- Egypt’s non-oil business activity falls again in October… (Speed Round)

- …but almost 90% of Egyptian businesses optimistic about growth next year -HSBC. (Speed Round)

- Is Israel getting closer to scuppering our gas hub ambitions? (Speed Round)

- CIB plans to purchase stake in unnamed Kenyan bank. (Speed Round)

- Cleopatra Group finalizes El Katib Hospital acquisition. (Speed Round)

- CBE proposes online smart wallets, days after greenlighting nano-lending. (Speed Round)

- Cabinet greenlights fast-track VAT refunds. (Speed Round)

- Shoukry in Washington for GERD talks today. (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 6 November 2019

Non-oil business activity falls again in October

TL;DR

What We’re Tracking Today

We could inadvertently end up with a sixth legislative cycle in a five-year parliamentary term. Why? Our illustrious members of parliament set the legislative cycle to run between October and June every year, quite forgetting that their five-year parliamentary term will end in January 2021. The House Legislative Committee is now looking into whether a sixth, curtailed legislative session will be needed to bridge the gap between June 2020 and January 2021. Al Masry Al Youm has the story.

GERD talks get underway in Washington today: Foreign Minister Sameh Shoukry is in Washington D.C. today for talks with his Ethiopian and Sudanese counterparts aimed at breaking the deadlock on Grand Ethiopian Renaissance Dam (GERD) negotiations. President Donald Trump invited the three countries to the US capital two weeks ago as temperatures rose between Egypt and Ethiopia. It’s still not clear precisely what the US role is in the situation: Ethiopia has refused to accept the US as a mediator and said that today’s meeting will feature discussions only. Meanwhile, technical talks are due to resume in the coming weeks following President Abdel Fattah El Sisi and Ethiopian PM Abiy Ahmed’s agreement at the Russia-Africa summit. The National has more background on the talks.

Trump has chosen US Treasury Secretary Steve Mnuchin to lead the meeting, instead of letting the State Department take the reins, which has been discussing the issue with the parties since at least 2011, Voice of America says.

We also know that World Bank President David Malpass will be present during the talks. Law professor Ayman Salama tells Ahram Online that the World Bank is the “most competent” international authority to lead mediation efforts given that it has studied the economic, social and environmental effects of dams built on transboundary rivers.

Shoukry thanked the US for its efforts to solve the dispute during talks with Trump advisor Jared Kushner yesterday, a cabinet statement said. They also discussed the situation in Palestine, and Turkey’s invasion of northern Syria.

Today is the last day of the Arab Sustainable Development Week, which has been running all week in our fair city.

Key dates on which to keep your eye:

- Sunday, 10 November is inflation day, with the CBE and state statistics agency CAPMAS releasing figures for headline and core inflation;

- Thursday, 14 November is interest rate day, when the CBE’s Monetary Policy Committee meets to seat interest rates. The committee has cut rates at its last two meetings.

Uber books third-largest loss in 3Q, insists it is on the way to profitability: Ride hailing giant Uber is optimistic it will turn a profit in 2021 despite posting a series of bn-USD quarterly losses, according to the Wall Street Journal. CEO Dara Khosrowshahi said Uber projects its full-year EBITDA to be in the green within two years despite recording a USD 1.2 bn loss in 3Q2019. Shares promptly dived almost 10% to hit a new record low of USD 28.01, MarketWatch says.

OPEC predicts that demand for its oil will decrease by roughly 7% over the next four years, with the market being flooded with supplies of US shale, Bloomberg reports. Demand could reach as little as 32.7 mn bbl/d in 2023, OPEC said in its annual report. By contrast, US shale output could climb by over 40% to reach 17 mn bbl/d — or a fifth of global daily output at that time, it predicts.

Trump administration mulls China tariff concessions: The US is considering removing some tariffs on Chinese goods in a bid to freeze hostilities and agree an initial trade pact, five sources familiar with the talks told the Financial Times. In order to reach an agreement, the White House would reportedly lift the 15% tariffs on USD 112 bn of Chinese goods (such as clothes, appliances and flatscreen TVs). The RMB strengthened past RMB 7 per USD for the first time since August on the news.

Moody’s downgrades Lebanon as economic crisis intensifies: Moody’s cut Lebanon’s credit rating yesterday to Caa2 with a negative outlook, reflecting the increasing risks that the government may default on its debt, Bloomberg says. Widespread protests and political paralysis make it likely that the government will fail to pass a budget in 2020 and push ahead with emergency economic reforms, Moody’s analyst Elisa Parisi-Capone said. Lebanese bonds plummeted 4.8% after the decision, making them the worst-performing sovereigns in the EM space.

Another nail in the coffin of the Iran nuclear agreement: Iranian President Hassan Rouhani has announced that the country will begin supplying centrifuges with uranium gas, effectively restarting its nuclear enrichment program, the Associated Press reports.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s inauguration of several national projects in Sinai and Suez received a lot of attention from the talking heads last night. Tourism and human rights also got their share of airtime.

El Sisi inaugurates new Sharm highway: President Abdel Fattah El Sisi inaugurated yesterday a new EGP 5.5 bn 342 km road to Sharm El Sheikh from El Shahid Ahmed Hamdi Tunnel in Suez that will make long weekend getaways in Ras Sidr, Sharm, or even further up to Dahab and Nuweiba much more appealing. The new highway replaces a connection between Cairo and South Sinai that suffered regular downpours, reports Hona Al Asema Reham Ibrahim (watch, runtime: 3:12). The old two-lane “road of death” was prone to accidents, with cars not infrequently meeting in head-on collisions.

The president also inaugurated several others national projects, including a steel rolling mill in Suez, a granite and marble factory in Sinai’s Gifgafa, and social housing and bridges in Tur Sinai and Abou Zeneima. Ibrahim (watch, runtime: 0: 32) and Masaa DMC’s Ramy Radwan (watch, runtime: 20:26) were among those taking note.

Developing Sinai is a matter of national security, EGP 800 bn-worth of projects underway: El Sisi said following the inauguration that EGP 800 bn-worth of desalination plants, tunnels, roads, factories, and houses are being built in Sinai, and their completion is “a matter of national security” (watch, runtime: 3:32). Sinai development projects have been in the pipeline since before El Sisi took charge, but are now finally being executed, Ibrahim quoted the president as saying.

Tourism Ministry wins its first award in London conference: The Tourism Ministry won yesterday during the World Travel Market in London the International Travel & Tourism Award for Outstanding Contribution to the Industry, Masaa DMC’s Ramwan reported (watch, runtime: 12:13). Radwan phoned Al Mashat, who said tourism revenues were up 28% y-o-y, reaching their highest recorded level in FY 2018-2019. In a separate phone call with Abu Bakr, she also spoke of Egypt enjoying greater credibility among tour operators and airlines, and partnerships with some of the largest global organizations (watch, runtime: 14:03).

El Sisi phones Boris: El Sisi spoke yesterday to UK Prime Minister Boris Johnson over the phone, Radwan also reported. The president welcomed the recent lifting by the UK government of its four-year ban on flights to Sharm El Sheikh (watch, runtime: 0:54).

Human rights on Hona Al Asema: Hona Al Asema featured a lengthy segment last night on what was described as constant attempts by Ikhwan-led media to feed false information to international organizations about the human rights situation in the country. Ibrahim sat down with Saeed Abdel Hafez, head of the Forum for Development and Human Rights (watch, runtime: 21:37). Egypt is due to take part on 13 and 14 November in two meetings in Geneva for our human rights periodic review with the UN Human Rights Council, Abdel Hafez said. Abdel Hafez also said authorities have stepped up efforts in the past two years to respond to “politicized” and “false” reports by human rights organizations that are often promoted by Qatar and the Ikhwan, among other highlights from the conversation.

Speed Round

Speed Round is presented in association with

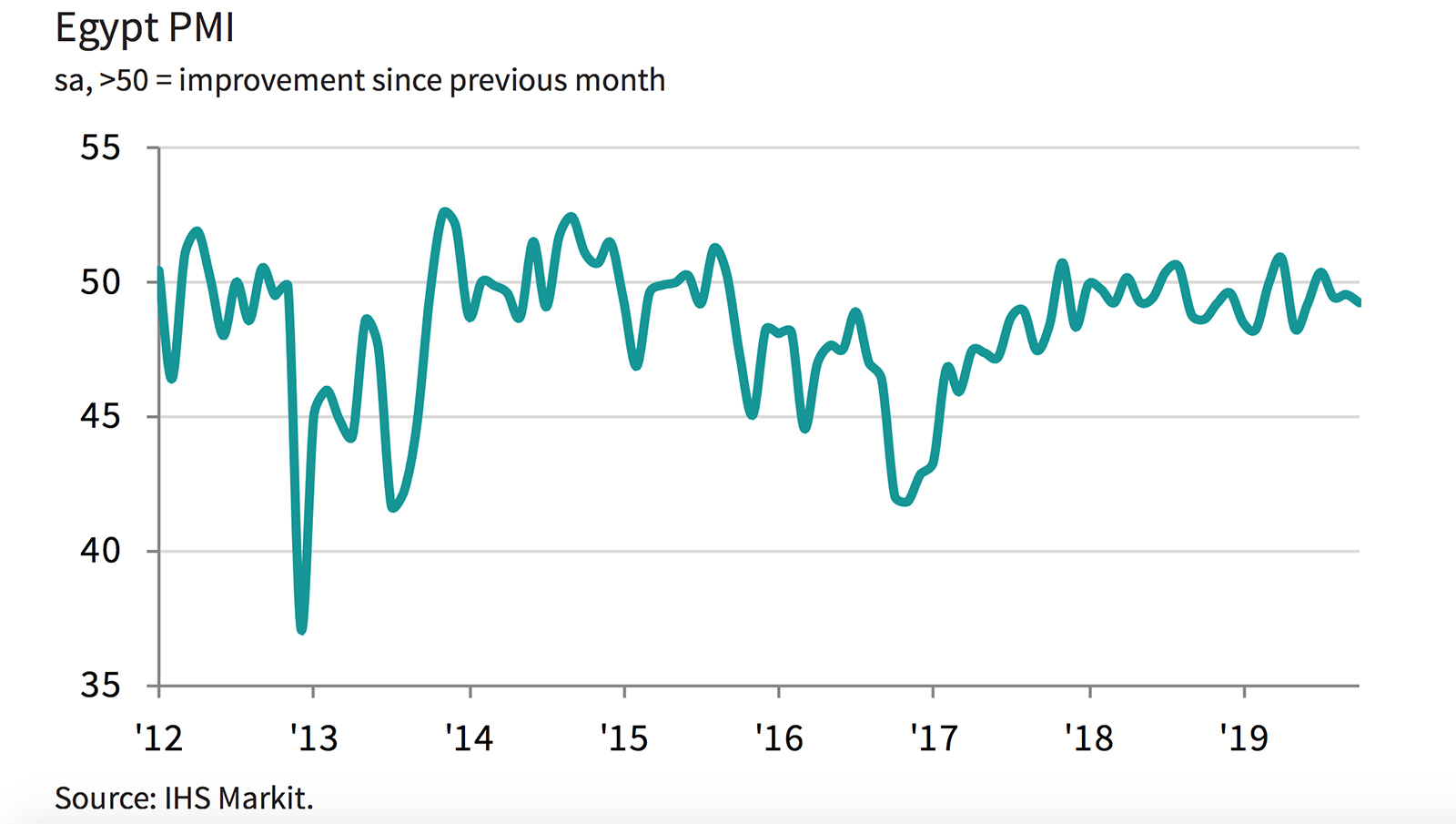

Non-oil business activity falls slightly in October, but sentiment is showing strong improvement: Egypt’s non-oil private sector remained in contraction territory in October, with output and new orders falling moderately, according to the Markit / Emirates NBD purchasing managers’ index (PMI) (pdf). The PMI gauge dipped marginally to 49.2 in October from 49.5 in September, making October the third consecutive month of contraction. However, October’s reading is “stronger than the average for the series (48.4).” A reading above 50.0 indicates that activity is expanding, while a reading below that mark means it is contracting. So far, Egypt’s PMI has been in expansion territory only twice this year.

New orders fell for the third consecutive month, and output also declined. The report notes that new domestic orders fell at the fastest pace since May, and sales to foreign clients also took a hit as survey respondents pointed to “poor market conditions.”

The decline in new orders led businesses to rein in their input buying in October, as inventories remained sufficient as a result of weak demand. The upside is that vendors were able to shorten their delivery times, “extending the current sequence of improvement to four months.” Output charge increases were also kept to a minimal, with some firms even cutting their fees in hopes of attracting new business.

Input cost inflation was at its weakest level since June, the report notes. Salaries seeing a “sharp rise” to compensate for higher living costs was the main driver of input cost increases. “On the flip side, purchase prices grew at a softer pace, as higher bills and customs fees were offset by lower raw material prices and an improvement in the exchange rate against the USD.”

Continued hiring activity points to positive sentiment for the year ahead: Business sentiment was widely positive, with 48% of survey respondents saying they expect a pickup in activity over the next 12 months. The generally positive outlook marks a rebound from September, when sentiment was at a near three-year low.

Egyptian businesses optimistic for growth -HSBC survey: Almost nine in 10 (88%) Egyptian businesses polled by HSBC expect to see growth next year as businesses enter new markets, and the quality and supply of raw materials improves. The HSBC Trade Navigator’s poll (pdf) shows that the vast majority (89%) of the 200 Egyptian businesses surveyed between August and September also sees growth over the next five years, with two in five (40%) of them expecting a 15% or above growth rate, making them more optimistic than their global (22%) and MENA-based (38%) counterparts.

Egypt’s top trading partners are MENA, Africa, Europe and North America, respectively. MENA remains our top partner as 59% named the region as such. More respondents this year, 40%, are also saying they are planning to expand in MENA in the next 3-5 years, more than the 32% of last year.

Growing protectionism in key trading partners is seen as positive: More than three quarters (76%) of the respondents see protectionist policies on the rise in target markets. Most “view this as a positive development, believing they have more to gain than to lose from it” as it could lead to an increase in the competitiveness of their businesses.

Adaptive strategies needed to live with geopolitical changes: More than 80% said geopolitics is having an effect on their businesses, leading them to deploy coping strategies, such as raising capital reserves, cutting down on borrowing, and developing local partnerships. This is compared to 64% globally.

Business is key to UNSDGs: A third of the participants felt their role in helping Egypt achieve the UN’s Sustainable Development Goals (SDGs) is key. They feel efforts toward the SDGs will promote operational efficiency and grow sales, as well as give them a reputational edge.

AI is the most cherished tech: More than a third of the businesses view artificial intelligence (AI) as the tech that will be the most impactful on their companies over the next five years. Nearly half of the respondents said AI is projected to lead to a lower cost of doing business, higher quality, and improved productivity. Data security, 5G, and robotics were also identified by many as key technologies in the coming period.

Is Israel getting closer to scuppering our energy ambitions? Israel Natural Gas Lines (INGL) signed an MoU yesterday with Greek-Italian JV IGI Poseidon to look into the technical, regulatory, and other issues of constructing a natural gas pipeline to Europe, the Israeli government-owned INGL said in a regulatory filing, according to Reuters. The proposed project, which will be named the Eastern Mediterranean (EastMed) pipeline would be able to carry 10 bcm of natural gas a year. It would run from the Levantine Basin off the coast of Cyprus and Israel to the Cypriot mainland, and continue through Crete to western Greece, where it would connect with the Poseidon pipeline between Greece and Italy.

A USD 8 bn pipe dream? We noted almost exactly a year ago that Israel inked agreements with Greece, Italy and Cyprus to supply them with natural gas through a USD 7-8 bn, 2k km pipeline that will take some five years to build. The project seemed like a difficult feat that, according to a 2016 statement by former director-general of the European Commission Michael Leigh, is neither commercially nor politically viable.

Israel is pushing forward nonetheless: Reuters’ coverage noted that the project has been promoted with the backing of the EU and Israel ever since vast gas reserves emerged in the East Med. According to the EastMed pipeline project description on IGI Poseidon’s website, the preliminary FEED, or front end engineering and design documents, have already been finalized with USD 2 mn in grants from Europe. Taking this into account, and recounting reports in 2018 that the EU has already provided USD 100 mn to fund further studies, the will to make the pipeline a reality clearly still exists. Whether it will be able to transform it into a commercially-viable project and navigate the geopolitical faultlines in the Mediterranean is a different matter entirely.

M&A WATCH- CIB plans to acquire a stake in a Kenyan bank: CIB’s board of directors agreed in principle to acquire an undisclosed stake in an unnamed bank in Kenya, the company said in an EGX disclosure (pdf). The bank is waiting on the necessary approvals before moving ahead with the acquisition, according to the disclosure. News of the acquisition plans, which came after the leading private sector bank reported a 23% rise in net profits in 3Q2019, drove up its share price 2.4% during yesterday’s trading session to close at EGP 83.8 per share.

CIB has been working to further expand into Africa, starting with the opening of its representative office in Ethiopia in April. The bank previously said it intended to enter the Kenyan market when it "finds the right [option].” Our friend Mohamed Sultan, chief operating officer at the bank, cited the bns of USD that flow in annual trade between Egypt and Kenya, as well as Kenya’s role as a major regional trade hub, as driving CIB’s interest in the country.

The bank is not alone in targeting east African countries: Banque Misr (BM) and Beltone Financial have also expressed interest in developing their operations further down the African coast. BM has recently received approval from the central bank to set up three representation offices in Somalia, Kenya, and Tanzania, Chairman Mohamed El Etrebi said. The bank also plans to launch digital banking services soon, El Etrebi separately said.

M&A WATCH- Cleopatra finalizes El Katib Hospital acquisition: Cleopatra Hospitals Group (CHG) has finalized its full acquisition of El Katib Hospital in Dokki after signing the business transfer agreement, according to a company statement (pdf). CHG will take over El Katib Hospital’s daily operations as of today, and had already acquired the hospital’s real estate assets in December 2018. The acquisition has added 100 beds to CHG’s in-patient capacity, the company said in its annual report earlier this year. The move will also see Cleopatra inaugurate a urology center at the hospital.

CBE ramps up digitization plans: The Central Bank of Egypt (CBE) is mulling introducing a new mechanism that would allow citizens to open smart wallets online, allowing them to make deposits and borrow via mobile phones as part of the CBE’s digitization drive, CBE Sub-Governor Lobna Helal said, according to Al Mal. This comes just a few days after the Financial Regulatory Authority had signed off on new regulations allowing microlenders to begin offering nano lending services through mobile phones. The CBE is also looking into setting up a fintech center in Egypt that would act as a regional hub for the Arab world and the rest of Africa, Helal said.

LEGISLATION WATCH- Cabinet econ group greenlights fast-track VAT refunds: Amendments to the executive regulations of the VAT Tax Act proposed by the Finance Ministry and approved in a cabinet economic group meeting yesterday would allow VAT taxpayers to provide authorities bank guarantees that would pay out refunds before an assessment on the tax return is made. The guarantees must cover the full amount of the proposed refund and be renewable. Taxpayers that have previously been convicted for tax evasion will not be eligible for a fast-track refund.

Why is this on the table? Investors and large taxpayers have been complaining that tax refunds take too much time. The reason for this is that claimants need to submit lengthy documentation that is in turn assessed by the Tax Authority to ensure their authenticity.

EBRD, FDA provide USD 15 mn loan to fund green tech for Egyptian SMEs: The European Bank for Reconstruction and Development (EBRD) and the French Development Agency are providing a USD 15 mn loan to support the use of green energy technologies among Egypt’s small and medium-sized businesses, the EBRD said in an emailed statement. The money will be transferred to the Arab African International Bank, and will be used to increase the uptake of technologies such as thermal insulation, solar PV, geothermal heat pumps and water-efficient irrigation systems.

EBRD gives its first microfinance loan in Egypt to EFG’s Tanmeyah: The EBRD is granting EFG Hermes subsidiary Tanmeyah Microenterprise with an EGP-denominated USD 5 mn loan, marking the bank’s first loan in Egypt’s microfinancing segment, according to an EBRD statement. The loan, which will be indexed to the newly-launched no-interest rate benchmark CONIA, comes as part of the EBRD’s Women in Business program to improve Egyptian women-led MSMEs’ access to financing. The loan “will help Tanmeyah to introduce new financial products, modified lending practices and business models that are more inclusive and gender-responsive,” according to the statement. Under the financing agreement, Tanmeyah will also work on implementing a digital transformation strategy.

REGULATION WATCH- Market regulator slashes service, inspection fees on green bonds in half: The Financial Regulatory Authority (FRA) will reduce its services and inspection fees on green bond issuers by half in a bid to encourage issuances, the market regulator said in a statement (pdf). The fees will now be 0.05% for IPOs and 0.025% for private placements. The FRA had in August named 11 independent institutions to oversee issuance of green bonds. The executive regulations to the Capital Markets Act, which were issued last July, opened the door to the introduction of new financial instruments, including green bonds, suku, short selling, and a futures and commodities exchange. The government has hinted it may issue green bonds locally.

EARNINGS WATCH- Cairo for Real Estate and Investment’s (CIRA) net profit soared 75% y-o-y to EGP 221.1 mn in its fiscal year, which ended on 31 August 2019, according to the company’s earnings release (pdf). Revenues rose 36% y-o-y during the fiscal year, coming in at EGP 704.7 mn. The strong revenue growth was “spurred by increases in revenue contribution from both the higher education and K-12 segments following tremendous increases in the number of students enrolled,” said CIRA CEO Mohamed El Kalla. The leading private education provider saw a total of 32k students enrolled in its higher education and K-12 segments, and extended EGP 41.8 mn-worth of scholarships and financial aid packages across the segments.

CIRA is continuing to add new faculties and schools to portfolio, and has completed construction on seven new facilities at Badr University, putting the company “well within our timeline to begin rolling out the faculties” next year, El Kalla noted. CIRA has also “made extensive progress” on its establishment of a new university in Assiut, and has broken ground on its EGP 60 mn integrated school in New Mansoura. Looking ahead, the company plans to push ahead with its expansion into several new governorates in a bid to raise the quality and magnitude of Egypt’s middle-income secondary educational sector.

Emaar Misr’s 9M2019 net profits fell 64.2% y-o-y to EGP 628.9 mn, slumping from EGP 1.759 bn during the same period last year, according to a company disclosure (pdf). The company's revenues also dropped to EGP 2.3 bn from EGP 2.8 bn.

Americana Egypt reported a 29.1% y-o-y drop in net profits in 9M2019 to EGP 65 mn, down from EGP 91.8 mn during the comparable period last year, the company said in a bourse disclosure (pdf). Revenues increased 12% during the first nine months of the year to EGP 3.13 bn up from EGP 2.79 bn last year.

MOVES- The former chairman of the General Authority For Investment (GAFI), Mohsen Adel, has been tapped by Bayt El Khebra Group as the firm’s new investment head, Al Mal reports. Adel completed his one-year term at GAFI earlier this year, and was succeeded by his deputy, former Investment Ministry consultant Mohamed Ahmed Abdel Wahab.

CORRECTION- CI Capital’s net profit before minority interest rose 26.6% in 9M2019, not 26.2% as we said in yesterday’s issue. We also mistakenly said that the company’s revenues increased to EGP 1.7 bn, compared to EGP 1.3 bn during the same period last year. The correct figures are EGP 1.8 bn in 9M2019 versus EGP 1.4 bn last year. The entry has since been corrected on our website.

Egypt in the News

We have a melange of stories popping up in the foreign press this morning:

- Rising Egyptian nationalism: Egypt is witnessing a heightened sense of nationalism that is discouraging dissent, argues Maged Mandour in OpenDemocracy.

- El Sisi heaps praise on Trump: The Associated Press notes the “lavish praise” heaped on Trump by President Abdel Fattah El Sisi on social media yesterday.

- El Gouna Film Festival accused of misogyny: The El Gouna Film Festival may be a groundbreaking vehicle for showcasing Arab film, but when it comes to regulating women’s dress, bodies and appearance, misogyny is alive and well there too, argues Rajaa Natour in Haaretz.

- Ancient Egypt: A team of Egyptian and Japanese archaeologists have discovered Roman-era catacombs near Sakkara, Xinhua says.

- Orientalist architecture: The Telegraph is out with a photo essay lauding the UK’s attempts at mimicking Egyptian-style architecture with mixed results.

Worth Watching

New technology looks set to transform the offices of the future beyond recognition: Workers in offices in Amsterdam run by Edge Technologies are already a few smart technology steps ahead of the rest of us, this Financial Times video shows (watch, runtime: 02:22). Using an app, they can control multiple aspects of their environment — from finding a parking spot (imagine having that in Cairo…) to customizing the temperature and light in their working space, or locating one another easily. The app even remembers how each person likes their coffee.

But this is nothing compared to what we can expect by 2050, with successive digital developments set to keep the pace of change accelerating all over the world. Offices are expected to contain innovations such as intelligent glass windows that can adapt to the weather and turn into screens, real-time translation software for virtual meetings, movable walls to transform shared space, and more options for health-conscious employees to stand and move around. While these developments may be a convenience seeker’s dream, they will have their downsides. Above all, they will impinge on privacy, with much of the technology relying on tracking systems and storing huge amounts of our personal information.

Diplomacy + Foreign Trade

Egypt, Cyprus, Greece condemn Turkish nat gas adventurism: The defense ministers of Egypt, Cyprus and Greece have condemned Turkey’s natural gas exploration activities in Cyprus’ exclusive economic zone as illegal following trilateral talks in Athens, Greek daily Kathimerini reported. They also criticized Ankara for its invasion of northern Syria last month, and its violations of Greek airspace and territorial waters in a joint statement issued after the meeting.

Egypt, Jordan sign power linkage MoU with GCC Interconnection Authority: Egypt and Jordan signed an MoU and two data confidentiality agreements with the GCC Interconnection Authority to link the two countries' electric grids with GCC countries, according to a cabinet statement. The transmission capacity of the GCC interconnection grid is 1.2 GW and can supply any of the Gulf states with about 900 MW. The GCC Interconnection Authority is planning to use Egypt’s USD 4 bn power linkage with Cyprus and Greece to eventually link Gulf energy grids with Europe. Egypt has plans to export electricity to Syria and Iraq through Jordan, once we double the capacity of our existing link with Amman. The Egypt-Jordan electricity link is part of a larger project to link Egypt’s grid to Libya, Palestine, Syria, Lebanon, Iraq, and Turkey.

Energy

Egypt could postpone USD 6 bn-worth of coal power projects

The Electricity Ministry is looking at potentially postponing all coal-fired power projects or offering investors the option to switch to a renewable energy project, Egyptian Electricity Holding Company (EEHC) head Gaber El Desouky told Al Mal. According to El Desouky, the pending coal projects are worth a combined USD 6 bn and would produce 9.25 GW of energy. The ministry pulled the plug on Al Nowais Investments’ USD 4 bn, 2.65 GW coal station in Oyoun Moussa last month due to the country’s current electricity surplus and the high price tag of the project. The Emirati company began bidding to build USD 700 mn-worth of renewable energy plants in Egypt after Al Nowais was pulled.

BP, Eni begin production from two Baltim South West field in Egypt’s Delta

BP and Eni have begun production from the first two exploration wells in the Baltim South West offshore natural gas concession, according to a cabinet statement. The two wells have a combined output of 190 mcf/d and 1,300 bbl/d of condensate. Eni had suggested the field holds 1 tcf of gas following the results of the appraisal well Baltim South West 2X. The remaining four wells in the field are expected to be brought online by 2Q2020 to bring the field’s total output to 500 mcf/d.

Gama Construction completes 6 PV power plants in Benban totaling 360 MW

Triangle Group’s Gama Construction has completed and delivered six solar power plants in the Benban solar park with a combined output of 360 MW, the company said in a statement (pdf). The company’s work is considered to be the largest to be fulfilled by a single local contractor.

Basic Materials + Commodities

Sawiris’ La Mancha plans GBP 6.6 mn investment in Altus Strategies:

Naguib Sawiris’ La Mancha mining company has signed a letter of intent to invest GBP 6.6 mn in Altus Strategies, the UK-based mining firm announced in a statement. The move would see La Mancha obtain a 34.5% stake in the company for around GBP 6.56 mn. The company would buy 124.23 mn shares at GBP 0.053 per share — a 20% premium on the closing market price on 2 November. Altus will launch a private placement of 58.5 mn shares simultaneously with La Mancha’s strategic investment. The La Mancha investment is expected to be completed by January 2020.

Agro Egypt to establish EGP 20 mn sorting and packaging station

Agro Egypt plans to establish a EGP 20 mn sorting and packaging facility in Sixth of October to double its production capacity, export director Hady Selim told the local press. Construction on the facility will begin by the end of this year and is slated for completion by the end of 2021. The company is also eyeing raising its exports to USD 40 mn by the end of this year up from USD 30 mn last year.

Manufacturing

Mondelez begins making Milka chocolate in Egypt

Snack-maker Mondelez has begun operating a new production line at its Tenth of Ramadan City facility to manufacture Milka chocolate, according to Al Mal. This is the first domestic production line for Milka in the Middle East, and will be used to export the chocolate to Morocco and up to 24 other countries around the world.

Tourism

EasyJet to begin launching holiday packages to Egypt, operate Naples-Hurghada flights

EasyJet has announced that it will launch package holidays to Sharm El Sheikh and Hurghada for the first time in summer 2020, the Irish Sun reports. The company plans to feature travel offers for 24 hotels in the two Red Sea resorts. The UK travel provider is the second company to announce new holiday packages since the UK lifted its four-year ban on direct flights to Sharm last month. Tui said last week it will soon launch new offers for Sharm El Sheikh and will start flights next February. In related news: EasyJet has begun a twice-weekly flight route between Naples and Hurghada, according to eTurboNews.

Telecoms + ICT

Credit scorer i-Score seeks partnership to export services to Arab countries

Egyptian credit bureau i-Score is looking to enter other Arab markets, and has met with investors from Bahrain and Libya to discuss the matter, Deputy Chairman Mohamed El Houshi told Hapi Journal. El Houshi also said that the company is reviewing a new online SME marketplace, where small companies would be able to advertise their financing needs and have investors bid to offer financing.

Automotive + Transportation

Egypt to launch Alexandria metro tender in 1Q2020

The Alexandria governorate will launch an international tender in 1Q2020 for building an underground metro in Alexandria, Governor Abdel Aziz Konsowa said, according to the local press. The EGP 17 bn first phase of the project will link Abu Qir in the east to the mid-western Mahatet Masr in Attarin, and take up to two years to complete. The second and third phases will then extend westward to El Max and Km 21 on the Alexandria-Matrouh road. All technical and financial studies of the project, which will see the governorate partner up with the Transport Ministry, were recently completed, Konsowa said. Construction was set to begin later this year, but it appears to have been postponed.

Banking + Finance

Egypt’s Misr Travel seeks EGP 150 mn loan from EBRD

The Holding Company for Tourism and Hotels subsidiary Misr Travel is in talks to borrow EGP 150 mn from the European Bank for Reconstruction and Development (EBRD) to finance the renewal of its tourist transport fleet, according to the local press. The company aims to buy 50 new tourist buses and 50 limousine-service cars. The current fleet includes 128 buses and 80 limousines, serving 40 branches. Banque Misr and the National Bank of Egypt were reportedly in negotiations with the company over the loan.

Tawriq signs EGP 500 mn securitization issuance

Arabia Investment’s Tawriq for Securitization will issue EGP 500 mn of asset-backed securities for Raya Holding, pending the approval of the Financial Regulatory Authority, according to a disclosure to the bourse (pdf). Raya had signed last month its first securitized bond issuance for its subsidiaries, Raya Electronics, Aman Financial Services, and Aman Microfinance, worth EGP 500 mn and was reportedly seeking to issue more bonds next year.

Other Business News of Note

Egypt introduces new water-saving equipment to smallholders

Egypt has introduced new equipment capable of preparing and cultivating land with less time and effort, increasing yields by 15-20% and saving up to 25% of irrigation water, according to SciDev.Net. The Raised Bed Machine (RBM) is the brainchild of the International Centre for Agriculture Research in Dry Areas (ICARDA) and was designed to suit wheat, alfalfa, and barley, but Egyptian farmers have managed to also use it for fertilization.

Egypt Politics + Economics

Egypt could exempt charity funds from paying taxes

The Finance Ministry has agreed in principle to exempt charity funds from paying taxes in a bid to encourage the sector, Italy-based asset manager Azimut Group Managing Director Ahmed Abou El-Saad tells Al Mal. Azimut has been hired to manage the assets of Egypt's first charitable investment fund, Ataa, which will serve people with disabilities. The Financial Regulatory Authority had approved a directive allowing the establishment of charitable investment funds, whose profits would go towards charity and other social welfare and development projects last year.

Environment Minister discusses reducing pollution with World Bank

Environment Minister Yasmine Fouad met with a World Bank delegation to discuss her ministry’s new program to combat air pollution and address climate change in Greater Cairo, according to a cabinet statement. Fouad met last month with World Bank Regional Director Marina Wes to discuss plans to reduce greenhouse gas emissions by converting public buses to run on natural gas and developing the railway system to reduce traffic. Following this Investment Minister Sahar Nasr discussed a potential USD 500 mn facility to help Egypt reduce pollution with bank officials in Washington.

On Your Way Out

Egypt’s road quality ranking has jumped 90 spots over the past five years, putting us at 28th worldwide, a cabinet infographic showed. The number of road accidents per year dropped 41.1% between 2014 and 2018, while the death and injury rates from these accidents have been halved over the same period of time.

The Market Yesterday

EGP / USD CBE market average: Buy 16.07 | Sell 16.19

EGP / USD at CIB: Buy 16.07 | Sell 16.17

EGP / USD at NBE: Buy 16.09 | Sell 16.19

EGX30 (Tuesday): 14,790 (+1.1%)

Turnover: EGP 824 mn (14% above the 90-day average)

EGX 30 year-to-date: +13.5%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.1%. CIB, the index’s heaviest constituent, ended up 2.7%. EGX30’s top performing constituents were Egypt Kuwait Holding up 1.7%, Cleopatra Hospital up 1.3%, and Abu Dhabi Islamic Bank up 1.1%. Yesterday’s worst performing stocks were Qalaa Holding down 1.6%, KIMA down 1.5% and Orascom Construction down 1.4%. The market turnover was EGP 824 mn, and foreign investors were the sole net buyers.

Foreigners: Net long | EGP +78.4 mn

Regional: Net short | EGP -13.2 mn

Domestic: Net short | EGP -65.2 mn

Retail: 57.1% of total trades | 50.4% of buyers | 63.7% of sellers

Institutions: 42.9% of total trades | 49.6% of buyers | 36.3% of sellers

WTI: USD 57.17 (-0.1%)

Brent: USD 62.96 (+1.3%)

Natural Gas (Nymex, futures prices) USD 2.87 MMBtu, (+0.4%, December 2019 contract)

Gold: USD 1,485 / troy ounce (+0.1%)

TASI: 7,782 (+1.7%) (YTD: -0.6%)

ADX: 5,154 (+0.9%) (YTD: +4.9%)

DFM: 2,687 (-0.7%) (YTD: +6.3%)

KSE Premier Market: 6,150 (-0.4%)

QE: 10,303 (+1.0%) (YTD: +0.1%)

MSM: 4,026 (+0.1%) (YTD: -6.9%)

BB: 1,518 (-0.2%) (YTD: +13.5%)

Calendar

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

November: The government will host the Egypt Economic Summit with 40 speakers and experts across all economic fields to discuss the country’s vision post the IMF program.

November: British Egyptian Business Association’s Annual door knock mission, United Kingdom.

November: ITIDA to announce the winning bid in a tender to manage three new innovation centers.

3-7 November (Sunday-Thursday): Employment Creation in The Arab Countries, Cairo, Egypt.

4-6 November (Monday-Wednesday): Egypt’s Chamber of Tourism Establishments will participate in the UK’s World Travel Market (WTM) event in London.

7 November (Thursday): AmCham will hold the Prosper Africa Event.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-9 November (Friday-Saturday): Startups Without Borders Summit, The American University in Cairo Downtown, Tahrir, Egypt.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

10 November (Sunday): National holiday for Prophet Mohammed’s birthday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

12 November (Tuesday): Egypt Economic Summit, venue TBA.

13-15 November (Wednesday-Friday): Africa Early Stage Investor Summit, Cape Town, South Africa.

14 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

17 November (Sunday): The share price for the Aramco IPO will be announced (expected).

18 November (Monday): AmCham’s US-Egypt Proposer Forum in Cairo. US trade delegation visits Cairo to discuss investments in health, energy and information technology as part of the gathering.

20-29 November (Wednesday-Friday): Cairo International Film Festival, Cairo Opera House, Egypt, Cairo, Egypt.

20 November (Wednesday): The Investment Ministry and the Islamic Development Bank will organize the “leaders for change” startup competition as part of the Fekretak Sherketak initiative, location TBD, Cairo, Egypt.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

23 November (Saturday): HHD extraordinary general assembly to approve the 10% stake + management request for proposal

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

25 November (Monday): Global Trade Matters international dialogue on climate neutrality, Marriott, Cairo.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company

December: Indian automotive delegation to visit Egypt

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

3 December (Tuesday): Emirates NBD / Markit PMI for Egypt released.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

4 December (Wednesday): Subscription to the Aramco IPO will begin (expected).

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10 December (Tuesday): Egypt Automotive summit, Nile Ritz Carlton, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO (expected)

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.