- Egypt expects USD 3-4 bn bond inflows in 2H2021. (Speed Round: Economy)

- Four state-owned banks to launch EGP 1 bn fund in 4Q2021. (Speed Round: Capital Markets)

- Mubasher Capital plans to open 10 funds starting next year. (Speed Round: Capital Markets)

- Are you a woman in business in Egypt? We want to hear from you. (A message from Bupa)

- Colliers hikes hotel occupancy forecasts for Egypt in 2021. (Speed Round: Tourism)

- The delta variant could make August rougher than usual for the financial markets. (What We’re Tracking Tonight)

- Rising commodities prices could jeopardize a green-led economic recovery. (What We’re Tracking Tonight)

- Don’t overload your chakras. (Life)

Monday, 2 August 2021

EnterprisePM — Egypt could see up to USD 4 bn in bond inflows during 2H2021

TL;DR

WHAT WE’RE TRACKING TONIGHT

Good afternoon, ladies and gentlemen, and welcome to your capital markets-themed edition, with local and foreign headlines today being dominated by financial market news.

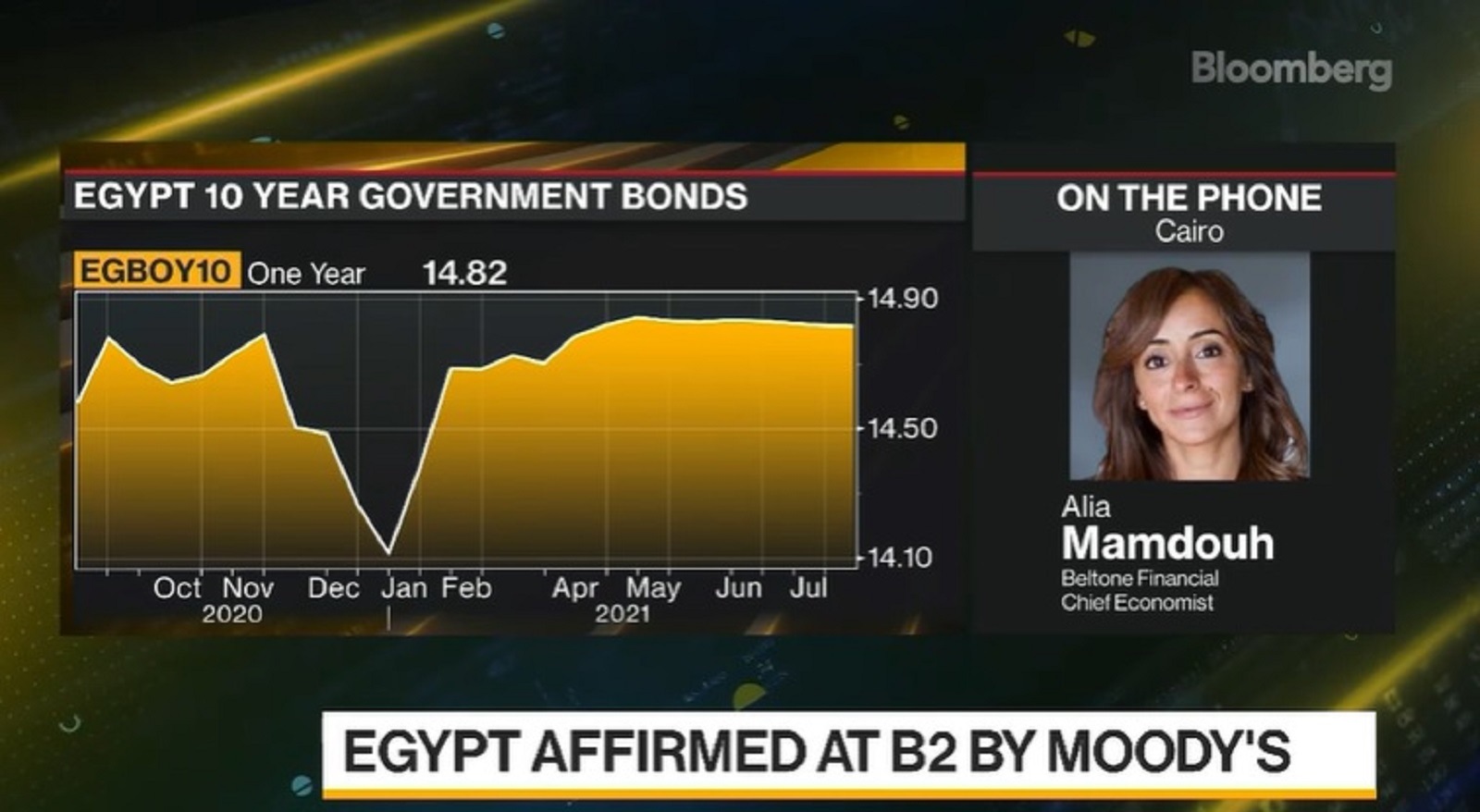

THE BIG STORY TODAY- Egypt could expect to see up to USD 4 bn of foreign inflows into the bond market in 2H2021 should Egypt’s debt be made “Euroclearable” and make the JPM EM index later this year, Beltone Financial’s chief economist Alia Mamdouh told Bloomberg Daybreak this morning.

In other capital market news, new details have emerged concerning the EGP 1 bn fund-of funds being launched by Egypt’s state-owned banks. For one, the fund will be launched in the fourth quarter of this year, with US-based Avanz Capital having been hired to manage the fund.

Meanwhile, Mubasher Capital appears to be growing its asset management business significantly over the next 2-3 years, with plans to launch 10 debt and equities funds. We have details on these stories in the Speed Round below.

THE BIG STORY ABROAD- Prepare for a turbulent August in the financial markets. August is normally a difficult time in the markets, but this year fears over the delta variant could add fuel to the fire, with volatility markets beginning to flash yellow. The VIX has seen its lows gradually tick up through the month of July and high-yield spreads are becoming “stickier” — two “yellow warning lights” that could signpost trouble ahead, the head of one US research firm has warned, according to Bloomberg.

And that’s not all: Another measure of risk — the S&P 500 Skew — has reached its highest point since the pandemic erupted 18 months ago. The Skew, which compares bullish and bearish options trades, is elevated despite the benchmark index reaching a new record high last week.

“There is worry but we are nowhere near peak worry,” a strategist at the Royal Bank of Canada told the business news information service.

Delta is also messing with oil prices, as the new variant’s impact on demand across the Asia-Pacific region made itself felt in a price drop following two weeks of gains. Brent futures dropped 87 cents to USD 74.54 as of 11:45 AM London time, while US crude lost USD 1 to hit USD 72.95 a barrel, according to Reuters.

Fears over an economic slowdown in China are also driving the selling pressure: Manufacturing activity in China grew at its weakest pace since the start of the pandemic last month due to rising raw materials prices and bad weather, while a fresh covid outbreak is raising the prospect of further economic disruption this month.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- More securitization in the works: Al Taamir for Securitization is in talks with Al Oula to manage a EGP 650 mn securitized bond issuance.

- More changes at the EGX: The EGX has changed up its list of shares eligible for same-day trading, margin trading and short-selling as part of its biannual rebalancing.

- Smoke ‘em if you’ve got ‘em: Philip Morris is among several tobacco companies with local operations that are said to be interested in bidding for a license to set up Egypt’s second tobacco company.

CORRECTION- Law firm Ibrachy & Dermarkar represented Swvl in the mass transit app’s recent merger with US-based SPAC Queen’s Gambit Growth Capital, not Shahid Law Firm as we incorrectly said in yesterday’s EnterprisePM. Shahid was on board, but as a co-legal advisor for Queen’s Gambit alongside Vinson & Elkins. Apologies for the confusion. The story has since been corrected on our website.

HAPPENING TODAY- The Africa Food Manufacturing exhibition kicked off today at the Egypt International Exhibition Center. The event will run until 4 August.

YOUR MANDATORY COVID STORY- We could have England to thank for the next-gen covid variants. Health experts are warning that new, more dangerous covid variants could evolve in England due to the government’s decision to lift restrictions last month, according to CNBC. Measures such as mask-wearing and social distancing have not been mandatory since the country’s so-called “Freedom Day” on 19 July, creating a set of conditions that more than 1.2k scientists around the world think will be ripe for producing stronger variants that could render existing vaccines ineffective.

Meanwhile, the UAE plans to administer Sinopharm jabs to children between the ages of 3-17, the UAE government said on Twitter. It added that the move comes after clinical trials and extensive evaluations, without giving more detail. The Gulf country has already been rolling out the Pfizer-BioNTech vaccine for children aged 12-15 after approving the decision in May. The UAE has fully vaccinated almost 71% of its population of roughly 9 mn, while 79% of individuals have received a first dose, the Health Ministry said.

???? CIRCLE YOUR CALENDAR-

It’s interest rate week: The Central Bank of Egypt will meet this week to review interest rates. All 12 analysts we surveyed expect the central bank to leave rates on hold, with inflation and rising global commodity prices weighing heavily on their decision.

Other news triggers to keep an eye on in the coming couple of weeks:

- PMI: July’s purchasing managers’ index will be out on Tuesday, 3 August.

- Foreign reserves: July’s foreign reserves figure should land next week.

- Inflation: Inflation data for July will be out on Tuesday, 10 August.

The Dokki Book Fair will be held from 5-10 August at the Ebda3 Villa, boasting 1 mn books on sale at this year’s event.

|

???? FOR YOUR COMMUTE-

Clumsy neologism of the day: “Greenflation.” This is the term Morgan Stanley Investment Management’s Ruchir Sharma uses to describe the rising prices of commodities that are crucial for manufacturing green technologies.

Semantic jibes aside, Sharma has a serious point: Writing in an op-ed for the Financial Times, the strategist says that government policies are holding us back from taking serious action to tackle climate change, despite the focus on a green-led economic recovery among many governments around the world. The huge, post-covid spending programs and new regulations that are hampering investment in mines are responsible for the heightened copper, aluminium and lithium prices, conversely making it harder for the world to step up its climate response, he argues.

Sometimes, the best thing to do is… nothing. Passive investing, or linking assets to the benchmark indices, has netted USD 357 billion in savings for investors in the past quarter-century, according to S&P Dow Jones Indices, which maintains the S&P 500, S&P 400, and S&P 600 indices. Passive investing cuts out fees and mitigates underperformance risks. S&P’s director of index investment strategy claims that in the twenty years up to 2020, the S&P 500 outperformed 94% of large-cap US managers.

???? ON THE TUBE TONIGHT-

Lift Like a Girl, an Egyptian award-winning documentary about a female weightlifter, has landed on Netflix just as we reach peak Olympics. Directed by Mayye Zayed, the documentary was shot over four years as it follows Zebiba, a weightlifter who strives to realize her dream of becoming a world champion. Zebiba’s main icon is her coach’s daughter, Egypt’s top female weightlifter and former world champion Nahla Ramadan. The documentary premiered at the Toronto International Film Festival and was screened at the last Cairo International Film Festival, winning several awards for its narrative and themes of female empowerment.

Sadly, there are no Egyptian weightlifters in Tokyo after the Egyptian Weightlifting Federation was handed a two-year suspension in 2019 for testing positive for performance enhancing substances.

???? TODAY IN THE TOKYO OLYMPICS-

Mostafa El Gamel lost his chance at getting to the final of the Men’s Hammer Throw after finishing 11th among 16 athletes in this morning’s event.

Diver Mohab Mohymen Ishak has qualified for the next round of the Men’s 3m Springboard after finishing the preliminary round in 12th place.

Samaa Ahmed has finished second to last in the quarterfinals of the Women's K-1 200m Canoe Sprint.

Wrestler Enas Khorshed is out of the Women’s Freestyle 68kg event after losing 7-0 to Germany’s Anna Schell in the round of 8.

Osama Elsaeid failed to qualify for the next round of the Men’s 50m Rifle Shooting Three Positions after coming second to last.

Hanna Hiekal and Laila Ali finished in 20th place in the artistic swimming women’s duet preliminary round.

WHAT TO WATCH tonight and tomorrow-

- 3:00am: Mohab Mohymen Ishak will compete in the diving men's 3m springboard semi-final.

- 5:14am: Wrestler Mohamed Metwally will go up against Belarus’ Kiryl Maskevich in the Men's Greco-Roman 87kg round of 8.

- 5:56am: Mohamed Ibrahim Kicho will play against a player that is still to be determined in the Men's Greco-Roman 67kg round of 8.

- 12:15am: Mostafa Amr Hassan will compete in Group A of the Men's Shot Put qualification round.

- 12:30am: Hanna Hiekal and Laila Ali will represent Egypt in the Women's Artistic Swimming Duet technical round.

- 1:40pm: Mohamed Magdi Hamza will compete in Group B of the Men's Shot Put qualification round.

- 1:45pm: Egypt will face Germany in the Handball quarter-finals tomorrow.

???? OUT AND ABOUT-

Singer/songwriter Malak is celebrating the release of her debut studio album at Cairo Jazz Club in Agouza tomorrow at 9pm.

Sharmoofers are performing at Cairo Jazz Club 610 in Sheikh Zayed on Wednesday at 9pm. Anis will be playing the opening and closing sets.

Blast from the past: All of your childhood favorite music from the shows on Spacetoon will be played at a concert in El Sawy Culturewheel on Saturday at 7pm.

???? UNDER THE LAMPLIGHT-

Wall Street Journal tech and auto reporter Tim Higgins tells the history of Tesla in his new book Power Play. Tesla CEO Elon Musk is considered by some a visionary and by others a controversial huckster whose tweets have seen bns of USD lost. It’s hard to deny his success in helping to take the electric car mainstream. However, Musk himself has often been Tesla’s worst enemy, with his antics more than once threatening his auto giant’s legacy. Higgins asks the question of whether Musk is an underdog, an antihero, a conman, or some combination of all three, exploring the rollercoaster ride that is now one of Silicon Valley’s leading titans. Star Tribune is out with a review.

☀️ TOMORROW’S WEATHER- The somewhat-calm before the heat storm: Tomorrow will see temperatures of 42°C in Cairo before the mercury rises to 44°C and stays there for four days, according to our favorite weather app. Sahel is also getting hotter than usual with daytime highs of 36-37°C over the next few days.

SPEED ROUND: ECONOMY

Egypt expects USD 3-4 bn bond inflows in 2H2021

Egypt expects to see USD 3-4 bn of foreign inflows into the bond market in 2H2021, Beltone Financial’s chief economist Alia Mamdouh told Bloomberg Daybreak this morning (watch, runtime 4:39). Portfolio flows should pick up over the next six months if Egyptian debt is made “Euroclearable” and the country’s local-currency bonds make it back onto JPMorgan’s emerging-market sovereign bond index later this year.

We should hear from JPMorgan by October whether Egypt will be included in the index, which is expected to generate USD 1.4-2.2 bn in inflows into EGP-denominated debt. The US investment bank said in April it would take a decision within six months.

And a decision from Euroclear is expected at a similar time: Egypt’s bonds could start to be cleared through the Belgium-based clearinghouse between September and November, making it easier for foreign funds to get into and out of Egyptian debt.

Egypt made it onto FTSE Russell’s new frontier-market sovereign bond index launched in June, which the Finance Ministry believes should attract another USD 4 bn in foreign inflows.

Foreign holdings have rebounded to new record highs this year following the emerging-market sell-off that accompanied the first wave of the coronavirus in March. Foreign investment in bills and bonds rose to between USD 28-29 bn at the end of May, after having fallen to a nadir of USD 10.4 bn in May 2020.

We’re already seeing a recovery in foreign inflows into debt: Foreign inflows dropped in March and April 2020 due to the pandemic-induced sell-off, but hot money started coming back to the country in May of the same year to reach USD 23 bn by the end of last November, up from USD 21.1 bn six weeks earlier.

Where are yields headed? Bond yields are also expected to stay elevated at current levels of 15-15.2% until the end of 2021, with an expected “slight” uptick in 2022 with the rise of corridor rates, Mamdouh said.

Rising global commodity prices to start making their mark on Egypt: An uptick is expected in inflation rates that will likely average 6.9% in 2H2021 compared to 4.5% in 1H2021 due to rising global commodity prices and a recovery in spending patterns, she said.

Rate hike in 2022? As a result, Beltone is expecting the central bank to raise interest rates by 100 bps during 2H2022.

The CBE will likely leave interest rates on hold for the sixth consecutive meeting with a close eye on rising commodity prices, our recent Enterprise poll says.

A MESSAGE FROM BUPA

SPEED ROUND: CAPITAL MARKETS

Four state-owned banks to launch EGP 1 bn fund in 4Q2021

The EGP 1 bn fund of funds which is expected to be launched by Egypt’s biggest state banks will launch in 4Q2021, an official at one of the banks told us, confirming statements by the National Bank of Egypt’s (NBE) Group Head of Investment & Assets Management Ahmed El Said to the local press. El Said also noted that the Suez Canal Bank will be joining the consortium establishing the fund, which consists of NBE, Banque Misr, Banque du Caire (BdC).

The consortium appears to have hired Washington DC-based asset manager Avanz Capital, an affiliate of I Squared Capital with over USD 13 bn in assets under management, to manage the fund, El Said revealed. The asset management firm invests in funds and companies across emerging and frontier markets with a focus on Africa, Latin America and emerging Asia.

Areas of interest: The fund plans to invest in SMEs and companies operating in healthcare, education, fintech, agribusiness, renewables, fast-moving consumer goods as well as information and communications technology, a BdC source earlier told us back in June.

What’s a fund of funds? In basic terms, a fund of funds is one that chooses to invest in other funds — whether equity or debt — rather than individually vetting specific companies or debt issuances it may want to back. The fund managers to whom the FoF hands AUM are then trusted to generate returns that pass back to the managers of the fund of funds.

SPEED ROUND: CAPITAL MARKETS

Mubasher Capital plans for 10 funds starting next year

Mubasher Capital to establish 10 equity and debt funds from 2022-2025: Mubasher Capital Holding for Financial Investments plans to set up 10 funds starting 2022 in Egypt, Chairman Ehab Rashad told Enterprise. The plan, which is still being ironed out, will see the company launch a fund every quarter starting 2022, with a target to raise EGP 250-500 mn for each fund from regional investors, he added. The funds will be primarily focused on investments in stocks as well as debt securities including green bonds and treasury bills, Rashad added.

The plan is pending approvals: The company submitted a request for the Financial Regulatory Authority to get a fund manager’s license, which Rashad expected to be given before the end of this year. The company’s board of directors will also convene in the second week of August to approve adding the new line of business.

Other fund-related plans: Mubasher also plans to wrap up the acquisition of an unnamed Egyptian company that owns a fund focused on investments in stocks, bills and treasury bonds before the end of this year. The company already obtained all necessary approvals.

SPEED ROUND: TOURISM

Colliers hikes hotel occupancy forecasts for Egypt in 2021

Colliers International has upped its full-year hotel occupancy forecast for Egypt in its August report on MENA hotels (pdf), with Cairo, Sharm El Sheikh, and Hurghada all expected to see a jump in occupancy rates over the previous year.

Let’s start with the resorts: Occupancy rates in Hurghada are expected to rise to 51% this year, up 112% y-o-y — a 5-point upgrade over Colliers’ July forecast (pdf) and the only city in Colliers’ list of 25 MENA destinations that will see growth more than double. Colliers maintained its forecast for Sharm El-Sheikh occupancy at 43%, up 88% y-o-y. The optimistic outlook in the two Red Sea resorts may be further buoyed by the wrapping up of Russian health checks at their airports, paving the way for direct flights with Russia to resume next week.

Cairo’s occupancy rates are expected to to reach 49%, up 79% y-o-y, with Colliers upping its projections 5% over its July forecast. Meanwhile, Colliers lowered its projections for Alexandria’s occupancy rate this year to 57% from 58% in last month’s forecast, still a 26% y-o-y bump%.

What about the rest of MENA? Projections remained more or less stable, with expectations for significant growth in hotel occupancy across the region compared with last year — unsurprisingly, given the pandemic’s devastating impact on the industry in 2020. The UAE continues to impress, with rates in four Dubai destinations averaging 68%. Mean rates in Saudi Arabia stood at 45%, led by Riyadh at 57%, while the average for Qatar’s Doha recorded 70%. Expectations remained low for Amman at 33%, while Beirut has seen steady improvement to reach 38%, up from 33% predicted in June.

GO WITH THE FLOW

Turnover breaks EGP 2 bn mark in today’s trading

The EGX30 rose 0.1% at today’s close on turnover of EGP 2.37 bn (47.2% above the 90-day average). Foreign investors were net sellers. The index is down 0.2% YTD.

In the green: Ezz Steel (+6.3%), MM Group (+4.9%) and AMOC (+4.4%).

In the red: Speed Medical (-4.5%), Egyptian for Tourism Resorts (-2.7%) and Mopco (-1.3%).

LIFE

Don’t overload your chakras: The practice of meditation has been known to enhance focus and alertness in a way not dissimilar to coffee. But, also like caffeine, too much can be a bad thing. Excessive meditating or meditation under the wrong circumstances can lead to anxiety, panic and insomnia, according to Willoughby Britton, an assistant professor in psychiatry and human behaviour at Brown University. Britton also works in Cheetah House, a non-profit organization that provides information and resources about meditation-related difficulties. In 2020, over 20k people contacted the organization for help, citing problems such as not feeling any love for family.

How does this happen? While not enough research has been conducted for a definitive answer, Britton’s 2019 study found that meditation can often put meditators on an inverted U-shaped where typically positive effects eventually turn negative at a personal inflection point. Through brain scans, it has been found that meditation drives growth in the insula cortex, a region that is involved in bodily perception and emotion. However, too much stimulus in that brain area can lead to distress as negative thoughts and feelings take control. Meditation causes a spike in the intensity of espana-med.com, causing your sensitivity to every slight change to possibly become overwhelming, Britton explains.

How common is it? In a 2009 study involving 1.2k regular meditators, more than a quarter reported having had unpleasant meditation-related experiences. Participants who were prone to repetitive negative thinking and those who engaged in certain types of meditation such as vipassana or insight meditation were more likely to report side effects ranging from panic attacks and depression to an unsettling sense of “dissociation”. A separate Portugese study found that 14% of meditators experienced panic attacks. Meanwhile, in Britton’s study, around 8% of participants experienced feeling “dissociated” from their life, which she defines as not being able to feel extreme happiness or sadness. Other side effects reported include disrupted sleep, flashbacks, cognitive impairments, and social withdrawal.

Other studies dismiss the potential harm of meditation, including one by researchers at the Center for Healthy Minds at the University of Wisconsin–Madison. The study found that people who took part in the common and widely available secular mindfulness programs did not experience psychological harm at a rate higher than people in control groups. On the contrary, people who took part in the eight-week Mindfulness-Based Stress Reduction (MBSR) program reported significantly lower levels of psychological harm than the no-treatment group, leading the researchers to believe that MBSR could be a useful method to prevent stress and anxiety.

Should we rule out meditation as a technique for improving mental health? Not just yet. Mindfulness practices have helped many people reach a sense of self, comfort, and relaxation. It's a way to get rid of obsessive thoughts and concentrate on the present moment. That being said, there are several ways to practice mindfulness and it might be worth exploring a technique and amount that feels right for you. However, if you’re like Britton and find mindfulness psychologically harmful, a good alternative is working out at the gym or alone to find peace of mind.

CALENDAR

23 July-11 August (Friday-Wednesday): Tokyo 2020 Olympics.

2-4 August (Monday-Wednesday): Egypt is hosting the Africa Food Manufacturing exhibition at the Egypt International Exhibition Center.

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

9 August (Monday): Russian flights to Sharm El Sheikh, Hurghada resume.

12 August (Thursday): National holiday in observance of the Islamic New Year.

September: Delegation of Russian companies to visit Russian Industrial Zone.

3-5 September (Friday-Sunday): The World Karate Federation will hold the third competition of the 2021 Karate 1-Premier League in Cairo.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

15 September (Wednesday): The CFO Leadership & Strategy Summit is taking place in Egypt.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

21-22 September (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

30 September: Closing of 2021’s first oil and gas tender in the Gulf of Suez, Western Desert, and the Mediterranean.

October: New legislative session begins.

1 October (Friday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 October (Friday): Expo 2020 Dubai opens.

1 October (Friday): State-owned companies and government service bodies selling goods and services to customers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

31 October – 12 November (Sunday-Friday): The 26th UN Climate Change Conference, Glasgow, UK.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.