What will our real estate market look like by 2025?

Is our real estate market in line for a full post-covid recovery? Savills seems to think so: Egypt’s five largest listed real estate companies reported a combined drop in profits of around 31% in 2Q2020 due to the covid-induced economic slowdown. Initial sales dropped and deliveries were delayed, while a “fear of buying” spread among customers.

But almost a year has since passed, and plenty appears to have happened to turn the market around: Lockdown measures were eased; interest rates were cut 50 bps in November, we saw the launch of capital mortgage companies and real estate SPVs; and finally, a CBE mortgage financing program was launched in March. Now we’re seeing more international corporations looking to set up shop in Cairo office spaces, new asset classes for residential buildings emerging, and a near-perfect occupancy rate of retail outlets and strips, according to Savills’ 2021 report on the Egypt property market.

By 2025, Savills predicts Egypt’s real estate sector will see much more high-income, mixed-use, and retail strip developments in East Cairo, according to the global property advisor’s report. The report tells us that the residential market in Greater Cairo may likely face a supply surplus, despite a demand increase. Office spaces will grow tremendously in terms of amount of mixed-use sqm, as foreign companies resume expansion plans in Egypt after a covid-induced halt. Retail spaces across Greater Cairo will move towards retail strips and open shopping streets.

We will see almost 7.6 mn homes across Greater Cairo, compared to the current 7.1 mn homes by 2025, Savills writes. Grade A (high-end, luxury homes) homes will increase to almost 170k in West and New Cairo, from almost 70k currently. Residential demand is expected to grow resiliently throughout the post-covid recovery, but a supply surplus may be in the books, Savills writes in its report. Demand for residential homes will remain concentrated across the mid- to high-end segment, attracting mainly the top income category of the population. But with the large inventory of new projects rolled out across several areas and market segments, a surplus will definitely take place, the company states.

Serviced residences will grow faster in Egypt than anywhere else in the world. In the long run, organized and Grade A developments, as well as serviced residences are expected to gain popularity. More mid-to-high projects will be delivered in the next few years, while new types of real estate products, such as branded residences (think Four Seasons residence, etc.) are becoming so popular that the sector is forecast to grow faster in Egypt than in any other country in the world over the coming four years, Catesby Langer-Paget, who heads Savills Egypt, writes.

Consequently, areas like West Cairo and New Cairo are where we should see the most growth, while the rest of Greater Cairo appears to be saturated with limited supply. This is also thanks to a strong push by the New Urban Communities Authority (NUCA) and other governmental authorities making land available to a number of private developers for master plan projects.

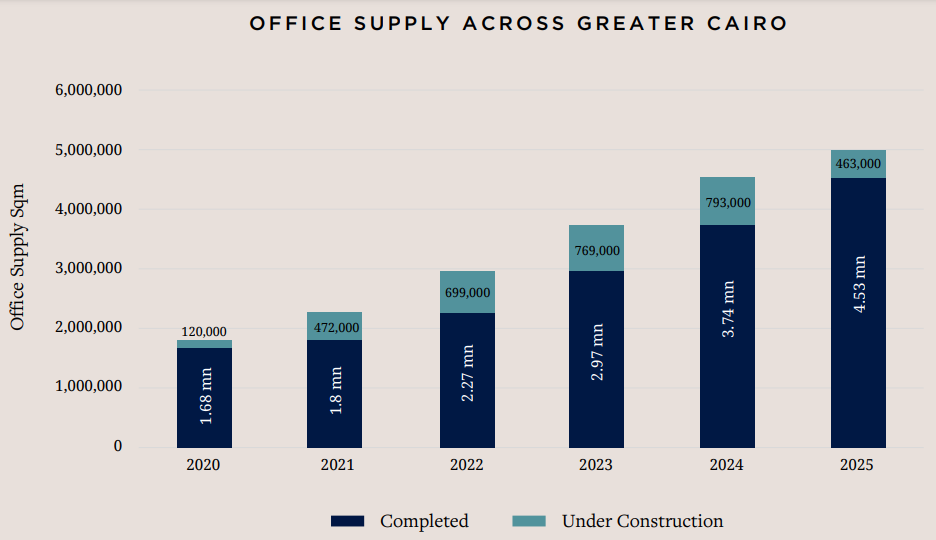

Office space will increase to over 4.5 mn sqm in Greater Cairo by 2025, compared to today’s 1.7 mn sqm. “Mixed-use office parks” is the new buzzword for corporate tenants seeking office spaces. Developers and occupants are moving towards office parks that offer amenities and sufficient parking. These developments have witnessed skyrocketing prices over the past year, due to high demand. Developers usually offer part of their parks for sale, while leasing the remaining space.

And this is being driven by more foreign corporate residents: Foreign corporations and investors have increasingly been either setting foot in Egypt or expanding their footprint, Langer-Paget says. Recent years have seen multinational companies moving either to East or West Cairo, abandoning Downtown Cairo and Giza, with East Cairo becoming the preferred destination, thanks to its proximity to the New Administrative Capital and Cairo International Airport, according to the report.

Just in time for a post-covid recovery: Although the pandemic has put some expansion plans of multinational companies on hold, confidence in the Egyptian economy’s growth has pushed global firms to resume their plans. The product offering has thus changed towards “modern investment grade and integrated developments to match the international corporates’ requirements,” Langer-Paget adds.

This clearly has had an impact on prices: New Cairo boasts the highest office rents, with an average of EGP 450 per sqm/month, an increase over an average of EGP 350 per sqm/month in 2019, we previously wrote. Today, the price can jump to about EGP 650 in certain neighborhoods. Lowest average office rent can be found in Mohandessin and Maadi at EGP 350. Even neighborhoods such as Heliopolis and downtown Cairo can see rents of EGP 350-450 per sqm/month on average.

What if I'm a startup and can’t afford these prices? Read our Hardhat series on how new companies are struggling and overcoming the high rents here, here, and here.

Annual retail sales are expected to grow to USD 160 bn in 2023 from USD 149 bn in 2019, Langer-Paget states. This comes off the back of an expected increase in consumer spending. As consumer spending goes up, demand for retail centers focusing on F&B and family entertainment concepts will remain strong.

And the proof is in the pudding: Major malls and retail strips are seeing an average occupancy rate of over 90%. Galleria40, Tivoli and Waterway even boast a 100% occupancy rate, Savills suggests.

Egypt’s real estate market shows little sign of slowing down, the report tells us. And while a lot of the policies we mentioned earlier in the piece have contributed to this, Savills sees the fundamentals as being the main driver for this growth. Namely, a young population with many still yet to enter their prime earning and purchasing years, and steady economic growth. Add to that, the very real perception that real estate is a safe and preferred investment asset that has been steadily rising since the EGP float back in 2016.

Your top infrastructure stories for the week:

- Orange, SODIC partner for smarter infrastructure: Orange Egypt will provide SODIC’s real estate projects with smart technology services including “triple play” broadband, internet protocol television, and other smart home solutions.

- Egypt continues infrastructure diplomacy in Iraq: Egypt’s ICT Ministry inked an MoU with its Iraqi counterpart to boost digital infrastructure investments by companies in the two countries.

- Alex is getting a new logistics zone: French market Rungis and the Supply Ministry will set up a EUR 100 mn logistics zone for agricultural goods in Alexandria’s Borg El Arab.

- Chinese finance: HSBC has provided finance to Chinese companies who are investing in USD 20 bn worth of Egyptian projects.

- EBA eyes up Africa: The Egyptian Businessmen Association (EBA) is considering establishing a consortium to compete for infrastructure and reconstruction developments in Africa.