- Covid-19 in Egypt: New cases, flights to be suspended Thursday, “new measures” to roll out in three locations, school closure could be extended. (What We’re Tracking Today)

- CBE makes biggest rate cut on record to protect economy from covid-19 outbreak. (Speed Round)

- EGX sell-off continues as shares fall 7%. (Speed Round)

- Market volatility nears record levels as US stocks suffer biggest one-day loss since 1987. (Speed Round)

- Egypt to postpone EGX capital gains for one more year, slash stamp tax -sources. (Speed Round)

- Egypt is at the forefront of a new breed of sovereign wealth fund. (Worth Reading)

- Covid-19 could take a USD 2 tn swing at global income -UNCTAD. (Speed Round)

- Argineering raises USD 400k in follow-on investment. (Speed Round)

- The Market Yesterday

Tuesday, 17 March 2020

CBE orders surprise 300 bps rate cut; Egyptian airspace to effectively close on Thursday

TL;DR

What We’re Tracking Today

The Central Bank of Egypt slashed interest rates 300 bps in a surprise move yesterday evening — the same day that global markets plunged (the Dow was off 13% and the EGX fell a bit more than 7%), volatility hit a peak higher than back during the global financial crisis, both San Francisco and France went on lockdown, and the European Union said it is likely going to close its airspace for 30 days.

Heading into dispatch time this morning, the picture for markets is mixed: Japanese equities posted gains, but shares are slumping in Hong Kong, China and South Korea. Futures suggest the Dow, Nasdaq and S&P will all open in the green later today, while Europe looks set to open in the red.

Take a deep breath and contemplate the meaning of the central bank’s surprise rate cut. Our take: It means the bank is giving the government fiscal room to maneuver without running up double-digit deficits. A rate cut of this magnitude gives space (thanks to lower borrowing costs) to policymakers who need to deal with a potentially wide virus outbreak, support the economy, bail out EgyptAir, and still keep a bullet in the chamber against the unknown. The cut also signals to businesses and citizens alike that their cash is better put to use than it is left in the bank. There’s more, but we think this was the prime motivator.

Take a second deep breath and accept that neither you nor the rest of your team will be as efficient working from home this week (or next) as you have been working at the office. Projects will be late. You’re going to have new or different priorities. Productivity is going to drag (the opposite of what the “work from home movement” would usually suggest). This is natural when the world is topsy-turvey When your team is adjusting to new communications tools. When you’re still figuring out how to manage workflow remotely — and when you have kids at home (and their routines have been destroyed, too).

Now a third: Remember that for the vast majority of us alive today, life will go on. The coronavirus outbreak will resolve, and we’ll be left asking ourselves a whole bunch of new questions. You can get a hint of those questions here, if you’re so inclined: Some ask a taboo question: Is America overreacting to coronavirus?

And remember, if we can preach: Your prime directive right now? Keep your people safe — if a job can be done from home, let it be done at home.

Egypt has now reported 166 covid-19 cases, including 40 new cases confirmed yesterday, the Health Ministry said in a statement yesterday. With the majority of the new cases being Egyptians (35 of the new cases were nationals and five were foreigners), it suggests we’re now seeing community transmission. Eight of the Egyptians were people who had returned from performing the umrah pilgrimage in Saudi Arabia.

Two more people have died in Egypt, including a 72-year-old German national and a 50-year-old Egyptian from Daqahlia governorate who came into contact with the woman who died of the virus on 12 March.

Health Minister Hala Zayed told talk show host Amr Adib that unspecified measures will be rolled out in Daqahlia, Damietta and Minya to help control the outbreak. She declined in the interview to characterize those measures as a lockdown like those seen in Italy and now France (watch, runtime: 33:02)

Egypt is suspending all flights (inbound and outbound) from this Thursday and until 31 March, Prime Minister Moustafa Madbouly decreed yesterday, according to a cabinet statement. People looking to return home will be allowed to do so until noon on Thursday, Civil Aviation Minister Mohamed Manar said, according to Al Shorouk. Madbouly suggested the cost to the airline industry will be around EGP 2.25 bn. El Anani said he believes the opening of the Grand Egyptian Museum, among other initiatives, will help bring tourism back once the global covid-19 crisis abates.

School shut-down could be extended: Education Minister Tarek Shawky told nighttime talkshow host Lamees El Hadidi in a sit-down interview that the two-week shutdown of Egyptian schools and universities will likely be extended (watch, runtime: 3:29).

The World Health Organization is happy with our covid-19 response to-date, with the organization’s Dr. John Gabor telling CNN Arabic that Egypt’s detection system is “strong.” Cabinet posted the video on its Facebook page.

The Sisi administration is preparing a new stimulus package to help the economy. Prime MInister Moustafa Madbouly said it will target both the stock exchange and the real economy. Madbouly’s remarks came at a meeting that included the planning minister and the governor of the Central Bank of Egypt, a cabinet statement said, without offering further detail.

Governors are rolling out local bans on shisha in public places.

Prime Minister Moustafa Madbouly wants many civil servants to stay home, whether they work at ministries, government agencies or state-owned companies. The exception: Those working in healthcare and critical sectors including water and electricity services, a cabinet statement said.

Half the staff at the House of Representatives will be on leave for two weeks starting today. Priority was given to women and to staff with children under the age of 12, Al Shorouk reported.

The Governor of Cairo Khaled Abdel Aal said weekly markets must close and ordered the shuttering of 129 gymnasiums in the capital, Al Mal reports.

We won’t price gouge if you don’t hoard: Some domestic manufacturers have promised not to increase prices in the coming two weeks after consumers rushed to stores in a covid-19-motivated buying spree, said Six of October Investors Association head Mohamed Shaaban said. Factory and retail store owners are asking shoppers to stop stockpiling so as not to mess up supply-demand dynamics, Shaaban said.

Raya Contact Center is the latest business to announce it has implemented a work-from-home policy. The measure is for all employees at the company’s customer support centers in Egypt and UAE, according to Masrawy.

Schools nationwide will undergo deep cleaning starting Friday, according to Egypt Today. Cabinet closed schools for two weeks effective this past Sunday.

GLOBALLY: The European Union is closing its borders at 12 noon today to all non-essential travel.

France is going on lockdown, saying people can only leave home for work, to shop for food or to help the elderly and other at-risk populations, the Associated Press reports. The UK is also urging people to work from home.

Canada is closing its borders to non-citizens / residents. The only exceptions: The immediate family of citizens, plus diplomats, aircrew and (for the time being) Americans, Canada’s CBC reports. “If you’re abroad, it’s time for you to come home,” Prime Minister Justin Trudeau said yesterday.

Non-essential services and businesses are closing the world over. Among the measures now being implemented in one combination or another: shopping hours are being curtailed while museums, houses of worship, bars and non-essential shops are closing in Germany, Morocco, New York and Los Angeles

Covid-19 vaccine trials begin, but it won’t be rolled out for at least a year: The US’ National Institute of Health (NIH) started a coronavirus vaccine trial yesterday, a US government official told the Associated Press. Public health officials estimate that it will take 12 to 18 months for the potential vaccine to be validated and ready for widespread use.

Virus-related deaths outside of China surpassed those inside the country for the first time since the outbreak, with more than 3.3k deaths recorded in countries including Italy, Iran, and Spain as of early yesterday. A total of 3.2k deaths were reported inside China, according to figures compiled by Johns Hopkins University reported by The Wall Street Journal.

Other international covid-19 updates:

- G7 country leaders held a video conference yesterday to discuss a coordinated response to the virus outbreak, officials have said, according to Reuters. Little of substance appears to have emerged other than a pledge to work together and a warning not to hoard any eventual vaccine.

- Saudi Arabia has sent home employees home at all government agencies for a period of 16 days, according to a statement. The decision does not apply to government employees working in health, security, military and electronic security centers.

Demand for oil worldwide has hit a new low as more countries resort to “unprecedented” responses to the covid-19 dilemma, reports Bloomberg. The pandemic is leading traders, executives, hedge fund managers, and consultants to revise their oil consumption forecasts by margins, says the business information service.

Throw in a little oil war with Russia and it’s little wonder, then, that Saudi Aramco is slashing capital spending by as much as 23%, down to USD 25-30 bn from USD 32.8 bn, to make up for falling oil prices, the company said on Sunday, according to the Financial Times. Aramco’s stock price dipped by 2.8% yesterday, marking a record low, having fallen by 13% from its initial listing price. That’s not stopped the company from leaving in place a promise of delivering USD 75 bn in dividends, according to Bloomberg.

Oil prices dipped below USD 30 a barrel yesterday, Reuters reports, and Saudi Aramco said it was “very comfortable” with the price, adding that its plan to increase output to record levels to capture a larger share of the global market will run from April through to May.

Also in KSA: The kingdom has detained hundreds of government officials in a corruption clampdown, Reuters reports. Anti-corruption authority Nazaha tweeted on Sunday that 298 people had been rounded up on charges of bribery, embezzlement, and abuse of power involving USD 101 mn.

Also: Happy Birthday to The Colonel. We miss you, Dad. Every day.

Enterprise+: Last Night’s Talk Shows

CBE interest rate cut: Al Kahera Alaan’s Lamees El Hadidi spoke by phone with Hany Genena, head of research at investment bank Prime Holding, to discuss the Central Bank of Egypt’s unprecedented decision to cut interest rates by 300 bps. He lauded the timing of the decision saying it will help to preserve cash flow for businesses in the months ahead. He added that foreign investment in Egyptian bonds may not be affected as inflation is expected to decrease, ensuring returns remain attractive (watch, runtime: 4:22) and (watch, runtime: 5:20). Adib spoke by phone with the deputy head of the National Bank of Egypt, Yehya Aboul Fotouh, who said that the CBE’s decision was bold and presented a chance for SMEs to consider expansion (watch, runtime: 3:31). We have chapter and verse on the CBE’s announcement in this morning’s Speed Round, below.

Flights suspended from Thursday: El Hadidi also spoke by phone with Tourism Minister Khaled El Anani who confirmed that the flights will be suspended from Thursday until the end of the month and that after that time, airports will allow the landing of empty planes to evacuate foreigners (watch, runtime: 6:34). She also spoke by phone with State Information Minister Osama Heikal, who said tourists will leave according to the scheduled departure dates unless otherwise requested. Land and sea ports will remain open to allow for the flow of goods. (watch, runtime: 3:37). Adib also covered the story (watch, runtime: 2:36).

WHO delegation to visit Egypt: Adib spoke by phone with Health Minister Hala Zayed, who said that a delegation from the World Health Organization will visit the country on 24 March to review the measures taken against the spread of covid-19 upon a request from Egypt. She added that since two covid-19 deaths were from Daqahliyah, some 300 families in the governorate have been quarantined for 14 days (watch, runtime: 33:02). Min Masr’s Amr Khalil (watch, runtime: 2:48) had the same report.

Speed Round

Speed Round is presented in association with

The CBE has made its biggest rate cut on record, saying the move is to protect economy from covid-19 outbreak: The Central Bank of Egypt (CBE) slashed interest rates by 300 bps during an emergency meeting yesterday, it announced yesterday evening in a statement (pdf). The central bank’s Monetary Policy Committee (MPC) was due to review rates on 2 April, but announced what it said was a “preemptive decision” that would provide “appropriate support” to the economy amid the global covid-19 outbreak and its economic implications.

Where rates stand now: The CBE’s overnight deposit rate fell to 9.25% from 12.15%, the first time it has been in single digits since March 2016. The bank’s lending rate is now 10.25%, and the main operation and discount rates are both at 9.75%. The central bank had left rates on hold during its past two meetings, having lowered them by 450 bps between February and November last year.

What the CBE said: “The MPC’s preemptive decision provides appropriate support to domestic economic activity given the current challenging external environment, while the inflation outlook remains consistent with achieving the inflation target of 9% (+/-3%) in 4Q2020,” it said in the statement. “The MPC will continue to closely monitor all economic developments and will not hesitate to adjust its stance to achieve its price stability mandate over the medium term.”

CBE Governor Tarek Amer acknowledged the seriousness of the measures, describing it in remarks to reports last night as a “sacrifice to support the Egyptian economy.”

Amer also said the central bank is extending the tenor of all bank loans for a period of six months. The extension applies whether the facility is held by an SME, a large corporation or an individual borrower.

“It is a very bold and unexpected move,” Radwa El Swaify, head of research at Pharos Holding, told Enterprise. “This will reflect positively on economic growth and the industrial sector and the budget deficit, and potentially on the EGX.”

The jury is out on whether the rate cut would stimulate new investment: Muharram Hilal, vice president of the Investors Union, said it is way too early to start forecasting whether the lower interest rate environment will spark investment given the uncertainty over how the covid-19 outbreak will hit the economy.

What about the hot money? The deep rate cut suggests the central bank has shifted focus from the carry trade to supporting the real economy, said Abou Bakr Imam, head of research at Sigma Securities.

The emergency cut is not likely to cause a significant dip in the EGP-USD exchange rate, especially after the US Federal Reserve on Sunday cut its benchmark rate to zero, said Hany Genena, head of research at Prime Holdings. The EGP has gradually eased against the greenback since the global crisis intensified after surging more than half a pound during the first seven weeks of the year. The currency remained steady at 15.69 yesterday, having dropped 20 piasters since its peak on 23 February.

EGP debt remains “relatively attractive,” HC Securities said, but foreign bondholders are likely to continue offloading Egyptian debt as concerns over covid-19 grow around the world. The interbank market will likely pick up the slack, Monette Doss, vice president of research at HC Securities, told Enterprise. Yields on Egyptian government debt will remain “relatively attractive” following the rate cut, offering a 0.95% real interest rate (accounting for the 3% rate reduction and HC’s forecast for 9% inflation through 2020) compared to 0% for Turkey, she said.

Yields jump as investors fret over covid-19: Yields on nine-month and seven-year treasuries jumped during auction yesterday as investors grew more concerned about Egypt’s exposure to the covid-19 outbreak. The yield on nine-month bills rose 93 bps to 15.273% — with the government selling just EGP 4.2 bn of the EGP 10.5 bn offering — and the rate on seven-year notes jumped 67 bps to 14.653% — selling EGP 1.2 bn of the EGP 3.5 bn on offer. The yield on three-month bonds fell marginally to 12.892% but the government was only able to offload EGP 92 mn of the EGP 4 bn offering after investors demanded an average yield of 15.857%. The government cancelled its EGP 4 bn auction of three-year bonds and reduced its seven-year offering by 66%, Al Mal reported.

We probably haven’t seen the last of CBE stimulus:

- Expect another 225 bps in cuts over the coming months, Capital Economics says. “The hit from the coronavirus outbreak is likely to mount in the coming weeks and months and, with inflation no longer a major concern for the CBE, more stimulus lies in store. We now expect the overnight deposit rate to be lowered by an additional 225 bps to 7.5% in the next couple of months, said Jason Tuvey, senior EM economist at Capital Economics.

- Another cut coming in April -Shuaa: The MPC is likely to cut again at its next meeting on 2 April, said Amr Al Alfi, head of research at Shuaa Securities Egypt, without predicting by how much.

Calls for the CBE to rethink manufacturing support initiative: Magd El Manzalawi, head of the industry committee at the Egyptian Businessmen’s Association, called on the CBE to rethink the subsidized rates of interest offered under its EGP 100 bn program to support manufacturers. The initiative provides loans to medium-sized factories with a preferential 10% rate of interest. Now with interest rates 3% lower, Manzalawi said the program no longer provided benefits to the manufacturing sector, and called on the CBE to reduce the interest by 300 bps to 7%.

The story is getting coverage in the international press, most notably from Bloomberg and Reuters.

The selloff on the EGX continued yesterday, tripping circuit breakers yet again: The sell-off on the EGX continued at pace yesterday, with the benchmark EGX30 index finishing 7.1% in the red and the wider EGX100 falling more than 6%. CIB, the EGX30 heavyweight, closed down 6.7%. Qalaa Holdings and El Motaheda For Housing & Reconstruction each saw their stock prices fall by 10%, while EFG Hermes’ shares dropped by 9.99%, market data showed.

Circuit breakers were triggered for the second time this week and third time this month, suspending trading for 30 minutes after the index fell 6.16% in the first half hour of trading.

Several individual companies also saw trading on their stocks suspended after reaching the permissible 5% loss limit, including CI Capital, QNB ALAHLI, Telecom Egypt, GB Auto, and Rameda, among others.

This came just a day after the index delivered its worst showing since November 2012, with shares tumbling 9.3%.

The sea of red continued across regional indices yesterday, with only Qatar’s stock exchange seeing gains. Israel’s bourse was the worst hit, closing down 8%, while the Abu Dhabi Exchange dropped 7.83%, and Dubai’s main index fell 6.15%. Saudi’s Tadawul fell 5.21%.

With shares trading at valuations unseen since the float of the EGP, companies are turning to buybacks: Madinet Nasr Housing and Development, Egypt Kuwait Holding, Palm Hills, and GB Auto have all announced share buybacks during yesterday’s session (here, here, here, and here — pdfs). Raya Holdings’ board of directors also approved buying back 10% of Raya Contact Center’s treasury shares to support its stock price, according to a regulatory filing (pdf). Many listed companies said earlier this month they’re lining up to buy back treasury shares to take advantage of temporary rules by the Financial Regulatory Authority to allow them to notify the EGX and complete buybacks on the same day to hedge against the volatility.

The EGX is now the second-worst performing index in the region: The EGX30 is now down 32.5% YTD, a decline matched only by the Dubai Financial Market, which is currently 33.36% in the red since 1 January.

Market volatility nears record levels as US equities suffer biggest one-day loss since 1987: The volatility in the US stock market showed no signs of letting up yesterday after indices yesterday followed up Friday’s biggest one-day gain since 2008 with their largest one-day loss since 1987. The Dow Jones shed an incredible 3,000 points (or 13%) to close at a two-year low, and the S&P 500 plunged 12% to erase its 2019 gains and fall 30% from its all-time high in February.

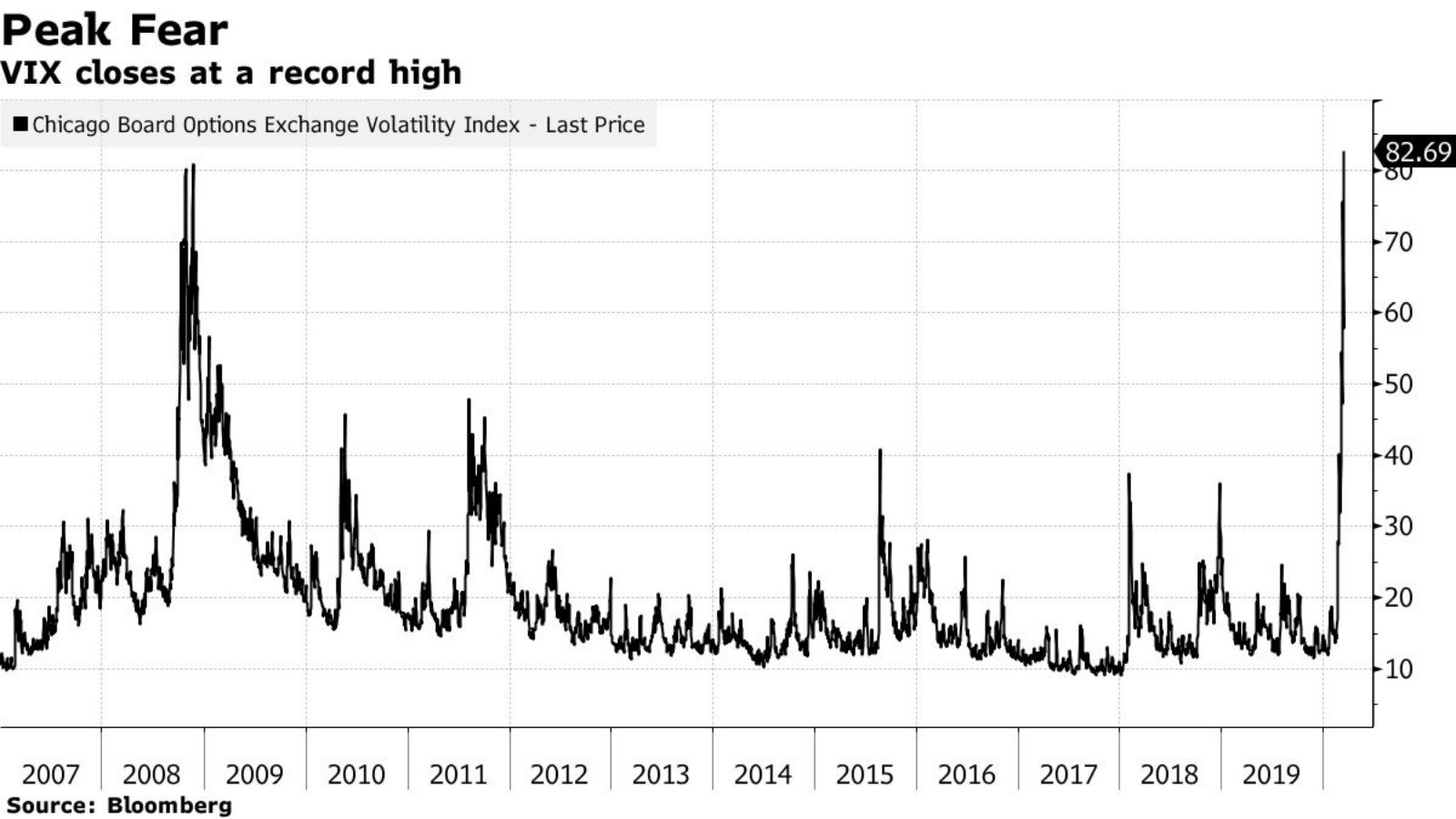

The VIX tells you everything you need to know: The index that tracks volatility in US equities closed at a record high of 82.69 yesterday. The gauge rose as high as 83.56 during trading, just a few points short of its intraday record at the height of the financial crisis in October 2008. “In 2008, you pretty much knew it was the banking system breaking down, but didn’t know exactly how, and now it’s everything breaking down and how that spills over,” said Steve Sosnick, chief strategist at Interactive Brokers. “The latter is worse, I’d argue — this is dislocating everything.”

The market panic was started by the Fed’s surprise stimulus dump… Within hours of the Federal Reserve’s declaration of war on covid-19 on Sunday evening, US stock futures were limit down in a sign of the turbulence to come. Sure enough, the S&P 500 plummeted 8% after the opening bell, triggering circuit breakers that suspended trading for 15 minutes. Allianz economic advisor Mohamed El Erian described bemusement and sadness at the Fed’s emergency announcement, and placed the blame for the chaos at the door of the FOMC.

…and continued as investors became increasingly aware that realisation that the US economy is heading into lockdown: “This is different,” Steve Chiavarone, a portfolio manager with Federated Investors, told Bloomberg. “The thing that is scarier about it is you’ve never been in a scenario where you shut down the entire economy… You get a sense in your stomach that we don’t know how to price this and that markets could fall more.”

The Fed is still throwing bns of USD to try and stabilize the repo market: The Fed yesterday injected another USD 500 bn into the repo market after its USD 1.5 tn emergency operation last week did little to solve a growing liquidity crisis in interbank lending.

European equities aren’t doing much better: With both countries now on full-scale lockdown, Spain’s IBEX (down almost 8%) and the Italian FTSE MIB (6.1% in the red) among the biggest losers yesterday. The French CAC lost 5.75%, Germany's DAX ended 5.31% down, and London's FTSE 100 fell 4.61%.

Gov’t to postpone EGX capital gains for one more year, slash stamp tax -sources: Officials have reportedly agreed to delay reintroducing the capital gains on EGX transactions for one more year, and are planning to cut the provisional stamp tax to 0.05% from 0.15%, Al Mal reports, quoting unnamed sources it said have knowledge of the move. The decision was due to be presented yesterday to the cabinet economic group for review, but we have yet to see any official confirmation. Government sources told the press yesterday that there is a near consensus in the cabinet for the move given current market conditions.

Background: The government said in 2017 it was shelving for three years a proposed 10% capital gains tax on stock market transactions after a revolt by investors, and instead introduced a 0.125% stamp tax that was planned to rise to 0.15% and then 0.175%. Now, with the EGX following the sell-off in the global markets sparked by the covid-19 outbreak, authorities have decided to suspend the reintroduction of capital gains tax by an additional year. The capital gains tax was an IMF recommendation as part of conditions for the USD 12 bn facility, but sources said in May that the tax would not be brought into effect in the near future.

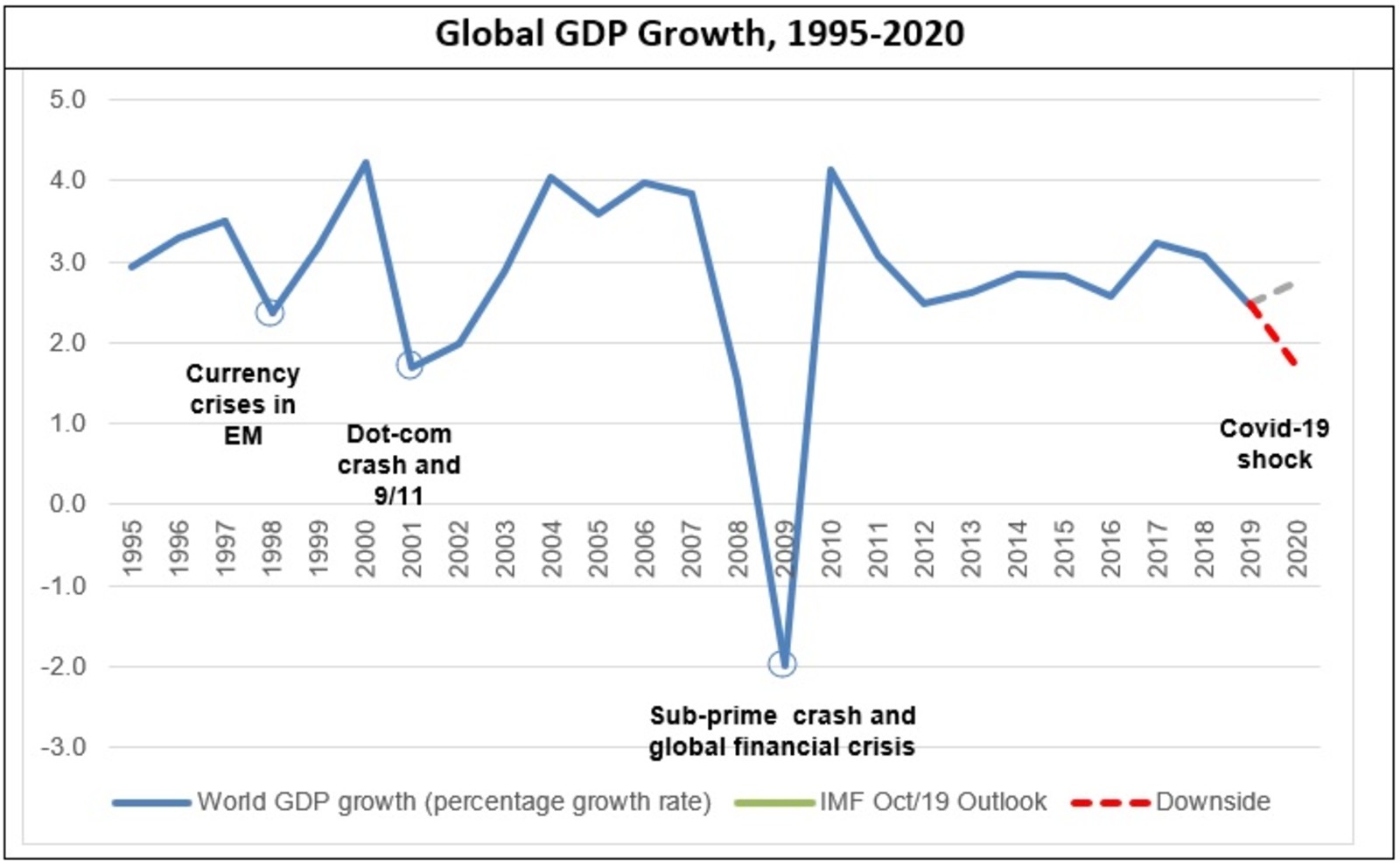

UNCTAD says covid-19 could take a USD 2 tn swing at global income: Global income could fall as much as USD 2 tn from initial 2020 projections because of the covid-19 outbreak, according to a preliminary downside scenario from UNCTAD. USD 220 bn of the total will be incurred by developing countries (excluding China) and the worst-affected countries will be oil and commodity exporters. Countries that have strong trade links with economies that had a wide spread initially will also bear the brunt of the income loss. The most affected countries stand to lose more than one percentage point of growth. A complete analysis of UNCTAD’s forecasts can be found here.

The spread of the coronavirus could cause global foreign direct investment (FDI) to shrink by 5-15% with the automotive, aviation, and energy industries expected to be most affected, according to a separate UNCTAD report. The UN trade body had forecasted (pre-corona) a stable level of global FDI inflows in 2020-2021 with a potential increase of 5%. Post-outbreak estimates warn that FDI flows may be at their lowest levels since the 2008-2009 financial crisis, should the epidemic continue throughout the year.

The report also estimates that companies have lowered earnings forecasts for FY2020 by an average of 9%, largely on the back of a slowdown in manufacturing and the disruption of world trade. A separate report estimates these disruptions could result in a USD 50 bn decrease in exports across global value chains. The ripple effect of the slowdown has most affected sectors including precision instruments, machinery, automotive and communication equipment, with the EU being the most affected economy.

STARTUP WATCH- Argineering raises USD 400k in follow-on investment: Creative tech startup Argineering raised USD 400k in a follow-on investment round led by Silicon Valley based venture fund 500 Startups, with participation from Flat6Labs and angel investor Islam Mahdy, according to a company press release (pdf). The company, which was founded in 2018, is looking to use the funds for growth in European markets, research and development and team expansion.

Argineering, which won EGP 100k at the CIB-sponsored Hona Al Shabab startup competition on Hona Al Asema, focuses on bringing tech to the creative industry. The company’s RGKit gadget and accompanying app allows brands and designers to create dynamic, interactive visual displays. The RGKit has been used in displays at Ted Baker, Charles Tyrwhitt and London’s Science Museum.

EARNINGS WATCH- Raya Holding for Financial Investments has reported losses of EGP 85.1 mn during 2019, compared to profits of EGP 89.1 mn a year earlier.

MOVES- Don Kwak has stepped down from his role as CEO of LG Egypt, Al Mal reports. Kwak served as the company’s chief since February 2016, and headed a USD 250 mn expansion in the Tenth of Ramadan City factory that added new TV and washing machine production lines. An unnamed Korean national has assumed his position.

Egypt in the News

Worth Reading

A new kind of sovereign wealth fund is emerging, and Egypt is at the forefront: Sovereign wealth funds have traditionally been set up by states with hefty oil and gas revenues or external account surpluses, but a new approach is gaining popularity among states with a very different profile. The establishment of the Sovereign Fund of Egypt (SFE) is a bid to more effectively manage state-owned entities, setting up a commercially oriented arm of the government while reducing the army’s influence in business, according to analysts quoted in a Financial Times opinion piece. Egypt’s approach marks a shift away from sovereign wealth funds being sourced by large sums of oil money — as they are in the Gulf, for example — and closer towards the example of Singapore, which successfully created its sovereign wealth fund Temasek in 1974 to manage government stakes in telecoms, airlines, manufacturing and shipping companies.

The goal is effective management, but without all the bad press of privatization: The SFE was created last year in part as a response to the broadly unpopular privatization drives of the 1990s and 2000s, the FT piece argues. It’s an example of a sovereign wealth fund operating in a way that more closely resembles private equity than playing its traditional role as a savings bank or mutual fund, says one Renaissance Capital economist.

Other countries are also following this approach, but success has been mixed. Turkey’s sovereign wealth fund was created in 2016, has an equity value of USD 33 bn, and was seeded with government stakes in some of the country’s biggest companies. But it had a rocky start, initially being plagued by political infighting and having its credibility called into question. A Malaysian state development fund, meanwhile, allegedly lost USD 4.5 bn due to embezzlement in the run up to 2015. And South Africa, which has just announced plans to create its own sovereign wealth fund, is widely expected to use the cash flows generated to balance some of its soaring budget deficit, the piece says.

Diplomacy + Foreign Trade

Foreign Ministry continues to internationalize GERD dispute with calls to North Africa: A Foreign Ministry delegation has visited Algeria, Tunisia and Mauritania to deliver a message from President Abdel Fattah El Sisi calling for support in its dispute with Ethiopia over the Grand Ethiopian Renaissance Dam, Ahram Online reports, citing a ministry statement. Foreign Minister Sameh Shoukry last week embarked on a regional tour and visited several European capitals seeking backing for its position in the dispute, which has escalated in recent weeks after the two countries failed to find an agreement during several months of US and World Bank-mediated talks.

Infrastructure

Egypt to complete 13 industrial complexes by end of 2020

The government will complete 13 industrial complexes, including nine in Upper Egypt, by the end of this year, Trade and Industry Minister Nevine Gamea said at a conference yesterday, according to an official statement. The facilities will house around 4.5k factories and will be built in 12 governorates.

Basic Materials + Commodities

CBE extends cash cover for basic foodstuffs

The Central Bank of Egypt has extended the exclusion period for some basic food commodities, namely rice, lentils and fava beans, from their 100% cash cover for one year until 15 March 2021, Al Mal reports.

Manufacturing

Raya, China’s Haier Electric to establish EGP 200 mn home appliances factory

Raya Holding has signed a EGP 200 mn partnership agreement with Chinese Haier Electric to establish a home appliances factory under the name Haier Raya Electric, reports Al Mal. The factory will be constructed on Raya-owned property in the first industrial zone in Sixth of October city. Ownership of the factory will be split between the two, with Raya holding 85% and Haier holding the remaining 15%.

Automotive + Transportation

El Nasr Automotive restarts talks with Dongfeng over EV manufacturing

State-owned El Nasr Automotive has restarted talks with Wuhan-based Dongfeng, the front-runner to become Egypt’s first domestic electric vehicle manufacturer, after negotiations were temporarily halted due to the covid-19 outbreak, Youm7 reports, citing an official at El Nasr. We noted late last year that El Nasr was conducting a feasibility study to manufacture 25k electric cars in partnership with Dongfeng, and had expected at the time to sign an agreement by 2Q2020. It remains unclear how much this timeline has shifted.

Banking + Finance

EBE to launch factoring arm with ECGE, NIB, National Bank of Egypt in 2Q2020

The Export Development Bank of Egypt (EBE) is planning to launch a EGP 50 mn factoring arm in 2Q2020, Board Chairman Mervat Sultan tells Al Mal. The EBE will hold a 60% stake in the new arm, while its subsidiary the Export Credit Guarantee Company of Egypt will hold 15%, the National Investment Bank will hold 15%, and the remaining 10% will be held by the National Bank of Egypt (NBE).

Fawry, National Bank of Egypt to begin distributing 43k PoS devices to stores

The National Bank of Egypt (NBE) and e-payments platform Fawry are rolling out 43k point of sale (PoS) devices in retail outlets around the country to encourage payments through bank cards and e-wallets, NBE retail CEO Karim Soos said, according to Al Mal. The devices will increase Egypt’s PoS capacity by over 54%, says Soos. The move is part of partnerships between Farwy and local banks to help the government’s bid to transition toward a “cashless economy.”

Egypt Politics + Economics

El Sisi approves EUR 53.2 mn financing agreement with IFAD

President Abdel Fattah El Sisi has ratified a EUR 53.2 mn financing agreement with the International Fund for Agricultural Development (IFAD) for job promotion and the development of desert areas, Egypt Today reports. The loan is part of a USD 62 mn support package signed in Rome last year.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.81

EGP / USD at CIB: Buy 15.7 | Sell 15.8

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Monday): 9,429 (-7.1%)

Turnover: EGP 621 mn (4% above the 90-day average)

EGX 30 year-to-date: -32.5%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 7.1%. CIB, the index’s heaviest constituent, ended down 6.7%. Yesterday’s worst performing stocks were Qalaa Holding down 10.0%, EFG Hermes down 10.0% and Egyptian Resorts down 9.9%. The market turnover was EGP 621 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -96.6 mn

Regional: Net long | EGP +2.7 mn

Domestic: Net long | EGP +93.9 mn

Retail: 54.5% of total trades | 53.9% of buyers | 55.0% of sellers

Institutions: 45.5% of total trades | 46.1% of buyers | 45.0% of sellers

WTI: USD 28.70 (-9.55%)

Brent: USD 29.78 (-12.02%)

Natural Gas (Nymex, futures prices) USD 1.82 MMBtu, (-2.89%, April 2020 contract)

Gold: USD 1,486.50 / troy ounce (-1.99%)

TASI: 5,959 (-5.21%) (YTD: -28.96%)

ADX: 3,548 (-7.83%) (YTD: -30.10%)

DFM: 1,842 (-6.15%) (YTD: -33.36%)

KSE Premier Market: 4,661 (-4.97%)

QE: 8,431 (+1.45%) (YTD: -19.13%)

MSM: 3,681 (-1.78%) (YTD: -7.52%)

BB: 1,395 (-1.36%) (YTD: -13.35%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit.

24 March (Tuesday): The Annual Export Summit, Nile Ritz Carlton, Cairo, Egypt.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action”, new administrative capital, Egypt.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

17-19 April (Friday-Sunday): IMF, World Bank hold Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.