- FinMin says it could tap bond market three more times this fiscal year. (Speed Round)

- House wants the Madbouly gov’t to conjure up a debt relief program for struggling manufacturers. (Speed Round)

- CBE outlines how it will will guarantee participating banks reasonable margin on EGP 150 bn industrial, mortgage lending programs. (Speed Round)

- Saudi Arabia’s Alameriah plans to invest EGP 15 bn in New Alamein. (Speed Round)

- Peugeot is latest auto manufacturer saying it may be interested in assembling cars in Egypt. (Speed Round)

- Egypt is a top-growing tourism market in the MENA region this year, say operators. (Speed Round)

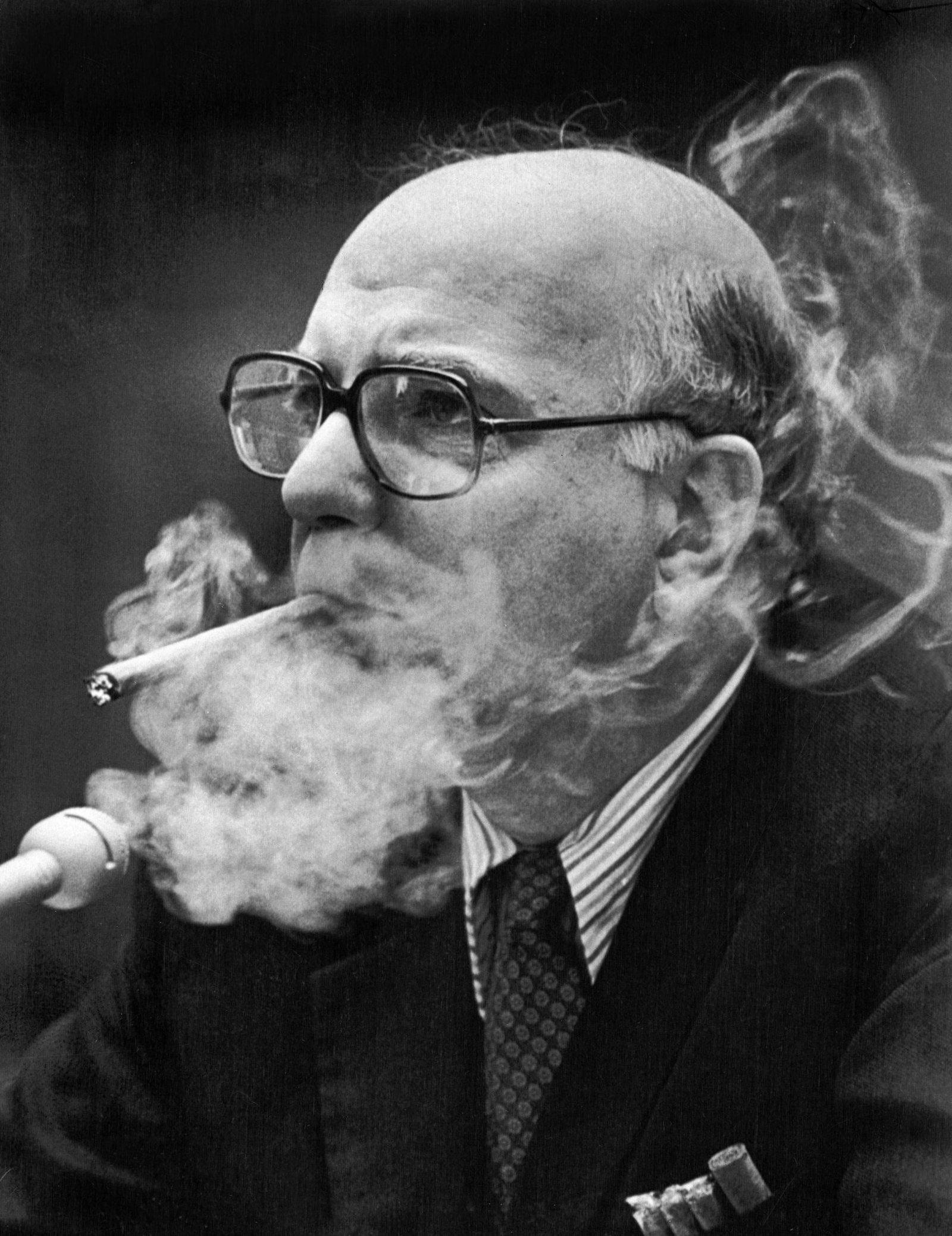

- Paul Volcker, former US Fed chairman who helped create the modern role of central bank governor, passes away at 92. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 10 December 2019

CBE makes clear how it will guarantee margin on subsidized loan program.

Plus: FinMin could tap bond markets three more times this FY

TL;DR

What We’re Tracking Today

It’s another day in which the House dominates the nation’s news agenda, but there’s still no sign of the much-awaited cabinet shuffle. Pundits in the nation’s capital now say it’s today or after the World Youth Forum, which gets underway this weekend and ends a week from today.

A Lebanese business delegation is in Egypt to talk public-private sector cooperation as part of regular meetings organized by the Egyptian Lebanese Businessmen Association, according to Al Shorouk.

Rameda Pharma shares make their EGX debut tomorrow, trading under the ticker RMDA.

Also making its trading debut tomorrow: Saudi Aramco, where Bloomberg argues that policymakers have gone to great lengths to ensure the shares have a strong debut. Look for “a lot” of the proceeds from the transaction to be deployed locally, the business information service suggests.

The US Federal Reserve will tomorrow wrap up its final meeting of 2019. Given Fed chair Jay Powell’s statements last month, it’s pretty much a dead cert that interest rates will remain unchanged at 1.5%-1.75% heading into 2020.

Speaking of the Fed:

The story of the morning in the global business press: The man who in many ways invented the modern role of the central bank governor has died. Paul Volcker, who led the US Fed in the ‘70s and ‘80s, was 92. Volcker’s time at the helm of the US central bank is most widely known for successfully addressing runaway inflation that coincided with a period of economic stagnation. Perhaps most importantly, Volcker, who “personified the idea of doing something politically unpopular but economically necessary” helped cement the notion of a politically independent central bank in modern times, the New York Times says. “He became one of the most unpopular Fed chairmen in history for pushing interest rates as high as 20% to break the soaring inflation that consumed the US economy in the 1970s. But his actions succeeded in bringing [down] inflation, making Mr. Volcker one of the most successful central bankers in history,” the Wall Street Journal says in an obit.

Volker, a fly-fishing enthusiast, had a long career as a public servant, most recently coming out of retirement in his 80s to advise then-US president Barack Obama. But he made more in one day in the 1990s than he did in 30 earlier years of service when the investment bank he had helmed was bought out. Check out additional obits in the Financial Times and Bloomberg.

Is Trump about to curb stomp the WTO? The press is all but signing the death warrant for the World Trade Organization this morning as the US looks set to veto the appointment of judges to its dispute settlement body. The move would effectively cripple the appeals body, which is responsible for adjudicating country-to-country disputes. The Financial Times warns of “serious damage” to the global trading system, the Wall Street Journal says the US is “threatening the global body’s survival,” while a headline in the Nation literally reads “RIP, World Trade Organization?”

Assets held by ETFs may be surging, but investors are pulling out record amounts of cash: Outflows from US-equity focused mutuals and exchange-traded funds have reached a record USD 135.5 bn this year, the Wall Street Journal reports, citing Refinitiv data. Analysts say that the deterioration of US-China trade relations and concerns over a possible US recession has driven investors to exit equity funds and move into bonds and money-market funds.

The robots are coming for the millenials: The impact of workplace automation needs to be spread more evenly among generations, or younger members of the workforce who don’t have employment protections risk becoming alienated, argues Ferdinando Giugliano in Bloomberg. Read that alongside this piece from the Wall Street Journal out overnight, which argues that US factories are now demanding white-collar education for blue-collar work, suggesting that within three years, more US manufacturing workers will have college degrees than not.

Bloomberg is out with a profile of Khaldoon Al Mubarak: Mubadala CEO, Manchester City chairman, and special envoy to China.

Predictions for 2020 are rolling in:

- The optimists: UBS Global Wealth Management sees the global economy finally recovering from the slowdown in 2H2020. UBS is hanging its prediction on the notion that a) the US and China will; put aside their differences and reaching a meaningful trade accord, and b) that this year’s swell of monetary stimulus will be successful in supporting growth. (CNBC)

- The pessimists: Saxo Bank’s chief economist Steen Jakobsen says that monetary easing will increase inequality across “society as a whole” over the coming 12 months, and suggests that oil and gas companies will continue to account for the bulk of energy investment given the comparatively low returns offered by renewables. (CNBC)

International news worth knowing:

India plans to make it nearly impossible for Muslims to become citizens, the New York Times reports, and the move comes at the same time as business leaders are showing signs of breaking ranks with the government amid economic strains, according to the Financial Times.

Officials from the US, Canada and Mexico will meet in Mexico City today to hammer out final changes to a “languishing” North American trade pact, Reuters notes.

The world’s youngest serving prime minister is now from Finland. Sanna Marin, 34, was previously her coalition government’s transportation minister. (CBC)

Setback in the race to find a Lebanese PM: Lebanon’s main candidate to replace Saad Hariri as prime minister, Samir Khatib, has said he is dropping his bid after facing opposition from the Sunni community, the Associated Press reports.

*** Entertainment for your morning commute: The trailer for the next Ghostbusters movie (coming summer 2020), which the resident 12-year-old declares looks “awesome” (watch, runtime: 2:34). The flick stars Paul Rudd and one of the kids from Stranger Things.

Help choosing your next binge: The full list of Golden Globe nominees is out now, and streaming services from Apple TV+ (The Morning Show) to Netflix (The Irishman) dominated.

Enterprise+: Last Night’s Talk Shows

Our roundup of last night’s talk shows is off today, but will be back as of tomorrow morning. The wicked do need to rest on occasion.

Speed Round

Speed Round is presented in association with

The Finance Ministry is considering tapping bond markets three more times before the end of the current fiscal year, Finance Minister Mohamed Maait said yesterday, according to the local press. The offerings could be made up of sukuk, green bonds and variable-rate bonds, he said, without disclosing a target figure. The minister said in September that the government plans to issue USD 3-7 bn in international bonds during the current fiscal year, USD 2 bn of which was sold to investors in a eurobond issuance in November. A government official told Enterprise earlier this year that the ministry could offer up to USD 1.5 bn in sukuk in early 2020.

The House Industrial Committee is calling for the Madbouly government to conjure up a debt relief program for struggling manufacturers, with one proposal calling for policymakers to forgive fines on unpaid taxes. The committee argues that the government should forgive fines charged on unpaid corporate income tax, real estate tax, and stamp tax payments to support the industrial manufacturing sector, which is struggling amid rising energy and raw material costs, committee member Samir El Bateekhy said, according to Al Mal.

Paper industry says it’s specifically vulnerable: The committee singled out the need to assist paper manufacturers, which have been struggling amid high energy prices, high customs and tax rates, and the challenge posed by cheaper imported products. A number of paper companies attended the meeting to lobby for the introduction of a 30% import tariff and new restrictions that limit imported paper to newsprint.

Trade Minister Amr Nassar refused to impose the tariff, saying at the meeting that to do so would see Egypt run afoul of the World Trade Organization. Nassar did say he would look at cutting the price of natural gas and other essential production inputs — cost inputs over which his ministry does not have direct control.

Committee to consult Oil Ministry on gas prices: The committee also invited Oil Minister Tarek El Molla to another meeting at a later time to discuss further natural gas price reductions for industry, after the government began heeding lobbying efforts by factories.

You need to consider this story in the context of the recently-announced subsidized loan initiative: Debt relief could help highly-leveraged manufacturers clean up and access a EGP 100 bn initiative launched by the government and central bank last week to allow medium-sized factories to access subsidized loans at a declining 10% interest rate.

CBE breaks down how it will compensate bank lending under EGP 150 bn industrial, mortgage programs: The Central Bank of Egypt (CBE) will ensure banks have at least 200 bps of margin when they loan out to factories and homebuyers under the two subsidized lending initiatives it recently launched with the government, Deputy Governor Gamal Negm said at a presser to announce the fine points of the programs, according to Hapi Journal.

How it will work: The central bank will cover the difference between the 10% subsidized rate offered to borrowers and what is currently the 12.75% discount rate — and then give banks an extra 2%. Banks will therefore effectively be lending at 14.75% (with interest rates where they are today), making their participation in the program commercially feasible.

Refresher on the initiatives: The government and the CBE announced last week a EGP 100 bn initiative to boost manufacturing by allowing medium-sized factories with annual sales revenues of less than EGP 1 bn to access subsidized loans at a declining 10% interest rate. A separate initiative will allow middle-income homebuyers access to EGP 50 bn in subsidized mortgages at a preferential 10% interest rate. The funds will be channeled through state-affiliated banks which the government either fully owns or in which it holds a stake.

The first initiative will be restricted to privately-owned factories with sales between EGP 50 mn and EGP 1 bn. It will prioritize manufacturers aiming to raise working capital or fund capital expenditure, Negm was quoted as saying. Qualified companies which exceed the EGP 1 bn mark during the lifespan of the loan will retain the preferential rates, he added.

On the mortgage program: Middle-income homebuyers will be classified under the second initiative as those earning between EGP 4.2k-40k for individuals and EGP 4.7k-50k for households. Subsidized mortgages will be offered on homes of up to 150 sqm and a maximum value of EGP 2.25 mn, Negm said. The properties also need to have not been beneficiaries of previous subsidized mortgage programs. Mortgage lenders will also be eligible to participate in the program alongside banks.

Negm optimistic on Egypt trade balance: The deputy governor has predicted that Egypt will achieve a USD 50 bn trade surplus by 2030, Youm7 quoted him as saying. Exports could increase to as high as USD 200 bn over the coming decade, rising at a faster rate than imports, which are projected to reach USD 150 bn, according to Negm. Negm says that the industrial lending initiative will be crucial to achieving this target as it could increase the sector’s contribution to GDP to 24% from 16.5% in as little as six months. This ambitious target would mean that exports would need to grow at a 17.39% compound annual rate. In FY2018-2019, the central bank’s balance of payments report (pdf) recorded a trade deficit of c. USD 38 bn, with exports coming at USD 28.5 bn and imports at USD 66.5 bn.

The Export Subsidy Fund plans to disburse 40% of total overdue subsidies before mid-2020, head of the Textile Export Council Magdy Tolba said, according to Al Mal. A total of 370 companies are currently owed export subsidies. The fund signed nine agreements last week to settle EGP 1.4 bn-worth of overdue subsidies, according to Vice Minister of Finance Ahmed Kouchouk.

Background: Exporters are owed bns of overdue subsidies under the old subsidies framework. Settlements of the overdue payments have reportedly been moving forward since last September, in tandem with the launch of a new EGP 6 bn framework the Madbouly government had approved in June. The executive regulations for the new program were out last week and prompted backlash from industry, which had objections to the mechanism through which the annual allocations would be paid out. Exporters are also concerned about how the fund plans to settle away bns in back due subsidies. Export councils were reportedly due to sit down yesterday with Export Subsidy Fund boss Amany El Wassal to discuss the fine points of implementing the framework.

INVESTMENT WATCH- Alameriah Investment Company is “gearing up” to invest EGP 15 bn in New Alamein City, Chairman Bandar Al Ameri said during a meeting between the Egyptian-Saudi Business Council and Prime Minister Moustafa Madbouly, according to a cabinet statement. Al Ameri told Madbouly he exited his investments in other countries in favor of bringing his business to Egypt, where he sees a promising investment climate.

The council also looked at investment prospects offered by Egypt’s SWF: Planning Minister Hala El Said discussed investment prospects offered by Egypt’s new sovereign wealth fund with representatives from the Egyptian-Saudi Business Council, according to a separate statement. The fund, which officially launched last month, wants to collaborate with other countries in the region, with its CEO, Ayman Soliman, scheduled to kick off a roadshow in the GCC early next month. The SWF has already established a USD 20 bn joint investment fund with the UAE, and is in talks with the Oman Investment Fund over a similar venture.

Cairo Poultry Company plans to invest EGP 1 bn in the sector over the coming 3-5 years if it finds prospects in line with its expansion strategy, Managing Director Adel El Alfy tells Al Mal. The company is looking to expand its business through either acquiring existing players in the industry or setting up new chicken farms, which would be financed at a 50-50 debt-to-equity ratio, El Afly said. Cairo Poultry is publicly traded on the EGX, and has a market capitalization of almost EGP 2.2 bn.

Peugeot is mulling assembling some of its car models to Egypt and is currently looking at several existing factories it could use, unnamed sources familiar with the matter tell the local press. The sources did not disclose which facilities are being looked at, or the expected investment value and timeline for the potential move.

The French company would be the latest international automotive manufacturers to say it is looking to assemble cars in Egypt after the government began talking up a package of incentives to automakers designed to spur domestic automotive manufacturing and assembly. The incentives, which include customs breaks, were expected to be implemented in October through amendments to the Customs Act, but have yet to see the light of day.

Who else is interested? Mercedes-Benz is preparing to return to local assembly again as soon as early next year, and Korean automaker Kia has announced plans to assemble 15,000 cars annually locally. Germany’s Volkswagen is negotiating to assemble natural gas-powered cars in the local market. The government also opened talks with a number of foreign automotive companies, including India’s Tata and Japan’s Nissan.

M&A WATCH- United Oil conditionally raises USD 6.3 mn to partially fund Rockhopper Egypt acquisition: Irish energy company United Oil & Gas has conditionally raised USD 6.3 mn to partially finance its planned USD 16 mn acquisition of Rockhopper Egypt’s business, United Oil said in an LSE disclosure. The company raised the amount through a share issuance, according to the statement. Rockhopper had said in October that the transaction — which would see United acquire a non-operating 22% interest in the onshore Abu Sennan oil concession, among other assets — is on track to be completed by the end of 4Q2019. The agreement “will be satisfied” once United makes a cash payment of at least USD 11 mn. BP had previously agreed to provide USD 8 mn to partially fund the acquisition after it entered an offtake agreement for United’s future oil and gas production.

M&A WATCH- Greek cement company Titan Group launched its mandatory tender offer (MTO) for 100% of Alexandria Portland Cement at EGP 6 per share, Alexandria Cement said in a bourse disclosure (pdf). Titan plans to delist Alexandria’s shares from the EGX after completing the transaction, according to the disclosure. The offer has yet to be reviewed and approved by the Financial Regulatory Authority, while the company has to hire a financial advisor.

Background: Titan had acquired Alexandria Cement’s parent company, Alexandria Development, which made it an indirect majority owner through a related party and therefore triggered an MTO requirement. The Financial Regulatory Authority had ordered the Greek company last month to present an MTO.

M&A WATCH- Reacap to acquire Naeem Consulting Services for EGP 47.45 mn: The Reacap Financial Investments board approved on Sunday plans to acquire Naeem Holding’s 98% stake in Naeem Consulting Services for EGP 47.45 mn, it said in a bourse disclosure (pdf). Shareholders will vote on the move during an ordinary general assembly on 30 December. Naeem Holding owns a 47.61% stake in Reacap.

INVESTMENT WATCH- Hani Sarie-Eldin’s private equity firm Union Capital is planning to launch its second SME-focused investment fund in 2020, Managing Director Minouche Abdel Meguid tells Al Mal. The new fund will be on the lookout to acquire stakes in small and medium-sized companies operating in the renewables, electric cars, mining, and logistics sectors, and draft up plans for those companies to encourage them to diversify their business and ownership base. Union’s first fund, which is currently approaching the end of its life cycle, was established in 2008 and had a portfolio of small and medium-sized manufacturers.

The Central Bank of Egypt (CBE) sold yesterday USD 1 bn in 1-year USD-denominated t-bills, official CBE data shows. The bills carry an average yield of 3.589%, rising slightly from 3.587% in the last similar auction in November, which saw Egypt sell USD 1.56 bn-worth of paper.

REGULATION WATCH- Market regulator looking to introduce solvency standards for NBFS: The Financial Regulatory Authority (FRA) is planning to introduce regulations to ensure non-banking financial services firms remain solvent, FRA boss Mohamed Omran said at a conference yesterday, according to Al Mal. Omran did not disclose further details on the forthcoming regulations, but noted that they are part of the market regulator’s plans for next year. The FRA had issued similar standards for leasing and factoring companies back in January.

Separately, Omran said the FRA will begin requiring EGX-listed companies to issue disclosures on how climate change is affecting their business, according to Al Mal. Again, no further details were announced.

REGULATION WATCH- The government is inviting ride-hailing companies to come in for a talk about the executive regulations of the Ride-Hailing Apps Act, Masrawy reported. The regulations were made official in September after winning cabinet approval and being published in the Official Gazette, and the meetings now taking place are about bringing the regulations into effect. They cover everything from registration to licensing, taxes and social insurance — stipulating that all licensed ride-hailing companies must show their drivers are meeting their social insurance payments in accordance with the law. The provisions also mandate that ride-sharing companies share their full data sets with the state.

Egypt — especially Sharm El Sheikh — is one of the top-growing tourism markets in the MENA region this year, Colliers International MENA senior manager James Wrenn tells Hotelier Middle East. Egypt saw 22.6% y-o-y revenue per available room (RevPAR) growth in 3Q2019, STR Global data showed. According to Colliers, the country’s total RevPAR growth for the whole of 2019 is expected to reach 30%, marking a huge leap compared to previous years.

Hotel operators plan expansions in Egypt: Marriott representative Alex Kyriakidis termed Egypt a key market, to which the hotel operator is planning to add four more hotels in five years. Hilton and InterContinental, likewise, have substantial growth plans, with the intention of increasing their presence in Egypt, where they plan to add 10 new hotels, and Morocco, where six new hotels are in the pipeline. The 41% y-o-y increase in the number of tourists visiting Egypt in 2018 is giving people within the industry increased confidence and a push to expand their presence, said Hilton vice president of operations for Egypt and North Africa Mohab Ghali.

Worth Listening

Karim Awad takes a deep dive into the building of EFG Hermes 3.0 in the third episode in the debut season of Making It, our podcast on how to build a great business in Egypt. The financial world can seem abstract and impenetrable to the uninitiated. But in the latest of Making It, we have an inside voice to give us the ins and outs. Karim Awad, CEO of EFG Hermes, began his career with the firm as an analyst, rising to become group CEO. Karim talked to us about 17-hour workdays, of always staying hungry for something bigger, and how he thinks of strategy.

*** Listen to the episode on: Our website | Apple Podcast | Google Podcast.

Egypt in the News

It’s another slow morning for Egypt in the foreign press, with only a couple of headlines to skim:

- What’s driving Egyptians to switching to dual-fuel vehicles? Besides the cheaper fuel, the government is subsidizing the cost of conversion for consumers and eyes converting 50,000 vehicles this fiscal year, jumping from just 6,000 conversions in FY2015-2016, Mahmoud Mourad writes Reuters.

- A feel-good story of overcoming obstacles: A blind man living in Shubra, determined not to let his disability stop him from earning a living repairing home appliances, is the subject of this photo essay by Voice of America.

Worth Reading

RiseUp and Egypt’s startup scene: As the seventh RiseUp Summit concluded with its Pitch by the Pyramids event seeing 15 startups from across the MENA region compete for thousands of USD of investment, Wamda’s Triska Hamid looks at the extent to which the growth of the summit reflects the development of Egypt’s entrepreneurship sector as a whole. This year, RiseUp drew over 8k attendees from 56 countries and was populated by innovative startups that demonstrate an understanding of their local market, Hamid says. As a result, sectors including healthtech, edtech and fintech are starting to thrive, Egyptian talent has become sought after by startups around the world, and even the thorny issues of access to capital and creating a friendlier regulatory environment are being seriously addressed by accelerators and the government.

Diplomacy + Foreign Trade

Egypt, Sudan, Ethiopia’s ministers outline roadmap for next round of GERD talks: The foreign and irrigation ministers of Egypt, Ethiopia, and Sudan agreed yesterday on a roadmap for the ongoing negotiations over the Grand Ethiopian Renaissance Dam (GERD) and the points that must be addressed to reach a mutual agreement, according to a Foreign Ministry statement. The ministers met in Washington for talks mediated by the US and World Bank and are next scheduled to meet in Sudan on 21 December.

The US is nudging things along: The three countries “agreed that the strategic direction of the next two technical meetings should be the development of technical rules and guidelines for the filling and operation of the [dam], the definition of drought conditions, and drought mitigation measures to be taken,” according to a US Treasury statement. The three countries have committed to reaching an agreement by 15 January 2020, which will mark the end of the fourth round of talks, scheduled to begin in Washington on 13 January.

Foreign Minister Sameh Shoukry also met with US Secretary of State Mike Pompeo yesterday to discuss the GERD talks ahead of the ministers’ meeting, that is otherwise scant on details.

Energy

Egypt and Saudi Arabia to sign electricity interconnection project by May 2020

Egypt and Saudi Arabia are due to complete signing all electricity interconnection project contracts by May 2020, head of the Egyptian Electricity Transmission Company Sabah Mashaly told the local press. She noted that a consultant has been selected to survey the route of the maritime cables, which had been changed by the Saudis to avoid conflict with their USD 500 bn Neom city megaproject. The new route is 25 km long up from the original 16 km, which raised the costs by 30%.

Egyptian parliament approves nine oil and gas E&P agreements

The House of Representatives approved yesterday nine oil and gas exploration and production agreements the Oil Ministry signed with international companies, according to Al Shorouk. The agreements cover several concession areas in the Mediterranean, the Nile Delta, and the Western Desert.

Basic Materials + Commodities

Egypt gives private sector first call at cotton bids next year

The government plans to have the private sector make the first bid for cotton in the coming season to attract increased private sector participation, Public Enterprises Minister Hisham Tawfik tells Masrawy. The government will also hand over organizing the new cotton auctioning mechanism to a new or existing company. The public auction system was trialed in Fayoum and Beni Suef this year, and proved controversial with private companies which complained about the high prices.

GASC to receive local rice starting March 2020

The Federation of Egyptian Industries’ industry division will begin supplying local rice to the General Authority for Supply Commodities starting from mid-March next year, Al Masry Al Youm reported.

Egypt plants a third of its wheat area so far this year -Agriculture Ministry official

Egypt has cultivated roughly a third of its wheat area — some 1 mn feddans out of a total of 3.5 mn feddans — so far this year, an Agriculture Ministry official told Reuters. The planting season began on 15 November and will continue until the end of this month. Last year, Egypt harvested 8.5 mn tonnes of domestic wheat from some 3.16 mn feddans.

Tourism

Dar Misr Development, Hilton to establish DoubleTree hotel in Ain Sokhna

Dar Misr Development and the Hilton International Hotel Management Group have announced plans to launch a DoubleTree hotel complex in Ain Sokhna, according to the local press. The hotel is scheduled to open in 2024 and will cost around EGP 400 mn.

Telecoms + ICT

Mariout Hills signs agreement to set up USD 11 mn tech park on Egypt’s north coast

Mariout Hills has signed an agreement with a Swiss-German consortium to set up a technology park specialized in software development in its sustainable Eco City on the north coast, Mariout Chairman Ahmed Hassan said. The park is expected to cost USD 11 mn and will target the European market, Hassan said.

Automotive + Transportation

Egypt to tender Cairo Metro Line 1 renovation contract in 1H2020

The National Authority for Tunnels (NAT) will issue a tender for the development of Cairo Metro Line 1 in 1H2020, NAT head Essam Waly said, according to Al Mal. NAT is still seeking funding for the project, which would include buying new trains and overhauling old ones to reduce overall commute time.

DP World Sokhna to become Egypt’s new capital’s main import terminal

DP World Sokhna signed a partnership agreement with the China State Construction Engineering Corporation (CSCEC) and the China Ocean Shipping Company Ltd (COSCO), to become the main terminal for construction material imported for the central business and financial district of the new administrative capital, according to Mubasher.

Banking + Finance

National Bank of Egypt seeks CBE's approval to establish a digital bank next year

The National Bank of Egypt is seeking approval from the Central Bank of Egypt to establish a digital bank in 2020, Deputy Chairman Yehia Aboul Fotouh said during a conference on Sunday, according to Masrawy.

Bank Audi to loan EGP 2 bn to SMEs to achieve 20% portfolio target

Bank Audi is planning to loan EGP 2 bn to small and medium-sized businesses by the end of next year to meet CBE targets portfolio targets, Managing Director Mohamed Bedeir told Al Mal. The CBE’s 5% SMEs lending initiative, which was launched in 2015, requires banks to increase the proportion of SME loans on their portfolios 20% by 2020. The bank’s outstanding loans to SMEs currently stands at EGP 3 bn.

Vitas Microfinance to extend EGP 300 mn loans to SMEs in 2020

Vitas Misr for Microfinance, a subsidiary of B Investments’ Ebtikar, is planning to extend EGP 300 mn in loans to SME clients next year, CEO Hossam Heiba tells Mubasher. The company is also in talks with four local banks for a EGP 200 mn loan, Heiba said.

Al Baraka Bank Egypt looks to acquire USD 400 mn loan from foreign lenders

Al Baraka Bank is in talks with foreign lenders for a USD 400 mn loan, CEO Ashraf El Ghamrawy tells Al Mal. The bank is negotiating with the Islamic Development Bank, World Bank, and the European Bank for Reconstruction and Development, and expects to acquire the funds next year.

Egypt Politics + Economics

Self-exiled dissident Mohamed Ali found guilty of tax evasion in Egypt

A criminal court has handed down a EGP 50k fine and five-year prison sentence to self-exiled contractor-turned-political dissident Mohamed Ali on charges of tax evasion, Al Masry Al Youm reports. The court said Ali evaded paying EGP 41 mn in taxes and falsified tax records. The finance minister had requested that the prosecutor general investigate Ali.

The Market Yesterday

EGP / USD CBE market average: Buy 16.08 | Sell 16.20

EGP / USD at CIB: Buy 16.08 | Sell 16.18

EGP / USD at NBE: Buy 16.07 | Sell 16.17

EGX30 (Monday): 13,443 (-0.4%)

Turnover: EGP 431 mn (40% below the 90-day average)

EGX 30 year-to-date: +3.1%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.4%. CIB, the index’s heaviest constituent, ended down 0.1%. EGX30’s top performing constituents were Credit Agricole up 3.2%, CIRA up 2.5%, and Egyptian Iron and Steel up 0.8%. Yesterday’s worst performing stocks were Egyptian Resorts down 3.2%, Cleopatra Hospitals down 2.8% and Sidi Kerir Petrochemicals down 2.5%. The market turnover was EGP 431 mn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -103.9 mn

Regional: Net Short | EGP -4.1 mn

Domestic: Net Long | EGP +108.1 mn

Retail: 37.1% of total trades | 31.5% of buyers | 42.7% of sellers

Institutions: 62.9% of total trades | 68.5% of buyers | 57.3% of sellers

WTI: USD 58.88 (-0.24%)

Brent: USD 64.25 (-0.22%)

Natural Gas (Nymex, futures prices) USD 2.24 MMBtu (+0.31%, January 2020 contract)

Gold: USD 1,465.50 / troy ounce (+0.04%)

TASI: 8,120.01 (+0.26%) (YTD: +3.75%)

ADX: 5,023.04 (-0.40%) (YTD: +2.20%)

DFM: 2,684.44 (-0.35%) (YTD: +6.11%)

KSE Premier Market: 6,747.19 (+0.59%)

QE: 10,277.02 (-0.97%) (YTD: -0.21%)

MSM: 4,020.87 (-0.13%) (YTD: -7.00%)

BB: 1,549.43 (+0.14%) (YTD: +15.87%)

Calendar

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company.

December: Indian automotive delegation to visit Egypt.

2-13 December (Monday- Friday) The COP25 Climate Change Conference, Madrid

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10 December (Tuesday): Egypt Automotive summit, Nile Ritz Carlton, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO (expected).

11-12 December (Wednesday-Thursday): “Forum on peace and sustainability in Africa,” venue TBD, Aswan.

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia.

12-14 December (Thursday-Saturday): AEEDC Education Cairo dentistry conference and exhibition, Royal Maxim Palace Kempinski Cairo.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

21-22 December (Saturday-Sunday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the third round of Grand Ethiopian Renaissance Dam negotiations in Khartoum, Sudan.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

13 January 2020 (Monday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the fourth and final round of Grand Ethiopian Renaissance Dam negotiations in Washington, DC.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.