- Egypt was the top destination in MENA for foreign direct investment last year. (Speed Round)

- FX reserves rise for the first time since February — stable outlook for the back half of the year? (Speed Round)

- Mass-transport app Swvl was hacked. (Speed Round)

- Al Ahly Capital reportedly aims to close El Nada Hospital acquisition within two months. (Speed Round)

- IDG launches e2 Alamein, Egypt’s first eco-sustainable industrial park. (Speed Round)

- No breakthrough on day 5 of GERD talks. (Diplomacy + Foreign Trade)

- Economy dominates conversation on Egypt in the international press. (Egypt in the News)

- Egypt’s private-sector waste management industry is struggling. Here’s why. (Hardhat)

- The Market Yesterday

Wednesday, 8 July 2020

Egypt was the top destination for FDI in MENA last year

TL;DR

What We’re Tracking Today

Good morning, nice people, and welcome to the day the team here thinks of as “almost-THURSDAY.” Yes, in all-caps. Tuesday hates us, today is almost-THURSDAY and tomorrow is the best day of the workweek (followed, oddly enough, by Sunday, but that’s another story).

Some good news to start the day: Even if it was in a down market, Egypt was the top MENA destination for foreign direct investment last year, accounting for 23% of total inflows. Meanwhile, foreign reserves ticked up last month as Egypt took receipt of an IMF facility according to yesterday’s CBE reserves report, and we have continuing signs that M&A remains very much on the agenda in 2020. Details on all this and more in this morning’s Speed Round.

New covid cases inched up slightly yesterday after slipping below 1k earlier in the week (the lowest figure since the end of May), but deaths continued their downtrend.

Food security remains a top priority as state grain buyer GASC remains aware that future covid flareups in major grain producers could see a return of the protectionist sentiment that prompted Romania and others impose or contemplate export bans earlier in the crisis. GASC issued yesterday an international tender for an unspecified quantity of wheat for shipment between August 8-18, according to Reuters.

So, what does a new normal look like? And when will we get there? There won’t be a sharp before-and-after, but rather a slow slide toward some approximation of normal, argues Obama administration health boss Andy Slavitt in this excellent thread of tweets. Good news: Progress on vaccines (plural) is moving along nicely, monoclonal antibody therapy for sick folks could be a game-changer, and every expert he’s consulted with is adamant that universal masking is going to be key to stamping out covid. All this and more if you hit the link.

SIGNS OF THE TIMES (or otherwise just worth reading — the FT knocked it out of the park this morning):

- What does an M&A boutique do when the [transactions] dry up? (FT)

- Global investors unwittingly subscribed to bonds issued by the Italian mafia. (FT)

- The world is falling apart as America implodes (FT)

- The Donald’s life is about to get complicated as his niece’s book is published (NYT)

And a reminder of a gentler time when we could all travel: Our friend Karim Helal, the finance veteran, is an accomplished street photographer who turned his lens on the least camera-friendly place in the Arab world — Morocco — back when we could all travel. He writes of the experience for Fujilove magazine.

The House continues to grind its way toward summer recess. Amendments to the Public Enterprises Act will be up for a vote in Parliament within a week, Minister Hisham Tawfik told ONTV E’s “Every Day” show. We have highlights of a busy day in parliament in the second half of Speed Round.

Inflation data for June is due tomorrow. Annual urban inflation cooled in May to 4.7% — its lowest level since November 2019.

Brokerage firms are required to submit license papers to the Financial Regulatory Authority through an online portal in the coming days. The FRA has given brokers three days to upload licensing, registration, and other documentation to an online platform recently developed to monitor and track brokers, according to a circular carried by the press. The authority rolled out online services earlier during the pandemic to limit visits to its headquarters.

COVID-19 IN EGYPT-

The Health Ministry confirmed 67 new deaths from covid-19 yesterday, bringing the country’s total death toll to 3,489. Egypt has now disclosed a total of 77,279 confirmed cases of covid-19, after the ministry reported 1,057 new infections yesterday. We now have a total of 21,718 cases who have fully recovered.

Investment in Egypt’s tourism industry expected to fall around 29% in FY2020-2021 to EGP 5.2 bn, from EGP 7.3 bn during the fiscal year that ended on 30 June, Planning and Economic Development Minister Hala El Said said yesterday, according to a statement. The National Planning Institute also said last month that tourism revenues will likely nosedive c.73% in 2020 as the pandemic continues to put a damper on leisure travel despite flights resuming earlier this month.

Reopened restaurants want more customers, longer opening hours: The Chamber of Tourism Establishments is lobbying the government to increase to 50% the 25% capacity limit on cafes and restaurants and allow the sites, which are required to close their doors by 10pm, to remain open until 1am, Chairman Adel El Masry told Hapi Journal. Some eateries had begun saying last month that they don’t want the government to permanently impose a 10pm closing time for restaurants and coffee shops.

ON THE GLOBAL FRONT-

Airborne coronavirus transmission a possibility, WHO says: The World Health Organization yesterday said that there is “evidence emerging” that the coronavirus may be spread through the air, a few days after hundreds of scientists called on the health agency to review its recommendations, Reuters reports.

A covid-19 vaccine might not be the panacea we’ve hoped it would be, top US virus expert Anthony Fauci warned, saying its protection would likely be “finite,” Bloomberg reports. A vaccine at this stage in the virus’ evolution will provide no long term solution but it may help us get through the worst of the first wave of infections, Fauci said.

The US has formally quit the WHO in the middle of a pandemic, but will remain a member of the organization until next July, leaving open the possibility that a Biden presidency could turn things around.

Brazil’s covid-sceptic president catches covid: Brazilian President Jair Bolsonaro has contracted covid-19 after repeatedly and vocally downplaying the seriousness of the disease since its outbreak and turning his homeland into an epicenter of the global pandemic with over 66k deaths, Reuters reports.

Meat consumption has dropped over 3% worldwide in 2020 as the pandemic hit demand, with restaurants closing their doors to customers, Bloomberg Green says, citing UN data. In the US, it is estimated that meat consumption won’t return to pre-covid levels until at least after 2025.

GLOBAL MACRO-

It’s a particularly downbeat morning on the macro front:

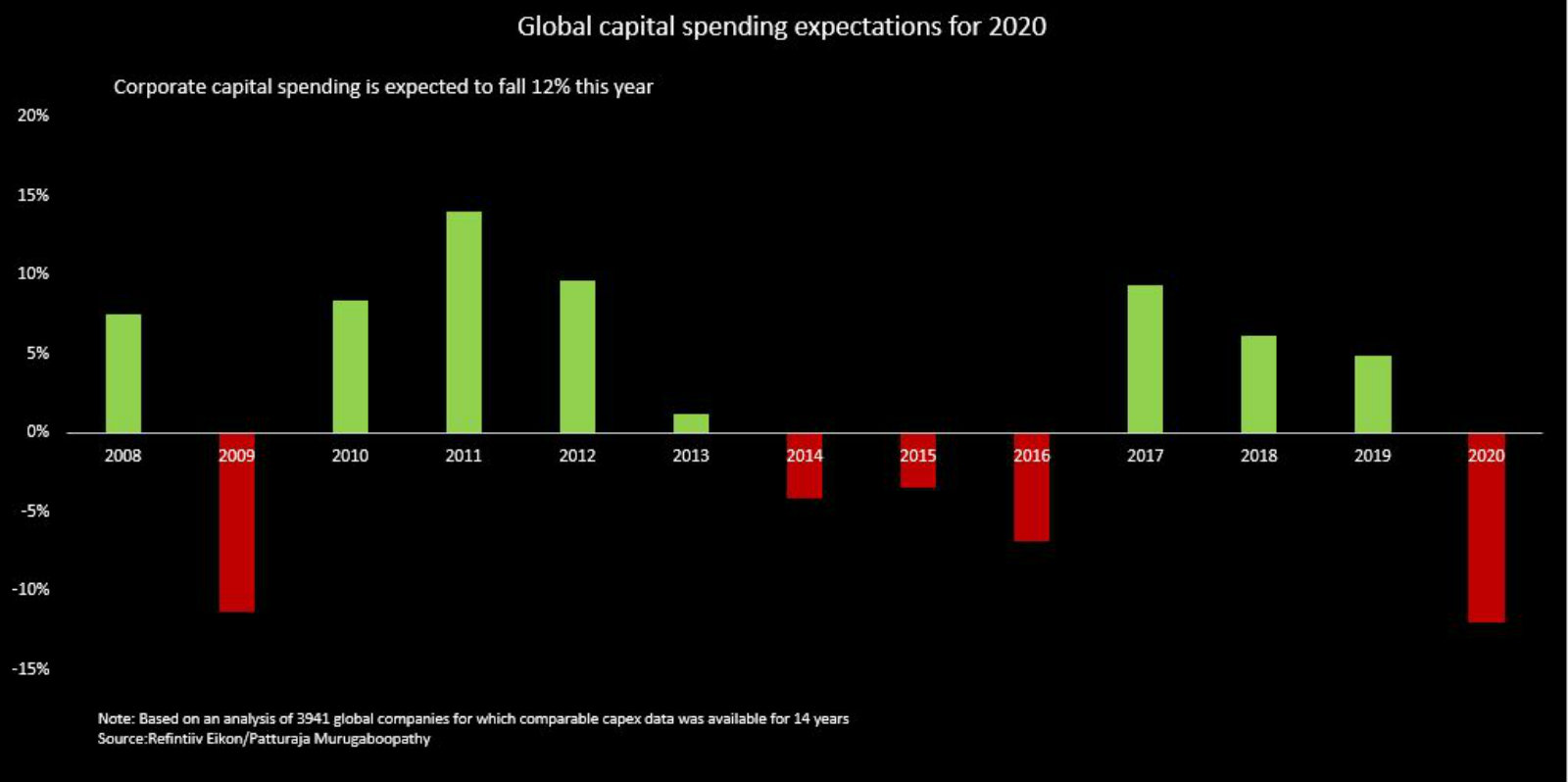

Global capex is set to plunge more this year than during the global financial crisis: Companies are set to slash capex by an average 12% in 2020 in response to lockdowns imposed to contain the coronavirus, Reuters reports, citing Refinitiv data. The anticipated fall in spending beats out the 11.3% drop seen in 2009 after the global financial crisis. Energy, consumer discretionary and real estate are expected to be the hardest hit sectors, with capex falling 25%, 23% and 20% respectively. As far as countries are concerned, US firms will cut spending by 22%, Russian companies by 22% and French by 13.4%. China, whose companies will only cut capex by 4.5%, is comparatively unscathed.

Europe’s economic outlook is looking even bleaker than it did two months ago: The EU has downgraded its economic projections for this year, now estimating that the continent will experience a 8.7% contraction, according to Bloomberg. Economic activity is projected to rebound during the second half of 2020, but the European Commission warned yesterday that the recovery will remain “incomplete” and “uneven” due to the social distancing measures, according to CNBC.

US voters are becoming increasingly pessimistic about the prospects of an economic rebound from covid, a Financial Times and Peter G Peterson Foundation poll found.

Policymakers seem to agree: Officials at the Federal Reserve are increasingly worried that the spike in coronavirus cases could cause further damage to the job market and consumer spending as existing stimulus programs expire, Reuters reports.

The African Development Bank has revised downwards its growth outlook for Africa and now projects that the continent’s economy will shrink 1.7% this year, Bloomberg reports. Look for that figure to hit 3.4% if the pandemic continues through the second half of the year, it added.

The Lebanese economy is going downhill fast, with more families plunging into poverty as the currency continues to take a beating, Bloomberg said. The LBP has plunged nearly 60% against the USD over the past month, “threatening to suck the economy into a hyper-inflation spiral.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: We look at why Egypt’s private sector waste management firms are struggling, and why the government’s pro-market reforms have failed to solve the waste sector’s woes.

Enterprise+: Last Night’s Talk Shows

It was a mixed bag on the airwaves last night: The IMF’s Egypt mission head dropped in for an interview on Masaa DMC, there was more non-news on the GERD talks on Ala Mas'ouleety, and EgyptAir’s boss revealed plans to increase flights this month.

Economic reform program is paying off under covid -IMF: Egypt entered the coronavirus crisis in a strong position compared to other emerging markets due to its perseverance with the 2016-2019 economic program, IMF mission chief for Egypt Uma Ramakrishnan told Masaa DMC’s Ramy Radwan in an interview last night. The reform program made it much easier for the government to access emergency funding from the IMF to tide it through the crisis, she said. In recent weeks the fund has approved more than USD 8 bn in new loans for Egypt: a USD 2.8 bn rapid financing instrument and a USD 5.2 bn standby facility. Ramakrishnan reiterated the IMF’s expectations for 2% growth in FY2019-2020 and FY 2020-2021. Watch the full interview (runtime: 25:33)

Deadlocked GERD talks: Ethiopia wants to encroach upon Egypt and Sudan's share of the Nile and operate the Grand Ethiopian Renaissance Dam (GERD) unilaterally, former irrigation minister Mohamed Nasr Eldin Allam told Ala Mas'ouleety's Ahmed Moussa. Allam said that Egypt has no objection to discussing share allocations but claimed that Ethiopia wants the freedom to change how it operates the dam without consulting Egypt and Sudan (watch, runtime: 12:23). Yahduth Fi Misr’s Sherif Amer reviewed a statement from the Irrigation Ministry, which also accused Ethiopia of intransigence during the talks (watch, runtime: 2:29).

EgyptAir’s new normal: EgyptAir will operate 35 flights every day by the middle of July, EgyptAir CEO Roshdy Zakaria told Moussa. He said that the airline is working at 20% of its staff capacity, and serves around 2-2.5k passengers a day for inbound flights, and 3-3.5k passengers for outward bound flights. Zakaria was downbeat on the recovery, telling Moussa that it is unlikely that the airline will see a return to pre-covid passenger levels before the middle of 2021 or a pre-covid flight schedule before 2023 (watch, runtime: 6:41).

Speed Round

Speed Round is presented in association with

Egypt was the top destination in MENA for FDI last year: Egypt attracted USD 13.7 bn worth of foreign direct investments(FDI) in 2019, putting it atop the Middle East and North Africa region league table, according to a report from the Arab Investment and Export Credit Guarantee Corporation (Dhaman). FDI inflows to Egypt accounted for 23% of total netted by MENA countries and was up 7% from 2018. Egypt also topped the chart of average value per investment at USD 98 mn and registered the highest average number of jobs created per project at 180 jobs.

The UAE ranked first in the region in terms of the number of projects, as the country saw 445 projects in 2019, followed by Egypt with 140 projects and Saudi Arabia at 134 projects. The three counties were also the sole destinations to move the needle on real estate investment, led by Egypt by a significant margin at USD 7.1 bn, followed by the UAE at USD 1.3 bn and USD 0.6 bn in Saudi Arabia.

These numbers are significantly higher than the figures put out by the UN last month: According to UNCTAD, Egypt received USD 9 bn in FDI during 2019 — an 11% increase from the year before — making it the biggest recipient of FDI in Africa.

FX reserves rise for the first time since February — stable outlook for the back half of the year? Foreign reserves rebounded slightly in June, rising to USD 38.2 bn from USD 36 bn in May after three consecutive months of decline, according to Central Bank of Egypt (CBE) data. Reserves have fallen almost USD 10 bn from a peak of USD 45.5 bn since the outset of the covid-19 pandemic in March as foreign capital fled the country, the vital tourism industry shut up shop, and the central bank stepped up purchases of strategic commodities and met debt repayments.

The disbursal of the first tranche of the IMF standby loan may be responsible for the uptick, Reuters quoted Naeem Brokerage’s head of research Allen Sandeep as saying. The IMF approved the immediate disbursal of the first USD 2 bn tranche of the USD 5.2 bn facility at the end of last month. The CBE did not provide an explanation on the increase.

Expect reserves to stay roughly flat until year’s end: “We expect foreign reserves to be largely flat until the end of the year, as the interbank market is well funded to deal with the non-essential trade balances,” Sandeep said.

Swvl was hacked: The mass-transport app said yesterday that it faced a security breach involving “unauthorized access” to its system earlier this month. Swvl claims it has yet to find evidence that customers were “directly impacted” by the breach and that sensitive data such as passwords and credit card information were not exposed. The company has not said how many user accounts were affected or what information may have been taken. It has also not said whether it believes the attack was by criminals, a competitor or a state actor.

M&A WATCH- Al Ahly Capital reportedly aims to close El Nada Hospital acquisition within two months: Al Ahly Capital Holding, the investment arm of the National Bank of Egypt, is in the final stages of negotiations to purchase a majority stake in maternity care-focused El Nada Hospital, the local press reports, citing unnamed sources. The agreement is expected to be signed within two months. There’s no news yet on valuation or the size of th stake Ahly is going after. The acquisition comes as part of Al Ahly’s plans to invest USD 150 mn in Egypt’s healthcare sector. CEO Karim Saada said in May that the fund intends to set up a JV with Emirati MBF Group and announced that an unnamed hospital will be its first purchase.

Smart industrial park developer and operator Industrial Development Group (IDG) launched yesterday Egypt’s first eco-sustainable park, e2 Alamein, in New Alamein City, according to a statement (pdf). The park pitches tenants on the benefits of “multiple trade agreements, including COMESA, GAFTA, Egyptian-European partnership, and others.” The 2.7 sqkm park will provide its tenants with services designed “to provide a conducive environment where businesses can thrive,” including a licensing center, 24-hour emergency and maintenance services, internal transport, conference spaces, food outlets, and banks. Industrial properties available in e2 Alamein are as small as 3,000 sqm, while warehouses and pre-built workshops start at 400 sqm.

Background: IDG is also the developer of the East Port Said Industrial Zone, where it broke ground a year a go, MD Shady William notes.

Gov’t announces “seriousness” fees for settlement of building code violations: Prime Minister Moustafa Madbouly announced the values of fees required to demonstrate seriousness for applicants seeking to settle building code violations, in a meeting with the ministers of finance, housing and local development on Tuesday, a cabinet statement said. The fees must be submitted alongside the settlement applications, and will be deducted from the overall charges if the applications are accepted. Demolition procedures will commence right away for rejected applications.

Applicants who have already submitted settlement requests can start paying their fees from 15 July. There is currently a backlog of 325k such applications. For new settlement applicants, the deadline will be 30 September.

The new fees must be brought in line with current building legislation, House Housing Committee member Ihab Mansour told Al Mal. Legislation stipulates that applicants must pay at least 25% of the overall violation fees in a lump sum within 60 days of the application being accepted, or in quarterly installments over a maximum of three years.

LEGISLATION WATCH- The Unified Tax Act is making its way to the House general assembly: The House Planning and Budgeting Committee has wrapped up discussions of the proposed Unified Tax Act ahead of handing over a report for a vote on several last-minute changes in the upcoming plenary session, Al Mal reported. The committee scrapped a contentious clause that would have required prosecutors to obtain the finance minister’s permission to go after tax officials who have claims filed against them. The committee also approved on Monday adding real estate taxes to a planned single tax filing platform that will be set up when the bill becomes law. The platform had previously only allowed taxpayers to file income tax, stamp tax and VAT returns.

BRIEFLY NOTED- People released from prison on parole will be able to report to police stations or precincts near their residence regardless of where they committed the crimes for which they were convicted, according to proposed amendments to a law regulating the conditional release from prison that received a committee nod from the House yesterday.

LEGISLATION WATCH- You can get consumer finance for just about anything now: Consumers will now be able to pay for more products in installments after the Financial Regulatory Authority (FRA) approved a list of new goods eligible for financing under the consumer financing law, according to Hapi Journal. Consumer finance companies can extend credit for the purchase of furniture, clothing, jewelry, medical products, toys, books, food and auto parts under the ruling. This comes as part of government efforts to stimulate consumer spending and support the economy through the covid-19 pandemic.

Egypt’s natural gas exports to Jordan look set to decline over time as the Hashemite Kingdom aims to generate half of its energy needs as part of its 2030 vision, up from its current 15% self sufficiency, Reuters reports. The move is both cost related, as the global pandemic has brought into sharper focus that it imports 93% of its total energy supplies — a sizable 8% of its GDP — as well as an effort to lean into a reliance on greener energy.

Falling demand from Jordan is already contributing to Egypt’s LNG oversupply. A healthy supply line had resumed after a rupture of natural gas supplies from Egypt from 2011-2015, a once dependable lifeline the report notes, but that may prove short-lived given Jordan’s new energy strategy.

MOVES- Hassan El Aroussy (Linkedin) has been appointed as CEO of Amer Group subsidiary Porto Club Sports Investment, according to an EGX disclosure (pdf). El Aroussy was previously the sports executive director at Wadi Degla Clubs and the sports development director at Sodic.

Ernst & Young has tapped Ahmed Al Esry (LinkedIn) as MENA head of tax consultancy services, according to Hapi Journal. Al Esry has been working with the firm for the last 20 years, serving in the auditing and tax service departments.

Trade and Industry Minister Nevine Gamea will stay on at the helm of the government’s MSME Development Agency for another one-year term, according to Al Mal. Prime Minister Moustafa Madbouly also tapped Tarek Shash as deputy CEO of the agency.

Egypt in the News

For the first time in a long time, business and the economy are leading the conversation on Egypt in the foreign press. Bloomberg looks at the uptick in recent unemployment figures and a Capmas survey showing falling household income, saying that while the outlook for the economy is improving as covid-19 restrictions are lifted, policymakers need to “translate” these gains into an improved labor market. Elsewhere, the CFA Institute looks at how ongoing economic and structural reforms have helped “steady the nerves of foreign investors” in Egypt’s financial markets.

The fraught GERD negotiations are continuing to receive plenty of attention: The Financial Times and the Times both take stock of recent events as Ethiopia prepares to fill the Nile dam amid deadlocked negotiations.

Diplomacy + Foreign Trade

Day 5 of GERD talks finish with no breakthrough: Positions remained entrenched during the fifth day of high-stakes talks over the future of the Grand Ethiopian Renaissance Dam (GERD), with Egypt, Ethiopia and Sudan still unable to agree a framework for filling and operating the dam. Parallel meetings were held by the countries’ legal and technical teams yesterday ahead of more bilateral talks to be held today, according to the Egyptian Cabinet.

Meanwhile, Ethiopian PM Abiy Ahmed is continuing to play hardball, telling Al Arabiya that Ethiopia is set to begin filling the dam’s reservoir to take advantage of the ongoing heavy rain season. Ahmed said that the move is not meant to hurt Egypt and Addis Ababa still intends to reach an agreement with downstream Cairo and Khartoum over the dam through the ongoing talks.

Egypt, France, Germany, and Jordan warn Israel on West Bank annexation: The foreign ministers of Egypt, France, Germany and Jordan have warned Israel that attempts to annex parts of the West Bank will harm diplomatic ties and have “serious consequences” for regional stability in a joint statement published by the German Foreign Ministry. The four countries said that they will not recognize any changes to the 1967 borders and that unilateral moves would be a violation of international law.

Egypt’s private-sector waste management industry is struggling. Here’s why. Almost two decades ago, Egypt embarked on a mission to manage waste properly instead of using traditional open air incineration or dumping waste in unsanitary landfills. Key to what policymakers hoped would be a landmark change: Giving the private sector an incentive to process waste and recycle part of it into intermediary raw materials. To back the strategy, the government allocated bns of pounds of investment and took on loans and grants from multilateral organizations, international cooperation agencies, and western governments, the head of the Waste Management Regulatory Authority (WMRA) Ahmed El Berri tells Enterprise.

But the private sector end of that program has stalled with as many as 15 companies closing down since 2013, says Karim El Sabee, CEO of waste management company Reliance Investments.

The private sector couldn’t find a way around structural problems in the industry, including the lack of a nationwide collection infrastructure and a market that is no longer conducive to the byproducts of recycling, according to industry players we’ve spoken with. On top of that, the government stopped paying service fees to recyclers who handle waste — which had been mitigating these structural issues. Private sector players are now asking the government to step in with incentives to save the industry.

Why did the gov’t turn to the private sector on waste management in the first place? The short answer: Waste management is an expensive process. Egypt produces 50k-60k tonnes of solid waste per day, totaling 22 mn tonnes annually, WMRA’s El Berri tells us. The process starts (pdf) with collection at the source (the home or company). The cost of waste collection alone amounts to USD 30-75 (EGP 480-1,1122) per tonne in lower and middle income countries. In Egypt, the cost could roughly reach some EGP 480 per tonne, according to Hisham El Sherif, CEO of Qalaa Holding-owned waste management company ECARU.

A fee to cover the costs of collection barely scratched the surface: The government passed legislation in 2005 establishing a solid waste collection fee, which is tacked on to the electricity bills paid by households and businesses. The problem is that the fees are collected only in major urban centers (Cairo and Alexandria), leaving local councils of other governorates to fund the process themselves or rely on local associations and NGOs. This has meant that the fees cover only 20% of the costs of collecting waste, El Sherif tells us.

The government tried to bring the private sector into the equation back in 2012. The National Solid Waste Management Program (NSWMP) landed funding from the European Union and Germany to build dedicated waste management departments in Gharbiya, Kafr El Sheikh, Assiut, and Qena. The idea was that the private sector would then get incentives to come in and handle processing and recycling. The government would provide waste management companies with waste at no charge and lease them the land to build recycling facilities, whose byproducts would then be able to sell. In some cases, companies are also contracted to collect the waste themselves.

Companies were also promised a variable incentive fee to handle the solid waste, with the fee negotiated on a per-company basis that factored in what services they delivered. ECARU, one of the first companies to benefit from the system, was paid EGP 78 per tonne to process garbage, El Sherif told Enterprise. These service fees were funded in part through the NSWMP. Another company, Nahdet Misr (a subsidiary of Arab Contractors), was paid an annual fee of EGP 850k when they were hired in 2011, the company’s vice chairman Osama Elkholy tells us.

These companies would then be expected to recycle 65-80% of the waste they receive — an ambitious target as the rate is only 39% in high income countries, El Sherif told Enterprise.

…and then sell any byproducts they produce: On top of the service fee, waste management companies earn revenues through the sale of byproducts. The highest value can be obtained from recyclables (cans, plastics, and glass), which yield up to USD 70 / tonne, while refuse-derived fuel (RDF) is sold to cement factories at USD 30 / tonne and compost to farms for USD 3 / tonne, according to El Sherif.

But the hurdles in the system start at the source — collection: Only 20% of the total waste is actually brought to companies for recycling due to the lack of adequate garbage collection and transportation systems, Reliance’s El Sabee told us. High-value recyclables account for just 0.5% of total recyclable waste, he added. Garbage is only collected from homes in the Greater Cairo area, while the rest of the country’s residences either have to find their own dumpster or make arrangements by informal garbage collectors and salvagers (such as the Zabbaleen) every morning — and the Zabbaleen thus get first pick of high-value recyclables, according to El Sabee. The lack of an official system outside the capital has been a serious concern for citizens and officials alike. The local press reports that even major cities such as Alexandria have issues and that the problem is acute enough that some hospitals lack access to proper waste disposal.

The problem with selling RDF: Though this use of waste was promising, it is now barely surviving and at least a dozen companies have been forced to shut down, Reliance’s El Sabee says. During the natural gas shortage of 2012, RDF emerged as a potential alternative fuel to gas and coal for cement production. But the drop in coal prices has pushed companies away from RDF, he explained. Coal prices have halved since the beginning of 2019, while the EGP has appreciated, which cut the import cost of coal by about 50% down to EGP 1,100 / tonne. Local coal coke is even cheaper at EGP 750-800 / tonne. In addition to being more cost efficient, coal is also more reliable than RDF, generating twice the thermal energy that RDF does.

The problem with selling WtE: Waste-to-energy (WtE) has been touted by the government as a big win for private sector companies entering the space. El Berri says that 93 companies bid in a pre-qualification tender last month to build new WtE projects, tempted by a high energy tariff of EGP 1.40/ kWh. But as we noted in our series on how the renewable energy sector is faring amid covid-19, Egypt now has too much generation capacity, which is threatening to temporarily halt investment in renewables and alternative energy. “Why would a factory buy electricity produced from waste at this high price when electricity is already available for a cheaper price?” El Sherif asked. WtE is in an even worse state than renewables thanks to the availability of solar and wind — and the decreasing costs of renewables compared to generating electricity from waste.

The problem with selling compost: Selling compost isn’t profitable, says Nahdet Misr’s El Kholy — it costs EGP 200 to produce a ton of compost that sells for just EGP 50.

Service fees, which had become the lifeblood of struggling companies, are off the menu. Companies that entered after 2013 were unable to negotiate a service fee and relied exclusively on proceeds from selling the byproducts they obtained from processing waste, El Sabee said. El Berri told us that the government paid a “service fee” to companies as an incentive in the beginning to help jumpstart the market, but stopped paying it after more investors entered the fray. When Reliance Investments started in 2015, they were fully dependent on the revenues from selling RDF until that market collapsed. Similarly, Nahdet Misr’s 2011 contract in Alexandria expired in 2015 and, when renewed in 2016, they were unable to obtain the service fee.

Industry players now want the government to step in with a lifeline — starting by bringing back service fees. Selling waste byproducts can eventually become a profitable business in a regulated market with government support, but until then, it is not, El Sabee said. The collection and transport of waste alone costs the state, so investing in a better waste management system would reduce the volume of this waste, cut its impact on the environment, and introduce cheaper recycled raw materials, El Sabee said. Globally, the average annual fee for recycling and burying waste in sanitary landfills is USD 33-120 / tonne, which is why waste management companies want to negotiate with the government a similar fee, which they think should come in at around EGP 650 / tonne, El Sherif said.

Who usually foots the bill? El Sherif highlights a report from the World Bank, which notes that local governments represent about half of global waste services investments, with national governments subsidizing 20%, and the private sector accounting for 10–25%. In the NSWMP case, Egypt, supported by international lenders, fostered dedicated waste management departments and tapped new investments that benefit over 29k households, El Berri told Enterprise. “The government has been very supportive of the local industries and offered several initiatives to help,” El Kholy said, highlighting the recent discounts on electricity and natural gas. “We only want to have similar incentives.”

Cabinet is reviewing the requests: Several companies pitched their ideas to former environment ministers and Prime Minister Moustafa Madbouly back in December 2018, El Sherif said. El Berri told Enterprise that the government is aware of the demands and has prepared a study, which is now with Madbouly for review.

Can a new waste regulatory authority come to the rescue? The House Environment Committee has greenlit the establishment of a new independent authority for the waste management industry, after the Madbouly Cabinet approved the proposal last year. Although representatives were apparently hesitant to approve the legislation for fear of generating losses, the Environment Ministry’s legal advisor argued it would, in fact, solve some of the constraints that face the current regulators, such as concluding new contracts. Having a single body set policy for a fragmented market would be a strong start, El Sherif says. But perhaps, this agency’s greatest role in solving the current crisis is acting as a single point of contact and grievance for companies looking for rescues, he added.

Correction (08/07/2020): A previous version of this article incorrectly stated that Karim El Sabee is the CEO of Reliance Logistics. El Sabee is the CEO of Reliance Investments.

The top infrastructure stories of the week:

- IDG launched the country’s first eco-sustainable industrial park. We have the story in this morning’s Speed Round, above.

- The government is banning residential construction in certain overpopulated urban neighborhoods.

- Fourteen railway signaling systems being upgraded by Thales International will be completed by December 2020, according to Transport Minister Kamel El Wazir.

- 16k sqm of land in Upper Egypt is up for grabs without charge to investors as part of the government’s plan to develop Upper Egypt’s governorates.

The Market Yesterday

EGP / USD CBE market average: Buy 15.99 | Sell 16.09

EGP / USD at CIB: Buy 15.97 | Sell 16.07

EGP / USD at NBE: Buy 16.01 | Sell 16.11

EGX30 (Tuesday): 11,050 (-0.3%)

Turnover: EGP 1.8 bn (111% above the 90-day average)

EGX 30 year-to-date: -20.9%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.3%. CIB, the index’s heaviest constituent, ended down 0.5%. EGX30’s top performing constituents were Sodic up 7.0%, Orascom Development up 3.5%, and Egyptian Resorts up 2.4%. Yesterday’s worst performing stocks were Ezz Steel down 3.4%, TMG Holding down 2.4% and Porto Group down 2.4%. The market turnover was EGP 1.8 bn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -142.7 mn

Regional: Net short | EGP -3.7 mn

Domestic: Net long | EGP +146.4 mn

Retail: 47.6% of total trades | 46.9% of buyers | 48.4% of sellers

Institutions: 52.4% of total trades | 53.1% of buyers | 51.6% of sellers

WTI: USD 40.49 (-0.34%)

Brent: USD 42.93 (-0.39%)

Natural Gas (Nymex, futures prices) USD 1.88 MMBtu, (+2.73%, August 2020 contract)

Gold: USD 1,807.50 / troy ounce (+0.78%)

TASI: 7,400 (+0.13%) (YTD: -11.79%)

ADX: 4,341 (+0.52%) (YTD: -14.48%)

DFM: 2,097 (+0.50%) (YTD: -24.12%)

KSE Premier Market: 5,636 (+0.16%)

QE: 9,243 (+0.51%) (YTD: -11.33%)

MSM: 3,503 (-0.23%) (YTD: -12.01%)

BB: 1,280 (+0.28%) (YTD: -20.64%)

Calendar

12 July (Sunday): Postponed court session for the appeal filed by the Egyptian Resorts against the Tourism Development Authority

15 July (Wednesday): STC will reportedly announce at 5pm Riyadh time whether it intends to go through with its offer to acquire a controlling stake in Vodafone Egypt.

23 July (Thursday): 23 July revolution anniversary, national holiday.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

5 August (Wednesday): IHS Markit PMI for Egypt released.

11-12 August (Tuesday-Wednesday): Senate elections take place.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

23-31 October (Friday-Saturday): Updated dates for El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

12-15 May (Wednesday-Saturday): Eid El Fitr (TBC).

10 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

22 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.