- Egypt’s debut USD 1.5 bn sovereign sukuk issuance wraps 4x oversubscribed. (Debt Watch)

- Gov’t to offer 25% of new hotel company to strategic investors, EGX. (Privatization Watch)

- Misr Life Ins. stake sale could go ahead before July. (Privatization Watch)

- Valuation dispute puts United Bank sale at risk. (Privatization Watch)

- Almarai now owns 100% of Beyti. (M&A Watch)

- Automotive agreements could see almost USD 150 mn invested in local assembly. (Investment Watch)

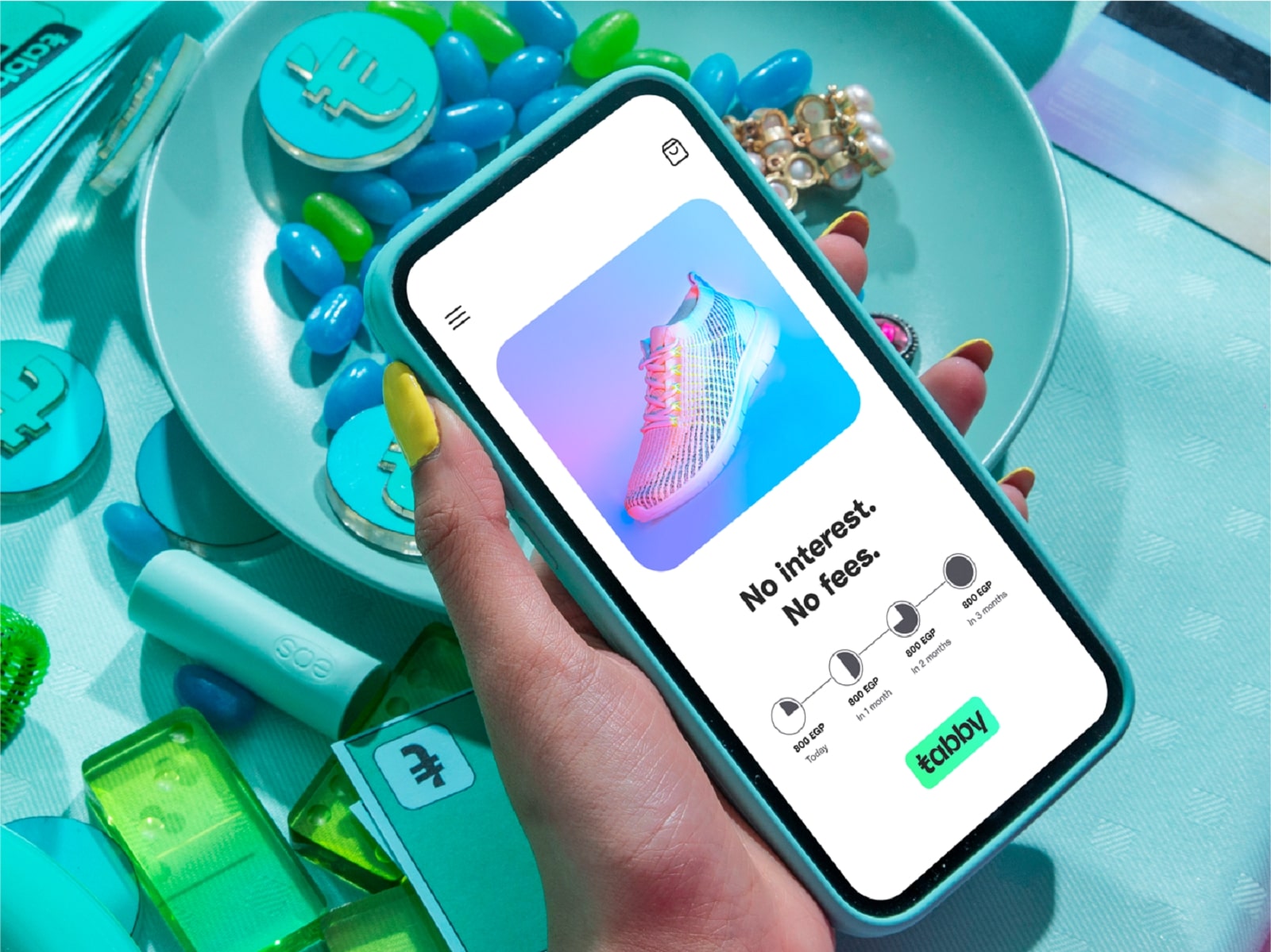

- Tabby suspends Egypt operations on Egypt economic woes. (Startup Watch)

- BasharSoft has moved to a four-day workweek. (What We’re Tracking Today)

- Fed could hike interest rates for longer to curb inflation, minutes show. (Planet Finance)

- My Morning Routine: Lamyaa Gadelhak, partner at Baker Mckenzie.

Thursday, 23 February 2023

AM — Five reasons we’re ending the week a bit more optimistic than we were on Sunday

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and happy THURSDAY. We have an absolutely packed issue for you this morning — one that sees us ending the week in a slightly better mood than we began it. Why? A handful of healthy signals.

#1- The Finance Ministry’s maiden sukuk issuance has closed 4x oversubscribed. We’re not delighted to see the nation taking on more debt, but it was necessary. The question was whether foreign investors had appetite, and the answer is now clear: The offering drew significant demand from across Europe, Asia and North America as well as the GCC, including from new investors to Egypt.

#2- We’re even happier to see so much _concrete_ chatter about the rebooted privatization program. If we’re having arguments about valuation, we’ve left theory and public pablum behind and are getting down to brass tacks.

#4- We’re also very happy to have heard from officials all week long that their preferred method of sale is capital increases, meaning the state isn’t netting proceeds from the sales, but be diluted down. That will leave the companies in which stakes are being sold with new liquidity to invest in growth, process improvements, new talent, upgrades, you name it.

#5- And we’re even happier to see Almarai buying out PepsiCo’s stake in Beyti. “But Enterprise,” you say, “that’s not part of the privatization program?” Indeed it is not. It’s an example of a well-managed private-sector player doubling down on its investment in Egypt. (Yes, PIF owns a minority stake in Almarai, but the company is publicly traded and its largest shareholder is Savola, with 34.5%.)

***

DO YOU HAVE A COMMENT OR QUESTION? Want to set us straight on something? Or need help with your subscription? All you need to do is hit “reply” to this email — we read every email we get.

***

EGP WATCH- The EGP slipped by another three piasters against the greenback yesterday, with the USD changing hands at 30.68 from 30.65 a day earlier, according to central bank data. The currency hit the 30 mark at the end of January following a sharper devaluation and has lost nearly half its value against the greenback over the past year amid the fallout from the war in Ukraine and rising interest rates.

WATCH THIS SPACE-

#1- The SCZone wants that CNY: The Suez Canal Economic Zone could be making its way to China soon for a roadshow, the zone’s Chairman Walid Gamal El Din told representatives of China’s TEDA trade zone, according to a statement. During the meeting, he expressed the authority’s readiness to cooperate with TEDA in organizing a planned Chinese investment conference. Gamal El Din’s statements come days after he wrapped up a visit to Tokyo, during which he met more than 100 companies and financial institutions to drum up interest in Egypt.

#2- BasharSoft trialed a four-day workweek last year — and it’s happy with the results: Egypt-born tech startup BasharSoft has reported impressive results from a three-month pilot of a four-day work week it ran last year. In a LinkedIn post this week, the company said that 89% of its employees reported higher productivity, 82% said they were better able to manage their time, and 93% experienced lower levels of stress. BasharSoft’s business results have “either improved or remained stable” throughout the trial period and after, it said.

As we noted earlier this week: The UK is running one of the largest pilots yet: A significant majority of the 61 British businesses participating in the six-month trial said they would continue with it after recording lower staff turnover and absenteeism while maintaining productivity. Check out the official website for the trial or read about it in the Wall Street Journal.

HAPPENING THIS WEEK-

G-20 debt relief talks are taking place in India: G-20 finance ministers will meet in India this week to try to end a deadlock between the US and China that is threatening to torpedo a global framework to restructure the debt of low-income countries, Bloomberg reports. Signed in 2020, the G-20’s Common Framework was meant to bring newer creditors like China, India, and Saudi Arabia into conversations on debt relief for more than 70 low-income countries with some USD 326 mn in outstanding debt.

US-China tensions aren’t helping matters: Disagreements between Washington and Beijing on how to move forward has left debt-distressed countries like Zambia and Sri Lanka without access to restructuring and bns of USD in IMF aid. Neither the US or China have shown willingness to restructure the countries’ debts, with China conditioning any agreement on western lenders like the World Bank agreeing to a haircut — an idea that Washington refuses to countenance.

Getting serious on debt relief could make a huge difference: A 30% haircut for debt-distressed nations could save them USD 148 bn over eight years, the UN Development Programme said in a report ahead of the G20 meetings.

|

THE BIG STORY ABROAD-

Cold War-style rhetoric is continuing to dominate the global front pages this morning on the eve of the one-year anniversary since Russia’s invasion of Ukraine. In the wake of Joe Biden’s three-day visit to eastern Europe this week and yesterday’s talks between Vladimir Putin and the Chinese foreign minister in Moscow, there’s much talk in the western press of east vs west alliances, though — as the New York Times points out — the reality is more complicated, with plenty of countries around the world refusing to be drawn into the conflict. (AP | Reuters | NYT | Financial Times | BBC | WSJ | CNN)

COME TO OUR NEXT ENTERPRISE FORUM-

We’re excited to unveil our next C-level event: The Enterprise Exports & FDI Forum, where we will take a deep dive into two of the most critical topics affecting our community.

Exports and foreign direct investment (FDI) have never been more important to our economy — or our businesses — than in the wake of the float of the EGP. We think we have a once-in-a-lifetime chance to build an export-led economy that makes us a magnet for FDI and all the benefits that will come with it for our nation.

CIRCLE YOUR CALENDAR-

El Gouna Film Fest is back after a one-year hiatus: El Gouna Film Festival (GFF) will return for its sixth installment this year, and will be held from 13-20 October, according to a statement out yesterday. The festival was postponed last year on the back of what the organizers described as “current global challenges.”

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

Somabay brings out the best in majestic natural elements where raw beauty and endless activities reign supreme. Immerse yourself into a picturesque getaway all year long. This is simply Somabay. For more information, call 16390 or visit www.somabay.com.

DEBT WATCH

Egypt’s debut USD 1.5 bn sovereign sukuk issuance wraps 4x oversubscribed

Egypt closes USD 1.5 bn sukuk issuance: The Finance Ministry successfully closed its maiden sukuk issuance yesterday morning, it said in a statement.

The USD 1.5 bn issuance was c.4x oversubscribed, attracting an order book of USD 6.1 bn, the ministry said. This narrowed the final yield to 10.875% from an initial guidance price of 11.625%.

Who subscribed? Some 250 global investors subscribed to the sukuk, which attracted new investors to Egypt from markets including the Gulf and East Asia as well as the US and Europe, the ministry said. Investors included asset managers, pension funds, ins. and investment funds, and banks. The bonds will be traded in the secondary market on the London Stock Exchange (LSE).

More to come: The issuance is the first in a three-year, USD 5 bn sukuk program, the ministry said. Moody’s last week gave a (P) B3 rating to the USD 5 bn sukuk program, which will be used to finance investment and development projects.

Costly refinancing: The proceeds helped Egypt to fund the repayment of a USD 1.25 bn eurobond on Tuesday. Those bonds carried an interest rate of 5.577%, almost half the rate that the country will be paying on the sukuk.

BACKGROUND: Egypt has been unable to access fresh finance from the international capital market over the past year due to the knock-on effects of the war in Ukraine and tighter global financial conditions. The sukuk issuance is Egypt’s first international debt sale since last March.

More debt issuances in the pipeline? The sale could pave the way for more issuances this year as the government looks to finance upcoming debt repayments. The Finance Ministry had been planning to issue its maiden USD 500 mn CNY-denominated panda bond in China in 1Q 2023, and previously said it would issue USD 500 mn of sustainable development bonds before the end of the current fiscal year.

Advisors: Our friends at HSBC are acting as lead managers and bookrunners along with Citigroup, Credit Agricole, Emirates NBD Capital, First Abu Dhabi Bank and Abu Dhabi Islamic Bank. Adsero-Ragy Soliman and Partners and Clifford Chance provided legal advice to the Finance Ministry, and Zaki Hashem & Partners and Linklaters acted as counsel to the joint lead managers.

PRIVATIZATION WATCH

State-owned hotels company will offer 20% to strategics — and 5% on the EGX. PLUS: Misr Life sale update

Twenty-five percent of new hotels company up for grabs: The government will offer a 20% stake in its new hotels company to strategic investors, followed by an offering of 5% on the bourse, Public Enterprises Minister Mahmoud Esmat told Asharq Business in an interview (watch, runtime: 1:20).

The government has finished transferring hotels to the new holding company, which is joint-owned by the Holding Company for Tourism and Hotels (HOTAC) and the Egyptian General Company for Tourism and Hotels (EGOTH), Esmat said. The special-purpose vehicle has an initial capital of EGP 10 mn, EGP 1 mn of which the government has paid in, he added.

Valuation TBD: The final valuation of the company will depend on the outcome of fair value studies for each of the hotels, the minister said, without confirming which hotels will be transferred to the company.

What will really matter is the mechanism: We expect the state to execute the transaction with the strategic (at least) via a capital increase, not a sale of existing shares. By having a new investor inject fresh capital, the company will have new funds to deploy as part of a growth and turnaround plan. In a sale of existing shares, the proceeds would benefit the selling parties, not the new company.

REFRESHER– The government is bundling seven of its five-star properties nationwide — including the Cairo Marriott Hotel in Zamalek and Marriott Mena House next to the pyramids complex — into one firm that will offer shares as part of the Madbouly government’s privatization program. Unnamed hotels are on the list of the 32 state-owned companies that will see stake sales over the next year. A government source told Enterprise in January that most of the interest was coming from Gulf funds. Saudi Arabia’s Public Investment Fund (PIF) has been named as one of the most eager potential investors.

Is 20% enough? Most strategic investors have strong preferences for majority stakes (to ensure they can fully consolidate the results of their new investment) with clear management control (to make sure they can drive performance improvements). Stake sizes have been a sticking point in ongoing negotiations with Qatar to sell stakes in Vodafone Egypt and two container terminal operators, with the government reportedly unwilling to meet Qatari demands for sizable ownership.

MISR LIFE INS. SALE BEFORE JULY-

Misr Life Ins. stake sale could ahead by the end of 1H 2023: State-owned ins. company Misr Life is ready to offer stakes — barring some final technical details that advisors are working on — in a transaction that could go ahead before the end of June, Esmat told the news outlet. He didn’t disclose how much of the company will be on offer or specify whether the company would be up for listing on the EGX, to a private investor, or both.

Background: The Misr Ins. subsidiary is one of the 32 companies on the government’s privatization list for the next year. It was previously eyeing a 2H 2022 window for its IPO but was put on ice due to unfavorable market conditions.

PRIVATIZATION WATCH

Valuation dispute puts Saudi United Bank acquisition at risk

Saudi wealth fund takeover of United Bank in jeopardy? The Public Investment Fund (PIF) has reportedly hit ‘pause’ on talks for the acquisition of state-owned United Bank due to a dispute over its valuation, Bloomberg and Reuters reported yesterday, citing sources they claim are familiar with the matter. The two sides have reportedly not been able to agree on how to value the bank following the devaluation of the EGP, which has lost almost half its value over the past year.

The sticking point: The PIF wants to agree on a valuation in local-currency terms, with the USD amount payable determined at the time of the transaction according to the exchange rate at the time of execution. The Central Bank of Egypt, which owns 99.9% of the bank, is arguing for a USD-based valuation from the beginning, the newswires report.

REMEMBER- The PIF opened talks to purchase United Bank last year. Bloomberg reported in December that the wealth fund could acquire the lender for USD 600 mn.

Lining up an alternative buyer? House Planning Committee Chair Fakhri El Fiqi told local media last week that Saudi lenders Riyad Bank and Al Rajhi Bank are interested in acquiring shares in United Bank. The bank is among a line-up of 32 companies that the state plans to sell stakes in as part of a rebooted privatization program announced earlier this month.

KSA has pledged to invest bns of USD in Egypt: The transaction is part of a USD 10 bn investment pledge by the Saudis, which last year joined the UAE and Qatar in offering bns of USD to Egypt to help stabilize its economy following the war in Ukraine.

This isn’t the first sticking point in ongoing acquisition talks: Talks with Qatar over several acquisitions have reportedly hit stumbling blocks in recent weeks due to the government’s reluctance to sell down sizable stakes in the companies. The Qatari wealth fund is looking to acquire Telecom Egypt’s entire 45% stake in Vodafone Egypt and majority ownership in two container terminal operators — stakes that the government is reportedly unwilling to hand over.

M&A WATCH

Almarai now owns 100% of Beyti

Saudi’s Almarai buys PepsiCo out of Beyti: Saudi dairy producer Almarai has bought PepsiCo’s entire 48% stake in the parent company of juice and dairy producer Beyti for SAR 255 mn (c. USD 68 mn), it said in a disclosure to the Saudi stock exchange on Sunday. Almarai now owns 100% of International Dairy and Juice Limited (IDJ), its former joint venture with PepsiCo. The acquisition was funded through Almarai’s internal cashflows, the company said.

Expansion in the works: “The full ownership of IDJ will allow Almarai to further expand strategically in the wider region,” Almarai said in the disclosure.

Almarai sat down with gov’t days after the acquisition to talk FDI + exports: Almarai is considering exporting some USD 240 mn worth of Egypt-made juices and food products to its Saudi factories every year, Almarai CEO Abdullah Albader told Prime Minister Moustafa Madbouly in a meeting on Tuesday, according to a cabinet statement. Company chairman Prince Nayef bin Sultan Al Kabeer told Madbouly that the company “excited to invest more in Egypt” to boost exports to neighboring countries and across Africa.

Beyti was already growing: Beyti previously said it plans to invest EGP 440 mn in Egypt in 2023 and 2024. The company added six new local production lines at a cost of EGP 165 mn in 2022, bringing its total number of production lines to 25.

Our Gulf friends have a taste for our F&B sector: Emirati firm — and Almarai rival — Agthia last year bought a 60% stake in Egyptian food company Auf Group, after snapping up 75% of Atyab brand owner Ismailia Agricultural and Industrial Investments in 2021. Agthia is owned by Emirati wealth fund ADQ, while Saudi sovereign wealth fund PIF owns a c. 16% stake in Almarai. PIF and ADQ together invested USD 3.1 bn in government-owned shares in EGX-listed companies last year, and have reportedly expressed interest in several of the 32 companies earmarked by the government for privatization.

INTEREST IN MARCYRL PHARMA-

Two unnamed British and French investment funds are seeking an acquisition of a 20% stake in Marcyrl Pharma, the company’s general manager Wagdy Mounir told pharma-focused outlet Souq Al Dawaa. He said the British fund is eyeing a 15% stake, while the French could acquire the remaining 5%, without providing a value of the transaction. The transaction has entered its final stage, with the involved parties now seeking the necessary regulatory approvals, he said. Proceeds from the transaction would be invested into expanding the company’s operations, he added.

About Marcyrl: Established in 1998, Marcyrl Pharma “formulates dosage forms of recently generic drugs from local and imported intermediates” in the forms of solid, liquid, semi-solid, suppositories and soft gelatine capsules, according to its website. It acts as a sole agent and representative of Germany’s Merz Pharma, Schwabe Group, Engelhard Arzneimittel and Switzerland’s IBSA Group.

INVESTMENT WATCH

Stellantis, Nissan and Mansour could invest USD 145 mn in local assembly

Stellantis, Nissan and Al Mansour Automotive could invest a total of USD 145 mn in the nation’s auto industry over the next three years under individual framework agreements signed with the government earlier this month, Prime Minister Moustafa Madbouly said yesterday. If all three agreements are executed, the companies would produce a total of 60k-70k traditional and electric vehicles every year, some of which would be earmarked for export, the PM said. Madbouly didn’t specify how many traditional vehicles will be assembled versus EVs or break down the split by assembler.

Background: Madbouly’s statements come days after the government signed framework agreements with the three automakers on localizing their assembly operations. The agreements aim to “achieve binding cooperation between the government and the companies towards the goals of the [national automotive strategy],” working with all three of the new automotive bodies as well as state investment body GAFI, cabinet said last week.

REMEMBER- The government is still working on its long-awaited automotive strategy AKA the Automotive Industry Development Program (AIDP). The strategy is expected to offer incentives to carmakers to increase local assembly and component manufacturing, increase the sector’s competitiveness, and raise exports.

STARTUP WATCH

Tabby puts Egypt business on ice on economy woes + Big Bosta news

Tabby suspends Egypt operations: Emirati buy now, pay later firm Tabby is putting its operations in Egypt on hiatus only six months after entering the country, company representatives confirmed to Enterprise. The news was first reported by the National, which picked up a leaked email the startup sent to Egyptian merchants.

No staff cutbacks: “There are no layoffs in our Egypt office. Our Egypt team will continue to support operations in other core markets. We'll continue to expand hiring in the Egypt market,” company co-founder and CEO Hosam Arab told Enterprise.

The rationale? A tough economy: “Recent macroeconomic developments have made our operating model challenging while maintaining our principles of interest-free payments,” the leaked email read. The fallout from the war in Ukraine and rising interest rates has tipped the Egyptian economy into crisis over the past year, causing the EGP to lose almost half its value against the greenback and sending inflation to its highest rate in five years. “We must prioritize projects that align with our long-term goals in core markets, and as a result, we have decided to pause our commercial operations in the Egyptian market,” Tabby said in an emailed statement.

This may not be goodbye forever: “We remain optimistic about the future of the Egyptian market and will continue to assess opportunities to re-engage in the future,” Tabby said.

Tabby customers have one month to find alternatives: Local customers will no longer be able to make new payments through Tabby as of 23 March, according to the email. The company has requested that its partner sellers remove any Tabby branding from their shops, apps, and websites by that date. “We understand if you prefer to switch Tabby off before 23 March,” the company told merchants.

REFRESHER- Tabby, which offers zero-interest, zero-fee BNPL services, entered our market in September after securing USD 275 mn from global and regional investors. Egypt was the company’s fourth market after the UAE, Saudi Arabia, Bahrain, and Kuwait.

IN CONTEXT- The economic turmoil of the past 12 months has been a boon for others in the BNPL industry: Surging inflation is forcing more Egyptians than ever to rely on installment services to meet their needs, according to Reuters. Homegrown BNPL platform Sympl saw a 50% m-o-m increase in new clients in January and existing customers are turning to the company more regularly to fund purchases, co-founder Yasmine Henna told the newswire.

ALSO IN STARTUP WATCH-

Big news for Bosta: Logistics industry leader and ex-DHL Express Global CEO Ken Allen (LinkedIn) has joined Egyptian courier startup Bosta as an investor and board member, the firm said in a statement (pdf) yesterday. Allen spent 37 years at the German logistics giant, serving as its global CEO for a decade and heading up its e-commerce arm for three years. “Allen’s leadership and experience in the logistics industry will be invaluable as we continue to expand Bosta's footprint beyond Egypt and into new international markets,” said Bosta CEO and co-founder Mohamed Ezzat. The company did not disclose the size of Allen’s investment.

TELECOM

Regulator fines telecoms providers 3x more over service y-o-y in 2H 2022

Telecoms providers face higher fines over service failures: The National Telecommunications Regulatory Authority (NTRA) has ordered the four telecom providers — Telecom Egypt, Orange Egypt, Etisalat Egypt, and Vodafone Egypt — pay a combined EGP 35.7 mn in fines for failing to meet standards, according to the regulator’s biannual complaints report. That’s nearly triple the fines they were told to pay in H2 2021.

They’ll also have to refund 4x more to customers: The providers were ordered to reimburse users a combined EGP 3.3 mn for service failures during 2H 2022, a more than fourfold increase from EGP 780k during the same period in 2021.

IN CONTEXT- Those payouts are absolute peanuts — mere rounding errors in view of the size of each operator’s P&L here.

Complaints rose more than 50%: Users submitted 184.2k complaints during the second half of last year, up from 121.8k in the same period in 2021.

What were people complaining about? Mobile services took the lead, making up 35% of the complaints made to the NTRA over the six-month period. Fixed internet came in second at 34% and landlines at 30%.

The most complained about provider? Orange, which received some 1.9k complaints per 100k subscribers for its internet services and 77 complaints per 100k for mobile.

WiFi down? You’re entitled to compensation: The regulator has introduced a new mechanism to compensate fixed internet users “no less than the actual cost of service” when their service is interrupted.

For visual thinkers: The NTRA released an infographic (pdf) highlighting all the key figures.

KUDOS

Tub-tubs for exceptional alumni of UK universities: The British Council has awarded its Study UK Alumni Awards 2022-23 to four Egyptian alumni of British universities “for their outstanding achievements as business professionals, entrepreneurs, and community leaders,” according to an emailed statement. Twelve alumni were shortlisted for the award. The final four will now be put forward for the organization’s Global Alumni Awards:

- Asmaa Kamal, University of Southampton (LinkedIn) — Business and Innovation award

- Dalia El Adb, University of Nottingham (LinkedIn) — Culture and Creativity award

- Mona Allouba, Imperial College London (LinkedIn) — Science and Sustainability award

- Mohamed Moamen, University of Birmingham (LinkedIn) — Social Action award.

LAST NIGHT’S TALK SHOWS

Last Night’s Talk Shows: Commodities and food prices were the main topic of conversation on the airwaves last night, while the country’s maiden sukuk issuance continued getting attention and Masa’a DMC’s Ramy Radwan did his best to make us all feel better about the current economic situation.

Contract farming and food prices led the conversation on the talk shows last night: The government’s decision to hand farmers a guaranteed price for selling corn, soy and sunflower crops was covered across the airwaves last (check out this morning’s Also on our Radar for more details). Cabinet spokesman Nader Saad appeared on Al Hayah Al Youm (watch, runtime: 9:13) while an Agriculture Ministry official phoned in to Yahduth Fi Masr to explain the decision. Masaa DMC also had coverage (watch, runtime: 1:01).

At least we’re not Venezuela: That was the message delivered by Masa’a DMC’s Ramy Radwan last night, who eagerly pointed out all the countries that currently have higher inflation rates than Egypt (watch, runtime: 3:49) and noted ongoing food shortages in the UK (watch, runtime: 3:09), before mounting a defense of the Egyptian economy and the government’s handling of the situation.

Rising chicken prices were given particular attention, with Radwan talking to an industry figure about the government’s plan to increase imports (watch, runtime: 9:07) and Ala Mas’ouleety’s Ahmed Moussa accusing producers of undermining authorities’ attempts to solve the crisis (watch, runtime: 3:13). Cabinet spokesman Saad also made an appearance on Ala Mas’ouleety, who described the decision to import chicken as a “fast solution to increase supply before Ramadan” and stressed that the FX shortage is the reason behind the problems (watch, runtime: 28:40).

Rice also got a mention: With the lifting of the price cap last week sending rice prices soaring, Radwan opted to cover yesterday’s purchase of 50k tons of imported rice and spoke to Ragab Shehata, the head of the Federation of Egyptian Industries’ rice division, about how imports will impact the market (watch, runtime: 6:42).

Sukuk for dummies: Egypt successfully wrapping up its maiden sukuk issuance yesterday under a three-year, USD 5 bn sukuk program got coverage, with Yahduth Fe Masr’s Sherif Amer trying to help viewers get the hang of the concept. Mohamed Hegazy, head of the Finance Ministry's debt management unit, joined Amer to discuss the issuance (watch, runtime: 5:29).

The talking heads were keen to restate the recent rise in foreign direct investment, with Al Hayah Al Youm (watch, runtime: 0:34) and Masa’a DMC (watch, runtime: 0:28) reiterating balance of payments figures published earlier this month that showed FDI had risen to USD 3.3 bn in FY 1Q 2022-2023.

ALSO ON OUR RADAR

COMMODITIES-

Farmers to sell corn, soy and sunflower to gov’t at guaranteed prices: Ministers approved yesterday setting price floors for corn, soybean and sunflower crops sold by farmers to the government, cabinet said in a statement. Following the decision, GASC will purchase soybeans at a minimum price of EGP 18k per ton and sunflower crops for EGP 15k per ton. Farmers will receive a guaranteed price on white and yellow corn of EGP 9k and 9.5k per ton respectively.

The thinking: The move aims to encourage farmers to increase production and lower the country’s import bill, Prime Minister Moustafa Madbouly said.

It’s a win-win for farmers: The government could pay more to farmers if the price of crops at the Egyptian Mercantile Exchange (EMX) at the time of harvest and crop delivery is higher than the set guaranteed price, Madbouly said. The state would still commit to paying the set guaranteed price to farmers even if the price of crops at the EMX is lower at the time of harvest, he added.

DEBT-

A fresh loan for Qatari Diar subsidiary: Qatari Diar subsidiary East Gate Developments will get a EGP 2 bn syndicated medium term-facility from the National Bank of Egypt (NBE), Banque Misr, and QNB Alahli to fund part of the construction of the first phase of its City Gate development in East Cairo, the syndicate said in a joint statement (pdf) yesterday. The facility comes nearly two weeks after the company recruited Consolidated Contractors Company to construct a new EGP 1.75 bn phase of the project. The residential project will be valued at over USD 12 bn once complete.

REMEMBER- Qatari Diar has until 2031 to finish City Gate per a new deadline reportedly set by the New Urban Communities Authority (NUCA) in November to compensate the company, after its work had been suspended for years amid a legal dispute.

PLANET FINANCE

Fed could keep raising rates for longer: Federal Reserve officials could decide to keep raising interest rates for longer due to the unexpected strength of the US economy, minutes (pdf) from the central bank’s last policy meeting indicated yesterday. The vast majority of officials were on board with lowering the increase to 25 bps last month, though all participants thought that “ongoing” increases would be needed to bring inflation down to the 2% target, which is “likely to take some time,” the document shows.

ALSO WORTH NOTING-

- Record high interest rates in the eurozone? Investors expect the European Central Bank to hike its key interest rate to a record high of 3.75% by September — up 125 bps from its current level — as the bloc’s economic resilience raises concerns that inflation may be more difficult to curb than previously thought. (Financial Times)

- Iraq wants CNY-denominated trade with China: Iraq's central bank is planning to allow payment in CNY for Chinese imports as it grapples with a shortage of the greenback. (Reuters)

- Lebanon’s inflation continued to soar in January, hitting 123.5% y-o-y as the country continues to suffer amid a devastating economic crisis. (Lebanon’s Central Administration Statistics, pdf)

- Chinese state firms to shun the Big Four: The Chinese government has urged state-owned companies not to renew contracts with Western auditing giants KPMG, Deloitte, PwC, and EY over data security concerns amid tensions with the US. (Bloomberg)

|

|

EGX30 |

16,777 |

-1.5% (YTD: +14.9%) |

|

|

USD (CBE) |

Buy 30.58 |

Sell 30.68 |

|

|

USD at CIB |

Buy 30.58 |

Sell 30.68 |

|

|

Interest rates CBE |

16.25% deposit |

17.25% lending |

|

|

Tadawul |

10,270 |

-1.0% (YTD: -2.0%) |

|

|

ADX |

9,888 |

-0.6% (YTD: -3.2%) |

|

|

DFM |

3,427 |

-0.9% (YTD: +2.7%) |

|

|

S&P 500 |

3,991 |

-0.2% (YTD: +4.0%) |

|

|

FTSE 100 |

7,931 |

-0.6% (YTD: +6.4%) |

|

|

Euro Stoxx 50 |

4,243 |

-0.2% (YTD: +11.9%) |

|

|

Brent crude |

USD 80.45 |

-3.1% |

|

|

Natural gas (Nymex) |

USD 2.17 |

+4.5% |

|

|

Gold |

USD 1,833.90 |

-0.5% |

|

|

BTC |

USD 23,803 |

-1.6% (YTD: +44.1%) |

THE CLOSING BELL-

The EGX30 fell 1.5% at yesterday’s close on turnover of EGP 1.67 bn (15.4% below the 90-day average). Local investors were net sellers. The index is up 14.9% YTD.

In the green: Eastern Company (+0.1%).

In the red: GB Auto (-4.9%), Cleopatra Hospitals (-4.9%), and Palm Hills Development (-4.8%).

DIPLOMACY

Egypt condemns Israeli raid in Nablus which kills 11: Egypt’s Foreign Ministry has denounced a raid by Israeli forces in the Palestinian city of Nablus that killed at least 11 Palestinians and wounded more than 100 others. The ministry expressed “deep concern about the ongoing and dangerous escalation” in the West Bank “which undermines efforts to achieve calm between the Palestinian and Israeli sides” in a statement. Palestinian sources said that two Islamic Jihad commanders died in the raid, during which Israeli forces also killed four civilians, according to Reuters.

MY MORNING ROUTINE

Lamyaa Gadelhak, partner at Baker Mckenzie: Each week, My Morning Routine looks at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Lamyaa Gadelhak, partner at Baker Mckenzie (LinkedIn). Edited excerpts from our conversation:

I am Lamyaa Gadelhak, partner at Baker Mckenzie. To the business community, I am a lawyer. To myself, I'm a human — I like to rise above it all — and I'm a mother.

Growing up, I lived abroad with my family. My father was a diplomat, so I lived across many African countries, including Cameroon, Zimbabwe, and Sudan. The experience is still a highlight of my life. I came back to live in Egypt when I was relatively young in 1996. I'm originally French-educated, but I tried the American, Egyptian, and British education systems, and then in law school, I went back to French. I graduated from the affiliation of Sorbonne in Cairo University and also received a master's degree from there. I started my career as an in-house lawyer for one year in the oil and gas sector.

I joined Baker McKenzie around 18 years ago and have been there ever since. I joined as a junior and now I am a partner. I am on the management committee of the office, the Africa Steering Committee of the global firm, and the global project finance committee. I co-head the local banking and projects team in the office, and I also cover as a niche area of practice "environmental and climate change" since 2008. Despite how difficult sometimes it is to do this job, I love it very much.

I’m not very fond of strict routines. As lawyers, our heads are organized all the time, and it's sometimes exhausting talking to us — I get it [laughs]. But a few years back I decided that I didn't want the idea of a routine to add stress to my life. I decided to listen to myself. I like the day to be structured, but I also like some flexibility. So I listen to myself in the morning. I try to reflect and let myself be before I plug into the system.

We are human, not robots. There are days when I wake up with the kids at 6am. I jump on a walking treadmill — not a running treadmill. I enjoy some music in the morning and have breakfast, and I try to avoid my phone, which is a real effort. I prefer that the day begin earlier than my working day because it allows for some me-time. But what I do during that time is my prerogative. I make sure to have breakfast with friends before work at least once a week.

The weather has a big impact on my day. If it's cold, I don't like to push myself to do things. Which is not to be mistaken with laziness. I'm an active person. I love competitive sports. I love going out, and I love the sun. So my office is the sunniest spot in the office. I chose the location because the sun has a huge influence on my day.

I usually read Enterprise in the car on my way to work. Our entire office reads Enterprise. When we hire new lawyers, we remind them to subscribe to Enterprise. It’s an unmatched quality of information delivered to our desktops.

I think we all embraced more flexibility in how we do work after covid. It shifted a lot of perspectives for all of us, but even before that, I had a very integrated model in which I was always a mom and a lawyer, and I multitask.

We live in phases. Nothing stays the same — your business grows, your children grow, and your needs and capabilities change. I slowly shifted from an integrated model that served me at the time to a more focused model. So the time I have with my kids now is time I want to focus on them. And when I do work, it's time to focus only on doing it well. Maybe this is a message for women: Just don't be too hard on yourself. See what works for you today and do it; this is not necessarily what's going to work for you tomorrow.

With the current dynamics of my family and job, I do less multitasking on purpose. I actually had to put effort into switching off or putting the volume down on my multitasking abilities. It's what's working for me at this phase of my life, not necessarily the next one, and certainly not the previous one. With covid, I think we all entered each other's homes through Zoom, and simply dispelled the notion that having children in the background makes you unprofessional.

The one constant in my day is that I tell myself to slow down. As a lawyer and a mother, you tend to be running around in many directions at the same time, and I have been making a conscious effort for the past few months to slow down. Starting with the simplest things, like putting work aside and enjoying your meal rather than eating while working. It's a deliberate effort to reduce the amount of stress in the day. We live in a very lively city, which can be quite hectic. So you need to counterbalance it by controlling your own pace and being more mindful.

I stay organized by setting my priorities for the day. This is crucial because otherwise I'll find myself juggling tasks without a clear focus on what needs to be done first. Setting priorities is an acquired skill. I set my priorities for the day on the professional and personal level. Because I'm the same person at the end of the day, and it’s one list. Then I remain focused. I like the feeling of engaging all my senses in doing one thing at a time.

I'm very passionate about my job. I know it sounds a bit geeky, but I really enjoy drafting a contract that was never drafted before. It feels like I'm composing a piece of music.

Before having kids, I was more inclined to work because I knew this is the time where I had more flexibility. I made it very clear to myself that now is the time for me to act in a way that will enable me to advance professionally, so that I could be successful at both when I had a family in the future.

Having a career and a family is not possible without the right support system at work and outside of work. My family and friends have been a great support system for me, and the support I have received at work is tremendous. I don't think it would've been possible without them trusting me. Whether I worked from home or in the office, I always followed through on my promises.

I like to walk a lot. A lot. So one of my favorite hobbies when I'm traveling is just to get lost. I don't use the GPS and I just put on my earphones, listen to music and walk aimlessly. Just appreciating what's around. I love playing competitive sports, like soccer and basketball, and also love horse riding. But it's not a sport that I have the luxury of doing frequently.

I enjoy books that are less story-based and more article-based. The likes of the books by Malcolm Gladwell. But my most recent interesting read was Humankind by Rutger Bregman. It debates whether humans are naturally good and that living in a society with rules brings out the worst in them, or whether they are not naturally good and must be maintained by society and rules.

One of the best pieces of advice I received was from my mentor, Mohamed Ghannam, who is also the managing partner in the office. A long time ago he told me something that has always stuck in my head. He told me no one is indispensable. And interestingly enough, when he said it to me, I was annoyed. But as I grew, I understood it. No one is indispensable. Things keep on moving. Life doesn't stop.

CALENDAR

FEBRUARY

19 February-11 March (Sunday-Saturday): 2023 Africa U20 Cup of Nations, Egypt, various locations.

22-25 February (Wednesday-Saturday): The government-hosted Sports Expo Egypt 2023 at the Al Manara Conference Center, New Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

23 February (Thursday): Telecom Egypt to announce its 2022 results.

24-26 February (Friday-Sunday): The Egyptian Private Equity Association and the African Private Equity and Venture Capital Association are hosting a three-day private capital funds masterclass.

27 February (Monday): House reconvenes.

MARCH

March: 4Q2022 earnings season.

March: Gov’t to launch the National Governance Index.

Beginning of March: Rice to be added to the EMX.

3 March (Friday): Journalists’ Syndicate midterm elections.

5 March (Sunday): Senate reconvenes.

5 March (Sunday) Nahda Economic Forum, Intercontinental Cairo Semiramis.

6-9 March (Monday-Thursday): EFG Hermes One-on-One conference, Atlantis, Dubai.

21-22 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

23 March (Thursday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

APRIL

April: GAFI to launch the country’s first integrated electronic platform to facilitate setting up a business.

1 April (Saturday): Deadline for banks to establish sustainability units.

10-16 April (Monday-Sunday): IMF / World Bank Spring Meetings, Marrakesh, Morocco.

16 April (Sunday): Coptic Easter

17 April (Monday): Sham El Nessim.

21 April (Friday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

30 April (Sunday): Deadline for self-employed to register for e-invoicing.

30 April (Sunday): End of Mediterranean, Nile Delta oil + gas exploration tender.

Late April – 15 May: 1Q2023 earnings season.

MAY

1 May (Monday): Labor Day.

2-3 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Thursday): National holiday in observance of Labor Day (TBC).

4 May (Thursday): IEF-IGU Ministerial Gas Forum, Cairo.

9-11 May (Tuesday-Thursday): First edition of the Arab Actuarial Conference, Cairo.

16-18 May (Tuesday-Thursday): Egypt will host its first conference on cybersecurity and defense intelligence systems (CDIS-Egypt).

18 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

20-21 May (Saturday-Sunday): eGlob Expo, St. Regis Almasa Hotel, Cairo.

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE

7-10 (Wednesday-Saturday): The second edition of Africa Health Excon.

10 June (Saturday): Thanaweya Amma examinations begin.

13-14 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

19-21 June (Monday-Wednesday): Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

22 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

25-26 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

AUGUST

3 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

19-20 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER

6 October (Friday): Armed Forces Day.

13 October- 20 October (Friday-Friday): The sixth edition of El Gouna Film Festival (GFF).

Late October-14 November: 3Q2023 earnings season.

31 October – 1 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

NOVEMBER

2 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

DECEMBER

12-13 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

EVENTS WITH NO SET DATE

2023: The inauguration of the Grand Egyptian Museum.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Egypt + Qatar to launch joint business forum.

1Q 2023: FRA to introduce new rules for short selling.

1Q 2023: Internal trade database to launch.

1Q 2023: The Madbouly government will choose which state-owned hotels will be merged into a new hotels company ahead of an offering to foreign and Gulf investors.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.