- IMF forecasts deeper global recession, slower recovery as virus fears linger. (Speed Round)

- EFG, sovereign fund look to take 76% stake in Arab Investment Bank. (Speed Round)

- Reminder: Our nighttime curfew ends + restaurants, cafes, and houses of worship are reopening on Saturday. (What We’re Tracking Today)

- EMRA extends int’l gold and mineral exploration bid round until September. (Speed Round)

- El Sisi talks new capital transport infrastructure, higher education cooperation with Canada’s Trudeau. (Diplomacy + Foreign Trade)

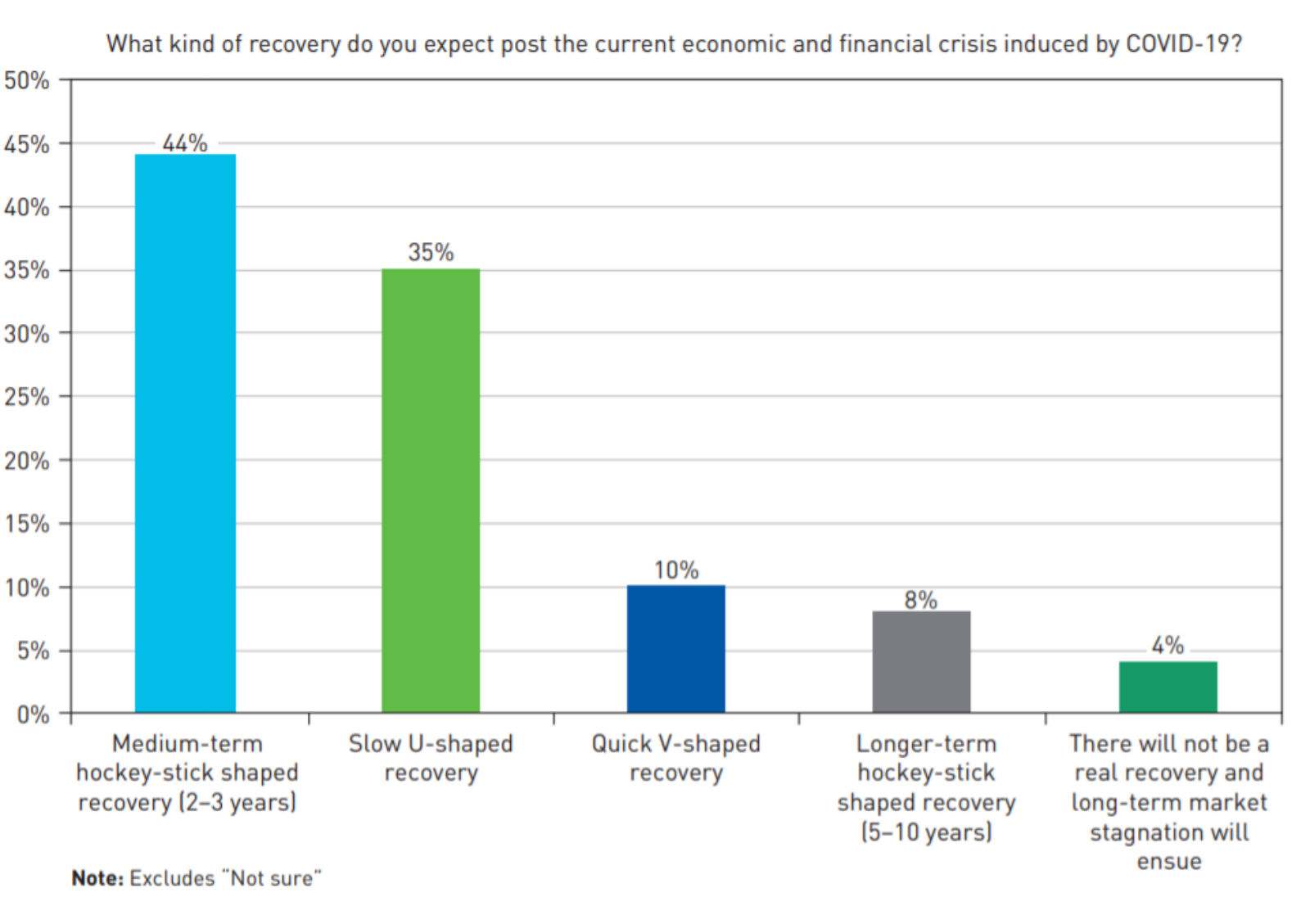

- True to their conservative nature, CFA holders are banking on slower recovery. (The Macro Picture)

- The final episode of season two of Making It is out today with Trella CEO Omar Hagrass. (What We’re Tracking Today)

- My WFH Routine: Aaloak Jaswal, head of the UN Technology Innovation Lab in Egypt.

- The Market Yesterday

Thursday, 25 June 2020

The IMF thinks the global recession will be worse than it originally predicted

TL;DR

What We’re Tracking Today

Welcome to Thursday, ladies and gentlemen. We hope the day passes productively and uneventfully — and that you’re all looking forward to a very relaxing weekend.

Two big stories eclipse all other headlines today: The IMF thinks the global recession will be worse than it first predicted and EFG Hermes has partnered with the the Sovereign Fund of Egypt to make a bid for the Arab Investment Bank and fully transform itself into a universal bank. We have chapter and verse on both stories in this morning’s Speed Round, below.

It’s interest rate day today. Our poll earlier this week showed consensus among analysts that the central bank will leave rates on hold for the third consecutive meeting. The CBE’s overnight deposit rate is at 9.25% and the lending rate is at 10.25%. The main operation and discount rates are both at 9.75%.

The IMF’s executive board will meet tomorrow to discuss Egypt’s request for a USD 5.2 bn standby facility, according to the fund’s calendar. Approval would bump up Egypt’s recent IMF borrowing to USD 8 bn after the fund last month disbursed a USD 2.8 bn rapid financing instrument.

The story to watch today: Asian shares are down sharply in early morning trading and futures suggest more of the same in Europe and the US later today after US stocks plunged yesterday amid fears that covid-19 was taking off in America. The trigger: Large states including Arizona, Texas, and California posting record numbers of new cases. The WSJ and the FT have more if you need to dive deeper. Is it any wonder that gold is hovering near an eight-year high? Not that we’re goldbugs…

The EGX30 closed up 2.6% yesterday on very heavy trading (about 74% above the trailing 90-day average), leaving the benchmark index down 21% year-to-date.

The antidote to the rollercoaster of negativity that is the market of late: Planet Startup, where we have a shoutout this morning to the brave folks who breezed through Flat6Labs’ demo day for investors like MSMEDA and the press yesterday. It takes guts to build a company — even more to pitch it online during a pandemic. Our friends at Flat6 have put the whole thing online, so you can watch here if you didn’t catch it yesterday (watch, runtime: 52:54) or check out the homepage for demo day here.

And speaking of entrepreneurs: Instagram is rolling out new requirements for small businesses and creators and will require them to “tag products on Instagram from a single website that they own and sell from.” The requirement goes into effect on 9 July for folks in Egypt. More in this press release (pdf).

PSA #1- The nighttime curfew ends on Saturday. Restaurants, coffee shops and houses of worship are set to reopen and retailers will be allowed to stay open until 9pm. Restaurants will have to close their doors at 10pm.

PSA #2- We are blessed with a midweek holiday next week as the nation is off on Tuesday in observance of 30 June.

COVID-19 IN EGYPT-

The Health Ministry confirmed 85 new deaths from covid-19 yesterday, bringing the country’s total death toll to 2,450. Egypt has now disclosed a total of 59,561 confirmed cases of covid-19, after the ministry reported 1,420 new infections yesterday. We now have a total of confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 15,935 have fully recovered.

Six professional footballers tested positive for covid-19 just days after returning to the pitch for training ahead of matches restarting on 1 July, the Egyptian Football Association (EFA) said in a statement yesterday. All EFA personnel are currently being tested, the association said.

All courts across the nation will fully resume work starting Saturday, the Justice Ministry said yesterday, according to Youm7. The ministry has also decided to reopen its offices, including real estate registry offices and the ministry-affiliated forensic medicine department. A maximum of 20% of employees will be present at any given time, and will implement rotational shifts to avoid community spread. The decision comes after the government announced a partial reopening of the economy starting this weekend.

EgyptAir will resume flying to 29 destinations by mid-July, with 22 destinations available for booking on 1 July and seven more being phased in by 15 July, according to a statement. Did you book before 15 June? You need to reconfirm your flights.

DONATIONS- The nation’s banks, international organizations, and NGOs are the top financial donors to efforts to fight the economic and health impact of covid-19 according to this deck (pdf) put together by Meacoms. The top financial donor was the European Union with contributions totaling EGP 1.6 bn, while the top corporate donors were our friends at CIB followed by Banque du Caire. The food and beverage industry gets credit for in-kind donations of food, with the parent company of Pepsi and Chipy leading the league table with 2 mn meals, the analysis says. The top beneficiaries of financial donations were the government, the Tahya Misr Fund and the Egyptian Food Bank.

ON THE GLOBAL FRONT-

Chinese vaccine developer moves into final stage of testing in UAE: Chinese state-owned vaccine developer CNBG has secured approvals to begin the final stage of human trials in UAE, according to Bloomberg. CNBG is the first company out of China to enter phase three testing and one of the few to have hit that benchmark globally as the race to be the first to discover a vaccine quickens and covid-19 cases top 9.2 mn.

UK restaurants, hotels and pubs will reopen from 4 July as part of sweeping changes to end the country’s lockdown restrictions announced yesterday, the BBC reports.

AND THE REST OF THE WORLD-

Uncle Joe is crushing King Cheeto in the latest New York Times-Siena College poll. With five months remaining until American voters goes to the polls, Joe Biden has taken a commanding 14-point lead over the orange incumbent.

US considers ramping up trade tensions with Europe… The Donald may be staring down the barrel of an embarrassing electoral defeat, but he isn’t done flexing his muscles on trade. The US Trade Representatives yesterday said that Washington could bring in USD 3.1 bn in tariffs of up to 100% on additional goods imported from the UK, France, Germany and Spain, Bloomberg reports.

…as Europe mulls US travel ban: American citizens may be banned from traveling to European countries as the coronavirus continues to rampage across the US, according to draft EU rules seen by the New York Times.

Out today: The final episode of season two of Making It, our podcast on building a great business in Egypt.

Today’s interview: Omar Hagrass, CEO of Trella: After working as an expansion manager at Uber Eats, Hagrass was bitten by the entrepreneurial bug after learning how fragmented the trucking industry was. His research led him and his co-founders to launch Trella, an application that connects shippers and carriers directly through a booking system resembling ride-hailing services — eliminating the need for middlemen.

A digital trucking marketplace was born after he secured a USD 600k pre-seed round led by Algebra Ventures in early 2019. Trella then graduated from Y Combinator, acquired its Egyptian rival Trukto to become the largest digital trucking marketplace in Egypt, and launched its services in Saudi Arabia to act as a gateway for further expansion into the GCC countries.

The potential to solve a big problem with a good team raises investor interest, Hagrass told us. His goal? To turn the company into Egypt’s first unicorn.

Tap or click here to listen to the episode on our website | Apple Podcast | Google Podcast | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It here.

Enterprise+: Last Night’s Talk Shows

It was a relatively quiet night on the airwaves, save for Foreign Minister Sameh Shoukry’s phone-in to Yahduth fi Misr to talk about the Grand Ethiopian Renaissance Dam (GERD) negotiations and the situation in Libya.

Egypt’s efforts to reach a political resolution in Libya, which culminated in the announcement of the Cairo Declaration earlier this month, has earned wide international backing, Shoukry said. The minister stressed that Egypt would like to see both Libyan parties coming together at the negotiating table to agree on the road ahead.

The UN Security Council is not meant to entangle itself in the technical details of GERD, such as the timeline for filling the dam’s reservoir, but will act as an authority figure of sorts to ensure Egypt, Sudan, and Ethiopia each do their part in the ongoing negotiations and don’t take unilateral action. Shoukry warned that Egypt will not continue to entertain “endless” negotiations over the dam, in which it has already invested plenty of time (watch, runtime: 18:52). President Abdel Fattah El Sisi also reiterated yesterday that Egypt would like to reach a diplomatic solution to the dam dispute, Masaa DMC’s Ramy Radwan noted (watch, runtime: 1: 48).

Irrigation Minister Mohamed Abdel Aty also gave Amer a recap of the GERD negotiations so far, pointing out that disagreements over the technical parts of the dam led to a standstill in the talks. Abdel Aty reiterated that Egypt is more than willing to engage in more talks if Ethiopia signals its intention to reach a mutually satisfactory agreement on these issues and on a mechanism to resolve potential disputes down the line (watch, runtime: 10:28).

Radwan noted that Sudan also wants to hammer out an agreement with Egypt and Ethiopia, with Sudanese Irrigation Minister Yasser Abbas calling for a legally binding accord. Abbas also said yesterday that Khartoum is preparing its own policy letter on the GERD issue to submit to the Security Council (watch, runtime: 2:46).

Speed Round

Speed Round is presented in association with

YOUR DAILY DOSE OF GLOOM- IMF forecasts deeper global recession, slower recovery as virus fears linger: The global economy will suffer a deeper recession than previously expected as the pandemic continues to intensify in some parts of the world, and businesses and consumers continue to reel from the effects of the “Great Lockdown,” the IMF said yesterday. In its updated World Economic Outlook, the fund projects the world economy to contract 4.9% in 2020, a significant revision from the 3% recession projected in April. Growth forecasts for next year have also been taken down a notch, with the economy now expected to expand at a 5.4% clip, down from 5.8% previously.

“The downgrade from April reflects worse than anticipated outcomes in the first half of this year, an expectation of more persistent social distancing into the second half of this year, and damage to supply potential,” IMF chief economist Gita Gopinath wrote in a blog post accompanying the report.

Things just got that much worse for the developed world: The IMF now expects advanced economies to shrink by 8% (a deterioration from 6.1% in April). France, Italy, and Spain will each contract by almost 13%, the UK more than 10% and the US 8%. Economic projections in the emerging world were also lowered by 2%, with the fund now expecting GDP to fall 3% on aggregate. China will be the lone big emerging economy to expand this year, seeing 1% growth before surging to 8.2% in 2021.

“This crisis like no other will have a recovery like no other”: When it comes to recovery, we’re going to have to be patient. The unprecedented damage caused to the labor market will bite, as will uneven recoveries when everyone — developed markets and EM, exporters and importers — has just taken it on the chin. Consumption and investment are both expected to improve next year but a host of variables — including the restoration of supply chains, job creation, voluntary social distancing and workplace safety measures — could soon throw this off.

The IMF now sees the Egyptian economy maintaining 2% growth through to the end of 2021, scaling back its earlier projection that Egypt’s economy would grow 2% in 2020 and 2.8% in 2021.

Still, this would be a pretty exceptional performance, given the dire situation for other economies in the region and the wider world. Of the MENA countries surveyed by the IMF, Egypt will be the only economy to maintain growth this year. Saudi Arabia is now expected to contract by a whopping 6.8% this year (a 4.5% downgrade from April) and Turkey’s economy will shrink 5%.

Take all of this with a massive pinch of salt: Gopinath was at pains to convey the level of continued uncertainty surrounding the trajectory of the global economy. “A high degree of uncertainty surrounds this forecast, with both upside and downside risks to the outlook,” she wrote, noting the potential for both a vaccine and a second outbreak to seriously change the dynamics of the economy.

You can tap / click here for the full report (pdf), and download the raw data here in xlsx format, which is where you’ll find the Egypt figures.

M&A WATCH- EFG, sovereign fund look to take 76% stake in Arab Investment Bank: EFG Hermes and the Sovereign Fund of Egypt (SFE) have obtained regulatory approval from the Central Bank of Egypt to conduct due diligence ahead of a potential acquisition of state-affiliated Arab Investment Bank (AIB), the two said in a joint press release (pdf). If completed, the acquisition would see EFG take a 51% stake and the SFE up to 25%. AIB is both a commercial and investment bank and offers traditional and sharia-compliant services.

The two buyers will contribute to a round of capital increase, the statement notes without specifying how much capital they plan to inject. EFG and the SFE could also acquire some secondary shares from state-owned National Investment Bank (NIB), which holds 91.4% of AIB today. The remaining 8.6% stake in AIB is held directly by the government. Reuters also had the story.

What EFG Hermes had to say: The move “is an important step in a strategy that we started several years ago and that aims to transform EFG Hermes from a pure play investment bank into a universal bank,” CEO Karim Awad said. EFG’s shares were up 5.2% at market close yesterday.

What the SFE had to say: “The partnership with EFG Hermes comes as part of the Fund’s strategy to cooperate with the Egyptian private sector to invest in promising sectors and in particular financial services and fintech,” CEO Ayman Soliman said. Attracting private sector partners has been a key mandate of the fund since it launched last year.

The move will not require external finance or help from EFG’s investors, CEO Karim Awad said yesterday during a presser on the sidelines of the bank’s Virtual Investor Conference, the region’s first remote investment conference. Around 480 investors and 72 companies and institutions — including major sovereign and investment funds in the Arab region — participated.

AIB is profitable: It turned in a net profit after tax of EGP 154 mn in 2017 on net interest income of 494 mn and fee and commission income EGP 282 mn as well as income from dividends, investments and trading, according to the income statement (page 24) of its latest available annual report.

Background: The National Investment Bank, AIB’s parent company, had announced a plan earlier this year to take several of its portfolio companies to market with the help of the SFE. The plan was postponed earlier in the covid-19 crisis, but seems to have now been brought back. In addition to AIB, the NIB holds stakes in state-owned companies including Abu Qir Fertilizers, Sidi Kerir Petrochemicals, and e-Finance. The state investment bank also holds a stake in Madinet Nasr Housing and Development.

Also from the EFG investor conference yesterday:

Economic recovery to commence at the end of the year: The Egyptian economy will begin to recover at the end of the year in light of the government’s decision to unwind its lockdown restrictions, said Ahmed Shams El Din, EFG’s head of research. Corporate performance is expected to take around 18 months to recover, Shams El Din said. With somewhat of a global consensus that 2Q2020 was a “lost quarter,” the firm expects corporate earnings have dropped around 25% YTD.

Egypt’s carry trade “still tempting”: Shams El Din described the investment in the Egyptian bond market as “still tempting” for investors with a real interest rate of 2.5%, and suggested that foreign flows will return as the crisis alleviates. This comes as June was the first month since the outset of the pandemic in which Egypt saw net capital inflows, Bloomberg reports, citing EFG. Egypt currently has the second-highest inflation-adjusted real interest rates in the world.

Privatization to resume in 4Q at the earliest: Mohamed Ebied, co-CEO for the investment bank at EFG Hermes, said that it is possible that the state privatization program could resume in 4Q2020 or 1Q2021, but cautioned that the timing remains hard to predict due to the drop in corporate valuations and volatile market conditions globally.

EMRA extends int’l gold and mineral exploration bid round by 2 months: The Egyptian General Authority for Mineral Resources (EMRA) will extend the year's first international gold and mineral exploration bid period by two months to 15 September because of the covid-19 pandemic, an Oil Ministry statement said on Wednesday.

Background: The bid round began on 15 March and was originally scheduled to end on 15 July, and marks the first time the industry tests legislative amendments passed last year that scrapped production sharing agreements in favor of a more investment-friendly tax, rent, and royalty model. An industry source said last month that ten undisclosed mining companies, which they did not disclose, have taken out condition booklets for the bid round to scope out a 56k sqkm exploration area in the Eastern Desert.

Sanad Fund lends Export Development Bank of Egypt USD 15 mn for MSME, agribusiness funding: The Export Development Bank of Egypt (EBE) is receiving a USD 15 mn medium-term loan from German Development Bank KfW’s Sanad Fund to on-lend to MSMEs and agribusinesses, according to an EGX disclosure (pdf). The Sanad Fund last provided the EBE with a USD 10 mn loan in 2018 to expand financing and technical support to SMEs.

MOVES- Yasser Saleh has been appointed as CEO of the National Automotive Company (NATCO), the production and distribution partner of Mercedes-Benz passenger cars in Egypt, according to the local press. Saleh has previously served as CEO of Egyptian German Automotive, CEO of SAPPL Mercedes-Benz in Algeria, and export manager at Egypt’s Manufacturing Commercial Vehicles.

MOVES- Former head of the National Press Authority (NPA) Karam Gabr has been selected to preside over the Supreme Media Council replacing Makram Mohamed Ahmed in a shuffle of the oversight body ordered in a decree issued by President Abdel Fattah El Sisi yesterday, according to a statement. Abdel-Sadek El-Shorbagy will succeed Gabr as the head of the NPA.

The Macro Picture

True to their conservative nature, CFA holders banking on slower economic recovery: Chartered Financial Analyst (CFA) certificate holders expect the post-covid recovery to either be hockey stick-shaped or U-shaped, according to a report of the survey results by the CFA Institute. As many as 44% of the respondents expect the former scenario, which implies a medium-term rebound, while 35% are pricing in the latter, which is tantamount to a slow-paced comeback. Another 10% still seem to think that a quick and robust V-shaped recovery — which some expected in the earlier stages of the crisis, but has since been widely seen as unlikely — could be in the cards.

CFA holders based in the Middle East agree, with 46% expecting a hockey stick, 33% penciling in a ‘U,’ and 9% banking on a ‘V.’ Most respondents applauded central bank intervention, but remained split on whether this should continue or if it’s time for the invisible hand to take over.

Long-term impact: Large-scale bankruptcies were shown to be the most concerning long term risk posed by the deterioration of market condition due to the pandemic, with 39% of the survey respondents expecting institutions to run out of money. Over a third (38%) expected companies to be forced to speed up operational automation and increase reliance on outsourcing to save costs and 34% see large-scale consolidations taking place on the longer term.

Also, as many as 33% expect the long-term to drive a wedge between emerging and developed markets and drive them further apart. One explanation is that liquidity in EMs has most likely dropped as three-quarters of the CFA respondents believe it to have suffered more than in developed countries.

Egypt in the News

Foreign policy challenges dominate the conversation on Egypt this morning starting with Bloomberg Opinion’s Bobby Ghosh, who notes the country is grappling with Turkey’s involvement in Libya, Ethiopia’s dam, Israel’s potential annexation of its West Bank settlements — and the economic impact of covid-19. Tension over Libya is also on the mind at Washington-focused site the Hill

Also making the rounds: The Associated Press picked up on the arrest yesterday of Nora Younis, the editor of news outlet Al-Manassa. Trans-activist Noor Hesham Selim is being sued for promoting vice after posting an instagram clip expressing concern over the reaction to the death of exiled LGBTQ activist Sarah Hegazy, Reuters reports. And workout addicts are looking forward to the reopening of gyms this coming Saturday, with facilities set to open 6am-9pm, AFP writes.

Diplomacy + Foreign Trade

East Libya to push for Egypt military intervention if Sirte attacked: Libya’s eastern parliament will formally ask Egypt to send troops if the Turkey-backed west Libyan forces attack Sirte, the Associated Press reports, citing MENA. President Abdel Fattah El Sisi last week threatened to deploy troops to the east of the country if forces loyal to the Tripoli-based government move in Sirte, calling an attack on the strategic town a “red line.” Egyptian military action would be “legitimate … if the terrorist and armed militias crossed the red line,” MENA quoted speaker of the eastern House of Representatives Aguila Saleh as saying. Turkey’s entry into the war has turned the tide for the Tripoli government, bringing an end to Khalifa Haftar’s 14-month offensive on the capital and mounting a campaign to retake territory in the country’s east.

El Sisi talks higher education, infrastructure and coid with Canada’s Trudeau: President Abdel Fattah El Sisi and Canadian Prime Minister Justin Trudeau discussed potential investment and cooperation in higher education programs in Egypt in a phone call yesterday, according to an Ittihadiya statement. The two countries also discussed “advanced transportation infrastructure for Egypt’s New Administrative Capital,” the Canadian PM’s office said in a readout. “The two leaders welcomed the steps taken to deepen cooperation between the two countries,” the Canadian statement said, noting that the two leaders also discussed the importance of international collaboration to fight the health, social and economic impacts of covid-19

Energy

SDX Energy optimistic it will extend gas production at South Disouq till 2026

SDX Energy will maintain its 50 mcf/d gas production rate at its onshore South Disouq block for another 18 to 24 months, with a further extension to mid-2026 also likely, the company said in a statement. The block’s Sobhi well will generate USD 25 mn of cash flow, according to the statement. SDX will also begin drilling in West Gharib next year to increase production in the Meseda and Rabul fields to gross around 4,000 bbl/d by 2022.

Fitch gives Apicorp AA rating, with stable outlook

Fitch Ratings has awarded multilateral development bank Arab Petroleum Investments Corporation (Apicorp) an ‘AA’ rating with a stable outlook. The assessment was reached by the lender’s “excellent” capitalization and low risk profile that has shown itself to be “resilient to negative pressures from the covid-19 outbreak,” the ratings agency said.

Automotive + Transportation

Shipping line now connects Ain Sokhna to UAE's Jebel Ali

The Saudi Ports Authority launched yesterday the first direct shipping line connecting Ain Sokhna Port to the UAE’s Jebel Ali Port, in partnership with Dubai-based DP World, the Saudi Gazette reports. The shipping line runs through the Jeddah Islamic Port.

Brilliance Bavarian halts plans to assemble Chinese-brand cars over covid-19

Brilliance Bavarian Auto has temporarily shelved expansion plans, including locally assembling vehicles of the Chinese brand and increasing sales outlets, due to the covid-19 pandemic, General Manager Khaled Saad told Al Mal.

My Morning Routine

Aaloak Jaswal, head of the UN Technology Innovation Lab in Egypt, who wants to use AI to stop the spread of covid-19 and bring us all solar power (among other things): My Morning / WFH Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Aaloak Jaswal, head of the UN Technology Innovation Lab (UNTIL) in Egypt and all-around great guy. Edited excerpts from our chat:

Who are you and what do you do?

I’m Aaloak Jaswal — I grew up in Canada, of Indian origin. Despite the fact that we’re on a convergence between the fourth industrial revolution and the sixth mass extinction in a global economy that perpetuates patterns of discrimination and exclusion, we do really cool, impactful things by bridging the gap between innovation, sustainable development and inclusivity.

Like others in the business community, covid-19 has monopolized our bandwidth. Among other things, we’re partnering with Orascom subsidiary Gemini on a covid-19 “uplift” initiative and we ran an online “Hack the Virus” challenge with TIEC, Dell, Novartis and other UN agencies calling on innovators to develop solutions to stop the spread of the virus. We’re also exploring a women’s innovation hub with the National Council for Women and UN Women.

We were working on some great stuff before covid, like cold-chain solutions, and Uber-izing farm equipment for farmers who can’t afford to buy. Closest to my heart, we’re working with the German University in Cairo, targeting an impoverished community in Minya with no water, sanitation, or hygiene systems. With no grid access, we will implement a water treatment system driven by solar energy and AI and address the issues of gender-based violence and irrigation for agriculture simultaneously.

What’s your morning routine?

Working from home, I start at 6am, checking WhatsApp, email and reading Enterprise. By 7am, I’m stretching and then running before I shower and have a smoothie while taking 30 minutes to prioritize the day’s tasks. By 8:30, I change gears and make breakfast for my seven-year-old boy, Shivshankar, and get him ready for “e-learning” before I start the day with my team.

What does the rest of your day look like?

I’m privileged to collaborate with phenomenal team members (shout out to Raghda El Milegy and Ghada Hamdy), with great Egyptian entrepreneurs, our hosts the Government of Egypt, and other UN agencies with one aim: Meaningful and sustainable impact through innovation.

Covid has added an entirely new dimension — I research and vet proven and scalable solutions that accelerate progress toward addressing the pandemic, especially for vulnerable people. I’ve introduced AI technology to the Health Ministry that minimizes human interaction in testing for the virus; it can handle 10 mn concurrent calls, thus making call centers unnecessary to schedule testing appointments or contact patients to provide results. The Government of Ireland had to contact 8k people to inform them of their negative C-19 results, paying 250 call center workers over the course of a week. My proposed solution completed the task in 10 minutes and is usable by everyone from Luddites to the tech savvy.

You talk a lot about inclusion. How does tech factor into that?

Millennials have grown up with access to more information than all previous generations combined — and that will be the difference. Mark Twain said travel is fatal to ignorance, thus big data will lead to insights that are the enemy of ignorance and false biases. It will also have an exponential impact on development, but we must remain vigilant; when big data is corrupted by big silences, the truths you get are half-truths. And often, for vulnerable populations and women, they aren’t true at all. Digital inclusion must remain at the forefront.

How is your sector changing?

It cost roughly USD 2.7 bn to sequence the human genome in 2003. Today, USD 699. Medical knowledge doubled every 3.5 years in 2010. In 2020, it will double every 73 days. Technology is changing at a mind boggling rate. Moore’s law is no longer valid, and I tell people we’re living in Star Trek times. Arthur C Clark was one of the greatest visionaries of the 20th century — what I would give to hear his thoughts on the upcoming 80 years.

What keeps you up at night?

There have been five mass extinction events in the Earth’s history, each wiping out 70-95% of the planet’s life. The last was 66 million years ago and led to the extinction of the dinosaurs. We’re now in the middle of the sixth mass extinction, and it’s entirely our fault.

We didn’t inherit the earth from our ancestors — we borrowed it from our children. Shivshankar is being handed back a hotter planet, with melting glaciers, rising oceans, biodiversity wiped out, and where extreme weather patterns leading to natural disasters will be commonplace. I lay in bed thinking how sustainable energy can restore equilibrium. Throw Donald Trump into the mix, and it’s a wonder I ever sleep.

What do you do in your free time?

I stay on top of bleeding edge sustainable energy — solar street lighting, panels, batteries, pumps. That’s my passion. The solutions I’ve seen in the ME and Africa are rudimentary and expensive. I want to impact vulnerable populations by implementing sustainable energy through the affordable advanced technologies I can bring to the market.

I’m also a car guy. I own a 1992 Pontiac Firehawk with 3k km on it. There’s only 25 in existence. I’m passionate about the arts — I was a DJ in NYC. I love playing soccer and tennis. What I enjoy most is introducing Shivshankar to new things. He loves music: David Bowie, The Tragically Hip, Tom Petty, Stevie Wonder, and Michael Jackson.

What was the last great thing you read?

Johnny Marr — Set the Boy Free. The greatest composer and guitarist of my generation, and the list of bands he’s played with is as vast as my body long. His impact prompted Ray-Ban to create special edition Johnny Marr sunglasses and Fender made the Johnny Marr Jaguar guitar. His creativity and humility combined with his precision and passion for being the best is something I deeply admire but fail miserably to emulate. He’s a wizard; he’s so good that Johnny Marr can’t even play Johnny Marr. He always wears impeccable shoes and sports a great haircut.

Mahatma Gandhi — An Autobiography. Einstein said: “Generations to come will scarcely believe that such a one as this ever in flesh and blood walked upon this earth.”

Honorable mention: Pete Townshend — Who I Am.

What was the last great thing you watched?

The Last Dance: A Netflix documentary on Michael Jordan and the 1997-1998 Chicago Bulls playoff run. No one was more present in the here and now. When it came down to the final seconds, he wanted the ball. That presence, drive and confidence used to be me on the soccer field— and it’s me in everything I’m doing professionally and personally now.

What’s the best piece of advice (business or personal) you’ve ever been given and by whom?

Can I choose two? From Dad: “You can kick at nature for so long before she kicks back.” And from Mom: “Don’t listen to your head or your heart – they’ll set you on a wrong path. Listen to your conscience. ”

The Market Yesterday

EGP / USD CBE market average: Buy 16.12 | Sell 16.22

EGP / USD at CIB: Buy 16.12 | Sell 16.22

EGP / USD at NBE: Buy 16.10 | Sell 16.20

EGX30 (Wednesday): 11,040 (+2.6%)

Turnover: EGP 1.4 bn (74% above the 90-day average)

EGX 30 year-to-date: -20.9%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 2.6%. CIB, the index’s heaviest constituent, ended up 2.0%. EGX30’s top performing constituents were GB Auto up 8.4%, TMG Holding up 7.6%, and CIRA up 7.6%. Yesterday’s worst performing stock was Dice down 0.5%. The market turnover was EGP 1.4 bn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -93.6 mn

Regional: Net Short | EGP -21.9 mn

Domestic: Net Long | EGP +115.6 mn

Retail: 72.4% of total trades | 71.5% of buyers | 73.3% of sellers

Institutions: 27.6% of total trades | 28.5% of buyers | 26.7% of sellers

WTI: USD 38.11 (+0.26%)

Brent: USD 40.31 (-5.44%)

Natural Gas (Nymex, futures prices) USD 1.58 MMBtu, (-0.94%, July 2020 contract)

Gold: USD 1,770.60 / troy ounce (-0.25%)

TASI: 7,213.36 (-0.71%) (YTD: -14.02%)

ADX: 4,329.72 (+0.24%) (YTD: -14.70%)

DFM: 2,099.21 (-1.01%) (YTD: -24.08%)

KSE Premier Market: 5,669.35 (+1.45%)

QE: 9,225.92 (-0.38%) (YTD: -11.51%)

MSM: 3,524.55 (0.00%) (YTD: -11.47%)

BB: 1,280.83 (+0.04%) (YTD: -20.45%)

Calendar

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

26 June (Friday): The IMF’s executive board will decide on whether to disburse a USD 5.2 bn standby loan.

27 June (Saturday): Nationwide curfew ends.

30 June (Tuesday): Anniversary of the June 2013 protests, national holiday.

1 July (Wednesday): Official reopening of Egypt’s airspace to inbound and outbound international flights.

12 July (Sunday): North Cairo Court will hold a court session for the international arbitration case filed by Syrian Antrados against Porto Group for USD 176 mn after being pushed back from an initial 17 May court date.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.