- Enterprise poll: CBE to leave rates on hold tomorrow. (Speed Round)

- Egypt now has 710 confirmed cases of covid-19. (What We’re Tracking Today)

- Egypt achieves record USD 13 bn tourism revenues in 2019. (Speed Round)

- FRA asks securitized bondholders to extend maturities. (Speed Round)

- Consumer finance companies are looking for FRA licensing. (Speed Round)

- Trump administration says 100k-240k people in America could die of covid-19. (What We’re Tracking Today)

- Global stocks close one of the worst quarters on record. (What We’re Tracking Today)

- How the Egyptian construction sector is responding to the covid-19 crisis: Amr and Hassan Allam, co-CEOs of Hassan Allam Holding. (Hardhat)

- The Market Yesterday

Wednesday, 1 April 2020

CBE to leave rates on hold tomorrow: Enterprise poll

TL;DR

What We’re Tracking Today

Can you believe it’s the first day of 2Q2020? Our heads are still spinning over here.

Ten of 11 analysts in our Enterprise interest rate poll see the CBE leaving rates on hold when its monetary policy committee meets tomorrow. We have all the details in this morning’s Speed Round, below.

The government will also review petrol prices tomorrow or next Sunday at the latest, Al Mal reports, citing unnamed government sources. Petrol prices are allowed to move up or down 10% when the committee meets every three months, moving in tandem with oil prices. The committee met for the first time last October and left prices unchanged at its January meeting.

News triggers triggers to keep your eye on as April starts.

- PMI figures for Egypt, Saudi Arabia and the UAE will land (doubtless with a thud) on Sunday, 5 April.

- Foreign reserves figures for March will be released on or around Sunday, 5 April.

- Inflation figures for March are due on Thursday, 9 April.

The House of Representatives will review the Madbouly government proposed 2020-2021 budget when MPs return from recess on 12 April, Al Mal reports. We had the full report on the draft budget and its targets yesterday.

Two covid-19 trends to keep your eye on going forward:

- Will “immunity passports” become a thing? Germany is planning to issue certificates to folks who have recovered from covid-19, allowing them to return to work and daily life — with all of the creepiness attendant to living in that kind of world. Business Insider and the Guardian have more.

- European hospitals are reporting shortages of meds thanks to supply chain disruptions. We suspect disruption of the supply chain will be a theme across industries and around the world for several months after the crisis abates.

Markets this morning: Asian markets are up as they approach mid-session at dispatch time — major indexes in Hong Kong, China and South Korea are all up, as are India, New Zealand and Australia. The exception: Japan. Futures currently point to a lower open for the Nasdaq, Dow and S&P across the pond, while Europe is looking mixed right now.

The EGX30 closed up 0.8% yesterday on moderately heavy trading, with total turnover coming in at 39% above the trailing 90-day average.

COVID-19 IN EGYPT-

Egypt now has 710 confirmed cases of covid-19 after the Health Ministry reported 54 new infections yesterday, all Egyptians. Five Egyptians were reported to have died of the disease, bringing total deaths in the country to 46. A total of 157 patients are now reported to have fully recovered, while another 205 appear to be on the path to recovery after having tested negative following treatment.

Egypt’s private airlines want a bailout package, Reuters reports, saying Civil Aviation Minister Mohamed Enabah met yesterday with the heads of private carriers. A ministry statement later said that the companies are asking for help to “stop the bleeding … suffered by the private companies and help them overcome this crisis.” The government has so-far been silent about any assistance it may be providing to EgyptAir, the national flag carrier. All international flights except cargo hauls are suspended until mid-April.

They’re not alone: Dubai has announced it will provide a bailout package to Emirates Air to keep the airline afloat, Bloomberg reports.

Tourists who want to ride out covid-19 in Egypt can do so, the government signaled yesterday. Tour operators and hotels have been directed to work with the Interior Ministry to renew visas (the visa and passport office is otherwise closed for business at the moment under covid-19 restrictions). Tourists who want to stay will also need to be tested for the virus that causes covid-19, Youm7 reports.

The state-owned Holding Company for Metallurgical Industries (MIH) is looking to manufacture ventilators after Minnesota-based Medtronic announced that it’s putting the intellectual property behind its PB560 model into the public domain, MIH Chairman Medhat Nafea said. Medtronic is making all design files for the PB560 model available to the public on its website.

Emergency fund for construction workers? The Real Estate Development Chamber is considering setting up an emergency fund for construction workers facing mandatory unpaid leave of they’re furloughed to help slow the spread of covid-19, Al Mal reports.

Egypt should temporarily ban the export of food commodities and medical supplies, a group of MPs said yesterday, according to Al Mal.

Price cuts on electricity for factories are now in effect. The cuts were part of the government’s economic response to covid-19 and reduce prices for peak and offpeak times for medium, high and ultra-high voltage users. The price change was made official with its publication in the Official Gazette yesterday. Other moves to support industry announced earlier last month included lower natural gas prices for factories and the payout of EGP 1 bn in overdue arrears to exporters by no later than April.

Egyptians have collectively sunk EGP 39.2 bn into 15% fixed-rate savings certificates launched by Banque Misr and the National Bank of Egypt in the 10 days since the certificates were offered, Masrawy reports, citing unnamed banking officials.

The MoH has set up two hotlines to offer a friendly ear to folks suffering during the ongoing lockdown or from covid-related fear, anxiety or distress. The numbers: 080 888 0700 and (02) 2081-6831.

ON THE GLOBAL FRONT-

GLOBAL STORY OF THE DAY: The Trump administration says 100k-240k people in America could die of covid-19 based on a model released overnight. The news dominates front pages in the global business press: Reuters | FT | WSJ.

Global stocks wrap one of the worst quarters on record: US stocks have had their worst quarter since 2008 as a sell-off in late trading yesterday brought losses to 20% year-to-date. It was worse for the Dow Jones which experienced its largest quarterly sell-off since 1987 as the covid-19 pandemic put the market through a historic bout of turbulence. The Financial Times and Bloomberg are both out with post-mortems.

Believe it or not, there were actually two companies that held their heads above water in the sea of red. Microsoft made it through unscathed by the closest of margins, closing up 0.00006% in the green for the quarter. The big winner though was Jeff Bezos, who saw Amazon’s shares gain 5.43% over the three months as consumers threw money at emergency supplies and Slack and Zoom did the same for Amazon Web Services. CNBC has more.

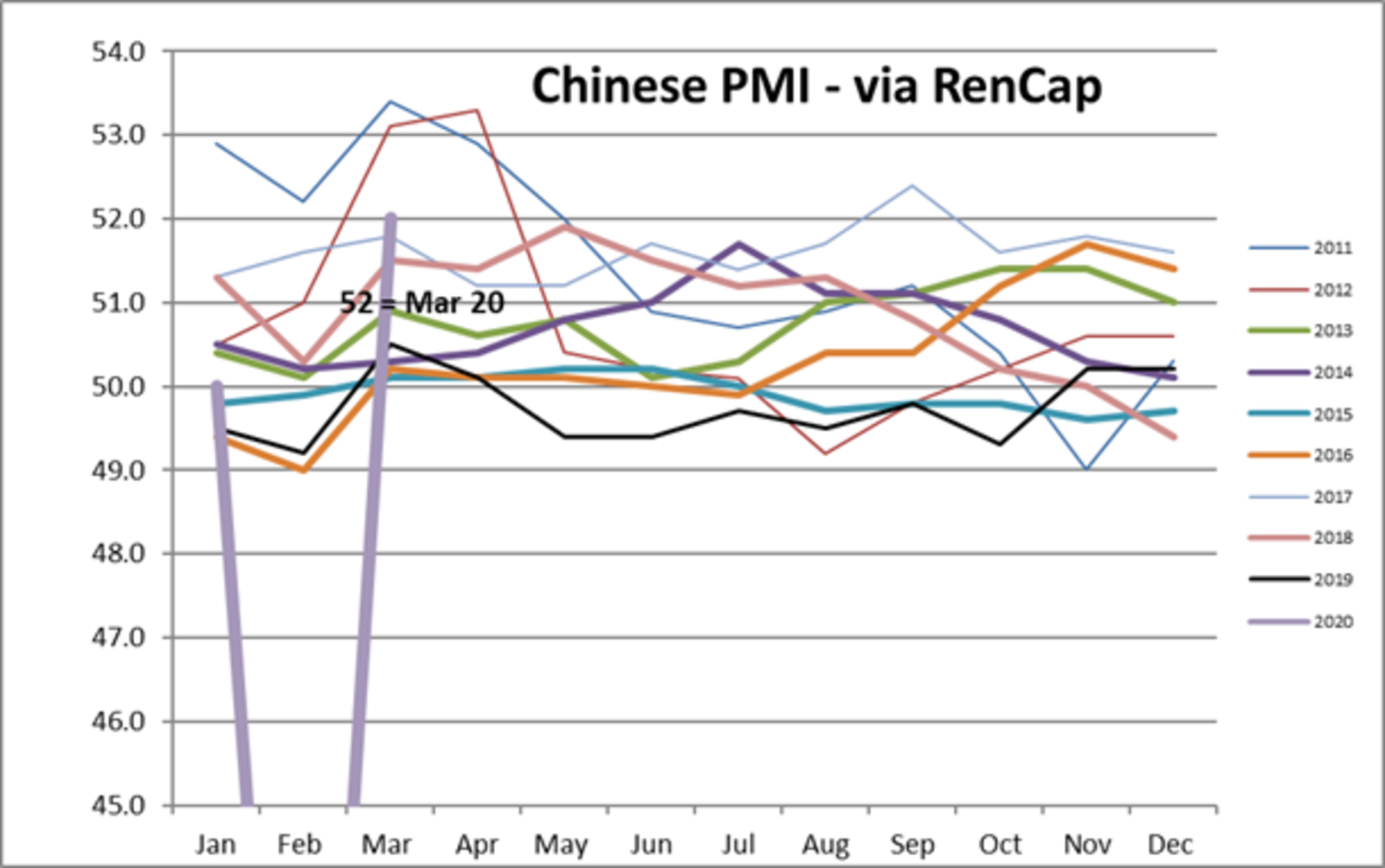

New PMI out of China suggests hopes for a v-shaped recovery may not be totally pie in the sky: China’s manufacturing purchasing managers’ index (PMI) surged last month in the first sign that the economy could be making a speedy recovery after several months of shutdown. Figures released yesterday by the National Bureau of Statistics showed manufacturing sector activity expanding after falling to an all-time low in February.

Encouraging signs but the country has a long way to go, says Capital Economics: “This does not mean that output is now back to its pre-virus trend. Instead, it simply suggests that economic activity improved modestly relative to February’s dismal showing, but remains well below pre-virus levels,” said Julian Evans-Pritchard, senior China economist at Capital Economics, in a note picked up by Reuters.

Whatever the state of the Chinese economy, the figures helped to perk European stocks — which closed out their worst first quarter on record: European stocks rallied yesterday after the PMI figures were released but still ended up clocking in their worst quarter since 2002, CNBC reports.

And the dire economic predictions of the day go to S&P Global Ratings and Goldman Sachs, who are back to remind us how [redacted] we’re going to be in the months ahead:

- S&P Global Ratings has scaled back its 2020 global growth forecast to a dire 0.4% in light of the covid-19 outbreak’s impact on global economies and markets, according to its chief economist Paul Gruenwald. It’s a drastic drop from the 3.3% estimated before the pandemic, and the forecast hasn’t been seen since the 1982 economic crash which saw global growth calculated at 0.43%. Gruenwald also predicts a rebound to 4.9% in 2021.

- Goldman Sachs has somehow managed to blacken its outlook for the US economy even further: The investment bank is now predicting the US economy to contract by a stunning 34% in the second quarter, lower than its previous forecast of a 24% contraction, Reuters reports. It also dropped its 1Q target to 9% from 6%, and sees unemployment reaching 15% by midyear instead of its previous 9% estimate.

Saudi Arabia has begun to flood the market with ultra-cheap crude: Saudi Aramco is delivering on its promises to ramp up production to record levels and slash its prices in April, with tankers already on their way to Europe and the US, and several supertankers hired earlier this month to boost exports now loaded, Bloomberg says.

What is about to take place is going to have effects on the oil market for years to come: As Ben Sharples writes for Bloomberg: “Oil is entering a period of unparalleled demand destruction this month that promises to transform the industry for years to come.”

In other international covid-19 news:

- Dubai imposed the UAE’s first lockdown on its famous gold and spices market for two weeks, expanding the partial curfew in place to curb the spread of the covid-19, according to Reuters.

- Communities across Italy and Spain are starting to push back against lockdown, some out of desperation having depleted their resources and others just rebelling against the draconian restrictions, the Financial Times reports.

*** We’ve never asked you for a penny, but we’re doing so today — not to put a coin in our pocket, but to help the folks at the Breathe campaign raise funds to acquire ventilators the nation needs.

The Breathe Campaign is raising funds to purchase mechanical ventilators from suppliers around the world. As the number of covid-19 cases rises in Egypt, so does the need for ventilators across the country. For critically ill patients, mechanical ventilation can be the difference between life and death — all of you reading Enterprise have seen the stories about shortages in developed economies including Italy and the United States. The Breathe Campaign, a pilot project by charity startup Humankind with the aid of the Egyptian Cure Bank, has created a star-studded campaign featuring public figures including Yosra, Amina Khalil and Naguib Sawiris simply inhaling and exhaling.

Keep up to date with the campaign on Instagram and check out the ad (watch, runtime: 1:08).

Want to make a contribution? Hit up the Egyptian Cure Bank, Fawry or the FawryApp or check out the description section of the Youtube page for other options.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and even social infrastructure such as health and education.

In today’s issue: Our exclusive sitdown with Amr and Hassan Allam, Co-CEOs of Hassan Allam Holding, the second in a two-part series on how the construction industry is managing the covid-19 crisis. The brothers spoke with us on the state of the sector during covid today, what can we expect on the long term, and what lessons or positive outcomes we can draw in a post-covid-19 world. Part one, which ran last week, featured a sit-down with Orascom Construction CEO Osama Bishai.

Enterprise+: Last Night’s Talk Shows

Pensions in the spotlight: Al Hayah Al Youm’s Lobna Assal spoke with Social Solidarity Minister Nevine El Kabbaj who discussed efforts to reduce crowds as pensioners start heading to banks to collect their payments today. Day slots — from 1-9 April — have been assigned for each income bracket to limit footfall, she said. She added that the ministry is working on vetting its lists of irregular workers to ensure that they receive their economic relief stipends in April. She also discussed ongoing talks with the Financial Regulatory Authority to see if people with microloans can join those with bank loans in having their repayments frozen for six months (watch, runtime: 12:38).

The rehabilitation of Ahmed Moussa continued last night as he held an extended interview with cabinet spokesman Nader Saad about fake news online: Fresh off of his extended interview with CBE Governor Tarek Amer and a chat with Finance Minister Mohamed Maait, Moussa talked to cabinet spokesman Nader Saad about certain rumors spreading online about the government’s plans for combating covid-19.

Saad denied the government intends to extend the curfew hours or impose a nationwide lockdown and rejected claims that the entire banking system was about to shut down (watch, runtime: 37:12). Yahduth Fi Misr’s Sherif Amer also spoke with Saad (watch, runtime: 0:57). Masaa DMC’s Ramy Radwan (watch, runtime: 0:45), and Assal (watch, runtime: 2:40) also covered the issue of online fake news.

Daily covid-19 update: Masaa DMC’s Ramy Radwan covered the Health Ministry’s daily statement on covid-19, which yesterday reported 54 fresh cases and five more deaths, taking Egypt’s total number of cases to 710 and the overall death toll to 46 (watch, runtime: 3:05). Min Masr’s Reham Ibrahim (watch, runtime: 4:59) also covered the statement.

Locally-made ventilators in the works: Ibrahim also spoke with the chairman of the board directors at the Holding Company for Metallurgical Industries, Medhat Nafea, who said that his company is already in the process of developing a prototype ventilator, after US-based medical devices company Medtronic made the design specifications for their patented PB560 ventilator publicly available yesterday (watch, runtime: 8:15).

Speed Round

Speed Round is presented in association with

ENTERPRISE POLL- CBE to leave rates on hold tomorrow: The Central Bank of Egypt is likely to leave interest rates on hold when its Monetary Policy Committee meets tomorrow, according to a poll of analysts conducted by Enterprise. Ten of 11 analysts polled expect the bank to leave interest rates unchanged after slashing rates 300 bps in an emergency cut barely two weeks ago. The bank said the move was “preemptive” to support the economy through the covid-19 pandemic.

Where rates stand now: The CBE’s overnight deposit rate is at 9.25% and the lending rate is at 10.25%. The main operation and discount rates are both at 9.75%.

The central bank’s monetary policy committee has made clear that it’s prepared to cut rates if necessary: During the announcement of its biggest-ever rate cut on 16 March, the central bank said that it “will not hesitate” to make further cuts if needed, a point reiterated earlier this week by Governor Tarek Amer.

That time is not now, analysts say:

Central bank to wait and see the effects of its emergency cut -EFG Hermes: The CBE will likely wait and see how the emergency rate cut impacts prices and how the rest of the world responds to the pandemic, Mohamed Abu Basha, chief MENA economist at EFG Hermes, told us. “Nothing has changed since [the emergency rate cut] and the government is gradually rolling out more measures to curb the spread of covid-19, but without taking drastic measures that could prompt the CBE to cut rates,” he said.

Inflation could tick up in the coming months: HC Securities’ Monette Doss expects the central bank to hold off on making another cut because of the likelihood of inflation increasing over the coming months. The hoarding of staples and pharma products prompted by the 7pm-6am curfew, potential production disruptions during the lockdown, and high demand during Ramadan will see annual inflation peak at 11.45% by December, she said. Inflation slowed from 7.2% in January to 5.3% in February, outside the lower bound of the central bank’s 9% (+/-3%) target range.

“Current risk levels also discourage further rate cuts,” Doss said, noting the rise in Egypt’s five-year credit default swap (CDS) spread and the demand for higher yields in the bond market. The price of five-year CDS (basically the cost of insuring Egypt’s debt) surged to 650 bps from 258 bps in the third week of February, reflecting growing anxiety about the country’s creditworthiness as well as nervousness on the part of investors over global developments. In the bond markets, yields in the primary market have only dipped slightly despite the CBE making a 300 bps rate cut.

The CBE won’t want to give foreign investors more reason to dump bonds: The central bank will leave rates on hold to ease pressure on the EGP amid a sell-off in local-currency bonds, said Abou Bakr Imam, head of research at Sigma Capital. Leaving rates unchanged is probably not going to stop portfolio investors from selling, counters Ahmed Hafez, head of MENA research at Renaissanceذ Capital, who suggested outflows will continue until global markets stabilize.

Capital Economics takes the contrarian view: The firm, which last week forecast the economy to contract 1.3% this year, thinks the CBE will go ahead with another rate cut tomorrow. “With central banks globally loosening policy further since [the emergency rate cut] and inflation pressures in Egypt under control, the CBE is likely to step up its policy support with another 100 bps cut in interest rates next week,” said James Swanston, MENA economist at Capital Economics. “As the full extent of the damage becomes clearer, we expect an additional 125 bps of monetary policy easing over the coming months.”

Don’t expect the recent cut to spark a capex splurge: Mohamed Saad, equity analyst at Shuaa Capital, said that despite interest rates falling to pre-float levels, most businesses seeking credit are looking for short-term loans to maintain cash flow and keep their operations running.

It’s a fine line for the CBE to walk in a time of global uncertainty: Cut rates and you do two things: Reduce the cost of borrowing for government (giving it more room for stimulus spending to keep the economy going — without completely nuking its budget deficit target) and encourage individuals and companies alike to put cash to work rather than letting it sit in bank accounts earning high interest. On the other hand, high interest rates keep Egypt attractive to the carry trade in a no-interest world.

No further cuts before the end of the year? Abu Basha, who originally forecast 200 bps of cuts through 2020, said it is unlikely that the central bank will make another rate cut until the end of the year.

Tourism revenues hit a record high of USD 13.03 bn in 2019, climbing more than 12% from USD 11.6 bn in 2018, according to data from the Central Bank of Egypt (here and here — pdfs). The industry’s previous record was USD 12.5 bn in 2010. Some 13.1 mn tourists visited Egypt in 2019, but average spending was higher than in 2010, according to Al Shorouk. Former Tourism Minister Rania Al Mashat had said that tourism revenues during FY2018-2019 reached USD 12.6 bn, despite lower arrival numbers. The minister explained at the time that tourists are staying longer and spending more.

Egypt was expecting to set another record in 2020, projecting USD 15 bn in tourism receipts. That forecast is now out the window with covid-19 putting the global industry into a flatline. Finance Minister Mohamed Maait told us earlier this week that he thinks it will take a year for the industry to mount a full recovery — a best case scenario, given what’s happening globally.

The average time for a tourism industry to recover after a crisis? 19.4 months, according to the World Travel and Tourism Council, which notes that it can take anywhere between 10 to 34.9 months (pdf) in the crises it studied.

DEBT WATCH- FRA asks securitized bond holders to extend maturities: The Financial Regulatory Authority approved a request from corporate bond issuers to extend the maturities of securitized bonds by six months and asked bondholders to follow suit, according to an official statement.

Background: A number of players in the securitized bond market met with the FRA earlier this week to request a six-month extension to maturities after the regulator granted a similar grace period for clients of mortgage lenders, factoring and leasing companies.

valU, Premium Card, Souhoola and Aman are looking for consumer finance licensing: Consumer finance outfits valU (an arm of EFG Hermes), Premium Card, Aman Installment Company (a subsidiary of Raya Holding), and Souhoola (a CI Capital subsidiary) will apply to the Financial Regulatory Authority (FRA) to receive licenses, according to Al Mal. The licenses will be awarded under the Consumer Credit Act, a piece of legislation that regulates the consumer finance sector. President Abdel Fattah El Sisi ratified the legislation last month.

CORRECTION- 1 April 2020

An earlier version of this story suggested that the companies had already submitted initial requests for the license.

Acrow Misr eyes Africa expansion: Scaffolding and formwork manufacturer Acrow Misr is planning to set up a subsidiary in Tunisia and to enter the Kenyan market as a prelude to further expansion in Africa, investor relations director Ahmed Abdel Azim said, according to the local press. Azim did not specify a timeline or specify the nature or cost of the ventures.

MOVES- Former investment minister Osama Saleh is now non-executive chairman of SODIC’s board of directors, following the departure of Hani Sarie El Din, the company said in a statement (pdf). Saleh was appointed to the board early last month as Sarie El Din stepped down after a six-year term.

MOVES- HSBC has appointed Samer Deghaili (Linkedin) and Marc Abourjeily (Linkedin) as co-heads of capital markets for the MENAT region, according to Reuters. Deghaili was previously HSBC’s head of equity capital markets for MENA and Abourjeily was HSBC’s head of MENA debt finance and risk solutions.

MOVES- Credit Agricole Egypt’s board of directors has approved the resignation of Vice Chairman Michel Mathieu (bio), according to an EGX filing (pdf).

Image of the Day

The goats are reclaiming Wales: A herd of goats invaded the seaside Welsh town of Llandudno yesterday as streets lay deserted under the government’s covid-19 lockdown measures. The Guardian has a full image gallery here.

Egypt in the News

No single story is dominating the conversation on Egypt this morning. Industry rag Foreign Policy claims that the US is considering trimming back military assistance to Egypt at the behest of lawmakers, while the country’s response to covid-19 are the subject of op-eds in the the Guardian and Al Monitor.

Distractions: The New York Times features six Egyptian female lion tamers (five of whom are related) while the BBC has photo essay on Bahariya and Farafra.

How the Egyptian construction sector is responding to the covid-19 crisis: Amr and Hassan Allam, co-CEOs of Hassan Allam Holding (part two of a two-part series). Our look at how infrastructure projects were faring in the early days of covid-19 had industry players tell us that projects had so far been largely unaffected. Fast forward three weeks and we’re looking at a very different world: Many businesses have instituted work-from-home policies, the government and the central bank have announced a raft of fiscal and monetary stimulus measures, flights have been grounded, and we’ve been confined to our homes at night for a week now.

We spoke with two of the largest players in the game to see how the industry is grappling with it all: Orascom Construction and Hassan Allam Holding. You can read the full interview with Osama here. Today we feature our sit down with Amr (the gentleman on the left in the photo above) and Hassan Allam, co-CEOs of Hassan Allam Holding. Edited excerpts from our discussion:

How have you responded to covid-19?

Hassan Allam (HA): Since the crisis began, Hassan Allam took safety precautions to minimize the risk of infections, including sanitizing equipment and offices, cutting down shifts, and working from home. But because of the scale of our operations, we knew that wasn’t enough. We employ 35k people, and they interact with suppliers, subcontractors and numerous third parties. We then decided to put 50% of our workforce on paid leave, and we would rotate them on a weekly basis. That still wasn’t sufficient because there were still thousands of people that were interacting on a daily basis.

As the situation became more critical, we decided last Thursday on a complete one-week halt on work sites, with paid leave for all staff and labor to elevate our safety precautions and add more stringent measures on sites. We decided we would assess the situation at the end of the first week and decide whether to extend the suspension. I believe that the big and serious players in the sector will do this, if they haven’t already.

Have projects or the delivery time on projects been impacted for Hassan Allam?

HA: They will be impacted as a consequence of the slowdown, and the longer the situation persists, the more projects will be delayed. Some projects will be able to recover from these delays, while others won’t. It will be on a case-by-case basis.

Which projects will be most heavily impacted by these delays?

HA: Projects that will be most heavily impacted are ones with long lead items that have suffered delivery delays. These will likely be projects that require particular construction methodologies that are a bit more restricted than traditional building works.

Amr Allam (AA): I think there will be delays across the board, and across the whole supply chain — whether it's workforce or materials — because of the nature of the global supply chain. It's an interconnected industry in general. A lot of the components that we use are imported from Europe or China or elsewhere. So, from a delivery standpoint, the delays are already impacting some projects today.

HA: You can’t say one part of the construction sector will be hit more than others. Both building and infrastructure works rely heavily on imported materials and skilled technicians. Lots of water projects, for example, rely on internationally procured technology and technology providers. On the labor side, we are also running into some inefficiency, as people are scared to be at work and want to stay at home.

How has Hassan Allam been managing its relationship with clients during the shutdown, whether on the delivery or the payment side?

HA: I have to say that the clients have been extremely supportive and cooperative. There is a very healthy dialogue going on, and it is a testament to the kind of relationship we have with out stakeholders and partners. So we have no complaints on that front. When such events happen there will be extended conversations with clients whereby both parties will compromise. Legally speaking, nobody factors in a global pandemic in a construction contract, so force majeure clauses are in place to protect both the contractor and the client.

AA: The clients in general understand that the construction industry is one that pulls numerous other industries behind it, such as subcontractors or material manufacturers. They understand that the cash flow cycle for the construction industry is a crucial one to keep alive. And I think the dialogue is open and we see a lot of support there to allow for us to be able to keep our staff — including day laborers — at home, on full paid leave for the next 1-2 weeks while we reassess our safety precautions. This couldn’t have happened if clients weren't supportive in terms of paying their invoices.

How will the crisis shape infrastructure development for 2020 and beyond?

HA: I think that once this pandemic is controlled, governments will want to kickstart the economic cycle, and pump liquidity into the economy and to get people back working again. We all know that construction is a leading industry when it comes to picking up employment. So we do expect the macro climate to benefit the construction industry in general; I am optimistic.

How is your business strategy adapting to covid-19 in the long-term?

HA: We have had plans in place since 2011 to diversify into cash flow positive, revenue-generating businesses that help support our core construction operations — which are prone to the cyclicalities of the market. These businesses include utilities, building materials, manufacturing, and engineering services. Basically work that can be done from a standalone location that is less dependent on labor and has a positive cash flow or a cash flow neutral business model — a cash and carry kind of situation. So most people will pay their electrical bills, their water bills, and pay in advance for engineering services, whereas it's common practice to delay bills associated with construction services. So we have decided to diversify our portfolio so that in the event of global pandemics, revolutions, and other situations that stress the cash flow, we are well-balanced.

AA: I think going forward we're going to look at avenues where we are going to be able to become more efficient and more cost conscious. There are a lot of items that drain your cash flow that can be cut. Cash flow and cash, in general, is the name of the game for 2020. So we’ll be looking at managing cash flows very tightly, while becoming more maneuverable and agile. We want to do this without impacting our employees as much as we can, and this is something we take very seriously. I want to stress that you really can't have a concrete (no pun intended) plan beyond four months from now because things are so fluid and they change on an hourly basis.

Have the government’s crisis response and economic policies been helping?

HA: The central bank has once again taken steps by reducing interest rates for us, and this is a big ticket item. Because we use working capital facilities to support some of our projects and our cash flows, reducing the interest rates associated with these working capital facilities has helped us reduce our costs significantly. So we’re seeing strong support from the government, led by the prime minister and the central bank.

What policy recommendations would you make?

HA: I would strongly recommend that the government delays 2019 taxes until December, rather than have them paid in April. We’re seeing this in other countries that pay taxes in April, like the US, which has delayed payments until July. I would recommend that we delay them even further here in Egypt. I'm not asking for taxes to be canceled; on the contrary, I believe that they have to be paid and in full. But pushing them forward is important to help the construction industry in particular overcome this situation.

AA: Postponing payments on non-performing loans for six months would be another positive step. It would be better if we are entering a no-interest period, rather than just a no-penalty period. In general, I would support policies that would make it easier for clients to pay dues owed to contractors. Banks can assist clients by extending further lines of credit.

I would also like to stress that paying old unpaid dues would go a long way to helping the sector — it would not need support if arrears were paid off.

What’s a positive outcome that could come out of the covid-19 crisis for the industry?

HA: The government realized that there is a significant need for further infrastructure development, particularly when it comes to healthcare and its supporting infrastructure. And this has important business potential for companies like Hassan Allam and our peers. There will be openings for large-scale contractors, engineering firms and building materials companies to have significant work to do in Egypt and in the region.

AA: The world is going to come out of this crisis a very different animal, particularly when it comes to the global supply chain. We will see a change in the mentality of businesses that used to rely exclusively on suppliers from certain regions. It’s unlikely that China will be relied upon as heavily as it used to be before the crisis. Egypt has the chance to be the main supply hub for Europe. We are geographically located in a very unique position. We have the workforce, the industrial infrastructure and the brains to capitalize on these circumstances.

What message would you like to send to industry, employees, shareholders, the business community, and the country at large?

AA: Every company today needs to ask itself what more it can do. The government can only do so much, so the private sector has a very large role to play in the coming months.

HA: We’ve been communicating a message of hope to our teams across 11 subsidiaries and seven countries. This is a very important time for companies that have done well here to show their employees how serious they are about being transparent with their staff and how far they’re willing to go to stand side by side with them during this crisis — be that through financial or emotional support.

Your top 5 infrastructure news of the week:

- The Cairo Airport Company has launched a EGP 1 bn tender for local companies to renovate the airport’s Terminal 2 over five years.

- The Transport Ministry has received bids from three international consortiums to build the second container terminal at Damietta Port in a project worth USD 300 mn.

- Cairo Metro’s three lines are getting five extra trains during rush hour in a bid to ease overcrowding.

- Four international companies withdrew their bids to build signal boxes for the Giza-Beni Suef railway line after the National Railway Authority refused to extend the tender by three months due to the covid-19 outbreak.

- Elsewedy Electric signed an agreement with Swiss-Swedish power company ABB Group to help it expand the Toshka 2 substation.

The Market Yesterday

EGP / USD CBE market average: Buy 15.68 | Sell 15.81

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Tuesday): 9,594 (+0.8%)

Turnover: EGP 834 mn (39% above the 90-day average)

EGX 30 year-to-date: -31.3%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.8%. CIB, the index’s heaviest constituent, ended down 0.6%. EGX30’s top performing constituents were Kima up 7.7%, Egyptian Resorts up 6.5%, and El Sewedy Electric up 4.4%. Yesterday’s worst performing stocks were GB Auto down 2.6%, CIB down 0.6% and Credit Agricole down 0.2%. The market turnover was EGP 834 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -385.1 mn

Regional: Net short | EGP -15.3 mn

Domestic: Net long | EGP +400.4 mn

Retail: 37.1% of total trades | 38.8% of buyers | 35.5% of sellers

Institutions: 62.9% of total trades | 61.2% of buyers | 64.5% of sellers

WTI: USD 20.30 (+1.05%)

Brent: USD 22.74 (-0.09%)

Natural Gas (Nymex, futures prices) USD 1.66 MMBtu, (-1.83%, May 2020 contract)

Gold: USD 1,591.90 / troy ounce (-3.12%)

TASI: 6,505 (+2.07%) (YTD: -22.46%)

ADX: 3,734 (-0.25%) (YTD: -26.42%)

DFM: 1,771 (-1.02%) (YTD: -35.93%)

KSE Premier Market: 5,198 (+1.61%)

QE: 8,207 (-0.91%) (YTD: -21.28%)

MSM: 3,448 (-0.55%) (YTD: -13.39%)

BB: 1,350 (-0.36%) (YTD: -16.12%)

Calendar

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action,” new administrative capital, Egypt.

12 April (Sunday): House of Representatives covid-19 recess ends.

12 April (Sunday): Western Easter Sunday.

12 April (Sunday): Court session for a lawsuit against Amer Group and Porto Group by Syria-based Antaradous for Touristic Development.

13 April (Monday): Earliest date on which suspension K-12 and university instruction is set to be lifted.

15 April (Wednesday): Suspension of international flights to / from Egypt expires.

15 April (Wednesday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

16 April (Thursday): New deadline for individuals to file their tax returns to the Egyptian Tax Authority.

17-19 April (Friday-Sunday): IMF, World Bank will hold virtual Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 April (Sunday): Court session for a lawsuit against Amer Group and Porto Group by Syria-based Antaradous for Touristic Development.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.