- Our international airspace officially reopens this morning as we slide into a three-day weekend. (What We’re Tracking Today)

- A gold deposit with > 1 mn ounces was discovered in the Eastern Desert. (Speed Round)

- Expect to pay more for your next mobile phone. (Speed Round)

- Passenger car sales fell in May as the sector has yet to recover from the pandemic’s consumer demand slump. (Speed Round)

- Seven would-be consumer finance companies want to enter the increasingly crowded industry. (Speed Round)

- What risks lie in store for us over the next 18 months? (Image of the Day)

- 2020 is the year green bonds become real in Egypt. (Hardhat)

- The Market Yesterday

Wednesday, 1 July 2020

International flights resume today — the perfect note on which to start our long weekend

TL;DR

What We’re Tracking Today

Welcome to the first day of 2H2020, everyone — offering faint hope of a new start after a period in which the (only?) winners globally appear to have been investors in US equities, as Wall Street closed yesterday its best quarter in more than 20 years. The Dow and S&P have trimmed their losses for the year to single digit percentages, while the Nasdaq is now up 12% since 1 January (which feels like what … three years ago?). Closer to home, the EGX30 is down 22.9% year-to-date.

It’s also the first day of the state’s new fiscal year, with electricity prices set to rise 16-30%, a new 1% surtax on all employee salaries expected to go into effect for one year, and a 14% rise in pensions becoming effective this morning.

Don’t look now, but there’s another virus brewing in China with pandemic potential — and it could be a nasty one. Top US virus expert Dr. Anthony Fauci warned yesterday that there is an emerging strain of swine flu found showing similarities to H1N1 and the 1918 flu, which he said health officials are “keeping a close eye on.” The strain — dubbed G4 EA H1N1 — hasn’t yet been detected in humans but shows the potential for “reassortment capabilities” that could see it mutate into a contractible virus, MSNBC reports. It’s not “an immediate threat where you're seeing infections, but it's something we need to keep our eye on,” Fauci said.

What to do is simple enough that even a first-year analyst can model it: “We find a national [facemask] mandate could … cut the daily growth rate of confirmed cases by 1.0pp to 0.6% … a face mask mandate could potentially substitute for lockdowns that would otherwise subtract nearly 5% from GDP,” Goldman Sachs writes, speaking to the situation in the United States.

On a much brighter note: Our international airspace officially reopens this morning, allowing regularly scheduled commercial flights in and out of the country for the first time since the government imposed a ban in March.

The first EgyptAir flight taking off from Cairo today is heading to London, Al Masry Al Youm reports, citing an unnamed source at Cairo International Airport. The flight is expected to depart at 9:10am with 265 passengers on board. EgyptAir has 25 active destinations as of this morning, with six more scheduled to start between 8 and 15 July. Not on the list: Turkey, where flights are unlikely to resume before August, Masrawy reports, citing aviation ministry sources.

Egypt is the #1 destination for Emiratis looking for a post-lockdown holiday, according to data provided by travel search engine Wego, the National reports. Would-be holidaymakers are mostly searching for bookings to Egypt, while India, the Philippines, Turkey and Sudan rounded off the top 5, the company said.

If you’re not a citizen, you’re not headed to the EU anytime soon. Egypt isn’t on the final list of 14 countries whose residents will be allowed into the Schengen area, which is starting to reopen to outside visitors today. The main criteria for inclusion on the list is an infection rate below 16 per 100k people and a declining new case rate.

Don’t worry, you won’t be rubbing elbows with the Griswolds if you are indeed able to make it to Europe. The US has also been left off the list.

So who is allowed to plan a European vacation? The list includes Algeria, Australia, Canada, Georgia, Japan, Montenegro, Morocco, New Zealand, Rwanda, Serbia, South Korea, Thailand, Tunisia, and Uruguay. Incoming travelers from China will also be permitted to enter Europe — making it 15 countries — if China moves to allow European travelers to enter its borders.

PSA- You’re off work tomorrow as Egypt observes the anniversary of the 30 June Revolution. We’re off, too, but will be back in your inboxes at the appointed hour on Sunday morning. Enjoy the break, everyone.

PSA #2- State banks and the Egyptian Exchange are closed today and tomorrow.

News triggers coming up in July:

- The purchasing managers’ index for June is due on Monday, 6 July.

- Foreign reserves figures for June should be out sometime next week.

- Inflation: Inflation data for June will land Thursday, 9 July.

COVID-19 IN EGYPT-

The Health Ministry confirmed 81 new deaths from covid-19 yesterday, bringing the country’s total death toll to 2,953. Egypt has now disclosed a total of 68,311 confirmed cases of covid-19, after the ministry reported 1,557 new infections yesterday. We now have a total of 18,460 confirmed cases that have fully recovered.

CBE extends tenor of special tourism loans to three years: Hotels, tour operators, restaurants, and tourism transport companies can now apply for credit facilities with a tenor of three years (including a one-year grace period) to pay wages, commitments to suppliers, and maintenance, the Central Bank of Egypt (CBE) said in a circular to banks. The CBE had originally allowed the hard-hit companies to obtain soft loans with a two-year tenor when it launched the pandemic relief initiative in March. The initiative came as part of a EGP 50 bn tourism support package the CBE deployed last year.

Restaurant and cafe owners don’t want the government to permanently shorten their opening hours: Some eateries want to be allowed to remain open until midnight once covid-19 restrictions are fully lifted, Cairo Chamber of Commerce Vice President Sameh Zaki tells Al Mal. The government has tasked the Federation of Egyptian Chambers of Commerce with running a survey among retailers and eatery owners to gauge their opinions on plans to permanently impose a closing time of 9pm for shops and malls, and 10pm for restaurants and coffee shops, according to Zaki. Retailers are reportedly happy closing their doors anytime between 7pm and 9pm.

Masks will be made available to citizens with ration cards starting this month, with the Trade Ministry aiming to distribute 19 mn masks by the end of July, according to a statement. Each ration card holder will be entitled to two masks per month.

Vezeeta announces health awareness partnership with MSD Egypt: Digital healthcare startup Vezeeta is partnering with MSD Egypt to run a series of nationwide health awareness campaigns targeting doctors and patients using digital tools, it announced in a press release (pdf). The initiative will provide doctors and patients with accurate medical information and scientific updates from MSD using Vezeeta’s platform and digital channels in Egypt.

Prime Minister Moustafa Madbouly’s media advisor, Hany Younes, has recovered from covid-19 following two weeks spent quarantining at home, he said in a statement.

DONATIONS-

Huawei has donated 10k masks to Egypt’s National Press Authority to distribute among local media offices, according to a statement.

ON THE GLOBAL FRONT-

The US could soon see 100k new covid cases a day, White House coronavirus advisor Anthony Fauci warned yesterday. The news is front page on both sides of the Atlantic this morning.

The UK economy suffered a deeper contraction than first thought, falling 2.2% in 1Q2020 in the biggest drop since 1979, revised figures showed yesterday. The official statistics agency originally estimated that GDP fell 2%.

US bankruptcy filings surged to a seven-year high as more than Over 3.4k companies filed for Chapter 11 protection under US law between the start of the year and 24 June, reports the Financial Times. This is the highest number since 2013, in comparative terms, and teeters very close to the 3,491 filings during the full first half of the 2008 crisis year. Among those filing were Canada’s Cirque du Soleil, car rental giant Hertz and shale drilling pioneer Chesapeake Energy.

Shell running massive asset impairment test: Royal Dutch Shell could slash by up to USD 22 bn the value of oil and gas assets it believes have been impaired by the pandemic’s blow to energy demand, Reuters reports. Plans to write down the value came after the fuel giant cut its forecast for energy prices through 2023 as it expects a slow recovery post-covid.

AND THE REST OF THE WORLD-

Adidas, Reebok, Clorox, Conagra, Denny's and Ford have joined the ranks of big businesses boycotting Facebook advertising after Founder Mark Zuckerberg’s attempts to spread oil on troubled waters did little to satiate the #StopHateForProfit campaign, according to CBS News. So far, over 100 brands have pledged to boycott the Facebook (and, in many cases, other social media platforms), causing Facebook’s shares to drop more than 8% last week. Also on the full list of known boycotters: Starbucks, Levi’s, Hersheys, Unilever, Coca-Cola, and Verizon.

Microsoft also pulled its Facebook ads, but said the decision was unrelated to the campaign, according to Axios. Microsoft suspended ads in May after seeing them come up next to inappropriate content such as hate speech and terrorist content. The news comes days after the tech giant said it was permanently closing its retail stores.

Almost a third of the world’s biggest brands might suspend spending on social media, according to a survey by The World Federation of Advertisers (WFA), reports The Financial Times. Don’t give them too much credit, though: It’s an easy way to turn budget cuts into an easy “earned PR win.”

China approved its controversial national security law for Hong Kong yesterday, which will require the city to form a security committee responsible that answers to the government in the mainland, the Associated Press reports. The move threatens the city’s status as Asia’s financial capital, the FT’s James Kynge writes.

Uber is finalizing talks to acquire food delivery start-up Postmates, as the latter is ramping up preparations for an IPO. The ride-hailing giant was looking to acquire delivery rival Grubhub, but Europe’s Just Eat takeaway beat it to the punch weeks ago, the Financial Times reports.

India could join 5G boycott of Huawei: India could block Chinese tech giant Huawei from getting involved in the rollout of 5G infrastructure, only months after giving it the green light to participate in trials, CNBC reports. The news comes amid increasing tensions between the two Asian powers: military skirmishes on the contested border have become increasingly frequent this year while Delhi announced on Monday that it would ban almost 60 Chinese apps including TikTok on grounds of national security.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: Despite all that’s happening with covid-19 (or maybe in spite of it), 2020 is the year Egypt will begin issuing its first green bonds. On deck first: Our friends at CIB. In conversations with CIB and the Finance Ministry, we explore details of the issuance, and how they might work during the covid-19 crisis. We also look at how the government plans to push ahead with its own green bond issuance and how the instruments might be the harbinger of further debt diversification.

Enterprise+: Last Night’s Talk Shows

The talking heads divided their attention last night between the anniversary of the 30 June revolution and the ongoing talks on the Grand Ethiopian Renaissance Dam. Yahduth fi Misr’s Sherif Amer had a chat with political pundit Abdel Moneim Said about how Egypt’s government has been faring over the seven years since the revolution (watch, runtime: 2:56). ‘Ala Mas’ouleety’s Ahmed Moussa had a lengthy segment reminiscing about the ouster of the Ikhwan (watch, runtime: 43:04).

Shoukry on the UN Security Council’s GERD talks: Foreign Minister Sameh Shoukry had a chat with Masaa DMC’s Ramy Radwan to recap Monday’s UN Security Council meeting on the Grand Ethiopian Renaissance Dam, which Egypt took as a chance to clearly present its vision for talks. The minister noted that members of the council are deliberating a draft resolution Egypt put forth on the talks that would give international impetus to reach an agreement (watch, runtime: 9:50).

The Ethiopian press isn’t exactly full of praise for Egypt’s move to take the issue to the Security Council and is calling on the UN to refrain from intervening in the matter and instead leave it to the African Union, Ahmed Moussa noted (watch, runtime: 7:52). Saudi Arabia offered Egypt support, reaffirming in a statement that Egypt and Sudan’s water security are part and parcel of the Arab world’s national security, Moussa noted (watch, runtime: 1:57).

Two tourist flights are expected to land in Egypt this morning as we reopen our international airspace, Tourism Minister Khaled El Enany told Yahduth fi Misr’s Sherif Amer, who also had a chat with EgyptAir CEO Roshdy Zakaria about the national flag carrier’s resumption of international commercial flights (watch, runtime: 2:46 and runtime: 4:35).

Speed Round

Speed Round is presented in association with

A gold deposit estimated to hold over 1 mn ounces was discovered in the Eastern Desert’s Iqat region, the Oil Ministry said in a statement. The deposit, which also contains other minerals, is located in state-owned Shalateen Mining Company’s concession area. The area could see investments of more than USD 1 bn over the next 10 years to develop the deposit.

Shalateen will set up a JV with the Egyptian Mineral Resources Authority to mine the area, the statement notes. This will make the JV the third gold mine operator in Egypt alongside the government’s partnership with Centamin to operate the Sukkari gold mine and the Hamash Company, a JV between the state and Cyprus’ Matz Holding. Reuters also noted the find.

This comes amid an ongoing international exploration tender: EMRA kicked off the country’s first international bid round for gold and mineral exploration in March and will accept bids until 15 September for a 56k sqkm exploration area in the Eastern Desert, close to where the discovery announced yesterday was made.

The bid round is the first time the industry tests the investor-friendly amendments to the Mineral Resources Act which scrapped production sharing agreements in favor of a more attractive tax, rent, and royalty model.

Expect to pay more for your next mobile phone: The National Telecom Regulatory Authority (NTRA) issued a decision yesterday imposing a new 5% fee on imports of all mobile phones as of today. The fee will essentially apply to all phones sold in Egypt, with the exception of those assembled by Egyptian electronics outfit Sico. Importers are widely expected to pass the hike directly on to consumers to protect what Al Mal says industry players claim are their “their already slim profit margins.”

It’s likely (but still unclear) that this is the 5% development fee the government plans to impose on mobile phones and accessories as the Finance Ministry looks to plug its fiscal deficit. The ministry previously said the development fee would be imposed on the total cost after tacking on VAT and other taxes.

Passenger car sales fell 17% y-o-y last May to 8,091 vehicles, as the sector has yet to recover from a consumer demand slump in response to the pandemic, distancing measures, and the partial lockdown of the economy, according to figures from the Automotive Information Council (AMIC). Truck sales also fell 17% y-o-y to 2,176 vehicles. In stark contrast, bus sales soared 57% y-o-y to 1,862 units, from 1,186 in May 2019. Chevrolet remained the best-selling brand across all segments, which includes commercial vehicles such as pickup trucks — while Renault, Toyota, and Hyundai topped the passenger car league table.

The drop in May’s car sales was less pronounced than in April, when sales plummeted by nearly a quarter y-o-y. Car companies saw business grind to a near-complete standstill when the government introduced the virus containment measures towards the end of March. New vehicle licensing was also suspended and traffic police offices were only reopened in May.

DISPUTE WATCH- Adeptio loses appeal Americana MTO dispute, receives new fair value study: An administrative court has rejected Adeptio’s appeal against a Financial Regulatory Authority (FRA) decision requiring it to mount a mandatory tender offer (MTO) for its acquisition of a minority stake in the Egyptian International Tourism Projects Company (Americana), according to a disclosure to the EGX (pdf). Adeptio had lost an appeal in February against the market regulator’s decision to reject the MTO last November. The FRA received a fair value assessment by Adeptio’s new financial adviser, Ernst & Young, it said in a statement (pdf).

Background: Adeptio was ordered last year to submit an MTO for an outstanding 9.563% of Americana Egypt’s shares, after it acquired a 67% stake in parent company Kuwait Food Company (Americana) and gained indirect ownership of more than 90% of the subsidiary’s shares. Adeptio initially claimed it should not be required to submit an MTO, but after a few denied appeals, the company submitted an offer based on a study by Fincorp. Americana’s minority shareholders rejected the offer and appointed a new financial adviser after Fincorp was suspended from carrying out valuation studies for three months by the FRA.

DISPUTE WATCH- Medhat Khalil pays EGP 10 mn fine to FRA over Raya ownership limits: Medhat Khalil has paid an EGP 10 mn fine the Financial Regulatory Authority (FRA) had handed him last year after it said he had crossed the ownership threshold that would require him to mount a mandatory tender offer for 100% of the company he founded, Youm7 reports. The Cairo Economic Court had ruled in January in the FRA’s favor, slapping the Raya Holding chairman with a EGP 110 mn fine. Khalil went on to appeal the Cairo Economic Court’s ruling.

Khalil’s decision to pay the original EGP 10 mn fine comes ahead of a Sunday hearing in the case, which now appears set to be closed.

Seven consumer finance companies have license applications in with the FRA to formally join an increasingly crowded industry, Al Mal reports, citing unnamed sources with knowledge of the matter. The newspaper suggests there are as many as 25 consumer finance companies that need to finish their license applications, with the FRA expecting to have licensed as many as 30 players by the end of the year. Egypt will have 10 licensed companies if the seven applications now under review win FRA approval, the newspaper says.

Where things stand: Sarwa Capital’s Contact and Raya Holding’s Aman became the country’s first to obtain consumer finance licenses in April, under the new Consumer Credit Act. EFG Hermes’ valU, Premium Card, and CI Capital’s Souhoola have also applied for licenses.

The FRA announced new solvency standards for consumer finance companies earlier this week, limiting to 10% of their capital base their lending to single borrowers, and to 9x their equity value the loans they are allowed to take out. The regulator also said new capital requirements will be introduced without providing specifics.

Edita Industries has expanded its cake segment with the launch of upsized strawberry- and chocolate-flavored HoHos, according to a press release (pdf) from the company. The new products will retail at EGP 2 per pack. The company’s cakes segment, which includes Twinkies, HoHos, Tiger Tail, and Todo products, account for the lion’s share of the company’s revenues, the snackfoods maker says.

Housing and Development Bank lands investment banking license: The Housing and Development Bank has landed a license from the Financial Regulatory Authority allowing it to offer promoting and underwriting services, according to an EGX disclosure (pdf). The license is the core permit to offer investment banking advisory services, including taking IPOs and other equity transactions to market.

EU to provide EUR 24.8 mn grants to renewable energy in Egypt: The EU will give Egypt a EUR 24.8 mn grant to expand the EBRD’s Green Energy Financing Facility (GEFF), which it launched to help Egyptian businesses invest in renewable energy, according to a press release. Extending credit through banks to green and energy-efficient Egyptian businesses is a strategic priority for the EBRD, the bank’s managing director for the SEMED region Heike Harmgart told Enterprise last month.

More grants to the region for green energy: The bank said the bloc is providing a total of EUR 61.3 mn to emerging countries neighboring Egypt to support green projects and action against climate change. Besides the grant to Egypt, Morocco will be getting a EUR 21.1 mn grant and countries of the EBRD’s Eastern Partnership — which include Armenia, Azerbaijan, Belarus, Georgia, Moldova and Ukraine — will be receiving EUR 15.4 mn.

Image of the Day

What risks lie in store for us over the next 18 months? A World Economic Forum survey of 347 senior risk analysts on which of the many threats presented by covid-19 are most likely to lead to global disruption has been turned into a digestible (if depressing) infographic by the good people at Visual Capitalist.

The bad news? There’s a high chance of substantial economic fallout — surprise, surprise — with the likelihood of a prolonged global recession topping all other risks at a whopping 68.6%. There’s also a pretty high risk of emerging market collapse, at 38%.

The better news? The risk of lower Foreign Direct Investment (FDI) remains well below other potential economic risks, at 17.9%, and the likelihood of higher anti-business sentiment is a comparatively miniscule 3.2%. This means a glimmer of hope — at least for Egypt — when it comes to economic recovery from the pandemic.

Egypt in the News

It’s a slow news day for Egypt in the international press, with the only stories of note being the WSJ reviving the story of the arrest of healthcare workers accused of criticizing the government’s response to covid-19 and a push by the Committee to Protect Journalists and the Electronic Frontier Foundation to draw attention to the arrests of four journalists during the pandemic.

Worth Listening

How Trella is bringing efficiency to the trucking industry: Trella co-founder and CEO Omar Hagrass managed to streamline an industry as fragmented as trucking by connecting shippers and carriers directly through a booking system resembling ride-hailing services, and in the process doing away with middlemen. As covid-19 hit and supply chain disruptions became the norm, Trella’s services became essential to lessen time consumption and inefficiency.

Tap or click here to listen to the episode on our website | Apple Podcast | Google Podcast | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It here.

Diplomacy + Foreign Trade

Egypt’s decision to take the Grand Ethiopian Renaissance Dam (GERD) dispute to the UN Security Council was not meant to escalate tensions, and is actually in everybody’s favor as an international body whose sole mandate is to preserve peace and security, Foreign Minister Sameh Shoukry told Sky News Arabia yesterday (watch, runtime: 20:31). The minister also said that Ethiopia had withheld information on its blueprint for the dam — which could pose a serious threat to Sudan if the structure fails. Shoukry also told Al Arabiya that the three countries are broadly in agreement on the timeline of filling the dam’s reservoir.

USAID has agreed to provide USD 105 mn in financing for five development projects in Egypt, including digitizing government services, the planned move to the new administrative capital, and work to support women economically and socially, according to an International Cooperation Ministry statement (pdf). International Cooperation Minister Rania Al Mashat is also in talks with the World Food Programme to cooperate with Egypt in its work to achieve food and financial security for small farmers, according to a separate statement.

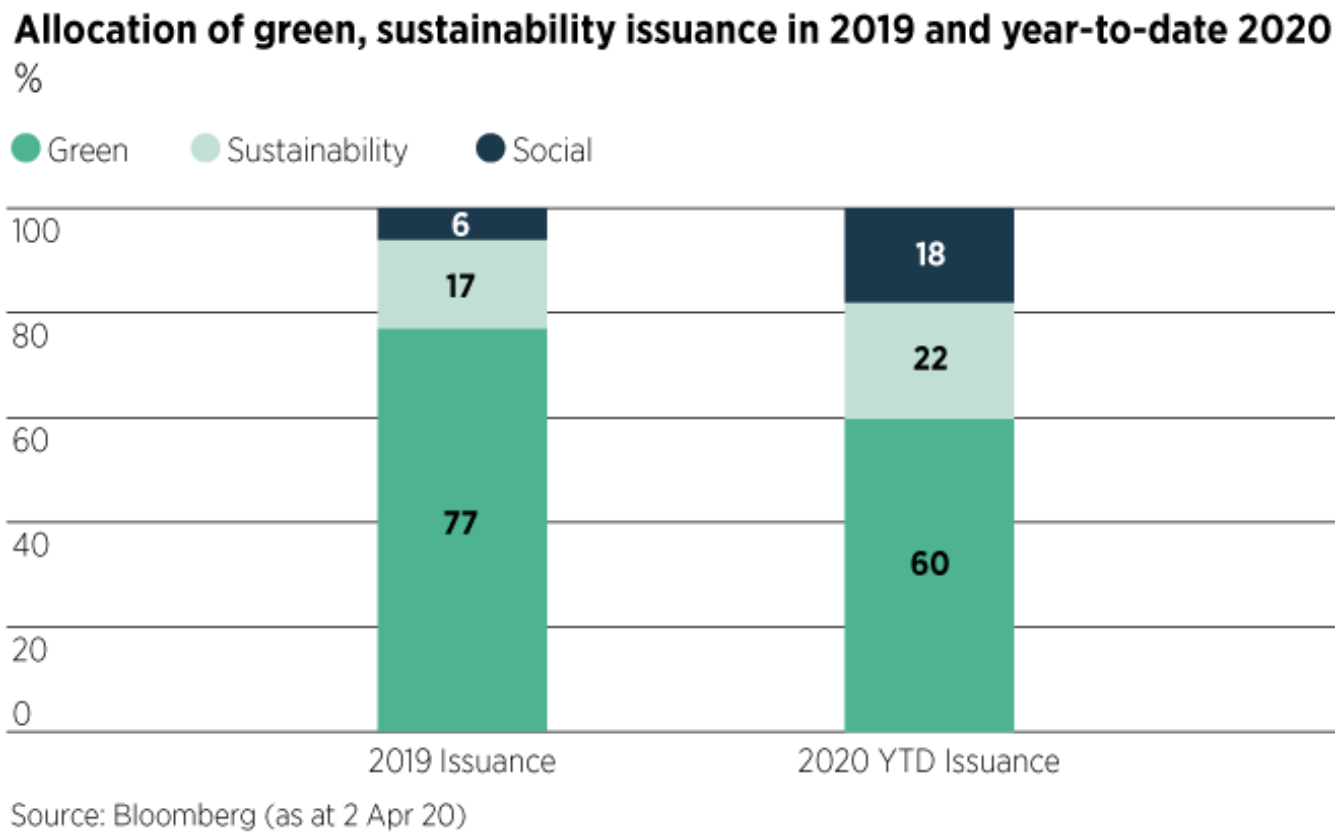

2020 is the year green bonds become real in Egypt: Both the private sector and the government have for long been mulling the issuance of green bonds to diversify funding sources and unlock finance for projects at a lower interest rate against traditional means of funding. The private sector has come out ahead, with CIB already on track to offer Egypt’s first green bonds. Next on deck will likely be an issuance from the Finance Ministry, which is cooking up its first issuance in FY2020-21. Green bonds are expected to pave the way for infrastructure bonds, as we noted in our feature on them back in February.

So, what are green bonds? A green bond is a type of fixed-income instrument that is specifically earmarked to raise money for climate and environmental projects. The World Bank was the first organization to offer green bonds in 2008 and has since issued over USD 13 bn equivalent in green bonds through more than 150 transactions in 20 currencies.

The new tool was already picking up momentum in Egypt before the covid-19 crisis, when EFG Hermes was said to be in talks to manage an unnamed state company’s green bond offering. Regulators, meanwhile, were deciding whether to approve an EGP 500 mn green bond issuance by an unnamed Norwegian renewable energy company, suggesting demand for this type of funding. At the same time, the Finance Ministry was at the size and timing of the infrastructure bonds the state may issue in FY2020-2021, Finance Minister Mohamed Maait had said.

CIB will be the first to test the water with a USD 65 mn offering: CIB is preparing to take to market a green bond in collaboration with the International Finance Corporation (IFC), Heba Abdellatif, head of debt capital markets at CIB, told Enterprise. The two parties are hoping to finalize the issuance through a private placement by 3Q2020. The proposal, which is still in the due diligence phase, will see the IFC invest USD 65 mn in the first tranche of the five-year bonds. “Though this is a relatively small investment, it is aimed to test appetite for Egyptian green bonds,” Abdellatif said. “If successful, the IFC will bring its investment up to USD 100 mn in another tranche.”

What will proceeds be earmarked for? It remains to be seen which projects will be financed through this green bond issuance, only that CIB has a pipeline of projects in place. Among them is a program to make buildings more energy efficient, the bank told us. The IFC will also share its expertise in climate finance to help CIB build its expertise in climate finance eligibility criteria, greenhouse gas emission savings calculation, green bond reporting, and green building financing. It could also invest up to spur the construction of green buildings in Egypt.

Globally, green bond issuances were gaining steam — then covid-19 hit. Global issuances of green, social, and sustainable bonds were forecast to rise 24% to USD 400 bn this year, with green bonds alone accounting for USD 300 bn. Through the first five months of 2020, green bond issuances were 36% lower in value than last year at a modest USD 66.6 bn compared to USD 261.9 bn in the same period of 2019. Issuances by financial institutions were halved as the pandemic shifted the banks’ priorities towards supporting existing customers as they scrambled to cope with the economic slowdown. Moody’s slashed its green bonds sales projections for 2020 to USD 175-225 bn from its original USD 300 bn forecast. This is becoming the trend globally, including in Japan, whose green bond issuance may drop this year for the first time in at least seven years, despite issuing a quarterly record of USD 2.7 bn of green bonds from January to March, according to S&P.

Among those staying the course on green bonds: Deutsche Bank, Russia, Sweden and Brazil, which has announced plans to build 8 GW of renewable energy projects with funding funneled from green bonds.

The global slowdown in issuances doesn’t faze CIB. Abdellatif told us that since the bank’s bond offering will be through a private placement, they are not worried about finding investors. The IFC is also not alone: Several other multilateral institutions have been in talks with the CIB for similar investments, Abdellatif said without disclosing the details of the talks. “CIB has been considering green bonds for over 18 months and has talked with several institutions to assist the bank’s first foray into the green bonds field,” she said. “We think it is either now or never.”

The government is also undeterred. Unlike other new-to-Egypt debt instruments such as sukuk that require a separate legislation, green bonds don’t. Moreover, thanks to the lower interest rate, green bonds will be the leading alternative for traditional debt instruments, such as USD-denominated Eurobonds.

There are four main reasons why the Finance Ministry has been particularly interested in green bonds, Finance Minister Mohamed Maait told Enterprise:

- Attracting new segments of investors who are on the lookout for sustainable, ethical, and green projects to finance;

- Lower interest rates compared to the traditional Eurobonds issuances;

- Diversifying debt resources to hedge against potential market volatility;

- And stimulating green projects in the local market.

Efforts have already been made to expedite the Finance Ministry’s first green bond since it hired Credit Agricole, Citibank, Deutsche Bank, and HSBC to market the first sovereign green bond issuance back in February. Credit Agricole and HSBC were tapped to prepare the prospectus for the offering. The cabinet had given the Finance Ministry the green light to push ahead with the offering last year, Maait said, noting that the ministry has renewed this approval recently, saying it is only a matter of time before we can see the first offering.

Egypt’s maiden issuance could be to the tune of USD 500 mn in FY2020-2021, although the exact figure and timing is still in the works, Assistant Finance Minister for Debt Khaled Abdel Rahman told Enterprise. This small issuance would mainly serve to test the markets’ appetite and gauge investors demand and the interest rates they would be seeking.

The transaction should meet significant appetite from Asian investors, Abdel Rahman said, if only because of the interest rate differential. Moreover, the demand from the latest Eurobond offering in May in Asia, Africa, North America, Europe, and the Middle East was so good that the final yield on the offering was cut 50 bps than levels at which the bonds were being marketed earlier in the day.

But it doesn’t come without hurdles: Interest rates may be low, but the procedures of marketing bonds in Asia are more complicated, Abdel Rahman said, explaining that Egypt would have to pay higher insurance fees for the companies that would cover the offering. Moreover, the Asian markets do not usually rely on the top three rating agencies to assess bonds (S&P, Moody’s, and Fitch), so Egyptian bonds will have to be evaluated through Asian rating agencies, which could lengthen procedures.

The exact type of projects that will be financed through green bonds is still in the works, where the Financial Regulatory Authority (FRA) has been in the process of setting up “green projects taxonomy” that categorizes three types of green projects: low carbon emissions projects, climate change adaptation and mitigation projects, and projects that specifically target the conservation and protection of biological diversity. The FRA has also prepared a preliminary list of international environmental observers to verify the green project criteria; created a register of local environmental monitors; and exempted green bonds issuers from 50% of fees.

And the timing could be good, since the flood of stimulus in advanced markets is pushing many investors to EM in pursuit of yield, helping defuse what some analysts feared would be a debt crisis in EM countries caused by capital outflows earlier in the pandemic. This all comes at a time when the Finance Ministry is exploring ways to ease its debt service burden, having already announced it would limit the number of bids it accepts in EGP-denominated bond sales until the end of FY2019-2020 while also tapping new sources of funding to cover revenue shortfalls caused by the covid-19 pandemic.

The green bonds will open the door to other, new sources of funding: The Finance Ministry has already drafted legislation to unlock access to sukuk and is waiting for cabinet and House of Representatives approvals, Maait told Enterprise, adding that the ministry could also begin considering other types of bonds that would be directed to social projects — are social bonds next?

Your top infrastructure stories of the week:

- Biomass energy projects to be ramped up: The New and Renewable Energy Authority plans to increase biomass energy projects to produce a nationwide capacity of 51 MW, with the Gabal El Asfar Wastewater Treatment Plant producing 10 MW.

- New transport body formed: Public Enterprises Minister Hisham Tawfik announced the formation of a new transport entity to support local products and foreign trade.

- Electric works begin soon on Lekela wind farm: Siemens Gamesa will announce the bid winner for electric works on the Lekela wind power project in Ras Gharib on the wind farm next month.

- More GE railway locomotives arrive: General Electric delivers 20 new locomotives to Egypt for a total of 70 of 110 purchased in 2017.

-

Electricity Co. to upgrade grid: The Electricity Holding Company is seeking an EGP 20 bn loan to increase the national electricity grid’s capacity by 145 MW.

The Market Yesterday

EGP / USD CBE market average: Buy 16.09 | Sell 16.19

EGP / USD at CIB: Buy 16.09 | Sell 16.19

EGP / USD at NBE: Buy 16.07 | Sell 16.17

EGX30 (Tuesday): 10,765 (+0.1%)

Turnover: EGP 1.1 bn (35% above the 90-day average)

EGX 30 year-to-date: -22.9%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.1%. CIB, the index’s heaviest constituent, ended down 0.7%. EGX30’s top performing constituents were Porto Group up 6.1%, SODIC up 3.5%, and Credit Agricole up 3.0%. Yesterday’s worst performing stocks were Dice down 1.9%, EKHO down 1.1% and CIB down 0.7%. The market turnover was EGP 1.1 bn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -120.1 mn

Regional: Net Short | EGP -20.5 mn

Domestic: Net Long | EGP +140.5 mn

Retail: 64.0% of total trades | 62.1% of buyers | 65.9% of sellers

Institutions: 36.0% of total trades | 37.9% of buyers | 34.1% of sellers

WTI: USD 39.27 (-1.08%)

Brent: USD 41.15 (-1.34%)

Natural Gas (Nymex, futures prices) USD 1.75 MMBtu, (+2.46%, August 2020 contract)

Gold: USD 1,800.50 / troy ounce (+1.08%)

TASI: 7,224.09 (-0.87%) (YTD: -13.89%)

ADX: 4,285.80 (+0.24%) (YTD: -15.56%)

DFM: 2,065.28 (-0.74%) (YTD: -25.30%)

KSE Premier Market: 5,607.07 (-0.24%)

QE: 8,998.56 (-0.59%) (YTD: -13.69%)

MSM: 3,516.00 (-0.13%) (YTD: -11.68%)

BB: 1,277.61 (-0.01%) (YTD: -20.65%)

Calendar

1 July (Wednesday): Official reopening of Egypt’s airspace to inbound and outbound international flights.

2 July (Thursday): Anniversary of the 30 June 2013 Revolution, national holiday.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day, national holiday.

23-31 October (Friday-Saturday): Updated dates for El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.