- All hospitals will face price controls when treating covid-19 patients. (Speed Round)

- Under a best-case scenario, Egypt’s tourism industry is expected to lose out on 73% of its revenue in 2020. (Speed Round)

- Daily covid death toll hits new record; House to reconvene on Sunday even as case load grows. (What We’re Tracking Today)

- A hint international flights could be back by the first week of July? (What We’re Tracking Today)

- Samsung plans to invest USD 84 mn in Egypt over the next five years. (Speed Round)

- CBE to finance purchase of 100k POS machines, promote use of QR-code-based payments to make it easier for consumers to spend using cards, not cash. (Speed Round)

- Brace yourselves for some inflation? Electricity prices are going up next month, and food inflation looks set to follow thanks to covid disruptions. (What We’re Tracking Today)

- How AUC is adapting to education under covid-19. (Blackboard)

- The Market Yesterday

Monday, 1 June 2020

Hospitals will face price controls on treatment of covid-19 patients

TL;DR

What We’re Tracking Today

It’s June, ladies and gentlemen — we are now in the last days of 1H. Since 2020 is the gift that keeps on giving, we’re not gonna hold our collective breath on what the back half of the year looks like.

Egypt’s nighttime curfew is now one hour shorter after Prime Minister Moustafa Madbouly announced yesterday it will end at 5am instead of 6am, according to a cabinet statement. The curfew will still begin at 8pm and will remain in place until mid-June, when it is next up for review.

Banks are shifting their opening hours back one hour and will open to customers from 8:30am to 2pm starting tomorrow, according to Masrawy. The move comes as the curfew rolled back an hour. Banks are open 9:30am to 3pm today. The Federation of Egyptian Banks continues to call for a return to a full eight-hour workday to help reduce footfall and congestion at banks.

REOPENING TODAY: Passport, work permit and visa sections at the Interior Ministry.

Could Egypt be resuming international flights by the first week of July? The Madbouly Cabinet is set to discuss this week potentially lifting the ban on international flights, and while no decision has yet been made, Cabinet spokesman Nader Saad said yesterday his (unofficial) expectation is that we could have commercial aircraft on the tarmac by the first week of July (watch, runtime: 8:05).

Are you ready for a little bit of inflation? It’s coming in the form of higher electricity costs (with all of the usual knock-on effects) and higher food prices.

Your electricity bill is going up again next month: The Electricity Ministry and the Egyptian Electric Utility and Consumer Protection Agency (Egyptera) are finalizing the figures for the upcoming hike in electricity prices, which will be implemented as of the beginning of the new fiscal year on 1 July, Al Mal reports, citing unnamed ministry sources. The price increases will be “minor” and will differ for each consumption bracket, but will be capped at 10% for even the highest consumption tier, the sources say.

Factories won’t be paying more, and the ministry is also mulling exempting the agriculture industry from price increases to help shield local farmers from the financial burden of the covid-19 pandemic.

We’ll see the last increase in electricity prices in July 2021, by which time the Electricity Ministry will have fully lifted subsidies. The ministry had originally planned to reach this point by 2019, but extended the timeline under orders from President Abdel Fattah El Sisi.

Meanwhile, the Madbouly government expects food prices to continue rising through December as the pandemic puts pressure on global supply chains, according to a study by the National Planning Institute (pdf). The study lays out three possible scenarios for food inflation for the remainder of the year: The first would see it sustained at April levels, the second would see it rise 25% beyond that, and the third scenario would see food price inflation rising 50% from where it stood in April. The study doesn’t make clear the factors that would lead us to each scenario playing out.

The markets today: Asia-Pacific shares have started the trading week comfortably in the green from China to Australia in early dealing this morning. Futures point to a lower open in most European markets, while Wall Street apparently doesn’t mind a little bit of violence: Futures at dispatch time this morning show US shares opening in positive territory later today. The EGX30 climbed 1.1% yesterday and is now down 26.8% year-to-date.

Key news triggers coming up now that we’re in the month of June:

- PMI data for Egypt, Saudi Arabia and the UAE is due out on Wednesday, 3 June.

- Foreign reserves figures for May should be out early next week.

- Inflation data for May will land on Wednesday, 10 June.

- The Central Bank of Egypt will meet to review interest rates on Thursday, 25 June.

- Founding members of the EastMed Gas Forum will meet in June to ink the Cairo-based energy organization’s charter.

COVID-19 IN EGYPT-

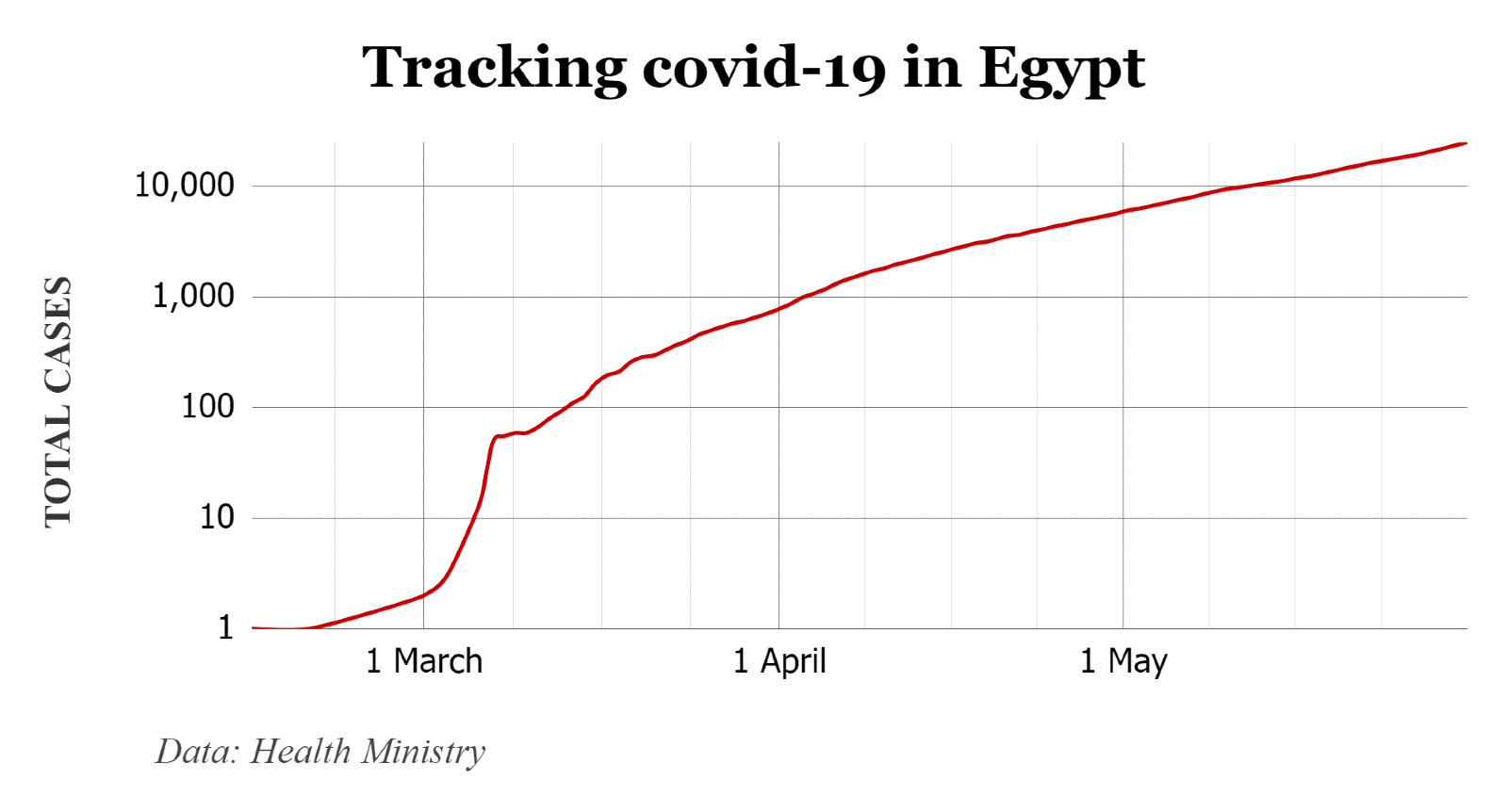

Egypt has now disclosed a total of 24,985 confirmed cases of covid-19 after the Health Ministry reported a new record high 1,536 new infections yesterday. The ministry also said that another 46 people had died from the virus, taking the death toll to 959. Yesterday’s death toll is also a new record. We now have a total of 6,810 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 6,037 have fully recovered. The Associated Press took note of yesterday’s new record figures.

Family visits during Ramadan likely fueled the spread of the virus, presidential health advisor Mohamed Awad Tageldin said yesterday as the Health Ministry said (unsurprisingly) that the capital city has the largest number of covid patients in the country.

The House of Representatives is still due to reconvene next Sunday, 7 June, according to Masrawy. The news comes even as five MPs are now confirmed to have tested positive for the novel coronavirus that causes covid-19, according to House Secretary General Mahmoud Fawzi told reporters yesterday. At least one other MP is waiting for test results.

Five media personalities have tested also positive for the virus, including state-owned Channel One’s Ilham Nimr; Reham El-Sahly and Aya Abdel Rahman from Extra News; Dalia Abu Emera from Al-Hayah; and Nagham FM host Amr Salah, according to Al Masry Al Youm.

An employee at Cairo’s Tora prison has died of covid-19, according to a cabinet statement. Other employees in the prison have since been tested and his workspace was disinfected.

Hotels that reopened under a 25% occupancy cap are operating at near full capacity, a tourism ministry official told Reuters. The 78 establishments, mostly along the Red Sea, currently have a 20-22% occupancy rate, the official said, adding that another 173 hotels will hear this week on their applications to open. Hotels are only allowed to open after acquiring a health and safety certificate from the government that proves they will operate according to new rules designed to prevent the spread of the virus.

The hotels hope to be allowed to go to 50% capacity later this month even as a report in the domestic press suggests at least one Egyptian staying at an unnamed Hurghada hotel tested positive for the coronavirus after the property opened for the Eid El Fitr holiday, according to Alaa Aqel, head of the Red Sea Chamber of Hotels, who voiced concern that fears of a renewed outbreak at Egyptian resorts could persuade domestic tourists to stay at home.

Travco has indefinitely delayed opening four new hotels due to the travel restrictions currently in place, the local press reports. The new hotels, which cost the group some EGP 2.5 bn, are set to hold a combined 1.4k rooms upon completion.

Briefly noted:

- The government will supply 30 mn low-cost cotton face masks per month to help people abide by new requirements to wear masks in closed public spaces, Trade and Industry Minister Nevine Gamea said yesterday.

- More than 1 mn people are now using the Health Ministry’s covid-19 app, Youm7 reports. The app provides users information on the nearest quarantine and medical facilities, tracks infected users’ locations and delivers notices to users approaching locations with suspected cases. The app can be downloaded from the App store here and from the Google Play store here.

Somabay is naturally shifting its mindset to adapt to a new course of direction, paving the way for what’s yet to come. A new perspective is just over the horizon.

Somabay is naturally shifting its mindset to adapt to a new course of direction, paving the way for what’s yet to come. A new perspective is just over the horizon.

ON THE GLOBAL FRONT-

Global coronavirus cases topped 6mn yesterday, according to the Johns Hopkins University’s covid-19 tracker.

South Korea is re-imposing lockdown restrictions — closing hundreds of schools, museums and art galleries — after 177 new cases were reported towards the end of last week, Sky News reports.

India has said that it plans to loosen lockdown measures from 8 June despite the country recording a record daily rise in cases on Saturday, the BBC reports.

Saudi Arabia opened mosques for the first time in over two months but will still require worshippers to abide by strict guidelines while attending prayers, according to the Associated Press. The kingdom is phasing out its curfew by 21 June except in Mecca.

THE REST OF THE WORLD BEYOND COVID-

Our Twitter feed shows America is grappling with another night of violence nationwide as protesters clash with security forces following the on-camera murder of a black man at the hands of a four white police officers. It’s still early given the time difference, but the New York Times and Washington Post are liveblogging as the night unfolds. It is the sixth night of nationwide protests and major cities from coast to coast are under curfew, including Los Angeles and Atlanta. The Wall Street Journal characterized the clashes in the past two days as the worst civil unrest the US has faced in decades.

Trump delays G7 after Germany snub, unilaterally vows to bring Russia back into the fold: The Donald has postponed the in-person G7 summit scheduled to take place in the US this month, a day after German Chancellor Angela Merkel refused to confirm whether she would attend. Describing the group as “outdated,” Trump said that he would invite other developed countries — including Russia, India and South Korea — to join, according to Reuters.

Tensions to rise in the east Med as Turkey expands gas exploration ambitions: Turkish Petroleum could begin oil exploration in the eastern Meditteranean in three to four months under the unilateral border demarcation agreement Ankara signed with Libya’s Tripoli-based government late last year, Turkish Energy Minister Fatih Dönmez said on Friday, according to Reuters. The agreement was condemned by Egypt and its Mediterranean allies, who are already locked in a diplomatic row with Turkey over its gas activities in disputed Cypriot waters.

Is the US stock market out of touch with reality? US stocks have rebounded on the back of business reopenings and hopes of a vaccine, the WSJ reports. The rally — largely driven tech stocks — has lifted the S&P 500 up 36% from March, reducing yearly losses to 5.8%. But Citi

thinks markets in the past two weeks have been “way ahead of reality.” the FT reports. Promising stock performance in the short term is based on the assumption that markets will follow a V-shaped recovery, which the firm believes will not be so clear cut with likely greater difficulties to come in 2Q2020 ahead of an upturn.

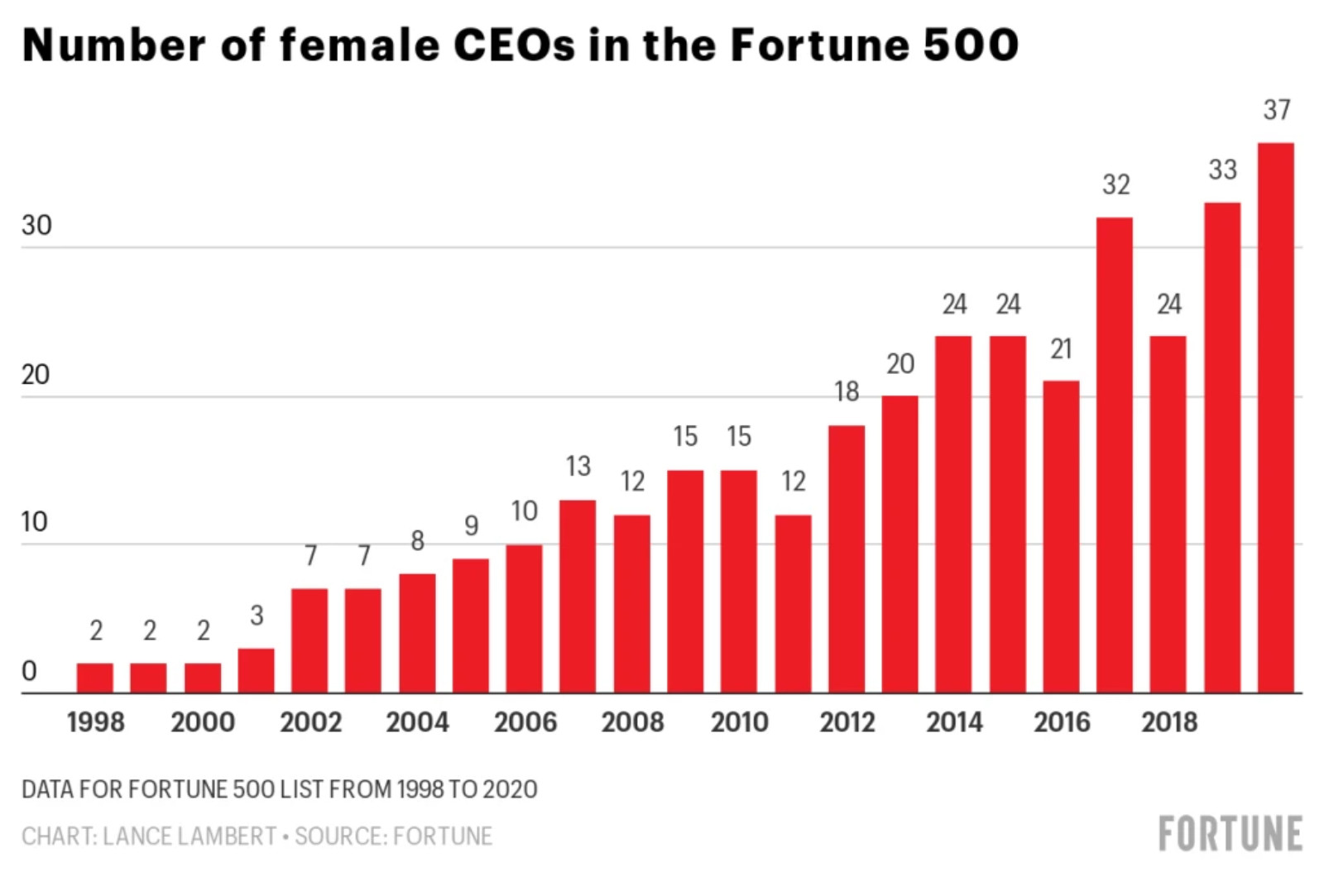

The Fortune 500 list now has a record number of women chief executives: Thirty-seven companies on this year’s Fortune 500 are led by women, up from 33 last year. Changes at the top saw women taking over leading positions from their male predecessors. Among the new faces: Sonia Syngal, who assumed the top role at clothing giant Gap in March, and Carole Tome, the incoming boss of package delivery company UPS.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: We sat down with the American University in Cairo’s (AUC) President Francis Ricciardone and Provost Ehab Abdel Rahman for a conversation on how AUC is coping with the shift to online learning in the time of covid-19 — and how this is all affecting tuition fees and accessibility.

Enterprise+: Last Night’s Talk Shows

Planned price controls on private hospitals providing medical services for covid-19 patients was the main talking point on the airwaves last night. We have the full story in this morning’s Speed Round, below.

The government decided to shorten the nighttime curfew by one hour following calls from business owners who complained that the curfew was causing logistical problems for them, Information Minister Osama Heikal told Al Kahera Alaan’s Lamees El Hadidi (watch, runtime: 20:37).

The Education Ministry is not planning to postpone Thanaweya Amma exams again despite the rising number of covid-19 cases, Minister Tarek Shawki told El Hekaya’s Amr Adib. Shawki had previously said that students who choose to sit for this year’s exams will be required to maintain safe physical distances within the testing rooms, which will be rearranged to hold fewer students than normal. The exams are slated for 21 June (watch, runtime: 2:02).

Adib noted that Lufthansa has made available flights from Germany to Egypt in mid-June, although it remains undecided when Egypt will reopen its airspace to international commercial flights. The Madbouly Cabinet extended last month the international flight ban for two weeks, ending on 13 June. Cabinet is expected to decide this week whether to resume flights around mid-June or early July (watch, runtime: 2:18).

Speed Round

Speed Round is presented in association with

Hospitals, including private-sector operators, will face price controls when treating covid-19 patients. The controls will apply to both medical treatment as well as to lower-level “isolation” services, according to a cabinet statement. The decision comes after some providers had allegedly been “overcharging” patients for services, the statement says. It also follows an increasing number of calls from MPs to regulate pricing at private hospitals.

Prices will be decided within the week: Prime Minister Moustafa Madbouly ordered a “specialized committee” to draw up a pricing scheme, which will be made public within days, Cabinet spokesman Nader Saad said yesterday (watch, runtime: 8:05), adding that all hospitals will have to abide the controls.

The legal basis: The Consumer Protection Act, which President Abdel Fattah El Sisi ratified in 2018, sets a legal framework through which the government can impose price controls. The state now also has the power to order any hospital to operate under government control in a defined crisis thanks to changes to the Emergency Act passed by the House of Representatives last month.

Only 17% of beds on special covid wards are occupied at the 320 state-run hospitals presently accepting covid patients, Saad told Kol Youm’s Khaled Abu Bakr (watch, runtime: 12:00), while the 20 original state-run treatment facilities are at 85% capacity. Those facilities hit the 17% capacity figure after just 10 days, Saad said, noting that they are only admitting the most severe cases and encouraging patients with mild symptoms to self-isolate and ride out the illness at home in a bid to ensure there is sufficient hospital capacity for those who need it most.

With rising infection numbers, health officials are now allowing the private sector to treat cases, having first limited treatment to a single facility in Matrouh. The Health Ministry then announced a list of 20 state-run isolation and treatment facilities before adding university hospitals to the list, then another 320 state-run facilities. In total, there are 367 state facilities now authorized to treat covid patients. All are now permitted to accept covid cases. The expansion of where covid patients can seek treatment came after officials said earlier in May that the country’s isolation hospitals had reached full capacity, prompting the ministry to look at alternatives such as using hotels to add capacity.

The ministry hasn’t publicly said how many private sector hospitals or beds are available to treat covid patients, but Alameda Healthcare CEO Neeraj Mishra (who oversees facilities including As-Salam International and Dar Al Fouad) told us in April that all private-sector operators had been told to prepare isolation wards.

The price controls are, in concept, the right thing, but regulators will need to strike a careful balance between their inner Nasserist (everything without charge, all the time) and the simple reality that treating very sick covid patients is very expensive — and puts pressure on the hospital P&Ls in other departments thanks to lower revenues and resource drain to focus on covid treatment.

Under a best-case scenario with the ongoing pandemic, Egypt’s tourism industry is expected to lose out on c.73% of its revenue in 2020, according to a report (pdf) from the National Planning Institute. The best-case scenario would entail a recovery beginning in 3Q2020 with flights resuming by mid-June or early July. The persistence of the pandemic would still put a damper on leisure travel, however, and would result in the country’s tourism industry closing out the year with USD 3.45 bn in revenues. Under a less optimistic scenario, normal life and travel would fully resume by 4Q2020, which would give Egypt 25% of its regular tourist arrival and income. This scenario assumes a total of 750k tourist arrivals and USD 3.1 bn in revenues throughout the year. The final (and worst-case) scenario, which assumes the virus continues to spread aggressively until December and travel restrictions remain in place until the end of the year, would result in a 100% y-o-y drop in Egypt’s tourist arrival figures from April until December.

M&A WATCH- The Suez Canal Bank has completed the sale of its USD 30.6 mn stake in the Middle East Oil Refinery (Midor) to state-owned Egyptian General Petroleum Corporation (EGPC) after obtaining the necessary approvals from the Financial Regulatory Authority and the EGX, according to Masrawy. The bank had agreed last month to sell its 1.27% stake in Midor to EGPC, which owns 78% of Midor. Cairo Capital Securities acted as the broker in the sale, reports the local press.

INVESTMENT WATCH- Samsung is planning to invest USD 84 mn in Egypt over the next five years, including USD 23 mn for a new production line to assemble computers that is expected to go online in August, Samsung Egypt Chairman Choonki Kwon said yesterday during a meeting with GAFI boss Mohamed Abdel Wahab, Hapi Journal reports. Choonki did not disclose what the remaining investment is earmarked for. Samsung is looking to use Egypt as a regional production and export hub for the Middle East, Europe, and Africa, according to the newspaper. Samsung currently exports 85% of its output from its Beni Suef facility to African and European markets.

Israel’s Leviathan gas field back online after temporary closure last week: Israel’s offshore Leviathan natural gas field which supplies Egypt has resumed production after an emergency shutdown, its Texas-based operator Noble Energy said last Saturday, Reuters reports. Israel’s Energy Ministry initially reported an emergency closure after the platform’s flare system was activated but later said it was a false alarm triggered by the failure of a gas detector. The report does not say for how long or to what extent the shutdown affected supplies to Egypt.

Background: Israel began pumping natural gas to Egypt at the top of the year, after a landmark USD 19.5 bn agreement signed in 2018 between Alaa Arafa’s Dolphinus Holding and the operators of Israel’s Delek Drilling and Noble, which will see Israel ship more than 85 bcm of gas to Egypt over the next 15 years. Leviathan, owned by Delek Drilling and Israel’s Ratio Oil, is one of two fields which supply Egypt and Jordan. It became operational at the end of last year.

CBE finances purchase of 100k POS machines: The Central Bank of Egypt (CBE) said it will finance banks’ purchase and distribution of 100k new POS machines this year as part of a wider plan to expand the use of e-payment services, according to a circular (pdf). The CBE will give incentives to banks that promote POS payments with a bonus equivalent to 0.5% of the value of the total transactions processed via their POS for three months.

Central bank to promote QR Codes: Banks that allow clients to pay bills and transfers by swiping a QR code would be granted a 0.5% bonus of their total transactions while merchants will be awarded EGP 3k for every 150 new QR codes scanned until the end of December. This comes in tandem with the Finance Ministry beginning to collect government payments through QR codes that work in a similar way to contactless cards: either by having the customer scan a bill code to process the payment or the merchant scanning the customer’s code. Finance Minister Mohamed Maait said (pdf) would be faster and safer than using ATM machines and bank cards.

STARTUP WATCH- Disruptech plans to invest USD 5 mn in fintech startups this year, founder Mohamed Okasha tells Al Mal. The fintech fund is looking to acquire two unnamed companies before the end of the year, Okasha said. The former Fawry CEO told Al Mal last month that over the next three years, Disruptech would invest in 15-18 young companies in the field. Disruptech made its first investment in Khazna and Brimore last April. Fawry is among several other local and international institutions that contribute to the USD 25 mn fund.

STARTUP WATCH- EYouth secures USD 180k in seed funding from EdVentures: Cairo-based social enterprise EYouth has raised USD 180k in seed investment from EdVentures, the VC fund announced in a statement (pdf). The organization, which runs entrepreneurship training programs for young people, will use the funds to develop an online platform to extend its services in Egypt and expand to other African countries. EYouth, which was founded in 2010, offers training programs to help young entrepreneurs can start and build their own businesses and connect to investors.

MOVES- Raya Contact Center CFO resigns: Raya Contact Center Chief Financial Officer Mostafa Hasaballah has resigned effective 31 May, the company said in an EGX disclosure (pdf). The company has appointed Governance Director Haytham Salama (LinkedIn) to replace him temporarily until a new CFO is hired.

MOVES- HHD general assembly approves new board: State-owned Heliopolis Housing and Development shareholders approved the appointment of the new board of directors, according to a regulatory disclosure (pdf). The new appointments include Tamer Mohamed Nasser as the company’s new managing director and CEO, and former Giza governor Khaled El Adly as non-executive chairman. The old board resigned in April having failed to attract offers for its tender for a 10% stake + management rights in February, prompting it to abandon its share sale plans.

EARNINGS WATCH- Madinet Nasr Housing & Development’s (MNHD) net profit grew 13.7% in 1Q2020 to reach EGP 378.1 mn, up from EGP 332.3 mn in the same period last year , according to an EGX disclosure (pdf). Revenues surged by 48% on an annual basis, reaching EGP 941.9 mn during the quarter from EGP 634.22 mn last year.

Arafa annual profits surge: Arafa Holding reported a five-fold increase in net profits during FY2019-2020, reaching USD 15.2 mn from USD 3.1 mn the year before, according to an EGX disclosure. Arafa Holding’s fiscal year begins in February.

Making It, our podcast on how to build a great business in Egypt, is back on the airwaves this Thursday. This season, we’ve already spoken to CEOs who built businesses in the education, confectionary, microfinance and fintech industries. Curious to hear their stories? Our season 2 guests so far include:

- Sahar Salama, CEO of TPay

- Amro Abouesh, CEO of Tanmeyah

- Laila Sedky and Adel Sedky, Founder and CEO of Nola

- Mohamed El Kalla, CEO of CIRA

Catch all of seasons 1 and 2 on our website | Apple Podcast | Google Podcast | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.

Image of the Day

Forty-one countries have begun to relax lockdown restrictions: How are they faring? Visual Capitalist is out with a chart mapping the progress of 41 countries that have begun to unwind lockdown restrictions. The graphic measures the level of mobility afforded to citizens and the rate of recovery from the virus: countries in the top-right quadrant contains countries with lax preventative measures that have experienced a rapid rate of recovery while and the bottom-left houses states with severe lockdown restrictions and a sluggish recovery rate.

Egypt in the News

It’s a relatively quiet morning for Egypt in the foreign press. A handful of stories making the rounds:

- Walid Phares, a former adviser to US President Donald Trump, was previously investigated by the FBI for possible “covert ties” to Egypt. “Investigators scrutinized ties between Walid Phares and the Egyptian government. He was never charged with a crime,” the New York Times reports.

- GERD is still getting digital ink: Quartz Africa is recapping the Grand Ethiopian Renaissance Dam dispute between Egypt, Ethiopia, and Sudan ahead of a new round of talks to break the deadlock.

- NGOs are criticizing conditions in Egypt’s prisons following the death of 24-year-old filmmaker Shady Habash behind bars earlier this year, according to Deutsche Welle.

Diplomacy + Foreign Trade

Egypt will begin exporting grapefruit and citrus to Uzbekistan and Indonesia, Agriculture Minister El Sayed El Qusair said last week.

How AUC is adapting to education under covid-19: With the covid-19 pandemic forcing universities across the world to make a sudden shift to online learning, we wanted to understand more about how the American University in Cairo (AUC) has been coping with the situation. We spoke with AUC President Francis Ricciardone and Provost Ehab Abdel Rahman, who told us that the government’s measures to contain the spread of covid-19 are accelerating long-term trends towards distance learning and the more efficient use of resources. We also delved into other plans for the university, including issues including tuition fees and accessibility. Edited excerpts from our discussion:

Remote instruction was an emergency move to cope with covid-19. As covid-19 numbers rose, AUC held intensive general training for some 800 faculty members on how to hold online classes — a process made easier by the university’s 15 years of investment in its Center for Learning and Teaching (CLT), which is constantly developing new learning methodologies, Abdel Rahman tells us. Even with systems in place, the rapid shift to online instruction wasn’t easy. AUC leadership moved spring break from the third week of April to mid-March to use the week for preparation, says Ricciardone, which was a controversial decision but proved to be necessary.

Now it’s spurring the shift to long-term online teaching. Having been forced into remotely instructing students, the university is looking to institute a longer-term, more comprehensive system for online teaching as of the summer term, says Abdel Rahman. This move should increase student engagement, Abdel Rahman says, telling us that this is what differentiates remote instruction from online learning. A positive byproduct of the rapid shift online is that it has demonstrated the value of blended learning, which should help to reduce any resistance to the shift, he adds.

With proctored classroom exams a no-go, instructors have resorted to take-home exams and other assessment tools. These include oral assessments, written essays, or research papers, says Abdel Rahman. Special software for proctored exams has also been made available for subjects such as science and engineering, where AI tracks students’ eye movements, scans the rooms they are sitting in, and monitors their computer screens. This technology remains in limited use though, with take-home exams currently the most widely-used assessment tool, Abdel Rahman says.

The university is now also overhauling policies that are no longer fit for purpose. Many policies designed for face-to-face instruction are not applicable to online study, requiring the university to rethink how it approaches everything from classroom attendance to regulations to protect confidentiality in exams, says Ricciardone. An example of this is the implementation of an optional credit/fail grading policy, where students were able to switch their final grade to credit for certain courses during the spring semester.

The financial impact of the pandemic may be heavy — but the university is taking the chance to streamline: Although the disruptions caused by the virus are having — as Ricciardone tell us — “huge budget impacts,” AUC’s leadership wants to use this to drive reforms that are already underway such as reducing cash transactions on campus. Special committees have been set up to look at how to allocate resources more efficiently and secure new sources of funding. Digital innovation will play a role, but the idea is not simply to digitize paper-based processes, but to use digital tools to deliver services in a better and cheaper way, says Ricciardone.

AUC hasn’t refunded or reduced tuition fees for this academic year, Abdel Rahman says, because while there have been a small number of requests for refunds, AUC’s costs haven’t really decreased. Its current policy involves refunding specific fees that go to specific services not being used, such as for the dormitories that students couldn’t stay in for the last half of term, or bus fees.

Tuition hikes announced in February will still be implemented, but the university won’t put fees higher than that this year. The tuition rate for undergraduate Egyptian students for 2020-2021 was set at USD 647 per credit hour, according to the AUC website. This is up from USD 583 per credit hour in 2019-2020. The aim is to keep prices down without compromising on quality, says Ricciardone. In USD terms, tuition has been relatively flat for 10 years, he says, maintaining that the 2020-2021 rate is about the same in USD terms as what was charged in 2013. But the rate in EGP terms has skyrocketed over the past decade because of depreciation and the EGP float in 2016. AUC’s Egyptian students can pay tuition and fees in EGP, while international students must pay in USD.

The university already incurs large costs and subsidizes all students up to a point. 45% of AUC students receive some sort of financial assistance from the university, ranging from a 10-15% reduction in tuition fees to an almost 100% reduction, depending on the student’s circumstances, says Abdel Rahman. Meanwhile, it costs about USD 28k every year to educate a student, while the university will charge each student in the incoming Fall class maximum fees of USD 19.4k per year, says Ricciardone, so even students who pay full tuition fees are still getting a c.30% subsidy. The USD 9k per student gap is bridged from the university’s endowment fund, which is invested, and which will have to be used more in the coming year to cover expenses, he adds. “We are not-for-profit,” says Ricciardone. “We are seriously unprofitable if you measure profit by USD coming in versus what it costs to educate students.”

AUC committed to increasing financial aid in November 2016, to ensure greater accessibility. AUC doesn’t want to lose any student in good academic standing because of an inability to meet tuition charges, says Ricciardone. This came after protests by the student union, which took place after the devaluation. “We’ve stood by this commitment, although it gave us a USD 6 mn deficit for the last half of that fiscal year and into the next year,” he says. As part of its commitment to inclusivity, AUC recently signed an amendment to a 1975 MoU with the government, allowing it to grant 30 scholarships to students from Egypt’s public schools nominated by the Egyptian educational apparatus, Ricciardone tells us. This is in addition to a recent grant cooperative agreement with USAID, the US embassy and seven partner universities that will bring 700 Egyptian students from underprivileged areas all over the country to study in these universities in five cohorts over 10 years. The initiative was funded by USD 35 mn from USAID and USD 5.5 mn from AUC, he adds. The students selected must fulfil particular criteria, with an overall 50-50 male-female ratio, and at least 15% being disabled or having special educational needs.

Long-term, AUC has been trying to leverage its value proposition to bring more international students back to Egypt. Covid-19 threatens these efforts. Attracting international students has been a strategic priority for AUC since numbers fell dramatically between 2011 and 2015. The university caters particularly to foreign students who can come to Egypt to study a range of contemporary issues and problems in the developing world, says Ricciardone. They were making headway bringing those students back, he adds, but the pandemic will make this more difficult, with one of its major effects being the drop in enrollment of international students. This impacts both AUC’s revenue and — one can infer — the diversity of the experience it can offer.

Your top education stories of the week:

- The government plans to invest EGP 24 bn in new and expanded higher education facilities in FY2020-2021, Planning Minister Hala El Said said last week.

- Access to learning platforms has increased by 395% since the beginning of the covid-19 lockdown, reports the local press.

- President Abdel Fattah El Sisi has directed the government to purchase laptops for students to help them with distance learning.

- The ministry is considering a “flipped classroom” model in technical schools in the next academic year, deputy minister for technical education Mohamed Megahed said.

- Post-corona transnational education in Egypt: Convincing overseas students to study in Egypt after the pandemic will be a “hard sell” due to administrative inefficiencies, corruption and the political situation, University World News suggests.

The Market Yesterday

EGP / USD CBE market average: Buy 15.83 | Sell 15.93

EGP / USD at CIB: Buy 15.84 | Sell 15.94

EGP / USD at NBE: Buy 15.82 | Sell 15.92

EGX30 (Sunday): 10,220 (+1.1%)

Turnover: EGP 613 mn (13% below the 90-day average)

EGX 30 year-to-date: -26.8%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 1.1%. CIB, the index’s heaviest constituent, ended up 0.6%. EGX30’s top performing constituents were Cleopatra Hospitals up 5.9%, Madinet Nasr Housing up 4.9%, and AMOC up 3.6%. Yesterday’s worst performing stock was Eastern Company down 3.1%. The market turnover was EGP 613 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -809.3 mn

Regional: Net Long | EGP +72.9 mn

Domestic: Net Long | EGP +736.4 mn

Retail: 8.0% of total trades | 8.4% of buyers | 7.6% of sellers

Institutions: 92.0% of total trades | 91.6% of buyers | 92.4% of sellers

WTI: USD 35.35 (-0.39%)

Brent: USD 37.74 (-0.26%)

Natural Gas (Nymex, futures prices) USD 1.80 MMBtu, (-2.76%, July 2020 contract)

Gold: USD 1,755.40 / troy ounce (+0.21%)

TASI: 7,213.03 (+2.30%) (YTD: -14.02%)

ADX: 4,14.61 (+0.54%) (YTD: -18.40%)

DFM: 1,945.09 (-0.84%) (YTD: -29.65%)

KSE Premier Market: 5,424.33 (-0.57%)

QE: 8,844.74 (-0.32%) (YTD: -15.16%)

MSM: 3,544.58 (+0.68%) (YTD: -10.97%)

BB: 1,269.63 (-0.50%) (YTD: -21.15%)

Calendar

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

13 June (Saturday): Earliest date on which suspension of international flights to / from Egypt expires.

13 June (Saturday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 June (Tuesday): Anniversary of the June 2013 protests, national holiday.

12 July (Sunday): North Cairo Court will hold a court session for the international arbitration case filed by Syrian Antrados against Porto Group for USD 176 mn after being pushed back from an initial 17 May court date.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.