- The FinMin’s debt reduction strategy has officially begun. (Speed Round)

- Sanlam is eyeing investments in Egypt. (Speed Round)

- The government is looking to more than double Egyptian exports to USD 55 bn with its incentives program. (Speed Round)

- Is there a storm coming? Emerging markets should prepare either way. (The Macro Picture)

- Egypt is set to become the next startup hotspot, say VCs. (Speed Round)

- Cabinet members have been stricken from the subsidy rolls. (Last Night’s Talk Shows)

- The deputy house speaker wants to put an end to fake news. (Speed Round)

- The 1919 Revolution: How the British caused it and how the Americans looked the other way. (Worth Reading)

- The Market Yesterday

Sunday, 10 March 2019

The FinMin kicks off its debt reduction strategy

TL;DR

What We’re Tracking Today

Two thoughts are rattling through our brains this morning as we slide back into our usual routine after a week in the UAE at the EFG Hermes One on One conference. It was the best-attended edition of the One on One yet, and sentiment is strong. Those two thoughts (because we’re rarely capable of maintaining more than one at a time): First, the themes running through emerging markets are striking. From Cairo to Kampala by way of Port Louis and Dar Es Salaam, companies are largely facing variations on the same challenges — and the same upside. Second, Mark Mobius still goes to investor meetings. The man invented emerging markets as an asset class (and created jobs for so many of us in the process) and still goes to investor meetings at age 82. [Redacted] legend.

Wall Street’s oldest-ever bull market turned 10 yesterday. “The S&P 500 has more than quadrupled from its devil's bottom of 666 in March 2009. The Dow has spiked nearly 19,000 points, or almost 300%. And the Nasdaq has skyrocketed just under 500%,” CNN reports. Reuters and Seeking Alpha have the story, but Bloomberg isn’t sure how much longer it will last.

Deutsche Bank and Commerzbank are mulling a potential merger, the Wall Street Journal writes, saying top Deutsche execs have agreed to hold discussions with their rivals at Commerzbank as the two sides “explore strategic options after suffering prolonged performance and share-price declines.”

Elizabeth Warren is promising to break up Facebook, Google and Amazon if she wins the US presidency. The Democratic senator said at a campaign event this weekend that it is “time to challenge the increasing dominance of America’s biggest technology companies,” Reuters and the Verge report.

Qatar returned to the bond market last week with a USD 12 bn issuance, meaning the country has now raised some USD 24 bn in less than a year, Bloomberg reports. The issuance saw healthy appetite from investors flocking back to emerging markets, recording demand of USD 50 bn.

Speaking of EM debt (Egypt, take note): Investors are worried the market may be overheated, Bloomberg reported. EM borrowers have so far raised about USD 360 bn in 2019 (including Egypt’s USD 4 bn eurobond issuance) — a record on a year-to-date basis fueled by a pause in US interest rate increases and prospects of an ‘imminent’ trade agreement between US and China. Investors expect yields to take a hit if the US Fed changes policies to target inflation.

Libyans fear a shutdown as the country’s eastern commander Khalifa Haftar may move to take control of Tripoli, reports Reuters. The Egypt and UAE-backed leader of the Libyan National Army recently took control of Libya’s southern oil fields, effectively monopolizing the country’s crude oil output. The news comes after discussions of potential Libyan elections were floated just last week in a United Nations-led effort to de-escalate tensions between Haftar and Tripoli’s UN-recognised government led by Prime Minister Fayez al-Serraj.

PSA #1- Clocks change in the US and Canada this morning. Readers visiting (or living in) much of North America will ‘spring forward’ today, meaning New York and Toronto will become CLT -6. Remember:

- Clocks don’t change in the UK until 31 March, so London is still CLT -2 this morning.

- Clocks never change in the UAE or KSA, which don’t observe daylight saving time.

- Time won’t change here in Egypt — in one of their brighter collective moments, our elected representatives did away with DST a few years back after a year in which we sprang forward, then fell back for Ramadan, sprang forward again after Ramadan, and then finally fell back in fall.

PSA #2- You can expect a high of 23°C in the capital city today and an overnight low of 11°C as average temperatures continue to warm up now that we’re effectively in spring, according to the Egyptian Meteorological Authority (pdf). Alexandria will see a high of 20°C and low of around 9°C, while the mercury in Upper Egypt will rise to the upper 30s.

PSA #3- Ramadan begins in less than two months. Depending on whose forecast you believe, the Holy Month begins in about 56 days.

Enterprise+: Last Night’s Talk Shows

Another Nasserist legacy bites the dust as Supply Ministry kicks Cabinet members off welfare rolls: The Supply Ministry has removed all members of cabinet (including the prime minister and all deputy ministers) from the nation’s subsidy rolls, adviser to the supply minister Amr Madkour said on Sada El Balad. According to Madkour, the ministry will revoke welfare privileges from MPs next. The ministry had set out last month new criteria for individuals no longer eligible for welfare benefits (watch, runtime: 2:37). El Hekaya’s Amr Adib also interviewed Madkour, who said the ministry is working closely with other state institutions to ensure the process is sound (watch, runtime: 07:19) and (watch, runtime: 02:07).

President Abdel Fattah El Sisi’s meeting with senior officials in his administration yesterdaymade the airwaves. The gathering discussed reserves of strategic commodities, security and progress on development projects (watch, runtime: 01:30). Hona Al Asema also highlighted government efforts to make available affordable commodities, especially ahead of the holy month of Ramadan (watch, runtime, 04:18).

Why do real estate prices keep going up even though supply is (allegedly) up and demand is (supposedly) lower? Masaa DMC’s Eman El Hosary tackled Egypt’s real estate sector with a group of experts (watch, runtime: 50:18).

Speed Round

Speed Round is presented in association with

The Finance Ministry has begun implementing its comprehensive debt reduction strategy, which aims to reduce debt to 80% of GDP by 2022, according to a ministry statement. During a meeting with a delegation from the European Bank for Reconstruction and Development (EBRD), headed by first vice president Jurgen Rigterink, ministry officials reiterated the government’s plans to prolong debt maturities, outlined targets for growth and deficits, and recapped status of the state privatization program, which kicked off earlier this month with Eastern Tobacco’s secondary offering.

(An aside worth noting: The EBRD is looking to invest more in Egypt this year after having provided EUR 1.2 bn-worth of financing for about 50 projects in 2018, Rigterink said, according to a ministry statement.)

EXCLUSIVE- Egypt will issue 10- and 30-year bonds to cover interest due on 3- and 9-month treasury bills in the fiscal year starting in July, a senior government official told Enterprise. The mechanism is part of the government’s bid to reduce pressure on the budget, he said. “We have spoken to our international partners and found very high interest from foreign investors, domestically and internationally, in long-term securities,” the source said, adding that the government is now targeting a budget deficit of 7% and GDP growth of 6.1% for the coming fiscal year.

Background: The ministry has been drafting the strategy since last year. An initial draft of the FY2019-20 state budget that Finance Minister Mohamed Maait had presented to President Abdel Fattah El Sisi in January set a revised debt target of 80-85% of GDP by the end of FY2021-22. Previously-issued guidelines for FY2019-20 had set a public debt target of 79.3% of GDP for that fiscal year.

INVESTMENT WATCH- South African insurer Sanlam intends to enter the Egyptian and Moroccan markets,Reuters reports. The firm is looking to take an equity stake in an Egyptian player. The company’s expansion plans appear to be at least partly fueled by weak growth at home and challenging conditions in several of its expansion markets. Worth remembering: Egypt’s market already sees too many players chasing market share rather than looking to grow the overall size of the market, Misr Insurance Holding Company chief Basel El Hini told us for our 2019 CEO Poll.

VCs see Egypt, Saudi Arabia as the next big hubs in the Middle East’s startup scene: Venture capitalists believe Egypt and Saudi Arabia have a promising future in the region’s start-up scene and are advising investors to keep a close eye on them, the National reports. Speaking at the London Business School Middle East Conference, founding partner and CEO of Saudi-based Raed Ventures Omar Almajdouie said that while the UAE maintains its position as the region’s current entrepreneurial hub, Egypt and Saudi Arabia will be the focal points of the next wave of big startups in the region. “[Egypt and Saudi Arabia] will be the biggest inception point of the next wave of startups in the region. Not medium or small-scale startups, the big startups like Careem,” he said, citing Cairo-based Swvl as an example.

Speaking of tech: Silicon Valley will lose ground over the next four years to rival power centers including New York, Boston, Beijing and London, according to a KPMG study. The shift comes as each of these cities makes a conscious investment to become tech innovation hubs — and partly because we live in an “always-on, constantly connected world” in which geography is less important, the Wall Street Journal writes.

Egypt’s still-in-the-works non-cash incentives program for exporters aims to more than double exports to USD 55 bn, according to a Cabinet statement. The program will come as part of a larger strategy to increase exports of manufactured goods and encourage foreign and domestic investments in key sectors. The strategy also aims to improve the competitiveness and broaden the outreach of globally traded goods and services and contribute to employment, to name a few. The program is expected to kick off between April and early FY2019-20.

Al Mashat meets tourism ministers, travel agencies at Berlin tourism expo: Tourism Minister Rania Al Mashat met with her Greek and Cypriot counterparts on the sidelines of the ITB Berlin tourism expo to discuss increasing cooperation between the three countries, according to Cyprus News Agency. Al Mashat also met with German Travel Association President Norbert Fiebig, who told the minister that Germans are keen on visiting Egypt, particularly on the back of increasing political and economic stability, according to Egypt Today. This comes as German flights to Egypt are expected to increase 25-30% during the upcoming summer season, Masters Travel Service head Nora Ali said, according to Al Shorouk.

Thomas Cook plans to bring 820k tourists to Egypt’s Red Sea resorts this year: The minister also met with Sayed El Gabry, Thomas Cook’s agent in Egypt, who announced the British travel agency is looking to bring 420k Russian and Chinese tourists and 400k travelers from other countries to Egypt’s Red Sea resorts in 2019, Al Masry Al Youm reports. UK-based travel firm TUI also plans to bring more Chinese tourists to Egypt this year, CEO Friedrich Joussen told Al Mashat, according to Masrawy.

MPs aren’t delighted with the idea of setting aside 25% of all seats for women: Opposition is crystallizing to the introduction of a quota that would see as much as 25% of all seats in the House set aside for women under proposed amendments to the nation’s constitution, according to a report by Al-Ahram Weekly.

Background: The pro-government Support Egypt coalition had introduced last month amendments that would, if passed, allow President Abdel Fattah El Sisi to remain in office until 2034. The package is now with the House Legislative Committee for review ahead of a vote in the general assembly, where the amendments must be approved by at least two-thirds of parliament. The president would then put the changes to a national referendum.

LEGISLATION WATCH- Deputy House speaker to draft “anti-rumor” law: Deputy House Speaker Soliman Wahdan is planning to draft a law to put an end to what he says is the “systemic” spreading of rumors across the country, Wahdan said in a statement picked up by El Watan. The legislation would set up a cabinet-supervised body to track, identify, and address destabilizing false news and statements, which Wahdan says are spread by terrorist groups. The measure also proposes tougher sanctions for those found guilty than the current fine, which tops out at EGP 20k.

MOVES- Bank of Alexandria has appointed economist and former deputy prime minister Ziad Bahaa El Din as non-executive chairman, according to Al Mal. Bahaa El Din is the managing partner and founder of Bahaa-Eldin Law Office (now in cooperation with BonelliErede) and of Thebes Consultancy. In addition to serving as deputy PM, he previously served as international cooperation minister and head of the precursor to today’s Financial Regulatory Authority.

EARNINGS WATCH- SODIC reported 37% y-o-y growth in its adjusted bottom line to EGP 815 mn in 2018, the company said in its earnings release (pdf). Revenues for 2018 came in at EGP 3.73 bn, compared to EGP 2.30 bn in 2017, while net contracted sales declined 10% y-o-y to EGP 5.2 bn. Notably, more than half of cancellations in the full year owed to a cancelled sale at Polygon; excluding that transaction, cancellations are below the company’s historical average. SODIC is proposing a dividend of EGP 0.50 per share subject to shareholder approval. The company successfully delivered 1,079 units during the year, including the first units at its New Cairo development, Villette, and its North Coast development, Caesar.

Ibnsina Pharma reported a 54.3% y-o-y rise in its net profit to EGP 262.5 mn in 2018 “despite one-off charges of EGP 59.7 mn incurred during the period,” the company said in its earnings release (pdf). The company’s normalized net profit grew 55.1% y-o-y to EGP 322.2 mn during the year. On a quarterly basis, Ibnsina’s revenues grew 35% y-o-y to reach EGP 3.9 bn, while net profit jumped 172.8% y-o-y to EGP 74.2 mn in 4Q2018. “I am pleased to report that in its first full year as a publicly-traded company, Ibnsina Pharma has delivered exceptional growth and value to shareholders while upholding best corporate governance and disclosure standards. Although we witnessed several challenges during the year, including the rollout of stringent regulations, stock market volatility and a legal dispute that loomed over our business, we have emerged a more versatile company and have built on a solid reputation developed over our 18-year track record,” said Executive Chairman Mohsen Mahgoub.

Up Next

A delegation of 50 Japanese companies is expected in Egypt today and tomorrow, reports Egypt Today.

AmCham is putting on a one-day entrepreneurship event on Monday, 11 March in collaboration with the AUC School of Business, Mindsalike Network, the Entrepreneurs’ Organization and Endeavor Egypt.

The US Federal Open Market Committee will next meet to review interest rates on Tuesday, 19 March and Wednesday, 20 March.

The Central Bank of Egypt’s Monetary Policy Committee will follow suit on Thursday, 28 March.

A consortium of Russian companies is expected to visit Egypt this month to explore investment and operational logistics in the Russian Industrial Zone area of the Suez Canal Economic Zone, reports the local press.

An Egyptian ministerial delegation will visit France this month to discuss bilateral trade, local press reported.

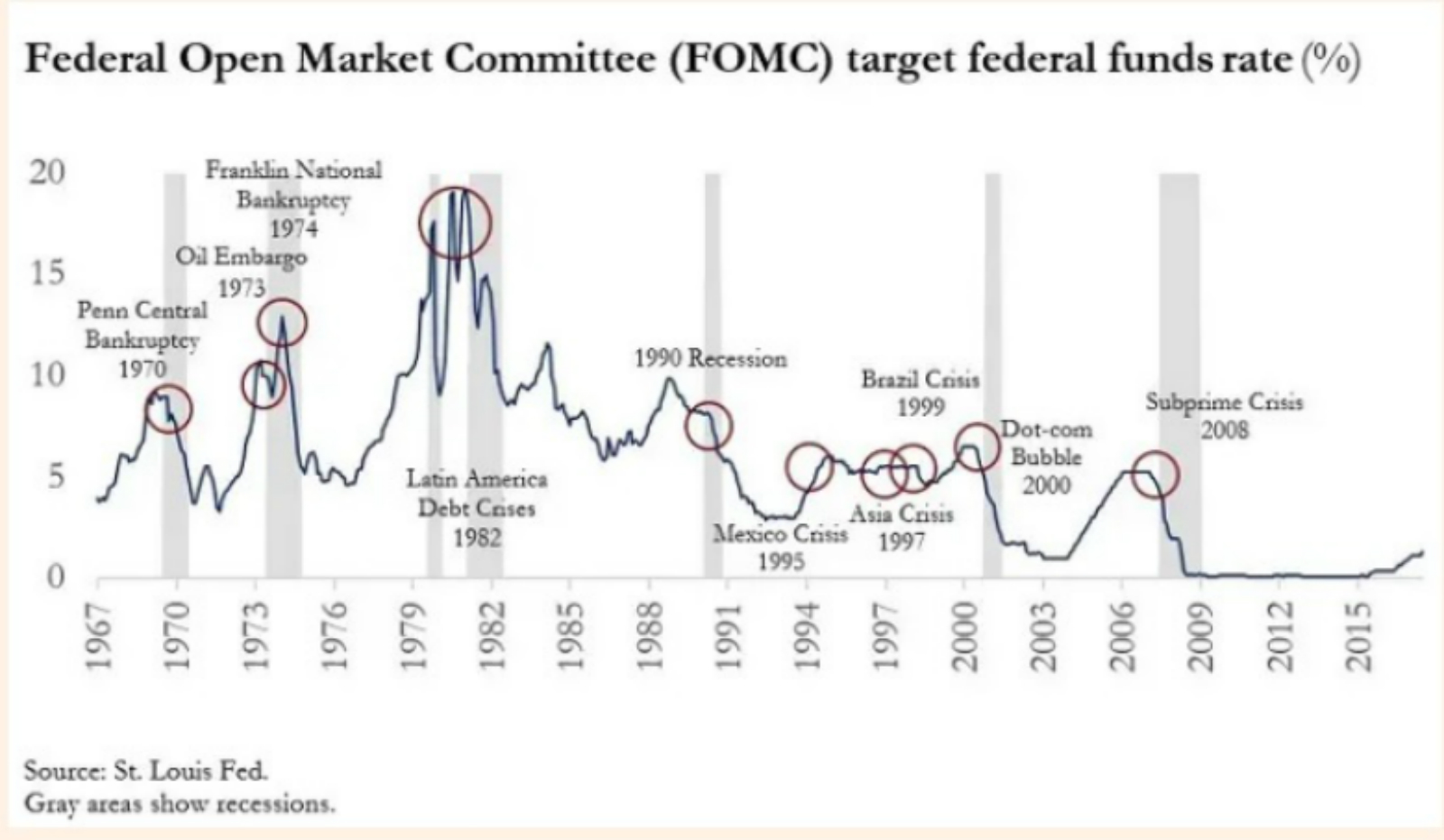

The Macro Picture

Emerging markets should brace for an incoming storm: History tells us that every monetary tightening cycle by the US Federal Reserve is followed by something getting broken in the global economy. With a storm currently brewing, emerging markets should take the necessary precautions to avoid being the victims, former Mexican finance minister José Antonio González writes for the FT. The Fed began a tightening cycle in 2015 that has so far involved nine hikes — and more may be on the horizon. Higher US interest rates have preceded several financial crises in the past. “A looming recession or deceleration in advanced economies will lower export demand, which, coupled with trade tensions, will probably cause commodity prices to fall, hurting export-dependent emerging market economies,” González writes. “Rising interest rates in the developed economies will cause capital flow reversals.”

So what should EM do to ward off a potential shock? “There are no magic bullets. The best course of action is to make sure the basic macroeconomic indicators are in order,” González says. He suggests that governments should narrow (or eliminate altogether) fiscal deficits, shift to local borrowing, borrow with longer maturities and fixed rates, and balance their external accounts.

Image of the Day

Egypt attends world’s largest mining convention in Canada: The oil ministry attended the Prospectors & Developers Association of Canada’s (PDAC) annual convention from 3-6 March to attract investment into Egypt’s mining sector. The gathering is the world’s largest mineral exploration and mining convention, attracting more than 25k attendees each year. Pictured: Egypt’s booth, with Tamer Abu Bakr (center) of the Federation of Egyptian Industries on hand to support of the oil ministry. H/t Mark C.

Egypt in the News

Human rights were again front and center in the international press over the weekend: Egyptian actor Amr Waked has been sentenced in absentia to eight years in prison for "disseminating false news and insulting state institutions," according to the AP. Waked, who resides in Spain and is a vocal critic of the government, says he doesn’t know what the cases against him are about, but fears he could be arrested if he returns to Egypt. Deutsche Welle also had the story. The arrest of transgender woman Malak Al-Kashef was also picked up after Amnesty International issued a statement calling for her immediate release. The story made the Independent and ABC News, among other outlets.

And there’s still more:

- Australian-Egyptian Hazem Hamouda is being barred from leaving Egypt despite his release from detention last week, the Guardian reports.

- EU countries should hold Egypt accountable for its human rights record, Rainer Hermann writes for Deutsche Welle.

- Malaysian officials detained and may already have extradited four Egyptians who say they have been singled out for their opposition to the Sisi administration.

Egypt’s role in the development of natural gas resources in the east Med received attention from several outlets: Simone Tagliapietra writing in the FT highlights the importance of Egypt’s LNG facilities to the export ambitions of both Israel and Cyprus. A piece in Al-Monitor, meanwhile, notes that the long-standing rivalry between Egypt and Turkey is heating up as the east Med as an energy source grows in importance.

Other stories on Egypt making international headlines:

- The presidential directive to paint “uncivilized” red brick buildings is getting attention again, with the New York Times’ Declan Walsh focusing on the broader context of the scheme and local reactions.

- There are parallels between the protests in Algeria and Egypt’s January 2011 uprising, Andrew England writes for the FT.

- The collapse of Daesh’s Syrian stronghold could have repercussions for Egypt: The group’s Sinai operations may lose access to funding, but could see their forces bolstered with the return of Egyptians who fought in Syria, The Arab Weekly suggests.

On The Front Pages

President Abdel Fattah El Sisi’s meeting with his government to urge them to step up efforts to make affordable goods available ahead of Ramadan top the front pages of all three state-owned newspapers this morning (Al Ahram | Al Gomhuria | Al Akhbar).

Worth Reading

The British occupation and the roots of Egypt’s 1919 Revolution: The impact of the British occupation of Egypt in 1881 not only sowed the seeds of the country’s 1919 revolution, but set in motion a pattern of inequality and wealth concentration that continued long after the British had been driven out, Sherine Abdel-Razek writes for Ahram Online. The article tells a familiar story of an exploitative colonial power controlling and profiting from the country’s natural resources with an iron fist: crippling taxes on Egypt’s textile industry, inflationary monetary policies and enforced dependency on cotton exports.

“The ugliest of treacheries”: This state of affairs was allowed to continue after the First World War after US President Woodrow Wilson backtracked on his pledge to recognize the sovereignty of colonized peoples, Erez Manela recounts in an essay for the New York Times. After the British arrested Saad Zaghloul — setting off a wave of demonstrations later to be called the 1919 Revolution — Egyptians called on Wilson to follow through on his rhetoric and help the country assert its right to self-determination. Their pleas fell on deaf ears: Wilson decided to recognize British control of the country, a move that leading Egyptian intellectual Mohammed Hussein Heikal described as “the ugliest of treacheries” and “the most profound repudiation of principles.”

Diplomacy + Foreign Trade

The World Bank is currently reviewing and renewing its strategy with Egypt, a process that should be completed in the next few months, newly-appointed Country Director for Egypt, Yemen and Djibouti Marina Wes told Egypt Today. This comes as the World Bank is reviewing its strategy for the wider Middle East and North Africa region. Wes did not disclose further details on the strategy, but said Egypt is a “critically important partner” for the bank.

Chad and Egypt have agreed to enhance investment cooperation across various sectors, including infrastructure, health, education and agricultural development, according to an Investment Ministry statement. The agreement came amid a visit by an Egyptian delegation to the African country over the weekend.

USAID has inaugurated two development projects in Sohag, one to provide sanitation to over 23,000 Salamoun village residents and another to provide vocational training to local university students, according to an emailed press statement. Vocational training will be provided in a newly-built career center at Sohag University, which is one of 20 planned as part of a USD 20.8 mn initiative.

Energy

DEA signs Red Sea concession extension agreement with EGPC

German energy company DEA signed a five-year extension agreement with the Egyptian General Petroleum Corporation (EGPC) for its concessions in the Ras Budran and Zeit Bay oil fields, the company said in a statement. The agreement also includes an option to further extend DEA’s concessions until 2027. DEA will invest a minimum of USD 20 mn in the concessions and is planning to invest about USD 700 mn in Egypt over the coming three years, according to a cabinet statement.

Egypt oil and gas production reaches record 1.8 mn boe/d

Domestic oil and gas production reached a record 1.8 mn boe/d in February, Oil Minister Tarek El Molla told President Abdel Fattah El Sisi and PM Moustafa Madbouly during a meeting, according to an Ittihadiya statement.

Trial operations for Egypt-Sudan power linkage project waiting on new gov’t in Khartoum

The Egyptian Electricity Transmission Company (EETC) has completed the construction works for the USD 60-70 mn electricity interconnection project between Cairo and Khartoum, and trial operations on the project are now waiting on the formation of a new government in Sudan, according to unnamed Electricity Ministry sources. Once the new government is formed, the two countries will discuss the power purchase agreement before beginning trial operations, the sources said. The electricity minister had previously said the two countries would exchange 200-300 MW of power in the first phase, with the second phase expected to be completed in 1Q2020, bringing capacity to 600 MW.

ADES Holding, Vantage sign Egypt drilling service contract with Dana Gas

Dana Gas has signed an exploration agreement with ADES International Holding and Vantage Drilling International JV, ADVantage, to perform deep water drilling services for one well in the Mediterranean Sea, Offshore Magazine reports.

Infrastructure

Polaris Parks to deliver first phase of Bosla SMEs complex in April

Industrial developer Polaris Parks is planning to deliver the EGP 450 mn first phase of Bosla SME’s industrial complex west of Cairo to investors in April, local press reported. The company will begin working in the second phase in 2H2019.

Basic Materials + Commodities

Central Bank of Egypt excludes rice, beans, lentils from 100% cash margin

The Central Bank of Egypt has excluded rice, beans and lentils from the 100% cash margin requirement imposed on most imports, according to a statement (pdf). This exempts the three crops from a decision (pdf) taken in 2015 requiring importers to fully cover import letters of credit (LC) at commercial banks at the time of opening them. The decision — which will alleviate liquidity constraints for importers and encourage the import of rice and legumes — comes amid a strategy to save water by limiting the cultivation of water-intensive crops.

Manufacturing

Dakahlia Poultry inaugurates EGP 450 mn poultry, fish fodder factory

Dakahlia Poultry inaugurated last week a new EGP 450 mn poultry and fish fodder factory, reports the local press. The new facility has a daily production capacity of 3k tonnes of poultry fodder and 400 tonnes of fish feed, according to company head Mahmoud El Enany. QNB Al Ahli and the National Bank of Egypt provided loans of EGP 200 mn and USD 13 mn respectively to finance the construction of the factory.

Real Estate + Housing

Hill International wins consultancy to work on megaprojects Taj City and Sarai

US consultancy Hill International announced on Tuesday it has been awarded the contract to provide project management services to Madinet Nasr for Housing and Development’s Taj City and Sarai developments. The value of the contract was not disclosed.

Tourism

New Star for Aviation Services in negotiations with European and Asian airlines

New Star for Aviation Services is currently negotiating with four European and Asian airlines to offer their services to airlines in the local Egyptian market, according to statements from general manager Seif Bahgat reported by Al Shorouk.

Legislation + Policy

EBA urges for new NGOs Act amendments

The Egyptian Businessmen Association’s (EBA) Economic Legislation Committee has urged for new amendments to the NGOs Act to replace the government’s draft law that failed to get the president’s approval, Al Masry Al Youm reports. The current NGOs Act has been widely criticized by international organizations for cracking down on Egyptian civil society.

Egypt Politics + Economics

House Econ Committee summons El Moselhy to review subsidy rolls purge

The House Economics Committee has requested a meeting with Supply Minister Ali El Moselhy to review the ministry’s criteria for purging the nation’s subsidy rolls, Rep. Amr El Gohary said. According to El Gohary, some of the criteria have loopholes that require “a closer look.” The ministry had announced last month that it would cut from welfare rolls individuals who consume more than 650 KW of electricity per month, spend more than EGP 800 on their monthly phone bill, spend more than EGP 30k on school fees for their child at an international school, and those who own a luxury car made in 2014 or later.

Egyptian man sentenced to death for murder of Ukrainian woman in Hurghada

An Egyptian man has been sentenced to death for killing a Ukrainian woman in Hurghada after attempting to rob her, Al Masry Al Youm reports. The Red Sea Criminal Court will issue a final verdict on the case, which has been referred to the Grand Mufti, on 4 May.

El Sisi ratifies USD 200 mn EBRD loan to Egypt’s EGAS

President Abdel Fattah El Sisi issued a presidential decree ratifying a USD 200 mn loan from the European Bank for Reconstruction and Development “to finance the modernization of selected gas infrastructure facilities, which shall improve energy efficiency and reduce impacts on the environment,” according to Al Masry Al Youm. The decree was published in the Official Gazette on Wednesday.

National Security

Egypt’s defense minister discusses cooperation with Greek counterpart

Defense Minister Mohamed Zaki discussed military cooperation with his Greek counterpartEvangelos Apostolakis, who was in town on Thursday according to an Armed Forces statement.

On Your Way Out

The president of Egypt’s National Council for Women, Maya Morsy, praised recent efforts to further women’s empowerment in a statement to mark International Women’s Day on 8 March. She highlighted the impact of the constitution in enshrining certain principles of non-discrimination in law, as well as steps that have been taken to punish Female Genital Mutilation (FGM) and harassment.

We’re not ones to discount progress, but let’s not go overboard: A CAPMAS statement issued to celebrate IWD showed that women make up less than 20.9% of the country’s workforce. AMAY has the stats.

In other IWD miscellany: Magda Gobran (aka Mama Maggie) became the first Egyptian woman to receive the International Woman of Courage award last week.Gobran established the Stephen’s Children NGO in Mokattam to provide food, clothing and education to impoverished children. And Lebanese artist Christina Atik is getting coverage in Reuters for her latest project:a series of digital paintings tackling the everyday social criticism faced by women in the Arab world.

The Egyptian-Russian Cultural Foundation has released the first images of Egypt Sat A in space, the remote-sensing photography satellite that was launched last month, reports Al Mal. The satellite is expected to transmit its first images next week.

The Market Yesterday

EGP / USD CBE market average: Buy 17.39 | Sell 17.49

EGP / USD at CIB: Buy 17.40 | Sell 17.50

EGP / USD at NBE: Buy 17.40 | Sell 17.50

EGX30 (Thursday): 14,904 (+1.8%)

Turnover: EGP 1.16 bn (26% above the 90-day average)

EGX 30 year-to-date: +14.3%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 1.8%. CIB, the index heaviest constituent ended up 2.4%. EGX30’s top performing constituents were Oriental Weavers up 5.0%, Orascom Development Egypt up 3.7%, and Elsewedy Electric up 3.4%. Thursday’s worst performing stocks were Qalaa Holdings down 0.7%, Egypt Kuwait Holding down 0.4% and Egyptian Resorts down 0.4%. The market turnover was EGP 1.16 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +57.2 mn

Regional: Net Long | EGP +4.5 mn

Domestic: Net Short | EGP -61.8 mn

Retail: 47.9% of total trades | 44.5% of buyers | 51.4% of sellers

Institutions: 52.1% of total trades | 55.5% of buyers | 48.6% of sellers

WTI: USD 56.07 (-1.04%)

Brent: USD 65.74 (-0.84%)

Natural Gas (Nymex, futures prices) USD 2.87 MMBtu, (-0.03%, Apr 2019)

Gold: USD 1,299.30 / troy ounce (+1.03%)

TASI: 8,479.16 (-0.64%) (YTD: +8.34%)

ADX: 4,914.39 (-1.26%) (YTD: +-0.01%)

DFM: 2,594.52 (-1.20%) (YTD: +2.56%)

KSE Premier Market: 5,597.37 (+0.02%)

QE: 9,781.18 (-1.04%) (YTD: -5.03%)

MSM: 4,112.92 (-0.98%) (YTD: -11.69%)

BB: 1,408.92 (-0.14%) (YTD: +5.36%)

Calendar

10 March (Sunday): CIB will hold an EGM meeting to look into planned capital increase.

10-12 March: A delegation of 50 Japanese business companies is expected to visit Egypt.

11-13 March (Monday-Wednesday): International Conference on Material Science & Engineering Recent Advances and Challenges, Sofitel El Gezirah, Cairo, Egypt.

14-16 March (Thursday-Saturday): Metal & Steel, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): WINDOOREX, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): Egypt Projects, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): FabEx Middle East, Egypt International Exhibition Center, Nasr City, Cairo.

March (date TBD): Traders Fair, Nile Ritz Carlton, Garden City, Cairo, Egypt.

15 March (Friday): Arab World Social Innovation Forum, American University in Cairo, Cairo, Egypt.

16-18 March (Saturday-Monday): Automation Technology Expo, Cairo International Convention Center, Nasr City, Cairo, Egypt.

17 March (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen, seeking EUR 150 mn in damages.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg).

18-19 March (Monday-Tuesday): Coaltrans, Four Seasons Nile Plaza, Garden City, Cairo, Egypt.

19-20 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19 March (Tuesday): Portfolio Egypt Conference for non-banking financial services, venue TBD, Cairo, Egypt.

20-22 March (Wednesday-Friday): Egypt International Green Building Conference, Egypt International Exhibition Center, Nasr City, Cairo.

20-22 March (Wednesday-Friday): Watrex, Egypt International Exhibition Center, Nasr City, Cairo.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28-30 March (Thursday-Saturday): International Conference on Advanced Machine Learning Technologies and Applications, Venue TBD, Cairo, Egypt.

30-31 March (Saturday-Sunday): International Conference on Architecture Engineering and Technologies, Grand Nile Tower Hotel, Cairo, Egypt.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe said.

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

1-3 April (Monday-Wednesday): Infra Africa & Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

2-5 April: APPO Cape VII petroleum and energy conference, Malabo, Equatorial Guinea.

4 April: Egypt’s Emirates NBD PMI for March released.

4-6 April: LafargeHolcim Forum for sustainable Construction, American University in Cairo.

9-11 April (Tuesday-Thursday): International Conference on Aerospace Sciences & Aviation Technology, Military Technical College, Cairo.

9-12 April (Tuesday-Friday): International Conference on Network Technology, The British University in Egypt, Cairo.

9-12 April (Tuesday-Friday): International Conference on Software and Information Engineering, The British University in Egypt, Cairo.

16-17 April (Tuesday-Wednesday): North Africa Iron and Steel Conference, Four Seasons Nile Plaza, Cairo.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

June: International Forum for small and medium enterprises (SMEs).

04-05 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

11-13 February (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.