- Africa Finance Corporation lines up USD 1 bn+ investment after Egypt becomes member. (Investment Watch)

- Telecom Egypt stake sale possible, company confirms. (Privatization Watch)

- National Paints Holding just raised its bid for Pachin. (Privatization Watch)

- Bedaya + Al Oula close EGP 1 bn securitized bond sales. (Debt Watch)

- Abu Dhabi Ports is looking at the Suez Canal Economic Zone. (Also on our Radar)

- Fawry’s net income rises 70% in 2022. (Earnings Watch)

- Further + faster rate hikes possible, warns Fed’s Powell. (Planet Finance)

- What the tourism sector needs in terms of infrastructure changes, according to industry players. (Hardhat)

Wednesday, 8 March 2023

AM — Africa Finance Corporation lines up USD 1 bn+ investment for Egypt

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. Before we get stuck into the issue…

A WORD FROM THE DEPT. OF TOOTING OUR OWN HORN- Longtime readers know we talk a lot about gender equity issues (among others). We also try to walk the walk — it simply makes no sense to leave 50% of your potential labor force untapped. So we did some math yesterday on the occasion of International Women’s Day.

Fully 47% of our team are women across both our news and advisory division — and eight of our 17 most senior leaders are women. Zoom into our newsroom, and you’ll find that 57% of our team are women. Our last pay equity audit found no differences in comp between men and women in the same roles (and with the same seniority), and we proudly offer women- and family-friendly benefits, from a whole-family health plan to generous maternity and paternity leave.

A special shout-out to our dev team, which has added seven women software developers, UI / UX specialists and other professionals to its team in the past 18 months.

WHAT’S HAPPENING TODAY-

The EFG Hermes One-on-One conference continues at the Atlantis Dubai. The largest investor conference in frontier and emerging markets — which is running this year under the theme Outplaying Challenges — brings together more than 560 fund and portfolio managers and C-suite execs from almost 180 companies in 29 countries.

Armenian Foreign Minister Ararat Mirzoyan is on the second day of his three-day visit to Egypt that will see him meet with Sameh Shoukry and participate in an Arab League session. This comes a month after President El Sisi visited the country as part of a diplomatic tour that also took him to Azerbaijan and India.

HAPPENING THIS WEEK-

Inflation figures for February will land at the end of this week. Consumer prices accelerated at their fastest pace in five years in January on the back of record food price inflation triggered by the devaluation of the EGP.

Feb inflation to hit a fresh five-year high -Reuters poll: The median prediction in a Reuters poll of 14 analysts has inflation climbing to 26.7% in February from 25.8% the month before. This would be the highest print since October 2017 when inflation was running at 30.8%.

The US defense secretary is in Egypt: US Secretary of Defense Lloyd J. Austin is in the region this week for a multi-day trip that will take him to Egypt, Israel, Jordan and Iraq. The Pentagon has not disclosed Austin’s itinerary. Austin began his trip in Jordan earlier this week and landed in Baghdad yesterday.

The two-day Techne Summit starts on Saturday at the National Museum of Egyptian Civilization.

|

THE BIG STORY ABROAD-

The front pages of the international business press are all bracing for further Fed rate hikes this morning following Chairman Jerome Powell’s statements at the Senate yesterday. We have more on this in this morning’s Planet Finance section, below. (AP | Reuters | Bloomberg | Financial Times | Wall Street Journal | New York Times | CNBC)

MEANWHILE- President Kais Saied’s stoking of anti-African sentiment is having economic consequences: Investors have dumped Tunisian bonds and the World Bank is suspending some cooperation with the country following a spate of violence against sub-Saharan migrants, Bloomberg reports. Hundreds of Africans have left the country in the wake of an anti-migrant speech by President Kais Saied last month that leaned heavily into ‘great replacement’ theory and triggered a wave of attacks on migrants. In response, the World Bank is pausing its Country Partnership Framework with the country that provides “strategic directions for operational engagements” in 2023-2027, it said in a statement yesterday.

WATCH THIS SPACE-

An extension to the UN-brokered Black Sea Grain Initiative? Ukraine has opened talks to extend the Black Sea Grain Initiative past 18 March, enabling it to continue exporting grain around the world, Reuters reports citing an unnamed senior Ukrainian government source. Kyiv hasn’t had contact with Russia but understands that its partners are taking the lead in trying to find an agreement with Moscow, the official said. The Kremlin said it would agree to the extension as long as its agricultural suppliers are taken into account, according to the newswire.

Remember: The pact, brokered by the UN and Turkey last year, ended Russia’s blockade of Ukrainian ports and helped temper a global food supply crisis triggered by the war.

We are delighted to share with you that the Enterprise Exports & FDI Forum will be taking place on Monday, 15 May at the Four Seasons Hotel at Nile Plaza.

DO YOU WANT TO ATTEND? The first wave of invites is going out soon. If you’re a C-suite exec, exporter, investor, official, banker, or someone who should be part of the conversation, please TAP OR CLICK HERE to request a spot at this exclusive event.

What’s the Enterprise Exports & FDI Forum? It is the latest in our series of must-attend, invitation-only gatherings for C-suite-level business leaders. The Enterprise Exports & FDI Forum will discuss the critical topics of exports and foreign direct investment (FDI) in Egypt.

We will be taking an in-depth look into some of the most vital industry topics, including:

- How to effectively break into new export markets

- How to leverage domestic trends in order to create export opportunities

- What foreign investors are looking for

- What the government’s role should be

Why now? Exports and foreign direct investment (FDI) have never been more important to our economy — or our businesses — than in the wake of the float of the EGP. We think we have a once-in-a-lifetime chance to build an export-led economy that makes us a magnet for FDI, and all the benefits that will come with it for our nation.

Think of the Enterprise Exports & FDI Forum as a hands-on lab for how to turn the devaluation of the EGP into something that will turbocharge your company and our economy.

WANT TO SHARE YOUR STORY ON STAGE? Drop a note to Patrick here and let’s talk.

WANT TO BECOME A COMMERCIAL PARTNER? Ping a note to Moustafa, our head of commercial, here.

CIRCLE YOUR CALENDAR-

Italian FM in Egypt next week to talk Israel-Palestine: Italian Foreign Minister Antonio Tajani is heading to Egypt on Monday after visiting the West Bank and Israel, Italian news agency ANSA said yesterday.

Ahlan Ramadan: The government’s Nasr City Ahlan Ramadan discount supermarket expo will kick off on 15 March and will run through to 21 March, the Supply Ministry said in a statement yesterday. The government has some 455 Ahlan Ramadan locations across the country.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, and urban development, as well as social infrastructure such as health and education.

In today’s issue: In a Cabinet Information and Decision Support Center (IDSC) forum last week, tourism players had their say about the infrastructure upgrades needed for the industry to take off.

Somabay brings out the best in majestic natural elements where raw beauty and endless activities reign supreme. Immerse yourself into a picturesque getaway all year long. This is simply Somabay. For more information, call 16390 or visit www.somabay.com.

PRIVATIZATION WATCH

Telecom Egypt stake sale possible, company confirms

The gov’t is studying a stake sale in TE: The Finance Ministry yesterday confirmed that the government is working on a feasibility study regarding the sale of an undisclosed stake in Telecom Egypt (TE), the state-owned telecom giant said in a disclosure (pdf) to the bourse yesterday. Reuters on Monday reported that the government is planning to sell 10% of the company’s shares, most likely to a local investor.

It’s early days: The government may decide not to go ahead with the stake sale after studying its options, the statement reads. The company could choose to securitize future receivables as an alternative means of raising capital, a source told Asharq Business earlier this week.

Advisors: Al Ahly Pharos and CI Capital are managing the transaction.

Shares continued to sell off yesterday: TE’s share price lost 4.5% to settle at EGP 25.55 during trading yesterday. The company has seen more than 8% knocked off its share price since the news broke on Monday.

Background: The state currently holds 80% in the EGX-listed company, with the rest in freefloat, according to TE’s website. The transaction would be worth some EGP 4.4 bn at TE’s current share price.

Is Qatar’s wealth fund interested? Representatives of the Qatar Investment Authority (QIA) expressed interest in purchasing a stake in TE during Prime Minister Moustafa Madbouly’s visit to Qatar last week, Al Mal reports, citing unnamed sources it says have knowledge of the matter.

Talks over TE’s stake in Vodafone Egypt are ongoing: This doesn’t mean Qatar is shying away from talks with TE to buy the telecoms company’s 45% in Vodafone Egypt, the sources told Al Mal. Talks have reportedly stalled over a disagreement about the size of the stake on offer. Bloomberg is reporting that both the QIA and Saudi wealth fund PIF have submitted offers for part of TE’s stake in Vodafone, without giving more details.

PRIVATIZATION WATCH

National Paints Holding just raised its bid for Pachin

National Paints Holding ups Pachin bid: Dubai-based National Paints Holding (NPH) has raised its offer for Paint and Chemical Industries (Pachin) by 17% in a mandatory tender offer (MTO) submitted yesterday, according to a Financial Regulatory Authority (FRA) statement (pdf). The company has offered to purchase at least 75% of the company for EGP 34.00 a share, up from its initial EGP 29.00 bid in November. The offer values the company at some EGP 816 mn by our math.

The new offer makes NPH the highest bidder so far for Pachin: Pachin has fielded at least five takeover offers in recent months. Last we heard, two other suitors were still in the running and conducting due diligence on the firm: Compass was leading the pack with a EGP 30.00 per-share bid while Eagle Chemicals offered EGP 29.50.

The updated bid offer is the first following PM Madbouly’s decision to include Pachin in the gov’t privatization program. The three bidders were reportedly rethinking their options for EGX-listed Pachin following its inclusion in the state privatization program in early February. Pachin’s inclusion on the list had raised the possibility that the government could look to dilute its position by calling for a capital increase via the EGX or decide not to bring in strategics. Pachin is currently approximately 54% owned by state companies and banks.

What’s next? Pachin’s shareholders will take a month or more to evaluate NPH’s offer, a source with knowledge of the matter told Enterprise yesterday. The company hasn’t yet received new or renewed offers from any other bidders, but isn’t ruling it out, he added.

Advisors: Al Ahly Pharos is advising Pachin, while Shalakany Law Office is counsel. The advisors on the buy side were not disclosed.

INVESTMENT WATCH

Africa Finance Corporation lines up USD 1 bn+ investment after Egypt becomes paid-up member

AFC plans to invest USD 1 bn in Egypt’s energy + industrial sectors: The Africa Finance Corporation (AFC) has identified an “immediate project pipeline” of investments worth more than USD 1 bn in Egyptian infrastructure projects, it said in a statement (pdf) yesterday. The projects are in the renewable energy, natural gas, heavy industries, tech, telecoms, banking, and finance sectors, it said.

We’re now a fully paid-up member of the AFC: Egypt has made an unspecified equity investment in the pan-African multilateral development institution, becoming its first North African sovereign shareholder, according to the statement. The corporation had not updated its shareholder information on its website at the time of writing.

REMEMBER- The House of Representatives in December greenlit plans for Egypt to join the multilateral lender, which were approved by cabinet a year earlier. Speaking with Enterprise back in July 2021, AFC President and CEO Samaila Zubairu said that Egypt’s membership would put the country in line for more than USD 1 bn in big-ticket investments, way beyond the few sub-USD 100 mn investments received as non-members.

On renewables, think Lekela: AFC will primarily look to invest in firms where it has “influence and representation on the board,” Executive Director and Chief Investment Officer Sameh Shenouda was quoted as telling Al Arabiya. AFC and our friends at renewables player Infinity Group agreed to acquire 100% of pan-African renewables firm Lekela Power from private equity firm Actis and Irish wind / solar developer Mainstream Renewable Power last summer, in a transaction that reportedly valued the company at USD 1.5 bn. AFC and Infinity last year said they want to raise USD 2.5-4 bn over the next four years to double the capacity of Lekela.

AFC is also in talks with the Sovereign Fund of Egypt regarding “more than one project,” Shenouda told Al Arabiya. The central bank and the Finance Ministry are also in discussions with AFC for it to act as a guarantor on international bond issuances, he added.

DEBT WATCH

Bedaya + Al Oula close EGP 1 bn securitized bond sales

Two mortgage companies issue securitized bonds: Bedaya Mortgage Finance and Al Oula Mortgage Finance each issued securitized bonds worth nearly EGP 1 bn yesterday.

#1- Bedaya closes EGP 958 mn securitization: Bedaya Mortgage Finance issued securitized bonds worth EGP 958 mn in the second round of its EGP 3 bn program, according to a statement (pdf) from Dreny and Partners, which was the legal advisor on the transaction.

About the issuance: The six-tranche bond is backed by a receivables portfolio of EGP 1.56 bn, representatives of Dreny and Partners told us. The tranches received ratings ranging from A to AA+ from the Middle East Rating and Investor Service (MERIS).

Bedaya is now more than halfway through its EGP 3 bn securitization program. It issued EGP 651.2 mn worth of bonds to kick off the program last year. The entire program should be completed within the next two years depending on Bedaya’s operational needs, Dreny and Partners told Enterprise.

Who bought in? Arab African International Bank (AAIB), CIB, and National Bank of Egypt (NBE), Dreny and Partners said.

More advisors: EFG Hermes acted as financial advisor. It was joined by NBE, AAIB and CIB as underwriters, with NBE also acting as bookrunner and custodian. KPMG was the auditor.

About Bedaya: The mortgage provider is a joint venture between EFG Hermes Holding, Talaat Moustafa Group and GB Capital.

#2- Al Oula Mortgage Finance closed its first securitization issuance worth EGP 998.5 mn, also part of a planned three-year, EGP 3 bn program, according to a separate press release (pdf) from Dreny and Partners. The six tranches were backed by an unspecified receivables portfolio and were rated from A to AA+ by MERIS.

Advisors: EFG Hermes acted as the financial advisor. It also acted as an underwriter alongside NBE, AAIB and Banque du Caire, with AAIB acting as the custodian and the subscription. Baker Tilly was the auditor and the legal advisor for the issuance was Dreny and Partners.

** The securitization market in 2023: The two issuances bring the total securitized bonds brought to market so far this year to almost EGP 9.6 bn. That’s more than the EGP 8 bn that went to market in the same period of last year — which was already a hot year for securitization issuances.

CORRECTION-

This story was corrected on 8 March, 2023 to remove Al Ahly Pharos from the list of banks that bought in to Bedaya’s securitization issuance. Al Ahly Pharos was not involved in the transaction. AAIB also acted as the subscription bank, rather than the bookrunner as a previous version of this story incorrectly stated.

ECONOMY

CBE unveils terms of new subsidized lending program

Ts & Cs of new subsidized loans: The Central Bank of Egypt (CBE) is capping the funding provided for a single individual at EGP 75 mn and a total of EGP 112.5 mn per individual and all related parties under the new subsidized lending program for industry and agriculture players, the bank said in a statement (pdf) laying out the terms and conditions yesterday.

REMEMBER- The government introduced a new EGP 150 bn subsidized loan program for industry and agriculture last year shortly after the central bank announced it would stop handing out soft loans as part of the loan agreement with the IMF. The IMF agreement required the central bank to transfer responsibility for funding subsidized loans to the state, which is now offering industrial and agricultural companies 11% loans, slightly more expensive than the CBE’s previous 8% rate.

Also worth noting: The vast majority of the funding (EGP 140 bn) will go towards funding working capital while the remaining EGP 10 bn will finance the purchase of machinery and equipment. The program will last five years and the Finance Ministry will bear the cost of financing the interest rate.

EARNINGS WATCH

Fawry’s net income rises 70% in 2022

E-payments giant Fawry’s adjusted net income climbed 70% y-o-y to EGP 316.9 mn in 2022, according to its earnings release (pdf). Revenues, meanwhile, rose 38% to EGP 2.3 bn for the year. Net income was adjusted to exclude the impact of EGP 73.2 mn in one-time expenses from Fawry’s employee stock ownership program (ESOP).

On a quarterly basis: Adjusted net income more than tripled to EGP 137.1 mn in 4Q 2022, while revenues rose 39% to EGP 651.3 mn.

Banking services + microfinance underpinned revenue growth: Fawry’s banking services segment was the single largest driver of the rise in revenues, accounting for 56% of overall top-line growth. Revenues generated by the segment jumped 85% to EGP 760.6 mn in 2022, accounting for 33% of revenues. The microfinance segment also performed well, generating EGP 251 mn worth of revenues, up 83% and contributing 11% of total revenues.

As did the expansion of the firm’s product mix: “The primary reason behind our sustained revenue increase and market penetration levels across Egypt [is] the launch of new innovative services and an expanded offering that caters to our diverse community of customers,” CEO Ashraf Sabry said in the release. He name checked the Tamweelak Fawry mobile app that launched in November and Fawry’s ins. offering.

MOVES

Jumia Egypt has appointed Hisham El Gabry (LinkedIn) its new CEO, the company said on Twitter. El Gabry has served as the e-commerce company’s CCO since January 2022. Prior to joining Jumia, El Gabry was head of fashion at Amazon UK after spending more than a decade at Vodafone. He replaces Hesham Safwat (LinkedIn) who spent more than eight years at the helm of the company.

LAST NIGHT’S TALK SHOWS

The train accident in Qalyub was one of the most talked about stories on last night’s talk shows, with Kelma Akhira (watch, runtime:2:29) and Ala Mas’ouleety (watch, runtime: 7:00) both covering the story. At least two people died and 16 were wounded when a train derailed in the city yesterday.

More on the state’s privatization plans: The state’s plan to sell off an undisclosed stake in Telecom Egypt (TE) is more advanced stages than it is letting on, according to Egyptian Capital Market Association VP Ayman Sabry, who claimed in an interview on Kelma Akhira that the Finance Ministry has kicked off a roadshow to market the sale to local and regional investors (watch, runtime: 7:32). The transaction could close within days, he said. It wasn’t clear where Sabry had received the information from.

Quantity over quality: “The most important thing at the moment is speed of implementation because we need to get the ball rolling,” Sabry told show host Lamees El Hadidi. “The price isn’t the main priority but rather having transactions happening on a regular basis,” he said, referring to the state privatization program (watch, runtime: 1:37).

We have more privatization news in this morning’s news well, above.

Ahmed Moussa really doesn’t like the US: In a five-minute rant last night, the firebrand show host accused Washington of intentionally increasing poverty rates and aggravating inflationary pressures around the world (watch, runtime: 5:44). Referencing Federal Reserve Chair Jerome Powell’s remarks yesterday (more on that below), Moussa described the Fed’s aggressive monetary policy as the “US’ economic war against the entire world.”

Predictions roll in for the CBE’s upcoming policy meeting: “I see the central bank moving forward with a rate hike in its upcoming meeting,” banking expert Sahar El Damaty told Moussa (watch, runtime: 13:18), citing inflationary pressures and outflows triggered by the Fed raising rates. Inflation hit a five-year high of 25.8% in January as the impact of the ongoing depreciation of the EGP pushed food prices to accelerate at a record rate.

EGYPT IN THE NEWS

The “smiley” Sphinx is still dominating the conversation on Egypt internationally: Archaeologists in Qena have discovered a small Sphinx believed to represent the Roman emperor Claudius at the Temple of Dendera. (AFP | Washington Post | BBC | CNN | The National | Xinhua | The Week)

Also making headlines:

- In the spirit of international women’s day: Egyptian scooter driver Eman Al Adawi wants to create a new ride-hailing app run by an all-woman team — complete with female mechanics and instructors — after finding success in providing women with scooter rides to financially support her family. (Reuters)

- Mada Masr trial begins: Three journalists at independent news outlet Mada Masr have gone to trial on charges of offending Mostakbal Watan MPs after publishing an article alleging corruption. (The Guardian)

- A 280-year jail term was apparently a good result for this Egyptian migrant: An Egyptian fisherman facing a 4760-year jail sentence in Greece for helping to smuggle almost 500 Libyans across the Med has been handed a comparatively lenient 280 years inside. The fisherman was one of the migrants on board but was steering the vessel, leading activists to criticize Greek authorities for using him as a scapegoat. (Euronews)

- Egypt’s date expo makes headlines: The Cairo International Dates Festival is helping Egypt tap new export markets and market its wealth of dates around the world. (Xinhua)

ALSO ON OUR RADAR

INVESTMENT-

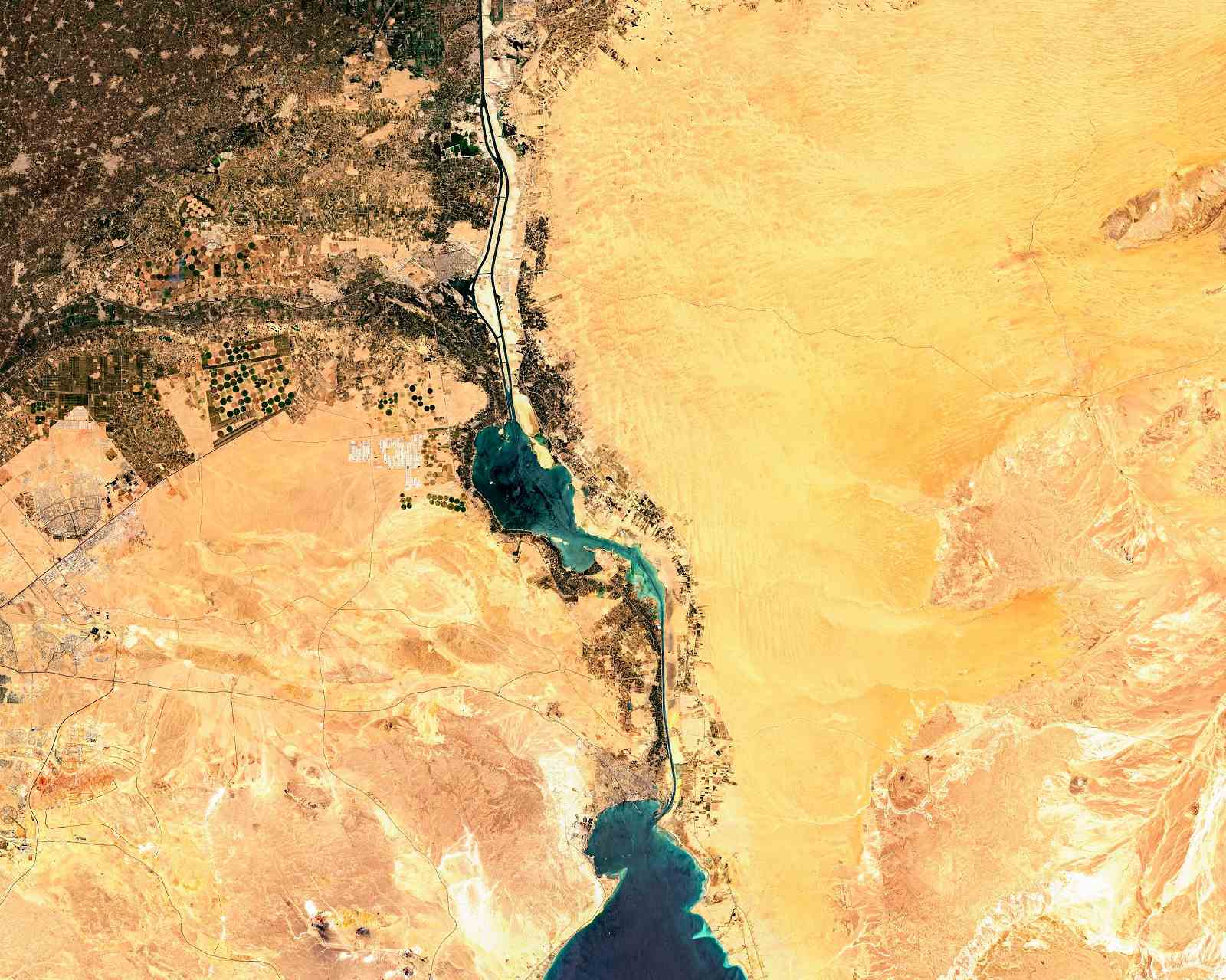

Abu Dhabi Ports + UK green fuel, desalination companies are looking at the Suez Canal Economic Zone: Representatives of Abu Dhabi Ports discussed operating berths in ports and setting up logistics zones in the Suez Canal Economic Zone during talks with zone head Walid Gamal El Din, SCZone said in a statement yesterday. This came two days after ADP’s CEO met President Abdel Fattah El Sisi to discuss expanding its involvement in Egypt’s ports and logistic zones.

Remember: The ADQ-owned company has been pushing aggressively into Egypt’s maritime sector. It said in 2021 that it could invest USD 500 mn to develop a terminal at Ain Sokhna port and one at Safaga port, and is expected to bid in the upcoming tender for the Tenth of Ramadan dry port.

UK firms talk green fuel + desalination investment at the SCZone: Several British companies working in green fuel and water desalination met with SCZone representatives to talk about investment opportunities, according to a SCZone statement.

TRANSPORT-

Train derails in Qalyub, killing at least two: Two people died and 16 were injured after a train derailed in Qalyub, the Health Ministry said in a statement yesterday. Authorities are looking into the cause of the accident and those injured are currently receiving treatment. The Solidarity Ministry said it will disburse EGP 100k in compensation to the families of the deceased.

TOURISM-

State to tap Italian partner to boost yacht tourism? The Madbouly government met with representatives from the Italian Navigo Group to discuss the future of yacht tourism in Egypt, according to a statement. The two sides agreed to draft an MoU outlining proposals for future cooperation to boost yacht tourism in Egypt.

STARTUPS-

#1- Flat6Labs launched its StartMashreq initiative to support entrepreneurs across Lebanon, Jordan, and Iraq, it said in a statement (pdf) yesterday. The program aims to support budding entrepreneurs from underprivileged and marginalized groups, including women and displaced people, through customized training programs and virtual incubation programs. The Dutch government and the International Finance Corporation are co-partnering with Flat6Labs on the initiative.

#2- Rabbit goes bulk: Grocery delivery startup Rabbit has launched a bulk delivery service, Gomla, it said in a statement (pdf) yesterday. The new service allows customers to buy in bulk through the Rabbit app and receive their products the following day.

#3- Career 180 joins the IFC’s She Wins Arabia: Edtech startup Career 180 was awarded the Golden Ticket to join the International Finance Corporation’s She Wins Arabia, during the latest episode of Shark Tank Egypt (watch, runtime: 1:08). The initiative aims to help women-led MENA startups get access to advice, mentorship, and finances they need to grow.

Career 180? It's an online platform that allows users to connect with career experts in virtual one-to-one sessions, and provides them with resources like career counseling videos to help equip them with skills for the job market. The company secured USD 200k from EdVentures in 2021.

SUSTAINABILITY-

CIRA Education has published its first annual sustainability report, laying out the company’s use of natural resources and what it is doing to boost sustainability at its facilities and operations. The education investment firm plans to reduce energy use and emissions by 10% and implement an enhanced waste and recycling plan by 2026, as well as implement one renewable energy project each year for the next three years. Check out the report here (pdf).

REMEMBER- Corporates must now publicly disclose their performance on key environmental, social and governance metrics each year when they submit their annual financial statements.

PLANET FINANCE

From the horse’s mouth: The Federal Reserve will likely need to hike interest rates further and faster than currently expected to temper inflation, central bank chair Jerome Powell told lawmakers yesterday. The comments, made during Senate testimony yesterday, signaled that the Fed could raise its key rate by 50 bps at its next meeting in two weeks time. “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” he said. Reuters, Bloomberg and Financial Times have more.

Reminder: Following a series of huge 75-bps hikes last year, the central bank has been slowing the pace of increases in recent meetings, and in February raised them by just 25 bps. A series of strong economic data and a surprise increase in the Fed’s preferred gauge of inflation has raised expectations that policymakers could get more hawkish in the coming months as they battle to get inflation closer to the 2% target.

The markets didn’t take the news well: Powell’s comments triggered nervousness in the markets yesterday as investor fears of a US recession resurfaced. Shares ended sharply lower — the Dow Jones was the worst performer, losing 1.7% to erase 2023 gains — the USD gained 1.2%, and Brent tumbled 3.6%, its biggest single-day loss since the first week of the year.

The sell off is continuing in Asia this morning, where most exchanges are in the red. The Hang Seng is leading losses (-2.5%) while shares in China, South Korea and Australia are also nursing losses. Shares in Europe and the US are also expected to fall when markets open later today.

MEANWHILE- Sheikh Tahnoon is setting up one of the largest asset managers in the region: Abu Dhabi sovereign fund ADQ and International Holding Company (IHC) are partnering to set up what they’re calling “region’s largest multi-asset class investment manager.” The firm will manage assets from ADQ’s alternative investments platform, Abu Dhabi Growth Fund and IHC, and raise fresh funds from investors, they said. The two companies are bringing on board US private equity General Atlantic as a strategic investor. Sheikh Tahnoon bin Zayed Al Nahyan chairs both ADQ and IHC and is also the UAE’s national security adviser.

| EGX30 | 16,433 | -2.2% (YTD: +12.6%) | |

| USD (CBE) | Buy 30.78 | Sell 30.89 | |

| USD at CIB | Buy 30.78 | Sell 30.88 | |

| Interest rates CBE | 16.25% deposit | 17.25% lending | |

| Tadawul | 10,473 | +0.2% (YTD: -0.1%) | |

| ADX | 9,948 | -0.5% (YTD: -2.6%) | |

| DFM | 3,429 | -0.8% (YTD: +2.8%) | |

| S&P 500 | 3,986 | -1.5% (YTD: +3.8%) | |

| FTSE 100 | 7,919 | -0.1% (YTD: +6.3%) | |

| Euro Stoxx 50 | 4,279 | -0.8% (YTD: +12.8%) | |

| Brent crude | USD 82.95 | -3.8% | |

| Natural gas (Nymex) | USD 2.66 | +3.4% | |

| Gold | USD 1,818.30 | -2.0% | |

| BTC | USD 22,055 | -1.6% (YTD: +33.2%) |

THE CLOSING BELL-

The EGX30 fell 2.2% at yesterday’s close on turnover of EGP 1.9 bn (6.9% below the 90-day average). Local investors were net buyers. The index is up 12.6% YTD.

In the green: Ezz Steel (+3.4%).

In the red: Qalaa Holdings (-4.6%), Telecom Egypt (-4.5%) and GB Auto (-4.3%).

DIPLOMACY

Egypt condemns latest Israeli raid: The Foreign Ministry has condemned a raid by Israeli forces in the Jenin refugee camp in the Occupied West Bank which according to Reuters killed at least six Palestinians and wounded 16 others. The ministry expressed “total rejection” of Israel’s repeated incursions in the territory, which have escalated markedly since the Netanyahu-led far-right coalition came to power in January.

Egypt x Kenya: President Abdel Fattah El Sisi rang his Kenyan counterpart William Ruto yesterday to discuss ties and African security, Ittihadiya said without providing further details.

AROUND THE WORLD

Qatar’s top diplomat appointed PM: Qatar’s emir has appointed the country’s foreign minister, Sheikh Mohammed bin Abdulrahman Al Thani, as prime minister, according to the state-owned Qatar News Agency. Sheikh Mohammed will retain his role as foreign minister, a position he’s held since 2016, but will step down as the chairman of the country’s sovereign wealth fund, the Qatar Investment Authority. Khalid bin Khalifa Al Thani will step down as both Qatar’s prime minister and interior minister

The move was part of a broader cabinet shake-up: The move was accompanied by the appointment of 18 other ministers. The finance and energy ministers of the natural gas producer also retained their roles.

Tourism players have their say about the infrastructure upgrades needed for the industry to take flight: Last week, the Cabinet Information and Decision Support Center (IDSC) held a forum to discuss measures and initiatives to boost the tourism industry, bringing together 16 investors, hotel owners, academics, tourism and aviation companies, and government representatives, according to a cabinet statement. In addition to discussing the government’s ongoing work to develop the sector, the forum saw the participants offer up proposals to attract more tourists and increase efficiency, including traditional and digital infrastructure upgrades.

In case you needed reminding about how vital tourism is for Egypt’s economy: Egypt is looking to invest some USD 30 bn into tourism to grow the sector by 25-30% annually between now and 2028. The government has an ambitious plan to increase tourism by up to 30% every year for the next five years, targeting 30 mn tourists to the country by 2028, more than double the number that visited the country in 2019. The government also wants to more than triple annual tourism revenues over the next three years to USD 30 bn a year, up from almost USD 9 bn last year and USD 11-12 bn currently.

Hotels need upgrading and expansion: The Tourism Ministry is looking to raise the overall capacity of hotels across Egypt, according to the head of the Tourism Ministry’s hotel division Mohamed Amer. There are currently 1,210 establishments with a combined 212.7k rooms in the country, Amer said, without specifying whether the ministry has a target for the number of rooms or hotels, or where this additional capacity is earmarked. The government is also working on improving infrastructure at tourist destinations outside the main metropolitan hubs, including eco-tourism spots such as Siwa. Infrastructure upgrades include raising internet speeds to be on par with international upgrades, Amer said.

We could also benefit from capacity expansions geared towards more diverse travelers, suggested Amr Sedky, head of the Creative Group for Tourism and Hotels. Investors would be keen on building out resorts and establishments for wellness, medical, and cultural tourism, Sedky said, pointing out that there are north of 1.3k sites across the country that can be developed specifically for wellness tourism. Sedky called on the government to develop an investment map for these sites to help guide investment decisions and diversify the country’s tourism industry beyond beach tourism.

However, that capacity expansion can’t go the distance alone: In Marsa Alam, for example, there are several vacant rooms, likely because of how some services are priced, Tarek Shalaby, vice chairman of the Tourism Investors Association in Marsa Alam said. Shalaby called for a more structured framework to address the issue of unregulated pricing.

There’s also consensus that the industry needs to up its digital infrastructure game: Several forum participants proposed various digital platforms to consolidate tourism-related procedures and data, including setting up a single unified electronic platform for tourism through which travelers can book airline tickets, hotels, and other services or activities. This type of platform would streamline the process for tourists and could help the government reel in more revenues, suggested Samia Sami, head of the Central Administration for Tourism Companies. The platform could also help the government crack down on unofficial platforms operating in the industry and redirect revenues to the formal economy, which would also widen the government’s tax base, Sami suggested.

Egypt could also give its medical tourism a boost by creating a digital platform that would link prospective patients from abroad with service providers in Egypt, suggested Dalia Hashem, founder of the Circle Care, which facilitates medical tourism in Egypt.

Digitizing would help create transparency and guide future policy and investment decisions: The Central Bank of Egypt, the tourism and planning ministries, and state census bureau CAPMAS should coordinate more closely to have unified, regularly updated data made available to track the tourism industry’s performance, said Cairo University Center for Economic and Financial Research and Studies Director Adela Ragab. Having this consolidated data would go a long way to guiding policies, including which markets to target for tourism promotion campaigns, Ragab suggested. The Central Bank of Egypt is presently the only state-affiliated entity that publishes official data on tourism revenues.

Some also want to see investment-related infrastructure tacked onto tourism destinations: Along with promoting the development of hotels and other wellness establishments in the country, Sedky suggested setting up business infrastructure in tourism hotspots like Nuweiba, where he believes an economic freezone for SMEs could be an attractive pull for businesses. The government is currently looking at a proposal to set up tourism freezones that would give investors certain privileges, including tax cuts and other exemptions, for a specific period of time to help draw in investor interest, Assistant Tourism Minister for Financial Affairs and Investment Ehab Salem said.

Your top infrastructure stories for the week:

- More electricity for Jordan? Egypt could increase the capacity of its electricity line with Jordan to up to 3 GW from 550 MW currently.

- One step closer to Tarboul Industrial City: Real estate developer GV Developments and Qalaa Holdings’ Taqa Arabia have signed an agreement to set up a company to build the infrastructure at the Tarboul Industrial City in Giza

- Egypt x Copenhagen Infrastructure Partners: Representatives from the Danish infrastructure investor met Planning Minister Hala El Saeed to discuss green investment opportunities in Egypt. (Statement)

- The Electricity Ministry received a nearly completed draft of the national hydrogen strategy and is working to complete it. The government is aiming to publish the strategy before the beginning of Ramadan at the end of March, sources told us last month.

- A fresh World Bank grant to tackle waste: The World Bank will grant the government’s Greater Cairo pollution reduction project a USD 9.1 mn grant to improve the management of e-waste and healthcare waste disposal systems.

CALENDAR

FEBRUARY

19 February-11 March (Sunday-Saturday): 2023 Africa U20 Cup of Nations, Egypt, various locations.

MARCH

March: 4Q2022 earnings season.

March: Gov’t to launch the National Governance Index.

March: Palestine-Israel talks in Sharm El Sheikh.

Beginning of March: Rice to be added to the EMX.

6-9 March (Monday-Thursday): EFG Hermes One-on-One conference, Atlantis, Dubai.

7 March (Tuesday): Higher Education Ministry to unveil national strategy for higher education.

7-9 March (Tuesday-Thursday): Armenia foreign minister diplomatic visit.

11-12 March (Saturday-Sunday): Techne Summit, National Museum of Egyptian Civilization.

13 March (Monday): BEBA Egypt hosts discussion and dinner with Oil Minister Tarek El Molla.

13 March (Monday): Italian foreign minister in Cairo.

16-18 March (Thursday-Saturday): RiseUp Summit, Grand Egyptian Museum, Giza.

19 March (Sunday): House reconvenes.

21-22 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

23 March (Thursday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

26 March (Sunday): Senate reconvenes.

27-29 March (Monday-Wednesday): The first meeting of the COP transitional committee, focusing on adaptation, and loss and damage.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

31 March (Friday): Finance Ministry to present draft budget to House of Representative by this date.

APRIL

April: GAFI to launch the country’s first integrated electronic platform to facilitate setting up a business.

April: SCZone roadshow in China.

1 April (Saturday): Deadline for banks to establish sustainability units.

10-16 April (Monday-Sunday): IMF / World Bank Spring Meetings, Marrakesh, Morocco.

16 April (Sunday): Coptic Easter

17 April (Monday): Sham El Nessim.

21 April (Friday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

30 April (Sunday): Tenth of Ramadan dry port tender deadline.

30 April (Sunday): Deadline for self-employed to register for e-invoicing.

30 April (Sunday): End of Mediterranean, Nile Delta oil + gas exploration tender.

Late April – 15 May: 1Q2023 earnings season.

MAY

1 May (Monday): Labor Day.

2-3 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Thursday): National holiday in observance of Labor Day (TBC).

4 May (Thursday): IEF-IGU Ministerial Gas Forum, Cairo.

9-11 May (Tuesday-Thursday): First edition of the Arab Actuarial Conference, Cairo.

12 May (Friday): Expat car import scheme ends.

15 May (Monday): Enterprise Exports & FDI Forum, Four Seasons Hotel Cairo at Nile Plaza.

16-18 May (Tuesday-Thursday): Egypt will host its first conference on cybersecurity and defense intelligence systems (CDIS-Egypt).

18 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

20-21 May (Saturday-Sunday): eGlob Expo, St. Regis Almasa Hotel, Cairo.

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE

7-10 (Wednesday-Saturday): The second edition of Africa Health Excon.

10 June (Saturday): Thanaweya Amma examinations begin.

12 June – 15 July (Monday-Saturday): Thanaweya Amma exams.

13-14 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 June (Thursday): Deadline for bids in EGPC’s mature oil fields tender.

19-21 June (Monday-Wednesday): Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

22 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

25-26 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

AUGUST

3 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

19-20 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER

6 October (Friday): Armed Forces Day.

13 October- 20 October (Friday-Friday): The sixth edition of El Gouna Film Festival (GFF).

Late October-14 November: 3Q2023 earnings season.

31 October – 1 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

NOVEMBER

2 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

15-24 November (Wednesday-Friday): Cairo International Film Festival, Cairo.

DECEMBER

12-13 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

EVENTS WITH NO SET DATE

2023: The inauguration of the Grand Egyptian Museum.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Egypt + Qatar to launch joint business forum.

1Q 2023: FRA to introduce new rules for short selling.

1Q 2023: Internal trade database to launch.

1Q 2023: The Madbouly government will choose which state-owned hotels will be merged into a new hotels company ahead of an offering to foreign and Gulf investors.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.