- Pfizer just announced a breakthrough on a covid vaccine — but there are plenty of caveats. (What We’re Tracking Today)

- Maait promises no new taxes in fiscal update. (Speed Round)

- EBRD, CDC consortium acquire 99.6% of Egypt’s Adwia pharma. (Speed Round)

- Ibnsina Pharma acquires 75% stake in Egyptian digital pharmacy app 3elagi. (Speed Round)

- Al Futtaim Real Estate to invest EGP 5.5 bn in real estate developments in 2021. (Speed Round)

- EIB to sign off on EUR 1.1 bn financing package for transport projects in December and January. (Speed Round)

- Private sector minimum wage delayed by covid-19. (Speed Round)

- The “small government” consensus may be coming to an end — and that’s not necessarily a bad thing, says the EBRD. (Speed Round)

- Enterprise Explains: Securitized bonds.

- The Market Yesterday

Tuesday, 10 November 2020

World cheers covid vaccine breakthrough — but there are catches

TL;DR

What We’re Tracking Today

Good morning, wonderful people. We’re going to lead with the same thing everyone else in the world is trumpeting this morning, in one way or another: We just took a big step toward an effective vaccine against covid-19.

But don’t go celebrating just yet — there are lots and lots of caveats, especially for folks in our part of the world.

First, the facts: Pfizer and BioNTech’s covid-19 vaccine is 90% effective and could be submitted to authorities for emergency approval this month. The US and German companies said that no serious safety concerns were found and that the findings were a breakthrough for the industry, showing a proof of concept that vaccines can stop the disease. The reported efficacy rate is well above the 50% effectiveness required by the US Food and Drug Administration (FDA).

Pfizer and BioNTech said that up to 50 mn doses of the vaccine could be manufactured before the end of the year as well as 1.3 bn doses in 2021. The major development is on the front pages of Reuters, the Financial Times, Bloomberg, BBC, the Associated Press and the New York Times, among others.

Caveat #1: Divide that dose number by two and you get how many people will benefit from the vaccine if it makes it to market. Each person needs two doses taken some period apart.

Caveat #2: It’s tough to make — and even more difficult to distribute. The vaccine is synthetic mRNA and needs to be stored at -70°C. That type of super-cold storage is rare even in the US and Canada outside (really) major hospitals. “This will be a challenge in all settings because hospitals even in big cities do not have storage facilities for a vaccine at that ultra-low temperature,” one researcher told Reuters.

Caveat #3: It’s unclear whether the vaccine prevents infection, meaning we don’t know yet whether vaccinated people could still be asymptomatic carriers and infect others. This is a subtle point, but what the trial looked at was whether there were fewer symptomatic covid cases in people who got the vaccine than in people who got a placebo.

Caveat #4: In the meantime, you still need to wear your damn mask. It’s the single best thing any of us can do to constrain the spread of the virus. Don’t believe us? Fine. Go listen to Joe Biden.

But, but, but: There are plenty of vaccine candidates that don’t have that sort of crazy cold chain requirement. Moderna’s vaccine does, but other leading candidates being developed by AstraZeneca, Johnson & Johnson and Novavax, which target the coronavirus’ spike protein, don’t, the WSJ notes. Still: Scientists say cautious optimism is the watchword for now.

Could Pfizer manufacture its vaccine in Egypt? We’re not going to hold our breath given the complexity of the process and the investment cost involved, but Aly Auf — the head of the medicines division at the Federation of Egyptian Chambers of Commerce — told Masaa DMC’s Eman El Hosary last night that it is possible. (It’s not at all clear whether he was speaking for Pfizer.)

But the vaccine breakthrough is still good news for Egypt: We’ve already signed up with AstraZeneca for 30 mn doses of the Oxford vaccine when it receives regulatory approval. The government, which is also currently participating in the clinical trials of a Chinese-made vaccine, will compare the test results from the different vaccines and make a decision on which to distribute to the public, Auf said. (watch, runtime: 12:31). Immunology professor Abd El Hadi Khader told El Hekaya’s Amr Adib that science, not geostrategy, needs to drive the decision on which vaccines the government purchases (watch, runtime: 4:23).

Producing a viable vaccine is one thing. Distributing it is an entirely different ball game. Attempts to bring the pandemic to an end may be plunged into crisis if global leaders don’t work together to ensure that vaccines are distributed fairly, professor of epidemiology Islam Anan told El Hadidi. The Trump administration’s refusal to commit to the fair distribution of a vaccine would severely complicate efforts to eradicate the virus from all corners of the world, he said, expressing hope that Washington may change course (watch, runtime: 5:40).

The Health Ministry reported 221 new covid-19 infections yesterday, down from 239 the day before. Egypt has now disclosed a total of 109,422 confirmed cases of covid-19. The ministry also reported 12 new deaths, bringing the country’s total death toll to 6,380. We now have a total of 100,439 confirmed cases that have fully recovered.

Global stocks cheered the announcement yesterday, rallying an intraday high as the news combined with Joe Biden’s victory in the US election to push market euphoria to new levels. MSCI’s index of EM stocks rose over 0.6% to hit an all-time high, while the S&P 500 closed 1.2% in the green. Both exchanges trimmed intraday highs before the closing bell thanks to dashed hopes of new stimulus and Senate majority leader Mitch McConnell saying The Donald has “every right” to challenge the election process.

Oil also surged, with Brent crude rising as much as 6.5%, but tech shares slumped as investors looked at retailers, hotels and energy companies, which have lagged throughout the pandemic.

The rally isn’t looking like it’ll continue today, with US and European markets both projected to open in the red according to futures markets at the time of dispatch this morning.

The market rally is leading coverage in the global business press this morning: Bloomberg | FT | CNBC | WSJ | Reuters | Associated Press.

Closer to home, in the here and now:

It’s inflation day: The Central Bank of Egypt and Capmas are due to release inflation figures today, which will feed straight into the Thursday meeting of the CBE’s monetary policy committee. Annual urban inflation ticked up to 3.7% in September, but remained near a record low as seasonal factors such as the reopening of schools had a smaller-than-expected effect on monthly prices. Expect interest rates to be left on hold according to six of eight analysts and economists in our poll.

Renaissance Capital is hosting a five-day virtual conference on the 2021 outlook for emerging and frontier markets, including panel discussions on sectors in specific countries. The conference kicked off yesterday and wraps on Friday. Look for a panel discussion on Egypt’s fintech space with Fawry CEO Ashraf Sabry, Ebtikar CEO Ayman El Dessouky, Actis Partner Hossam Abou Moussa, and e-Finance subsidiary Khales CEO Moataz El Sayed. Tap / click here to stream the public sessions.

The Egyptian-British Chamber of Commerce and the British Egyptian Business Association’s Egypt Week continues today. International Cooperation Minister Rania Al Mashat, Finance Minister Mohamed Maait and presidential health advisor Mohamed Awad Tag El Din are due to speak on the second day of the conference today. The four-day virtual event kicked off yesterday with a speech by Prime Minister Moustafa Madbouly, who said that Egypt could serve as the UK’s gateway to Africa as the country looks to boost trade after leaving the European Union. Check out the agenda here (pdf).

KUDOS- Egyptian Paralympic Committee chief Hayat Khattab is one of the 100 individuals who were appointed to the Senate by President Abdel Fattah El Sisi, Inside the Games reports. Khattab, who is also president of ParaVolley Africa and teaches at several Egyptian universities, says she hoped to “achieve something for para-athletes” during her term. We had a chat with Khattab in our Work From Home Routine column last week, which you can read in full here.

President Abdel Fattah El Sisi will be in Athens tomorrow and Thursday for talks with Greek PM Kyriakos Mitsotakis, Greek media report.

Apple is widely expected to unveil new Macs powered by Apple silicon at an event set to stream tonight at 8pm CLT. You can catch it here.

Fitch cut Saudi Arabia’s outlook to negative but maintained its A rating as covid-19 and plunging oil prices continued to wreak havoc on the kingdom’s economy, Bloomberg reports. The move comes as a result of the continued weakening of the sovereign’s fiscal and external balance sheets, said Fitch analysts.

Crude futures contracts will be on the menu when Abu Dhabi debuts its commodities exchange next March, marking the first time investors will be able to trade the futures, according to Bloomberg. The futures trading will replace the emirate’s retroactive pricing scheme, allowing instead the market to determine oil prices, pending regulatory approvals.

From the region:

- UN-led talks in Tunisia on Libya’s future kicked off yesterday, with an eye toward arranging national elections to unify the fractured country, Reuters reports.

- Violence in Ethiopia’s Tigray region has killed hundreds, Reuters reports, citing government sources.

- Armenia, Azerbaijan and Russia have signed a peace agreement to put an end to six weeks of conflict over the disputed Nagorno-Karabakh region, the BBC reports.

POST-US ELECTION WATCH- All the latest from the transition — or to be more accurate, non-transition — from Planet Trump:

- Republican heavyweight Mitch McConnell has publicly backed Trump’s decision to persevere with legal action as pressure builds on the president to concede the election to Joe Biden. (Axios)

- Trump stalwart and US attorney general Bill Barr authorized a probe into possible instances of electoral fraud. (CNN)

- Hasta la vista: The ex-Apprentice host fired his defence secretary Mark Esper for unknown reasons, writing on social media that he had been “terminated.” (Twitter)

- The prospect of Trump 2024 is real: The Donald has already told his advisers that he intends to make a comeback bid for the White House in 2024. (Axios)

A Biden presidency won’t go easy on China, with tensions expected to persist albeit with less volatility, CNBC reports. In a Foreign Policy article earlier this year, the president-elect wrote “the United States does need to get tough with China” and suggested the most effective way to do that would be “to build a united front of US allies and partners to counter China’s abusive behaviors.” It is unclear what stance the Biden administration will take on tariffs and negotiating phase two of the China-US trade deal signed earlier this year.

…and Russia won’t be their BFF either: Moscow is bracing for more anti-Russia rhetoric and stricter sanctions as Biden takes on the US presidency, according to the Financial Times.

And Naguib Sawiris is also weighing in on the prospect of a Biden White House, telling CNBC that he will restore “ethics, some principles back to democratic values,” and expressing hope that he will be more balanced in his approach to the Israeli-Palestinian conflict.

Enterprise+: Last Night’s Talk Shows

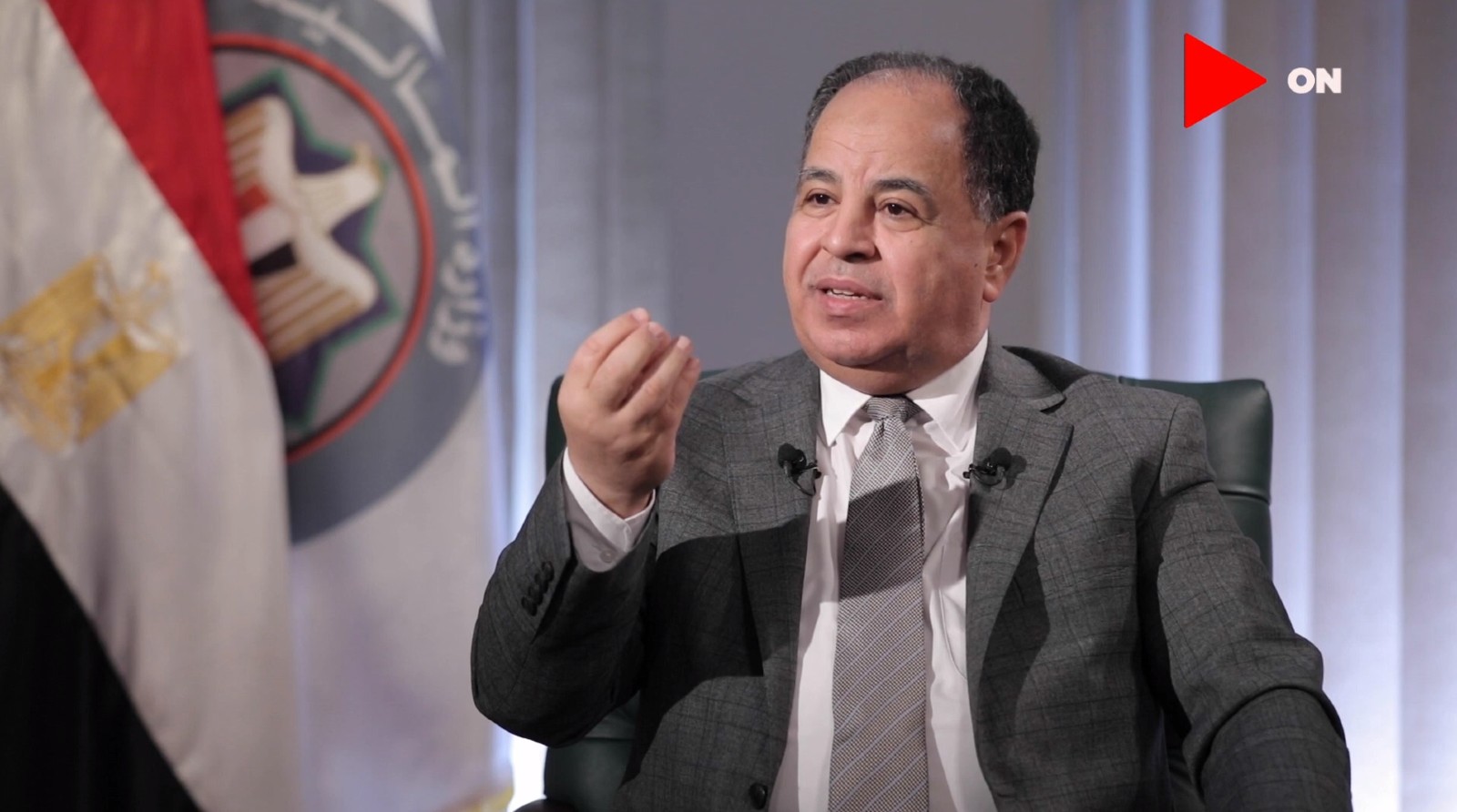

Finance Minister Mohamed Maait stole the limelight on the airwaves last night, sitting down with Kelma Akhira’s Lamees El Hadidi for a wide-ranging discussion on the state of public finance, the ministry’s covid-19 response, tax reform and the IMF standby loan (watch, runtime: 16:24). We have full coverage of the interview in this morning’s Speed Round, below.

Optimism about a covid-19 vaccine also got airtime, as we note in What We’re Tracking Today, above.

Are GERD talks now on hold amid conflict in Ethiopia? El Hekaya’s Amr Adib interviewed Amany Al Tawil, the African affairs expert at Al-Ahram Center for Political and Strategic Studies, who said that the conflict in Ethiopia’s Tigray region will mean that negotiations will likely be put on hold for at least two months until the incoming Biden administration engages with the dispute, and expressed hope that an agreement can be reached by next February (watch, runtime: 3:37).

Speed Round

Maait promises no new taxes in fiscal update: Egypt’s economy is expected to grow by 3.3% in the current financial year that began in July, but growth could hover between 2.8% to 3.5%, Finance Minister Mohamed Maait said in an interview with Kelma Akhira’s Lamees El Hadidi last night (watch, runtime: 16:24). This is a downgrade from the 5% figure Maait offered in June but identical to a Reuters poll of economists which last month also forecast GDP to grow at a 3.3% clip.

No new taxes on the horizon: The ministry has no plans to introduce new business or personal taxes, Maait said. The government already introduced a 1% salary tax earlier this year to help fund its response to covid-19, and Maait stopped short of promising that existing taxes would not be raised.

But it doesn’t sound like factories are going to get exemptions from real estate taxes: While Maait reiterated that the ministry is studying whether to exempt factories from real estate taxes, he also complained that it wasn’t generating enough revenue. Real estate tax provided less than EGP 5 bn, and the ministry is working to “simplify” the tax to boost revenues.

And really, why should manufacturers get breaks on real estate tax that other industries don’t? It’s time we stopped treating manufacturers as if they’re the only ones driving economic growth in this country.

Counting the costs of covid: Egypt suffered a EGP 220 bn shortfall in revenues in FY2019-2020 in the wake of the pandemic, Maait said. The country’s three-month lock earlier this year caused a drop in tax receipts while the shuttering of the vital tourism sector, which accounts for 15% of GDP, hit revenues hard. Meanwhile, CBE figures showed last month that remittances fell by 10.5% to USD 6.2 bn in 4Q2019-2020.

The situation began to improve in 1Q 2020-2021 though: Revenues rose by 18.4% y-o-y during the previous quarter, helped by a 14.1% increase in tax revenue, which Maait attributed to tax reform.

Emergency covid spending: The government has spent EGP 65 bn of its EGP 100 bn covid-19 warchest on purchasing medical supplies, staple goods, and paying employment grants for day laborers. Some EGP 70 bn has been spent on pensioners’ allowances and increases to public sector salaries and pensions, he said.

The government’s interest bill will fall this year: Maait forecasts that the government’s debt servicing bill will fall to EGP 540 bn during the current fiscal year, down from EGP 548 bn last year.

Maait said that Egypt would receive the remaining tranche of the IMF standby loan agreed earlier this year by the end of next June. The government has agreed to undertake structural fiscal reforms and amend customs regulations in return for the money, he said, without elaborating.

Export subsidies: The government will disburse some EGP 19 bn to exporters in the coming months, having paid out EGP 4 bn in subsidies so far during the pandemic. He added that there 400 companies have so far applied for payouts from the fund.

M&A WATCH- EBRD-CDC consortium acquires 99.6% of Adwia Pharma: A consortium of the European Bank for Reconstruction and Development, the UK’s Commonwealth Development Corporation, and an unnamed UK fund have acquired a 99.6% of pharma company Adwia, Al Mal reports, citing sources with knowledge of the sale. The USD 126 mn transaction buys out the 90% stake held by chairman Hossam Taher and his family as well as most of the 10% held by medical professionals. Minority shareholders holding 0.4% of the company’s equity could still participate in the transaction, the newspaper suggests.

Background: Adwia had previously rejected a USD 150 mn offer by UK private equity firm Development Partners International, saying the valuation was too low in light of increasing sales due to covid-19. The companies had reportedly reached an agreement for USD 200 mn in September, after which it became known that the EBRD and CDC were also interested in a stake. It’s entirely possible the unnamed UK investment fund referred to by Al Mal’s source is Development Partners International.

Advisors: EFG Hermes was reportedly buy-side advisor, while our friends at Pharos advised Adwia.

M&A WATCH- Ibnsina Pharma has acquired a 75% stake in digital pharmacy platform and app 3elagi, according to an EGX disclosure (pdf). The remaining 25% of the business continues to be held by the founders, who will remain onboard. The company has been working since the outbreak of the pandemic to “give patients access to their medications without having to leave their homes,” said Ibnsina Chairman Mohsen Mahgoub. 3elagi currently has 600k users, and plans to use the capital increase to expand its user base, as well as the number of registered pharmacies in its network.

Background: Ibnsina invested EGP 22 mn in 2020 in internal digital projects, including launching its own app last July. The app serves 4k pharmacies monthly, allowing them to digitally replenish their stock. The company announced last July it had set up an SPV to invest in pharma companies, and said it plans to invest EGP 16 mn in 2021.

INVESTMENT WATCH- Al Futtaim Real Estate will invest EGP 5.5 bn in real estate developments in 2021, Managing Director Ashraf Ezz El Din said during a presser yesterday, according to Al Mal. The company is also eyeing developing 1 mn sqm of land in East Cairo, he said, without disclosing what it will use the land for. Al Futtaim is currently undertaking the EGP 1.5 bn expansion of Cairo Festival City Mall, which is expected to be completed within two years.

DEBT WATCH- A EUR 1.1 bn financing package from the European Investment Bank (EIB) will officially be earmarked for Egypt’s public transport projects when the Transport Ministry signs contracts for the funding in December and January, according to a cabinet statement. The signing of the contract for the first EUR 600 mn tranche is scheduled for next month, and we will put ink to paper for the second EUR 528 mn tranche in January 2021.

Three projects will get funding, with EUR 138 mn going towards the renovations of the Raml tram in Alexandria, EUR 750 mn to the electrification of the Abu Qir-Alexandria railway, and EUR 240 mn will be allocated for the extension of Cairo Metro Line 2. The loan is part of a larger EUR 1.9 bn facility, with the remaining EUR 800 mn to be used for “covid-19 related business investment,” International Cooperation Minister Rania Al Mashat had said.

The Raml tram project might also receive up to EGP 2.5 bn in the coming period from local banks: The National Authority for Tunnels (NAT) is in initial talks with local banks for a loan of up to EGP 2.5 bn to partially finance the EUR 363 mn tram renovation project, reports Al Mal, citing sources close to the negotiations. Back in March, the EGP 410 mn tender to restore the tram was awarded to a consortium of French and Egyptian companies made up France’s Systra and Egis Rail and Egypt’s ACE Moharram Bakhoum and Projacs.

LEGISLATION WATCH- A minimum wage won’t be introduced to the private sector anytime soon thanks to covid-19, Al Watan reports, citing an unnamed source from the National Wages Council. The economic fallout from the pandemic makes a legally binding pay rise unfeasible given the losses suffered by factories earlier this year, said the source.

BACKGROUND: The council had met in 2019 to discuss implementing a minimum wage for the more than 24 mn individuals employed in the private sector, and Deputy Planning and Economic Development Minister Ahmed Kamal said last May that the ministry would look to implement a minimum salary of EGP 2k per month, or of EGP 12 per hour, for workers in the private sector after the crisis abates. The national minimum wage for public sector workers had been increased from EGP 1.2k to EGP 2k at the start of FY2019-2020.

The Egyptian-American Enterprise Fund (EAEF) remains “committed” to supporting the Egyptian private sector through the current crisis, and views the pandemic as an occasion to double down on its investment strategy, Chairman James Harmon wrote in a letter (pdf) to shareholders. Harmon announced that the EAEF joined Ezdehar to acquire a minority stake in Al Tayseer Healthcare Group in September and extended a USD 10 mn loan to Fawry Microfinance. He also noted that the fund’s PE arm Lorax Capital had recently raised USD 142 mn and said it had helped TCV to invest in nut company Abu Auf. The fund also invested USD 1 mn in Flat6Labs’ second closing.

“Our existing portfolio companies continue to report steady growth,” Harmon wrote, reporting successes at several of its companies including Dawi Clinics and Nermien Ismail Schools.

Correction 11 November 2020: A previous version of this story incorrectly said that the EAEF invested in Al Tayseer alongside Ebtikar.

The “small government” consensus may be coming to an end — and that’s not necessarily a bad thing, says the EBRD. Covid-19 is causing public opinion in emerging economies to shift towards favoring greater state economic involvement and a heavier hand in managing public crises, the European Bank for Reconstruction and Development (EBRD) has said in a new report (pdf). Entitled “The State Strikes Back,” the latest Transition Report suggests that state-owned enterprises and banks can successfully step in to provide economic and social assistance provided the state is equipped with strong institutions and has good governance.

States across the world have taken a far more hands-on approach this year as the pandemic forces governments to take emergency measures to protect their economies and preserve public health. Budget deficits have surged as the state’s fiscal firepower has been deployed to fund wages, unemployment benefits, provide debt relief, and bail out firms. And in a break from their hawkish pasts, institutions like the IMF have been urging governments to ramp up spending still further to stave off another economic downturn.

There is growing appetite for state intervention in advanced and developing countries alike: Some 45% of people living in post-communist economies surveyed by the EBRD expressed support for a bigger state while 33% of respondents in advanced economies said the same (up from 27% two decades earlier). A lot of this down to how risk has been socialized in recent years, which has seen people on lower-incomes bear the brunt of the economic risks, the report suggests.

State-owned enterprises can act as a stabilizing force for economies, providing public-sector employment during downturns and in poorer regions. They can also ensure that services such as utilities or broadband are widely available and affordable. However, inefficiencies and weak governance at state-owned firms can hamper productivity and growth.

State-owned banks have also grown in importance because many have less demanding lending standards, lower net interest rate margins, and higher tolerance of non-performing loans. However, they can also be more susceptible to, and dogged by, inefficiencies from political interference resulting in weak economic growth, the report says.

And the state is going to need to take an active role in nudging us towards greener economies: EBRD regions have to build in transitions to a green economy into their post-covid-19 recovery plans, as they continue to fall behind on their carbon emission targets. The bank calls for governments to take a “ruthless” approach to supporting industries that have zero-carbon futures, and argues that it will need to address market failures by introducing new incentives, subsidies and regulations to reallocate resources towards building a greener economy.

How well emerging economies deliver successful policies amid increasing state influence depends on the quality of institutions and governance, EBRD chief economist Beata Javorcik writes. Weak institutions could siphon off resources from those in need and fall into corruption and nepotism. Good governance, on the other hand, could steer an effective transition to a greener economy. Transparent state institutions that are distanced from politics and with clearly delineated responsibilities will be vital if the state is to become more involved in steering countries through the current upheaval, he says.

ON A RELATED NOTE- The National Bank of Egypt gets a walk-in mention in an opinion piece penned by the EBRD’s chief economist for the Financial Times headlined Covid has made the state’s hand more visible but there are risks.

MOVES- Anwar Fawzi Mohamed Shehata El Sherbiny has been appointed head of the Real Estate Tax Authority by Prime Minister Moustafa Madbouly for a one-year term, Al Masry Al Youm reports.

Mohamed Ghanem has been appointed as the spokesperson for the Irrigation Ministry by Minister Mohamed Abdel Aty, Al Shorouk reports.

Enterprise Explains

Enterprise Explains: Securitized Bonds. With a record-breaking offering about to hit the market, securitized bonds are becoming an increasingly popular method of debt finance among real estate and consumer finance companies — private-sector and government-owned alike. Sarwa, Madinet Nasr Housing, Palm Hills, Raya and NUCA have all hopped on the securitized bondwagon (ahem) as of late, but what are securitized bonds, and how do they work?

Securitized products are backed by a portfolio of financial assets, which are pooled and repackaged as tradable securities, in this case as bonds. A wide range of assets can be securitized: residential and commercial mortgages, credit card debt, auto loans and receivables can all be packaged up and sold off to investors. The bonds are issued by a special purpose vehicle (SPV), a separate legal entity set up by the institution specifically to sell the bonds. The company sells the assets to the SPV and pockets the cash — removing the assets from its balance sheet — and the SPV then issues the bonds.

But wait, aren’t they the same thing as secured bonds? The creation of an SPV is what differentiates securitized bonds from secured bonds. The latter are guaranteed directly by the assets without the SPV as an intermediary.

So what are they good for? Securitized bonds offer quick liquidity to companies with steady future revenue streams from things like installment payments, and they allow companies to pay out interest in installments rather than as a lump sum when the bond matures. For financial institutions, enhanced liquidity means they can provide loans at a lower interest rate. For other companies, it means they can have the cash on hand while parking risk on the SPV. The SPV makes its money off the spread, the difference between the interest rate at which they purchased the assets and the interest rate on the bonds.

They’re a versatile form of investment: Because securitized bonds are issued in tranches, investors are better able to diversify, combining products with different yields, risk, and maturity in their portfolio.

And they offer investors a low-risk alternative to sovereign and corporate bonds: As they’re ultimately backed by assets, the risk of default is relatively low. The securitization process creates bonds that are “credit enhanced,” meaning their credit rating is higher than that of the underlying asset pool. Consequently, though competitive, the interest rates offered by securitized bonds will generally be lower than unsecuritized alternatives, which offer no collateral in the event everything goes bust.

The catch, though, is that in Egypt the real buyers of securitized offerings have, so far, been banks. It’s only this year that the Financial Regulatory Authority has started talking about how to make it possible for retail investors and non-bank institutional investors to get in on the action through a new type of fund.

Want more?

- The IMF explains the concept of securitization here (pdf).

- Khan Academy has a solid albeit pixelated three-part explainer on mortgage-backed securities (watch, runtime: 7.56 | 9:35 | 9:18).

- The Brookings Institute explains (pdf) how mortgage-backed securities were responsible for the near-collapse of the global financial system in 2007-08.

- Or were they? The University of Chicago provides the counter point.

Egypt in the News

It’s a fairly quiet morning in the foreign press. Ezzedine C. Fishere is dialing up the hyperbole in the Washington Post, while Sara Khorshid muses about what the Biden presidency means for regional leaders in the tabloid known as Foreign Policy.

Worth Listening

One piece of software to rule them all: MagicCube cofounders and Egyptian power couple Nancy Zayed and Hisham Shawki built their careers questioning the boundaries of technological capability at companies like Apple, Netscape, Palm and Cisco. In the latest episode of Making It, the pair tell us how they built the first software replacement for hardware security components that could potentially make a USD 48 bn market redundant.

You already have a podcast player on your iPhone and you can listen to Making It on our Website | Apple Podcasts | Google Podcasts | Anghami | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi discussed intelligence and counterterrorism cooperation with MI6 head Richard Moore during talks in Cairo yesterday, Ittihadiya said in a statement.

Energy

EETC to tender Alexandria regional energy control center in 2021

The Egyptian Electricity Transmission Company is planning to launch a global tender in early 2021 for a regional energy control center in Alexandria’s Moharram Bey area, according to Al Mal, citing unnamed Electricity Ministry sources. The company is currently negotiating with international institutions for a USD 50 mn long-term financing package for the project, the implementation of which will take two years to complete, the sources added.

Manufacturing

Arab Organization for Industrialization to produce ID tech alongside Idemia

French tech firm Idemia has agreed to work with the Arab Organization for Industrialization (AOI) to locally produce identification and surveillance devices, the AOI said in a statement on Sunday. The agreement signed earlier this week will see the two companies manufacture fingerprint, iris and facial recognition devices for use in “civil and security fields,” the statement said without providing details.

Health + Education

CIRA to open Badr University in 2021

Leading private sector education outfit CIRA is planning to begin operating the first phase of its flagship Badr University in Assiut by September 2021, which will include four colleges, CEO Mohamed El Kalla told the local press. The company’s expansion plans will see it invest EGP 600-700 mn in 2021, which also includes the launch of four new K-12 schools. Two of the schools will be in Giza, one in Qena, and one in Sohag.

Tourism

200k Ukranian tourists visit Egypt since July

Almost 200k Ukranian tourists have visited Sharm El Sheikh and Hurghada since commercial flights resumed in July, a Ukranian embassy official has said, according to Al Mal. Tourism Minister Khaled El Enany said last week that over 380k tourists had visited Egypt since July, and that Ukraninan tourists made up the bulk of those visitors. Almost 1.5 mn Ukrainian tourists visited Egypt in 2019.

Banking + Finance

Who’s in the market for debt? Dar Al Fouad Hospital, Waterway Developments, Conrad Hotel

The Arab African International Bank will arrange and manage a EGP 1 bn syndicated loan for Dar Al Fouad Hospital, which will use it to fund the USD 120 mn expansion of its Nasr City hospital, Al Shorouk reports, citing sources from the bank. The sources did not disclose the other lenders participating in the syndicate.

Waterway Developments is seeking a EGP 1 bn medium-term sharia-compliant loan from a number of unnamed local banks to fund its real estate projects, Al Shorouk reports. Waterway is currently constructing residential and commercial properties in New Cairo, the new administrative capital, and Port Said, among others.

The International Company For Touristic Investments (ICTI) will borrow EGP 320 mn from the National Bank of Egypt to finance the Conrad Hotel’s working capital, Al Shorouk reports, citing unnamed banking sources. The finance comes under the Central Bank of Egypt’s tourism support program ,which allows companies in the sector to access low-interest loans.

Sports

Ali Farag retains Qatar Classic squash title after defeating Coll

Egyptian world squash no.1 Ali Farag held onto his Qatar Classic title after defeating New Zealand’s Paul Coll 3-1 on Saturday, according to PSA World Tour. This is Farag’s 21st PSA title and comes on the heels of winning the CIB Egyptian Squash Open last month.

The Market Yesterday

EGP / USD CBE market average: Buy 15.60 | Sell 15.70

EGP / USD at CIB: Buy 15.60 | Sell 15.70

EGP / USD at NBE: Buy 15.62 | Sell 15.72

EGX30 (Monday): 10,839 (+1.5%)

Turnover: EGP 1.4 bn (24% above the 90-day average)

EGX 30 year-to-date: -22.4%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 1.5%. CIB, the index’s heaviest constituent, closed up 0.4%. EGX30’s top performing constituents were Egyptian Iron & Steel up 5.4%, GB Auto up 5.3%, and Beltone Financial Holding up 5.0%. Yesterday’s worst performing stock was Telecom Egypt, which was down 0.2%. The market turnover was EGP 1.4 bn, and regional investors were the sole net buyers.

Foreigners: Net short | EGP -20.4 mn

Regional: Net long | EGP +43.1 mn

Domestic: Net short | EGP -22.7 mn

Retail: 73.3% of total trades | 71.1% of buyers | 75.5% of sellers

Institutions: 26.7% of total trades | 28.9% of buyers | 24.5% of sellers

WTI: USD 39.84 (+7.27%)

Brent: USD 42.04 (+6.57%)

Natural Gas: (Nymex, futures prices) USD 2.86 MMBtu, (-1.04%, December 2020 contract)

Gold: USD 1,862.30 / troy ounce (-4.58%)

TASI: 8,366 (+2.53%) (YTD: -0.27%)

ADX: 4,743 (+0.79%) (YTD: -6.55%)

DFM: 2,219 (+1.75%) (YTD: -19.71%)

KSE Premier Market: 6,176 (+1.52%)

QE: 10,094 (+1.88%) (YTD: -3.17%)

MSM: 3,547 (-0.13%) (YTD: -10.89%)

BB: 1,445 (+0.28%) (YTD: -10.23%)

Calendar

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

November: An Egyptian-Russian ministerial committee will meet to discuss trade and investment in Moscow.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 November (Thursday): The African Private Equity and Venture Capital Association (AVCA) is organizing an online conference titled “State of African Private Equity & Venture Capital: Regional Perspectives.” You can sign up here.

13-15 November (Friday-Sunday): A conference on banking in the time of covid by the Union of Arab Banks, Sharm El Sheikh, Egypt.

13-20 November (Friday-Friday): Cairo Jazz Festival.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

15 November (Sunday): Results of the second phase of Egypt’s parliamentary elections will be announced.

16 November (Monday): Postponed trial of alleged abuser Ahmed Bassam Zaki, after he failed to attend the previous court date

18 November (Wednesday): The 50 Million African Women Speak online event will be held, organized by the Egyptian MSME Development Agency and Comesa

19-28 November (Thursday-Sunday): Cairo International Film Festival, Cairo Opera House, Egypt.

21 November (Saturday): Deadline to install electronic vehicle stickers

22-25 November (Sunday-Wednesday): Cairo ICT 2020, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 November (Monday-Tuesday): Runoffs for parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

30 November (Monday): Final results will be announced for Parliamentary elections held in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

December (date TBC): Egypt Economic Summit, Cairo, Egypt, venue TBD.

December: Fifth round of Egypt-US Trade and Investment Framework Agreement (TIFA) talks.

December: The 110th regular session of the Egyptian-Iraqi Joint Higher Committee will be held under the chairmanship of the prime ministers of the two countries.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

5 December (Saturday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria.

7 December: Former Civil Aviation Minister Ahmed Shafik faces trial over embezzlement allegations.

7-8 December (Monday-Tuesday): Runoffs for parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

9-10 December (Wednesday-Thursday): BiznEx, the international business expo in Egypt, venue TBD.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15 December (Tuesday): House of Representatives reconvenes from recess.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1Q2021: The Seventh Annual Egypt Automotive Summit will be held

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

1 October 2021-31 March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.