- EFG Hermes is investing USD 60 mn in new pharma, education transactions. (Speed Round)

- We could be getting the last IMF loan tranche next week. (What We’re Tracking Today)

- B Investments’ Giza Systems awarded USD 30 mn contract for Saudi water project. (Speed Round)

- Africa is the key for Egypt to grow its cement exports and resolve the market glut, Shuaa says. (Speed Round)

- Exporters now have four new ways to claim their overdue payments from the Export Subsidy Fund. (Speed Round)

- Your ominous EM outlook of the week: Emerging markets are struggling to catch up with developed markets. (The Macro Picture)

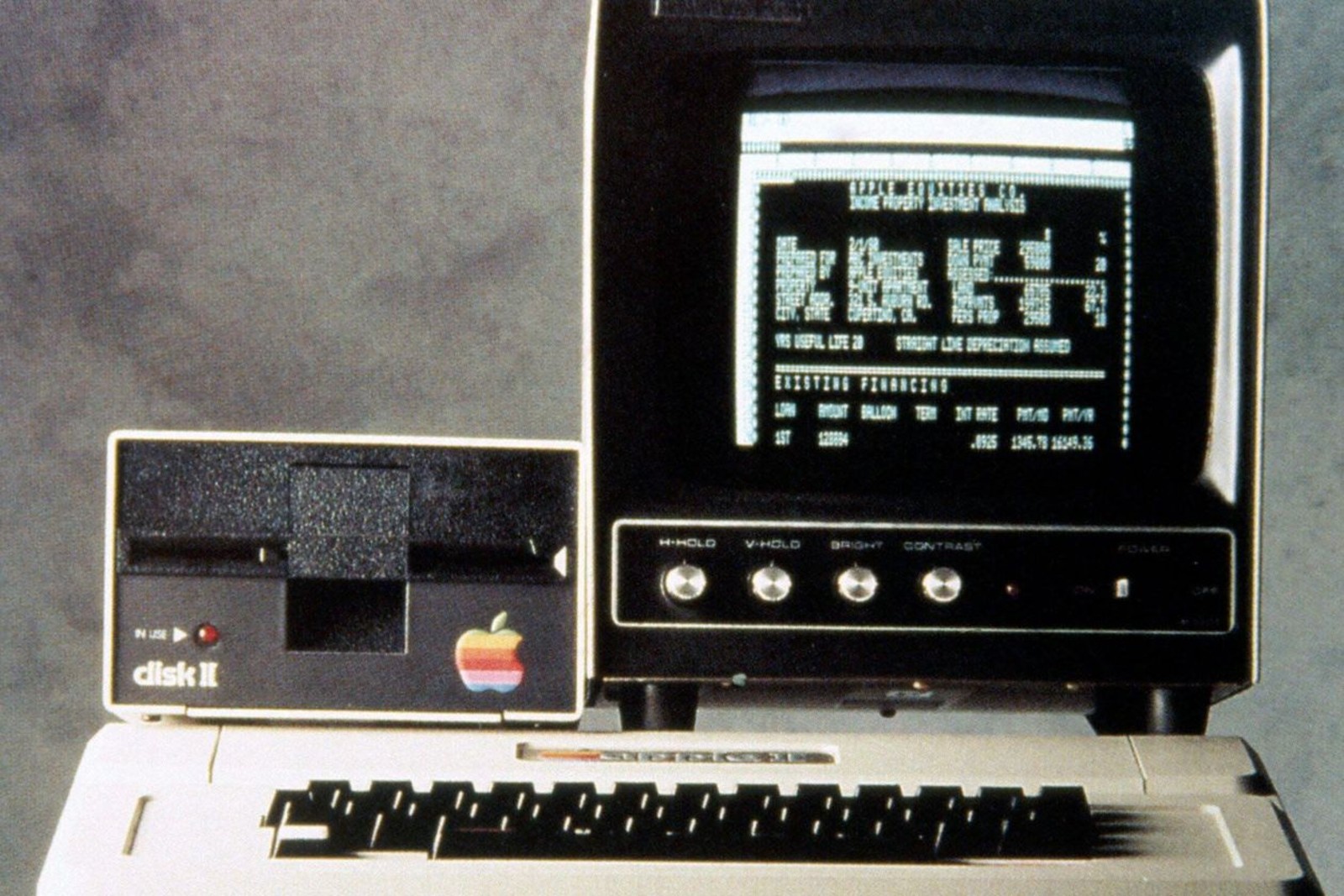

- Remember the world’s first “killer app”? We’ve come a long way. (Worth Reading)

- My Morning Routine: Janet Heckman, EBRD managing director for the SEMED region and Egypt country head

- The Market Yesterday

Thursday, 18 July 2019

Are we getting our last IMF loan tranche next week?

TL;DR

What We’re Tracking Today

Could we finally get our hands on the final IMF loan tranche next week? The IMF’s executive board will make its final decision over the fifth and final review of the USD 12 bn economic reform program on 24 July, potentially paving the way for disbursement at the tail-end of next week. The Finance Ministry has made it clear that the government is after some sort of non-financial post-loan agreement with the fund before October, although we’re not entirely sure yet what shape it will take. We’ll likely find out more in the coming weeks as the near-three-year program comes to an end.

Algeria and Senegal are going head to head tomorrow for the Afcon title. The final game will be played at 9 pm CLT at the Cairo International Stadium. Nigeria landed in third place after emerging victorious from its match against Tunisia yesterday.

As for our post-Afcon team, Hassan Shehata may just be what the doctor ordered: Golden-era coach Hassan Shehata may be tapped to return and salvage Egyptian football team, according to Ahram Online. It would be unsurprising to put an Egyptian in charge after two back-to-back disappointing runs from foreign managers.

Peace in Sudan? The Sudanese military and opposition coalition have signed a final power-sharing agreement that could bring months of anti-government protests and military crackdowns to an end. The two sides agreed to set up a council composed of five civilian representatives, five military leaders and an eleventh civilian to be selected by the other members. A military general will take the helm for the first 21 months before ceding power to a civilian who will rule for another 18 months. An election is expected to follow at the end of this period. The BBC has more.

President Abdel Fattah El Sisi congratulated Sudanese army Chief of Staff Hashem Abdel Muttalib Babakr during his visit to Egypt yesterday, according to an Ittihadiya statement. Babakr also held talks with Egyptian Armed Forces Chief of Staff Mohamed Farid to discuss military cooperation, army spokesperson said.

Across the pond, the US House voted yesterday against an attempt to impeach President Donald Trump over racist statements he tweeted out earlier this week against four congresswomen, according to the New York Times. Although the impeachment article was tabled, “the floor debate devolved into an extraordinarily spectacle as Republicans and Democrats argued about whether it was appropriate for [House Speaker Nancy] Pelosi to have branded the president’s tweets ‘racist.’” The process also brought to light schisms among Democrats over how to handle Trump’s actions, and whether they should address his conduct by moving to get him removed from office or focusing on their policy priorities.

The US may have just opened itself to further Chinese sanctions: The World Trade Organization has judged that the US did not comply with a ruling dating back to an Obama-era tariff dispute with China, giving Beijing an opening to retaliate, Reuters reports. China challenged US anti-subsidy tariffs on USD 7.3 bn of Chinese exports at the WTO in 2012. The US had argued the Beijing was using public companies to subsidize its economy but the WTO said that Washington had to accept Chinese prices. Beijing will now be able to impose counter-sanctions if the US continues to refuse the prices.

Enterprise+: Last Night’s Talk Shows

It was a rather bland night on the nation’s airwaves, with few noteworthy topics other than Egypt’s emerging role in Africa and the inauguration of new facilities at Zagazig University.

The internet and social media and the laws governing them took up the majority of Al Hayah Al Youm’s episode last night, with host Khaled Abu Bakr sitting down with a data protection expert to discuss cyber crimes and the Data Protection Act, among other topics (watch, runtime: 3:21). Abu Bakr also had an extensive conversation about the dangers of social media (watch, runtime: 25:47).

Egypt’s most valuable contribution to Africa boils down to health and education, former Egyptian diplomat and politician Mostafa El Fekki told Yahduth Fi Misr’s Sherif Amer in their weekly Wednesday pow wow (watch, runtime: 1:07). El Fekki praised President Abdel Fattah El Sisi’s recent initiative to treat Hepatitis C in African countries, and urged politicians to use soft power such as culture and music to deepen our ties with the rest of the continent (watch, runtime: 0:44).

The inauguration of three AUC-backed vocational training facilities at Zagazig University earned some airtime on DMC (watch, runtime: 2:18). Financing for the new facilities came from the U.S. Agency for International Development (USAID).

Speed Round

Speed Round is presented in association with

INVESTMENT WATCH- EFG Hermes to invest USD 60 mn in education, pharma acquisitions: EFG Hermes is set to acquire schools in Cairo and Alexandria in a USD 30 mn transaction, and will invest another USD 30 mn in a transaction in the pharma sector, Private Equity Head Karim Moussa said at a press conference yesterday, according to Youm7. Moussa did not disclose further details on the investments, but said that the school acquisitions should close within the coming weeks, and the firm will begin working on the pharma transaction as of the next quarter.

EFG has two private sector IPOs in the pipeline for the third and fourth quarter of the year, in addition to quarterbacking the planned secondary stake sales in state-owned Banque du Caire and Alexandria Container and Cargo Handling, Co-Head of Investment Banking Mostafa Gad tells Reuters’ Arabic service. According to Gad, one of the private sector companies looking to IPO is in the tech sector, and will likely debut on the EGX before the end of 3Q2019, while the second company’s IPO should go to market before the end of 4Q2019. Gad did not name either company.

EFG is also working on listing two “major” companies on the London Stock Exchange before the year is out, Gad tells the newswire, without providing further information. It is unclear whether the companies listing on the EGX are eyeing a dual listing on the LSE or if these are separate companies.

The firm is still committed to its expansion plans and has its eyes set on being ranked among the top five investment banks in the markets it operates in, EFG Hermes Group CEO Karim Awad said at the conference, according to Al Mal. EFG is planning on focusing during the coming period on increasing its market share across all 13 countries it operates in, but will not focus solely on its brokerage operations, Awad said.

Separately, EFG is planning to set up one or two non-banking financial services companies by year-end, EFG Finance CEO Walid Hassouna said at the press conference, according to Hapi Journal. Awad tells Arabic Reuters that these services will account for 40-50% of EFG’s profits within five years, compared to 25-28% currently. EFG’s mortgage finance JV with GB Capital and Talaat Moustafa is also set to launch within a month and a half, Hassouna said.

B Investments’ Giza Systems awarded USD 30 mn contract for Saudi water project: B Investments’ Giza Systems has won a c.USD 30 mn contract to supply, install and replace the water waste system in northern and north-western regions of Saudi Arabia, the company said in a press release (pdf). The project was awarded to Giza Arabia, Giza Systems’ KSA subsidiary, which will work in cooperation with the Saudi Civil Works Company. The company expects to finish the project by March 2024. “The smart solution developed will allow the [Saudi Environment] Ministry to gain a clearer vision and insights into the water consumption of the sites, thereby affecting water management for the region,” said Ashraf Attia, chief commercial officer at Giza Systems and KSA Giza Arabia manager.

INVESTMENT WATCH- NACCUD close to securing EGP 18 bn agreement for housing project with UAE investor: The New Administrative Capital Company for Urban Development (NACCUD) is close to securing an agreement with an unnamed UAE investor for an EGP 18 bn, 12k-feddan housing project, NACCUD boss Ahmed Zaki Abdeen told the local press without providing a timeline.

Promotional tours coming: NACCUD is preparing to organize promotional tours abroad, particularly in the Gulf region, as well as bilateral meetings with investors, to draw investments for the new capital, a government source said. The company is not planning to launch tenders for new land plots this year, but is currently studying a number of bids from local and Arab developers.

INVESTMENT WATCH- Farm Frites to invest EGP 300 mn to launch new potato line: Farm Frites Egypt is planning to invest EGP 300 mn in two production lines to launch a new variety of pre-fried potatoes mixed with eggs and seasoned air-dried cured beef(basterma), company head Ashraf Al Quttaim told the press. The new lines will have a capacity of 5k tonnes a month when they begin operations in mid-2020, with this figure planned to reach 10k as it receives more orders. Some 90% of the end-product will be earmarked for exporting into markets including East Asia, Japan and the US.

Africa is the key for Egypt cement export growth -Shuaa: Egyptian cement companies should look to Africa to expand their exports and clear excess production, Mai Abdelaziz, equity analyst at Shuaa Securities, wrote in a note. Sub-Saharan countries are projected to need an additional 10-15 mn metric tonnes per year amid increasing housing and infrastructure development, creating a solid potential export market.

Egypt should take advantage of Comesa: Just 0.3% of Egypt’s total exports went to members of the no-customs eastern and southern Africa common market (Comesa) in 2015 and 2016, 4% of which came from the cement industry. Shuaa believes that Egyptian companies can bump up this figure if export incentives and logistical measures are introduced.

Exporting to MENA may prove challenging: Egypt does not currently have a comparative advantage in the MENA space over countries like Turkey, Iran, and Saudi Arabia. Reconstruction efforts in Syria and Iraq will be extremely lucrative, but Egyptian companies would struggle to compete against other exporters who enjoy comparatively lower domestic input costs.

Incentives and cost reduction are essential: “Reduction in transportation costs, tax reduction/exemptions on imported coal, and reduction of clay costs could all help Egyptian cement producers find that comparative advantage for their exports,” Abdelaziz wrote.

Exporters now have four new ways through which to claim their overdue payments from the Export Subsidy Fund, according to a letter from the Trade Ministry seen by the press. Under the new framework, exporters could receive discounts on their obligations to the electricity, oil, and investment ministries and claim redeemable IOUs from the Finance Ministry. They will also be given the option of receiving bank loans with interest paid for by the ministry, or acquiring land designated for agriculture or administrative use and/or industrial or commercial development. These payout options are new alternatives offered alongside tax breaks, which the exporters are waiting to receive more clarity as part of a new framework that could see the government make good on overdue export subsidy payments.

Background: Making good on the overdue payments will come as part of a larger export subsidies framework that will see the government set aside EGP 6 bn annually in its budget. We were expecting more details as the fund’s board of directors met at the start of this week. Egyptian exporters claim they are owed up to EGP 12 bn since last year under a promise from the fund to pay out cash-based export subsidies. After repeated attempts by the exports council to reclaim the arrears, the fund’s board agreed to a new strategy which feature tax breaks as a way to reimburse the exporters. The finance and trade ministries then held meetings to discuss netting overdue subsidies off against the exporters due taxes.

SODIC gets top-up on CIB loan: Real estate developer SODIC has signed an agreement with CIB to raise the limit of a medium-term facility to EGP 500 mn to speed up construction of its October Plaza and complete it ahead of schedule, the company said in a statement (pdf). “It is a pleasure to work with CIB again, one of the largest commercial banks in Egypt,” CFO Omar Elhamawy said. “Increasing the facility comes as a testament to SODIC’s credibility and strength of its financial position,” he added. SODIC had signed the agreement with CIB for a EGP 270 mn medium-term facility in September 2017 to fund the west Cairo project, whose first phase was launched earlier that year.

Madbouly presents final FY2018-2019 figures: Egypt’s economy grew 5.7% in the final quarter of the fiscal year 2018-2019, Prime Minister Madbouly said at a presser yesterday, according to a cabinet statement. The budget deficit recorded 8.2% of GDP, or EGP 431 bn, falling below the government’s target of 8.4% for the fiscal year. The debt-to-GDP ratio recorded 90%, from a targeted 93%. We noted earlier this month the government met its 8.4% budget deficit and 2% primary budget surplus targets in FY2018-2019. Overall, the economy grew at a 5.6% clip, “placing Egypt on the list of the world’s fastest growing economies,” Madbouly pointed out yesterday.

Foreign holdings in Egyptian treasuries stood at USD 19.2 bn mid-June, Vice Finance Minister Ahmed Kouchouk said at the presser, according to Reuters’ Arabic Service. Foreign appetite for Egyptian securities has been recovering since the start of the year after a turbulent 2018. CBE data (pdf) shows that foreign holdings dropped by almost half to USD 11.5 bn in December, down from USD 21.2 bn in January.

CABINET WATCH- Cabinet approves draft legislation on dispute resolution: The Madbouly government agreed in its weekly meeting yesterday to a draft legislation to regulate procedures relating to special judicial mediation for out-of-court trade and civil dispute settlements, it said in a statement. The legislation applies to all disputes except for:

- Disputes where ministers or public figures are involved, in which case a conciliation committee will be formed to resolve the issue;

- Collective labor disputes;

- Economic or family court cases;

- Disputes resulting from the Investment Act;

- Cases under the judicial authority of the Council of State.

Cabinet has been focused on alternative ways to resolve disputes in recent months: In its meeting last week, it signed off on the settlement agreement between property developers Emaar Misr and state-owned El Nasr Housing, and the dispute between Al Kholoud for Touristic and Real Estate Development and the Egyptian government over El Nasr for Steam Boilers.

The cabinet also approved:

- A draft presidential decree to establish a university under the name “International Knowledge Universities” in the new administrative capital in collaboration with top international universities as part of Egypt’s 2030 vision to improve the quality of education. A local branch of the UK’s Coventry University will also be established in Egypt as an independent entity;

- For the Egyptian Railway Authority (ERA) to negotiate and sign contracts with the Egyptian Company for Pipe and Cement Products (Siegwart) to supply 150k concrete planks;

- A draft presidential decree on amendments to the Kyoto Protocol on climate change which extend the timeframe to 2020.

EARNINGS WATCH- Cairo for Real Estate and Investment (CIRA) reported a 51% y-o-y increase in net profit to EGP 249.8 mn in the first nine months of its fiscal year, which ended 31 May 2019, according to the company’s earnings release (pdf). Revenues rose 32% y-o-y during the period, coming in at EGP 642.4 mn. The strong revenue growth was “a direct result of our continuous efforts to differentiate our institutions in the market and cement CIRA’s brand presence,” the company said. Student enrollment in both CIRA’s K-12 and Upper Education segments has been “growing faster than our added capacity,” the company added, and this in turn has been driving growth at multiple levels. The construction of six new faculties at Badr University is ahead of schedule, with the faculties due to launch in the 2020 academic year, and the qualification process for 81 feddans of land to build a flagship university in Assiut has been concluded. In June 2019, CIRA acquired a majority stake in the British Columbia Canadian International School (BCCIS) — which, it notes, is one of the top ranked schools in the country — through the acquisition of a 60% stake in its parent company, Star Light Educational DMCC Corporation.

Looking ahead: CIRA “will continue to introduce high-demand and underserved specialties across our tertiary segment,” CEO Mohamed El Kalla said. The strong relationship between CIRA and the “top-notch” management team of the BCCIS will allow them to combine their expertise and form a new management team focused on enhancing the profitability of all the schools under CIRA’s belt, he added. Growth remains the company’s core focus, as “the addition of new schools and faculties are positioned to capture Egypt’s burgeoning middle-class segment’s pent-up demand for world class education at more affordable prices.”

CLARIFICATION- Egyptian fintech startup Paynas has been holding talks over potential financing to fund expansion plans with venture capital funds. Our coverage of the story yesterday suggested that Paynas was seeking loans. Similarly, our coverage of Shahid Law Firm’s Venture’s agreement with Gemini Enterprises Africa to provide entrepreneurs with business mentoring did not clarify that Gemini, not Venture, will be providing the mentoring services. Both stories have been amended on our website edition for clarity.

The Macro Picture

Ominous EM outlook of the week: Deglobalization, the Chinese slowdown, and a decade of financial stimulus in advanced economies are holding back emerging markets from catching up with the developed world, Jonathan Wheatley writes in the Financial Times. Emerging markets seemed destined for alignment with the West earlier this century, as increasing trade, growing global interdependence of supply chains, and the commodities boom of the 2000s fueled unprecedented economic growth and lifted mns out of poverty. But in the years since the 2008 financial crisis, emerging markets have set upon an altogether different path, and while demographic and technological trends bode well for the long term, there are significant uncertainties about what the short and medium-term future may hold.

The growth of protectionism has led to many proclaiming that the end of globalization is near, and while these apocalyptic predictions may prove to be unfounded, emerging markets are not best placed to cope with new trade barriers and geopolitical battle lines. A continuation of this trend may mean the emerging markets will need to find new ways to fuel growth at a time when investment is falling and productivity figures are slipping.

Growth in China, responsible for carrying so many emerging markets into the 21st century, isn’t what it was. GDP has slowed since 2008, its dependence on imports has increased, and non-financial sector debt has soared. “China is one of the big risks,” David Spegel, founder of Fundamental Intelligence, tells the FT. “As the economy matures, the ability of the authorities to have an impact is not what is was.”

We saw last year what a strengthening USD can do to emerging markets, and there’s a chance it could appreciate again later this year. Although the US Federal Reserve is likely to cut rates later this month, investors may well rush into the USD amid signs of a global slowdown. Any strengthening of the USD will only increase borrowing costs for emerging markets, tightening financial conditions.

Image of the Day

iSheep and Excel geeks would hardly recognize the world’s “first killer app,” unveiled 40 years ago. VisiCalc, the prototype of today’s spreadsheets, ran only on the Apple II, taking up 32KB of RAM — a huge amount at the time. The software cost USD 100 and the computer at least USD 2k. The brainchild of Dan Bricklin, VisiCalc generated an explosion of revenue for its publisher, from virtually nothing in 1979 to USD 40 mn in 1983. But it also demonstrated that enduring success is not ensured by a brilliant and successful app, and the story of VisiCalc remains a cautionary tale against complacency for the world’s largest tech companies. The WSJ has more.

Egypt in the News

The foreign press is blessing Egypt with another slow news morning. Enjoy it while it lasts, folks.

On The Front Pages

President Abdel Fattah El Sisi congratulating of Sudanese army Chief-of-Staff Hashem Abdel Muttalib Babakr for his country signing a final power-sharing agreement during a meeting topped the front page of state-owned daily Al Akhbar this morning. The main two other state-owned papers, Al Gomhuria and Al Ahram, are still down.

Worth Watching

We need to get companies investing in antibiotics: The growing phenomenon of antibiotic resistance is rendering the most common antibiotics useless and very few new ones are being developed, suggesting we may be headed into a “medical dark age,” the Financial Times says (watch, runtime: 4:35). World Health Organization numbers indicate the phenomenon is already killing at least 700k people a year and is on track to kill 10 mn a year by 2050, unless policymakers step in and introduce incentives for pharma companies to go to market. Because the reward to develop new antibiotics isn’t there for those who “live in the profit world,” none have been put out in the past 30 years, suggesting market incentives are necessary to resolve the issue.

Diplomacy + Foreign Trade

Egypt is one of six nations to have called for an immediate end to hostilities in Libya in a joint statement released on Tuesday. Along with Britain, France, the UAE, the US, and Italy, Egypt expressed its “deep concern” at the violence that has caused an increasing humanitarian emergency, and warned that terrorist groups could exploit the security vacuum. The countries “call for an immediate de-escalation and halt to the current fighting, and urge the prompt return to the UN-mediated political process," the statement said.

Energy

Egypt Kuwait Holding’s NSCO begins gas production from North Sinai well

Egypt Kuwait Holding’s (EKH) NSCO Investments Limited started production from its first North Sinai natural gas well on 13 July with a capacity of 25 mcf/d, the company said in a bourse filing (pdf). EKH completed the drilling of its first North Sinai gas well at a cost of USD 15 mn, and expects revenues to exceed EGP 500 mn within two years. The company has also completed drilling its second well, which will begin production in 3Q2019. EKH had said it could invest USD 110 mn in 2018 in developing five natural gas wells in North Sinai, including one in Camus gas field and another in the Tao field.

NREA, EETC discuss establishing 200 MW solar projects in Zaafarana

Discussions are underway between the New and Renewable Energy Authority (NREA) and the Egyptian Electricity Transmission Company (EETC) to set up 200 MW of solar projects in Zaafarana, the local press reports. The NREA will reallocate restored land plots, while the EETC will handle the process of selecting companies and purchasing energy. The EETC is reportedly working to complete two other auctions in the West Nile area to set up solar and wind stations with a combined capacity of 450 MW.

Basic Materials + Commodities

Egypt buys 3.3 mn tonnes of local wheat this harvest season

The local wheat supply season ended on 15 July, with the government having bought 3.3 mn tonnes from farmers for a total of EGP 2.24 bn, up from 3 mn tonnes the previous year, according to a Supply Ministry statement. The purchase came at an average price of EGP 670 per ardib. Minister Ali El Moselhy had previously said his ministry plans to procure 3.6 mn tonnes of wheat from local farmers this season. The government rejected a total of 50k tonnes of wheat this season due to poor quality.

Gov’t to purchase 75-80k tonnes from sugar producers to clear market oversupply

The Supply Ministry could purchase between 75-80k tonnes of sugar from sugar beet producers to help them clear off stacked inventories, ministry sources told the press. The ministry is currently in talks with state-owned Dakahlia Sugar & Refining, El Nubaria for Sugar Refining, and Delta Sugar Company to purchase the sugar at EGP 7,000, a discount from the market price of EGP 7,250 per tonne.

Egyptian onions could see falling price crisis in Saudi as exporters use middlemen

Egyptian onions are being dumped in the Saudi market as a result of exporters relying on middlemen to bring onions to the kingdom, causing prices to fall, exporters say. Exporters working with brokers are offering higher quantities at lower prices. This could lead to “a new crisis” for onion exports into the Kingdom, which has just lifted a ban imposed on the crop last April.

Real Estate + Housing

Mariout Hills to complete north coast Eco City project by 2023

Mariout Hills has confirmed plans to finish its USD 168 mn sustainable Eco City project on the north coast by 2023, Reuters reports. The project will be developed in two phases, with the hotel set to use solar energy and air condensation for its power and water requirements. Phase 1 is scheduled for completion in 2022, and will include a four-star hotel spanning 115 acres, a 2 MW solar power plant, and a 5k-liter per day water production plant. Phase 2 will include 288 homes and a commercial area. Discussions are reportedly ongoing with a Swiss hospitality firm to manage the hotel.

Automotive + Transportation

Kamel El Wazir, Sahar Nasr talk transport investments with EBRD’s Heckman

Transport Minister Kamel El Wazir and Investment Minister Sahar Nasr met yesterday with the European Bank for Reconstruction and Development’s managing director for the southern and eastern Mediterranean, Janet Heckman, to follow up on railway projects the bank is financing, according to a Transport Ministry statement.

Egypt Politics + Economics

Court to hear appeals for and against decision to impose 15% import duty on iron billets on 4 Aug

The Supreme Administrative Court will hear on 4 August a total of eight appeals filed by the State Lawsuits Authority and a number of companies to bring back the now-canceled 15% import duty on iron billets, the local press reported. An administrative court earlier this week turned down the Trade Ministry’s appeal to reinstate the 15% duty on iron billets, which it lodged after twenty-one iron factories won a case at the court reversing the ministry’s decision.

My Morning Routine

Janet Heckman, managing director for the southern and eastern Mediterranean (SEMED) region, country head of Egypt, EBRD: My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Janet Heckman (LinkedIn), managing director for the southern and eastern Mediterranean (SEMED) region and country head of Egypt at the European Bank for Reconstruction and Development (EBRD).

My name is Janet Heckman and I’m a 32-year Citibank veteran corporate and investment banker, who was then transformed into a development banker through the EBRD, and I love it. With my husband Dermot, I have lived and worked in 10 countries, but I am originally an Ohioan. My daughters (Amelia, 28, and Sorcha, 25) always say that the most difficult question for them to answer is where they are from, and I have to say that ‘who are you?’ is a bit the same for me.

I think that I have the best job ever. In the SEMED region, we invest in Morocco, Tunisia, Jordan, Egypt, Lebanon and the Palestinian Territories. It’s a great opportunity to really make a difference, and a job that combines the best of policy dialogue and banking.

I’m convinced that there are two types of people: early birds and night owls. I’ve always been an early riser and haven’t used an alarm in years. I’m up around 5am and start my day by reading for an hour, before heading off to swim some laps. It’s a great way to start the morning, because if I leave the exercise until the end of the day, it will never happen. Breakfast is always plain yogurt, along with whichever fruit is in season — right now it’s my favorite, mangos. Lately I’ve been trying to cut down on my screen time and resist looking at my phone until after breakfast, as otherwise I lose this valuable part of the day.

At heart I’m a banker, and I always try to spend as much of my day as possible out with clients or in meetings with government counterparties, whether I’m home in Cairo or in one of the other countries I visit frequently. My favorite visits are to sites and factories, as they really bring home the impact of the work that we do. Last week I was with colleagues in Alexandria and we visited one of the companies up for IPO — Alexandria Containers — and it was quite exciting to be there and literally see Egypt’s trade taking place.

I’m terribly disorganized, and have to make sure everything goes straight into my calendar so that I can factor it into my plans and schedule. I’m also a list maker.

Among the best things I’ve read recently are two books of historical fiction set in the Middle East. I reread Ahdaf Soueif’s The Map of Love, which is an amazing story encompassing the turbulent early 20th century in Egypt, and I also read Isabella Hammad’s new book, The Parisian, set in Palestine in the 1930s/40s.

I’m an avid reader of history, biography and good fiction, and I have a weakness for Scottish and Irish detective novels. I also collect signed first edition books and maps. I really enjoy being outdoors, swimming in the summer and skiing in the winter. Having been lucky enough to live in Egypt over the last three years, my family and I have spent as much time as possible exploring this amazing country. My favorite places so far are Siwa and the temples around Lake Nasser, but still on my to-do list are the whale fossils in Fayoum, the black and white desert, and Dahab.

For anyone going to London soon, I highly recommend going to see the Canadian play Come From Away, which tells the story of the 7k people who were forced to land in Gander, Newfoundland, when the US closed its airspace in the wake of 9/11. It’s a real take on humanity at its best.

Interestingly, both Egypt and Morocco were founding shareholders of the EBRD, which was initially set up in 1991 to help bring market economies to the former Eastern Bloc. With the regional turmoil of 2011/2012, our shareholders (now numbering 68 countries and two international organizations) asked us to start working in the SEMED region, due to our private sector focus. So we set up operations in Egypt, Morocco, Jordan and Tunisia. Last year we began operations in the West Bank and Gaza, and in Lebanon. It’s been a remarkably quick ramp-up, and as of today, we’ve invested more than USD 10 bn in the region, in 224 projects. In Egypt we’ve invested close to a total of USD 6 bn, and that includes USD 3 bn in the last two years alone. We work in all sectors of the economy, and provide SMEs with advisory support through our Advice for Small Businesses and our Women in Business programs.

EBRD is totally focused on the private sector, and our niche is that we successfully combine this with policy dialogue with the public sector to help open up opportunities for private sector investment. One excellent example of this is the landmark Benban solar park, where EBRD accounts for nearly 50% of the total investment. This was preceded by two years of policy engagement to get the right conditions in place to attract foreign investors. Another great example is the 6 October dry port, which is a PPP project for which bids will be opened next week. We work in all sectors of the economy. We have a strong team that consists of almost 70 people on the ground in Cairo and Alexandria, and we’ll be opening our third office in Ismailia later in the year. You can’t do development banking out of a suitcase.

Our large public sector transactions, such as the Cairo Metro or the Egyptian Rail, receive a lot of attention, and this means that many don’t realize that our key focus is actually on the private sector. In the long run, the private sector can always be effective in a way that the public sector can’t be. In the short term it may look as though public sector solutions are quicker, but they will rarely be sustainable.

Technological innovation is the key force that will create change in the industry. If you take Uber as an example, here’s a company that has created over 100k jobs in Egypt, in an industry that didn’t exist 10 years ago.

The best piece of business advice I’ve ever been given was from my father, who used to say that you attract more flies with molasses than with vinegar. Everyone can find problems or issues to complain about. It’s so much better to work with people who have a positive approach to life.

The Market Yesterday

EGP / USD CBE market average: Buy 16.55 | Sell 16.67

EGP / USD at CIB: Buy 16.55 | Sell 16.65

EGP / USD at NBE: Buy 16.56 | Sell 16.66

EGX30 (Wednesday): 13,642 (-0.6%)

Turnover: EGP 426 mn (34% below the 90-day average)

EGX 30 year-to-date: +4.6%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.6%. CIB, the index heaviest constituent ended down 0.6%. EGX30’s top performing constituents were CIRA up 3.5%, Telecom Egypt up 1.0%, and Egypt Kuwait Holding up 0.3%. Yesterday’s worst performing stocks were Palm Hills down 4.0%, GB Auto down 3.4% and Heliopolis Housing down 2.9%. The market turnover was EGP 426 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +36.2 mn

Regional: Net Short | EGP -59.5 mn

Domestic: Net Long | EGP +23.4 mn

Retail: 45.9% of total trades | 51.3% of buyers | 40.6% of sellers

Institutions: 54.1% of total trades | 48.7% of buyers | 59.4% of sellers

WTI: USD 56.51 (-0.48%)

Brent: USD 63.48 (-0.28%)

Natural Gas (Nymex, futures prices) USD 2.31 MMBtu, (+0.43%, Aug 2019 contract)

Gold: USD 1,426.20 / troy ounce (+0.20%)

TASI: 9,075.55 (+0.03%) (YTD: +15.96%)

ADX: 5,080.74 (+0.07%) (YTD: +3.37%)

DFM: 2,716.09 (-0.23%) (YTD: +7.37%)

KSE Premier Market: 6,768.80 (+0.19%)

QE: 10,613.53 (+0.12%) (YTD: +3.05%)

MSM: 3,748.03 (-0.25%) (YTD: -13.32%)

BB: 1,538.71 (+0.21%) (YTD: +15.06%)

Calendar

July: The National Railway Authority will launch a tender for the purchase of 100 new locomotives expected to be financed through an agreement with the European Bank for Reconstruction and Development (EBRD).

14-18 July (Sunday-Thursday): The government is expected to announce the details of the new export subsidies framework.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

21 July (Sunday): Amer Group and Antaradous Touristic Development will face off in court over a 2014 dispute brought by the Syria-based company for a fallout in their partnership to develop the Porto Tartous tourist resort. The date was postponed from 23 June.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

25 July (Thursday): US Secretary of Energy visiting Cairo.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

29 July (Monday): An administrative court will look into charges brought by the Financial Regulatory Authority (FRA) against Raya Holding founder Medhat Khalil in connection to a mandatory tender offer forced on him by the FRA.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

3 August (Saturday): A Cairo Criminal Court postponed “stock market manipulation” trial of Gamal and Alaa Mubarak, along with seven others.

3-4 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

4 August (Sunday): The High Administrative Court will hear appeals filed by the State Lawsuits Authority and a number of iron and steel companies to bring back the Trade Ministry decision to impose 15% import duty on iron billets.

7-11 August (Wednesday-Sunday): Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

25-27 August (Sunday-Tuesday): G7 Summit, Biarritz, France.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.