- Egypt’s economic growth will fall below gov’t targets this fiscal year, but will hit 6% by FY2021-2022 -The Economist. (Speed Round)

- Is EMRA scrapping its bidding system for gold exploration licenses? (Speed Round)

- Egypt has an inverted yield curve, too. (The Macro Picture)

- Telecoms regulator report finds Vodafone provides the best quality of service, WE lags behind. (Telecoms + ICT)

- The Finance Ministry is bringing back the daily customs rate system. (Speed Round)

- Remittances are outpacing FDI as developing countries’ biggest source of foreign capital. (Worth Reading)

- Emerging markets have a USD problem. (What We’re Tracking Today)

- The Market Yesterday

Monday, 2 September 2019

Egypt’s GDP growth won’t hit 6% until FY2021-22 -The Economist

TL;DR

What We’re Tracking Today

The Big 5 Construct begins today. The three-day construction conference opens today at the Egypt International Exhibition Center, and features over 240 exhibitors showcasing the latest in construction technology and innovation.

The Shared Services and Outsourcing Forum opens tomorrow: Global leaders in the shared services industry will discuss emerging technologies and business strategies during this two-day conference held under the auspices of the CIT Ministry.

The Egyptian Private Equity Association (EPEA) will hold its Venture Capital event on Wednesday, 18 September to promote entrepreneurship as a main driver for growth. Read the agenda here (pdf).

Key data points to keep your eye on in the coming days:

- PMI: The purchasing managers’ index for Egypt, the UAE and Saudi Arabia will be released on Tuesday, 3 September at 06:15 CLT.

- Foreign reserves: The Central Bank of Egypt is due to release Egypt’s net foreign reserves figures for August this week.

- Inflation: Monthly inflation figures for August at due out next week. Inflation fell unexpectedly to a four-year low of 8.7% in July.

Digital transformation of the MENA healthcare sector is coming, but digitization and raising public awareness will take time, co-founder of Egyptian pharmacy locator Chefaa Rasha Rady tells Wamda. While the sector has a lot of room for innovation, persuading pharmacies to agree to companies’ commission fee structure has proved a challenge. “It’s important that all stakeholders in [the] healthcare sector understand that it was never about the cost, but it’s all about being cost-effective,” Rady says. Wael Kabli, CEO of Cura, an app that allows customers to book medical consultations, says that although the growth of e-pharmacies are “inevitable” it will take a lot of time and effort to make them a reality.

Emerging markets have a USD problem: The continued strengthening of the USD is undermining emerging markets as attractive investment destinations for yield-hungry investors, analysts tell Bloomberg. The trade-weighted USD index hit record highs in August despite the Federal Reserve’s 25 bps rate cut in July, with the USD gaining against all but one EM currencies. This threatens to erode gains on EM assets, and places further pressure on EM businesses and governments owing USD-denominated debt. “My biggest concern is with the USD,” Paul McNamara, fund manager at GAM UK, said. “At the moment, when people want certainty, when they want a safe haven they tend to go to the USD. That tends to be a tough environment for emerging markets.”

Trade war continues to take its toll on China’s economy: Business activity in China’s manufacturing sector contracted for the fourth consecutive month in August, PMI data showed on Saturday.

Investors are beginning to lose their nerve as Brexit turmoil ratchets up: Investors have pulled USD 4.2 bn from UK equity funds since Theresa May announced her resignation as prime minister in late May, the Financial Times reports. This brings the total outflows since the 2016 referendum to USD 29.7 bn, with analysts now terming the UK stock market “unloved, under-owned and cheap.” New PM Boris Johnson’s upbeat rhetoric is doing little to assuage concerns as his government continues with its uncompromising approach to negotiations with the EU.

Apple may need to rethink its marketing strategy: Google researchers have detected more than a dozen security flaws in the iPhone that may have led to hundreds of thousands of phones being hacked, the company announced last week. Google’s threat analysis group found that a number of malicious websites had been used to hack potentially thousands of users each week. Apple became aware of the software flaw in February and had it fixed on the down-low, but not before hackers had access to iPhone users’ text messages, photos, and locations. Apple has not yet commented on Google’s findings.

Has the era of short-format programming arrived? Hollywood studios such as Disney, Warner and MGM have poured mns into a company that produces content designed to be watched in short bursts on a smartphone, all in the hope of grabbing the attention of today’s small screen addicts, the WSJ reports.

Enterprise+: Last Night’s Talk Shows

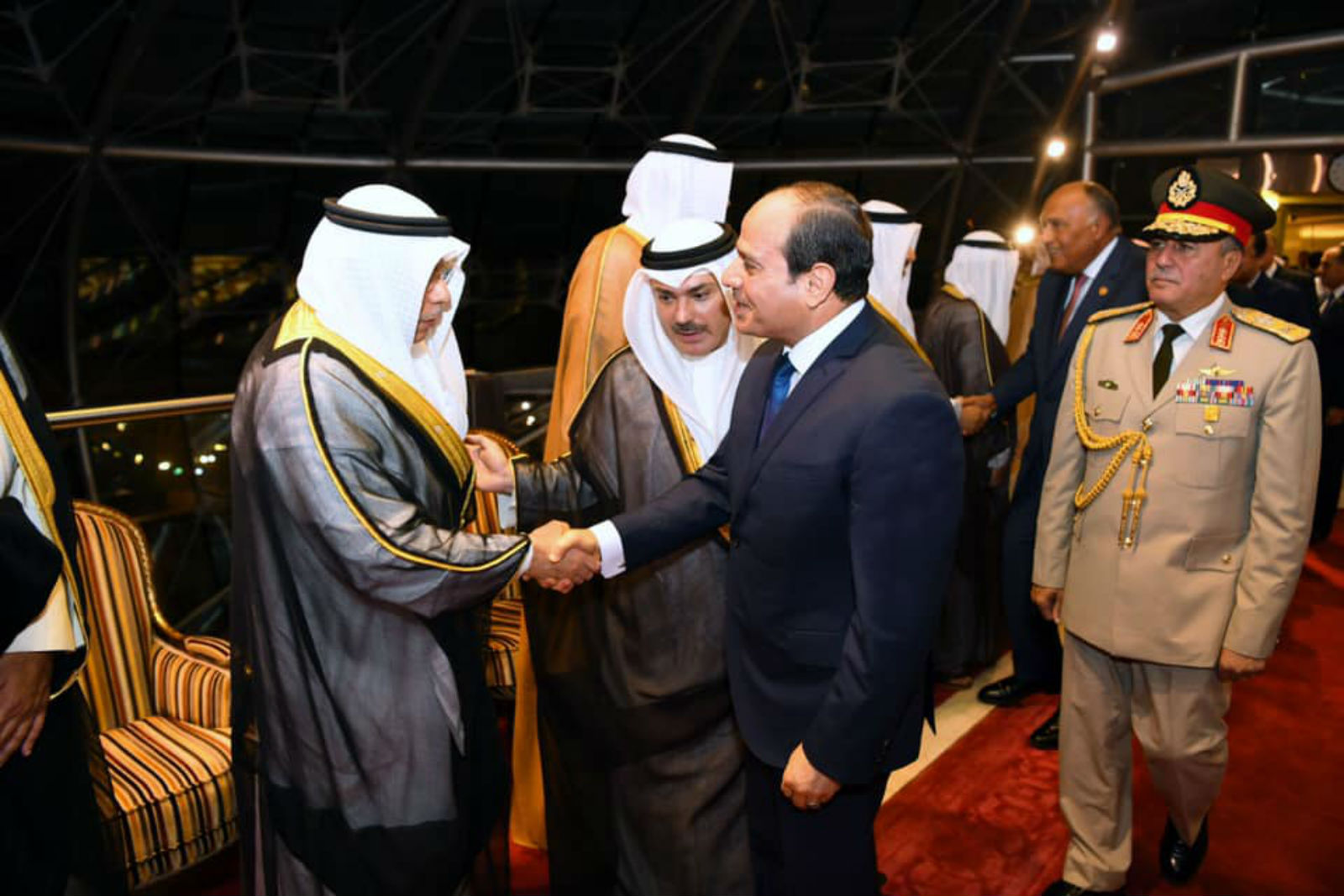

The last day of President Abdel Fattah El Sisi’s visit to Kuwait led the conversation on the airwaves last night. Hona Al Asema’s Reham Ibrahim took note of El Sisi’s meeting with Kuwaiti Emir Sabah Al-Ahmad Al-Jaber Al-Sabah and Kuwaiti National Assembly Speaker Marzouq Al-Ghanim (watch, runtime: 2:25). We have a full recap in this morning’s Speed Round, below.

Ibrahim also highlighted an op-ed published yesterday by Asharq Al Awsat saying that El Sisi is “on a mission to comprehensively reshape the country, defying political, economic and social challenges” through the 14 new cities currently under construction (watch, runtime: 1:04).

Meanwhile, Prime Minister Moustafa Madbouly took a tour of infrastructure projects under construction, including Alexandria’s El Kafoury-Borg El Arab and Sidi Kerir-Borg El Arab Airport roads, Masaa DMC noted. Madbouly also visited the Alexandria and Dekheila ports to follow up on their work (watch, runtime: 1:59).

Universal healthcare registration kicks off: The government opened the registration window for 25 primary healthcare units in Port Said under the new universal healthcare system, Ibrahim reported (watch, runtime: 1:04).

Fans may be returning to stadiums to attend Egyptian Premier League matches this season, head of the managing committee at the Egyptian Football Association (EFA) Amr El-Ganainy told El Hekaya’s Amr Adib on Al Hekaya (watch, runtime: 02:32). El-Ganainy says the plan still requires security approval, but could see up to 5k fans attending the first match of the season, with that number increasing gradually.

Speed Round

Speed Round is presented in association with

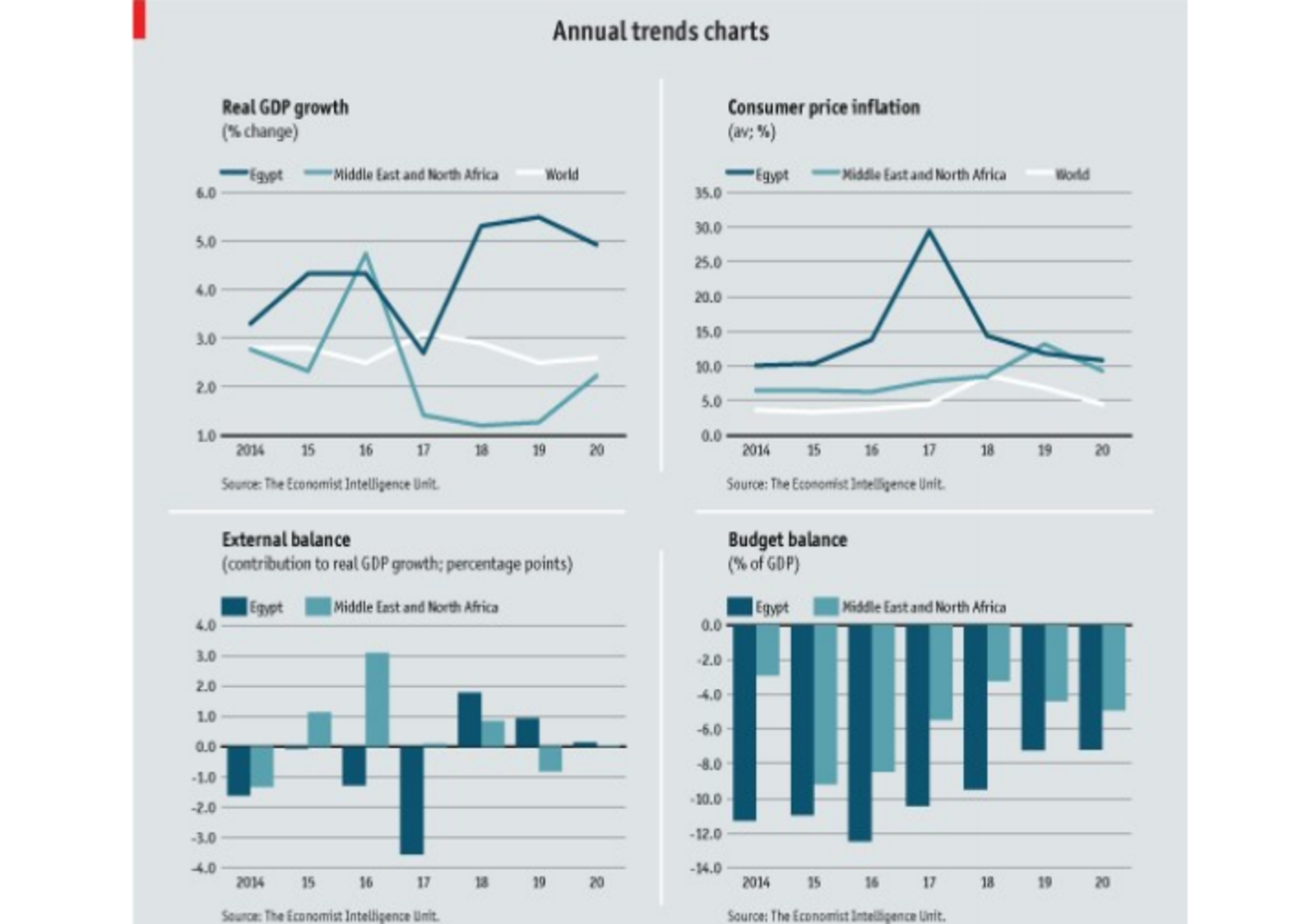

Egypt’s economy will grow at a 4.5% clip this fiscal year before accelerating to 6.0% in FY2021-2022, the Economist Intelligence Unit (EIU) said in a report last week (pdf). The forecast for the current fiscal year is much more modest than the government’s target of 6.0% outlined in the state budget. According to the EIU, measures to balance the tough reform program with “containing public discontent,” including raising public sector wages, will weigh on Egypt’s fiscal position, but tax revenues will improve public finances over the next four years “in tandem with robust GDP growth.” The report expects Egypt’s fiscal deficit to narrow to 6.0% of GDP by FY2022-2023, from 9.5% in FY2017-2018 on the back of lower spending on subsidies and higher tax revenues. “The current account will move into surplus from 2021, owing to lower oil import costs in the second half of the forecast period and as export growth outpaces import growth.” Inflation, meanwhile, is expected to average 11.8% this fiscal year before gradually cooling to 7.5% by FY2022-2023.

Economic, fiscal, and regulatory reforms are expected to continue past the end of the IMF program, the EIU says, “although business-related structural reforms will proceed slowly owing to opposition from vested interests within state bodies.” The report also notes that it does not expect Egypt to seek further funding from the IMF to support the remainder of its reforms. Finance Minister Mohamed Maait had said in June that Egypt is in talks with the IMF over a non-loan program and is hoping to reach a final agreement by next month.

The report identifies a few “major risks” to Egypt’s economic outlook, with a slowing pace of socially sensitive reforms due to concerns about popular unrest seen as a high probability risk with a high impact. Other risks with a moderate probability of occurring include the government raising corporate taxes on the back of fiscal pressure, increased volatility in the EGP from negative foreign assets (both of which would have a “very high” impact on the economic outlook), and investments being deterred from “opaque legal proceedings.” The EIU also sees a moderate probability of a sustained terrorist campaign that would negatively affect tourism.

Egyptian Mineral Resources General Authority to end bidding system for gold exploration licenses: The Egyptian Mineral Resources General Authority (EMRA) is reportedly planning to abolish the bidding system for gold exploration licenses next year and instead allow investors to apply for a license covering a specific area for up to six years, a source told the local press. The exploration and production phases will be separated under the new system, meaning that investors will need to have a development plan agreed with the ministry and approved by parliament should they make a commercial discovery. Investors will not need to sign an agreement with the government, and the Oil Ministry will issue licenses without the need for legislation.

Exploration licenses will be granted for an initial two-year period, renewable for another two two-year terms subject to evaluation. Investors are currently allowed to explore a concession for up to 30 years without making commercial discoveries. The ministry will grant investors tax breaks and customs exemptions if they make discoveries, and will revoke licenses if they fail to find anything during the license period.

Background: President Abdel Fattah El Sisi ratified the Mineral Resources Act two weeks ago, which introduces additional incentives for companies to invest in the mining sector. The amendments expand the size of concession areas, establish a new authority for issuing licenses of unlimited size, and allow investors to renew licenses for more than one term. You can read more details about the amendments here.

FinMin brings back daily customs rate, scrapping monthly system: The Finance Ministry has decided to scrap the monthly customs exchange rate introduced in 2017 and will revert to setting the rate on a daily basis according to FX rates announced by the central bank, according to a ministry statement. The daily rate system came into effect as of yesterday. The government had introduced the monthly system following the EGP float as an “exceptional measure” to stabilize the customs rate during a period of currency volatility, which is no longer necessary, the ministry said. The rate for non-essential imports was set at EGP 16.77 / USD 1 for July, while the discounted customs exchange rate was held at EGP 16.

FinMin to issue EGP 160 bn T bills and bonds this month: The Finance Ministry is planning to issue EGP 160.75 bn of treasury bills and bonds this month and debt instruments worth EGP 522 bn throughout the quarter to cover the budget deficit, according to a plan seen by the press. Of this month’s 24 offerings, 16 will involve T-bills worth EGP 151 and eight of treasury bonds worth EGP 9.75 bn. The government’s outstanding balance of treasuries owed to debt investors stood at EGP 1.97 tn at the end of July, according to ministry figures.

EFG Hermes topped the EGX’s brokerage league table for August with a market share of 47.9%, according to figures released by the EGX (pdf). CI Capital came in second with a 6.7% market share, followed by Beltone Financial (5.5%), Pharos Securities (2.9%), Arqaam Securities (2.7%) and Naeem Brokerage (2.2%).

Egypt, Kuwait sign judicial MoU: Attorney General Nabil Sadek signed with his Kuwaiti counterpart Dherar Al-Asousi an MoU to ensure “the exchange of information between both prosecutions, the judicial delegations, and judicial assistance which comes in accordance with diplomatic channels," according to Al Rai. The Kuwaiti government recently handed over a Muslim Brotherhood cell to Egypt, which may be a factor in the timing of these agreements.

El Sisi meets Kuwait emir, prime minister: President Abdel Fattah El Sisi yesterday held talks with Kuwaiti Emir Sabah Al-Ahmad Al-Jaber Al-Sabah in Kuwait, according to an Ittihadiya statement. The two sides discussed strengthening bilateral and economic ties, as well as increasing cooperation across various fields. El Sisi also held talks with Kuwaiti Prime Minister Sheikh Jaber Al-Mubarak and Kuwaiti National Assembly Speaker Marzouq Al-Ghanim, along with other top officials, the statement notes.

Nasr meets Kuwait Fund boss: Investment and International Cooperation Minister Sahar Nasr discussed cooperation on development and joint projects with the Kuwait Fund for Arab Economic Development during a meeting with the fund’s director general, Abdul Wahab Al-Bader, according to a ministry statement. Nasr presented her ministry’s investment map to Kuwaiti investors following the talks.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

Egypt’s inverted yield curve: The financial press last month was awash with commentary on the brief inversions of the 2-year 10-year US treasury yield curve. Here in Egypt, the yield curve has been inverted since the EGP float in November 2016. But in contrast to the prophecies of doom we’ve come to expect in the US, nobody in Egypt so much as bats an eyelid at the fact that the yield on Egyptian 10-year treasuries is currently almost 140 bps below that on 2-years. We could put this down to normalization, but in the immediate aftermath of the currency float Bloomberg was describing the inversion as a “welcome signal” from the bond market that “vindicates Egypt’s decision” to devalue the EGP.

An inverted yield curve isn’t necessarily a bad thing: Shuaa Securities’ Esraa Ahmed wrote yesterday that the inverted curve “conveys a positive perception” among bond traders of the inflationary trend and the central bank’s accommodative monetary policy. It reflects market expectations for continued easing, a path that signifies the central bank’s growing confidence in the economy.

Yields are on a downward trend: Rates have fallen more than 300 bps across the board since the beginning of the year as foreign investors piled into Egyptian debt. Unexpectedly low inflation readings and the appreciating EGP have also contributed to the strong downward pressure on yields, Ahmed says.

But the curve is unlikely to flatten anytime soon: It may be a while before yields on long-term bonds normalize and rise above short-term treasuries. The curve has actually steepened since the CBE cut rates last month: In the first auctions after the 150 bps rate cut, yields on 10-year bonds fell further than rates on short-term t-bills. The government is taking action to try to hold down short-term yields by limiting its t-bill issuances and intends to shift its focus towards bonds with longer maturities.

Egypt in the News

Gov’t investment in Sinai shows “genuine intent” for development plans despite security threats: The government’s plan to invest EGP 5.23 bn this year in developing Sinai is facing “challenges” due to the security situation in the peninsula, according to Al-Monitor. Sinai locals tell the outlet that development work is already underway there, but security conditions “remain an obstacle.”

Worth Reading

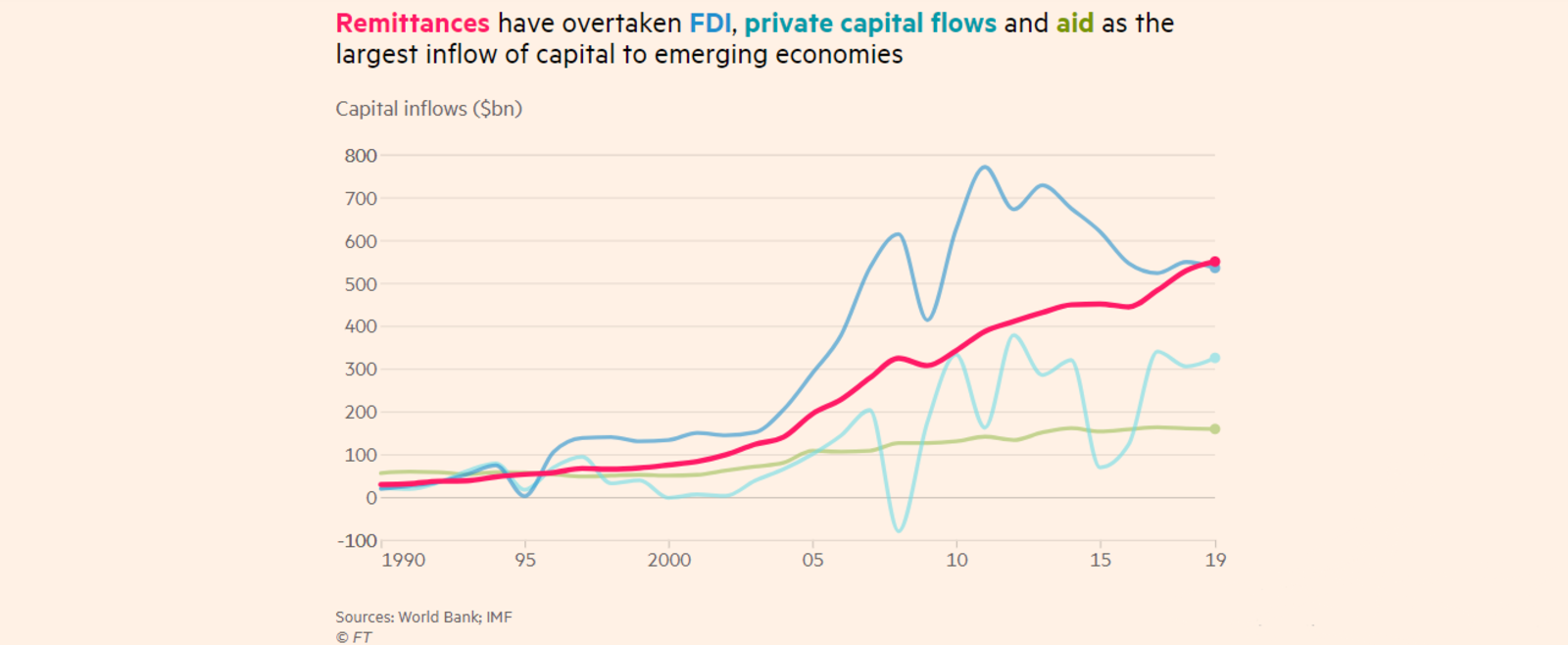

Remittances are officially set to outpace FDI, aid, and private capital flows as the biggest source of foreign capital in developing countries this year, the Financial Times says. As FDI levels from advanced economies is dipping, economists expect the reliance on remittances to remain strong, and continue serving as a “lifeline” for developing economies. “Remittances are ‘a relatively stable source of foreign currency in the current account, and that feeds directly into our sovereign ratings,’ says James McCormack of Fitch Ratings. ‘In the case of a country like the Philippines, Egypt or Nigeria, their current account positions would be much weaker in the absence of remittance flows.” In 2018, Egypt was one of the world’s top recipients of remittances, with inflows of Egyptians working abroad reaching USD 29 bn by the end of the year, according to World Bank figures. FDI in Egypt has also been in decline, with non-oil FDI in 1Q2019 falling to its lowest levels since 2014.

“No country is ever going to get rich from remittances”: The salmon-colored paper had noted last month that a number of emerging markets are trying to lure remittances into diaspora bonds for productive investment to offset low FDI, but these bonds remain “a niche part of financial markets.” Although remittances play a key role in developing economies, particularly when it comes to their balance of payments and credit ratings, they also provide a cushion for individuals’ incomes in the midst of slow economic growth. That, in turn, tends to give governments what can sometimes be too much breathing room in terms of policy reform to spur growth and raise standards of living. As long as the domestic job market fails to provide truly attractive alternatives, the push to emigrate to developed countries — and send home more remittances — will remain intact.

Worth Watching

You can now smell Ancient Egypt: The National Geographic Museum in Washington, DC is displaying the Mandzian fragrance of Queen Cleopatra, after scientists found a sticky substance in the Tel Tamai area near Cairo, and recreated it using ancient manuscripts, according to this BBC clip (watch, runtime: 02:10).

Diplomacy + Foreign Trade

Ninety-six Egyptian food and agriculture companies are hoping to sign new export contracts with European businesses during the Anuga food fair in Cologne next month, Edita Chairman Hani Berzi tells Al Shorouk. Germany imported products worth some USD 70 mn from Egypt in 2018, a 20% increase from the previous year, Berzi said.

Energy

Egypt Kuwait Holding’s NSCO begins production from second North Sinai well

Egypt Kuwait Holding’s (EKH) NSCO Investments started production from its second North Sinai natural gas well on 29 August with an output of 20 mcf/d, the company said in a press release (pdf). The new well brings the company’s total production to 75 mcf/d, a 200% increase compared to the first six months of 2019. The company is now drilling its third well, which it expects to complete during 4Q2019. EKH started production from its first North Sinai well in July.

Egyptera to begin restructuring electricity sector in December

The Egyptian Electric Utility & Consumer Protection Regulatory Agency (Egyptera) is set to begin restructuring the electricity sector in December, unnamed officials told the local press. The process will involve relocating employees within companies in the sector, encouraging more private sector investments to meet increasing demand for energy, and imposing a stricter control on procurement to avoid excess stocks of machinery and equipment.

Infrastructure

Contract for Lake Qaroun wastewater project to be awarded this month

The Holding Company for Water and Wastewater (HCWW) is currently in the process of selecting one out of four consulting companies bidding for a wastewater project at Lake Qaroun, according to the local press. The USD 300 mn project will be by the European Investment Bank, the European Bank for Reconstruction and Development, and the European Union. HCWW will announce the winner in September.

Egypt to tender 2k sqm of industrial land through online portal launching soon

The Industrial Development Authority (ITDA) will tender 2k sqm of industrial land through a new online portal to submit land allocation requests expected to be launched soon, ITDA head Magdy Ghazi said. The new portal, the so-called “land bank” will be the sole gateway handling industrial land tenders to streamline the allocation procedures, Ghazi said.

Manufacturing

Manufacturers call on gov’t, Central Bank of Egypt to change i-Score credit information system

Manufacturers and investors are calling on the government and Central Bank of Egypt (CBE) to change the i-Score credit information system, which they say make it harder for companies to obtain financing, Al Shorouk reports. Businesses in financial trouble are currently designated as “distressed” for between five and 10 years, a period which manufacturers want reduced to one year. The Federation of Egyptian Industries previously sent a letter to CBE Governor Tarek Amer requesting that he review the period for which companies are placed on the “distressed” list. The federation also recommended creating new “settlement” and “rescheduling” classifications for companies undergoing debt restructuring programs, instead of putting them all under “legal dispute.”

Real Estate + Housing

GV Investment looking to develop three land plots on Egypt’s north coast

GV Real Estate Development, a subsidiary of GV Investment Group, is mulling developing three land plots on Egypt’s north coast, said the company’s head of engineering Nahla El Ibiary. The company is currently in talks with private companies over the three plots in addition to a 70-feddan plot in Katameya.

Telecoms + ICT

NTRA releases mobile QoS report of Egypt’s four service operators

The National Telecommunications Regulatory Authority (NTRA) has released its first quality of service (QoS) report (pdf) on Egypt’s four mobile networks in two years, measuring their performance in delivering voice and data services in the country’s main cities throughout July 2019. The data — which was compiled through tens of thousands of test calls — revealed that state-owned WE falls back on voice quality, falling below Orange, according to a local press rundown of key findings. Both WE and Etisalat networks are prone to failed calls in Cairo and Giza, while Orange is prone to the same in the Canal region. Vodafone, with the exception of a high rate of dropped calls in the Delta, performed better across the board.

Banking + Finance

Egyptian market regulator grants Cairo Capital Securities short selling license

Cairo Capital Securities has joined the growing list of brokerage firms authorized by the Financial Regulatory Authority to short sell, CEO Ahmed Abu Hussein said, according to Al Mal. Shuaa Securities, Arqaam, EFG Hermes, CI Capital, the Arab African International Securities, Prime Holdings, HC Securities, and Premiere Securities have all recently acquired the license. Short selling transactions are due to hit the EGX this quarter, FRA deputy head Khaled El Nashar said in July.

BdC looks to issue EGP 20 bn in corporate financing by end of 2020

State-owned Banque du Caire (BdC) plans to issue EGP 20 bn in corporate loans by the end of 2020, an unnamed bank official told Al Shorouk. The bank will reportedly lend to businesses working in the energy, petrochemicals, real estate, food and communications sectors. The bank expects to lend EGP 3 bn between now and the end of the year, raising its corporate financing portfolio to EGP 43 bn.

Al Yosr Group to borrow EGP 1.1 bn from three banks

Al Yosr Group has signed loan agreements with Banque du Caire (BdC), Suez Canal Bank (SCB) and the Industrial Development Bank (IDB) for a combined EGP 1.1 bn, sources told Al Shorouk. Al Yosr will borrow EGP 800 mn from BdC, EGP 200 mn from SCB and EGP 100 mn from the IDB to raise capital and pay for operational expenses.

Egypt’s Nasser Social Bank taps Prime Holding as advisor for restructuring plans

Nasser Social Bank has tapped Prime Holding as an advisor for its restructuring plans, the first phase of which will be funded by a USD 555k grant from the African Development Bank, CEO Sherif Farouk told the local press.

Other Business News of Note

Ikea opens new store in Mall of Arabia

Swedish furniture and home accessories retailer Ikea opened a new store west of Cairo in the Mall of Arabia to serve customers in the area until its full-scale store opens its doors in 2020, Al Shorouk reported. Fawaz AlHokair Group’s Marakez inked a long-term lease agreement with Al Futtaim Misr for Retail to open a 20k sqm Ikea store at the mall last December.

Egypt’s exporters awaiting clarity on new export subsidies program

Egypt’s exporters are awaiting clarity on how the government is planning to implement the new export subsidies program, Ihab Abdel Zaher, member of the export council for textiles and readymade garments said. The new program promises to disburse EGP 6 bn per year in export subsidies, and was supposed to have started from the onset of the current fiscal year. The export councils are, however, saying the program has still not taken flight and they still do not know how to calculate their export-related expenses under the framework. We have a rundown here on the new framework, which the government announced in July.

The Market Yesterday

EGP / USD CBE market average: Buy 16.49 | Sell 16.62

EGP / USD at CIB: Buy 16.50 | Sell 16.60

EGP / USD at NBE: Buy 16.50 | Sell 16.60

EGX30 (Sunday): 14,932 (+0.7%)

Turnover: EGP 622 mn (2% above the 90-day average)

EGX 30 year-to-date: +14.5%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.7%. CIB, the index’s heaviest constituent, ended up 1.1%. EGX30’s top performing constituents were Egyptian Resorts up 3.4%, SODIC up 3.1%, and Egyptian Iron & Steel up 3.0%. Yesterday’s worst performing stocks were Juhayna down 1.9%, Emaar Misr down 1.6% and Elsewedy Electric down 0.9%. The market turnover was EGP 622 mn, and domestic investors were the sole net sellers.

Foreigners: Net Long | EGP +27.5 mn

Regional: Net Long | EGP +13.6 mn

Domestic: Net Short | EGP -41.1 mn

Retail: 65.1% of total trades | 61.9% of buyers | 68.3% of sellers

Institutions: 34.9% of total trades | 38.1% of buyers | 31.7% of sellers

WTI: USD 54.80 (-0.54%)

Brent: USD 58.85 (-0.68%)

Natural Gas (Nymex, futures prices) USD 2.28 MMBtu, (-0.44%, October 2019 contract)

Gold: USD 1,538.10 / troy ounce (+0.57%)

TASI: 7,912.30 (-1.34%) (YTD: +1.09%)

ADX: 5,121.17 (-0.86%) (YTD: +4.19%)

DFM: 2,758.34 (-0.01%) (YTD: +9.04%)

KSE Premier Market: 6,571.97 (+0.68%)

QE: 10,253.69 (+0.20%) (YTD: -0.44%)

MSM: 4,004.86 (+0.81%) (YTD: -7.38%)

BB: 1,533.09 (-0.09%) (YTD: +14.64%)

Calendar

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8 September (Sunday): The Supreme Administrative Court has postponed appeals filed by the State Lawsuits Authority and a number of companies to bring back the now-canceled 15% import duty on iron billets after two judges resigned from the panel, Mubasher reported.

9 September (Monday): Japan Arab Economic Forum, Nile Ritz Carlton, Cairo.

9-10 September (Monday-Tuesday): The Euromoney Egypt Conference 2019, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

9-12 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Cairo.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17 September (Tuesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): Venture Capital Event (pdf) at the Conrad Hotel, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

22 September (Sunday): The Justice Ministry’s dispute resolution committee will look into a case filed by Raya Holding’s Chairman Medhat Khalil against the Financial Regulatory Authority (FRA).

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): Vested Summit, Sahl Hasheesh, Red Sea.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.