- The pandemic’s effect on our fiscal position has been limited + a swift recovery is in the cards, IMF says. (Speed Round)

- Gov’t spending, expansions in ICT + energy could help GDP growth hit 3.5% this fiscal year -Deutsche Bank. (Speed Round)

- Angel investor Khaled Ismail to launch USD 35 mn Africa-focused fund. (Speed Round)

- UAE’s ADQ Holding could be in the running to grab a majority stake in Ismailia for Agricultural Investments. (Speed Round)

- The new flavor of healthcare outside Cairo? Dar Al Fouad takes on operations at Alexandria-based Elite Hospital. (Speed Round)

- Egypt-founded edtech platform Marj3 raises seed investment. (Speed Round)

- Making It: Ashraf Sabry, CEO of Fawry. (What We’re Tracking Today)

- Global central banks are laying the foundations for a digital currency revolution. (The Macro Picture)

- Matouk Bassiouny & Hennawy win IFLR’s Egyptian law firm of the year. (Speed Round)

- The Market Yesterday

Thursday, 15 October 2020

IMF sees a swift rebound for Egypt’s fiscal position post-covid

TL;DR

What We’re Tracking Today

Good morning, ladies and gentlemen, and welcome — finally — to THURSDAY, which we here at Enterprise have made a tradition of celebrating with all-caps. We have a stacked issue with which to end the week, so let’s dive right in.

But first, a quick programming note: Our popular Work From Home Routine column, which typically appears in our Thursday issues, is on hiatus this week but will be back next Thursday.

PSA- The US Embassy has exchange programs for high schoolers and career professionals:

- The first is a scholarship program for high school students to spend up to one academic year in the United States under the Kennedy-Lugar Youth Exchange & Study program (KL-YES). The program aims to help them develop leadership, problem-solving, language and intercultural skills.

- The second program — titled Community Solutions Program (CSP) — targets career professionals working in issues such as environment, conflict resolution, and women and gender. Participants will spend a year in the US and attend a four-month fellowship at a US community-based organization, government office or legislative body.

The deadline for applications for KL-YES is this coming Saturday, while the deadline for CSP is 28 October. For a list of all exchange programs you can check out the embassy’s webpage here.

The Health Ministry reported 128 new covid-19 infections yesterday, down from 132 the day before. Egypt has now disclosed a total of 104,915 confirmed cases of covid-19. The ministry also reported 6 new deaths, bringing the country’s total death toll to 6,077. We now have a total of 97,920 confirmed cases that have fully recovered.

Developing countries are getting USD 12 bn in financing from the Word Bank to support their fight against covid-19, the bank said in a statement. The funding is part of a larger USD 160 bn package, which will cover access to vaccines, tests, and other treatments for citizens of developing countries. The statement does not specify which countries are eligible for the funding.

A further USD 25 bn in support to developing countries could also be in the pipeline through the International Development Association, a World Bank arm that supports the poorest countries, World Bank President David Malpass said, according to Reuters.

Air Arabia is resuming flights from the UAE’s Ras Al Khaimah International Airport to Cairo starting today, according to Emirates news agency WAM.

An unspecified safety concern has led Eli Lilly & Co to pull the brakes on enrolling participants in a clinical trial of its antibody treatment for covid-19, according to Bloomberg. This comes a few days after Johnson & Johnson was forced to put its vaccine trials on hold after a participant became ill after taking the shot.

Is austerity necessary to offset widening deficits from the pandemic? That depends on how easily each country can access international financial markets, the IMF said in its October Fiscal Monitor yesterday. In an about face from its demands for austerity following the 2007-08 financial crisis, the fund’s fiscal policy head, Vitor Gaspar, urged governments to maintain emergency support, particularly in health and education, until at least 2021 — even if that pushes debt levels higher. Although deficits are expected to surge by 9% in 2020 and global public debt forecast to hit a record high of 100% of GDP, deficits should return to pre-pandemic levels by the middle of the decade, indicating that high debt levels are not the most immediate risk.

We have a rundown on how the IMF sees Egypt’s public finances faring in this morning’s Speed Round, below.

Short-sellers are circling some of the best-performing shares during the pandemic, with some hedge fund managers now believing the strong earnings generated by health and grocery retail firms won’t be sustained for much longer, according to the Financial Times.

Wall Street is still smiling: Goldman Sachs almost doubled profits to USD 3.6 bn in 3Q2020, up from USD 1.88 bn last year, according to an earnings release (pdf). This comes after JPMorgan and BlackRock reported strong 3Q earnings figures on Tuesday.

Are falling oil prices pushing Aramco towards a USD 10 bn stake sale in its pipeline business? Saudi Aramco is in initial talks with BlackRock over a planned USD 10 bn agreement to sell a stake in its pipeline arm, sources close to the talks told Reuters. The sale would give the oil giant much-needed liquidity as Brent crude is still down 36% year-to-date and a USD 75 bn dividend payout looms ahead, the newswire notes. The news of the potential sale came as Saudi Crown Prince Mohammed bin Salman and Russian President Vladimir Putin put out a statement urging OPEC+ to stick to production cuts to shore up oil prices, Bloomberg reports.

Covid has been awful for humanity but great for the planet: Global CO2 emissions fell by 8.8% during the first half of the year, at the same time global economic output took its worst hit in decades, according to a study published in Nature Communications. The downside? Global emissions are going right back up again as China powers full speed ahead through an economic recovery.

Google may be forced to sell its Chrome browser and parts of its advertising business by US prosecutors in response to alleged antitrust violations, Politico reports, citing three people familiar with the matter. A forced sale by the Department of Justice, which would come after an antitrust lawsuit that is expected to start in the coming weeks, would be the first break-up of a US company in decades, and mark a watershed moment for regulators looking to rein in the powerful tech monopolies. Chrome has the largest market share in the US, and Google has been accused of using access to web histories granted by the browser to aid its advertising business.

Egyptian actor Mahmoud Yassine passed away yesterday at the age of 79 after a long illness, his son announced on Facebook. Yassin’s 55-year career includes cinema classics such as the 1973 war film The Bullet is Still in my Pocket (1974), and the political allegory A Thing of Fear (1969), as well as numerous small screen roles that made him a household name.

It’s Making It Day: A fresh episode of the third season of our podcast on building a great business in Egypt is out today.

Ashraf Sabry, CEO of Fawry: When time came to build his own company after extensive corporate experience he had two driving motivators: he wanted to use technology to solve a problem and create a business model with a sustainable revenue stream.

Fawry is ubiquitous in the world of Egyptian fintech: Launched in 2008 and backed by major investors, the Fawry platform now connects over 29 mn customers with over 850 bill payment services through 166k service points. Last year, the company debuted on the EGX and became Egypt’s first unicorn this year when its market capitalization surpassed USD 1 bn.

Connecting the unbanked to the banking system is an integral part of financial inclusion — and Fawry plugs that gap. Beyond moving money from A to B and the convenience of being one of now many payment options, Fawry helps individuals and businesses who would otherwise struggle to meet minimum banking requirements access finance. It connects them to the banking system and brings them into the formal economy.

Tap or click here to listen to the episode on our website | Apple Podcast | Google Podcast | Anghami | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.

Enterprise+: Last Night’s Talk Shows

It was a rather insipid night on the airwaves, as the talking heads focused largely on recapping the news cycle without adding much by way of commentary.

Discussions on Egypt’s electricity network upgrades during a meeting between President Abdel Fattah El Sisi, Prime Minister Moustafa Madbouly, and Electricity Minister Mohamed Shaker were of particular interest to the talking heads, with Al Hayah Al Youm’s Lobna Assal (watch, runtime: 1:58), Yahduth Fi Misr’s Sherif Amer (watch, runtime: 1:30), and Masaa DMC’s Ramy (watch, runtime: 3:35) all taking note.

Libyan lawmakers’ agreement to begin preparing for a permanent peace settlement to move out of the country’s transitional period after three-day talks in Egypt was also on Assal’s radar (watch, runtime: 2:28). Our neighbors to the west agreed to host another round of talks in Egypt to reach a final, comprehensive political agreement.

Elsewhere, the Consumer Protection Agency’s efforts to enforce the Consumer Protection Act on bakeries around the country was the main topic of conversation for authority head Ahmed Farag and Yahduth fi Misr’s Sherif Amer (watch, runtime: 3:07).

Speed Round

The impact of covid-19 on the Egyptian government’s finances may not be as drastic as previously feared, according to the IMF’s October 2020 Fiscal Monitor Report (pdf). Though fiscal indicators have weakened slightly from the last outlook in April (pdf), the fund is now predicting a rapid recovery over the coming five years, with the budget deficit narrowing significantly from 2022 onwards.

The hit to the deficit will be limited: After shrinking to 7.5% of GDP in FY2019-2020, the IMF sees Egypt’s budget deficit widening to 8.1% this fiscal year before narrowing significantly to 5.2% in FY2021-2022. The deficit will then continue to gradually decline to reach 3.8% by FY2024-2025. The IMF attributes this to a comparatively muted fiscal response to the pandemic, caused by an already large debt pile exceeding 35% of GDP.

The report sees our primary balance just about remaining in a surplus this fiscal year, shrinking to 0.4% from 1.4% in FY2019-2020. This will then pick up, reaching 2.1% in FY2021-2022 until the middle of the decade. Egypt has so far achieved a small primary surplus of EGP 100 mn in 1Q2020-2021 despite ballooning spending needs due to the pandemic, Finance Minister Mohamed Maait said in yesterday’s cabinet weekly meeting.

On the flipside, projections for the current fiscal year seem to have worsened slightly since April, when the IMF predicted a budget deficit of 6.6% and a 1% primary surplus.

The government looks to reel in more revenues: The fund sees revenues inching up this fiscal year to 20% from 19.2% last fiscal year, then continue a slow but steady rebound through FY2024-2025. Revenues are being cushioned by the government’s 1% tax on salaries, and a significant increase in borrowing, which has seen it receive USD 8 bn from the IMF, a USD 2 bn loan from foreign banks, while also generating revenue through a USD 5 bn eurobond issuance in May.

The IMF expects Egypt to tighten its purse strings as of the next fiscal year, when spending is projected to dip to 25.4% of GDP from 28.1% in the current fiscal year.

Yesterday’s report came on the heels of the IMF’s World Economic Outlook. Amid an overarching tone of uncertainty, Egypt came out of the report relatively unscathed, with the fund upgrading its 2020 GDP forecast to 3.5% from the 2% in June. On the other hand, the IMF expects the country’s account deficit to widen to 4.2% of GDP in 2021 from 3.2% this year, and listed Egypt among several countries that are particularly vulnerable to a decline in remittance flows.

Egypt’s economy could grow at a 3.5% clip this fiscal year, supported by government spending, an expansion in the ICT and energy sectors, and growth in net exports, Deutsche Bank said in a report cited by the local press. Meanwhile, construction and non-oil industries are getting the support they need through the EGP 100 bn stimulus package the government allocated in March, according to the bank.

Positive growth rates underpin Egypt's status as an emerging market darling, the bank said. The pandemic-induced slowdown brought growth to a level lower than the country’s actual capabilities, it added. Egypt is one of just three Middle Eastern and Central Asian economies that will escape contraction this year, the IMF said this week.

On monetary policy, Deutsche Bank isn’t ruling out more easing this year, but expects the Central Bank of Egypt (CBE) to maintain rates when it next meets on 12 November. A hold would come as the CBE already cut rates by 50 bps in its most recent meeting last month, and as a move to preempt global market volatility ahead of the US presidential elections, the bank said. The CBE could see fit to lower interest rates by 50 bps in its final meeting of the year on 24 December, and by a total 150 bps in 2021.

Real interest rates in Egypt are expected to rise to 5.3% next month from a current 4.9% as inflation figures in October are forecast to remain subdued, the bank added. This gives policymakers room to cut rates without driving away carry traders in search of high real returns.

Angel investor Khaled Ismail to launch USD 35 mn Africa-focused fund: KIAngel founder Khaled Ismail and three other investors will launch a new USD 35 mn Grow In Africa (GIAF) investment fund targeting companies in Nile Basin and COMESA countries in March 2021, Al Mal reports. The group, which includes two other Egyptian businessmen as well as a Jordanian investor, is approaching the European Bank for Reconstruction and Development, the International Finance Corporation, the Islamic Development Bank and local banks to participate in the fund. GIAF will be geared towards companies looking to grow internationally, with 80% of its capital being allocated to firms targeting expansion in other African countries and the remaining 20% going towards those eyeing local growth. GIAF will fund companies working in agriculture, recycling, and healthcare among other fields, with a focus on tech-powered startups. The fund had been postponed from last January because of covid-19, Ismail said, without providing further details.

Background: Khaled Ismail founded the one-man non-profit KIAngel after selling his software outfit SySDSoft to Intel in 2011 and has invested in Egyptian startups, including home services marketplace Fil Khedma, as well as fashion platform Fustany, among over a dozen others. Ismail teamed up with other investors to transform KiAngel into HIMangel in 2017, and has since invested in healthcare startup Rology, mental health app Shezlong, gaming platform GBarena, and data mining outfit Wayak, among others.

M&A WATCH- ADQ Holding could be in the running to grab a majority stake in Ismailia for Agricultural Investments: Emirati state-owned investment firm ADQ Holding — formerly known as Abu Dhabi Development Holding — has reportedly submitted an offer to purchase a majority stake in frozen meats and poultry company Atyab, in what could be an acquisition valued at EGP 3 – 3.2 bn, Al Mal reports, citing unnamed sources familiar with the negotiations. While still in the early stages of discussion, ADQ is set to soon start due diligence on Atyab, sources added. UK private equity firm Alta Semper had previously attempted an acquisition of Atyab, but withdrew from the running after ADQ’s offer came in 40% higher than the company’s own.

EFG Hermes has been tapped as financial advisors for the acquisition.

The acquisition offer comes as food security is growing evermore important because of the pandemic. Press reports earlier this week suggested a bid from an Arab sovereign wealth fund to acquire 75-100% of Atyab for EGP 3 bn was being positioned as a means of increasing Egyptian exports and supporting food security in both countries.

What else has ADQ been up to recently? Reports earlier this year indicated that ADQ could be working alongside the Sovereign Fund of Egypt to participate in Banque du Caire’s USD 500 mn IPO on the EGX. The two had also agreed last year to set up a USD 20 bn joint investment fund to invest using a variety of structures in manufacturing, traditional and renewable energy, and technology and other sectors

DEBT WATCH- Sarwa Capital’s upcoming EGP 2.5 bn corporate sukuk issuance will be covered and guaranteed by Banque Misr and Misr Capital, after the consumer- and structured-finance player signed an agreement with Banque Misr and its investment arm, according to an emailed statement. The issuance — which will be the second corporate issuance of the sharia-compliant bonds to hit the Egyptian market since the Financial Regulatory Authority published regulations for the bonds last year — is on track to go to market before the end of this month, said Ayman El Sawy, managing director of Sarwa Promotion & Underwriting. Sarwa’s single-tranche issuance will carry a seven-year tenor.

Advisors: Sarwa tapped ALC Alieldean Weshahi & Partners as legal counsel and KPMG Hazem Hassan as financial auditor for the issuance. Middle East Ratings and Investor Services (MERIS) will issue a rating on the offering.

DEBT WATCH- Egypt could seal the first USD 250 mn tranche of a USD 500 mn loan from the Japanese International Cooperation Agency (JICA) before the year is out, the local press reports, citing government sources. The first tranche would be used to plug shortfalls in the government’s budget and implement reforms in the electricity sector, among others.

What else is in the pipeline? Negotiations are underway with the French Development Agency (AFD) for an EUR 150 mn loan to be disbursed over two tranches, the first of which should be finalized in 1Q2021, the sources said. This comes as part of a commitment made by AFD last year to put EUR 1 bn into projects in Egypt over a four-year period. JICA has recently stepped up its activity in Egypt, providing finance for a number of projects including the construction of Cairo’s new metro line, a solar plant in Hurghada, and an expansion of a children’s hospital, as well as pledging USD 250 mn to support the government’s universal healthcare scheme.

Dar Al Fouad Hospital has signed an MoU to manage and operate Alexandria’s Elite Hospital, according to a statement seen by the press. The agreement will see the high-profile hospital — which is owned by Alameda, one of Egypt’s leading private sector hospital groups — take over management and train Elite’s doctors and staff, as well as allow Elite’s patients to be referred to Cairo for complex operations such as organ transplants and sophisticated heart and vascular surgeries. This is the second management agreement Dar Al Fouad has signed for a facility outside of Cairo, suggesting a trend that established players from the capital are taking healthcare elsewhere through a management services model. A similar agreement with Sohag’s Misr Hospital was inked last March, according to the press.

Advisors: Law firm ALC Alieldean, Weshahi & Partners acted as legal advisors to Dar Al Fouad, sources close to the transaction told Enterprise.

Dar Al Fouad Hospital has signed an MoU to manage and operate Alexandria’s Elite Hospital, according to a statement seen by the press. The agreement will see the high-profile hospital — which is owned by Alameda, one of Egypt’s leading private sector hospital groups — take over management and train Elite’s doctors and staff, as well as allow Elite’s patients to be referred to Cairo for complex operations such as organ transplants and sophisticated heart and vascular surgeries. This is the second management agreement Dar Al Fouad has signed for a facility outside of Cairo, suggesting a trend that established players from the capital are taking healthcare elsewhere through a management services model. A similar agreement with Sohag’s Misr Hospital was inked last March, according to the press.

Advisors: Law firm ALC Alieldean, Weshahi & Partners acted as legal advisors to Dar Al Fouad, sources close to the transaction told Enterprise.

CABINET WATCH- The final executive regulations of the new NGOs Act should be issued soon after the Madbouly Cabinet gave the regs preliminary approval during yesterday’s meeting. They have been with cabinet for a final review since February, after having previously expected to be released at the end of 2019.

Background on the law: The bill, which was ratified in August of last year, replaces the controversial Law No. 70 of 2017 that generated considerable criticism both in Egypt and overseas. It received both praise and criticism after it passed the House last year, with supporters applauding the removal of jail sentences for funding-related violations and detractors saying that it does not offer enough protections for civil society. Need a refresher on the key points of law? We’ve got you covered.

Also approved during yesterday’s meeting:

- An initiative from Arab Fund for Economic and Social Development to grant Egypt a one-year moratorium on debt repayments from 7 July 2020 to 30 June 2021;

- A decision to consolidate the public treasury and Egypt Mint into a unified entity;

- Setting up a state-owned company based in the Suez Canal Economic Zone to repair and upgrade railway cars.

DISPUTE WATCH- Edita Food Industries has begun legal proceedings against Greek food manufacturer Chipita at the Cairo Regional Center for International Commercial Arbitration over a contractual dispute relating to a manufacturing and technical services agreement signed in 2011, according to an EGX disclosure (pdf). Edita management claims the company received no technical support from Chipita (pdf) during the agreement, which was worth EUR 150k each year. The contract was signed in 2011, amended in 2013 and annulled in 2016.

Background: Chipita co-founded Edita in 1996 along with the Berzi family. The Greece-based company’s Exoder Limited sold all of its shares in the company last year.

STARTUP WATCH- E-commerce company Capiter plans to invest EGP 500 mn next year to expand its geographical presence and the network of its SME clients, CEO and founding partner Mahmoud Nouh said, according to Al Mal. The Cairo-based company, which was founded in May 2019, operates an app that connects small and medium companies to suppliers.

STARTUP WATCH- Ed-tech platform Marj3 has secured an unspecified seed investment in a round led by US-based VC firm Expert Dojo, with participation from other unnamed angel investors, according to an emailed statement (pdf). The funding will be used to finance growth, the statement says. Marj3 was founded in Egypt back in 2016 by Sami Al Ahmad, a Syrian entrepreneur, along with Egyptians Abdullah Samy and Ahmed El Gebaly. It is now the MENA region’s largest ed-tech platform, with some 2.4 mn visitors per month.

KUDOS- Our friends at Matouk Bassiouny & Hennawy won the International Financial Law Review’s 2020 Egyptian law firm of the year award for “continuing to innovate in its business approach … [which] helped drive the Matouk Bassiouny brand into new markets.” MB&H was also one of several winners of the M&A transaction of the year award for their work on the milestone Uber/Careem acquisition. You can read the law firm’s announcement here (pdf).

MOVES- CIB non-executive board member Paresh Sukthankar (bio) has been selected by Canada’s Fairfax Financial Holdings to represent their investments in the bank, according to an EGX filing (pdf). Fairfax holds a 6.55% stake in CIB. Sukthankar will succeed Bijan Khosrowshahi (Linkedin) who is stepping down after six years on the board in compliance with the CBE’s corporate governance directives.

The Macro Picture

Global central banks are laying the foundations for a digital currency revolution: Thinking among global central bankers about how best to usher in national digital currencies has moved into higher gear over the past week, with both the Bank of International Settlements (BIS) (pdf) and the Financial Stability Board (FSB) (pdf) releasing papers on how policymakers can integrate virtual cash into the financial system. Facebook’s ambitions to launch its stablecoin, Libra, has placed central banks in a quandary about how to prevent private digital currencies from superseding government-issued monies, and how to introduce them without undermining financial stability and facilitating cross-border crime.

What are the key risks? Existing national legislation does not fully cover global stablecoins, and their widespread use risks destabilizing exchange rates and might expose financial institutions to adverse confidence effects if they are seen as a more reliable store of value than state-issued currencies, the FSB said. Meanwhile, central bank-backed currencies risk increasing the reliance on payment systems and data storage capacity beyond the control of domestic institutions, and provoking runs into central bank currency, the BIS said.

How can regulators overcome them? The FSB recommends that authorities put in place a comprehensive governance framework that entails cross-border cooperation, and ensure that stablecoin issuers include effective risk management and robust data security capabilities. It also urged further reviews of how existing regulations are being implemented, which will be completed by July 2023, as well as a review of whether the new regulations are doing enough to prevent money laundering, which will be done in December 2021.

We’re rapidly moving into an era of digital currencies: China, which is planning to be the first nation to issue a digital currency, has just begun trialling its digital yuan in Shenzhen ahead of a possible nationwide roll-out later this year. Sweden started testing its e-krona in February, Russia has announced it is considering launching a digitized ruble, and the European Central Bank is floating the idea of a digital Euro, with President Christine Lagarde saying the digital euro would supplement, not replace cash. The Central Bank of Egypt is also said to be mulling its own cryptocurrency.

Egypt in the News

The foreign press is awash with coverage of Israeli actress Gal Gadot’s casting as Cleopatra: The Guardian writes that the film industry has a “frustrating habit of whitewashing history and movies about Cleopatra.” Debates have arisen about Cleopatra’s race with many saying Gadot’s casting is justifiable as the historical figure had Macedonian-Greek heritage on her father’s side while others say her mother’s unverified background means she is mixed race. Elsewhere, the Committee to Protect Journalists is calling for the release of Kamal El Balshy — whose brother Khaled is already in detention.

Diplomacy + Foreign Trade

Topping diplomatic coverage this morning: President Abdel Fattah El Sisi discussed with South African President Cyril Ramaphosa the latest developments of the Grand Ethiopian Renaissance Dam talks with Ethiopia and Sudan, Ittihadiya said, without disclosing any details on the conversation. South Africa, which is mediating the dispute as the current chair of the African Union, is still reviewing Egypt, Ethiopia, and Sudan’s reports on their last round of meetings, but the three countries are in talks on sticking issues, Irrigation Ministry spokesperson Mohamed El Sibai said this week.

Egypt could be part of a revived oil pipeline project linking it to Iraq and Jordan, AlKhaleej Today quoted Jordanian Foreign Minister Ayman Safadi as saying. Jordan and OPEC member Iraq were planning under a 2013 agreement to construct a pipeline between Aqaba and Basra, but the project was never completed. The two countries renewed their agreement this year and stretched plans to Egypt.

Meanwhile, on the foreign trade front, fears of a second wave are spurring more wheat imports: Egypt imported over 3.5 mn tonnes of wheat since the beginning of FY2020-2021, with the current quarter seeing a 64% increase compared to the same period last year as the country braces for a second wave of covid-19, advisor to the Supply Minister Nomani Nasr Nomani told the local press. Current reserves should last six-and-a-half months until the start of the next local wheat season in mid-April 2021, he said, adding this will be supplemented with more imports.

Frozen fava beans will be exempt from a Trade Ministry ban on the export of beans and legumes according to a decision seen by Al Mal. The exemption came in response to industry lobbying efforts after the ministry decided last week to keep the ban, which was originally introduced in March and renewed in June to shore up food security in the early days of covid-19, in place for three additional months.

Energy

Agiba to raise investments drilling and exploration investments by 50% in 2021

Eni-EGPC JV Agiba will increase investments in well exploration and production by 50% next year, Al Mal reports, citing an unnamed Egyptian General Petroleum Corporation (EGPC) official. "With the start of life returning to normal again, and the improvement in global oil prices, the injection of research and exploration investments will be expanded," the official said. The company plans to drill 60 new exploratory wells and increase production rates to 50k barrels per day next year.

SDX Energy receives EGAS approval to extend South Disouq concession agreement

SDX Energy has received approval from state-owned EGAS to extend its South Disouq concession agreement for another two years, Al Mal reports. The company requested the extension following promising results from recent discoveries in the area and is planning to drill two new wells to tap into 165 bcf of natural gas. SDX still needs the go-ahead from the House of Representatives and the Oil Ministry to confirm the extension.

Manufacturing

LG to export 70% of its Egypt-made products

]Consumer electronics giant LG is planning on exporting over 70% of its Egypt-made washing machines and TVs over the coming years, CEO Billy Kim said in a press conference, without providing an exact timeline, according to the local press. LG has invested USD 50 mn in its Egyptian production lines and plans to increase investments to manufacture OLED TVs.

Health + Education

GEMS in talks with six schools to provide access to its new online learning platform

Private sector education outfit GEMS is in talks with six schools to provide licensing agreements for its distance learning platform, Phoenix, CEO Ahmed Wahby told the local press. The system facilitates school administrators’ online instruction efforts and student management through a unified platform. GEMS has so far signed an agreement to provide services to one unnamed institution, while talks are still on going with other interested parties.

Real Estate + Housing

La Verde Developments to invest EGP 1 bn in new capital project

La Verde Developments will invest EGP 1 bn over the next year to fund the construction of its real estate projects in the new administrative capital and pay off some of the installments on the land allocated for the project, Chairman Ibrahim Lashin told the local press. The company has plans to invest an additional EGP 2 bn for a second project under the name La Verde Cassette, bringing their total investments in the new capital to EGP 5 bn.

Misr Italia to invest EGP 400 mn in 4Q2020

Misr Italia Properties will invest EGP 400 mn by the end of this year across its real estate development projects in the new administrative capital, Mostakbal City and Ain Sokhna, bringing its total investment this year to EGP 1.1 bn, co-CEO Hany El Assal told Al Mal.

Banking + Finance

Who’s in the market for debt? EgyLease + Porto Group

Financial leasing company EgyLease is in talks for an EGP 200 mn loan from the National Bank of Egypt to expand its portfolio, Chairman Iman Ismail told Al Mal. The company is also negotiating loan agreements with United Bank and Ahli United Bank, he said, adding the amounts have not been decided. EgyLease had been in talks with Banque Misr for an EGP 400 mn loan last month, the outcome of which has not been made public.

Meanwhile, Porto Group subsidiary Porto 6 October for Touristic Development has signed a EGP 500 mn sharia-compliant loan agreement with Banque Misr, company Co-Chairman Ayman bin Khalifa said. The proceeds aim to speed up work at the 1.38 mn sqm Porto October project west of Cairo.

Suez MTO for 100% of Tourah Cement kicks off today

Shareholders in Portland Tourah Cement Company (Tourah Cement) will be able to subscribe to a mandatory tender offer by parent company Suez Cement starting today, the EGX said. The offer, which targets 20.075 mn shares at EGP 7.12 apiece, will expire on 19 November. Subscribed shares will then be transferred to Suez within five working days.

Masary to help Banque Misr develop its e-payments services

Banque Misr is equipping Ebtikar’s e-payment app Masary with banking services, including QR code payments, Meeza card services, and accepting e-payment cards, according to a statement (pdf).

Sports

Egyptian women squash players reach CIB Open semis

Egypt’s Nouran Gohar and Hania El Hammamy have secured their spots in the semi-final round of the CIB Egyptian Squash Open, according to PSA World Tour. Nour El Sherbini and Nour El Tayeb, meanwhile, are each playing a quarter-final match today. The semi-finals games are scheduled for Friday, with the final set to be played on Saturday.

On Your Way Out

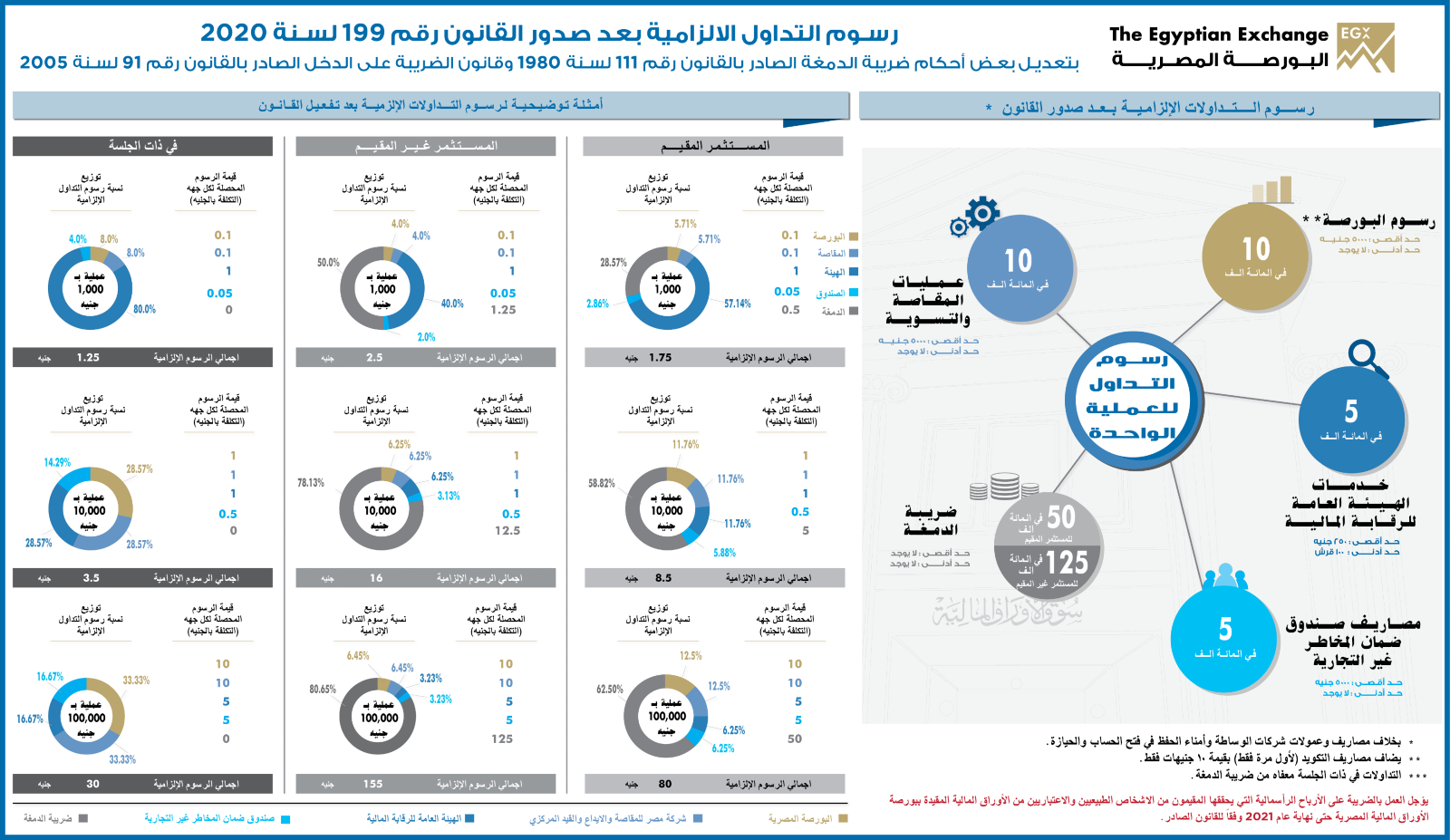

How much tax should you pay on EGX transactions? The EGX has published a helpful infographic guide on taxes and fees on EGX transactions after the amendments to the income tax and stamp tax acts came into law this year. The amendments set a stamp tax rate on EGX trades of 0.125% for foreign investors and 0.05% for residents, both of which were previously set at 0.15%.

The Market Yesterday

EGP / USD CBE market average: Buy 15.64 | Sell 15.74

EGP / USD at CIB: Buy 15.63 | Sell 15.73

EGP / USD at NBE: Buy 15.65 | Sell 15.75

EGX30 (Wednesday): 11,334 (+0.4%)

Turnover: EGP 1.3 bn (16% above the 90-day average)

EGX 30 year-to-date: -18.8%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.4%. CIB, the index’s heaviest constituent, ended up 0.03%. EGX30’s top performing constituents were GB Auto up 8.0%, Oriental Weavers up 5.1%, and Dice up 4.0%. Yesterday’s worst performing stocks were Egyptian Iron & Steel down 3.4%, Emaar Misr down 1.2% and Heliopolis Housing and Development down 1.0%. The market turnover was EGP 1.3 bn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -2.9 mn

Regional: Net Long | EGP +55.1 mn

Domestic: Net Short | EGP -52.2 mn

Retail: 73.5% of total trades | 74.6% of buyers | 72.5% of sellers

Institutions: 26.5% of total trades | 25.4% of buyers | 27.5% of sellers

WTI: USD 41.03 (+2.06%)

Brent: USD 43.31 (+2.03%)

Natural Gas: (Nymex, futures prices) USD 2.65 MMBtu (-7.22%, November 2020 contract)

Gold: USD 1,904.90 / troy ounce (+0.54%)

TASI: 8,592.10 (-0.10%) (YTD: +2.423%)

ADX: 4,573.00 (+0.61%) (YTD: -9.91%)

DFM: 2,218.21 (-0.86%) (YTD: -19.77%)

KSE Premier Market: 6,398.54 (-0.23%)

QE: 10,026.04 (-0.31%) (YTD: -3.83%)

MSM: 3,593.84 (-0.02%) (YTD: -9.73%)

BB: 1,476.61 (-0.38%) (YTD: -8.30%)

Calendar

October: Trade and Industry Ministry allocates SMEs seven industrial complexes.

10-15 October (Saturday-Thursday): Turathna 2020 exhibition for traditional handicrafts, Egypt International Exhibition Center, Nasr City, Cairo.

12-18 October (Monday-Sunday): 2020 Virtual Annual Meetings of the International Monetary Fund and the World Bank Group.

10-17 October (Saturday-Saturday): CIB Egyptian Squash Open, New Giza Sporting Club / Pyramids of Giza.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities.

18 October (Sunday): The newly-elected Senate will hold its inaugural session.

18 October (Sunday): A court will hold a postponed hearing to look into an unpaid claims lawsuit by Syria’s Antradous against Mansour Amer’s Amer Group and Porto Group.

18-22 October (Sunday-Thursday): The annual Cairo Water Week event — which will be semi- virtual this year — will be held under the slogan “Water Security for Peace and Development in Arid Regions”

21-23 October (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

24-25 October (Saturday – Sunday) Polls open for first round of Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

End of October: Last chance to settle building code violations for illegal buildings.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

November: An Egyptian-Russian ministerial committee will meet to discuss trade and investment in Moscow.

2 November: Former Civil Aviation Minister Ahmed Shafik faces retrial at Cairo Court of Appeals in the so-called Aviation Ministry corruption case.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-6 November (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo

7-8 November (Saturday-Sunday): Polls open for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

19-28 November (Thursday-Sunday): Cairo International Film Festival, Cairo Opera House, Egypt.

22-25 November (Sunday-Wednesday): Cairo ICT 2020, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 November (Monday-Tuesday): Reruns for Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

30 November (Monday): Final results will be announced for Parliamentary elections held in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

December: The 110th regular session of the Egyptian-Iraqi Joint Higher Committee will be held under the chairmanship of the prime ministers of the two countries.

December: IMF delegation visits Egypt in first of two reviews ahead of disbursement of second tranche of USD 5.2 bn SBA.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

5 December (Saturday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria.

7-8 December (Monday-Tuesday): Reruns for Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

9-10 December (Wednesday-Thursday): BiznEx, the international business expo in Egypt, venue TBD.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

1 October 2021-31 March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.