- It’s election season: We’re heading to the polls on 11-12 August to elect a Senate. (What We’re Tracking Today)

- Saudi health fund raises USD 108.5 mn to invest in healthcare in Egypt and Morocco. (Speed Round)

- Italian asset manager Azimut launches Egypt-focused equity fund. (Speed Round)

- CIB gets USD 100 mn in tier 2 capital from UK investment group CDC. (Speed Round)

- Your next phone is definitely going to cost a lot more. (Speed Round)

- Suez Canal Bank to launch EGP 250 mn money market fund this month. (Speed Round)

- It’s groundhog day at the GERD talks. (Diplo + Foreign Trade)

- EM portfolio inflows continue to recover in June as sentiment shifts. (The Macro Picture)

- The Market Yesterday

Sunday, 5 July 2020

We’re heading to the polls to elect a Senate on 11-12 August

TL;DR

What We’re Tracking Today

Good morning, friends. We hope all of you enjoyed the long weekend as much as we did. Only 18 days until your next three-day break: The anniversary of the 23 July Revolution — which is followed a week later by Eid Al Adha, suggesting that two-week period will be the true dog days of summer. Plan your escapes while the planning’s good, folks.

We’re heading to the polls in August and September for Senate elections: The first elections for the newly reconstituted Senate will be held on 11-12 August, with Egyptians abroad voting on 9-10 August, the head of the National Elections Authority Lasheen Ibrahim announced in a televised press conference yesterday (watch, runtime: 18:05). The results will be published in the Official Gazette on August 19. Run-offs will be held 8-9 September, with expats voting 6-7 September. The nominations period runs July 11-18. The Associated Press and Reuters both took note of the story.

The nation’s 300 senators will have five-year terms in office, with one-third elected on a list system, one third running as individuals and the remaining 100 appointed by the presidency. Ten percent of seats are reserved for women.

Expect to go back to the polls yet again toward the end of the year to elect the next House of Representatives. The current House — due to head on summer break any time now — will reconvene a final time this fall for a truncated session.

The Senate election was called two days after President Abdel Fattah El Sisi ratified a handful of laws regulating general elections — including a law on parliamentary elections and another to bring back the Senate as the country’s upper house of parliament.

Another busy day in the House ahead of summer recess: The Planning and Budgeting Committee will continue discussing the Unified Tax Act, the Arab Affairs Committee will discuss the charter to set up the Council of Arab African States (which will oversee maritime laws for nations along the Red Sea and Gulf of Aden), and an agreement with the Canadian government regarding the economic empowerment of women, the local press reports. Ahram Online has an expanded rundown on what you can expect from the House today through Tuesday.

GERD talks continue today, mediated by the African Union. There were no breakthroughs yesterday.

The government’s fuel pricing committee is set to meet in “a matter of days” to determine gas prices for the next three months, according to Hapi Journal. The committee cut prices on all grades of gasoline by 0.25 EGP at its last meeting in April.

News triggers coming up over the next few days:

- The purchasing managers’ index for June is due to land tomorrow morning.

- Foreign reserves figures for June should be out sometime this week.

- Inflation data for June will land Thursday, 9 July.

A record number of our readers now seem to be taking three-day weekends, judging from “out-of-office” replies we’re getting on Thursdays and Sundays — good on you. While you’re on a break, consider:

A workout for your brain: Is there such a thing as inclusive capitalism? Martin Sandblu at the Financial Times is out with The everyone economy: how to make capitalism work for all, arguing that “after four decades of rising inequality, the Covid crisis is a chance to change the rules.”

A workout for your body: The NYT’s inimitable Jane Brody has something for everyone — whether you’ve packed on the kgs during covid or you’ve physically become one with the couch since March. Whether you’re on WFH, heading to Sahel or waiting to see whether it’s safe to head to the club, read The Well summer workout challenge and get moving.

COVID-19 IN EGYPT-

The Health Ministry confirmed 79 new deaths from covid-19 yesterday, bringing the country’s total death toll to 3,280. Egypt has now disclosed a total of 74,035 confirmed cases of covid-19, after the ministry reported 1,324 new infections yesterday. We now have a total of 20,103 cases who have fully recovered.

Airports have been busy since the resumption of regularly scheduled commercial flights last week: Flights from countries including the UK, Italy, Belgium, and Lebanon carrying thousands of tourists and nationals landed in Cairo International Airport on Thursday, Friday, and Saturday. Charter flights from Ukraine, Belarus, and Luxembourg landed in Hurghada yesterday, reports Youm7. On Thursday, tourists from Switzerland, Belarus, and Ukraine arrived in Sharm El Sheikh and Hurghada, according to a cabinet statement. The Madbouly Cabinet decided to reopen Egypt’s airspace as of Thursday after nearly four months.

Inbound EgyptAir flights are flying at more than 90% capacity, while 70-75% of seats are booked for outgoing flights, the national flag carrier’s chairman Roshdy Zakaria said on Wednesday (watch, runtime: 07:20).

China’s aviation authority has suspended Sichuan Airlines’ Cairo-Chengdu route for a week starting 6 July, after six passengers arriving from Egypt tested positive for covid-19, reports Reuters.

Egypt could lose out on more than 3% of its GDP — equivalent to USD 7.7 bn — if international tourism remains at a standstill for four months, according to a report (pdf) from the United Nations Conference on Trade and Development (UNCTAD). This is the most optimistic scenario put forward by the UN body: Under the ‘intermediate’ scenario where tourism dries up for eight months, Egypt would lose around 6% of GDP (USD 15.3 bn) while in the doomsday scenario that tourism is suspended for an entire year the Egyptian economy would lose 9% (USD 22.9 bn).

Even in the most optimistic scenario, the global figures are staggering: The report says the global tourism industry stands to lose at least USD 1.2 tn — equivalent to 1.5% of global GDP — after a four-month pause in tourism activity. These losses could increase to USD 2.2 tn (2.8% of global GDP) if international tourism remains on hold for eight months.

Al-Hussein Mosque near Khan El Khalili has been closed until further notice after worshipers failed to abide health and safety guidelines during prayers, according to an Awqaf Ministry statement.

The Egyptian Drug Authority will permit pharmacos to export provided the needs of the domestic market are met for the coming six months, according to a cabinet statement. Spokesman Ali El Ghamrawy said companies exported EGP 30 mn of products during March and April, a 10% increase compared to the same period last year.

DONATIONS-

Star striker and newly-crowned Premier League champ Mohamed Salah has donated GBP 30k to build an ambulance station in Nagrig, his native village in Gharbia, according to the Daily Mail.

ON THE GLOBAL FRONT-

Globally, the pandemic continues to accelerate:

- Global single-day infections at record high: A record 212,326 cases were reported globally in a single day yesterday, according to WHO figures (pdf).

- Total confirmed cases surpassed 11 mn on Friday, just five days after hitting the 10 mn mark, Johns Hopkins data showed.

- The US again posted a new record of more than 55k cases on Thursday as the outbreaks in Florida, Texas, California and Arizona continue to intensify. Another 45k cases were reported on Saturday.

- India reported a record number of daily infections yesterday at more than 22k.

UAE residents and citizens are now allowed to resume international travel, according to state news agency WAM. All local and international airlines “will operate their flights according to a classification system, based on several health and safety standards.”

GLOBAL MACRO-

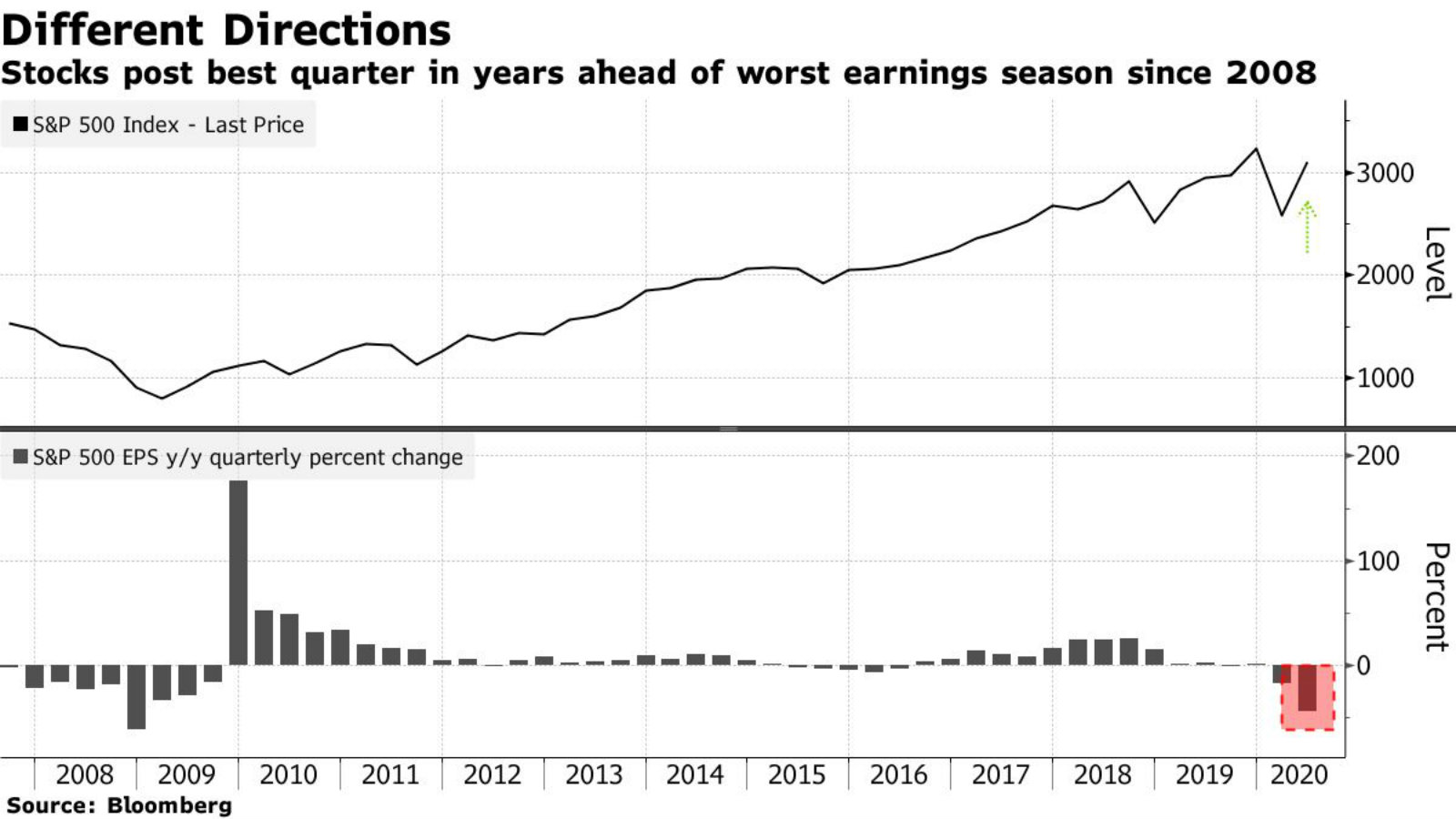

Investors to start pushing for answers as companies continue to keep quiet on guidance: US stocks have just delivered their best quarter in more than two decades despite the coming earnings season shaping up to be historic in its awfulness. Just how awful, we’re not quite sure as the vast majority of companies have refused to provide earnings guidance over the past three months. Maintaining the current rally — which has seen the S&P 500 surge 24% over the past three months, adding USD 10 tn in share value — might soon require companies to be more up-front with their earnings guidance for the remainder of the year. “Investors are going to start demanding a little bit more clarity — whether it’s good or bad, they just want to know,” said David Lebovitz, a strategist at JPMorgan Asset Management.

The emerging market debt market is expected to continue to perform in the second half of the year as worries of an oversupply of issuers have eased after Ukraine called off a USD 1.75 bn debt issuance following the resignation of a senior official, reports Reuters. Still, “the [debt] market is still concerned about the fundamentals and the outlook for some of the riskier names,” with Egypt’s recent issuance not turning out a stellar performance and issuances from Belarus and Albania trending sideways since launch, a pundit on the fixed-income emerging markets desk at Vanguard is quoted as saying.

The recovery many had penciled in for the US economy in 3Q2020 is looking more unlikely as the reopening of several states appears to have been premature and unsustainable, Allianz economic advisor Mohamed El Erian writes for Bloomberg Opinion. The risk the economy runs now is that short-term issues become “structurally embedded” as several relief measures and packages set to expire soon while the fallout from the pandemic has yet to be reversed. “The answer is not to roll back health measures aimed at regaining control of what is a worrisome acceleration of infections. Rather, it is to ensure changes in behavior and policy that allow for healthier and sustainable economic reopenings during this tricky period,” El Erian says.

Enterprise+: Last Night’s Talk Shows

It was a busy night on the airwaves last night, with the talking heads focused on the latest updates (or lack thereof) on the GERD negotiations and the harassment scandal taking over social media.

GERD update: Al Kahera Alaan’s Lamees El Hadidi also covered the GERD talks, speaking with Mohammad El Sibai, the spokesperson for the Irrigation and Water Resources Ministry, who said that each country’s technical and international legal committees were being listened to separately (watch, runtime: 57:20). Meanwhile, Masaa DMC's Eman El Hosary spoke with the head of the Cairo University’s International Law Department, Mohamed Sameh Amr, who said that this round of talks are focused on the technical issues, which he said weren’t significant sticking points (watch, runtime: 7:32). El Hekaya’s Amr Adib (watch, runtime: 2:10) and Al Hayah Al Youm’s Lobna Assal (watch, runtime: 5:59) also covered the talks.

Alleged repeat [redacted] offender in spotlight: El Hadidi spoke with Nihad Abu El Qumsan, the lawyer and head of the Egyptian Center for Women's Rights, who discussed the numerous calls she received from women who filed complaints against a former AUC student at the center of [redacted] assault and harassment case receiving widespread media coverage. Abu El Qumsan said that the women face an unfriendly environment when filing official complaints with prosecutors and that their anonymity is not always safeguarded (watch, runtime: 13:07). Adib spoke with the head of the National Council for Women, Maya Morsi, who said she received more than 100 separate complaints against the individual. She encouraged the women to pursue their complaints, assuring them that they will remain confidential and that they’ll receive the council’s full support (watch, runtime: 4:52). Assal also covered the story (watch, runtime: 11:55).

El Kabbaj on pensions in FY2020-2021: El Hosary spoke with Social Solidarity Minister Nevine El Kabbaj, who said that the total increase in the pensioners’ fund this year is EGP 60 bn, including EGP 35 bn for new bonuses for some 2.4 bn beneficiaries. She said that the ministry is considering extending the bonuses to the private sector, especially press institutions. She added that there are also plans to invest the takaful and karama pensions (watch, runtime: 3:02).

Mosque festivities ban: El Hosary also highlighted the Endowments Ministry’s statement on prohibiting any celebrations or religious ceremonies in mosques or their surrounding areas as a covid-19 precaution. The statement stressed that violators will see their mosques shuttered (watch, runtime: 1:42).

Speed Round

Speed Round is presented in association with

INVESTMENT WATCH- IFC, France and Denmark give Saudi’s Humania USD 108.5 mn to invest in healthcare in Egypt, Morocco: The International Finance Corporation, France’s Proparco and the Danish Investment Fund for Developing Countries are providing a USD 108.5 mn equity financing package to Saudi healthcare investment fund Humania to establish specialized medical facilities in Egypt and Morocco, the IFC said in a statement. Humania, part of the Saudi health group Bait Al Batterjee, plans to construct a “medical tower” in Cairo and a new hospital in Alexandria, as well as a hospital in the Moroccan eco-city of Zenata. The two hospitals will contain almost 600 inpatient beds and 240 outpatient clinics between them, the statement says, but does not make clear how much of that is in Alexandria and how much would be in Zenata. The IFC is investing USD 45 mn, IFU is contributing USD 43.5 mn, and Proparco is providing the remaining USD 20 mn.

The Humania news comes as Batterjee ramps up operations in Egypt: The Saudi German Hospitals Group pledged last year to pump EGP 40-50 bn into its Egypt operations over the next 15 years. The group had previously said it was looking for finance from the IFC for its expansion drive, which in addition to Batterjee Medical City in Alexandria will include a new hospital in Cairo.

The IFC estimates that Egypt will need some USD 60 bn in investment in healthcare by 2050 “to meet rising demand.”

Azimut launches its Egypt-focused equity fund: Italy-based asset manager Azimut has launched AZ Equity-Egypt, a fund that will invest in Egyptian equities headquartered in Luxembourg, according to a press release. Managing Director Ahmed Aboul Saad said last year that the fund would launch with USD 10 mn in capital. AZ Equity-Egypt is looking to secure USD 50 mn in AUM “as a first stage,” with a portfolio of 20-30 “high-conviction” Egyptian stocks. The fund is targeting Egyptian expats and investors in the GCC, as well as European investors.

The fund’s launch comes as Egypt’s economic reforms have made the country “one of the most attractive stories in the emerging markets universe,” particularly as Egypt is widely expected to be the only country in the MENA region to register positive GDP growth this year amid the covid-19 pandemic, Aboul Saad said. “Despite this backdrop, Egypt’s stock market is yet to capture the benefits of the transformation, reflected in attractive valuations for publicly-listed equities” compared to emerging market peers, he said.

DEBT WATCH- UK’s CDC provides CIB with USD 100 mn in tier 2 capital: Leading private sector bank CIB has received USD 100 mn in tier 2 capital under a financing agreement with UK government’s development finance arm, CDC Group, according to a British embassy statement. The facility, for which CIB and CDC signed an MoU earlier this year at the African Investment Summit in London, is in line with CIB’s “ongoing plan to further consolidate its capital base and support the bank’s future growth plans as we all look to get out of these unprecedented times stronger,” said our friend CEO Hussein Abaza.

What is tier 2 capital? Tier 2 capital forms a part of a bank’s capital reserves. Unlike core capital listed as tier 1 (such as reserves and equity capital), tier 2 is comprised of assets considered more unreliable or risky due to being more illiquid or being harder to quantify.

Advisors: Sharkawy & Sarhan Law Firm advised CDC Group on the agreement.

Your next mobile phone is definitely going to cost more as it is hit with two surtaxes: Imported mobile phones look set to be hit with two new taxes after local reports suggested over the weekend that the National Telecom Regulatory Authority’s 5% import fee will be imposed in addition to a 5% industry development fee. The NTRA last week announced that it would impose a 5% fee on imported mobile phones, which we assumed referred to the development fee passed by lawmakers in May. But industry figures have suggested that the NTRA levy has been introduced in addition to the 5% development fee imposed by the Finance Ministry.

The news has some retailers suggesting the fees will see sales contract as companies will have no choice but to pass the new levies directly on to consumers. The NTRA fee will be 5% of the customs value of any handset. The 5% development fee will be charged on the final price of a handset after VAT and any other taxes or fees. Only locally assembled handsets (of which there is only the Sico entry at present) are exempt from the fees.

Suez Canal bank to launch EGP 250 mn money market fund this month: The Suez Canal Bank will this month launch its first money market fund, Suez Daily, with EGP 250 mn in capital, the local press reports. The fund will offer daily subscriptions in short and medium-term financial instruments including bonds, treasury bills, bank deposits, and savings certificates, Chairman and Managing Director Hussein Rifai said.

CI Capital Asset Management, CI Capital Holding’s subsidiary, will manage the fund.

EFG Hermes topped the EGX’s brokerage league table in June with a market share of 14.1%, according to EGX figures (pdf), leaving the outfit in pole position for the first half. Our friends at Pharos came in second with a market share of 12.3%, followed by Pioneers (10%), CI Capital (8.2%), Beltone (4.5%), and Naeem (3.4%).

CABINET WATCH- Cabinet approves changes to Bankruptcy Act to further distinguish between creditors: Creditors will have more power to decide the future of bankrupt businesses if legislative amendments approved by the cabinet on Wednesday were to pass, Under the bankruptcy code, creditors would be able to vote on whether their debtors can continue operating, be placed into administration or liquidate their assets. The legislative changes passed by cabinet would also allow debtors to request bankruptcy protection, the statement notes without going into further detail.

Background: Passed in 2018, the landmark bankruptcy law effectively decriminalized bankruptcy by abolishing prison sentences. It also allowed companies more time and options for restructuring by introducing mechanisms to help settle commercial disputes outside the courtroom and simplify bankruptcy proceedings.

Cabinet’s weekly meeting also signed off on recent multilateral agreements. Including two with France’s AFD (background here and here) and a third to receive a EUR 200k grant from the Spanish Agency for International Development Cooperation for a female empowerment initiative in Upper Egypt. A fourth agreement will see Egypt receive a KWD 75 mn facility from the Arab Fund for Economic and Social Development to fund the construction of the USD 1 bn Bahr El Baqar water treatment system.

Cabinet also greenlit plans to set up new nonprofit universities in New Mansoura, New Alamein and Galala City and establish the King Salman International University, which will have three branches across South Sinai.

BUDGET WATCH- The House Planning and Budgeting Committee on Wednesday signed off on a EGP 80 bn overdraft for the FY2019-2020 state budget, Al Masry Al Youm reported. The overdraft was required to pay off the Electricity Ministry’s EGP 102 bn debt to the Oil Ministry and another EGP 50 bn first instalment on a EGP 160.5 bn debt to the state pension fund, Finance Minister Mohamed Maait said.

The governor of the Central Bank of Egypt if now a permanent member of two cabinet committees responsible for resolving disputes with investors, the local press reports, quoting a cabinet decision and statements from CBE sources. Tarek Amer, the current CBE governor, will assume the seat until his ongoing four-year term ends in 2023.

MOVES- Amr El Kady (Linkedin) has stepped down as managing director and executive vice president of Talaat Moustafa Group after less than five months in the role, according to Hapi Journal. He assumed the position in February after leaving his position as CEO of City Edge Developments.

EARNINGS WATCH- Qalaa Holdings’ revenues soared 191% y-o-y in 1Q2020 to EGP 10.4 bn, the company said in its quarterly earnings release (pdf). The revenue growth came as Qalaa’s flagship greenfield Egyptian Refining Company — which began operating at 100% capacity in 2019 — began booking sales revenue as an operational asset. ERC brought in EGP 6.8 bn in revenues, accounting for 66% of Qalaa’s topline. Qalaa Holdings booked a consolidated net loss after minority interest of EGP 405.1 mn in 1Q2020 against a net loss of EGP 154.6 mn in 1Q2019.

Qalaa expects the “serious challenges” posed by the covid-19 pandemic to persist in 2Q2020 and beyond, including the “dislocation” of oil and petroleum product markets globally, but the company is still confident that ERC will be able to “deliver significant incremental value to Qalaa’s bottom-line in due time,” said co-founder and Managing Director Hisham El Khazindar. Qalaa Chairman Ahmed Heikal also said the company is maintaining a positive outlook despite the pandemic and has no plans for layoffs at this time.

The Macro Picture

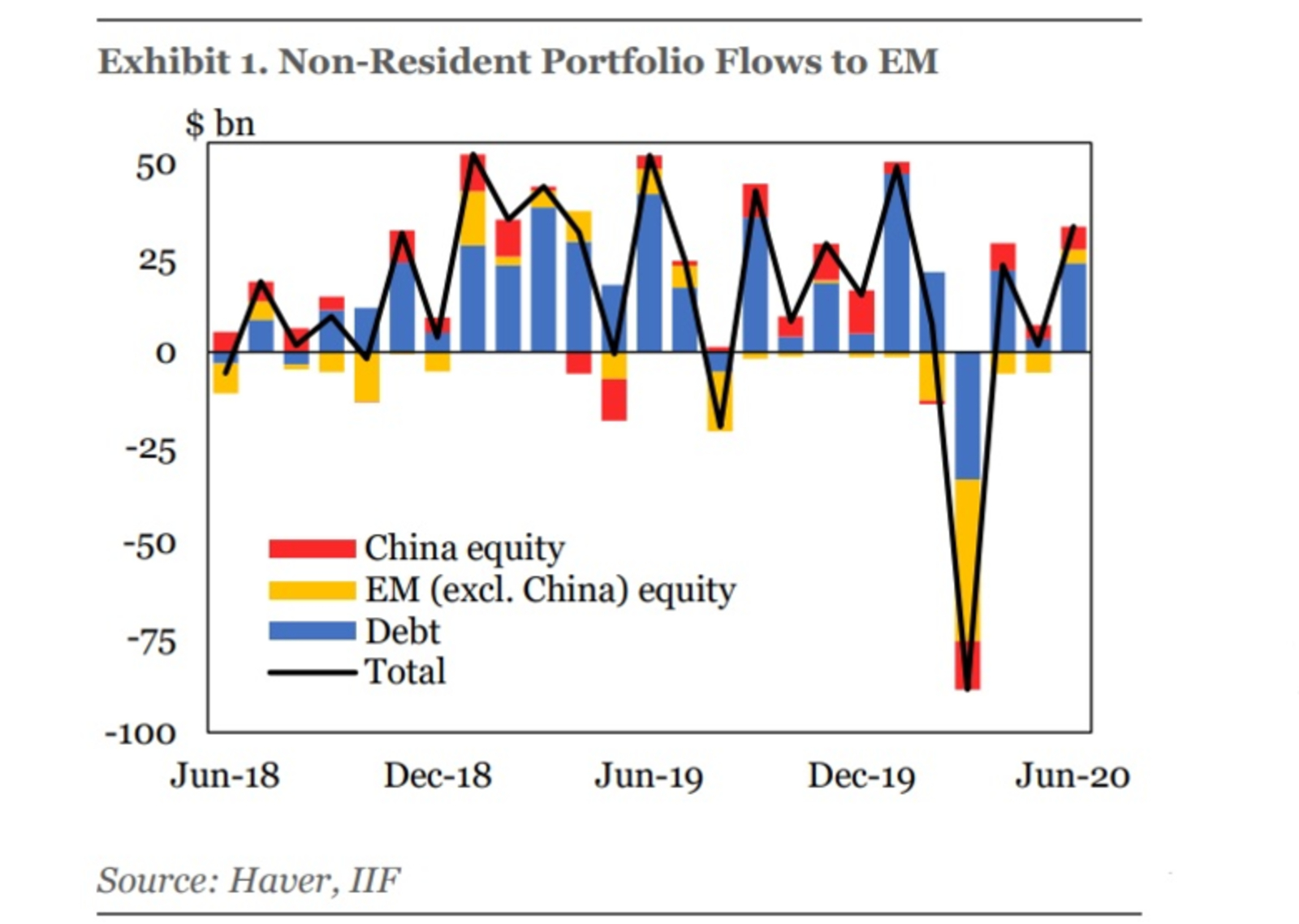

Net portfolio inflows to emerging markets continued to recover in June, soaring to USD 32.1 bn from USD 3.5 bn in May, according to the Institute of International Finance’s (IIF) most recent capital flows tracker.

Equity flows also turned positive again from a negative performance in May, with USD 3.4 bn in flows entering emerging markets excluding China. Debt flows also continued to recover “at a healthy pace” last month to reach USD 23.5 bn.

The more than tenfold month-on-month rise in non-resident inflows reflects a shift in sentiment from where it was in March, when “negative sentiment on emerging markets approached extreme levels,” the IIF said. This shift reflects “deeply discounted valuations in many places, which mean that adverse economic outcomes and weak growth are largely priced,” according to the report. Capital markets that were most severely affected by the fallout from the pandemic are starting to pick back up, the IIF says. However, the report warns that the recovery will largely depend on the policies EMs put in place to “catalyze” the process, and that investors will generally be more discerning when choosing where to direct their investments.

Egypt in the News

Egypt’s gradual economic and touristic reopening following a three-month closure is getting some digital ink in the foreign press this morning, including Euronews and France’s AFP (which focused on the return of trips to the Pyramids) and Voice of America (which published an image gallery of the cautious return of life to Cairo).

Also from Planet Economy: The IMF should impose more conditions on its funding to Egypt to reduce the role of enterprises run by state entities in the economy and increase auditory oversight, AUC’s Amy Austin Holmes writes for Foreign Policy.

From Planet Politics: The US “must cut a path [out] of alliances with Turkey, Israel, Egypt and Saudi Arabia,” Hisham Melhem of Washington’s Gulf States Institutes writes for the Financial Times. Meanwhile, the Economist argues that “Egypt, Ethiopia and Sudan must learn how to share the Nile river” or else “squabble over water could turn nastier.”

LGBT groups are urging Facebook to take action on hate speech in the MENA region in response to a surge in hateful content following the death of LGBT activist Sarah Hegazy last month, Reuters reports.

Court upholds 15-year jail term for 2011 activist: The Court of Cassation yesterday upheld the 15-year jail sentence handed to Ahmed Douma, one of the leading opposition activists during the 2011 revolution, in 2015. The Associated Press and Xinhua noted the story.

Diplomacy + Foreign Trade

No progress on GERD talks as “fundamental” differences persist, Egypt says: Renewed talks over the Grand Ethiopian Renaissance Dam (GERD) at the weekend failed to find a breakthrough, with the Egyptian Foreign Ministry announcing that there are still “fundamental” differences over the legal and technical aspects of the dam. The three countries agreed last month to resume talks in a last-ditch effort to reach a final agreement on GERD before Ethiopia begins filling the dam’s reservoir later this month. The negotiations — which will focus on pending legal and technical issues, including how to monitor water flow and handle dry years — are being brokered by the African Union.

The Trade and Industry Ministry will keep in place 55-74% anti-dumping duties on synthetic fiber blankets imported from China until August 2025, according to a ministry statement (pdf). The five-year renewal came after members of the Federation of Egyptian Industries requested the ministry refrain from lifting the tariffs, saying that doing so would result in the products being dumped in the Egyptian market again. The ministry will also launch a probe to impose protective tariffs on Turkish synthetic carpets, it said yesterday.

Suez Canal annual revenues were effectively unchanged in FY2019-2020 despite falling towards the end of the year due to the covid-19 pandemic, Reuters reports. Revenues for the year came in at USD 5.72 bn, down only slightly from USD 5.75 bn the previous year. Receipts in the month of May fell 9.6% y-o-y due to the slowdown in global trade caused by the virus, head of the Suez Canal Authority Osama Rabie said last month.

In related news, the Suez Canal Authority is offering an 8% rebate for ships launching from northwest Europe and then travelling directly from Spain’s Santander Port to the Port of Singapore, according to an authority circular (pdf).

Energy

Eni makes new gas discovery in Egypt’s Nile Delta

Italy’s Eni has made a new gas discovery after drilling the first well at its North El Hammad exploration block in the Nile Delta, on the Bashrush prospect, the company said in a statement. The company said it had discovered a 152-meter gas column which it will test for production with partners BP and Total. The prospect is located north-west of the producing Baltim South West and Nooros fields.

Real Estate + Housing

NACCUD signs land sale agreements in new capital with 12 companies

The New Administrative Capital Company for Urban Development (NACCUD) has signed land sale agreements with 12 local companies in the new capital, company head Ahmed Zaki Abdeen said, according to Hapi Journal. The sales come after NACCUD reduced the required down payment to 10% of each land plot’s total value, from 20% initially. NACCUD plans to roll out more incentives on land purchases, Abdeen said, without providing further details.

Automotive + Transportation

14 rail signal projects to be completed this year

Fourteen railway signalling systems being upgraded by Thales International will be completed by December 2020, said Transport Minister Kamel El Wazir according to a cabinet statement. The total cost of the upgrade and installation project will come to some EGP 46.8 bn.

Banking + Finance

Palm Hills seeks EGP 400 mn following debt restructuring to develop The Crown

Palm Hills Developments is reportedly in talks with seven banks to restructure its EGP 1.24 bn debt and borrow an additional EGP 400 mn to expand its Crown development in Sixth of October, Al Shorouk reports, citing unnamed sources. The banks are said to include Attijariwafa Bank Egypt, Emirates NBD, First Abu Dhabi Bank, Al Ahly Bank of Kuwait, the Suez Canal Bank, Mashreq Bank, and the AAIB.

Mashreq Bank managing USD 360 mn loan for Evergrow’s fertilizer project in Sadat city

The UAE’s Mashreq Bank is reportedly arranging a USD 360 mn facility for Evergrow Speciality Fertilizers to restructure its debt and complete the third phase of its fertilizer plant in Sadat City, Al Shorouk says, citing unnamed sources. The newspaper claims Mashreq gauging the appetite of local and Gulf banks who may participate. Some USD 275 mn of the loan will go toward restructuring the company’s outstanding debt.

Damietta Furniture withdraws EGP 1 bn loan installment

Damietta Furniture City has drawn down EGP 1 bn of its EGP 1.5 bn syndicated facility taken out from a consortium of local banks to finance working capital, Al Shorouk reports.

Egypt Politics + Economics

Egypt’s prosecutor general investigates 22-year-old’s alleged [redacted] assault of 100+ girls, women

A man accused of harassing more than 100 Egyptian women has been arrested and will face prosecution, a security source told Masrawy. More than 100 women have said on social media since Wednesday that a 22-year-old man [redacted] harassed, assaulted, and blackmailed them over the past several years, but the public prosecutor said yesterday that only one formal complaint had so far been submitted. The American University in Cairo, which the man previously attended, said on Thursday that he left the institution in 2018. It is unclear whether he was dismissed. AFP and Arab News also had the story, which has been making waves on social media over the long weekend.

Courts reduce sentences for monk in 2018 bishop murder, policeman who killed activist Shaimaa El Sabbagh

A Cairo court has reduced the sentence handed down to Ramon Mansour — one of two monks found guilty of killing a bishop at the St. Macarius Monastery in 2018 — to life in prison, from a death sentence, Reuters reports, citing a judicial source. Mansour had appealed the initial ruling. The second monk arrested for aiding the murder had his appeal rejected an still faces execution. The Court of Cassation, Egypt’s highest appeals court, also reduced to seven years the 10-year prison sentence handed to the police officer who killed activist Shaimaa El-Sabbagh in 2015 during a peaceful protest, according to the newswire. The officer was first sentenced to 15 years in prison in 2015.

On Your Way Out

Egypt has begun the USD 3.7 mn renovations of the historic Suez Canal House in Port Said, according to Al Masry Al Youm. The monument was designed by a French architect in the 1890s during the reign of Khedive Abbas Helmy II to accommodate important visitors. The house was also used by the British forces during the tripartite aggression in Port Said in 1956.

The Market Yesterday

EGP / USD CBE market average: Buy 16.08 | Sell 16.18

EGP / USD at CIB: Buy 16.09 | Sell 16.19

EGP / USD at NBE: Buy 16.07 | Sell 16.17

EGX30 (Tuesday): 10,765 (+0.1%)

Turnover: EGP 1.1 bn (34% above the 90-day average)

EGX 30 year-to-date: -22.9%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.1%. CIB, the index’s heaviest constituent, ended down 0.7%. EGX30’s top performing constituents were Porto Group up 6.1%, Sodic up 3.5%, and Credit Agricole up 3.0%. Tuesday’s worst performing stocks were Dice down 1.9%, Egypt Kuwait Holding down 1.1% and CIB down 0.7%. The market turnover was EGP 1.1 bn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -120.1 mn

Regional: Net short | EGP -20.5 mn

Domestic: Net long | EGP +140.5 mn

Retail: 64.0% of total trades | 62.1% of buyers | 65.9% of sellers

Institutions: 36.0% of total trades | 37.9% of buyers | 34.1% of sellers

WTI: USD 40.32 (-0.81%)

Brent: USD 42.80 (-0.79%)

Natural Gas (Nymex, futures prices) USD 1.75 MMBtu, (+0.92%, August 2020 contract)

Gold: USD 1,787.30 / troy ounce (-0.15%)

TASI: 7,312 (+0.81%) (YTD: -12.84%)

ADX: 4,311 (+0.62%) (YTD: -15.05%)

DFM: 2,061 (-0.14%) (YTD: -25.44%)

KSE Premier Market: 5,599 (+0.59%)

QE: 9,211 (+1.37%) (YTD: -11.64%)

MSM: 3,511 (-0.18%) (YTD: -11.79%)

BB: 1,274 (+0.17%) (YTD: -20.86%)

Calendar

23 July (Thursday): 23 July revolution anniversary, national holiday.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

11-12 August (Tuesday-Wednesday): Senate elections take place.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

23-31 October (Friday-Saturday): Updated dates for El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

12-15 May (Wednesday-Saturday): Eid El Fitr (TBC).

10 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

22 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.