- Blom Bank confirms it’s looking to exit Egypt as Lebanon falls into deeper economic crisis. (Speed Round)

- Is Amazon planning a P2P delivery program for Egypt? (Speed Round)

- Foreigners could be given a broader path to obtain Egyptian citizenship. (Speed Round)

- EBRD to provide Banque Misr with USD 100 mn loan for on-lending to covid-hit SMEs. (Speed Round)

- You now have more stock options for short selling. (Speed Round)

- Russia is first out the gate in the vaccine race as Europe sees a resurgence of covid-19 cases. (What We’re Tracking Today)

- With a surplus of electricity, why do we still get power cuts? (Hardhat)

- The Market Yesterday

Wednesday, 12 August 2020

Senate elections come to a close today

TL;DR

What We’re Tracking Today

National polls for the country’s inaugural Senate election close tonight: President Abdel Fattah El Sisi and Prime Minister Mostafa Madbouly both cast their votes on the opening day of the ballot in Egypt yesterday, which will see 200 candidates elected to the new 300-seat Senate. The 200 seats are allocated equally between individual candidates and candidates running on party lists, with the president appointing the remaining 100. The results are expected to be announced next week on Wednesday, 19 August. If necessary, voters will return to the polls on 8-9 September for a run-off election.

The elections are leading the conversation on Egypt in the foreign press this morning: Reuters | AFP | AP | Bloomberg | Xinhua | The National.

Its interest rate day tomorrow: The Monetary Policy Committee will meet tomorrow to review interest rates. All signs point to a hold, with nine of the 10 analysts we polled this week expecting the central bank to leave rates unchanged.

RiseUp is holding a three-day digital conference starting tomorrow: RiseUp from Home will bring together regional entrepreneurs for its first event since the onset of the pandemic and feature talks from some regional entrepreneurs, investors and business experts.

COVID-19 IN EGYPT-

The Health Ministry confirmed 24 new deaths from covid-19 yesterday, bringing the country’s total death toll to 5,059. Egypt has now disclosed a total of 95,834 confirmed cases of covid-19, after the ministry reported 168 new infections yesterday. We now have a total of 54,888 confirmed cases that have fully recovered.

The flouting of social distancing measures over Eid El Adha could come back to bite us in our rear ends and lead to an uptick in covid-19 cases around the country, director of the allergy and immunology department at Vacsera Amgad Al Hadad told Masrawy.

Then again, did the first wave of infections ever really end? Presidential health advisor Mohamed Awad Tageldin thinks not, saying that he anticipates a new rise in case numbers even though we never really emerged from the first wave, according to Youm7.

The Waltons want our masks: US hypermarket Walmart has approached several textile factories in the Tenth of Ramadan Industrial City to buy masks, said Sally Farouk, head of the Textile Industries Committee at the Tenth of Ramadan Investors Association, reports the local press.

Some 68k tourists have visited Sharm El Sheikh and Hurghada in the past six weeks, since the government lifted flight restrictions at the beginning of July, the Civil Aviation Ministry said yesterday.

Over 20 mn people around the world have now been infected with the virus that causes covid-19, according to the Johns Hopkins University coronavirus tracker. Cases in the US account for roughly a quarter of the figure, with 5.1 mn cases recorded as of yesterday.

Europe is starting to see a fresh pickup in new covid-19 cases. Greece has formally announced it’s in the throes of a “second wave” of infections, while new daily cases in the Netherlands are back up to around half of the country’s peak, according to the Guardian. In hopes of avoiding a return to a strict nationwide lockdown, France has made masks compulsory in several tourist sites and other areas in Paris “where physical distancing is difficult.” Italy and Spain are also seeing an “alarming” resurgence of the virus.

Lebanon also reported yesterday a record of daily covid-19 numbers, with over 300 single-day infections and seven deaths, according to Reuters.

Russia is first out the gate in the vaccine race: Russia has finalized a covid-19 vaccine that “has passed all the necessary checks,” becoming the first country to authorize a vaccine for the virus, President Vladimir Putin announced yesterday, according to Reuters. Named “Sputnik V” (they really couldn’t help themselves, could they?), the vaccine has been criticized by medical experts for being rushed through after undergoing less than two months of clinical testing on volunteers and failing to complete its final round of trials. Despite fears, the head of the country’s sovereign wealth fund said that Russia has received requests for 1 bn doses from other countries, with the UAE and the Philippines both agreeing to conduct clinical trials.

Outraged Lebanese citizens want more than their government’s resignation, and are demanding that President Michel Aoun and Parliament Speaker Nabih Berri step down, reports Reuters. Angry protesters yesterday rallied in the capital city after allegations surfaced that Aoun and former Prime Minister Hassan Diab were both warned about the explosive materials as recently as June.

Adding to their mounting woes, it’s slim pickings for Lebanese savers seeking assets or investments for their cash. Bloomberg highlights cases among those trying to hang on to their rainy-day pot amid the desperation and commonplace extortion that comes with a collapsing currency and spiraling inflation. Many are buying physical assets — including used cars — and investing in real estate.

Egypt vows to continue lending a helping hand: Foreign Minister Sameh Shoukry has pledged further support to the country in meetings yesterday with Auon and other key political figures, the Foreign Ministry said over several tweets yesterday. Besides sending three planeloads of supplies to Beirut, Egypt is preparing a shipment of building materials to restore buildings damaged from the explosion, Egyptian ambassador to Lebanon Yasser Alawi told Ahram Online.

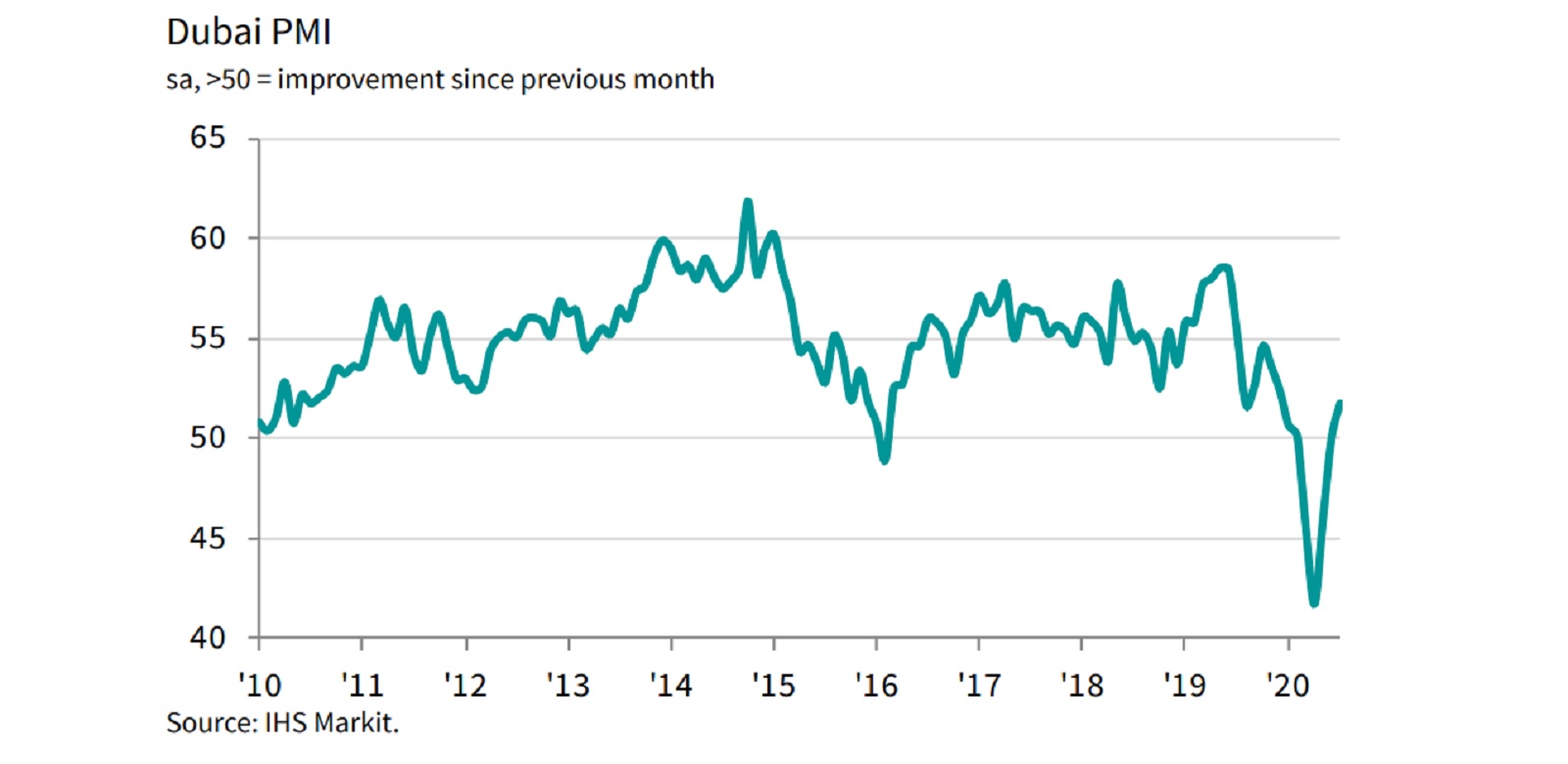

In Dubai, signs of another jobless economic recovery: Dubai’s non-oil business activity returned to expansion territory in July for the first time since the outbreak of the pandemic, with an uptick in construction and retail paving the way for a “the start of a post-covid-19 recovery,” according to IHS Markit’s purchasing managers index (PMI). New orders saw a “solid increase” in July but persistent job loss rates — which rose for the fifth consecutive month — and a less-than-optimistic outlook calls for some pause.

Kuwait’s USD 112 bn pension fund is looking to push up its investment in infrastructure projects more than threefold in the next few years, bringing its asset allocation in infrastructure to “roughly” 10%, Bloomberg reports. It’s also eyeing more investment in real estate and hedge funds, said Meshal Al-Othman, the director general of the country’s Public Institution for Social Security.

Across the pond: Joe Biden officially named Senator Kamala Harris as his running mate in this year’s US presidential elections. Harris, who is the first Black woman and also the first person of Indian descent to run for vice president, was herself vying for the Democratic presidential nomination before dropping out of the race in December. A host of Democrats — including former president Barack Obama and former presidential candidate Bernie Sanders — rallied behind Harris’ nomination. The story is front-page news across the international press this morning: Reuters | NYT | Washington Post | Wall Street Journal | Financial Times.

Airbnb is planning to file IPO paperwork later in the month in a move that could see its shares trading on Wall Street before the year is out, the WSJ reports. There’s no certainty that Airbnb will remain committed to this timeline, but an IPO for the company that was once valued at a record USD 31 bn “would underscore a surprising rebound for the home-sharing giant and the IPO market.” Despite being a household name, Airbnb has been facing one headache after another, leading to steep losses that were made worse as travel came to a standstill earlier during the pandemic. The company regained its pre-pandemic glamor in recent months, but remains a risky prospect as it still struggles to turn a profit.

The pandemic is helping sustainable investment to catch on: Assets held by funds that follow sustainable investment principles have surpassed USD 1 tn for the first time ever, according to data compiled by Morningstar. Record net inflows of USD 71.1 bn were reported between April and June, a trend that UBS analysts put down to governments focusing on a green-led economic recovery from the covid-19 crisis. The Financial Times and CNBC both picked up the story.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: Egypt has around 26 GW of surplus electricity generation capacity. So why are some of us still experiencing brownouts? The short answer: the grid was not built to handle the near 58 GW of electricity we have only recently begun producing. We spoke with government officials and heads of state electricity companies to explore why that is and what are they doing about it.

Enterprise+: Last Night’s Talk Shows

Speed Round

M&A WATCH- Blom Bank confirms potential Egypt exit as Lebanon falls into deeper economic crisis: Lebanon’s Blom Bank confirmed yesterday that it is looking to sell its Egypt assets in response to the financial crisis gripping its home country. The bank said in a statement that the Central Bank of Egypt (CBE) has approved a request for it to begin the due diligence process on a transaction that could be valued at USD 250-300 mn, Reuters reports, citing unnamed sources. Any agreement will be subject to approval by the bank’s board of directors and the CBE, the bank said.

Emirates NBD looks to be in the running: The local press reported earlier this week that Emirates NBD could be interested in buying Blom’s Egypt arm. Reuters’ sources corroborate the link, saying that the Dubai bank was among several potential suitors that Blom has approached. If Emirates NBD were to successfully snap up the Lebanese bank, its footprint in Egypt would increase substantially, adding Blom’s 41 branches to its existing 69.

This isn’t the first Lebanese bank to look for the exit door from Egypt: Rival Bank Audi has also been looking to sell its Egypt assets, but potential buyer First Bank Abu Dhabi shelved acquisition talks in May due to the uncertainty caused by the coronavirus.

A catastrophic economic crisis in Lebanon is to blame: Blom Bank reported a 77% plunge in profits last year as Lebanon endures its worst financial crisis since the country’s civil war. With the currency in freefall, soaring inflation and a paralyzed financial system, banks are racing to boost their capital after the Lebanese central bank raised capital requirements in a bid to shore up the banking sector.

Advisers: Sources cited by Reuters and local media report that Blom has hired CI Capital to advise on the sale. Baker McKenzie is reportedly providing legal advice.

Is Amazon planning a P2P delivery program for Egypt? E-commerce giant Amazon could launch a program to use private cars in Egypt to transport light goods, Amazon-owned Souq’s CEO Omar Al Sahi told General Authority for Investment Chairman Mohamed Abdel Wahab in a meeting yesterday, according to a statement carried by Youm7 and Al Masry Al Youm. The rollout of the program appears to be nothing more than a proposal so far, but it could mean that Egyptian cities would soon join something akin to Amazon Flex. The program, which is available in cities all over the world, allows private car owners to earn some extra income by working as a courier for Amazon in their spare time — similar to the model used by ride-hailing companies like Uber and Careem.

Amazon has other plans for its operations in Egypt: The company is planning to expand in the Egyptian market through several new services, involving artificial intelligence and e-payments, Al Sahi said, without providing further details. Amazon is also looking at digitizing warehouses and distribution centers in Egypt and supporting state-owned companies in engaging in e-commerce. No further information was provided on the expected investment cost or timeline for these plans.

Foreigners could be granted the Egyptian citizenship if they invest more working capital into their Egypt-based companies if a proposal gets a green light from the Madbouly Cabinet, Al Mal reports. The proposal was submitted by Sameh Sedky, the executive director of the Investment Ministry department responsible for processing citizenship requests. Cabinet had approved legislative amendments late last year that gives foreigners who hold assets in Egypt a path to citizenship. This path would be granted to foreigners if they deposit a non-refundable USD 250k into a local bank account that goes directly to the government, or deposit USD 750k-1 mn that will be refunded after a set number of years. Foreigners can also invest more than USD 400k in an investment project or purchase state-owned or private property worth at least USD 500k.

DEBT WATCH- EBRD to extend USD 100 mn for covid-hit SMEs through Banque Misr: The European Bank for Reconstruction and Development (EBRD) has approved a USD 100 mn facility to state-owned Banque Misr for on-lending to SMEs impacted by covid-19, International Cooperation Minister Rania Al Mashat said. The EBRD has recently issued equivalent loans to CIB and the National Bank of Kuwait Egypt to shore up liquidity in the private sector, as well as a total of USD 200 mn to the National Bank of Egypt.

M&A WATCH- Prime Holding is planning to offload the entirety of its stake in Al Tawfeek Leasing to avoid a conflict of interest with its new subsidiary Prime Fintech, CEO Mohamed Maher said yesterday, according to Al Mal. Prime launched its new arm on Monday, which among other things will offer financial leasing services akin to those provided by AT Lease. It has gradually reduced its holdings in the company in recent months, lowering its stake in July to 6.13% from 9.6%, and again this week to 3.9%. Maher did not provide specifics on when Prime will offload the rest of its holdings, stating that it will depend on the company’s investment strategy and the performance of AT Lease’s shares.

M&A WATCH- Americana Egypt approves delisting shares from EGX to fulfill Adeptio purchase: Americana Egypt’s board of directors have approved delisting the company’s shares from the bourse at EGP 6.32 per share after finalizing an agreement with Adeptio last week that will see it purchase a 9.6% stake in Americana Egypt, according to an EGX disclosure (pdf). Minority shareholders in Americana Egypt have already approved Adeptio’s offer price of EGP 6.32 per share under a proposed mandatory tender offer (MTO) agreed to in July. Americana Egypt’s voluntary delisting will see the company bring the shares off the main market before transferring them to Adeptio through its subsidiary and Americana Egypt’s parent company, Americana.

You now have more stock options for short selling: The EGX has added 16 new companies to its list of securities eligible for short selling, bringing the total number of stocks to 46, according to an EGX statement (pdf). The expanded list comes into effect at the opening bell today.

Who are the newcomers? Amer Group, Porto Group, Beltone Financial, Orascom Investment Holding, Orascom Development Egypt, Dice, Egyptian Iron and Steel, Arabia Investment Holding, Kima, Alexandria Containers, Maridive and Oil Services, South Valley Cement, Arabian Cement Company, Cairo Poultry, and Egyptian for Tourism Resorts. You can find the full list here (pdf).

The EGX earlier this week approved changes allowing investors to short smaller companies in a bid to encourage short selling activity which has failed to attract interest since it was launched in December. Investors were previously only permitted to short larger companies which account for a minimum 0.005% of the exchange’s total freefloating shares, but under the changes companies with a smaller market cap of 0.001% will also be eligible for short selling. The original threshold was put in place to shield smaller businesses from being pummeled by predatory short sellers but will now be lowered in a bid to boost liquidity and trading.

The Trade Ministry is opening a formal investigation into alleged dumping of ferrosilicon products imported from China, India, and Russia following a complaint from the Egyptian Ferrous Alloys Company, the local press reports. Ferrosilicon is an alloy of iron and silicon that is typically used in steel production. The ministry has notified the Chinese, Indian and Russian diplomatic missions in Egypt of the inquiry.

LEGISLATION WATCH- Cabinet will submit the law that will establish the Egyptian Commodity Exchange to the House of Representatives in its next legislative session, which is set to begin in October, Supply Minister Ali El Moselhy said, according to Masrawy. El Moselhy did not provide any details on the legislation. The bill was scheduled to be with the Madbouly Cabinet for review in May after the Supply Ministry completed the drafting process. El Moselhy said earlier this week the exchange itself — which previous reports indicated will initially trade wheat, rice, corn, potatoes, onions, and oranges — will be inaugurated by the end of August.

Government buildings will officially be ready for their move to the new administrative capital next summer, with work on the government district scheduled to be completed by 30 June 2021, Armed Forces Engineering Authority boss Ehab El Far said, according to a cabinet statement. A building that will host the newly reinstated Senate is also due for inauguration on the same date. Other work within the district is 86% complete and will wrap up on or before 30 September 2020 — including work on 34 ministries, the lower house of parliament, a cabinet building, a building that will house the Administrative Control Authority, and a portion of the so-called “green river.”

Background: President Abdel Fattah El Sisi earlier this year postponed to 2021 the planned relocation of government offices to the new administrative capital due to the covid-19 outbreak. The move to the new capital was previously scheduled to happen last June.

When can residents move in? Residential districts R2 and R3 are currently 79% and 89% complete, and are expected to be entirely ready by no later than 31 December, El Far said. Districts R2 and R3, meanwhile, are over 60% complete, and are slated for inauguration by the end of April of next year. The city’s main hospital is also expected to be completely built before 31 March 2021.

EARNINGS WATCH- AT Lease reported EGP 35.7 mn in net profits during 1H2020, up 4.6% from EGP 34.14 mn in 1H2019, according to an EGX disclosure (pdf). The company's revenues inched down to EGP 242.5 mn over the course of 1H2020 from reported revenues of EGP 242.7 mn in 1H2019, according to the company’s earnings release (pdf).

Domty reported EGP 710.9 mn in 2Q2020 revenues, up 10% y-o-y from EGP 646.8 mn during the same period last year, according to an EGX disclosure (pdf). The company reported a 15.5% drop in profits during the quarter to EGP 31.7 mn, down from EGP 37.5 mn.

Obour Land’s 2Q2020 net profit dipped 3% y-o-y to EGP 72 mn from EGP 74.3 mn in 2Q2019, according to the company’s earnings release (pdf). On a six-month basis, Obour’s net profit grew 10% y-o-y. Revenues in 2Q2020 inched up 9% y-o-y to EGP 666.2 mn from EGP 611.7 mn, while revenues grew 5% y-o-y in 1H2020.

The National Bank of Kuwait–Egypt reported profits of EGP 753 mn in 1H2020, down 28% y-o-y from EGP 1.05 bn in 1H2019, according to its earnings release (pdf). Revenues during the period fell 7% y-o-y to 1.71 bn from 1.84 bn in the same period last year.

Misr Cement Qena posted net profits of EGP 63.25 mn in 1H2020, marking a 330% y-o-y increase from EGP 14.7 mn in 1H2019, according to an EGX disclosure (pdf).

- A senior editorial leader, who will work on this product and help launch new products.

- A seasoned reporter to join our team and create stories and packages that fascinate and inform our readers.

Egypt in the News

On another relatively quiet morning for Egypt in the foreign press, the country’s anti-harassment movement and the reopening of the border crossing with Gaza for the first time since March were the only stories of note.

Worth Watching

Your regularly scheduled reminder to appreciate your morning cup of Joe while you can: The regions where coffee beans are typically grown haven’t been spared the brunt of climate change — the impact is already being felt in Columbia, where rising temperatures are scorching crops growing at lower elevations, wiping out 7% of the viable land in under a decade. If the effects of climate change continue at the current rates, the area could shrink 50% by 2050. Watch this Vox report (runtime 11:33) for a greater appreciation of the legal substance of choice for most of us here at Enterprise.

Diplomacy + Foreign Trade

Ankara flexes its muscles again over EastMed with potential issuance of gas exploration licenses: Turkey will issue gas exploration and drilling licences in the east Mediterranean this month, Turkish Foreign Minister Mevlut Cavusoglu said at a presser, reports Reuters. The move, which was announced one day after Ankara dispatched a vessel to conduct a seismic survey in the oil and gas-rich region, led Greece — which has been in a long-term dispute with Ankara over the region’s gas reserves — to mobilize its military force. Turkey responded with a strongly worded statement saying that Greece’s objections to the seismic survey had “no legal basis” and that it would continue as it sees fit. Greece has turned to the United Nations for help in resolving the dispute. Egypt and Greece signed a joint economic zone agreement in the EastMed earlier this week, which pundits say stirred the pot by adding a “new dimension” to the conflict.

With a surplus of electricity, why do we still get power cuts? With a major push to bolster electricity generation, Egypt has largely gotten over the worst of the power cuts that were rampant between 2011 and 2014. Egypt is now producing some 58 GW of power, providing a huge surplus even during peak demand in the summer. But despite this jump in power generation, consumers around the country still report blackouts. Officials and experts we spoke with did not refute these concerns — but said it is only a matter of time until the grid performs at optimal efficiency.

In Part 1, we look at how current blackouts were a consequence of power generation outpacing our transmission capacity, and what the government is doing (and spending) to resolve the problem.

Background — we’ve gotten good at energy generation: In the past seven years, Egypt has poured massive investments into the electricity sector to solve the chronic deficit in generation capacity, which according to official figures (pdf) reached a troubling 6 GW in 2014. Since then, the government has implemented a USD 2.7 bn emergency plan to add more than 3.6 GW of capacity. It also sped up construction on three 4.8 GW combined cycle plants developed by Siemens and Orascom Construction, along with renewable energy projects such as the Benban Solar Park, which produces 1.8 GW of energy at its maximum capacity. As of the end of last year, the Electricity Ministry had managed to add more than 28 GW of electricity through 27 power plants, excluding the Benban park, which by November 2019 was producing almost 1.5 GW.

…But that meant transmission had to take a back burner: These projects were all built quickly to satisfy Egypt’s immediate needs but relied on an outdated transmission and distribution network that made interruptions almost inevitable. For one, the transmission grid could only accommodate 31.4 GW of energy. To compound the issue, operational and equipment inefficiencies meant that some 4% of energy was lost.

But we are playing catch up, with significant results to boot: The Electricity Ministry built transmission lines between 2014 and 2018 extending over 2.6k km. That’s equivalent to the total lines established over the previous five decades, according to a ministry report (pdf).

A huge investment plan for the current fiscal year: Having spent more than EGP 25 bn between 2018-2020 to upgrade the transmission grid, the ministry is now planning to invest another EGP 12 bn during the current fiscal year, EGP 555 mn of which is going towards Greater Cairo alone, ministry spokesperson Ayman Hamza told Enterprise. By the end of this calendar year, the ministry plans to bring the total transmission lines to 6,006 km, adding another 500 km of lines from the start of the year. The plan is intended to raise the maximum load to 32.6 GW — a 600 MW or 1.87% increase. The ministry’s 2018-2021 plan called for reducing electricity loss from 4.07% in 2018-2019 to 3.82% in 2019-2020 and to 3.8% in FY2020-21. These losses were common due to the poor-performing transmission and distribution lines, in addition to consumers obtaining electricity illegally by linking houses to distribution lines directly without a meter to count consumption, thus avoiding paying of dues.

A parallel network is also in development: In addition to working on these expansions, the ministry is also planning to build another 500 km of transmission lines as part of what it calls a “parallel core grid” as a safety gap to improve the service and reduce loads on the main network, according to Hamza.

In tandem, the ministry is replacing more than 30 km of medium-voltage overhead lines at a cost of EGP 30 mn, Hamza said. While he did not specify how much of this was completed, he said that work on this project so far has led to a 25% decrease in blackouts.

Overhead electricity distribution lines vs underground cables: The South Delta Electricity Distribution Company is investing EGP 350 mn in the current fiscal year to replace overhead lines with underground cables, company head Mohamed Abdel Hakam told Enterprise. And according to Egyptian Electricity Transmission Company official Salah Ezzat, the government is doing the same in Cairo. As well as being safer to use in populated areas, underground cables are more efficient and will reduce the rate of energy loss from the grid, Ezzat tells us. The catch is that they are more expensive, so overhead lines will continue to be used outside heavily populated areas.

Bringing the grid to places that were never connected: The government plans to extend electricity lines to new areas of the country, such as East Owinat, while a similar project is being implemented in the North Coast, Ezzat says. Electricity Minister Mohamed Shaker also this year announced plans to link Marsa Alam to the core grid for the first time, and to extend the grid all the way to Halayeb and Shalatin on Egypt’s border with Sudan.

But the grid’s capacity isn’t the only problem: The current grid for the most part relies on outdated technologies that incur major maintenance costs and make identifying the causes of interruptions difficult, Mohamed El Hefnawy, power systems marketing director at Schneider Electric North-East Africa and the Levant told Enterprise. He explained that whenever a power interruption occurred, electricity distribution companies had to wait for consumers to report the problem. Once they receive a complaint, they investigate the cause, and either find a quick fix or order a reroute of the line — altogether an exhausting and time-consuming operation.

Enter the smart grid: The ministry has now embarked on a new mission — to update the old grid and turn it into a smart grid, which incorporates digital technology into the traditional electrical system, allowing utilities and customers to receive information from and communicate with the grid, Hamza told us.

NEXT WEEK: We dive into these plans to upgrade to a smart grid. We explore what it will take to implement this ambitious plan, with input from the private sector players who are helping make it possible.

Your top infrastructure stories of the week:

- Modernizing irrigation systems: The Agriculture Ministry is planning to modernize the irrigation systems used in eight governorates by using drip irrigation, sprinkling, and laser land leveling systems.

- Auto dual-fuel transition: Egypt’s auto firms requested 3-4 months to prepare technical know-how and finalize supply agreements before launching the government initiative to transition to dual-fuel engines.

- Chinese company to invest in New Alamein: China State Construction Engineering Corporation will build a mixed-use tourism complex in New Alamein.

- East Port Said Industrial Zone linking to natgas lines: The General Authority For Suez Canal Economic Zone and Sinai Gas signed a contract to link the East Port Said Industrial Zone to the natural gas grid, according to an Oil Ministry statement.

- NUCA land tenders: The New Urban Communities Authority may soon issue tenders for 10k feddans as part of the third phase of its public-private partnership program.

The Market Yesterday

EGP / USD CBE market average: Buy 15.93 | Sell 16.03

EGP / USD at CIB: Buy 15.91 | Sell 16.01

EGP / USD at NBE: Buy 15.91 | Sell 16.01

EGX30 (Tuesday): 10,919 (-0.2%)

Turnover: EGP 1.5 bn (54% above the 90-day average)

EGX 30 year-to-date: -21.80%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.2%. CIB, the index’s heaviest constituent, ended down 1.3%. EGX30’s top performing constituents were Orascom Investment Holding up 6.0%, Cleopatra Hospitals up 3.6%, and Dice up 3.6%. Yesterday’s worst performing stocks were Sodic down 3.6%, Heliopolis Housing down 2.5% and Madinet Nasr Housing down 1.5%. The market turnover was EGP 1.5 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -62.3 mn

Regional: Net Long | EGP +41.2 mn

Domestic: Net Long | EGP +21.1 mn

Retail: 79.7% of total trades | 77.3% of buyers | 82.1% of sellers

Institutions: 20.3% of total trades | 22.7% of buyers | 17.9% of sellers

WTI: USD 41.56 (-0.91%)

Brent: USD 44.54 (-1.00%)

Natural Gas (Nymex, futures prices) USD 2.15 MMBtu, (-0.23%, September 2020 contract)

Gold: USD 1,931.50 / troy ounce (-5.30%)

TASI: 7,626.23 (+1.20%) (YTD: -9.09%)

ADX: 4,368.21 (+0.33%) (YTD: -13.94%)

DFM: 2,097.23 (+0.16%) (YTD: -24.15%)

KSE Premier Market: 5,608.00 (+1.1%)

QE: 9,523.63 (+1.12%) (YTD: -8.65%)

MSM: 3,572.62 (-0.12%) (YTD: -10.26%)

BB: 1,307.47 (+0.58%) (YTD: -18.80%)

Calendar

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.