG investor

New European Union (EU) rules to regulate ESG investment products and prevent greenwashing went into effect yesterday. The EU’s new rules are part of a wider series of green finance regulations that will see investment products categorised as sustainable or non-sustainable, reports The Financial Times. In the first stage, products will be designated as dark green, light green and non-sustainable depending on their climate and social impact. Any asset manager who wants to market their fund as a sustainable product will be subject to tough disclosure requirements.

New reporting criteria: The second stage, which comes into effect in 2022, will require funds to report on issues including carbon footprint, investments in companies active in fossil fuel sectors and exposure to controversial weapons such as cluster bombs.

But deforestation and other indicators were taken out of the equation, after heavy lobbying last month, the EUR 17 tn asset management industry swayed Brussels to remove a number of indicators asset managers have to report on, reports the FT.

You can find the EU’s directives on the new non-financial reporting legislation here (pdf).

So, what’s greenwashing? The term refers to companies that promote misleading claims about ESG credentials in a bid to attract investors, as environmental, social and governance issues have become a central part of the investment mainstream, experts tell the WSJ.

Case in point: While BlackRock and Vanguard signed a commitment entitled the Principles for Responsible Investment meant to integrate ESG information into their decisionmaking, the companies were all present on a list of “dirty thirty” funds that tracks asset managers with investments in coal. Vanguard topped that list, while BlackRock came in second. The icing on the cake: Vanguard last year threatened to vote against company directors who do not align with global efforts to reach net-zero greenhouse gas emissions by 2050. You can read all about this naughty list in a story we published last week.

As greenwashing ramps up, regulators have turned their attention to how investors can decipher sustainable investment products. The new regulation is “groundbreaking” and “allows investors to compare between different products and how sustainable they are and see what asset managers are doing to integrate sustainability,” Maria van der Heide, the head of EU policy at responsible investment activist ShareAction, told the FT. Meanwhile, University of Roehampton Professor Molly Scott Cato says the “overdue” regulation will allow investors to have a “better understanding of the impact of their investments on people and the planet.”

Could the US follow suit? The Trump administration pushed back on ESG and even introduced rules to make it harder for some pension funds to incorporate ESG principles into their portfolios, but things could change under the Biden White House. The Democratic Party has already unveiled a series of measures on climate change, including rejoining the Paris Climate Agreement.

The potential for more global regulatory scrutiny has triggered a chain reaction of companies scrambling to get green. Chevron CEO Mike Wirth laid out a “pathway” toward net zero emissions in the coming decades following years of the US oil giant shying away from such a move over concerns on eroding returns by pivoting aggressively to new, unfamiliar business lines, reports Bloomberg. This comes a week after Exxon Mobil said it sees “money-making” potential in carbon offsets and partnerships with venture funds to finance carbon capture.

The messaging shift has also been picked up by several pension funds and asset managers: The Institutional Investors Group on Climate Change launched a “net-zero investment framework” this week to provide practical guidance on how to both decarbonise investment portfolios and increase investments in climate solutions, according to a statement. Currently 33 asset managers and owners, managing USD 9.8 tn in assets, are putting the framework to practical use. What’s more, Wells Fargo, Goldman Sachs, and Citigroup are among the firms that have committed to achieving carbon neutrality, without going into details about the practicality or implementation, writes Bloomberg.

ESG boomed in 2020, fueled by the pandemic and rising concern over climate change, with the total assets in specialist sustainable investing mutual funds hitting a record of almost USD 1.7 tn during the year, up 50% from 2019. A majority of sustainable funds have outperformed their equivalent conventional funds over one, three, five and 10 years, according to a study by data provider Morningstar. Over 90% of leading sustainable indices beat their parent benchmarks in the 1Q2020 and continued to show resilience throughout the year’s volatility, according to research by BlackRock.

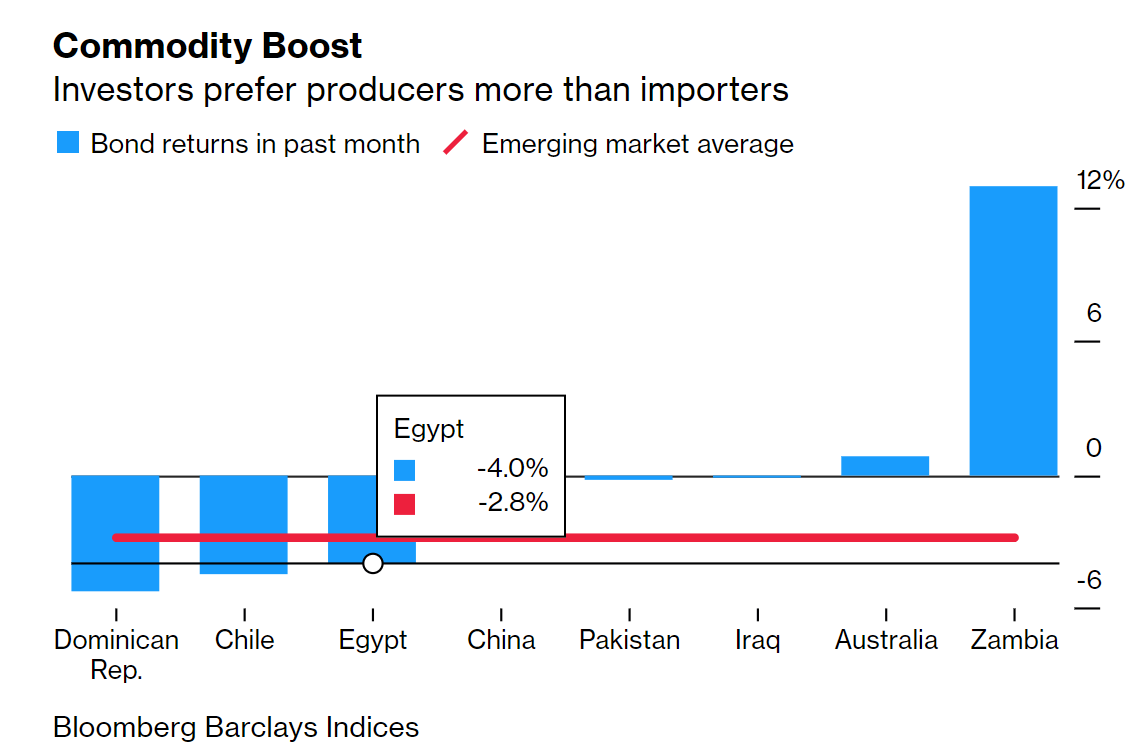

PARTING SHOT

Bloomberg thinks Egypt could be among the biggest losers from a commodities supercycle. “As the world’s biggest buyer of wheat and a net oil importer, Egypt suffers badly whenever commodity prices pick up,” writes Paul Wallace. Paying more for key imports puts pressure on the EGP and turbo-charges inflation.

But does the argument hold water? Bloomberg’s basic premise is that net importers will suffer massive inflationary risk, while net exporters (Russia, KSA) will be sitting pretty. But our starting point isn’t horrible at all: Inflation has been stable — annual urban inflation rose marginally to 4.5% in February from 4.3% in January — and foreign investors are still purchasing local bonds. Almost all analysts we’ve spoken with this week tell us that, yes, inflation is likely to increase if the commodities boom continues. Arqaam Capital sees inflation at 6-7% through 2021, EFG Hermes is forecasting 6%, while Pharos is penciling in a sustained rise in the headline rate averaging 7% until the fourth quarter, when it might begin to back off.

But we’re also starting from a low point in consumer demand. Metals factories, for instance, are at best operating at 50-60% capacity, officials told us this week, so the impact of rising global metals prices has been muted.

The risk could push the government to move harder on hedging — particularly with wheat. The government is currently considering hedging against rising wheat prices. As the world’s biggest importer of wheat, Egypt’s budget is heavily exposed to the ongoing rally that has seen wheat prices increase more than 40% from lows witnessed in March to USD 207 per tonne on 1 March. Traders will be eyeing state grain buyer GASC’s Wednesday’s tender, where it will look to buy 55-60k mn tonnes of wheat for delivery in mid-April, global commodities tracker Agricensus reports (paywall)

How should the CBE react? The central bank’s Monetary Policy Committee will meet on Thursday, 18 March, to decide on interest rates. Most analysts we spoke with this week feel that the CBE will leave interest rates on hold in anticipation of a rise in inflation. “While inflation numbers support a 25-50 bps cut in rates, the rise in US Treasury yields and the risk for EM portfolio exits might prompt the MPC to leave rates unchanged,” Pharos’ head of research Radwa El Swaify said.

So far, we don’t have to worry about an exodus: Foreign holdings of Egyptian debt recovered to exceed their pre-covid level, rising to USD 29 bn at the end of last month. Real rates on EGP bonds — or the yield adjusted for inflation — remain among the highest in the world, Pharos’ Radwa El Swaify told us, adding that “we’re relatively immune” to higher treasury yields. READ MORE on the impact of rising US bond yields on Egypt here.

Even managers shedding EM debt are holding on to Egypt, apparently. Loomis’ Emerging Markets Debt Blended Total Return fund, with USD 296.6 mn assets under management, has been selling local-currency notes from Russia and Indonesia. But it has retained its holdings of Egyptian debt among other positions, Bloomberg reports.

But even now, US yields appear to be stabilizing after a US Labor Department report out today said the consumer price index rose 0.4% in February, in line with expectations, after a 0.3% increase in January. US benchmark yields settled at around 1.5% after shooting to a one-year high above 1.6% last week, Reuters reports.

CALENDAR

March: Potential visit to Cairo by Russian President Vladimir Putin.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

11 March (Thursday): AmCham event featuring Oil Minister Tarek El Molla.

11-12 March (Thursday-Friday): Sudan’s Prime Minister Abdalla Hamdok will arrive for a two-day visit to follow up on GERD talks.

11-13 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

11-14 March (Thursday-Sunday): First edition of Afaq Real Estate Expo, Tolip El Galaa Hotel, Cairo, Egypt.

11-15 March (Thursday – Monday): Al Bazaar fair for handicrafts and house decors, Cairo International Conference Centre, Cairo, Egypt.

11-20 March (Thursday-Saturday): Photopia’s Cairo Photo Week 2021 will take place with this year’s theme being Depth OFF Field.

13-14 March (Saturday-Sunday): The Marketers League Conference will take place at Kundalini Grand Pyramids Hotel in Giza. This year’s theme is Beyond the Pandemic.

15 March (Monday): AmCham event featuring life coach Arfeen Khan.

16 March (Tuesday): AmCham webinar featuring business tech expert Patrick Schwerdtfeger. Non-members can register here.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

23 March (Tuesday): The British-Egyptian Business Association (BEBA) virtual conference on sustainable manufacturing in Africa.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

29-30 March (Monday-Tuesday): Arab Federation of Exchanges Annual Conference 2021.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

31 March (Wednesday): Income tax deadline for individuals. Real estate tax deadline.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.