- Russia steps up assault on Kyiv as the West looks to inflict pain with sanctions. (War Watch)

- GASC announces fresh wheat tender as war unfolds in Ukraine. (Commodities)

- Etisalat rebrands, eyes a push into our fintech sector + Etisalat Misr’s bottom line up 20% in 2021. (M&A Watch)

- Siemens / Orascom / Arab Contractors consortium set to ink final high-speed rail line contracts next month. (Transport)

- MSMEDA launches World Bank-backed USD 50 mn VC fund. (Startup Watch)

- Rameda Pharma, GB Auto + Contact Financial report strong growth in 4Q2021. (Earnings Watch)

- Could COP27 bring our first-ever net-zero target? (Also On Our Radar)

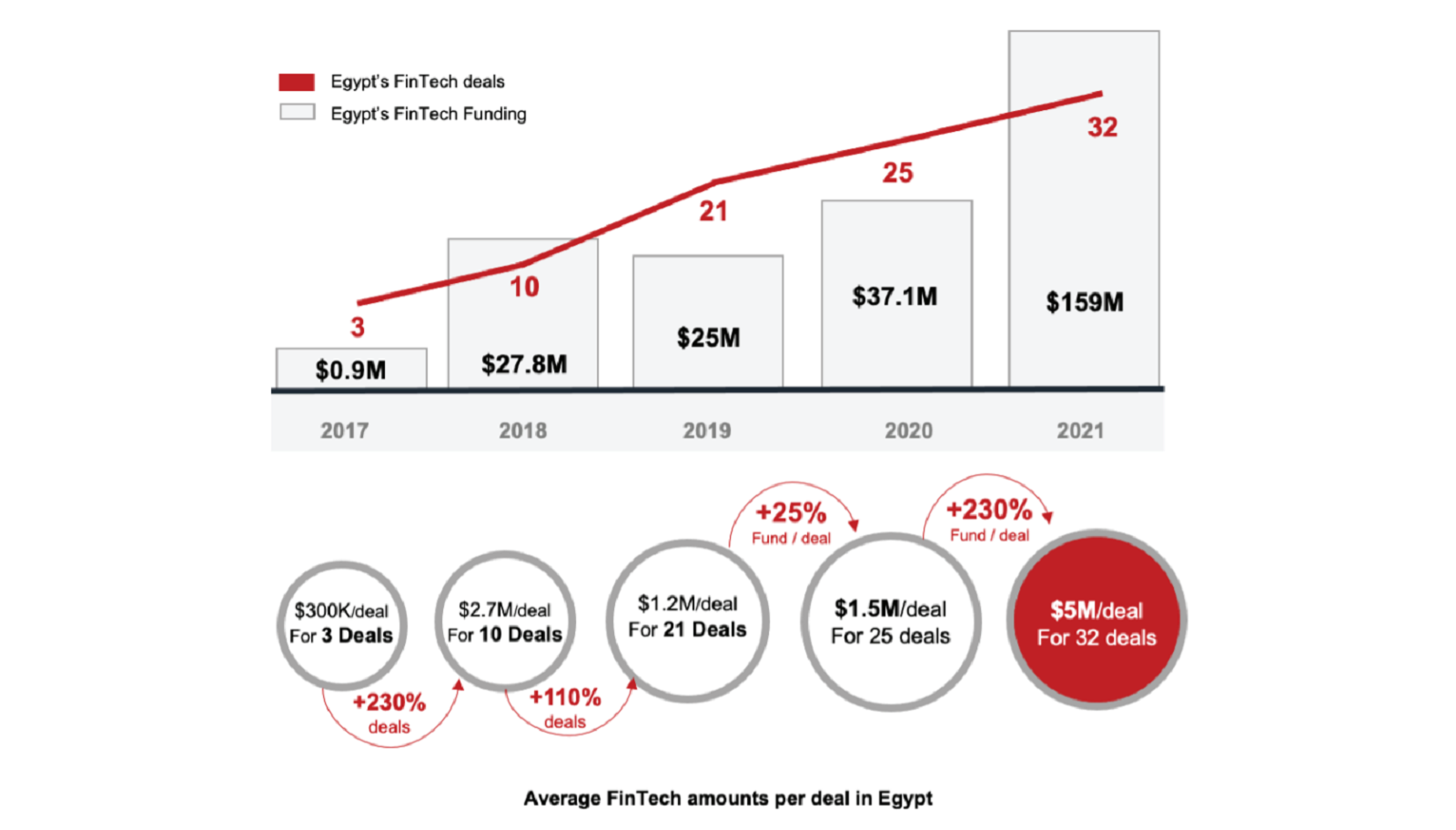

- Fintech investment went from strength to strength in 2021, a new central bank report shows. (What’s Next)

- The six quarter-point rate hikes expected from the Fed this year may not suffice to tame inflation -analysts. (Planet Finance)

Sunday, 27 February 2022

AM — As Russia advances on Kyiv, the West gets tough on sanctions

TL;DR

WHAT WE’RE TRACKING TODAY

The nastiest war to hit Europe since Yugoslavia disintegrated more than 30 years ago kicked off just after we hit “send” on Thursday’s edition. We think this is going to change a lot of things for all of us — the business climate this year, how and where we do business, who will be investing where, and who is allied with whom.

For the next while, we’ll be covering what’s happening in Ukraine (and its impact beyond that nation’s borders) in War Watch, a new section that leads this morning’s news well, below.

Here’s what you need to know right now:

- Russian forces stepped up their assault in Kyiv overnight after the Ukrainian Army and civilian volunteers put up unexpectedly stiff resistance. Pundits on our Twitter are suggesting Russia has so far committed barely a third of the total number of troops it has massed.

- Select Russian banks are about to be (kind of) cut off from the global banking system. Unplugging them from SWIFT, the banking world’s (archaic) global messaging system, will mean the affected banks need to reach out to other banks on a peer-to-peer basis if they want to transfer funds. And whether those banks will accept transfers is another question entirely.

- The big thing to watch for: Sanctions on Russia’s central bank. Western nations are preparing measures designed to make it difficult for Russian President Vladimir Putin to deploy his country’s >USD 600 mn in reserves to shore up his economy. One catch: Russia’s reserves pile is famously well-diversified. Expect the sanctions to be announced as early as today.

Ukraine has captured the world’s hearts with tough resistance to invasion — and some very memorable lines. Ukrainian President Volodymyr Zelensky refused an American offer of evacuation: “I need ammunition, not a ride,” he said, releasing a video proving he and his top officials were still in the capital. “Russian warship, go f— yourself” indeed.

In Russia, meanwhile, the invasion is playing out on state television as a liberation of two breakaway territories of Ukraine that Putin recognized last week. Protests against the war have cropped up in most major Russian cities, and many Russian celebs have taken to social media to call for peace.

THE IMPACT ON EGYPT-

Emerging markets including Egypt have so far born the brunt of the global reaction to the war, the Financial Times reports. Analysts noted steep sell-offs in Ghana, Turkey, Egypt and Pakistan, citing a “flight to safety from financially vulnerable countries.” The EGX closed down 3.6% on Thursday, on turnover of EGP 1.1 bn (7.8% above the 90-day average). Foreign investors were net sellers.

The big question: What does this mean for our access to wheat? We have the full story in this morning’s news well, below.

REMINDER- Egypt has deep economic ties to both Ukraine and Russia, which together account for well over 50% of our wheat supply and send us mns of tourists every year. Russia is building a nuclear reactor and an industrial zone here. Ukrainian companies work with us on transport and infrastructure projects.

Egyptian hotels are now required to extend stays of Ukrainian tourists stranded in Egypt under directives from the Egyptian Hotel Association (pdf) and the Tourism Ministry (pdf).

Egyptian citizens in Ukraine have been directed to stay home for the time being, while Romanian and Polish border checkpoints will allow safe passage for Egyptians in the port city Odessa, the Egyptian Embassy in Kyiv said in separate statements (here and here). Egyptians studying at Ukrainian universities have shifted to online learning, the Education Ministry said, according to a cabinet statement.

It’s only going to get more complicated as businesses brace themselves for continued high energy prices, jittery stock markets, and the prospect that inflation will be around even longer than expected. Need the rundown? Go read the Financial Times’ very good How will Russia’s invasion of Ukraine hit the global economy?

ELSEWHERE TODAY-

The Senate is set to discuss the unified ins. act in plenary sessions starting today, Al Mal reports. The draft bill. which has been at least three years in the making, aims to appoint the Financial Regulatory Authority the primary regulator for the ins. sector, make ins. compulsory for SMEs and freelancers, and set up new economic courts to mediate disputes.

|

CIRCLE YOUR CALENDAR-

The long-awaited tender for the Tenth of Ramadan dry port is kicking off today, Amr Ismail, head of the General Authority for Ports, told Al Borsa, adding that four consortiums — out of six that came forward with offers — are competing to build and operate the EGP 3.5 bn dry port and logistics hub. The four consortiums reportedly include Orascom Construction-Abu Dhabi Ports, Elsewedy Electric-CMA CGM, a consortium led by the Mediterranean Shipping Company, and another by Bollore Logistics.

Consoleya is holding its second Women Meet-up to discuss topics including inclusivity in investment. The program will include a panel discussion on gender-lens funding here in Egypt. The event takes place on Wednesday, 2 March.

ARE YOU BUILDING A FINTECH STARTUP? You might want to apply for Visa’s global startup competition, the Visa Everywhere Initiative, which is running in Egypt in partnership (pdf) with the Central Bank of Egypt. Lean more here. The deadline for applications in Egypt is 20 March.

The Diarna Handicrafts Fair kicked off on Thursday and runs through 7 March at Cairo Festival City from 10am until 10pm daily.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s What’s Next day: We have our weekly deep-dive into what makes and shapes pre-listed companies and startups in Egypt, the UAE and KSA, touching on investment trends, future sector insights and growth journeys.

In today’s issue: Egypt’s fintech scene has grown leaps and bounds over the past few years, with 2021 specifically being a good year to be a fintech startup. This is supported by the Central Bank of Egypt’s (CBE) fintech data, which were released last week as part of the Fintech Landscape report (pdf) published by CBE-backed initiative Fintech Egypt. Today, we break down those numbers and what they mean for the local fintech scene.

Experience luxury in every thoughtful detail where prestige hospitality is rediscovered with genuine warmth and passion. Awaken forgotten desires and build unforgettable memories to fuel a lifetime of inspiration. Spend your winter break at Somabay with special rates and choose among five different hotels at one destination. Visit: www.Somabay.com/hotels/

WAR WATCH

Russia steps up assault on Kyiv overnight — faces sanctions on its central bank and being cut off from SWIFT global banking network

Russia stepped up its assault on Kyiv overnight as the war in Ukraine entered its fourth day. Here’s what you need to know this morning:

“Huge explosions” were reported near Kyiv in the early hours of this morning as Russian troops advance on the Ukrainian capital, the Associated Press reports. Fighting continues across the country, though it’s unclear just how much of Ukraine is now held by Russian forces.

The human toll: More than 200 Ukrainians have been killed and another 1k injured — and some 150k Ukrainians have fled the country so far, the UN High Commissioner for Refugees said yesterday on Twitter. Around half of them have fled to neighboring Poland, which along with Romania effectively threw open its borders. There are no casualty figures available for Russian troops.

The financial toll: Russian bn’aires lost USD 39 bn in wealth in the first day of the war as Moscow’s benchmark stock market plunged more than 33% — the fifth-worst one-day plunge in the history of global markets, Bloomberg says.

THE WEST IS GETTING SERIOUS with arms and actions. In a major policy shift, Germany has agreed to supply Kyiv with weapons, going against historical restraint from exporting arms to war zones, Bloomberg reports. The US has also pledged an additional USD 350 mn in assistance to Ukraine as its army attempts to hold the capital.

Some Russian banks are about to be cut off from SWIFT… The US, Canada, UK, Germany, France, Italy and the European Commission announced in a joint statement that they would remove “select” Russian banks from the SWIFT global payments system. That would make it a whole lot more difficult for Russian companies to do business abroad, the Guardian and Wall Street Journal report. Tns of USD move through the SWIFT messaging system daily.

…and impose sanctions on Russia’s central bank. This is the big one. Sanctions on Russia’s central bank would be designed to make it difficult for Vladimir Putin to shore up the economy by deploying cash from Russia’s more than USD 600 bn stockpile of reserves. US officials said the measures are designed to “send the ruble into ‘freefall’ and promote soaring inflation in the Russian economy,” the Associated Press reports.

Putin himself and his Foreign Minister, Sergey Lavrov, have both been hit with personal sanctions by countries including Canada and Australia — and the US State Department has signaled that Washington may follow suit.

But don’t expect NATO to send troops or impose a no-fly zone — with pundits pointing out that a no-fly zone would, by definition, find Western countries in direct conflict with Russia.

There’s plenty of mumbling in Western capitals about finding ways to arm and support Ukrainian rebels for the long term if, as many expect, Ukraine’s army is ultimately overcome by the invading force.

ISOLATING RUSSIA- Russia finds itself increasingly isolated on the world stage. A total of 11 countries voted in favor of a UN Security Council resolution condemning Russia's invasion of Ukraine. Russia, as expected, used its veto power to block the resolution. Notably, the UAE (which cooperates with Russia on oil policy, among other things), China, and India abstained from voting.

China may be slowly distancing itself from Russia, with Foreign Minister Wang Yi on Friday calling on all sides to exercise restraint, shortly after President Xi Jinping called Putin to urge him to seek a diplomatic resolution.

DIGITAL WARFARE- Official Russian government websites became inaccessible yesterday due to reported cyberattacks, reports the Wall Street Journal.

And Big Tech has chosen sides: Youtube has restricted access to Russia’s state-controlled RT and other channels in Ukraine in response to a request from the Ukrainian government, the Wall Street Journal reported. In line with US sanctions, the Google-owned platform will be pausing several Russian channels’ ability to monetize their Youtube videos. Facebook joined YouTube in blocking Russian state-backed media from advertising on the site, while Twitter — which already banned such ads in 2019 — put a temporary pause on all advertising through its platform in Russia and Ukraine, NPR reports.

COMMODITIES

Fresh wheat tender on Monday after war breaks out between top suppliers Russia + Ukraine

State grain buyer issues fresh wheat tender as war in Ukraine threatens supply: State grain buyer GASC will look to buy 55-60k tonnes of wheat in an international tender tomorrow, according to the authority’s website.

The bid comes days after GASC called off a wheat tender due to a lack of offers as global grain markets face turmoil on the back of Russia’s invasion of Ukraine, Bloomberg reports. The authority canceled last Thursday’s tender after receiving only one offer for French wheat. Tender rules mean at least two offers must be submitted for a purchase to go ahead, Reuters cited a GASC official as saying.

Russian + Ukrainian ports close: Ports in Ukraine have been closed since Russia launched its invasion on Thursday, the same day as GASC’s canceled tender. Meanwhile, Russian wheat exports will likely be on hold for “a couple of weeks,” the country’s grain association said, adding that “It is difficult to plan any transactions at the moment.” Russia on Friday attacked a Panamanian-flagged cargo vessel due to load wheat for shipment to an unspecified destination near Ukraine’s Odessa port.

What about the Ukrainian grain we’ve already locked in? We’re waiting on two 180k-tonne purchases of Ukrainian wheat for February and March delivery — but traders are warning that those contracts could be canceled by force majeure as war rages in Ukraine, according to Reuters, which reports that one shipment of Ukrainian wheat bought by GASC is currently stuck at a Ukrainian port. A shipment of 60k tonnes of Ukrainian wheat purchased in a December tender is safely on its way to Egypt, Al Dostor reports, citing exclusive statements from GASC.

The gov’t is planning for further price hikes: Prime Minister Moustafa Madbouly met with Central Bank of Egypt (CBE) governor Tarek Amer on Thursday to ensure there is sufficient financing to help the government purchase food and oil supplies that could be impacted by the crisis, according to a cabinet statement. Government spokesperson Nader Saad reportedly said that we “will no longer be able to buy at the price before the crisis,” while business mogul Naguib Sawiris also took to Twitter to urge authorities to stockpile wheat before prices surge further.

Wheat futures surged to a record high on Thursday on the back of the war, Reuters reports, having already hit decade-highs over the past year amid a supply squeeze.

Casting a wider net: GASC’s latest tender calls for offers from the US, Canada, France, Bulgaria, Australia, Poland, the UK and Romania, as well as Russia and Ukraine. Egypt plans to continue to look for ways to further diversify wheat imports, cabinet said at a meeting last week held to weigh the economic impact of the war. GASC locked in its latest shipment of wheat from Romania despite Ukrainian suppliers offering a better price at the time. Russia and Ukraine’s breadbaskets together account for around 80% of supply to Egypt and nearly a third of the world’s wheat supply.

It might prove an upward battle to secure offers at Monday’s tender: “Last time there was only one offer before any attacks, now that the situation got serious I’m sure suppliers are more apprehensive,” Reuters cited an anonymous trader as saying. Egypt currently has a 4.5-month reserve of wheat on hand, Prime Minister Moustafa Madbouly said last week.

US sanctions could also impact the wheat market: Suppliers have reportedly asked some Egyptian traders and agents to switch from Russia’s Sberbank, which has been hit by US sanctions, according to Reuters. Meanwhile, some of Russia’s biggest wheat exporters have links to now-sanctioned state-owned bank VTB Group.

None of this is good for inflation — especially for EMs: “The food security impact of the conflict will likely be felt beyond Ukraine’s border, especially on the poorest of the poor,” the World Food Programme wrote in a statement on Thursday. “Interruption to the flow of grain out of the Black Sea region will increase prices and add further fuel to food inflation.” Annual urban inflation in Egypt hit its highest level in almost two and a half years in January — 7.3% — due to rising food prices, while analysts expect inflation to hit mid-7% or higher in the short term.

The gov’t is still mulling how to taper bread subsidies. The Supply Ministry is considering several scenarios for tapering bread subsidies for the first time in decades, with a final decision on how they will be reworked expected by the end of March. The government is also considering hedging wheat.

The impact of the war on wheat supply here at home and in the wider region is getting coverage pretty much everywhere: The New York Times | France24 | NPR | Financial Times.

M&A WATCH

Etisalat could push into Egypt’s fintech sector following rebrand to “e&”

Etisalat is now e& — and the rebranded firm wants in on our fintech sector: The UAE’s largest telecoms operator has rebranded itself as e&, according to a disclosure to the Abu Dhabi bourse (pdf), as the company looks to expand beyond telecoms to become “a global technology and investment conglomerate that accelerates the digital transformation journey.” Under the rebrand, the firm has split into consumer services branch e& life, digital services arm e& enterprise, mergers and acquisitions arm e& capital, and telecoms operator Etisalat, according to Reuters.

The company will soon make an announcement about a transaction related to Egypt’s fintech sector as part of its expansion drive, Reuters reported Group CEO Hatem Dowidar as saying in an interview. E& is reportedly eyeing “potential joint ventures, acquisitions and listings of subsidiaries” as it plots an expansion into new sectors and markets across Africa, Europe, and Asia.

No rebrand so far for Etisalat Misr: There are no current plans to rebrand the company’s operations in Egypt or any other foreign country, Youm7 reported an Etisalat Misr source as saying.

Etisalat Misr saw a 21% y-o-y increase in revenues to reach AED 5.0 bn (EGP 21.4 bn) in 2021, according to the parent company’s latest earning release (pdf). Revenues were up 22% yo-y in the fourth quarter to record AED 1.4 bn (EGP 6 bn).

More subscribers = more revenue: E& attributed the revenue rise in Egypt to a growing subscriber base and increased mobile data and national roaming revenue. The number of Etisalat Misr subscribers grew 5% y-o-y to hit 27.8 mn in 2021.

Higher revenues translated into stronger earnings: Etisalat Misr’s EBITDA was up 20% to hit AED 2.1 bn (EGP 9 bn) in 2021. Fourth-quarter EBITDA recorded AED 500 mn (EGP 2.1 bn) — up 15% on an annual basis, but down 18% compared with the third quarter. Etisalat attributed the quarter-over-quarter drop to higher costs for interconnection and roaming, mobile devices, and marketing.

Capex spending dips: Etisalat Egypt’s capital expenditure was down by 5% y-o-y in 2021 at AED 1.4 bn (EGP 6 bn), most of which went to 4G deployment and upgrades.

TRANSPORT

Siemens-led consortium set to sign on second + third high-speed rail lines next month

Contracts for second + third lines of Egypt’s high-speed railway to be signed in March: The Transport Ministry and the consortium of Siemens Mobility, Orascom Construction and Arab Contractors tasked with building Egypt’s first high-speed rail line are next month set to sign final contracts for the second and third lines of the project, after completing “marathon negotiations that lasted for several months,” according to a cabinet statement. The second and third lines of the 1.7k-km high-speed rail network will connect 6th of October with Aswan, and Luxor to Hurghada via Qena and Safaga.

Background: The three-line high-speed rail project is set to link Cairo, Aswan, the North Coast and the Red Sea. The Siemens / Orascom / Arab Contractors consortium was last year contracted to design, install and maintain the first phase of the line, which runs 660 km between Ain Sokhna, Alexandria and Marsa Matrouh and is set to be completed by 2023. Passenger trains on the line will travel at up to 250 km/hour, reducing journey times by around 50%.

STARTUP WATCH

Egypt launches new World Bank-backed USD 50 mn VC fund

MSMEDA partners with World Bank to launch USD 50 mn VC fund: The Micro, Small and Medium Enterprise Development Agency (MSMEDA) has launched a venture capital fund with USD 50 mn from the World Bank, according to a press release. Trade Minister and MSMEDA Executive Director Nevine Gamea announced the new fund at a private investment conference co-organized by MSMEDA, the African Private Equity and Venture Capital Association, the World Bank, German development agency GIZ, and Misr Ins. Holding.

How will the fund work? The program will funnel financing into existing investment funds and create new ones, according to the press release, which didn’t specify the targeted sectors or planned ticket sizes. International funds looking to enter African markets are eligible to receive funds through the program, Gamea is quoted as saying, in a move meant to boost pan-African trade and idea-sharing. Some funding will also go towards training financial institutions’ employees on VC funding, according to the statement.

EARNINGS WATCH

Tenth of Ramadan for Pharma Industries and Diagnostic Reagents (Rameda) reported an 18.8% increase in net income in 4Q2021 to EGP 74.1 mn, according to an earnings release (pdf). Revenues for the quarter grew 37.1% y-o-y to EGP 393.9 mn, marking the company’s highest-ever quarterly revenues. On a full-year basis, Rameda reported a 61% increase in its bottomline to EGP 181.2 mn, with consolidated revenues rising 30% y-o-y to EGP 1.25 bn.

The growth was underpinned by private sales, which grew 35.5% y-o-y in 2021, outpacing the overall private market for the year by 28.2 percentage points, CEO Amr Morsy said. Rameda also continued to grow its portfolio throughout the year, launching a total of seven new products throughout the year, including three in 4Q2021, which helped raise its overall retail pricing by 8% y-o-y to EGP 36.3 in 2021. Also contributing to Rameda’s strong 2021 showing was its export activity, including exports to the Levant, where the pharma company recently began exporting, as well as a rise in revenues from exports to Iraq and Yemen.

Rameda plans to launch another 8-10 products in 2022 “at relatively higher price points relative to its existing portfolio,” according to Morsy. These products include nutraceuticals and existing line extensions, Morsy said. Rameda is also looking to tap into new export markets, including in the GCC and Europe, with registrations underway.

GB Auto’s net income rose 64.2% y-o-y in 4Q2021 to EGP 472.6 mn, the company said in its earnings release (pdf). Revenues rose 25.6% y-o-y during the quarter to EGP 9.05 bn. GB reported a 61.2% y-o-y increase in its full-year bottomline to EGP 1.48 bn, on revenues of EGP 31.44 bn, up 34.9% y-o-y, thanks to recovering demand in 2021.

In detail: Revenues from the auto and auto-related segment grew 30.2% y-o-y in 4Q2021 to EGP 7.16 bn, while full-year revenues rose 38.7% y-o-y to EGP 24.92 bn thanks to “improved market conditions and strengthening consumer purchasing power,” the company said. GB Capital delivered 13.6% y-o-y revenue growth during the final quarter of the year, with full-year revenues rising 24.2% y-o-y to EGP 7.95 bn. GB Capital also reported a decrease in its non-performing loans, falling to 2.02% in 4Q2021 from 2.48% in 4Q2020.

Looking ahead: GB Auto is looking to further expand its footprint in Egypt’s compressed natural gas (CNG) vehicle market as the Sisi administration presses forward with its natgas conversion strategy, CEO Nader Ghabbour said. “We are optimistic that market conditions will continue to improve, consumer demand will persist and our refined pricing strategy will offset the impacts of supply chain disruptions and inflationary pressures.” The company also has “ambitious goals” in 2022 for GB Capital, as it works to introduce new products to the fintech market, Ghabbour said.

Contact Financial’s net income rose 32% y-o-y in 2021 to EGP 465 mn, according to the company’s earnings release (pdf).

Growth was buoyed by a 30% y-o-y increase in financing net income, reaching EGP 442 mn in 2021. Contact extended a record EGP 7.1 bn of new financing throughout the year, thanks to “increased physical and digital capabilities coupled with an expanded product offering.” Its ins. unit also delivered EGP 36 mn in net income during the year, soaring 185% y-o-y. Gross written premiums rose 82% y-o-y in 2021 to EGP 517 mn.

Looking ahead: Contact said it is entering 2022 “with confidence stemming from our outstanding performance in the year just ended” and said strengthening its digital capabilities will be a “key area of focus” this year. “On this front, our Contact Pay venture is pressing ahead with the rollout of its services, including e-payment solutions to provide, operate and manage payment solutions through integration with Contact channels. The services will first be rolled out at our digital financing channel, Contact App.” The company is also on the lookout to grow through “strategic partnerships,” noting that it has made investments in companies including Sakneen, Sa3ar, Synapse Analytics and ecommerce super-app Wasla. “Looking ahead, several other investments are in the pipeline as we continue to look for new ways to better serve our expanding audience, and continue to transform the way consumers and businesses access financial services.”

LAST NIGHT’S TALK SHOWS

The Russia-Ukraine conflict dominated our airwaves this weekend. At the top of the agenda were reassurances on our wheat supplies: Egypt has sufficient wheat reserves to last until the end of 2022, Internal Trade Development Authority head Ibrahim Ashmawy said in a phone call with Al Hekaya (watch, runtime 1:01). Russia and Ukraine together supply around 80% of our wheat imports, leading to fears that the war between the two countries could threaten supply. We have more on the story in this morning’s Commodities section, above.

Around 6k Egyptians live in Ukraine, including almost 4k students, whose evacuation is being prioritized, Emigration Minister Nabila Makram told Hadith Al Kahera (watch, runtime 11:10). Around 1.1k Egyptians have fled or are in the process of fleeing Ukraine to Romania, while some 120 students are making their way to or have already arrived in Poland, Makram told Ala Mas’ouleety’s Ahmed Moussa (watch, runtime 4:34). An operations room has been set up to communicate with Egyptians in Ukraine, Makram told Al Hayah Al Youm’s Lobna Assal (watch, runtime 7:48). She also shared how to communicate with the Egyptian Embassy in Kyiv to ensure a safe exit from Ukraine in a phone-in with Al Hekaya (watch, runtime 11:41).

The talking heads also gave us a wider rundown of events in Ukraine: A political expert based in Ukraine talked Kelma Akhira’s Lamees El Hadidi through the latest developments on the ground (watch, runtime 9:09 ), while Amr Adib broke down the situation for the audience of Al Hekaya (watch, runtime 24:13).

ALSO ON OUR RADAR

Egypt could announce its first net-zero target during COP27: Egyptian authorities may announce a net-zero carbon emissions target at November’s COP27 climate summit in Sharm El Sheikh, Oil Minister Tarek El Molla told Bloomberg TV (watch, runtime: 8:51). The government has pledged to expand renewable capacity to cover 42% of the country’s energy needs by 2030, up from 10% currently, but has not previously set a date for reaching overall carbon neutrality.

Economist Mahmoud Mohieldin has been appointed a high-level climate champion for the COP27 summit, according to a statement. Mohelden will work to coordinate on climate between the government, the business community, the private sector, and international financing institutions. Mohieldin, who is an executive director at the International Monetary Fund and the UN Special Envoy on Financing the 2030 Sustainable Development Agenda, will also work closely with Nigel Topping, the UK’s high-level champion for last year’s COP26 summit.

Transfers from Egyptians abroad rose 6.6% y-o-y in 11M2021 to USD 28.9 bn, according to a Central Bank of Egypt statement (pdf). The increase is in line with previous World Bank projections that remittance inflows to Egypt could hit a record high in 2021, with the bank forecasting transfers from Egyptian expats increasing nearly 13% y-o-y to USD 33 bn throughout the year. The projection would make Egypt one of the world’s top five recipients of remittances.

EDITOR’S NOTE- This story was updated on 27 February, 2022 to reflect that remittance inflows rose 6.6% y-o-y in 11M2021, not 9M2021.

COVID WATCH

Daily tally continues to fall

The Health Ministry reported 1,743 new covid-19 infections yesterday, down from 1,811 the day before. Egypt has now disclosed a total of 480,727 confirmed cases of covid-19. The ministry also reported 35 new deaths, bringing the country’s total death toll to 23,992.

29,953,832 Egyptians are now fully vaccinated against the virus, up 488.2k from last week. 9.7 mn people have received just one shot and close to 1.1 mn have received booster shots.

PLANET FINANCE

Will the Fed’s rate hikes be too little, too late? Almost half of economists polled by the Financial Times think the six quarter-point rate hikes expected from the Federal Reserve will likely be too slow to bring inflation in line. Just over 40% of economists said a total 1.5-percentage-point hike in 2022 would be “too little, too late,” in contrast with less than 5% who worried the Fed may move too aggressively to tame inflation, risking a recession. US inflation hit a forty-year high in January, prompting some market-watchers (including leading investment banks) to predict faster and more aggressive tightening from the Fed starting from its March meeting. Russia’s invasion of Ukraine is not helping matters, the FT reports, saying the potential economic repercussions of war have clouded the economic outlook.

Kuwait’s bourse plans push into derivatives trading in bid to up IPOs: Boursa Kuwait is planning to introduce derivatives products including index and single-stock futures towards the end of 2023, Bloomberg quotes CEO Mohammed Al-Osaimi said. The exchange is also closing in on launching a fixed-income market for corporate bonds and sukuk, and could introduce special purpose acquisition companies (SPACs) based on demand, Al-Osaimi said. The moves come as the Gulf country looks to encourage more listings to help boost its IPO pipeline, with debuts expected from some family-owned companies “soon,” followed by government-controlled firms, he added.

Saudi’s PIF could sell its USD 90 bn Aramco stake: Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), is mulling a full or partial sale of the 4% stake in Saudi Aramco it now holds, among other scenarios it’s looking at to monetize the stake, Bloomberg reports citing sources it says have knowledge of the matter.

|

|

EGX30 |

10,891 |

-3.6% (YTD: -8.9%) |

|

|

USD (CBE) |

Buy 15.66 |

Sell 15.76 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

12,298 |

-1.8% (YTD: +9.0%) |

|

|

ADX |

9,123 |

+0.6% (YTD: +7.5%) |

|

|

DFM |

3,312 |

+1.2% (YTD: +3.6%) |

|

|

S&P 500 |

4,385 |

+2.2% (YTD: -8.0%) |

|

|

FTSE 100 |

7,490 |

+4.0% (YTD: +1.4%) |

|

|

Brent crude |

USD 97.93 |

-1.2% |

|

|

Natural gas (Nymex) |

USD 4.47 |

-0.2% |

|

|

Gold |

USD 1,888 |

-2.0% |

|

|

BTC |

USD 39,404 |

+1.2% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 3.6% at Thursday’s close on turnover of EGP 1.1 bn (7.8% above the 90-day average). Foreign investors were net sellers. The index is down 8.9% YTD.

In the green: Mopco (+1.0%) and Abu Qir Fertilizers (+0.1%).

In the red: Orascom Development Egypt (-10.6%), Heliopolis Housing (-9.3%) and Palm Hills Development (-8.1%).

CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

24 February – 7 March (Thursday-Monday): The 72nd edition of the Diarna Handicrafts Fair. Cairo Festival City, Cairo.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

27 February (Sunday): British-Egyptian Business Association (BEBA) green finance event with Finance Minister Mohamed Maait, Semiramis Intercontinental, Cairo

27 February: Bidding for the construction and operation of the Tenth of Ramadan dry port kicks off.

28 February (Monday): Applications close for the incubator and accelerator program run by Information Technology Industry Development Agency (ITIDA), US-based VC firm Plug and Play, and USAID.

28 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

28 February-1 March (Monday-Tuesday): The Future of Data Centers Summit.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will

replace the existing “closed” financial management system.

March: Contracts for last two phases of Egypt’s USD 4.5 bn high-speed rail line to be signed.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

3 March (Thursday): Fawry’s extraordinary general assembly (pdf) to vote on EGP 800 mn capital increase.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

20 March (Sunday): Applications close for Visa’s global startup competition, the Visa Everywhere Initiative.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal (TBC).

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.