- Shell wins big in oil and gas bid rounds, ExxonMobil to launch inaugural exploration in Egypt. (Speed Round)

- Egypt has the makings of a booming fintech industry, says IMF. (Speed Round)

- Moody’s cites Egypt’s growth, reforms as credit-positive factors. (Speed Round)

- Expat remittances up 3% to USD 25.5 bn in 2018. (Speed Round)

- Tourism revenues could wipe out current account deficit- Capital Economics. (Speed Round)

- Risky business: Welcome to the world of catastrophe bonds. (The Macro Picture)

- Naguib could love Venezuela and North Korea, but wouldn’t touch Saudi Arabia. (What We’re Tracking Today)

- Uber raises fares to offset anticipated implementation of VAT. (Automotive + Transportation)

- Yeah, but is it still ‘nucular’ in Russian? (Image of the Day)

- The Market Yesterday

Wednesday, 13 February 2019

IMF sees potential for booming fintech industry in Egypt

TL;DR

What We’re Tracking Today

*** We are delighted this morning to welcome Nescafé and Nestlé, the world’s largest food and beverage company, to Enterprise. Nestlé is joining us for a multi-month campaign, sponsoring What We’re Tracking Today, our daily look at the news and trends that are driving the business agenda in Egypt, in emerging markets and in global financial capitals that are relevant to our readers. And each Thursday, Nestlé will present a health and nutrition tip in On Your Way Out for your consideration. The generous support of Nestlé and Nescafé and of our pillar sponsors Pharos Holding, CIB and SODIC are what allow us to continue bringing you Enterprise every morning without charge. We are honored to enjoy their support.

It’s shaping up to be a quiet day in a week that has been all oil and gas, all the time thanks to the Egypt Petroleum Show, which concludes today.

The big non-petroleum news today will still be a yawner as the House of Representatives votes in plenary session on a report on the proposed amendments to the constitution. The vote, which was originally scheduled for next week, is a prerequisite for the proposed amendments to be referred to the legislative committee, which will then have 60 days to review them. The report was prepared by its House’s general committee, which includes the speaker of the House and the chairpersons of its committees.

The world is Aramco’s playground, apparently: Saudi Aramco plans to launch an international hydrocarbon exploration and production company that will see it expand overseas for the first time, Saudi Energy Minister Khaled Al Falih told the FT. “We are no longer going to be inward-looking,” the minister said. “Going forward the world is going to be Saudi Aramco’s playground.”

Khalifa Haftar’s Libyan National Army has seized control of Libya’s largest oilfield, reports Bloomberg. Armed protesters had shut down the 300k-bpd field back in December. An LNA spokesman announced following the operation that the Egypt- and UAE-backed forces intend to hand control of the field back to the National Oil Corporation.

Is the (kinda modest) rally in emerging markets going to be fuelled by electric vehicles? Here’s how that could work: Copper prices could rise to USD 6,700 per tonne in 2019 from a current USD 6,139 as China ramps up its production of electric vehicles (EV), Citigroup analysts have predicted, according to the Financial Times (paywall). Chinese demand for the commodity is set to grow by 2% this year, more than offsetting the loss of demand from the country’s declining production of gasoline-powered cars, the analysts said. What’s the link to EM? As we noted in October, the price of copper has lately correlated closely with EM performance thanks to Chinese demand. Prices have already risen 5% this year, roughly correlating with the emerging market rally that began at the start of 2019.

Bn’aire Naguib Sawiris has spoken glowingly of opportunities in two non-traditional investment locations: Venezuela and North Korea. Egypt’s most outspoken business celebrity told Bloomberg that he is open to investing in Venezuela — on the condition, that is, that President Nicolás Maduro leave office. In a separate conversation with Reuters, Naguib said he is hopeful that talks between The Donald and North Korean leader Kim Jong Un will open up opportunities for investment in the world’s most isolated country, where Naguib founded the country’s mobile telecom operator, Koryolink.

Naguib singled out Saudi Arabia as one place we would not invest, telling CNBC, “Why would I go somewhere where I am not convinced there is a rule of law and order. And that there is real democracy, and that people are free.” He also urged the oil-rich kingdom to “come straight on human rights.” Sawiris was speaking in the run-up to a 27-28 February summit between US President Donald Trump and North Korean leader Kim Jong Un. Tap here for the full transcript of Naguib’s interview with CNBC.

Warning signs of an “earnings recession” in the US: Analysts have cut their 1Q2019 earnings forecasts for US companies, expecting S&P 500 companies’ profits to drop 1.7% y-o-y, the New York Times reports, citing data from John Butters, senior earnings analyst at FactSet. Earlier forecasts had expected earnings to grow 3.3% during the quarter — and that was a downward revision from October. Earnings in the US are now under pressure and the absence of new tax cuts to cushion the blow makes it more difficult.

On the flipside, EM are seeing a turnaround in sentiment from global investors. A Bank of America Merrill Lynch survey of 200 institutional investors found that February’s most popular trade is long EM, the Financial Times reports. Contrary to last year’s performance, MSCI’s EM stock index surged 7.7% this year, narrowly outperforming its DM counterpart, while bond spreads also narrowed as prices have risen. Investors are still not going full speed though on fears from the US-China trade spat and high borrowing by corporates.

PSA- You can expect decent weather today (mainly sunny with a high of 22°C), according to our favorite weather app, but it agrees with the national weather service that we’re looking at a sandstorm tomorrow — and, possibly, off-and-on showers on Friday.

Enterprise+: Last Night’s Talk Shows

The final outcomes of the African Union summit and the influx of updates from the Egypt Petroleum Show were competing for the talking heads attention last night. We have all the details on the latter in Speed Round, below.

President Abdel Fattah El Sisi set a “roadmap” for Egypt’s plans during its one-year chairmanship of the African Union, which touches on dispute resolution and development plans for the continent, deputy head of the Egyptian Committee for African Affairs Salah Halima said on Al Hayah Al Youm (watch, runtime: 06:44). The AU summit also saw discussions on solutions for climate change and advocating for a permanent seat in the UN Security Council for an African country, former Assistant Foreign Minister for African Affairs Ahmed Hajjaj said (watch, runtime: 07:41).

While we’re on the subject of Africa, the Cabinet Information and Decision Support Center reminded everyone that Egypt was Africa’s top FDI destination last year in a report that both Al Hayah Al Youm and Masaa DMC took note of (watch, runtime: 02:42 and runtime: 05:04).

Oil Ministry spokesman Hamdy Abdel Aziz gave the full rundown of the winners in oil and gas exploration tenders, which was announced at the Egypt Petroleum Show yesterday. He noted that mostly foreign companies were awarded exploration rights in several Mediterranean and Western Desert concessions (watch, runtime: 04:49).

Speed Round

The deluge of oil and gas news continues thanks to the second day of the Egypt Petroleum Show. Key takeaways from the second day of the gathering are below, and you can check our wrap-up of day one here.

Shell wins big in oil and gas bid rounds, ExxonMobil to launch inaugural exploration in Egypt: Egypt yesterday announced the winners of the two oil and gas exploration bid rounds launched by the EGPC and EGAS last year, the Oil Ministry said in a statement. Shell emerged as the big winner, being handed three concessions in which to drill for oil and two in which to explore for gas, and ExxonMobil will for the first time conduct exploration activities in Egypt. Shell, Eni, Merlon, Neptune Energy and EGPC were given seven oil exploration concessions between them, while Shell, Exxon, Petronas, BP, DEA and Eni were awarded five gas concessions. The EGPC-managed oil tender covered areas in the Western Desert, Eastern Desert, the Nile Valley and the Gulf of Suez, while EGAS’ comprised of concessions in the Mediterranean and the Nile Delta.

Dana Gas to invest USD 5 bn in potential mega gas field: UAE-based Dana Gas plans to begin drilling in its North Arish field in the Mediterranean, which seismic scans indicated has about 20 tcf of potential reserves, which would make it the second biggest after Zohr, CEO Patrick Allman-Ward told Reuters. Drilling will begin in April or May in the first prospect, which data shows has 4 to 6 tcf and the company plans to invest as much as USD 5 bn to develop the field.

Eni sang Egypt’s praises as a regional success story: Egypt is a success story when it comes to natural gas, boasting a domestic market that is one of the largest in Africa and combining it with strong growth, Eni’s head of legal and regulatory affairs Massimo Mantovani told Pipeline Oil and Gas Magazine. Mantovani also stressed the need for effective regulation and increasing power generation efficiency to continue capitalizing on the strides Egypt has made in LNG discoveries, production, and export developments.

Eni again called for the mothballed Damietta LNG export plant to be brought back online ASAP, with Mantovani saying Egypt’s liquefaction facilities are critical pieces of infrastructure for exporting gas. The Damietta plant should be re-opened if the country is going to maximize its opportunities as a gas hub, he said. As we noted yesterday, Egypt is in talks with Eni and its Spanish partners to have a JV drop a USD 2 bn arbitration claim related to the Damietta plant, which went offline after a supply disruption.

Egypt’s SUMED, Saudi Aramco sign oil storage agreements: The EGPC majority-owned Arab Petroleum Pipelines Company (SUMED) has inked two agreements with Saudi Aramco to provide refined oil storage facilities with a combined capacity of 387k cubic meters (cbm), according to an Oil Ministry statement (pdf). Under the terms of the agreements Aramco will make SUMED’s Sidi Kerir and Ain Sokhna storage terminals hubs for storing its refined crude products. Sidi Kerir will see 222k cbm of added diesel fuel capacity, and Ain Sokhna 165k cbm of added mazut capacity. All stored diesel fuel will be EU-certified and bound for re-exporting into Europe. The stored mazut, meanwhile, will be either re-exported, used as fuel for Saudi plants, sold in Egypt, or sold to ships in the region. Work on the mazut facilities is slated for completion in April.

Background: Oil giant Aramco revealed back in 2017 plans to use excess capacity at Egyptian refineries to refine Saudi crude and to use Egypt as a marketing hub. The company began supplying refineries here with 500k bbl of crude per month since January 2018. That said, it’s not yet clear if the new facilities will be used to store Aramco crude refined in Egypt or already-refined crude from Saudi. Oil Minister Tarek El Molla said in January that this will be the first time Egypt stores crude belonging to non-government companies.

Misr Petroleum, Petronas move ahead to bring Amreya refinery to full capacity: State-owned Misr Petroleum Company (MPC) signed an MoU with Malaysia’s Petronas to set up a JV that will bring MPC’s refinery plant in Amreya to full capacity, according to a separate ministry statement (pdf). The government announced the project last July. The ministry and Apache Egypt, Schlumberger, the Egyptian Drilling Company, Enppi, and SAB&T International Financial Consulting also signed training and operational efficiency MoUs.

Shell to boost LNG exports from Egypt: Shell plans to increase its LNG exports from the Idku liquefaction facility this year as output from its West Delta field increases, Shell Egypt chairman Gasser Hanter said on the sidelines of the conference, according to Reuters. The Dutch oil giant shipped 12 LNG cargoes last year from the 1.2 bcf/d plant and is “hoping for more” in 2019, he said.

Egypt has the makings of a booming fintech industry, says IMF: Egypt has tremendous potential to expand in fintech due to its large economy, mature banking industry, young population, and wealth of human capital, IMF Middle East and Central Asia Director Jihad Azour said during a seminar at the American University in Cairo yesterday. He also suggested the industry has a long way to go in banking small businesses, noting that only 50% of SMEs are participants in the formal banking sector, despite startups and SMEs accounting for 75% of Egypt’s labor force (higher than the MENA average of 50%). Supporting the companies will be key to promoting financial inclusion in the region, and this can be done through fintech and non-banking financial services, he said. Azour’s statements come amid efforts by his organization to convince SMEs to join the formal economy in Arab states.

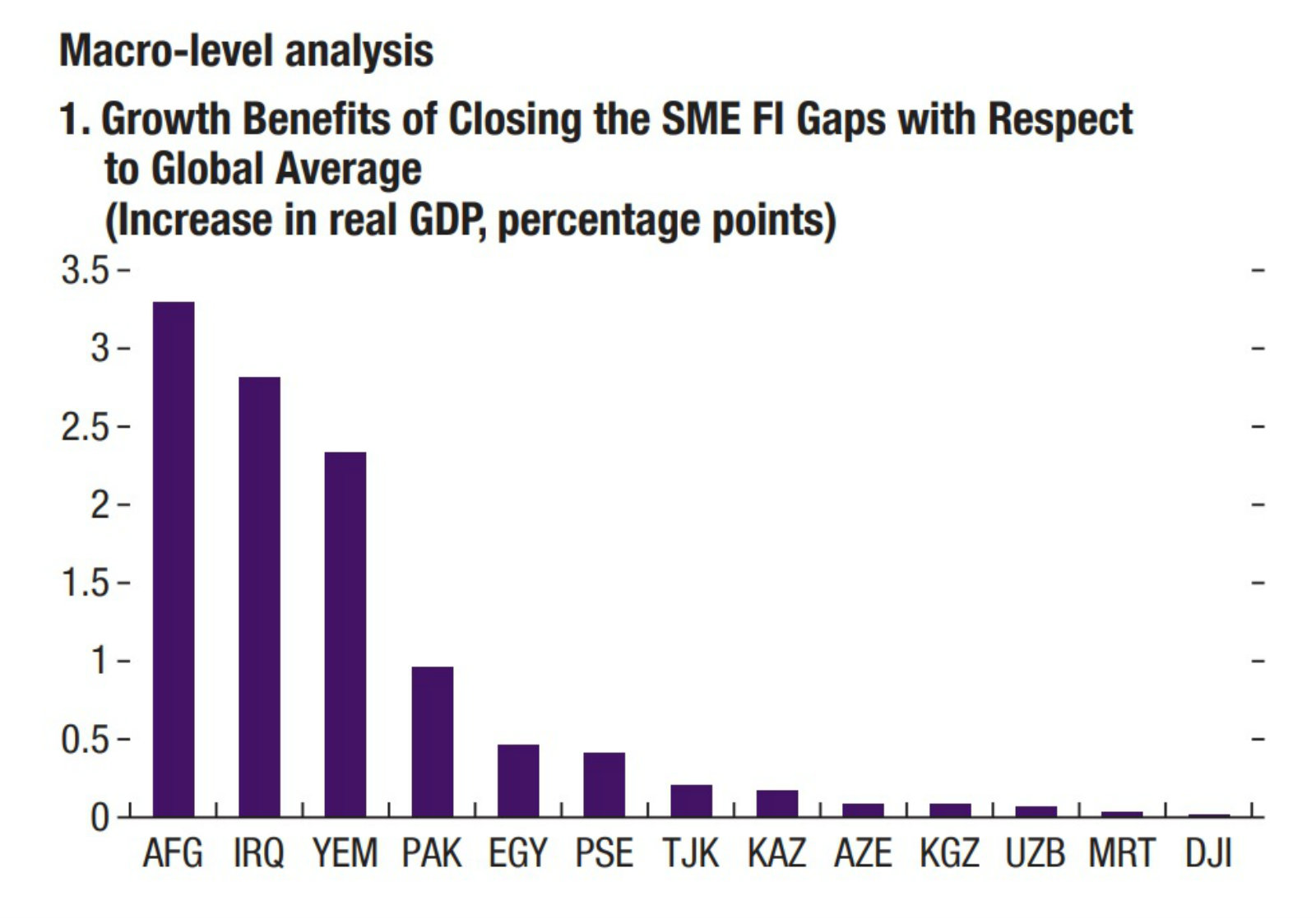

Increasing financial inclusion could add 1% to MENA GDP- IMF: Improving SME access to finance could boost annual economic growth in the MENA region by 1 percentage point, according to findings from an IMF research paper (pdf) on financial inclusion. The paper estimates that improved access to SME finance would increase employment in the sector by 1.3 percentage points, creating an estimated 14.3 mn new jobs by 2025. The biggest growth avenue for SMEs in MENA going forward is in the fintech industry, which the IMF says is just entering its growth phase. The report notes that Egypt, Saudi, the UAE, and Jordan are home to 75% of the MENA region’s startups and SMEs.

“No magic bullet” to improving inclusion: The MENA region — which has the lowest rates of financial inclusion in the world — requires a holistic approach if more of its SME sector is to access finance, the report says. Governments need to align their macroeconomic, financial policies and regulatory policies in a comprehensive strategy if they are going to integrate more SMEs into the formal economy. “To achieve meaningful, safe and sustainable SME access to finance, there is no magic bullet,” IMF Managing Director Christine Lagarde said at the World Government Summit in Dubai on Sunday. “Partial approaches are unlikely to suffice.”

What is Egypt doing to widen its formal economy? The long-awaited SME Act —designed to give SMEs incentives to join the formal economy — is expected to soon be passed to the House of Representatives. From what we know so far, the proposal could see businesses with revenues of less than EGP 500k a see their VAT rates cut to just 1%. Separate legislation passed last year will also give SMEs priority access and a 20% quota of government tenders.

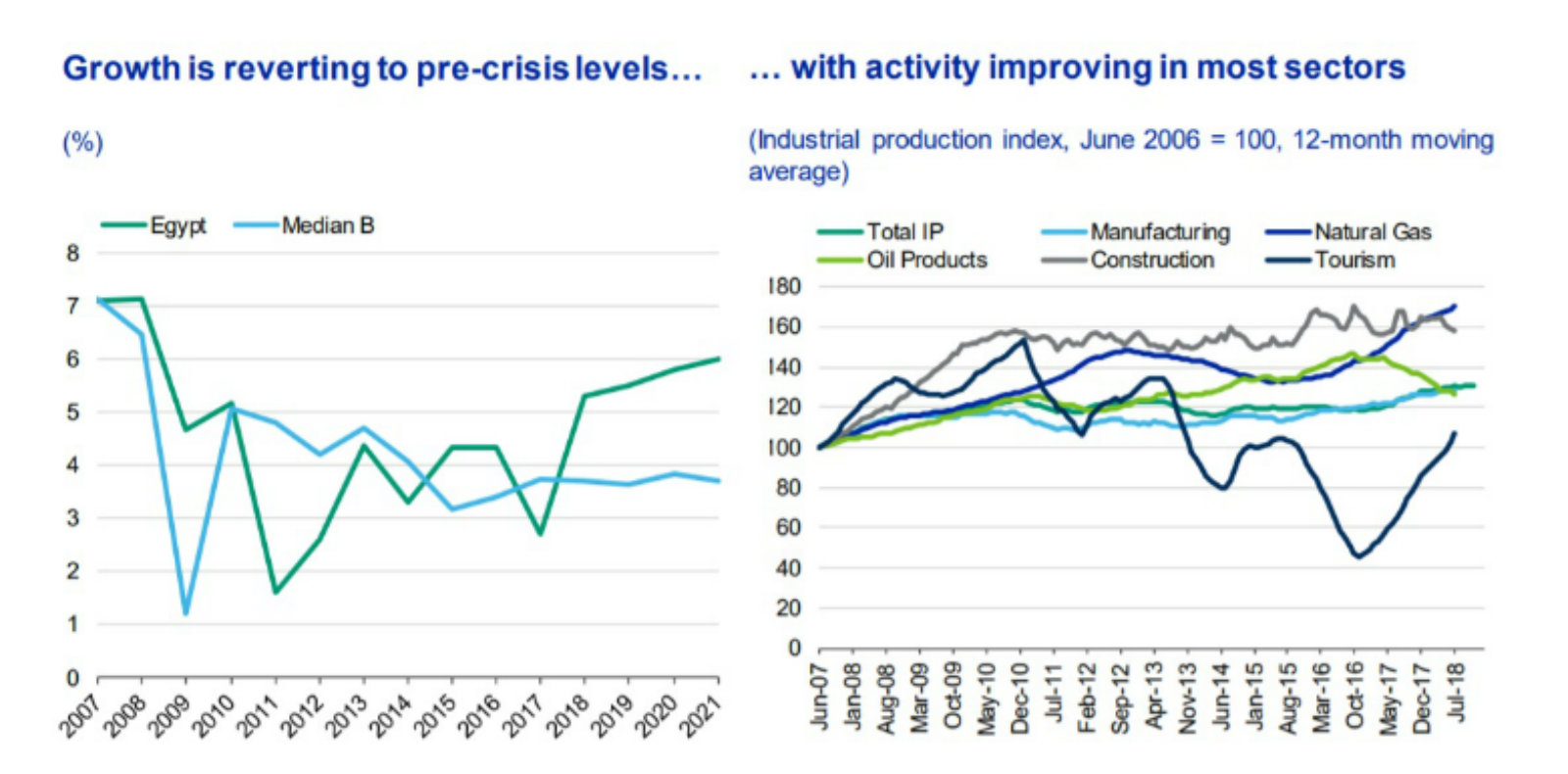

Moody’s cites Egypt’s growth, reforms as credit-positive factors: Moody’s said yesterday that “positive sovereign credit dynamics in Egypt defy global headwinds,” citing the nation’s “large and diversified economy with robust growth potential” and “strong reform momentum with support from international lenders,” which it said helped “reduce external vulnerabilities.” The ratings agency made the remarks in a presentation (pdf) that also noted growth is recovering to pre-crisis levels, with pickups in not just the energy sector, but also manufacturing, construction and tourism.

Challenges: Moody’s said high interest rates and public debt as well as weak financing amid high fiscal deficits remain a concern. “The credit profile remains constrained by labor market challenges to absorb the rapidly expanding labor force as durable basis for social stability,” the ratings agency added, pointing to security risks as another factor that raises concern.

Expat remittances up 3% to USD 25.5 bn in 2018: Remittances from Egyptians living abroad in 2018 rose 3.1% y-o-y to USD 25.5 bn, up from USD 24.7 bn in 2017, according to a Central Bank statement (pdf). December’s remittances came in at USD 2.2 bn, compared to USD 1.9 bn in November.

Tourism revenues could wipe out current account deficit- Capital Economics: Revenue generated in Egypt’s tourism sector could rise by as much as 2% of GDP in the coming years, wiping out the current account deficit, according to a report by Capital Economics. Tourism receipts may increase to as much as USD 5 bn if the number of arrivals follow their current trajectory and return to pre-2010 levels. The sector has undergone a speedy recovery over the past several years, helped by an improving security situation and European countries lifting flight bans in place since the Russian airline bombing in 2015. But still have a way to go through before we reach pre-2010 arrival numbers: We’re drawing around 8 mn visitors per year now, a far cry from the 14 mn people who visited in 2010.

REGULATION WATCH- FRA makes insurance mandatory in micro- and SME finance: The Financial Regulatory Authority (FRA) is forcing microfinance and SME finance players to provide insurance coverage for their borrowers, the authority said in a statement (pdf). The contracts will pay out an amount equivalent to the loans in the event of death or severe disability of borrowers, and lenders will not be allowed to mark up the cost of the coverage. The decision also includes provisions that allow microfinance lenders to demand that SMEs or the project that they would fund be insured.

EXCLUSIVE- Gov’t looking to issue new legislation to end tax disputes: The government is currently looking at new legislation that would provide a framework to resolve tax disputes, but has no intention to increase the basic salary tax exemption, Tax Authority head Abdel Azim Hussein told Enterprise. The domestic press had reported yesterday that one MP was pushing to have the House increase the basic salary tax exemption to EGP 9,000 per year, up from EGP 8,000 currently. Hussein provided no details on the new legislation the government is mulling.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Research analysts whose strength runs to words as much as models;

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech;

- Events managers who know how to produce outstanding live content.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Up Next

The central bank’s Monetary Policy Committee will meet to decide on interest rates on Thursday.

The EGP 500 mn first part of the fourth phase of Cairo Metro Line 3 will open between 15-17 February, Al Mal reports.

Suez Canal Authority boss Mohab Mamish will be in Moscow on 17 February to to move forward an agreement on a USD 7 bn Russian Industrial Zone, Al Mal reports.

The Egyptian, Sudanese and Ethiopian foreign and irrigation ministers will be in Cairo on 20 February for talks over the Grand Ethiopian Renaissance Dam, Foreign Minister Sameh Shoukry told Extra News.

A Russian delegation will visit Sharm El Sheikh and Hurghada airports in the second half of February to run a final security sweep ahead of a decision on whether to allow the resumption of direct flights, AMAY reports.

Antitrust ruling: The Cairo Economic Court is due to deliver a decision on an appeal by pharma distributors of an antitrust fine on 19 February.

FinMin to present debt control strategy to El Sisi in March: The Finance Ministry will present the final, reviewed version of its comprehensive public debt control strategy to President Abdel Fattah El Sisi in March, Finance Minister Mohamed Maait said.

Execs from 50 Japanese companies will be in Cairo in March to discuss potential investment opportunities, Youm7 reports.

The Macro Picture

Risky business: “Catastrophe bonds” and other securities where investors directly take on insurance risk in return for a premium are drawing the interest of the world’s biggest insurers, the FT reports. And although a spate of natural disasters in the last two years has brought with it investor losses, long-term sectoral growth is predicted, following the leap in investment in insurance-linked securities (ILS) — from USD 18 bn in 2009 to USD 93 bn in 2018.

The growth of “catastrophe bonds” and ILS: In the last couple of years, big insurers have displayed a particular appetite for merging with, acquiring or starting ILS managers, which are attractive partly because they enable the insurers to sell more insurance to customers by providing an extra source of capital. Just as importantly, they offer the insurer a different kind of business model. According to Gérald Harlin, chief financial officer of Axa, “It is like the originate to distribute model in asset management. It’s a fee business — it’s structuring risk.”

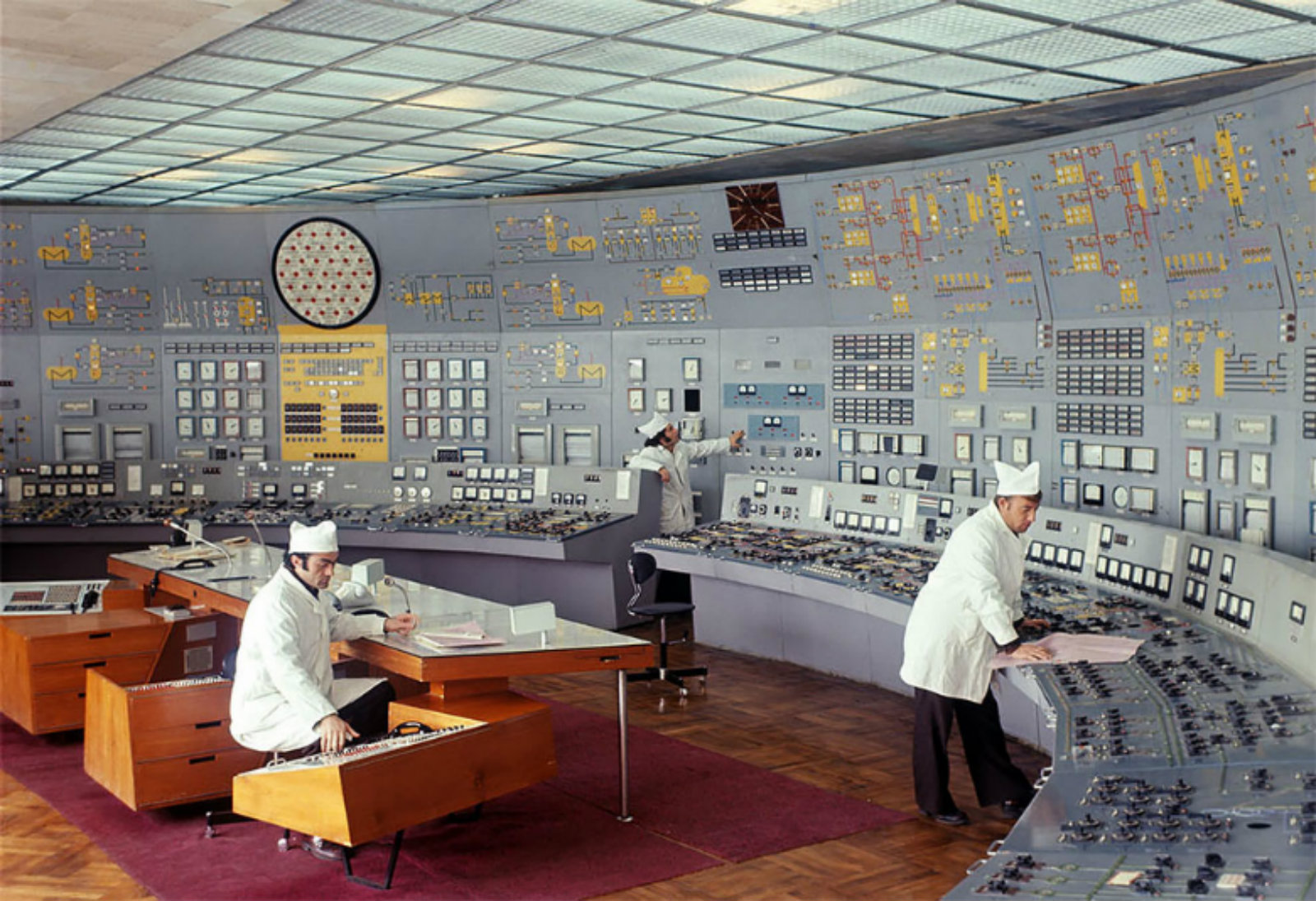

Image of the Day

You can’t fight in here, this is the war room: This has been floating around for a while, but we cannot get enough of this collection of photographs of Soviet-era control rooms, via Design You Trust. Things we love about these pictures: 1) the buttons, the buttons, the buttons, 2) we have no idea what these control rooms are for, and 3) that chef / nurses’ hats were de rigeur uniforms for very serious control room personnel.

Egypt in the News

On a blessedly quiet morning for Egypt in the foreign press, a headlines worth noting in brief:

- Four students were arrested last week after mocking Christian rituals in an online video, AFP reports.

- Love from Tunis: President Abdel Fattah El Sisi has the potential to do a great job in his presidency of the African Union, according to Tunisian President Béji Caid Sibsi, who was quoted in the Tunisian newspaper AlChourouk in a story picked up by Sada Elbalad.

- Judicial independence: The proposed constitutional amendments could have a negative impact on the judiciary’s independence, Human Rights Watch said in a statement yesterday.

- Ancient workshop: Archaeologists have uncovered an ancient workshop in Northern Sinai that was used to build and repair ships in the Ptolemaic Era, reports the Associated Press.

On The Front Pages

Egypt’s three state-owned dailies are still running with African Union-themed headlines on their front pages this morning as President Abdel Fattah El Sisi wraps up his visit to Addis Ababa (Al Ahram | Al Akhbar | Al Gomhuria). Al Ahram also features some highlights from the Egypt Petroleum Show, on which we have a full rundown in Speed Round, above, and Al Gomhuria takes note of IMF ME and Central Asia Director Jihad Azour’s seminar at the American University in Cairo yesterday. We have chapter in verse in Speed Round as well.

Worth Reading

Next-generation unicorns are doing things their own way: A new generation of tech start-ups hoping to become the world’s next unicorns — startups that rocket to a USD 1 bn valuation — are very different from their predecessors,Erin Griffith writes for the NYT. Globally, the number of unicorns has soared from 131 in 2015 to 315 today, and the market is changing rapidly. Their growth potential is significant, both because many of the start-ups are adding value to industries such as agriculture and science — which have been largely underserved and need more software tools to adapt to the tech era — and because the value of high-momentum companies has already been proven, so investors are always on the hunt for the Next Big Thing.

Watch out for these potential unicorns: CB Insights, a firm that tracks venture capital and start-ups, has identified 50 potential next-generation unicorns, many of which address industry-specific niche areas. Names to keep an eye out for include:

- Benchling (which allows scientists to keep their records stored in the cloud);

- Farmers Business Network (which provides a mechanism for farmers to share and analyze data about their farms, buy supplies and sell crops);

- Faire (an online marketplace where local boutiques and vendors buy and sell wholesale goods).

Energy

EETC signs LE 188 mn agreement for transformer station

The Egyptian Electricity Transmission Company has signed a EGP 188 mn agreement with EGEMAC for the construction of a transformer stationin Samannoud, EETC head Sabah Mashaly said, according to Al Mal. The transformer station will service increased demand in the delta region, and is expected to take a year to complete.

Real Estate + Housing

SODIC’s land has no real exposure to presidential decree

Real estate developer SODIC’s total land bank currently sits at 15.9 mn sqm, the company said, according to Al Mal. The total land under SODIC’s belt includes 6.2 mn sqm of coastal or highway-neighboring land, but the company noted that a recent presidential decree regulating such plots has had no effect on its holdings.

Tourism

GTI tourism to operate new flights to Hurghada from the Balkans

Global Travel International will begin operating weekly flights to Hurghada from Slovenia and Macedoniastarting June, according to Al Shorouk. Discussions are also underway to link Sharm El Sheikh and Macedonia, but no agreement has been reached yet.

Telecoms + ICT

Orange, Telecom Egypt sign agreement to provide high-speed bitstream services

Orange Data signed on Tuesday an agreement with Telecom Egypt to provide high-speed bitstream services to their customers, which would increase the maximum internet speed to 100 Mbps from 16 Mbps, according to a press release.

Automotive + Transportation

Uber raises fares to offset anticipated implementation of VAT

Ride-hailing app Uber has decided to raise its fares to offset inflation, an increase in its drivers’ fees, and the upcoming implementation of the 14% value-added tax (VAT) on its operations, according to an emailed statement (pdf). The Ride-Hailing Apps Act, which passed the House of Representatives in its controversial final form in May of last year, did not impose VAT on ride-hailing companies. A source from the committee drafting the executive regulations to the law had said earlier this year that the regulations would introduce a new levy of EGP 2-5 per trip, so it is likely that the regulations would also introduce the VAT.

Other Business News of Note

OIH-Prism JV agrees to negotiate settlement for sound and light show failure

A JV between Orascom Investment Holding (OIH) and Prism International has agreed to negotiate a settlement with the Sound and Light Cinema Company (SLCC) for last year’s contractual annulment, SLCC Chairman Sameh Saad said, according to Al Mal. SLCC contracted the JV to develop and run the sound and light show, but the latter allegedly failed to uphold contractual obligations. The state-owned company is seeking a total of EGP 200 mn in damages — EGP 100 mn from Prism for an earlier contract involving Saudi’s City Stars Properties, and a further EGP 100 mn from the OIH-Prism JV. Both Prism and OIH are planning to participate separately in a tender relaunch of the project after the settlement.

Egypt to set up medical waste recycling facility JV with UAE-based company

The Military Production Ministry is planning to partner with Emirates Industrial Conversion Factory to establish a medical waste recycling facility, according to a ministry statement. There was no mention of the project’s value, timeline, planned location, or output.

Sports

Egyptian Ali Farag tops world squash rankings

Egyptian squash player Ali Farag has cracked into the number one spot in the PSA world squash rankings for the first time in his career, edging out fellow Egyptian Mohamed El Shorbagy on 1 March after his victory at the J.P. Morgan Tournament of Champions in New York.

On Your Way Out

First StartEgypt forum introduces young entrepreneurs to investors, mentors: StartEgypt, a pre-acceleration incubation program targeting young Egyptian entrepreneurs working in fields of social impact, held its first forum event on Monday, according to a press release from the British Embassy. The event showcased 27 startups — whittled down from some 1,200 applications — from their first incubation cycle in 2018, and gave them the opportunity to present their ideas to investors, mentors and other stakeholders. Funded by the British Embassy in Cairo, the forum is supported by the International Finance Corporation and powered by Flat6Labs.

The Market Yesterday

EGP / USD CBE market average: Buy 17.56 | Sell 17.66

EGP / USD at CIB: Buy 17.55 | Sell 17.65

EGP / USD at NBE: Buy 17.55 | Sell 17.65

EGX30 (Tuesday): 14,928 (+1.0%)

Turnover: EGP 1.2 bn (37% above the 90-day average)

EGX 30 year-to-date: +14.5%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.0%. CIB, the index heaviest constituent ended up 1.2%. EGX30’s top performing constituents were Palm Hills up 2.8%, Ezz Steel up 2.3%, and El Sewedy Electric up 2.3%. Yesterday’s worst performing stocks were Arab Cotton Ginning down 2.9%, Sarwa Capital Holding down 1.2% and KIMA down 1.1%. The market turnover was EGP 1.2 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -47.7 mn

Regional: Net Long | EGP +20.5 mn

Domestic: Net Long | EGP +27.2 mn

Retail: 60.0% of total trades | 56.2% of buyers | 63.7% of sellers

Institutions: 40.0% of total trades | 43.8% of buyers |36.3% of sellers

WTI: USD 53.34 (+1.77%)

Brent: USD 62.57 (+1.72%)

Natural Gas (Nymex, futures prices) USD 2.67 MMBtu, (+0.95%, Mar 2019)

Gold: USD 1,314.20 / troy ounce (+0.18%)

TASI: 8,600.32 (+0.67%) (YTD: +9.88%)

ADX: 5,024.50 (-0.44%) (YTD: +2.23%)

DFM: 2,484.80 (-0.46%) (YTD: -1.78%)

KSE Premier Market: 5,504.21 (+0.87%)

QE: 10,302.41 (-1.33%) (YTD: +0.03%)

MSM: 4,124.79 (-0.40%) (YTD: -4.60%)

BB: 1,389.45 (-0.66%) (YTD: +3.90%)

Calendar

11-13 February (Monday-Wednesday): Renaissance Capital Egypt Investor Trip, Cairo.

11-13 February (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

14 February (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

19 February (Tuesday): Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

23 February (Saturday): The Supreme Administrative Court will rule in an appeal by Uber and its competitor Careem against a lower court ruling ordering the suspension of their operations.

24-25 February (Sunday-Monday): EU-Arab League summit, Sharm El-Sheikh, Egypt

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral

Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

10 March (Sunday): CIB to hold EGM meeting to look into planned capital increase.

March (date TBD): Traders Fair, Nile Ritz Carlton, Cairo, Egypt.

17 March (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen, seeking EUR 150 mn in damages.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg)

18-19 March (Monday-Tuesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

April: The EUR 250 mn first phase of Egypt’s national waste management program kicks off.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna (Bloomberg)

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

29 August (Thursday): Islamic New Year (TBC), national holiday.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Cairo, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.