- Egypt kicks off marketing for upcoming USD eurobond issuance. (Speed Round)

- Actis, Engie, Datang all in the running to acquire stake in Siemens power plants. (Speed Round)

- Elaj in talks to acquire Euro Mena II’s majority stake in International Eye Hospital. (Speed Round)

- Ebtikar ups stake in Masary for fifth time since July. (Speed Round

- EFG Hermes could close new education acquisition in Egypt this year. (Speed Round)

- EGX approves using private investment funds' cash securities as collateral for margin trading. (Speed Round)

- Cabinet passes amendments to Investment Act exec regs. (Speed Round)

- The Market Yesterday

Thursday, 14 November 2019

Egypt opens subscriptions for upcoming USD eurobond issuance.

TL;DR

What We’re Tracking Today

It’s interest rate day today: The CBE meets today to review interest rates, with five of the six economists we surveyed last week predicting a rate cut. A Reuters poll showed much of the same, with 12 of 14 economists surveyed expecting a rate cut.

Expectations for continued easing cycle supported by low inflation: Headline inflation hit lows not seen in almost a decade last month on falling food and beverage prices, and a favorable base effect. The annual headline rate fell to just 2.4%, from 4.3% in September, while core inflation remained basically flat, rising just 0.1% to 2.7%.

The base effect is likely to get less favorable in the months ahead but inflation should remain “contained.” Investment bank Pharos said in a research note last week that the base effect which contributed to low inflation readings over the past few months is likely to start diminishing, raising inflation to between 6-7% in November and December. Shuaa Securities also said that the base effect has peaked but any pickup in inflation in the coming months will be “contained.”

Meanwhile, across the Atlantic: Fed Chairman Jay Powell yesterday gave a firmer indication that the central bank will hold off on further interest rate cuts when it meets in December. The Fed has cut its Fed Funds rate by 75 bps since July on fears that the US economy may be tipping into recession. Speaking before a congressional panel yesterday, Powell listed off a string of positive economic data, but stressed the bank would “respond accordingly” if performance dipped enough to cause a “material reassessment” of its outlook.

El Sisi in Germany next week for G20 Compact with Africa: President Abdel Fattah El Sisi will be in Berlin next week to attend the G20 Compact with Africa on 19 and 20 November, the German Ambassador in Cairo Cyrill Nunn said in a press conference covered by the local press. El Sisi will be wearing his African Union hat during the summit and will witness the Egyptian Investment Ministry signing a EUR 154 mn loan to support renewable energy, water management, waste recycling, and technical education. Nunn noted that the second EUR 80 mn tranche of the EUR 240 mn four-tranche debt exchange agreement is due to be completed soon.

Egypt to offer USD 1.5 bn in USD bills next week: The Central Bank of Egypt (CBE) will offer USD 1.56 bn in one-year USD-denominated t-bills on Monday, 18 November. The last local USD issuance was back in June, when an auction for USD 715 mn in bonds was 1.3x oversubscribed. The yield was 3.87%, marginally down from 3.89% in a previous USD 1 bn May auction.

Our friends at AmCham are hosting the US-Egypt Future Prosperity Forum on Monday, 18 November, with Prime Minister Moustafa Madbouly, US Deputy Assistant Secretary of Commerce for Manufacturing Ian Steff, and several Egyptian ministers scheduled to speak. You can check out the full agenda here.

KUDOS- Our friends at CIB have been named among Forbes’ list of the World’s 500 Best Employers. The leading private sector bank ranked 90 overall, placing it among the world’s top 100 employers and making it the top-ranked employer across the entirety of Africa. The list is compiled based on 1.4 mn employment recommendations, accounting for employee ratings of their own employers and other employers they perceive positively.

Somabay is home to five luxury resorts, a lively marina, and outlets for premium entertainment and relaxation. Somabay caters to diverse tastes with a common thread of well-being,

Somabay is home to five luxury resorts, a lively marina, and outlets for premium entertainment and relaxation. Somabay caters to diverse tastes with a common thread of well-being,

relaxation, and sheer enjoyment of life that is reflected in all its hotels & facilities.

El Sisi in Abu Dhabi for talks with MbZ: President Abdel Fattah El Sisi arrived yesterday in Abu Dhabi for talks with UAE Crown Prince Mohamed bin Zayed, an Ittihadiya statement said. The visit, we suspect, may have something to do with this: Bloomberg reported yesterday that negotiations are progressing between Qatar and the Saudi-led group of countries that in 2017 imposed a blockade on the country. Saudi Arabia, the UAE and Bahrain have all agreed to take part in the Arabian Gulf Cup in Qatar this month as a goodwill gesture, ahead of what could be (as one Emirati academic called it) an “imminent” breakthrough.

Morgan Stanley both bear and bull on Aramco valuation: Analysts at US investment bank Morgan Stanley have put Saudi Aramco’s valuation at anywhere between USD 1.06 tn and USD 2 tn based on the dividend discount model, according to a presentation seen by Bloomberg. Another model, meanwhile, gives a range of USD 1.07 tn and USD 2.5 tn — a huge spread of more than USD 1.4 tn. Sixteen banks have so far given valuation estimates, with the midpoint being around USD 1.75 tn.

Private equity has been losing its luster as they no longer offer a value discount from public markets, but maintain the same level of risk, Verdad Advisers partners Daniel Rasmussen and Brian Chingono write for the Financial Times’ Alphaville blog. Whereas PE transactions saw success in the 1980s and ‘90s, this is no longer the case in today’s market, where the average PE company is purchased at 12x its Ebitda. This is around the same as the value on S&P 500.

The bigger issue with PE valuations and true debt burdens is that they tend to “overstate” Ebitda, the hedge fund partners say. “Many private equity [transactions] are valued on Adjusted Ebitda (as opposed to the standard approach of using actual Ebitda over the past 12 months). Adjustments to Ebitda help private equity firms to sell their [transactions]; just as some men exaggerate about their height in online dating apps.”

The digital yuan: Coming at the start of 2020? Beijing could begin issuing its new digital currency to commercial banks and online payment platforms within the next two or three months, according to HCM Capital. Jack Lee, managing partner of the PE firm, told CNBC that the government has completed the system and that it would soon launch the currency on a trial basis.

Be afraid, be very afraid, Kenneth Rogoff warns Capitol Hill: A Chinese digital currency that cannot be monitored by regulators in Washington poses a “real threat” to US national interests, the former IMF chief economist writes in the Guardian.

Google becomes the latest Big Tech firm to plot an entrance into financial services: Google execs are in talks with US banks about offering “smart checking accounts” to Google Pay customers, according to the Financial Times.

New evidence dropped during Day 1 of the Trump public impeachment hearings: Bill Taylor, the US charge d’affaires in Ukraine (pictured above), told the US House that President Donald Trump was overheard talking on the phone about “investigations” that he wanted the Ukrainian government to launch against rivals in the Democratic party. The Associated Press has more.

US, China trade negotiators hit stumbling block over farm purchases: China is refusing to buy a specific quantity of US agricultural products, weeks after Trump claimed that Beijing had committed to buying USD 50 bn worth, the Wall Street Journal reports. China will reject any agreement that appears to give preferential treatment to the US, and wants an escape route from the pact should trade relations again deteriorate, people close to the talks said.

Enterprise+: Last Night’s Talk Shows

It was one of the quietest nights on the airwaves that we’ve seen in a while. We’ve rounded up most of the topics that kept the talking heads busy, including the UN’s review of Egypt’s human rights record and President Abdel Fattah El Sisi’s visit to the UAE.

Egypt’s human rights record is put under the microscope: The UN Human Rights Council held its periodic review of Egypt’s human rights case in Geneva yesterday. The US, UK and Germany all called on the authorities to investigate instances of abuse and to release journalists detained following September’s protests. The story earned plenty of digital ink in the global press. We have more in this morning’s Egypt in the News below.

Nothing to see here, folks: Al Hayah Al Youm’s Khaled Abu Bakr said most UN discussions and international talks on human rights are highly politicized and only objective “10% of the time” (watch, runtime: 7:58). Masaa DMC’s Eman El Hossary, meanwhile, interviewed the foreign minister’s human rights aide Ahmed Gamal El Din, who said that torture and enforced disappearances cannot happen in Egypt because the country is a signatory to the UN’s Covenant on Civil and Political Rights (watch, runtime: 4:18).

El Sisi in UAE also gets some airtime: The president landed in Abu Dhabi yesterday for a two-day visit for talks with Crown Prince Mohamed bin Zayed Al Nahyan. The talking heads covered the story with the predictable generalities. “Strategic cooperation,” “Arab affairs,” and “mutual interest” all reared their ugly heads, telling us precisely nothing about the reasons for the visit. Abu Bakr (watch, runtime: 6:55), El Hosary (runtime: 3:03), and Yahduth Fi Misr’s Sherif Amer (runtime: 1:32) all said words. We recap the story in What We’re Tracking Today, above.

Seven killed, 16 injured in oil pipeline fire: An oil pipeline leak in Beheira led to severe fire that killed seven and injured 16 others, the Health Ministry spokesman told Yahduth Fi Misr’s Sherif Amer (watch, runtime: 2:52). Local press reported yesterday that the fire occurred after people attempted to steal fuel. The pipeline is owned by Tanta Petroleum Pipe Company.

Speed Round

Speed Round is presented in association with

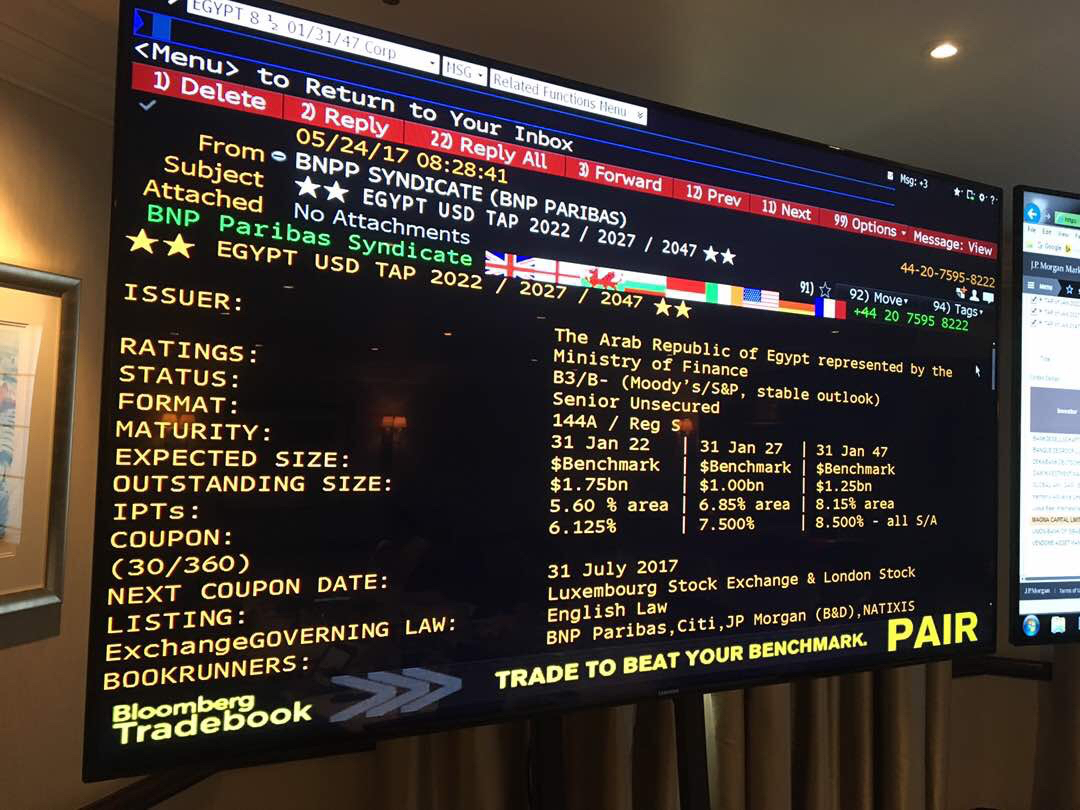

Egypt begins marketing for its triple-tranche USD eurobond issuance, says its receiving subscription requests: Egypt began yesterday marketing its upcoming eurobond issuance, Reuters reports, citing a document from one of the issuance’s advisors. The Finance Ministry, which is also inviting subscription requests, and is targeting a sale of between USD 2-3 bn on the Luxembourg and London exchanges. The subscription period was scheduled to wrap up yesterday ahead of pricing.

How much are we selling? The issuance will be divided into three tranches, with the bonds carrying tenors of four, 12, and 40 years. The initial price guidance on the four-year bonds has been set at 4.9-5%, and at 7.5% for the 12-year bonds and 8.6% for the 40-year bonds, which will be the longest USD bond the country has ever sold, according to Bloomberg.

The bonds were supposed to have been priced yesterday (per the prospectus), but as of this morning we still haven’t heard anything.

No roadshow this time around: Sources told the press last week that the ministry will not go on a roadshow ahead of the offering, noting that there are already open channels of communication with investors. Egypt’s last EUR 2 bn issuance in April was preceded by a roadshow in Asia and the Gulf. The government had also previously taken its eurobond roadshows to Europe.

Background: The Finance Ministry signalled last month that it will offer USD 2.5-3 bn in eurobonds either at the end of this year or the beginning of 2020. The ministry received cabinet approval to issue USD 5 bn-worth of eurobonds this fiscal year. The government, which earlier this year raised the limit of its eurobond program to USD 30 bn from USD 20 bn, last issued eurobonds in April when it sold EUR 1.25 bn in 12-year bonds at a 6.375% yield and EUR 750 mn in six-year bonds at a 4.75% yield.

Advisors: The government has named Citibank, JPMorgan, BNP Paribas, Natixis and Standard Chartered as joint bookrunners for the offering. Al Tamimi & Company was selected as local legal advisor, while Dechert was selected as international counsel.

Actis, Engie, Datang in the running to acquire stake in Egypt’s combined-cycle power plants: Actis, France’s Engie, and China Datang Overseas Investment are all competing alongside Blackstone’s Zarou to acquire a stake in the Siemens / Orascom Construction / Elsewedy Electric combined-cycle power plants, according to Bloomberg. Sources in the Electricity Ministry had said earlier this week that Zarou is the top contender to acquire the stake, having submitted the best financial offer. Edra Holdings is also reportedly one of the six investors in the running, leaving us with one remaining mystery investor.

Advisors: Egypt’s sovereign wealth fund, Tharaa, is set to select a financial advisor for the transaction next week, Tharaa CEO Ayman Soliman told the news information service earlier this week. While Soliman declined to drop any names, Bloomberg says that HSBC and Citigroup are bidding for the job. Zarou has tapped JPMorgan Chase, while Standard Chartered is advising Edra. World Bank country manager Walid Labadi tells Bloomberg that the bank’s International Finance Corporation has also submitted a proposal “to advise on attracting private investors to this project upon request from the Egyptian government.”

Background: Soliman said on Tuesday that an agreement to sell a stake in only a single plant is expected to be finalized in less than a year. Stake sales in the other two plants would then follow. He also said on Monday that the fund is planning to acquire 30% of the plants’ equity, and offer the remaining stake to an international investor as part of its efforts to encourage foreign participation in the economy. Post-sale, the shareholders could establish a joint venture that would then sign a power purchase agreement to sell the plants’ output to the government. There are two other scenarios that the fund is looking at, including one in which it takes a 60-70% stake in the plants, leaving a minority stake for the private sector. The three 14.4 GW plants were co-built by Siemens, Orascom Construction, and Elsewedy Electric, and were inaugurated in July 2018.

M&A WATCH- Saudi’s Elaj in talks to acquire Euro Mena II’s stake in International Eye Hospital: Elaj Group has entered talks with Euro Mena II to acquire the private equity fund’s 51% stake in Egyptian healthcare chain International Eye Hospital (IEH), two sources close to the matter told the press. A preliminary agreement has reportedly been signed, paving the way for Elaj to conduct due diligence on the group ahead of valuation.

Elaj already has a stake in the company: The Saudi group already owns a 15% stake in EIH, which would increase to 66% if they reach an agreement with Euro Mena.

We could see an agreement as soon as 1Q2020, one of the sources said. Euro Mena is reportedly eager to exit IEH, and is only waiting for a reasonable offer.

Where does this leave talks with the UK-based fund? We learned earlier this year that an unknown UK-based fund was in talks with Euro Mena over acquiring stake in EIH. We haven’t heard anything since then, but yesterday’s article seems to imply that the offer remains on the table.

Euro Mena I, II, and III are separate funds owned by a Lebanese private equity firm, EuroMena Funds.

Strategy to focus on Lebanon: The firm announced in 2017 a plan to exit investments in three Egyptian companies owned by Euro Mena I. The plan was reportedly part of a strategy to shift its focus to Lebanon, as well as to Africa-based companies with ties to the Lebanese diaspora.

Other interested parties, previous bids: The local press reported in March that US private equity firm TPG was considering making a bid for the International Eye Hospital. Euro Mena II has reportedly rejected two informal offers: one from private equity fund Ezdehar Management and another from a group of physicians who are also shareholders in the target hospital. Euro Mena II tapped global advisory firm Lazard last year as financial advisor and Matouk Bassiouny as legal counsel on the potential transaction.

M&A WATCH- Ebtikar ups stake in Masary for fifth time since July: Ebtikar for Financial Investment, a joint venture between B Investments, BPE Partners and MM Group, has increased its stake in Egyptian e-payments company Masary to 69.8% from 65.5% in a EGP 18.7 mn transaction, the company said in a statement yesterday (pdf). Ebtikar has effectively doubled its holdings of the company across a series of five transactions in the second half of this year, having held 35.7% prior to July. B Investments holds a 20.3% stake in Ebtikar, while MM Group holds 49.9%. Ebtikar Chairman Aladdin Saba said the latest transaction demonstrates the company’s “confidence” in the Egyptian e-payment sector, according to a press release by MM Group (pdf).

CORRECTED on 14 November 2019

MM Group holds a 49.9% stake in Ebtikar and not 52.9% as previously mentioned.

M&A WATCH- EFG Hermes looking to close new education acquisition this year: The Egypt Education Fund, EFG Hermes’ joint education platform with Gems Education, is expecting to close a new acquisition before the end of the year“to expand the platform’s service offering range,” according to the company’s earnings release (pdf). EFG did not disclose further information. The fund, which was established in 2018, is focused on K-12 education in Egypt through a 50/50 joint venture between EFG and Gems. Its investments in Egypt’s education sector are expected to reach USD 300 mn by 2023.

REGULATION WATCH- The EGX has decided to allow using private investment funds’ cash securities as collateral for margin trading, according to a statement picked up by Hapi Journal. The securities will be evaluated on a daily basis by management companies, and can be traded in for cash within one working day. The decision aims to encourage margin trading and raise turnover on the bourse. The executive regulations to the Capital Markets Act, which were issued in July 2018, opened the door to the introduction of new financial instruments, including short selling, and a futures and commodities exchange

LEGISLATION WATCH- Investment Act amendments require public, private entities to submit data on foreign investment assets to GAFI: Prime Minister Moustafa Madbouly signed off on amendments to the Investment Act’s executive regulations that would require public and private entities to submit quarterly reports to the General Authority for Freezones and Investment (GAFI) with their data on direct and indirect foreign investment assets, according to an Investment Ministry statement. Public bodies, including the Central Bank of Egypt, Financial Regulatory Authority, and EGX will also be required to notify GAFI of any agreements or contracts signed with foreign investors on a quarterly basis. The amendments are designed to help GAFI calculate direct and indirect foreign investment assets in Egypt..

M&A WATCH- Apicorp acquires 24% stake in Al Khorayef United Holding: The Arab Petroleum Investments Corporation (Apicorp) has acquired a 24% stake in Al Khorayef United Holding, its first private equity investment in a Kuwait-based company, the company said in a statement yesterday (pdf). Apicorp will partner with Saudi’s Al Khorayef Petroleum Company and Kuwait’s United Oil Projects, which own stakes in the oil and gas services company. Egypt is a shareholder of Apicorp, a multilateral development institution that invests in the Arab world’s oil and gas industries.

EARNINGS WATCH- Orascom Development Egypt (ODE) reported net profits of EGP 107.4 mn in 3Q2019, up from EGP 89.5 mn in 3Q2018. The company’s revenues rose to EGP 1 bn from EGP 868.1 mn during the same quarter last year, according to the company’s financial statements (pdf). In 9M2019, ODE more than doubled its net profits, increasing 82.9% y-o-y to EGP 501 mn. Revenues also increased 39.4% during the first nine months of the year to EGP 3.3 bn from EGP 2.3 bn on the back of enhanced operational performance across all business segments. Looking ahead, ODE is looking to further increase its revenues through new real estate sales, capitalizing on its O West project as well as El Gouna and Makadi Heights.

GB Auto posted a net loss of EGP 8.3 mn in 3Q2019 as revenues dropped 13.1% y-o-y. On a q-o-q basis, however, revenues rose 19.7% to EGP 6.7 bn, according to an earnings release (pdf). The company’s 9M2019 losses hit EGP 1.2 mn, after having turned a profit in 1Q2019. Revenues during the first nine months of the year dipped 1.5% y-o-y to EGP 18.3 bn. The company’s Auto & Auto-Related (A&AR) segment accounted for the bulk of revenues, which accounted for EGP 5.7 bn of revenues in 3Q2019.

Impact of zero customs on EU cars narrows: The company maintained growth in its top-line models despite the elimination of customs on cars of European origin, mainly supported by Egypt’s passenger cars and two- and three-wheelers segments in 3Q2019. GB Auto has also reduced its inventory of passenger car models facing stiff competition from European, Moroccan and Turkish counterparts that now have a pricing advantage, GB Auto CEO Raouf Ghabbour said. But the new regulations did damage the company’s bottom-line products, forcing them to liquidate 90% of its loss-making inventory.

Looking ahead: Ghabbour sees margins normalizing heading into 2020 despite the regulatory changes resulting in halting licenses for three-wheelers. “Going forward we are confident that the strong fundamentals that underpin the Egyptian and Iraqi markets will continue to help drive our operational and financial performance as our volumes and sales continue to grow and as margins begin to normalize,” Ghabbour said.

Credit Agricole Egypt’s net profits increased to EGP 1.9 bn in 9M2019 from EGP 1.7 bn in 9M2018, according to an EGX disclosure.

Raya Holding for Financial Investments reported net losses of EGP 103 mn in 9M2019, increasing from losses of EGP 5.63 mn in 9M2018, the company said in a bourse disclosure (pdf).

Alexandria Mineral Oils profits plunge 87.4% y-o-y in 3Q2019: Alexandria Mineral Oils’ (AMOC) net income dropped to EGP 31.8 mn in 3Q2019, compared to EGP 253.1 mn in 3Q2018, the company said in a bourse filing (pdf). Sales dropped during the same period to EGP 3.125 bn against EGP 4.105 bn last year.

CLARIFICATION- Pharos Holding is joint global coordinator for payments platform e-Finance’s upcoming IPO, while Renaissance Capital is acting as financial advisor on the transaction. Yesterday’s issue initially did not include Pharos among the advisors. The story has since been updated on our website.

CORRECTION- We also incorrectly stated yesterday that UAE-based Trukker raised a USD 2.7 mn series A funding round. The correct figure was USD 23 mn. We have corrected the entry on our website and will consult our optometrist to ensure we haven’t gone cross-eyed from too much screen time.

Image of the Day

Luxor sarcophagi arrive at Grand Egyptian Museum: Thirty painted sarcophagi, found last month in Luxor’s Asasif necropolis and collectively described as “the biggest coffin find in a century,” have been transported to the Grand Egyptian Museum (GEM). They will be put on display at the GEM’s opening at the end of 2020, Ahram Online reports. The sarcophagi are estimated to be 3,000 years old, and all were found to have perfectly preserved mummies inside them.

Egypt in the News

Human rights is leading the conversation on Egypt in the foreign press this morning, as the UN Human Rights Council held a periodic review of Egypt’s rights record in Geneva yesterday. The US, UK, Germany, and Sweden called on Egypt to investigate alleged incidents of torture and killings at the hands of security forces, and urged the government to increase freedom of expression. The head of the Egyptian delegation, Parliamentary Affairs Minister Omar Marwan, claimed a “blanket prohibition” on torture but admitted that there were “isolated cases.” Reuters and the Associated Press have the story.

Amnesty International also issued a statement yesterday calling on the international community to demand that Egypt release detained protesters and activists.

Yesterday’s gas fire (covered in this morning’s Last Night’s Talk Shows) is also getting international attention. Seven people died and 16 others were injured after a gas leak from a pipeline caught fire in Beheira province yesterday. The accident is thought to have been caused by people attempting to steal gas from the pipeline. Reuters and the National are both taking note.

Egypt’s push to increase renewable energy is getting positive attention: The drive to use renewables comes as an attempt to mitigate the impact of climate change and tackle environmental concerns, as are our efforts to implement waste reduction initiatives such as the ban on single-use plastics proposed in parliament in June, Arabian Industry reports.

Other headlines worth a moment of your time:

- Egypt continues pushing for peace in Gaza: Egyptian and UN officials urge a ceasefire between Israel and Gaza groups as tensions escalate, the Times of Israel reports.

- Ancient art with a modern twist: An international team of archaeologists studying an ancient Egyptian pharaonic palace from the 6th century BC found surprisingly modern paint, most commonly used in the Middle Ages, and never before seen in the art of ancient Egypt, Atlas Obscura reports.

- Reforming prisoners with industry: Manufacturing and production initiatives offer some Egyptian prisoners a chance for rehabilitation, according to Xinhua.

Energy

EETC signs two contracts to supply overhead conductors worth USD 9.9 mn

The Egyptian Electricity Transmission Company has signed two contracts with two Indian companies worth a combined USD 9.9 mn for the manufacturing and supply of 4k tonnes of aluminium alloy conductors to replace overhead electricity lines, according to a cabinet statement. The first contact was signed with Transrail Lighting Limited Company and the second with Apar Industries Limited Company.

Kuwait gives initial approval to increase crude exports to Egypt

Kuwait has given preliminary approval to increase crude exports to Egypt by 1 mn bbl per month, industry sources say, according to Youm7. This would mean that Egypt would import 2 mn bbl of crude each month, alongside 1.2 mn tons of petroleum products. The government’s oil and fuel purchase agreement with the Kuwait Petroleum Corporation is due to expire next month, but will likely be extended beforehand.

Banking + Finance

Raya to issue securitized bonds worth EGP 500 mn

The Financial Regulatory Authority has signed off on Raya Holding’s plans for its second EGP 497.5 mn securitized bond issuance for its subsidiaries, Raya Electronics, Aman Financial Services, and Aman Microfinance, the company said in a bourse disclosure (pdf). The four-tranche issuance will include bonds with maturities of six, nine, 12, and 24 months carrying yields ranging from 12.49-13.69%. Subscription will be open only to financial institutions. The date for the issuance has yet to be decided. Raya had issued its first securitized bond offering worth EGP 500 mn for the same three subsidiaries at the end of October.

Tamweely seeks EGP 300 mn in loans from two Egyptian banks

Tamweely Microfinance is negotiating with two unnamed banks to borrow EGP 300 mn to increase its women-focused funding portfolio and open several new offices, Chairman and Managing Director Amr Aboul Azm tells Al Mal. Tamweely is also ready to begin offering nano lending services, which were greenlit by the Financial Regulatory Authority earlier this month, Aboul Azm said.

Midor Electricity wants EGP 485 mn EUR loans to raise capacity of power plant

Midor Electricity (Midelec) is negotiating with local private and state-owned banks, including the National Bank of Egypt, to obtain a EUR-denominated loan worth EGP 485 mn to raise the capacity at its power plant by 50 MW, sources told Al Mal. The plant provides electricity to the Midor, Amreya, and Alexandria refineries. The financing would be disbursed over five to seven years, with the agreement and first withdrawals starting in 2020.

Other Business News of Note

Prime Group to establish first international outlet mall in Egypt

Prime Group’s real estate development arm has signed a contract to develop Egypt’s first international outlet mall, company chairman Tamer Wagih said, according to an emailed statement (pdf). “Prime Outlet Cairo” will be located on the regional ring road, close to the new administrative capital. It is due for inauguration in 18 months, and will be managed by London-based Freeport Retail.

My Morning Routine

Do you know of a business leader you’d like to see featured in My Morning Routine? We’re taking suggestions for interesting people to feature in this popular column. If you’d like to recommend someone who holds a key position in a prominent company or organization working in Egypt, doing something interesting, new, innovative or fun, please send an email to: editorial@enterprise.press.

The Market Yesterday

EGP / USD CBE market average: Buy 16.07 | Sell 16.20

EGP / USD at CIB: Buy 16.08 | Sell 16.18

EGP / USD at NBE: Buy 16.08 | Sell 16.18

EGX30 (Wednesday): 14,608 (-0.4%)

Turnover: EGP 611 mn (17% below the 90-day average)

EGX 30 year-to-date: +12.1%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.4%. CIB, the index’s heaviest constituent, ended down 0.7%. EGX30’s top performing constituents were Egyptian Resorts up 2.3%, Juhayna up 1.7%, and Cleopatra Hospitals up 1.4%. Yesterday’s worst performing stocks were CIRA down 2.5%, Ibnsina Pharma down 1.9% and AMOC down 1.3%. The market turnover was EGP 611 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -56.1 mn

Regional: Net short | EGP -9.9 mn

Domestic: Net long | EGP +66.0 mn

Retail: 56.3% of total trades | 60.4% of buyers | 52.1% of sellers

Institutions: 43.7% of total trades | 39.6% of buyers | 47.9% of sellers

WTI: USD 57.12 (+0.6%)

Brent: USD 62.56 (+0.8%)

Natural Gas (Nymex, futures prices) USD 2.60 MMBtu, (-0.8%, December 2019 contract)

Gold: USD 1,463 / troy ounce (+0.7%)

TASI: 7,932 (-0.6%) (YTD: +1.4%)

ADX: 5,069 (-0.1%) (YTD: +3.2%)

DFM: 2,650 (-0.5%) (YTD: +4.8%)

KSE Premier Market: 6,268 (+0.1%)

QE: 10,227 (+0.5%) (YTD: -0.2%)

MSM: 4,066 (+0.3%) (YTD: -6.0%)

BB: 1,510 (+0.0%) (YTD: +12.9%)

Calendar

November: Suez Canal Conference for Investment, organized in cooperation with the European Union.

November: The government will host the Egypt Economic Summit with 40 speakers and experts across all economic fields to discuss the country’s vision post the IMF program.

November: British Egyptian Business Association’s Annual door knock mission, United Kingdom.

November: ITIDA to announce the winning bid in a tender to manage three new innovation centers.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

13-15 November (Wednesday-Friday): Africa Early Stage Investor Summit, Cape Town, South Africa.

14 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

17 November (Sunday): The share price for the Aramco IPO will be announced (expected).

18 November (Monday): AmCham’s US-Egypt Proposer Forum in Cairo. US trade delegation visits Cairo to discuss investments in health, energy and information technology as part of the gathering.

20-29 November (Wednesday-Friday): Cairo International Film Festival, Cairo Opera House, Egypt, Cairo, Egypt.

20 November (Wednesday): The Investment Ministry and the Islamic Development Bank will organize the “leaders for change” startup competition as part of the Fekretak Sherketak initiative, location TBD, Cairo, Egypt.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

23 November (Saturday): HHD extraordinary general assembly to approve the 10% stake + management request for proposal

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

25 November (Monday): Global Trade Matters international dialogue on climate neutrality, Marriott, Cairo.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company

December: Indian automotive delegation to visit Egypt

1-6 December: Vietnamese trade delegation visits Egypt.

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

3 December (Tuesday): Emirates NBD / Markit PMI for Egypt released.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

4 December (Wednesday): Subscription to the Aramco IPO will begin (expected).

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10 December (Tuesday): Egypt Automotive summit, Nile Ritz Carlton, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO (expected)

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.