- Pharos tips banks, NBFS players, fintech and consumer stocks heading into 2020. (Economy)

- FinMin is hedging like it never hedged before. (Energy)

- The first two military-owned companies line up to sell shares. (IPO Watch)

- Ghazl El Mahalla to hit the EGX in 1Q2021? (IPO Watch)

- Egypt-Saudi Investment Fund could finally be becoming a thing. (Investment Watch)

- Transport, health projects to get EUR 715 mn in AFD funding. (Development)

- DPI on its big Adwia investment + why it likes Egypt right now. (Spotlight)

- We’re probably okay with bringing Qatar back in from the cold. (Around the World)

- Sinopharm’s jab is 86% efficient, and we have it as early as next month. (Covid Watch)

- Iman Ezzeldin, professor of drama, theater and film criticism at Ain Shams University. (My WFH Routine)

- Planet Finance

Thursday, 10 December 2020

Military IPOs are coming + stock pix and a vaccine for the new year

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. We made it through another week together. There are just 21 days left in 2020, if you — like us — are keeping count.

*** We’re a bit late this morning because one of our cloud services is glitching this morning. We’ve addressed most of the problem, but you may have intermittent issues seeing images in the email edition. We’re sorry for the inconvenience, folks, and will take steps to make sure it doesn’t happen again.

The big news globally this morning: Facebook is an illegal monopoly that has used a “buy or bury” strategy to crush its rivals, according to lawsuits filed by the US Federal Trade Commission and nearly every state in the union. El Face could be forced to sell instagram and WhatsApp, its prized possessions. “For nearly a decade, Facebook has used its dominance and monopoly power to crush smaller rivals, snuff out competition, all at the expense of everyday users,” the New York’s Attorney General said on behalf of the coalition.

The story dominates front pages in the business press on just about every continent. You’ll want to check out the NYT, the Wall Street Journal, Financial Times and Reuters to get oriented and go a bit deeper.

Big tech IPOs are also making headlines: Delivery outfit DoorDash shares popped 92% in their Wall Street debut yesterday, while the WSJ reports in an exclusive that it has priced its IPO at a point that “far exceeds” its expected range. Shares of the home-rental startup will make their debut today.

Closer to home: China’s top covid-19 vaccine is about 86% efficient, the UAE reported yesterday. Egypt was among the countries participating in the clinical trials. We have chapter and verse in this morning’s Covid Watch, below.

Also: At least three new state-owned companies are now in the government’s IPO funnel, including what could become the first two military-owned companies to make their EGX debut, as we report below.

It’s inflation day: Capmas and the Central Bank of Egypt are due to release November inflation figures today — two weeks ahead of the Monetary Policy Committee’s final meeting of 2020 to review interest rates on 24 December. Annual headline inflation accelerated to 4.6% in October on the back of a delayed start to the academic year, which always fuels inflation in fall.

The first in a new GIZ webinar series for the finance industry is set to take place today. You can learn more here (pdf) or register here.

ALSO: We love dogs. This morning and every morning.

|

THURSDAY KUDOS-

The Washington Post has named Siobhán O’Grady (LinkedIn) as its new Cairo bureau chief, succeeding Sudarsan Raghavan, the paper said. O’Grady began her news career in 2014 at Foreign Policy before freelancing for two years from Nigeria and Cameroon, where she reported on a divide between English- and French-speakers. The appointment is effective January.

Egypt-based Communications Platform as a Service (CPaaS) company Cequens took home the title of the “Most Innovative Communication Platform” in the International Finance Magazine’s 2020 Technology Awards, the company said in a press release (pdf).

** Have a suggestion for a Thursday Kudo? Email it on over at editorial@enterprise.press.

ECONOMY

Look at banks

Pharos tips banks, NBFS players, fintech and consumer stocks heading into 2020, our friend Radwa El Swaify and her team at Pharos suggest in their 2021 equity strategy out now. You can tap or click here to read the report in full (pdf). It includes solid, deep dives into sectors and shares heading into the new year along with a look at the macro backdrop.

Good news for traders: Pharos sees the market “has potential for 25-30% rerating” as corporate earnings continue to recover in the coming year. The key to bringing foreign investors back? Fresh IPOs. Foreign investors have been net sellers on a monthly basis since 2019 except when they piled into the Fawry IPO, and the trend accelerated during the EM selloff prompted by covid-19.

Worth a close read: Slide 9, which breaks down 19 themes heading into the new year and which shares benefit from them before going deep later in the report.

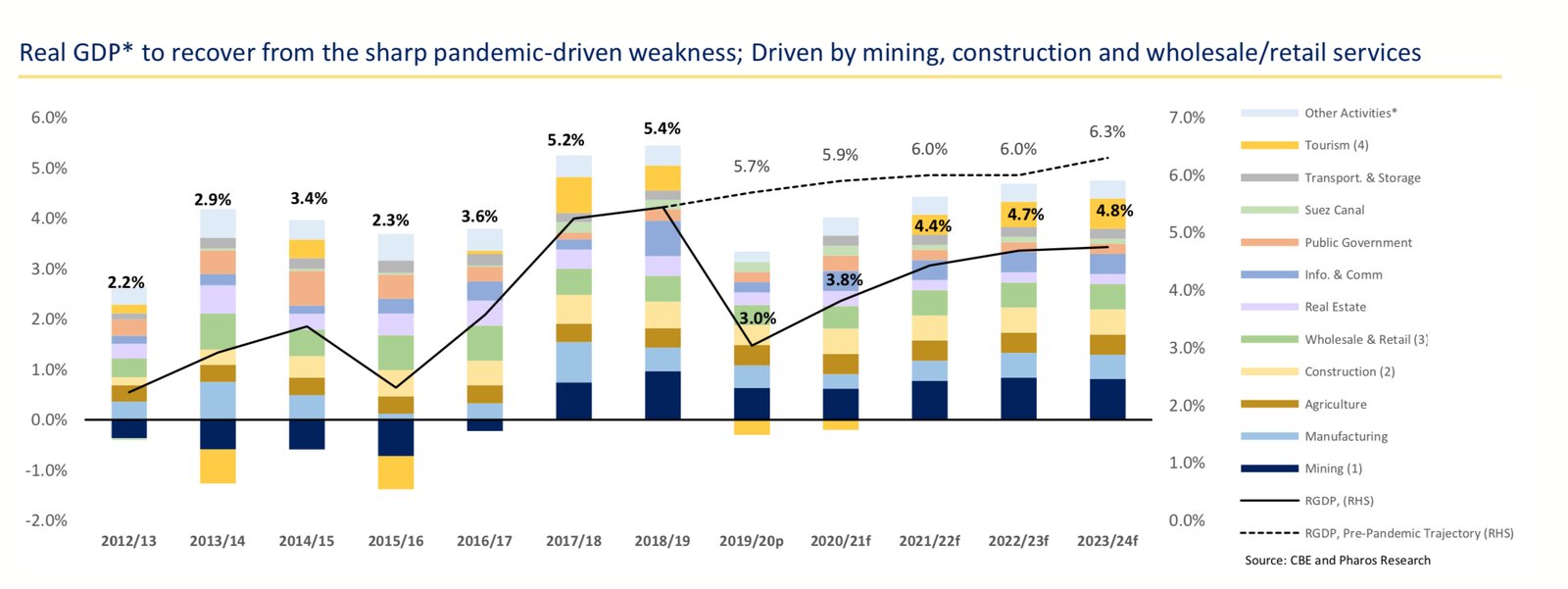

MACRO PICTURE- Low inflation, a stable EGP and early signs of real GDP growth point to smooth sailing for the remainder of FY2020-2021, the team at Pharos writes, even as a widening budget deficit and sluggish state revenues remain caution signs on the horizon.

Driving the economy: Resources and construction as oil prices recover and the government continues its large-scale national infrastructure projects, pushing real GDP growth back up to 3.9% in FY2020-2021, up from 3.5% last fiscal year.

The budget deficit will narrow to 7.9% of GDP in FY2020-2021, after having widened to 9.1% last year due to increased spending on fiscal stimulus, Pharos says. Increasing tax receipts will push state revenues up to EGP 1 tn, from EGP 900 bn in FY2019-2020, while spending will increase 4% — its weakest pace ever — to hit EGP 1.5 tn, according to Pharos. This is mainly thanks to a falling subsidy bill and a decreased interest burden.

Foreign debt is on the rise: Although domestic debt has formed the lion’s share of government financing, external debt has more than doubled in the past five years reaching 30% of total debt.

Inflation will remain stubbornly low, averaging 4.9% through to the end of the current fiscal year — more than a percentage point below the lower bound of the central bank’s 9% (+/- 3%) target rate.

This will pave the way for another 200 bps of interest rate cuts during 2021, taking the overnight lending rate down to 7.25% and the deposit rate to 6.25%. The move would still leave “some room for further easing, especially if global monetary conditions and hard currency inflows into Egypt remain as supportive of lower rates,” the research note said.

A stable outlook for the EGP will see the nominal exchange rate reach EGP 16.00 to the USD in FY2020-2021 and maintain the same annual average for the following three years.

Despite further easing, Egyptian treasuries will continue to be attractive to foreign investors relative to other emerging markets. Thanks to the waves of covid stimulus, developed countries are almost universally offering negative yields while rates in most other EMs are now below 5%. In comparison, Egypt currently offers a world-beating 1-year real yield of 7.7%.

Foriegn reserves will continue to tick up, reaching USD 43 bn by the end of the fiscal year, having hit a low of USD 36 bn in May due to the financial panic caused by the pandemic. Reserves stood at USD 39.2 bn at the end of November. BNP Paribas takes a far less generous forecast, putting foreign reserves at USD 38 bn by the end of FY 2020-2021.

The current account deficit will continue to widen in the short term reaching 4.3% of GDP due to falling tourism revenues, lower remittances, weak FDI inflows and low interest rates around the globe.

ENERGY

FinMin is hedging like it never hedged before

Egypt has nearly doubled its oil hedging contracts so far this fiscal year, as the government looks to lock in the benefits of low oil prices, Finance Minister Mohamed Maait told Bloomberg. “We did a huge number of hedging contracts,” Maait said without disclosing the value of the contracts. The government still hasn’t decided a plan for next fiscal year, the minister said, adding that “we are covered until 30 June.”

The government has been hedging for the past two years, taking out call options (a derivative contract that protects against rising oil prices by fixing the rate for a specified period of time) since FY2018-2019. Egypt purchased the contracts from Citibank and JPMorgan the first time around.

The 2020 oil crash gave us some much needed breathing room: Brent prices remain down 25% year-to-date at just below USD 50/bbl, having crashed to historic lows (remember negative oil prices?) during the initial onslaught of the virus in the second quarter. This is significantly below the USD 61 benchmark used by the Finance Ministry in the FY2020-2021 budget. The low prices have helped reduce Egypt’s energy subsidy bill, which fell 46% in the first quarter of FY2020-2021 to EGP 3.9 bn from EGP 7.25 bn in the same period a year earlier.

We’re still considering grain hedging: Egypt is still mulling hedging against rising grain prices, Maait confirmed to the business information service. “We are in talks with some banks,” he said. This opinion has been floated before due to Egypt’s heavy dependence on wheat imports. Wheat is currently trading at USD 211 per metric ton, slightly above the USD 199.5 price assumed in the state budget.

IPO WATCH

The first two military-owned companies line up to sell shares

Safi, Wataniya Petroleum are up first in Egypt’s plan to partially privatize military-owned companies: The Sovereign Fund of Egypt (SFE) decided that Wataniya Petroleum and the National Company for Producing and Bottling Water (Safi) as the first two subsidiaries of the National Service Products Organization (NSPO) the fund will move to privatize, Planning Minister and SFE Chairperson Hala El Said said yesterday, according to a cabinet statement. The SFE will market these companies to private investors in the first phase of the privatization plan, before eventually moving to list them on the bourse, the minister said without providing further details on the timeline or expected size of the listing.

Background: The SFE and NSPO had signed in February a cooperation agreement for the NSPO to open up its subsidiaries for investors, after President Abdel Fattah El Sisi said twice that stakes in army-owned companies and assets could be sold on the EGX as part of the state privatization program. The fund was looking at 10 of NSPO’s subsidiaries to offer them up for co-investment, SFE CEO Ayman Soliman said in March. Soliman did not disclose the company names under assessment at the time, and the fate of the rest of the roster so far remains unclear.

IPO WATCH

Ghazl El Mahalla could become the first sports club to hit the EGX in 1Q2021

Ghazl El Mahalla could sell shares in an initial public offering on the EGX as soon as 1Q2021, Public Enterprises Minister Hisham Tawfik said, according to Al Mal. A joint-stock company the ministry set up earlier this year to incorporate the state-owned football club will target EGP 100 mn through the listing. Tawfik previously said the ministry is planning to list around 66% of the company, but the final size of the stake is yet to be confirmed.

What to expect: The IPO will be open to both retail and institutional investors, with the ministry expecting to appoint a lead manager within one week, according to Tawfik. Original shareholders, which are state-affiliated, will be keeping a 50% stake for at least two years post-IPO, Tawfik noted. The state parent company will hold golden shares allowing it to outvote other shareholders. The IPO would make Ghazl El Mahalla, which has recently made a comeback to the Egyptian Premier League, the first sports club to float shares.

1Q2021 is shaping up to be quite a quarter for fresh listings (if they go ahead, that is): Ghazl El Mahalla joins state-owned fintech firm E-Finance, NBFS player Ebtikar, and CI Capital’s education management subsidiary Taaleem, who have all expressed ambitions in making their debuts on the EGX during the next quarter.

INVESTMENT WATCH

The Egypt-Saudi Investment Fund could finally be becoming a thing

The Egyptian and Saudi governments have drafted a final agreement to launch the long-dormant Saudi-Egypt investment fund, according to a cabinet statement following a meeting between Prime Minister Moustafa Madbouly and Saudi Minister of State Issam bin Saad bin Saeed. The fund’s mandate will focus on “priority sectors” including tourism, healthcare, pharma, ports and infrastructure, education, food, and digital payments and financial services, the statement said.

A refresher: The joint fund was first proposed back in 2016. The plan was to create a joint SAR 60 bn vehicle, but progress stalled over the past four years, and a previous agreement to launch in 2018 has so far come to nothing. A Saudi official told Reuters back then that Riyadh will provide funding to help develop the Egyptian side of NEOM (Saudi’s robot utopia).

Yes, but when is it going to launch? That remains one of the key unanswered questions.

Reminder: The Saudi wealth fund is also eyeing up Egypt. The Public Investment Fund could invest in Egyptian projects alongside the Sovereign Fund of Egypt, bin Saad said last month. We’re still none the wiser on what the two funds are cooking up.

DEVELOPMENT

Transport, health projects to get EUR 715 mn in AFD funding

The French Development Agency (AFD) is providing EUR 715.6 mn in financing to support an array of development projects, cabinet said in a statement yesterday. The agency signed seven agreements with International Cooperation Minister Rania Al Mashat in Paris yesterday in a meeting coinciding with President Abdel Fattah El Sisi’s trip to the French capital for talks with President Emmanuel Macron.

The funds come as part of a larger EUR 1 bn strategic partnership agreement between the two countries first signed in 2019.

Transport projects top the list: The Abu Qir railway project will receive EUR 250 mn, EUR 150 mn will be earmarked for developing an energy policy evaluation system that will assist in regulating the transition towards a more sustainable transit infrastructure, and the Tanta-Mansoura-Damietta railway modernization project will be allocated EUR 95 mn. Health, education and wastewater projects will also get runding. Full details in the release if you need the details.

ALSO FROM FRANCE-

El Sisi yesterday sat down with Naval Group’s Chairman and CEO Pierre Éric Pommellet, Ittihadiya said. The president also met with Éric Trappier, the CEO of aerospace company Dassault Aviation, which manufactures business and fighter jets. Egypt had ordered four corvettes a few years back from Naval as part of a USD 1 bn contract, which also included a tech transfer agreement to manufacture three corvettes in Egypt.

More: El Sisi discussed economic cooperation with France’s Economy and Finance Minister Bruno Le Maire and Organisation for Economic Co-operation and Development (OECD) Secretary-General José Ángel Gurría.

SPOTLIGHT

DPI on its big Adwia investment + why it likes Egypt right now

Private equity house DPI made waves last month with the USD 126 mn acquisition of Egyptian pharmaceutical platform Adwia along with the UK’s CDC and the European Bank for Reconstruction and Development. The pan-African private equity firm manages over USD 1.7 bn in assets through 24 investments across 29 countries and made its first Egypt investment in 2016, acquiring a third of Egyptian electronics and home appliance business B-Tech for USD 35 mn through its USD 725 mn African Development Partners (ADP) II fund. The fund, which is now fully invested, saw two further acquisitions in Egypt: The purchase of a stake in water pipe manufacturer Egyptian German Industrial Corporate (EGIC) in 2017, and a more recent USD 45 mn purchase of a 33% stake in GB Auto’s MNT Investment BV, the parent company of asset based lender Mashroey and microfinance player Tasaheel. MNT in turn holds a stake in tuk-tuk ride sharing, delivery, and microfinance business Halan.

We had a chat with Ziad Abaza, the DPI Principal primarily responsible for the firm’s Egypt portfolio, on the firm’s new healthcare venture, what industries they’re keeping an eye on, and DPI’s plans and prospects for Egypt. Edited excerpts from our conversation:

Egypt is one of the countries in Africa that has been very strong performing over the last four to five years, let's say since the devaluation. We always say, think of somebody moving from the suburbs to the city — what's that person going to need? They're going to need a bank account, they're going to need to put their kids in school, they’ll need to get healthcare. So everything around urbanization that benefits from the growing young population is what we’re interested in.

DPI has so far made three equity-based investments in Egypt, and we like the growth story here very much. All our Egyptian assets have performed well for us, so we've been quite comfortable making pure equity investments in Egypt. The firm’s modus operandi involves acquiring significant minority stakes in fast growing businesses and working with the existing management team. We help businesses with strategic direction, acquisitions, international expansion and ESG, which is perhaps not in the DNA of every Egyptian.

With a population of 100 mn+, Egypt still has one of the lowest banking penetrations, and Egypt’s non-banking financial services sector still has a lot of space to grow. Part of what has helped the industry grow so far is the 2015 Microfinance Act, which helped regulate the industry. When we first looked at this in 2015, you maybe had two or three players in the microfinance space. Fast forward and there’s more than ten players five years later.

Similarly, we expect regulation through the Consumer Finance Act will have a positive effect on DPI’s businesses like BTech, which operates much of their sales through credit. We feel that regulation will help protect and grow that industry as the Microfinance Act did with the microfinance industry. The Consumer Finance Act will regulate an industry that is increasingly important in supporting small enterprises, since consumers don’t just take on credit to buy goods, but also as working capital for their businesses. Especially on the microfinance side you can see that there's a great impact story.

After years of eyeing an entry point, DPI made its first investment in the healthcare industry with last month’s USD 126 mn Adwia acquisition, which was also the first drawdown from the 2019 ADP III fund. It's an asset that we've been following for quite some time. The issue with healthcare industry tickets is that they’re often either too small for DPI’s mandate, or overvalued through auctions.

Now with our joint USD 250 mn pharma investment platform with the EBRD and CDC Group, a big part of the thesis is bringing more affordable meds, especially in critical care and oncology, to the population and the wider continent.

What we're trying to do is provide affordable medication and therapeutic areas, which are perhaps not as easily available or as affordable in the country and the continent as a whole.

The platform’s investment in India’s Celon labs, which specialize in critical oncology, will provide the know-how while Adwia’s manufacturing facilities and regional export networks will facilitate the distribution of medicines across the continent. The platform is at the due diligence stage with several other healthcare related potential acquisitions in countries such as Morocco, Tunisia, Algeria, Nigeria, Côte d’Ivoire, and Ethiopia, and we have plans to establish a local distribution presence in the core regions of Africa.

Beyond our investments in retail, healthcare, and the non-banking financial services industries, we see growth potential in education, FMCGs, and the food and beverage industries. With a country like Egypt, what we do is we look at the demographic fundamentals of this country and what drives growth in this country. When you have a country of 100 mn people that are underserved in quite a few areas, there's always really good chance to create value that come out

Industries like infrastructure, energy and real estate are not within DPI’s mandate, but they’re not entirely off the table if we see the right opportunity. I don't think we've yet invested in all the industries that we like in Egypt. I do think there's some other industries that will be interesting in years to come and we will turn our attention to those out of the third fund.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

Our ties with France dominated last night’s talk shows as President Abdel Fattah El Sisi wrapped up his state visit to Paris.

It was International Cooperation Minister Rania Al Mashat’s turn to take to the airwaves, speaking to Yahduth fi Misr’s Sherif Amer about the business and economic side of El Sisi’s France trip, as well as the long-standing economic cooperation between the two countries. Al Mashat also broke down Egypt and France’s EUR 1 bn strategic partnership and what it entails (watch, runtime: 13:23). Masaa DMC’s Sarah Hazem also covered El Sisi’s meetings yesterday (watch, runtime: 3:47).

Also on the talking heads’ agenda yesterday: Debunking claims that the Pfizer vaccine is lethal, which were swirling on the interwebs after the US FDA announced that six participants in the clinical trial passed away. Four of those six were administered the placebo, meaning their deaths were in no way connected to the vaccine, Yahduth fi Misr’s Sherif Amer pointed out (watch, runtime: 3:42). Al Hayah Al Youm’s Mohamed Sherdy also took note of the FDA’s report (watch, runtime: 3:34).

EGYPT IN THE NEWS

It’s a mixed bag of nothing in the foreign press this morning.

ALSO ON OUR RADAR

SolarizEgypt was the first to install a solar rooftop as an independent power producer that sells electricity to another private company when it completed a 1 MW photovoltaic (PV) system for Coca Cola, the European Bank from Reconstruction and Development said. The project was supported by the EBRD’s Green Economy Financing Facility, which allowed Solariz to take out a loan from QNB AlAhli.

Other things we’re keeping an eye on this morning:

- EFG Hermes has signed a partnership agreement with fintech supply chain specialist Cayesh to allow suppliers to pay for their receivables using Cayesh services.

- Egypt Post will provide logistical services to e-commerce giant Jumia after the two inked a cooperation agreement, the local press reports.

- German rail company Deutsche Bahn has been tasked with the engineering consultancy and technical designs for the new, multi-bn USD electric rail line that will connect Abu Qir Port to West Port Said.

- Speed Medical will establish a joint venture with Saudi healthcare player Elaj to set up Elaj-branded lab facilities in North Africa and medical centers in Egypt under the terms of an MoU signed yesterday.

COVID WATCH

Sinopharm’s jab is 86% efficient, and we _could_ have it as early as next month

The Health Ministry reported 421 new covid-19 infections yesterday, down from 434 the day before. Egypt has now disclosed a total of 119,702 confirmed cases of covid-19. The ministry also reported 19 new deaths, bringing the country’s total death toll to 6,832.

Egypt could have a covid-19 vaccine next month, National Research Center Director Mohamed Hashem told Al Masry Al Youm. That vaccine is likely to be China’s Sinopharm, which conducted clinical trials in Egypt.

Trials of the Sinopharm vaccine in the UAE have shown a 86% efficacy rate in preventing moderate and severe cases of covid-19 and with no serious safety concerns, according to Bloomberg. The success of the trials has boosted the UAE’s confidence with officials saying the country would resume all economic, touristic, and cultural activities in the next two weeks and that a rollout may be imminent.

Regardless, Egypt is still waiting to ensure covid-19 vaccines’ efficacy before distributing them, including the AstraZeneca-Oxford shot, according to a Health Ministry statement. Minister Hala Zayed and British Ambassador to Egypt Geoffrey Adams discussed yesterday the logistics of bringing the vaccine to Egypt.

Good news for the AstraZeneca-Oxford vaccine: The folks at the Lancet Journal have given the vaccine their seal of approval, affirming that the shot is safe and effective in its peer review of phase three data, the Wall Street Journal reports. AstraZeneca and Oxford last month announced their two-shot vaccine was between 62-90% effective, with a higher efficacy observed when patients were given a half-dose followed by a full dose, rather than two full doses.

‘Meh’ news for the AstraZeneca-Oxford vaccine: They’re still not sure how effective the vaccine is in people aged over 55, nor why its efficacy seems to increase with a smaller initial dose. Still, this is the first jab to be subjected to a full peer review and the warm reception by the Lancet should be interpreted as a positive sign for Egypt, which will rely on it for 30% of its vaccine needs, and indeed much of the developing world. The one cautionary note: The UK, which began rolling out the vaccine on Tuesday, is warning that people with “significant” allergies should not be given the jab after two NHS workers became seriously ill after inoculation, Reuters reports.

PLANET FINANCE

The EGX30 was flat yesterday on turnover of EGP 1.7 bn. Foreign investors were net sellers. The index is down 21.1% YTD.

In the green: Sodic (+4.2%), Eastern Company (+4.2%) and Orascom Development Egypt (+1.8%).

In the red: Egyptian Iron & Steel (-3.5%), Export Development Bank (-3.1%) and GB Auto (-2.8%).

It’s a sea of red out there this morning, ladies and gentlemen: Asian shares are largely (if not deeply) in the red this morning, and futures suggest Wall Street and most of Europe will follow suit later today.

|

|

EGX30 |

11,018 |

-% (YTD: -21.1%) |

|

|

USD (CBE) |

Buy 15.64 |

Sell 15.74 |

|

|

USD at CIB |

Buy 15.64 |

Sell 15.74 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

8,660 |

+0.6% (YTD: +3.2%) |

|

|

ADX |

5,077 |

+0.3% (YTD: -%) |

|

|

DFM |

2,540 |

+0.3% (YTD: -8.2%) |

|

|

S&P 500 |

3,673 |

-0.8% (YTD: +13.7%) |

|

|

FTSE 100 |

6,564 |

+0.1% (YTD: -13.0%) |

|

|

Brent crude |

USD 48.86 |

-% |

|

|

Natural gas (Nymex) |

USD 2.4 |

-0.1% |

|

|

Gold |

USD 1,838.70 |

-% |

|

|

BTC |

USD 18,558.55 |

+1.4% |

Middle East governments could face something of a reckoning in the months and years ahead as low oil prices and spiraling debt heap pressure on public finances, Fitch Ratings said in a note this week. Despite expectations for an economic rebound in 2021, “balance sheets will continue to deteriorate” and the “painful fiscal adjustments” needed to rescue the situation, coupled with the economic effects of the pandemic, could provoke social and political unrest. The ratings agency, which currently has five of 15 MENA sovereigns on a negative outlook, said that even in the higher-rated GCC states, the consequences of covid will “raise questions” about the sustainability of their social and economic models.

Kuwait is a case in point: The ruling Al Sabah clan could be on a collision course with the newly-elected parliament over how the country pulls itself out of its fiscal hole, the Financial Times suggests.

Egypt is still good, though: The ratings agency earlier this year affirmed Egypt’s long-term foreign-currency issuer default rating at ‘B+’ with a ‘stable’ outlook.

AROUND THE WORLD

IN DIPLOMACY: We’re signaling we’re probably okay with bringing Qatar in from the cold. Foreign Minister Sameh Shoukry praised progress that could lead to a reconciliation between Qatar and the Arab Quartet, but said that any agreement must be “clear on the obligations required from all parties,” in an interview on TenTV on Tuesday (watch, runtime: 16:50). Egypt, along with Bahrain, the UAE, and Saudi Arabia, has been locked in a dispute with Qatar since 2017, severing diplomatic and trade ties with the island state in response to alleged support for terrorism. Saudi Arabia and Qatar have in recent days signalled progress in reaching an agreement to end the three-year dispute, while Egypt and the UAE have both hailed Kuwait’s mediation efforts. Bloomberg picked up on Shoukry’s comments.

Could we have a GERD agreement in 6 months’ time? Ethiopia’s ambassador in Cairo thinks so, telling Sputnik News that he hopes an agreement can be reached before the next rainy season, when Ethiopia plans to fill its dam reservoir for the second time. Negotiations came to a standstill last month after Sudan opted out of the talks and called for more involvement from the African Union, as an ongoing conflict in Ethiopia’s Tigray region threatened to destabilize the country. Talks between the three countries broke down in August over disagreements on the timeline for the filling and operation of the dam.

MY MORNING ROUTINE

Iman Ezzeldin, professor of drama, theatre and film criticism at Ain Shams University: Each week my Morning / WFH Routine looks at how a successful member of the community starts their day. Speaking to us this week Iman Ezzeldin (LinkedIn), professor of drama, theatre and film criticism at Ain Shams University.

I'm Iman Ezzeldin, professor of drama, theater and film criticism at Ain Shams University. I teach theater, film criticism and play analysis between Ain Shams University and the University of Hertfordshire in Egypt in the new administrative capital. I co-founded the film and theater criticism department at Ain Shams in 2006. I'm a regular jury member of several domestic literary awards and film festivals, one of which has been the Sawiris Foundation prize for theatrical texts. I'm also part of an organization called Madad which supports cultural initiatives in the poorer outskirts of Cairo and rural areas of the country.

I was formerly the director of the National Library in Bab al Khalq, the one that was bombed in 2014. It actually happened while I was on a plane heading to Paris. I landed, heard the news and immediately hopped on the next flight back to Cairo. It was a very difficult time for us.

I'm an early riser so I’m usually up at 5:00 am. I have three cats who wake me up pretty early to eat. I feed them, make myself a cup of tea, check my Facebook and Twitter feeds and start getting ready to head out of the house. When I actually leave my house is extremely variable. On some days I'm out of the house by 7:30 am and on others I can stay in until 9:00 am. It mainly depends on my lecture schedule at the universities and meetings at the Jesuit Cinema School, where I’m a board member and consultant. Reading papers and issuing corrections usually takes place from my home in the evenings.

We’re now back to 100% in-person learning: In late March, when the lockdown came into effect, our classes went entirely online. My conversations with post-graduate students, which used to take place in person, shifted to one-on-one video calls. For my undergraduates, lectures were pre-recorded and slides posted online. They could contact me to ask specific questions after reviewing the material. Lectures have now resumed their regular in-person schedule, which has been the case since September.

Staying home didn’t bother me, I actually enjoyed the break from commuting. I started going on more walks in the city, especially during Ramadan. I also got the chance to catch up with TV shows of my own choosing for the first time in years, so I started watching the popular Ramadan series ‘B 100 Wesh’ and ‘El Fetewa.’

Although I’m on a more regular schedule, I can’t say it's totally back to normal now. Meetings, theater visits and public film screenings have all been put on pause for me now. I would usually make it to the Cairo International Film Festival this time of year and spend the entire week watching films but the pandemic has kept me away from many of these cultural events. Even though I was a jury member for the Egyptian films bracket at the Gouna Film Festival earlier this year I chose not to attend over covid concerns.

Theater is in a very bad situation at the moment. With the closure of indoor public spaces there are very few remaining outlets for creators to express their craft to audiences. Individuals and troupes who once hosted theater workshops and plays are now completely destroyed. Some groups have resorted to performances at cafes or open air performances, but it can be difficult to acquire the appropriate licensing.

Young artists need more venues to display their work. Attending the physical performance of a play is a tremendously powerful sensory experience. Watching someone act on stage and in the flesh is irreplaceable, so having a physical theater to showcase these productions is direly needed.

I urge people to check out Zawya for really good independent films, especially during the European Film Festival coming up January 2021. I highly recommend the 2019 Sudanese documentary Talking About Trees. Ibrahim Abdel Meguid’s translation of Letters From Egypt by Lucie Duff Gordon gives an important and somewhat overlooked history of Alexandria. Ezzat El Amhawy’s Ghorft El Mosafrin is also a recent read that has been fascinating to get through. Mohamed Aboul Ghar’s recently published book The Pandemic That Killed 180k Egyptians on the 1918 Flu is a very well researched and timely read.

Improving yourself just a little bit every day is key. What I tell my students, and myself, is to always work on polishing their skills and performance whether that is through language, analysis or writing.

ON YOUR WAY OUT

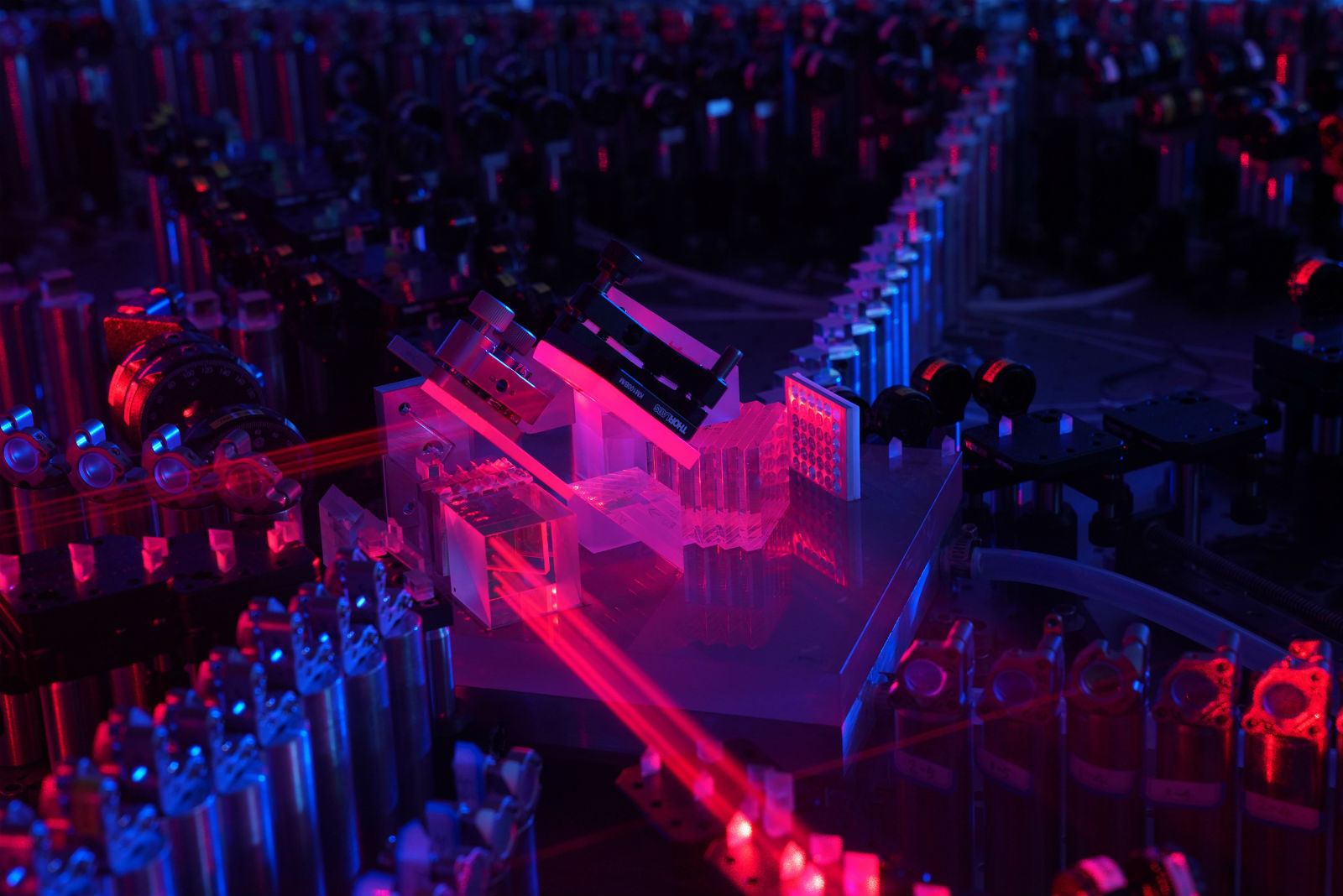

Chinese researchers claim to have achieved quantum supremacy after successfully using a prototype system to perform a task that would take one of the world’s fastest supercomputers 2 bn years in just a few minutes, reports Wired. The Jiuzhang system, built by a team of researchers at University of Science and Technology of China, seems to have comfortably outperformed Google, which last year also achieved quantum supremacy — a term referring to a computation beyond the brainpower of a conventional supercomputer. The Chinese model uses completely different technology, manipulating photons instead of the more conventional approach of using super-cold superconductors.

CALENDAR

December: Egypt-US Trade and Investment Framework Agreement (TIFA) talks.

December: A meeting to finalize membership and trading rules governing Egypt’s Commodities Exchange (Egycomex).

December: The Egyptian-Iraqi Joint Higher Committee will meet.

9-10 December (Wednesday-Thursday): BiznEx, the international business expo in Egypt, Nile Ritz Carlton Hotel, Cairo, Egypt.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15 December (Tuesday): House of Representatives reconvenes from recess.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

31 December (Thursday): Egypt-UK post-Brexit trade agreement to take effect.

31 December (Thursday): Deadline for car owners to comply with traffic regulations to install a RFID electronic sticker on their cars.

1Q2021: The Seventh Annual Egypt Automotive Summit will be held

1H2021: Egypt’s Commodities Exchange (Egycomex) will begin trading.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids.

17 January 2021 (Sunday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria in case 445 of 2019.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

30 May-15 June 2021 (Wednesday-Thursday): Cairo International Book Fair.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

30 June- 15 July 2021: National Book Fair.

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

1 October 2021-31 March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

December 2021: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.