- Is your home in violation of the building code? You’ve got to an extra month to settle up. (Speed Round)

- Everything you need to know ahead of election day in the US. (What We’re Tracking Today)

- Covid vaccine production draws nearer as cases begin “expected” rise. (Last Night’s Talk Shows)

- Tourist arrivals to Egypt fall more than 60% in 1H2020. (Speed Round)

- Fashion startup Brantu raises USD seven-figure investment. (Speed Round)

- Alex Angels plans follow-on investments in Mumm, Ordera, and El Gameya. (Speed Round)

- House passes tax code amendments that impose tough penalties on late filers. (Speed Round)

- Is a new authority the golden ticket to an effective vocational schools system in Egypt? (Blackboard)

- The Market Yesterday

Monday, 2 November 2020

Egypt edges toward a covid vaccine + everything you need to know as US voters go to the polls

TL;DR

What We’re Tracking Today

Good morning, friends. It’s one of those “in between” days in which most folks’ thoughts will naturally gravitate across the Atlantic as voters in the United States prepare to head to the polls tomorrow to decide whether Agent Orange gets another four years in office.

What are the pre-election day polls telling us? Joe Biden has a huge 10-point lead in the latest Wall Street Journal/NBC News nationwide poll, which puts him at 52% to Trump’s 42%. The former vice president also has a lead in four of the most crucial swing states, according to a New York Times/Siena College poll, which has him at +3% in Florida, +6% in Arizona and Pennsylvania and +11% in Trump’s former heartland of Wisconsin.

Pennsylvania may well be the key to the White House: With more electoral college votes than any other battleground state except Florida, both campaigns are piling resources into a last-ditch effort to swing the state in their favor, the New York Times says. While Biden focuses his energy on the Keystone State, Trump is on a two-day campaign blitz, holding over 10 rallies across seven states.

There’s a good chance we’re not going to know who won on election night. The surge in the use of mail-in ballots will mean the vote count takes longer than usual and it could be several days before a final result is announced. FiveThirtyEight has a useful breakdown of when we might see results from each state. The key to watch: When will CNN and the Associated Press call individual states.

Mail-in ballots may also lead to The Donald incorrectly declaring himself the winner on election night. One scenario now being touted by some observes suggests that it could appear Trump has triumphed after in-person votes are counted in the hours after the polls close, but as one data analytics company has suggested, the result could shift later in the week as mail-in ballots (which are used more by Democratic voters) are added to the tally.

Trump has already telegraphed a post-election legal battle, saying yesterday that he intends to take legal action to prevent ballots from being counted after election day.

Emerging-market investors are bracing for impact: The potential for a contested election is focusing the minds of emerging-market investors, many of whom had priced in a huge Democratic victory and a swift stimulus package, Bloomberg reports. EM stocks, bonds and currencies experienced their worst week in over a month last week and an equity volatility gauge spiked to its highest levels since June as concerns over the US election and rising covid cases caused a sell-off in Western markets.

Add oil prices to the list of things Gulf equities have to worry about: Stock markets in the Gulf slid yesterday as new restrictions in Europe and rising covid cases in the US heightened fears of a renewed slump in demand for oil, Reuters says. Kuwait saw the biggest losses, falling 2.1% during trading, while the Dubai bourse slid 1.6% and the Saudi and Abu Dhabi indexes both losing 0.5%.

The EGX also finished in the red yesterday, falling 0.6% during the session to leave the index down 25.1% year-to-date. Trading was 19% below the trailing 90-day average, with some EGP 911 mn worth of shares changing hands.

Asian shares were mixed at dispatch time this morning while US and European futures were pointing to a slight bounce from last week’s sell-off after Wall Street turned in its worst week since March.

The House is in recess once more so MPs can hit the campaign trail. The next House plenary session will be called to order on 15 December with the same faces reconvening for what should be the last time. Speaker Ali Abdel Aal made the announcement yesterday. Our elected representatives passed a flurry of bills yesterday before punching out to go kiss babies. We have a recap in this morning’s Speed Round, below.

Voters in Cairo, Sinai and 10 other governorates go to the polls starting this coming Wednesday. Expats registered to vote in those governorates cast ballots starting Wednesday, while voters resident in Egypt will hit the voting booths Saturday and Sunday.

Not sure where to vote? The National Election Commission has got you covered.

The new class of MPs elected in the polls that began late last month won’t be seated until at least 10 January 2021, as the current group of MPs are legally our representatives until 9 January.

First phase election results dominated the airwaves last night, as we report in Last Night’s Talk Shows, also below.

News triggers coming up in the next two weeks:

- PMI figures for October will land tomorrow;

- Foreign reserves figures should be out next week;

- Inflation data for October will be released on 10 November;

- The Central Bank of Egypt’s Monetary Policy Committee will meet to review rates on 12 November.

The Health Ministry reported 181 new covid-19 infections yesterday, up from 170 the day before. Egypt has now disclosed a total of 107,736 confirmed cases of covid-19. The ministry also reported 12 new deaths, bringing the country’s total death toll to 6,278. We now have a total of 99,555 confirmed cases that have fully recovered.

Covid vaccine production draws nearer as cases begin to rise: Clinical trials of two covid-19 vaccines have been completed in Egypt and one of them will be produced domestically alongside a Chinese vaccine, Health Minister Hala Zayed told El Hekaya’s Amr Adib last night (watch, runtime: 3:41). She added that she would meet the Chinese ambassador today to discuss issues related to production. This comes as the daily case rate begins to creep up, a trend that Zayed said was expected given that we’re heading into cooler weather (watch, runtime: 2:06) She said that 65% of the new cases have been among women who do not work outside the home and the elderly (watch, runtime: 2:03).

AstraZeneca’s covid-19 vaccine is now under accelerated review by UK regulators, a spokesperson from the British pharma company said, according to Reuters. This expedited approach could result in quicker approval for the vaccine candidate, which was recently shown to trigger an immune response in adults, raising hopes for the development of a vaccine by the end of the year. Egypt has also been in talks to import mns of doses of AstraZeneca’s vaccine.

The Eurozone is expected to fall back into contraction in the fourth quarter due to the new restrictions introduced last week. After growing by a record 12.7% in 3Q, economists polled by the Financial Times now see euro GDP falling 2.3% in 4Q, raising the spectre of a double-dip recession early in 2021.

Europe’s lockdown solidarity is starting to slip: Protests have flared in Spain and Italy over the past week as frustration builds over the handling of the coronavirus and the new restrictions introduced to curb the outbreak. Just hours after the Guardian published an alarmist “revolt is in the air” piece, the Spanish prime minister was out appealing for calm as demonstrations took place in cities across the country.

Introducing the new Mesca Beach: an exclusive slice of island paradise where you can slow down and sunbathe or simply live it up by engaging in exciting beachfront activities, offered in abundance above and below Somabay’s mesmerizing sea. Powered by top-class utilities and exceptional service, Mesca Beach is a heaven on earth.

Introducing the new Mesca Beach: an exclusive slice of island paradise where you can slow down and sunbathe or simply live it up by engaging in exciting beachfront activities, offered in abundance above and below Somabay’s mesmerizing sea. Powered by top-class utilities and exceptional service, Mesca Beach is a heaven on earth.

Central banks are capitalizing on record high prices to sell gold for the first time in a decade as some come under pressure from the pandemic, Bloomberg reports. The selling has largely been spurred by Turkey and Uzbekistan, both of whom are fiscally stretched and looking to offload some of their gold reserves to plug the gaps.

Could EU bonds become a more attractive hedge than US treasuries? The EU’s record-setting USD 275 bn social bond sale this month seems to imply as much, according to Bloomberg. With another USD 1 trn in debt slated for sale by the EU in the coming years and globally held EUR reserves jumping 4% last quarter compared to a 1.9% rise in USD reserves, analysts say the EUR could see long-term gains amid record issuance and continued pessimism over the greenback.

International investors will see reduced red tape accessing China’s capital markets thanks to new measures that came into effect yesterday expediting the application process and removing restrictions on the scope of investments, the Financial Times reports. The new rules will also open up its vast onshore futures market to international investors, allowing them to hedge their positions on the stock market. Investors will also be permitted to lend their holdings of shares trading in Shanghai and Shenzhen.

Veteran British foreign correspondent Robert Fisk has died at the age of 74. The journalist and author, famous for his coverage of the Middle East, passed away at a Dublin hospital after becoming unwell on Friday, the Irish Times reports.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: We take a look at a new government authority set up to accredit and oversee Egypt’s vocational education system as vocational schools set up under private-public partnerships are gathering steam.

Enterprise+: Last Night’s Talk Shows

Coverage of the results of the first phase of the parliamentary elections dominated the airwaves last night: Kelma Akhira’s Lamees El Hadidi (watch, runtime: 4:19), Al Hayah Al Youm’s Lobna Assal (watch, runtime: 3:34) and Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 6:43) all covered the National Elections Authority’s press conference announcing the results from last month’s poll, which saw voters from 14 governorates go the ballot box. We have more coverage in this morning’s Speed Round, below.

New covid-era umrah restrictions pose problems for Egyptian pilgrims: El Hadidi phoned Ashraf Shiha, a member of the Chamber of Tourism Companies, who said that new restrictions imposed by Saudi Arabia on umrah pilgrims will mean that many Egyptians will not be able to make the trip (watch, runtime: 7:50). The new conditions make PCR tests mandatory for all travellers, impose compulsory isolation for three days in KSA, and prohibit people aged under 18 and over 50 from travelling. Shiha noted that these conditions would raise costs, putting the trip beyond the financial reach of many Egyptians. Shiha also spoke to Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 4:21).

Wage hikes for public sector teachers: Assal phoned Rep. Samy Hashem, head of the House Education Committee, to discuss a bill that proposes better pay for teachers in the nation’s public school system, which cleared the House yesterday. Hashem said the committee made minor semantic adjustments to the draft law (watch, runtime: 10:41) but didn’t change the financial ratios that the Madbouly cabinet approved last month. Ahmed Moussa also had coverage (watch, runtime: 4:39).

Private schools, watch this space: El Hadidi phoned Rep. Mohamed Abu El Enein, who said the education minister told the committee he was looking into ways to prompt private schools to pay their teachers better and would report back within four weeks (watch, runtime: 6:22).

Speed Round

Is your home in violation of the building code? You’ve got to an extra month to settle up. The deadline to pay the fines for building code violations has been pushed to 30 November, Prime Minister Moustafa Madbouly said last week. The extension comes after the government received requests from property owners asking for time to complete the necessary paperwork, cabinet spokesperson Nader Saad said in an interview on DMC (watch, runtime: 5:49). The government has received 2.1 mn settlement requests and has taken some EGP 14 bn since it began taking a hardline approach towards code violations and wildcat builders at the beginning of September.

This is the second time the government has pushed the deadline, after originally saying that it would not negotiate the initial cut off point at the end of September. The deadline was ultimately pushed to the end of October and now to the end of November amid a flood of settlement requests. It also made concessions to MPs by slashing settlement fees after members raised concerns that many people would not be able to afford them. The policy provoked small protests in some areas of the country last month by people angered by the prospect of having their homes demolished.

FROM THE DEPARTMENT OF THE OBVIOUS- Tourist arrivals to Egypt dropped 62.3% y-o-y in 1H2020 as covid-19 travel restrictions and border closures vaporized international travel, according to the World Tourism Organization’s latest World Tourism Barometer (pdf). Egypt closed its airspace to most inbound and outbound commercial flights between March and July. Tourism receipts also dropped 11.4% y-o-y in 1Q2020 before tumbling further in 2Q2020, when they fell 90.4% y-o-y, the report says. Egypt’s tourist arrivals reached a record 13 mn last year before the covid-19 pandemic brought the industry to a halt.

Globally, the tourist arrivals figure didn’t do much better, dropping 65.5% y-o-y during the first six months of the year. Despite a slight pickup in July and August, the organization said it expects global numbers to fall 70% y-o-y in 2020, saying “the outlook is still highly uncertain and volatile as new cases of covid-19 continue to be reported worldwide,” leading some countries to re-impose lockdown measures and border closures. The majority of analysts polled in the report don’t expect to see international tourism rebounding in earnest before 3Q2021, and a return to pre-pandemic levels is unlikely before 2023.

STARTUP WATCH- Online fashion marketplace Brantu has raised an undisclosed USD seven-figure investment in a series A funding round led by Sawari Ventures, the company said in a statement (pdf). Brantu will use the investment to grow its user base and increase its market share in Egypt, and add new verticals to its platform. Launched in 2019, Brantu is an e-commerce fashion platform stocking local and international brands including Dalydress, Merch and Carina. The company (Instagram) has reportedly attracted some 20k customers since its launch and carries women’s fashion.

STARTUP WATCH- Fatura to add e-payments, aims to scale in early 2021: B2B e-commerce platform Fatura is in talks with several unnamed e-payments companies and financial institutions to allow retailers to pay for their orders electronically through its platform, co-founder and CEO Hossam Ali (LinkedIn) told the press. The company currently collects only cash payments from FMCG retailers, which use its app to restock, Ali added. Adding e-payments comes as part of a bid to become an “integrated logistics platform” by 1Q2021, according to Ali. Fatura recently announced an “aggressive” expansion plan after raising more than USD 1 mn in July in its first funding round led by Disruptech.

What does Fatura do? Fatura is a B2B marketplace that allows FMCG retailers to place orders from suppliers using a mobile app. The app also helps find the best prices, collects inventory data to build supply chain analytics, and allows retailers to sign up for extended payment plans.

STARTUP WATCH- Alex Angels plans to make follow-on investments in Mumm, Ordera, and El Gameya as part of its new EGP 100 mn startup fund, Chairman Tarek El Kady said, according to Al Mal. El Kady said the fund would be writing cheques in the EGP 500k to EGP 2 mn range for each investment it makes. The launch of the fund had been postponed from September to November as a result of administrative procedures. Alex Angels had previously invested an undisclosed sum in homemade food delivery platform Mumm in April this year, a six figure sum in collaborative savings app El Gameya in August, and a six-figure USD sum in on-demand food booking app Ordera in the same month.

EFG Hermes topped the EGX’s brokerage league table in October with a market share of 13.8%, according to EGX figures (pdf). Rounding out the top five: CI Capital with 9.9%, EGY Trend Brokerage (4.7%), Pioneers Securities (4.5%) and Naeem Brokerage (3.8%).

Supporting small businesses is near the top of the list of things HSBC says Cairo needs to do next if we want to cope with population growth: Successful urban growth management, embracing sustainability, and supporting entrepreneurial potential must be key development priorities for Cairo over the next several years, HSBC says in a city report (pdf) on the capital city. As one of the world’s fastest-growing megacities, Cairo’s population is expected to grow by 35% by 2030 to hit 28.5 mn residents. This growth “has added to imperatives to plan and invest effectively to reduce growth externalities,” the report says, pointing specifically to overcrowding, traffic congestion, and pollution. To achieve a higher quality of living for its residents while curbing the negative effects on the environment, the bank says it is imperative that Cairo’s development focuses on creating an adequate supply of housing and building “genuine new centers of demand, jobs and services” to accommodate its growing population. Cairo should also capitalize on its growing base of innovation and entrepreneurial talent “to adjust the policy mix to translate the promise of its SMEs into large scale commercialization serving African and global markets,” HSBC says.

If Cairo gets it right, we’ll cement our status as a key global trade hub and “global gateway” between Africa, the Middle East, Europe, and wider Asia, the report says. “Egypt’s proven ability to evolve in response to constant change over millennia can be seen clearly in Cairo’s response to supporting sustainable development and business growth despite the uncertainty caused by covid-19,” said HSBC Egypt CEO Todd Wilcox.

The report also takes note of the country’s sustainable development strategy, Egypt 2030, which includes the construction of the new administrative capital and other new cities, the development of public transport services — including the upgrade of the Ring Road, establishing the first monorail line, and introducing electric buses — as well as embracing green projects. Egypt plans to invest EGP 3.67 bn in green projects in FY2020-2021 — around 14 of its total investment budget for the fiscal year — Planning Minister Hala El Said said last month. Green projects are expected to account for 30% of government investments in FY2021-2022, according to the minister. El Said’s announcement came after Egypt successfully launched the region’s first sovereign green bond issuance, the proceeds of which have been earmarked for more than five major projects in transport, water, and waste management.

The pro-government National List of Egypt dominated the opening round of the parliamentary election, picking up all 142 seats allocated to party lists, head of the National Elections Authority Lasheen Ibrahim said at a press conference yesterday. Individual candidates picked up 32 seats and 18 districts, including 12 districts in Giza, three in the Red Sea, two in Alexandria, and one in Fayoum. The first round of the election saw voters in 14 governorates — including Giza and Alexandria — go to the polls last month. Voter turnout came in at 28.3%, Ibrahim said.

What next? Voters in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai will all be voting in the second phase of the election this month. Expats will vote on 4-6 November while polls open here at home on 7-8 November.

And then there are the runoffs: Runoffs for 110 seats in Giza and other governorates that went to the polls first will take place on 23-24 November. Runoffs for seats in Cairo and other phase two governorates will take place 7-8 December.

When will we have results? We’ll have the final list of individual candidates elected in phase one governorates on 30 November, while phase two results are set to be announced on 14 December.

LEGISLATION WATCH- House passes tax code amendments that impose tough penalties on late filers: The House of Representatives has passed amendments to the Unified Tax Act that impose harsher penalties for late tax filing, Al Shorouk reports. In a busy day before sending the House into recess until mid-December, House Speaker Ali Abdel Aal rushed through the legislation for a final vote just hours after sending it to the Magles El Dawla following the House Planning Committee’s sign-off on Friday. The changes impose fines of EGP 50k to EGP 2 mn on those who fail to submit their returns within 60 days of the deadline, while repeat offenders could also face jail time ranging between six months and three years.

A pay rise for public sector teachers: The House gave final approval to plans to raise the salaries of public sector teachers, cabinet said in a statement. From January, teachers will receive an extra EGP 390-630 each month after the teacher allowance and performance-related incentives are hiked by 50%, and the exam bonus is raised by 25%. The law received cabinet approval last month.

Also from yesterday’s session:

- The natgas sector will be allowed into freezones: Final approval was given to an amendment to the Investment Law that allows natural gas-intensive industries to apply for licenses to operate in freezones. Projects involving the refining, liquefaction and transportation of natural gas, as well as the production of fertilizers were banned from freezones under the 2017 law.

- SCZone ro-ro station: A draft law allowing the establishment of a roll-on roll-off station in the Suez Canal Economic Zone’s East Port Said Port got the green light. A consortium of international companies involving Bolloré, Toyota and NYK will work on the project.

- Legislative provisions to keep terrorists away from civil service jobs: The House Legislative Committee greenlit amendments to a 1972 law that aim to prevent individuals affiliated to extremist groups from working for the state.

- State of emergency: Parliament approved extending the state of emergency for another three months as of 26 October.

Parliament also approved 10 international agreements including a USD 630 mn facility from the Arab Monetary Fund to fund government reforms and a EUR 225 mn loan from the African Development Bank to finance electricity infrastructure upgrades. See here and here for more.

The results of Egypt’s latest gold and mineral exploration tender will be announced before the end of November, Al Mal reports, citing an unnamed government official. Canadian mining firm Barrick Gold, Naguib Sawiris’ La Mancha, and Egypt-focused Centamin are among the companies that have submitted bids in the tender for the rights to mine 320 blocks spread over 56k sqkm in the Eastern Desert. The government had launched the tender in March, and then extended the deadline by two months to 15 September due to the pandemic. Oil Minister Tarek El Molla said earlier this year that a new gold exploration tender would be launched every four months.

Think of retail as an experience, Majid Al Futtaim Properties CEO Ahmed Galal Ismail told us in the fourth episode of the latest season of Making It. In emerging markets with sparse public areas for leisure, malls are on an upward trend even as their Western counterparts struggle against online commerce. Majid Al Futtaim has operated in the Egyptian market since 2002 and has invested over EGP 40 bn, with more planned for the future.

You already have a podcast player on your iPhone, or you can listen to the episode through our website (no download required). We’re also on Google Podcasts | Anghami | Omny. Making It is on Spotify, but only for non-MENA accounts

*** WE’RE HIRING: We’re looking for smart and talented people to join our team at Enterprise, which produces the newsletter you’re reading right now and Making It, our very first podcast. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. Enterprise is currently in the market for:

- A seasoned reporter to join our team and create stories and packages that fascinate and inform our readers.

- A full-time copy editor to enforce house style, police facts and generally make us sound smarter than we really are.

Interested in applying? To apply for the editor / reporter positions, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. The CV is nice, but we’re much more interested in your clips and cover letter. Please submit all applications to jobs@enterprisemea.com.

Egypt in the News

Egypt isn’t doing much to interest the foreign press this morning. We are grateful.

Worth Watching

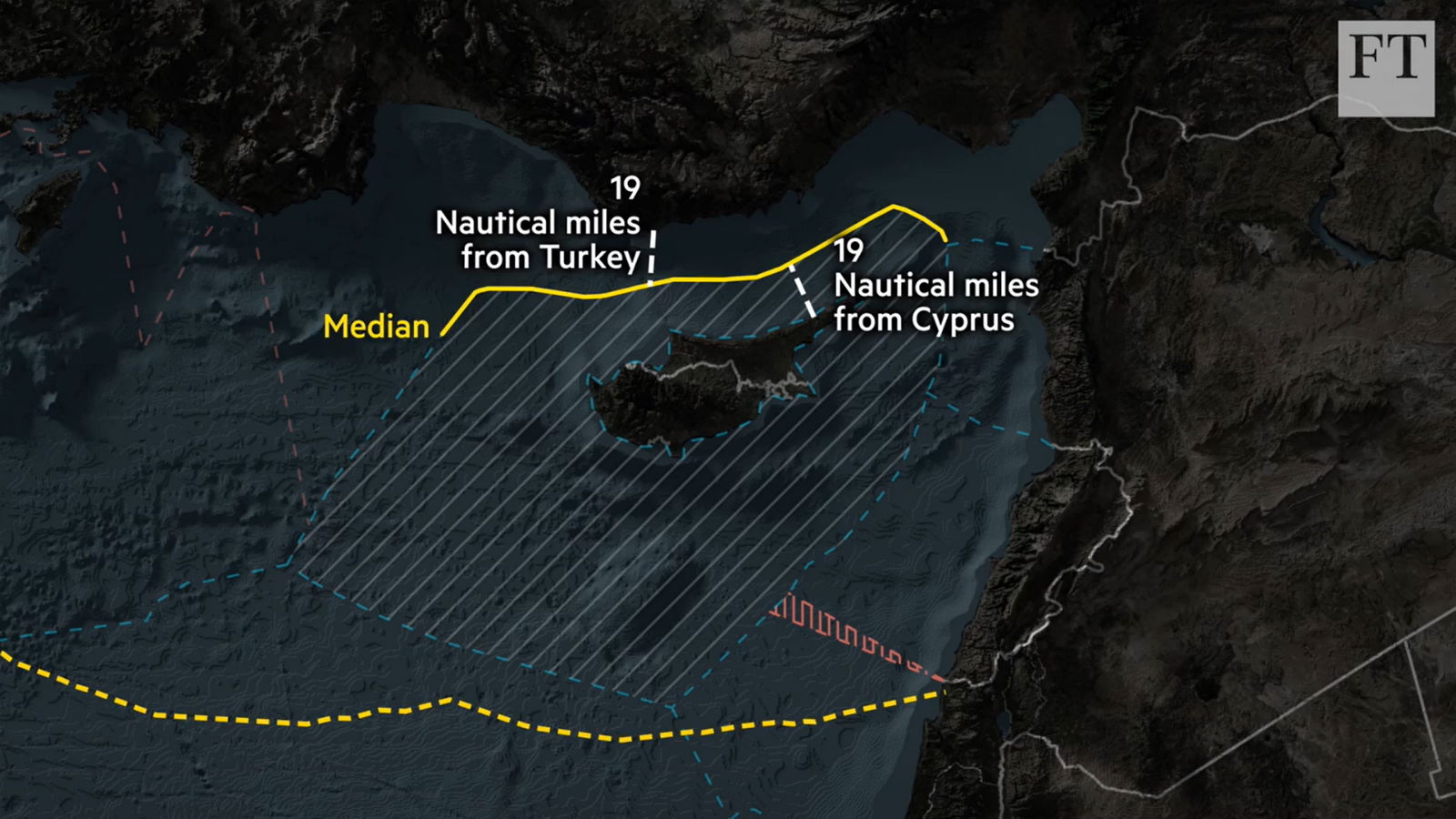

Explaining the EastMed gas fight: A dispute over the gas-rich eastern Mediterranean that has had Ankara and Athens butting heads in recent months can be put down to competing water claims in areas around the Turkish coastline, the Greek archipelago, and the divided island of Cyprus, Financial Times energy editor David Sheppard explains (watch, runtime: 4:46). Sheppard shows which waters are claimed by Turkey and lays out its side of the argument, as it looks to secure its share of the region’s lucrative gas reserves.

Diplomacy + Foreign Trade

Negotiations over the Grand Ethiopian Renaissance Dam resumed yesterday, with Sudan pushing for greater input from the African Union to build bridges between Egypt and Ethiopia, which are no closer to reaching a final agreement on the filling and operating timetable of the dam after months of talks. Technical and legal teams will hold talks today before submitting the results to ministers on Tuesday, the Egyptian Irrigation Ministry said yesterday.

There’s plenty of background diplomacy going on: The Egyptian army’s chief of staff was in Khartoum for talks with Sudanese generals on Saturday at the same time as the chairman of Sudan’s ruling council Abdel Fattah Al Burhan flew to Ethiopia.

Is a new authority the golden ticket to an effective vocational schools system in Egypt? As the job market grappled with a chronic shortage of key skills, the Education Ministry set about developing a long-term strategy centered on vocational schools. The strategy will see the government developing existing vocational schools and building some 100 new modern schools in cooperation with the private sector through 2030. Among the conditions set for private sector school operators: Earning accreditation for their institutions from international bodies. But with covid-19 slowing down or altogether derailing this process, the ministry forged an alternative path by establishing a local accreditation authority for technical learning and training programs, a bill for which the Madbouly Cabinet greenlit in September.

Private sector operators we’ve spoken with are keen on the idea as a potential way to streamline the procedures to set up a vocational school but remain wary that the authority will become another bureaucracy nightmare. The authority’s establishment is “an important step” in the development of the country’s vocational education system, and can help the system more effectively churn out students who meet the job market’s needs, El Araby Group Vice President Ibrahim El Araby tells Enterprise. El Araby Group operates an applied technology school.

Part of the government’s plan to develop vocational education is to give operators a specialized body whose main focus is vocational schools. Before the establishment of the authority, the Education Ministry’s National Authority for Quality Assurance and Accreditation of Education (Naqaae) was responsible for accrediting all types of schools, including technical and traditional ones. The new authority is meant to play the same role only for vocational schools, which in theory should streamline procedures, including receiving accreditation, Deputy Education Minister for Technical Education Mohamed Megahed tells Enterprise.

The authority is setting a quality control framework and standards with assistance from Germany’s Federal Ministry for Economic Cooperation and Development (BMZ). This includes the curricula, study systems, and all other aspects of the educational process, Megahed tells us. Germany is also helping Egypt with the development of its vocational education system by supporting the establishment of an academy to train teachers for vocational schools, according to BMZ’s website.

Government schools and private institutions, which will both be under the authority’s oversight, will have five years to meet the authority’s quality standards and obtain accreditation once the bill establishing the authority makes it through the House of Representatives and its executive regulations are published. According to Megahed, the new authority aims to accredit 2,500 schools. This is a significant increase from the 35 technical schools that are currently accredited.

In addition to providing accreditation specifically for vocational education institutions, the authority is mandated with focusing on encouraging PPP schools set up as part of the government’s strategy to develop the technical education and training sector in Egypt until 2030, Megahed tells Enterprise.

The authority is being given independence from the Education Ministry in terms of funding, and will report directly to the cabinet, instead of the ministry. The majority of the funding will come from fees it will charge private vocational schools for accreditation, but international partners such as the Italian Debt-Swap Fund along with future partners such as the German Development Agency (GIZ), the European Union, and USAID could also give a helping hand in the future, according to Megahed.

Since the new body will work closely with the private sector, its board of trustees will include industry players alongside gov’t officials: The new board of trustees will include representatives of the Federation of Egyptian Industries, the Federation of Egyptian Chambers of Commerce, the Federation of Tourist Chambers, and the Federation of Building and Construction — whose members are private sector players. The board will also include representatives from the ministries of education, manpower, trade and industry, planning, and international cooperation, according to Megahed.

The private sector sees the value of encouraging vocational training but has been seeking incentives and a more streamlined process that cuts red tape to really get on board, Federation of Egyptian Industries board member Mohamed Saad Eldin had told us previously. The government is looking to sweeten the terms by offering tax exemptions that partner with the Education Ministry, Megahed tells us, but Saad Eldin had suggested that incentives alone cannot offset the burden of the red tape.

So the possibility of this new authority creating another level of bureaucracy remains a concern for private sector operators we spoke with, who still have questions about the new authority’s efficacy. This body is a step in the right path but its effectiveness cannot be determined before the announcement of the actual mechanisms that will be adopted by the new body and the curriculum and education system, Hanan Rihani, executive director of ElSewedy Academy tells Enterprise.

Is the new body even needed? Not so much for established schools: For El Sewedy, which already operates two academies that obtained the international accreditation certificate from the German-based Technical Inspection Association (TUV NORD), and has enough experience in developing curricula, the authority might not have a lot to offer. But for newcomers to the vocational education game, the authority can actually be a major help, Rihani tells Enterprise.

But new operators likely don’t have the know-how to design a program, and would need the authority’s guidance in setting up its curriculum and study programs, says Khaled Hassan, director of development at Egypt Gold School, the first jewelry design and manufacturing school in the country. This guidance would help make the authority a beneficial part of the system for private sector operators, Hassan tells Enterprise.

And it’s not just about book learning — these schools also need to teach soft skills: ElSewedy has used its long experience to provide extracurricular activities for students to enhance their professional skills and model their behavior and personality, including courses in business ethics, cost reduction, interpersonal skills, International Computer Driving License (ICDL), and English language (both general and technical) accredited by the University of Cambridge.

This is why the government is not stopping at building schools: The strategy also aims to transform the learning process through a competency-based curriculum, train teachers at accredited bodies, and adapt work-based learning policies. In 2019, the Education Ministry had already launched competency-based curricula in 36 schools, followed by 12 others in September 2020. The plan is to have all technical education schools following them by 2024, Megahed says. In tandem, the ministry trained 400 trainers who then went on to train 3,200 teachers.

The bottom line: Private sector operators are still in wait-and-see mode when it comes to the new authority. While the government intends for the authority to encourage more private players to get in on the PPP framework for vocational education, the authority itself can only prove its value once it is established by making procedures easier, rather than fall into the same bureaucratic traps that it has been created to fix.

Your top education stories of the week:

- The King Salman International University was inaugurated on Saturday: The university has three branches across South Sinai — in Sharm El Sheikh, Al Tur, and Ras Sidr — and is a joint project between Egypt and Saudi Arabia.

- CIRA’s British Regent School in New Mansoura is now up and running after construction had fallen behind temporarily due to covid-19.

- Bus fees: Three schools could face fines between EGP 20k and EGP 1 mn for not abiding by a Consumer Protection Authority decision obliging schools to refund 25% of last year’s bus fees.

- Expanded state support for underprivileged students: As many as 1 mn additional students will receive state funding for their education, bringing the total number of students receiving support to 4.4 mn.

- New regulations to make sure parents pay up: Education Minister Tarek Shawki told Lamees El Hadidi new regulations were designed to make sure tuition fees are promptly paid, and prevent schools from changing fees mid-year.

The Market Yesterday

EGP / USD CBE market average: Buy 15.65 | Sell 15.75

EGP / USD at CIB: Buy 15.65 | Sell 15.75

EGP / USD at NBE: Buy 15.65 | Sell 15.75

EGX30 (Sunday): 10,456 (-0.6%)

Turnover: EGP 911 mn (19% below the 90-day average)

EGX 30 year-to-date: -25.1%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 0.6%. CIB, the index’s heaviest constituent, ended down 0.05%. EGX30’s top performing constituents were Egyptian Iron & Steel up 3.4%, Export Development Bank up 3.2%, and Telecom Egypt up 1.9%. Yesterday’s worst performing stocks were Heliopolis Housing down 3.8%, Ezz Steel down 3.7% and Orascom Investment Holding down 3.3%. The market turnover was EGP 911 mn, and local investors were the sole net sellers.

Foreigners: Net short | EGP -32.0 mn

Regional: Net short | EGP -2.5 mn

Domestic: Net long | EGP +34.5 mn

Retail: 80.5% of total trades | 81.2% of buyers | 79.7% of sellers

Institutions: 19.5% of total trades | 18.8% of buyers | 20.3% of sellers

WTI: USD 35.79 (-1.05%)

Brent: USD 37.94 (-0.84%)

Natural Gas: (Nymex, futures prices) USD 3.35 MMBtu, (+1.61%, December 2020 contract)

Gold: USD 1,879.80 / troy ounce (+0.64%)

TASI: 7,864 (-0.54%) (YTD: -6.25%)

ADX: 4,634 (-0.55%) (YTD: -8.69%)

DFM: 2,152 (-1.62%) (YTD: -22.15%)

KSE Premier Market: 5,879 (-2.07%)

QE: 9,640 (-0.53%) (YTD: -7.53%)

MSM: 3,552 (-0.15%) (YTD: -10.77%)

BB: 1,426 (-0.07%) (YTD: -11.42%)

Calendar

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

November: An Egyptian-Russian ministerial committee will meet to discuss trade and investment in Moscow.

2 November: Former Civil Aviation Minister Ahmed Shafik faces retrial at Cairo Court of Appeals in the so-called Aviation Ministry corruption case.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-6 November (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Cairo, Dakalia, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo.

7-8 November (Saturday-Sunday): Polls open for first round of Parliamentary elections in Cairo, Dakalia, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

7-9 November (Saturday-Monday): Techne Summit 2020, Bibliotheca Alexandrina, Alexandria.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 November (Thursday): The African Private Equity and Venture Capital Association (AVCA) is organizing an online conference titled “State of African Private Equity & Venture Capital: Regional Perspectives.” You can sign up here.

13-15 November (Friday-Sunday): A conference on banking in the time of covid by the Union of Arab Banks, Sharm El Sheikh, Egypt.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

19-28 November (Thursday-Sunday): Cairo International Film Festival, Cairo Opera House, Egypt.

22-25 November (Sunday-Wednesday): Cairo ICT 2020, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 November (Monday-Tuesday): Runoffs for Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

30 November (Monday): Final results will be announced for Parliamentary elections held in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

December (date TBC): Egypt Economic Summit, Cairo, Egypt, venue TBD.

December: Fifth round of Egypt-US Trade and Investment Framework Agreement (TIFA) talks.

December: The 110th regular session of the Egyptian-Iraqi Joint Higher Committee will be held under the chairmanship of the prime ministers of the two countries.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

5 December (Saturday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria.

7-8 December (Monday-Tuesday): Runoffs for Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

9-10 December (Wednesday-Thursday): BiznEx, the international business expo in Egypt, venue TBD.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

1 October 2021-31 March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.