- Egypt GDP to outperform EMs, regional oil importers but debt pressure is “acute” -IMF. (Speed Round)

- Egypt’s GDP grows at 5.6% clip in 1Q2019-2020. (Speed Round)

- We remain Africa’s top FDI destination. (Speed Round)

- Egypt, IMF continue talks for post-loan agreement. (Speed Round)

- Bank Audi’s acquisition of NBG could be postponed by up to six months. (Speed Round)

- CI Capital to list Taaleem on EGX by 2021. (Speed Round)

- New Pioneers Holding pharma arm looking to acquire manufacturer this year. (Speed Round)

- The World Radiocommunications Conference in Sharm could decide the fate of 5G. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 29 October 2019

A whole lotta macro news today

TL;DR

What We’re Tracking Today

Investors and political leaders are flocking to Riyadh for the third iteration of Saudi’s “Davos in the Desert,” which kicks off tomorrow. Bloomberg has a rundown of the politicians and Wall Street’s top brass who will be attending the Future Finance Initiative, including Indian Prime Minister Narendra Modi, White House adviser Jared Kushner, BlackRock CEO Larry Fink, and Goldman Sachs COO John Waldron, to name but a few.

Qalaa Holdings chief Ahmed Heikal will also be at the conference, where he will speak about the future of the energy sector alongside government and international business speakers.

Last year’s event was more desert than Davos as major figures and media partners spurned the kingdom in reaction to the murder of journalist Jamal Khashoggi. The Associated Press suggests that it is the hype surrounding the Aramco IPO that has brought the business community back to Riyadh.

The US Federal Reserve’s Open Market Committee meets today and tomorrow to review interest rates. The market is largely pricing in a third consecutive rate cut, but what is less certain is whether this will be the last of a round of “insurance cuts” or another step in an extended easing cycle.

Meanwhile, the Central Bank of Egypt’s Monetary Policy Committee is set to review interest rates on Thursday, 14 November. There has been early speculation from some, including Fitch Solutions, Beltone Financial, and EFG Hermes, that the CBE could squeeze in another rate cut before the year is out on the back of September’s surprisingly low inflation reading.

The Egyptian Medical Expo to Africa wraps today. The three-day event brought together seven countries to strengthen African medical cooperation in production and expertise, according to a Cabinet statement.

The conference that could decide the fate of 5G kicked off in Sharm yesterday: The World Radiocommunications Conference (WRC) that kicked off in Sharm El Sheikh yesterday could make or break the roll-out of 5G, the Verge says. More than 3.5k participants from 193 countries are expected to put an end to a tussle between meteorologists and mobile networks over the allocation of the radio frequency bands used by 5G.

What’s the issue? 5G networks use a frequency band close to the one used by weather satellites, which has meteorologists concerned that they will interfere with their ability to forecast weather patterns. Although some scientists have proposed putting stricter limits on 5G interference, the US argues otherwise and has begun to license companies to use potentially dangerous radio frequencies in its quest to become a leader in 5G.

About the conference: The WRC is held every 3-4 years to review international rules on the use of radio-frequencies. More than 3.5k participants from 193 countries and 297 observers from the ITU’s private sector members are attending the conference, which will run through to 22 November.

Egypt’s El Sherbini El Gawad, El Hammamy, Elshorbagy make it to quarter-finals of CIB’s squash championships by the pyramids: Nour El Sherbini, Hania El Hammamy, Karim Abdel Gawad, and Marwan El Shorbagy each secured a spot in the last eight of the CIB PSA Women’s World Championship and CIB Egyptian Squash Open Men’s Platinum. El Hammamy will face compatriot Yathreb Adel or France’s Camille Serme in the next round, according to PSA.

We have two all-Egyptian ties in the quarter-finals: El Welily and El Tayeb’s showdown takes place today, while Abdel Gawad and El Shorbagy will face off in the men’s championship tomorrow. Egypt’s world No.1 Ali Farag will play England’s Daryl Selby today, before Fares Dessouky takes on New Zealander Paul Coll. Nouran Gohar’s tie with Sarah-Jane Perry also takes place today, while El Sherbini and El Hammamy will play their quarter-final matches tomorrow.

Aramco execs hit the road to get investor backing for upcoming IPO: Executives from Saudi Aramco are on a roadshow in the US to drum up investor interest as the oil giant gears up for its IPO, according to the Financial Times. Expectations are generally running low, as institutional investors voice concerns over state interference in Aramco’s corporate strategy, with the company itself having a limited (if any) role in its production policy, reserves management, and OPEC relations. The valuation also continues to be a sticking point, with some investors arguing the company is worth USD 1.2 tn, far below MbS’ lofty USD 2 tn valuation.

US stocks hit record high: The S&P 500 rose to a record high yesterday on strong earnings and increasing confidence over a US-China trade agreement, CNBC says. The index closed 0.6% in the green, hitting a record 3,027. Third-quarter earnings have so far surpassed analysts’ expectations: 78% of the 206 S&P 500 companies that have so far reported have beaten forecasts.

The same can’t be said for HSBC: HSBC’s interim CEO, Noel Quinn, is shaking up parts of the bank in efforts to “remodel” the business after quarterly profits fell 24% in the third quarter, according to the Financial Times.

Recession fears overblown, CEOs suggest: CEOs have talked a lot of about strong consumption growth and little about the possibility of a recession during their company conference calls, according to CNBC. “These comments indicate it’s unlikely a recession will become a self-fulfilling prophecy,” said Sam Stovall, chief equity strategist at CFRA, adding that there has been a narrative shift from “recession” to “slower but stable growth.”

The counterpoint: Hiring by US companies has hit seven-year lows, according to a survey released yesterday, the Associated Press reports. Only a fifth of economists polled by the National Association for Business Economics said their companies had hired new workers over the past three months, down from a third in the last survey in July. “The US economy appears to be slowing, and respondents expect still slower growth over the next 12 months,” said Constance Hunter, NABE president and chief economist at the accounting firm KPMG.

Emerging markets need greater say in digital currency regs, says China official: EM governments should be given more of a say by global regulators on how digital currencies — such as Facebook’s Libra — are controlled, an official from China’s forex regulator has said, according to Reuters. Digital currencies pose foreign exchange risks and increase illegal cross-border flows, the official said, adding that the problems are particularly pronounced for emerging markets applying capital controls.

Lebanon faces economic disaster if no political solution is reached -central bank governor: Lebanon faces economic disaster in “days” if the government doesn’t find a solution to the ongoing political crisis, central bank Governor Riad Salamé tells CNN (watch, runtime: 9:51). “It’s a matter of days because the cost is heavy on the country but more important we’re losing every day confidence, more and more confidence. And finance and economy is all about confidence,” he said. Banks, schools and many businesses have been closed for more than a week amid large demonstrations against government economic mismanagement.

Economic reforms not enough -IMF: The IMF said yesterday that a package of emergency economic reforms unveiled last week by the government is “a step that is welcomed” but that more must be done to get the economy in shape, Bloomberg reports.

Trump wants to seize Syria’s oil fields: President Donald Trump suggested on Sunday that he will invite ExxonMobil or another US oil company to tap Syrian oil fields currently under the control of the US military. “What I intend to do, perhaps, is make [an agreement] with an ExxonMobil or one of our great companies to go in there and do it properly … and spread out the wealth,” he said, hinting that the resources would be split between the US and the Kurds.

There are two potential problems with this plan though: Breaking international law may not make for good optics heading into election season, and as Axios notes, oil companies probably won’t be rushing into a warzone any time soon. Reuters has more.

Enterprise+: Last Night’s Talk Shows

The economy dominated the airwaves last night, after the IMF threw a few good words in our direction in its latest regional outlook, and Planning Minister Hala El Said announced that the economy grew at a 5.6% clip in 1Q2019-2020. We have chapter and verse at the top of this morning’s Speed Round, below.

On the IMF report: Al Hayah Al Youm’s Khaled Abu Bakr highlighted the progress in the natural gas and tourism sectors, which the fund expects to continue to support growth. He also drew attention to the fund’s estimate that Egypt will need to create at least 700k jobs a year if it is going to cope with the rapidly growing population (watch, runtime: 2:20). Masaa DMC’s Eman El Hosary, meanwhile, phoned economist Abdel Moneim El Sayed, who said that Egypt’s status as the region’s fastest-growing economy speaks volumes about the economic reforms (watch, runtime: 7:20).

A closer look at the market with Lamees and Noman Khaled: Al Kahera Alaan’s Lamees El Hadidi phoned CI Capital’s Noman Khaled for his take on how the reforms are playing out on the ground. Khaled said that there are many factors that could explain the surprising fall in inflation over the past few months.

Why hasn’t the EGP float boosted exports? El Hadidi put the question to Khaled, who said it was wrong to assume that Egyptian products will suddenly become competitive on the back of the float. Solving this will require more than a currency devaluation, he said, calling on the government to focus more on sectors where we have a competitive advantage. Egypt’s non-oil exports grew by 3% in the first nine months of the year, which we recap in full in this morning’s speed round below. You can catch the Khaled interview here (watch, runtime: 9:09).

EGP continues to strengthen: The central bank’s buy price reached EGP 16.06 against the greenback yesterday, Al Hayah Al Youm’s Khaled Abu Bakr (watch, runtime: 2:28) and El Hekaya’s Amr Adib noted (watch, runtime: 3:49). The pound rallied to a new two-and-a-half year high at the end of last week, extending year-to-date gains of 9.9% against the USD.

The Personal Status Act got some airtime: El Hadidi hosted a live debate on the draft amendments recently drawn up by Al Azhar. Egypt’s highest religious authority has been criticized on social media and in the House of Representatives for doing legislative work beyond its purview. Islamic research academy member Abdullah Al Naggar, defending Al Azhar, and lawyer and chair of the Egyptian Center for Women's Rights Nehad Abou El Qomsan, offering a counterview, were on board for the debate (watch, runtime: 35:52).

The World Radiocommunications Conference opens in Sharm: Masaa DMC’s Eman El Hossary took note of President Abdel Fattah El Sisi’s inaugural remarks at the month-long event.

Man killed in Tanta train accident: A man died and another was injured after they were forced out of a train for not having a ticket, El Hadidi reported (watch, runtime 22:21). Eyewitnesses say the manager ordered the passengers to jump from the train while it was moving.

Speed Round

Speed Round is presented in association with

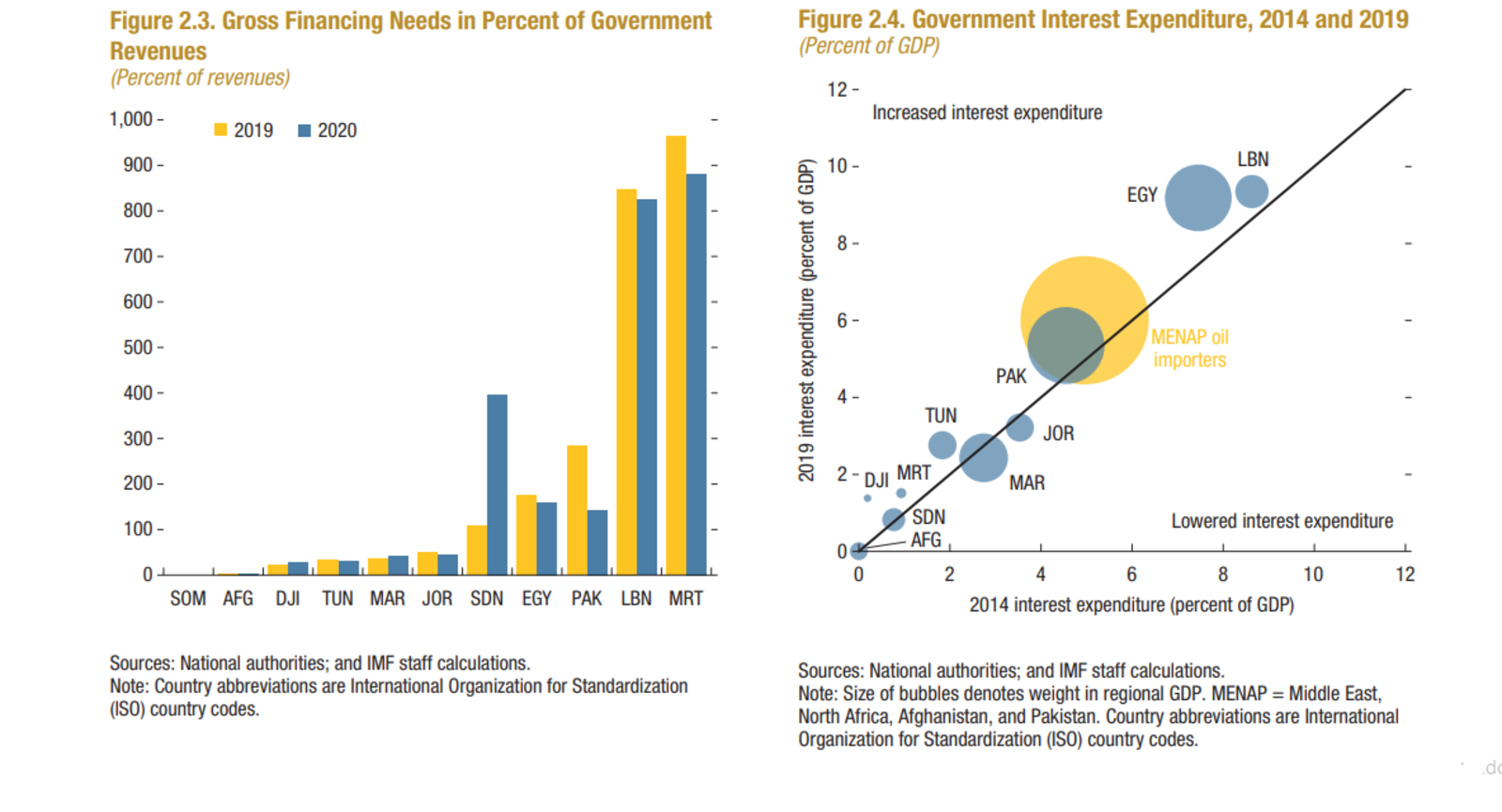

Egypt still expected to outperform EMs, regional oil importers on GDP, but debt pressure is “acute,” IMF says: GDP growth across MENAP oil importers is expected to average at 3.6% in 2019 and 3.7% in 2020, the IMF said in its October 2019 Regional Economic Outlook (pdf). When excluding Pakistan and Sudan, which are driving down the regional average, MENAP oil importers are forecast to see average economic growth at 4.4% this year. That’s still lower than the 5.5% growth forecast the IMF penciled in for Egypt this year in its World Economic Outlook, which it released earlier this month. Growth in Egypt is expected to remain “strong” on the back of rising gas production and tourism recovery, the IMF says.

Egypt got props as a model case when it comes to progress on structural reforms, which the IMF says was key in balancing social and economic challenges. The report notes that the government’s reform program helped to narrow the current account and fiscal deficits, while driving up growth and foreign reserves, and driving down inflation, unemployment, and debt figures.

But we’ve still got some ways to go when it comes to reforms: Egypt needs to focus on improving its business climate and curb the state’s involvement in the economy to make way for private sector investments that will spur growth, the fund says. The country currently needs to create 700k new jobs per annum to keep up with new entrants to the labor force — a target that will only be achievable through a “transparent, market-driven economy.” The fund also stresses that female labor force participation in Egypt, Mauritania, Morocco, and Tunisia is currently low despite being a “huge untapped resource,” which requires significant investments in education and health services to unlock.

Debt and interest payments remain the biggest risk for Egypt and oil importers: Gross financing needs for Egypt, Lebanon, Pakistan, and Mauritania are quite high; Egypt’s financing needs (which the fund notes accounts for the impact of debt maturity) are nearly double the size of government revenues. This is creating “acute” pressure on government budgets and are creating less space for the government to allocate funding to investments that are of “critical” importance for the region’s long-term growth trajectory. Consistently rising interest payments is “the largest component of short-term budgetary pressure” for Egypt, Lebanon, and Pakistan.

Speaking of growth, Egypt’s GDP grew at a 5.6% clip in 1Q2019-2020, up from 5.3% during the same quarter last fiscal year, Planning Minister Hala El Said told Sky News Arabia (watch, runtime: 01:37). El Said did not provide any further economic indicators for the quarter. The government is targeting a 6% growth rate for the remainder of this fiscal year. The IMF expects that Egypt’s GDP will grow 5.9% in FY2019-2020, and see inflation reaching 9.6% by the end of the year in June 2020.

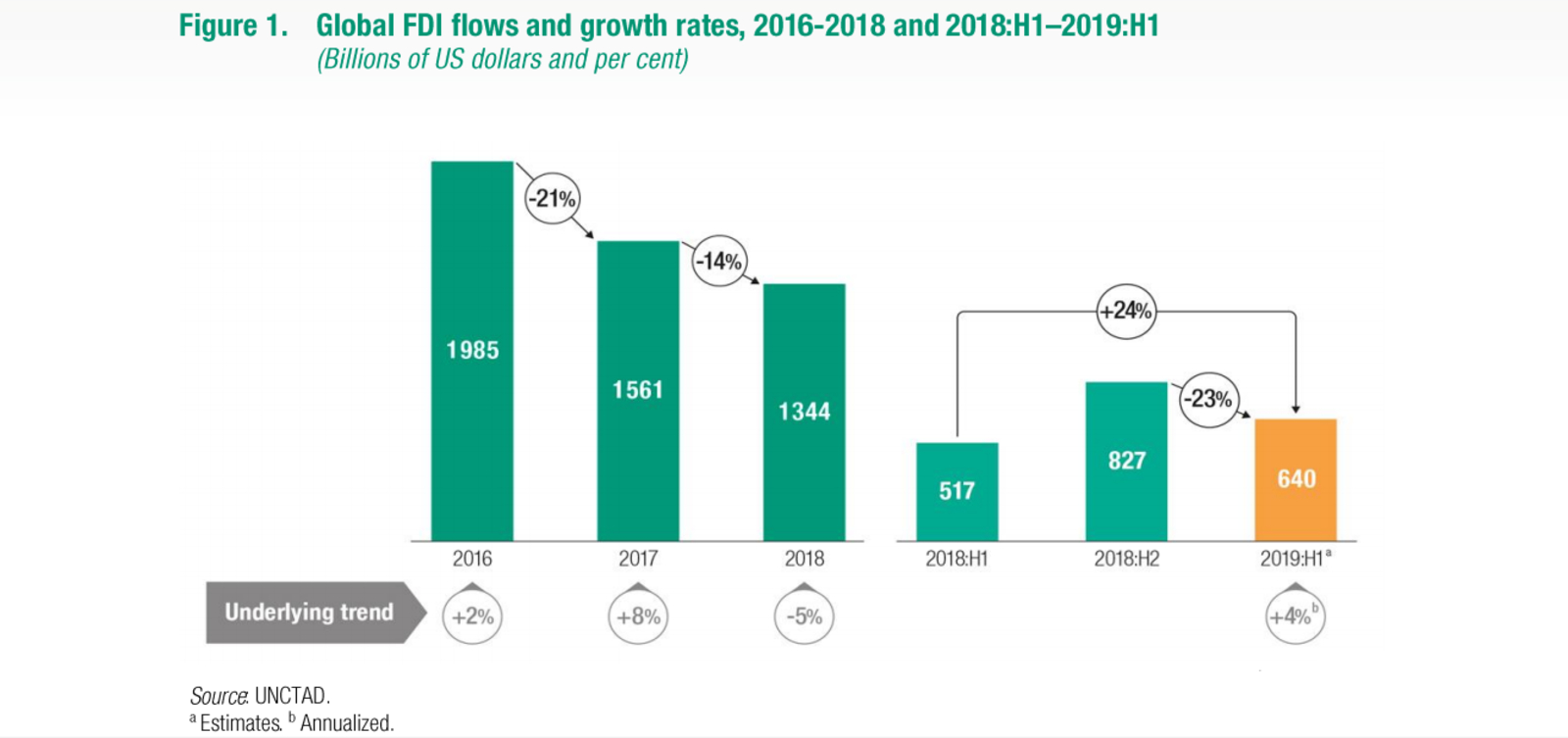

Egypt is still Africa’s top FDI destination as global flows pick up in 1H2019 -UNCTAD: Global foreign direct investment (FDI) grew 24% y-o-y in 1H2019 to USD 640, mostly thanks to a favorable base effect as a result of unusually low FDI levels during the same period last year, according to UNCTAD’s latest investment trends monitor report (pdf). Without the effects of one-off transactions and intra-firm financial flows, global FDI only picked up 4% during the first six months of the year.

Inflows increased in developed economies, while developing countries saw a minor dip: Developed countries saw FDI almost double from 1H2018 in North America, while flows to Europe “rebounded sharply” with an almost five-fold increase. In developing economies, FDI remained relatively stable, slipping 2% y-o-y to USD 342 bn.

FDI to Africa also fell 2%, mainly due to trade tensions and political instability in some countries. The report notes that Nigeria’s recent reforms attracted investments in the oil and gas sector, while South Africa lost almost two thirds of its FDI. Egypt remains the most attractive destination on the continent, accounting for USD 3.6 bn of the USD 23 bn funneled into the entire continent, despite non-oil FDI falling to USD 400 mn in 1Q2019, its lowest level since 2014. High interest rates, low consumer demand, and the slow rate of privatization have all been cited as key culprits behind Egypt’s lagging ability to attract more FDI.

The list of the top 10 host economies in 1H2019 was split between developed and developing economies, with the US topping the charts, followed by China. The UK and the Netherlands both fell out of the top 10 FDI destinations, while Singapore climbed to the third spot and France became the fourth largest recipient of FDI.

Global headwinds aside, investments are expected to continue recovering for the remainder of 2019. The report notes that geopolitical risks, trade tensions, and concerns about the emergence of protectionist policies threaten forecasts.

IMF’s Azour confirms talks are ongoing with Egypt on post-loan cooperation: Egypt and the IMF are currently in talks to set the parameters of a potential future engagement once our USD 12 bn Extended Fund Facility expires next month, the IMF’s Middle East and Central Asia Director Jihad Azour tells the National. The talks appear to be in the very early stages, as Azour says the fund is still looking with Egyptian officials at the priorities for future reform plans to define the type of arrangement. Azour remained tight-lipped on when we should expect to see an agreement, saying only that negotiations are “progressing.”

Where do our reform priorities lie moving ahead? Egypt’s next stage of reforms should foster business growth by “reforming the business environment, allowing the private sector access to greater market share and by improving the environment for doing business in Egypt," Azour said. He also stressed the importance of pushing ahead with structural reforms to increase growth and create jobs, while “allowing the private sector greater market share” and curbing state involvement in the economy. Azour pointed to education investment as a key part of Egypt’s path forwards.

Background: The Finance Ministry has said that Egypt is eyeing a post-loan agreement with the IMF, and initially said we could sign said agreement by this month. The ministry said at the time it was eyeing a two-year cooperation framework, but officials from the fund swiftly poured cold water on the idea, saying that Egypt would have to complete its current program before trying to get a second helping. More recent statements indicate that the government is hoping to secure the agreement by March 2020.

M&A WATCH- Bank Audi’s acquisition of NBG could be postponed by up to six months: The National Bank of Greece (NBG) is reportedly in talks with Bank Audi over extending its acquisition deadline by between one and six months amid an ongoing pay dispute with its employees, sources told the local press. NBG currently has until 2 November with which to reach an agreement with its employees, without which the CBE will not sign-off on the transaction.

Did NBG employees just force the CBE to intervene in Bank Audi acquisition? NBG’s employees appear to have escalated the dispute with the bank’s management over its pending acquisition by Bank Audi. The employees reportedly filed a complaint to the Central Bank of Egypt (CBE) alleging that NBG and its legal advisor, Matouk Bassiouny, are forcing them to jump ship to Bank Audi without receiving compensation, according to Al Mal.

What’s all the fuss about? The employees claim that they are entitled to severance pay if the transaction goes through, as they see the acquisition being tantamount to wrongful termination under article 122 of the labor law (pdf). Matouk Bassiouny had reassured them that nobody is losing their job or salary, and that only employees who choose not to accept transfers to Bank Audi on conclusion of the sale would be eligible to receive buyouts. The employees don’t seem to think that these reassurances have addressed their concerns.

IPO WATCH- CI Capital plans to take Taaleem to market in two years: Investment bank CI Capital plans to list Taaleem Management Service Company, the owner and operator of Nahda University in Beni Suef, on the EGX within two years, CEO Hazem Badran told Al Mal. Badran did not disclose the expected size of the offering. The listing could also include a capital increase, Badran said, without clarifying whether this would include a rights issue to shareholders. CI Capital itself is not looking to exit the company anytime soon, but plans to give current shareholders the option to do so.

Background: CI Capital and a group of co-investors — which included StonePine ACE Fund, a JV between StonePine Capital and ACE — acquired a 60% stake in Taaleem from Thebes Education Management Holdings in an EGP 1.2 bn transaction last month. The consortium acquired the stake though CI Capital investment vehicle EGY EDU Invest. The firm kicked EGP 305 mn for the acquisition, while the co-investors committed EGP 895 mn.

M&A WATCH- Pioneers’ new pharma arm on the lookout for acquisition targets, first transaction by year end: Pioneers Holding’s new pharma investment arm Al Noor Pharma is planning to acquire a pharma manufacturer before the end of the year, Al Noor chairman Khaled El Tayeb told the press, without naming potential targets. The company, which will begin business as a distributor, has EGP 1 bn set aside for its expansion plans into manufacturing. Pioneers Holding owns 60% of the company and the remaining 40% is held by unnamed shareholders with experience in the sector. Its upcoming acquisition agreements will be financed through shareholder equity.

Yields on short-term gov’t treasuries continue rallying, while long-term yields dip: Yields on Egypt’s short-term government treasuries are picking up for the third consecutive week, after falling 200 bps after the Central Bank of Egypt (CBE) began cutting interest rates in August. A gauge used by Al Mal to measure average yields showed that returns on three-month t-bills climbed 0.05% to 15.682% after last week’s sales, which saw an uptick in subscriptions. Other short-term bills also saw higher yields. Yields on five-year and 10-year bonds fell 0.07% and 0.114%.

The dip in yields on long-term debt shows the market is pricing in another rate cut next month, an unnamed local bank official tells the newspaper. Fitch Solutions had predicted the CBE to cut interest rates by 0.5% before the end of the year, and 1.5% in 2020, while EFG Hermes forecast a 100 bps cut in the upcoming meeting and Beltone predicted that the MPC will reduce rates by 50-100 bps due to the September shock fall in inflation. The CBE has cut rates by 350 bps so far this year, and 250 bps since August.

DISPUTE WATCH- Justice Ministry rejects Medhat Khalil’s mediation request: The Justice Ministry’s dispute resolution committee has ruled that it has no subject-matter jurisdiction to mediate the ongoing dispute between Raya Holding’s Chairman Medhat Khalil and the Financial Regulation Authority (FRA), the local press reports. Khalil, who is looking to reduce or overturn an EGP 11 mn fine imposed by the FRA in connection with a mandatory tender offer, had requested that the dispute resolution committee act as the mediator. The FRA then insisted in July that its own committee should handle the issue.

Background: The FRA filed the lawsuit against the company’s chairman, Medhat Khalil, in May alleging that he failed to pay an EGP 11 mn fine handed out after he exceeded the maximum ownership limit in Raya without making an MTO. Khalil was ordered to launch the MTO last year or sell down his stake after it emerged that he and related parties controlled a combined 42% of the company — a level that triggers an MTO under securities regulations. Khalil bought 26.7% (56.919 mn shares) of Raya Holding through his El Pharonia Real Estate Investment at a cost of EGP 314.76 mn in the MTO.

Industrial output rises by 21.6% in 4Q2018: Egypt’s non-oil industrial output jumped 21.6% in 4Q2018 to EGP 188.8 bn, up from EGP 155.3 bn in the same quarter the previous year, according to a Capmas release. The coke coal industry accounted for 24% of overall output. Steel, iron, and precious minerals comprised 21.2%, followed by the food manufacturing at 19.2%.

Egypt’s non-oil trade deficit narrowed slightly to USD 32.19 bn in 9M2019, down from USD 33.86 bn during the same period last year, according to a General Organization for Export and Import Control (GOEIC) report cited by Ahram Online. The improvement came on the back of a 3% growth of non-oil exports, which reached USD 19.2 bn in the first nine months of the year, up from USD 18.7 bn in the comparable 2018 period. Imports also fell slightly to USD 51.39 bn from USD 52.57 bn.

The breakdown: Exports of Egyptian-made textiles grew 10%, engineering products 9%, garments 7%, and medical supplies 3%. The growth came as the value of imported leather products, construction materials, chemicals, and furniture decreased.

Egyptians account for 0.2% of global wealth, with a total of 11 individuals with a net worth exceeding USD 500 mn, according to Credit Suisse’s Global Wealth 2019 report (pdf). There are currently 86 Egyptians with a net worth between USD 100 mn and USD 500 mn. If your wealth is worth more than USD 1 mn, you are among the top 0.1% in the country in terms of wealth. According to the report nearly three quarters of Egypt’s adult population has less than USD 10k to their name. The US and China have the highest numbers of high net-worth individuals, while Pakistan is at the bottom of the list with zero adults having a net worth above USD 5 mn.

Egypt’s GDP per adult places us in the “lower middle income” category, at USD 4,689. The average wealth per adult in Egypt at USD 15,395, up 11.5% y-o-y in 2019 from USD 13,810 in 2018, the bank says.

Egypt in the News

Human rights is once again the topic du jour in the foreign press: The Associated Press reports that 10 policemen will stand trial for allegedly torturing a street seller to death. No date has yet been chosen for the trial. The defendants are alleged to have killed Magdy Maken, a 52 year-old fish seller, while in police custody in 2016. Meanwhile, Irish-Egyptian student Ibrahim Halawa tells the BBC that he was subjected to torture during a four-year spell in prison for protesting the overthrow of former president Mohamed Morsi (watch, runtime: 03:33).

Also getting attention in the foreign press this morning: Dar Al Ifta’s new search engine for archiving fatwas will help Al Azhar identify religious extremists by crawling the web for specific keywords, Tarek Abu Hashima, head of Dar al-Ifta's Strategic Studies Unit, tells Al Monitor.

Worth Watching

Ladies and gentlemen, the USD 4 bn Benban solar power park is complete. Built over the course of more than two years, all the plots at Africa’s largest solar park are now operational, the European Bank for Reconstruction and Development (EBRD) said yesterday. The EBRD, the project’s largest financial backers, produced a video showing the “modern-day miracle” from space, including a timelapse of its development (watch, runtime: 4:01).

Diplomacy + Foreign Trade

The US is eyeing Egypt as a potential importer of commodities such as soybean, corn, and wheat as it looks to fill the China-shaped hole in its agricultural exports, according to KSFY. US lawmakers have invited Egyptian purchasers to visit South Dakota and Iowa to discuss new partnerships.

Basic Materials + Commodities

Egypt to increase wheat cultivation area to 3.5 mn feddans this season

Egypt will increase its wheat cultivation area to 3.5 mn feddans this season, up from 3.16 mn feddans during the last season, an Agriculture Ministry official told Reuters on Monday. The added feddans will be cultivated in the desert due to climate change and heavy rainfall.

Manufacturing

Egyptian Arab Metals to establish new USD 100 mn stainless steel factory

Egyptian Arab Metals (Zeinox) plans to establish a USD 70-100 mn stainless steel production plant, Deputy Chairman Wael Abbas told the local press. The company plans to meet local supply needs and export its products to Europe and the US as it looks to capitalize on the trade war between Washington and Beijing. Zeinox is currently conducting a feasibility study for the new plant with the European Bank for Reconstruction and Development, and is looking at different financing options.

Egypt’s SCZone receives bids worth USD 1.45 bn to establish iron, steel factories

The Suez Canal Economic Zone has received requests from two investors to implement USD 1.45 bn in projects, according to the local press. The requests include one from a Chinese company looking to establish an integrated 3 mn tonne steel and iron complex, while another unnamed investor is seeking to build a USD 156 mn stainless steel factory.

Real Estate + Housing

SODIC launches first phase of apartment buildings in east Cairo development

Upscale real estate developer SODIC has launched the first phase of apartment buildings in its flagship SODIC East development, an East Cairo equivalent of SODIC West on the Cairo-Alexandria desert road, the company said yesterday (pdf). The phase includes low-rise, five-story apartment buildings around a 4k sqm green park. The company said last week it had awarded construction contracts worth EGP 300 mn for the project, on which it broke ground last year. SODIC expects to begin delivering units in SODIC East, its largest development in east Cairo, as of November 2021. The master plan for the 655-acre development was designed by Massachusetts-based firm Sasaki.

Porto Heliopolis construction suspended on traffic concerns

Amer Group Holding has suspended construction of its Porto Heliopolis project following an order from a "competent authority" to put the project on hold until it reviews traffic studies for the area, Amer Group said in an EGX disclosure (pdf). The company says it already submitted these studies prior to beginning construction. Amer Group launched the EGP 3 bn development earlier this month.

Egypt’s HHD to auction land plots in El Shorouk

Heliopolis Housing and Development (HHD) is auctioning today an undisclosed number of land plots in Shorouk City, according to the local press. The plots range between one and 30 acres in size and can be used for residential, administrative, or commercial purposes. The company announced the auction earlier this month.

Banking + Finance

e-Finance partners with MasterCard to support government payments

State-owned payments platform e-Finance has signed an agreement with MasterCard to allow government service recipients to pay their fees online, MasterCard said in a statement seen by Masrawy. The move to e-payment for government services, which was mandated by the National Payments Council, is meant to help regulate public spending and drive financial inclusion.

Sports

El Badry backtracks on Salah captaincy

National football team coach Hossam El Badry has backtracked on plans to hand to captaincy to Mohamed Salah after current captain Ahmed Fathi threatened to quit the team, according to Ahram Online. The team captaincy has traditionally been granted to the most senior player, which is currently Fathi.

On Your Way Out

Opera Aida returned to Luxor over the weekend after a 22-year absence, attracting opera enthusiasts from around the world, according to Al Masry Al Youm. The opera’s first showing was held at the Mortuary Temple of Hatshepsut in Luxor on Saturday. Khedive Ismail commissioned Italian composer Giuseppe Verdi to write the opera, which was first performed at the Khedivial Opera House on 24 December 1871.

The Market Yesterday

EGP / USD CBE market average: Buy 16.06 | Sell 16.19

EGP / USD at CIB: Buy 16.08 | Sell 16.18

EGP / USD at NBE: Buy 16.09 | Sell 16.19

EGX30 (Monday): 14,301 (+0.5%)

Turnover: EGP 641 mn (10% below the 90-day average)

EGX 30 year-to-date: +9.7%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.5%. CIB, the index’s heaviest constituent, ended up 0.6%. EGX30’s top performing constituents were Madinet Nasr Housing up 3.5%, Ezz Steel up 3.3%, and Orascom Development Egypt up 2.2%. Yesterday’s worst performing stocks were Ibnsina Pharma down 3.0%, Egyptian Resorts down 1.1% and Eastern Co down 1.1%. The market turnover was EGP 641 mn, and foreign investors were the sole net buyers.

Foreigners: Net long | EGP +27.2 mn

Regional: Net short | EGP -0.2 mn

Domestic: Net short | EGP -27.0 mn

Retail: 64.7% of total trades | 63.3% of buyers | 66.1% of sellers

Institutions: 35.3% of total trades | 36.7% of buyers | 33.9% of sellers

WTI: USD 55.82 (+0.0%)

Brent: USD 61.57 (-0.7%)

Natural Gas (Nymex, futures prices) USD 2.46 MMBtu, (+0.7%, November 2019 contract)

Gold: USD 1,494.10 / troy ounce (-0.1%)

TASI: 7,784 (-1.4%) (YTD: -0.5%)

ADX: 5,134 (-0.3%) (YTD: +4.5%)

DFM: 2,777 (-0.4%) (YTD: +9.8%)

KSE Premier Market: 6,284 (-0.1%)

QE: 10,222 (-0.8%) (YTD: -0.8%)

MSM: 4,005 (+0.5%) (YTD: -7.4%)

BB: 1,523 (-0.3%) (YTD: +13.9%)

Calendar

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

October: German businessman delegation will visit Egypt to discuss good projects in order to spend German funds into Egypt.

October: A delegation of 40-50 Saudi companies will visit Egypt to discuss increasing exports of Egyptian furniture.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

27-29 October (Sunday-Tuesday): Egyptian Medical Expo to Africa, Hilton Heliopolis, Cairo, Egypt

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October (Monday): B2B conference for German companies organized by the German-Arab Chamber of Industry and Commerce and the Bavarian Ministry of Economic Affairs, Regional Development and Energy, InterContinental Semiramis, Cairo.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review key interest rates.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

29-30 October (Tuesday- Wednesday): 10th African Food Day Conference, Cairo, Egypt

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

November: The government will host the Egypt Economic Summit with 40 speakers and experts across all economic fields to discuss the country’s vision post the IMF program.

November: British Egyptian Business Association’s Annual door knock mission, United Kingdom.

November: ITIDA to announce the winning bid in a tender to manage three new innovation centers.

3 November (Sunday): Real Estate Debate 2019 Conference – Catalysts for Growth in 2020, Cairo Marriott Hotel.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

4 November (Monday): Narrative PR Summit, Hilton Heliopolis, Cairo.

4-6 November (Monday-Wednesday): Egypt’s Chamber of Tourism Establishments will participate in the UK’s World Travel Market (WTM) event in London.

7 November (Thursday): AmCham will hold the Prosper Africa Event.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

12 November (Tuesday): Egypt Economic Summit, venue TBA.

13-15 November (Wednesday-Friday): Africa Early Stage Investor Summit, Cape Town, South Africa.

14 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

18 November (Monday): AmCham’s US-Egypt Proposer Forum in Cairo. US trade delegation visits Cairo to discuss investments in health, energy and information technology as part of the gathering.

20-29 November (Wednesday-Friday): Cairo International Film Festival, Cairo Opera House, Egypt, Cairo, Egypt.

20 November (Wednesday): The Investment Ministry and the Islamic Development Bank will organize the “leaders for change” startup competition as part of the Fekretak Sherketak initiative, location TBD, Cairo, Egypt.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

25 November (Monday): Global Trade Matters international dialogue on climate neutrality, Marriott, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.