- Private sector activity dropped in January after the EGP devaluation. (Economy)

- AAIB could sell its Palm Hills stake to Emirati investor. (M&A Watch)

- A temporary capital gains tax waiver is on the table following the deval. (Taxation)

- Concord plans USD 40 mn investment in Egypt’s healthcare sector. (Investment Watch)

- Foreign reserves rise more than USD 200 mn in January. (What We’re Tracking Today)

- TransMin denies ADP-Suez Port talks. (Also on our Radar)

- Middle East executives are among the world’s most optimistic on growth. (A Message From HSBC)

- KSA warns of energy shortages on back of oil sanctions, lack of investment. (Planet Finance)

- How ready are Egypt’s schools for edtech? Part 2 of 2. (Blackboard)

Monday, 6 February 2023

AM — EGP devaluation pushes private sector into sharper decline in January

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people. It’s a good-news, bad-news kind of morning as we all continue adapting to our new FX and inflationary realities.

GOOD NEWS- Officials are reportedly considering a delay in collecting taxes owed by domestic investors on capital gains they made trading on the EGX last year. We also have plenty of M&A and investment news for you this morning to keep things interesting.

AND- Foreign reserves inched up again, rising to USD 34.2 bn in January from USD 34 bn the previous month, according to central bank data out yesterday. Reserves have been on a gentle upward slope the past five months and are now up by more than USD 1 bn since the end of August. Reserves fell 20% last spring on the back of the war in Ukraine and tightening financial conditions globally.

BAD NEWS- The Finance Ministry has no intention of scrapping its plan to hike wage taxes, we’re told. The Finance Ministry last month proposed legislative amendments that would create a new 27.5% personal income tax rate on salaries of more than EGP 800k a year — a change that won’t be revised by policymakers, our sources tell us. Annual earnings over EGP 400k are currently taxed at a top rate of 25%.

Oh, and the monthly PMI reading? It was worse in January — hardly a surprise as we all adapt to our new FX reality following last month’s devaluation.

^^ We have the rundown on all of this and more in this morning’s news well, below.

*** HOW ARE YOU FEELING ABOUT 2023? Let us know in our annual Reader Poll.

Want to have a meal with us? Leave your name, email, mobile number, and where you work in the box for “Is there anything else you want to tell us.” We’ll be inviting eight participating readers to a meal at one of our favorite restaurants.

HAPPENING TODAY-

It’s a busy Monday in the Senate:

- The Financial and Economic Affairs Committee will review a study calling for the expansion of private and public freezones;

- Supply Minister Ali El Moselhi will brief the Industrial Committee on strategic commodities reserves and the ministry’s preparations for Ramadan;

- The Housing Committee will discuss the Housing Ministry's electricity rationing plan;

- The Education Committee will review the government's digital transformation policy;

- The Agriculture Committee will debate hurdles facing the poultry industry;

- The Culture Committee will go over policies to promote religious tourism;

- The Senate will continue debating a report on family violence.

REMINDER- The House is still on break, with MPs due to reconvene on Sunday, 12 February.

Operation Save Lebanon: Egyptian officials are attending an international meeting in Paris called by France to discuss how to end a political impasse in crisis-hit Lebanon, AFP reports, citing statements by the French Foreign Ministry’s spokesperson. Officials from Saudi Arabia, Qatar and the US will also be in attendance.

It’s the last day of the Cairo International Book Fair: Today is your last chance to attend this year’s fair at the Egypt International Exhibition Center.

THE BIG STORY ABROAD-

There’s a presidential election going on in one of our closest EastMed allies: Former Cypriot FM Nikos Christodoulides will face off against leftist-backed candidate and career diplomat Andreas Mavroyiannis in runoff elections on 12 February, according to Reuters. Christodoulides grabbed 32% of yesterday’s first-round vote while Mavroyiannis unexpectedly came second at 29.6%.

MEANWHILE- The global business press continues to be transfixed by the Chinese balloon shot down by the US on Saturday: Reuters | AP | Bloomberg | FT | WSJ | NYT | Washington Post.

AND- Former Pakistani president Pervez Musharraf dies in Dubai: Pervez Musharraf, the army general who seized power in Pakistan’s 1999 military coup and remained president until 2008, died on Sunday at a hospital in Dubai aged 79, following a prolonged illness and years in self-imposed exile, CNN reports.

CLOSER TO HOME- Egypt and Qatar held their first political consultations since patching things up in 2021. Senior officials from the countries’ foreign ministries discussed regional and international developments, including the situation in Palestine, during talks in Cairo. (Egypt Foreign Ministry statement | Qatar News Agency)

For the iSheep ultras: Speculation is mounting that Apple could be gearing up to launch a new ultra-premium iPhone model carrying a higher spec than the Pro Max. Bloomberg’s Mark Gurman writes that the company has discussed debuting an “Ultra” version of the iPhone above both Pro models in time for the launch of the iPhone 16 in 2024. “It’s unclear how that top-of-the-line model would be different, but it will probably offer further camera improvements, a faster chip and perhaps an even larger display. There also may be more future-forward features, such as finally dropping the charging port,” Gurman wrote in his weekly Power On newsletter.

|

COME TO OUR NEXT ENTERPRISE FORUM-

We’re excited to unveil our next C-level event: The Enterprise FDI + Exports Forum, where we will take a deep dive into two of the most critical topics affecting our community.

Exports and foreign direct investment (FDI) have never been more important to our economy — or our businesses — than in the wake of the float of the EGP. We think we have a once-in-a-lifetime chance to build an export-led economy that makes us a magnet for FDI and all the benefits that will come with it for our nation.

Want to join the conversation? Drop us a line on events@enterprisemea.com.

ICYMI-

Missed this week’s Inside Industry? In our weekly vertical exploring all things industry and manufacturing, we looked at the fertilizer industry in Egypt, which is broadly expected to have another strong year in 2023 — albeit with a slight slowdown as market dynamics shift.

CIRCLE YOUR CALENDAR-

Palestine talks in Cairo: Hamas leader Ismail Haniyeh is expected to fly into Cairo this week to hold talks with Egyptian intelligence chief Abbas Kamel and other security officials, a Hamas spokesperson said in a statement picked up by the Jerusalem Post. The secretary of Palestinian Islamic Jihad was in Cairo yesterday for talks, the Israeli newspaper reported. The invite came days after Kamel visited Ramallah for talks with Palestinian President Mahmoud Abbas and other officials in a bid to end the recent violence in the West Bank and Jerusalem.

Inflation: The CBE and Capmas will publish inflation data for January in a few days.

Unis go back this week: The second semester of the 2022-2023 academic year begins for public universities on 11 February.

Petro-show next week: Oil and gas industry figures from Egypt and the region will congregate at the Egypt International Exhibition Center for the Egypt Petroleum Show (Egyps) starting next Monday. The three-day conference runs 13-15 February.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed.

In today’s issue: We look at how edtech could be the perfect fix to address challenges in the Egyptian education sector in the second part of this Blackboard two-parter. Last week, we examined the prospect of the current edtech adoption in Egypt and why British companies want in.

Experience a time of serenity and breathtaking views of the Red Sea where you get to enjoy life as it should be, only at Somabay. A gateway for the perfect winter vacation where you can combine all your vacation elements from one place. For more information, kindly contact us at 16390 or www.somabay.com.

ECONOMY

EGP devaluation pushes private sector into sharper decline in January

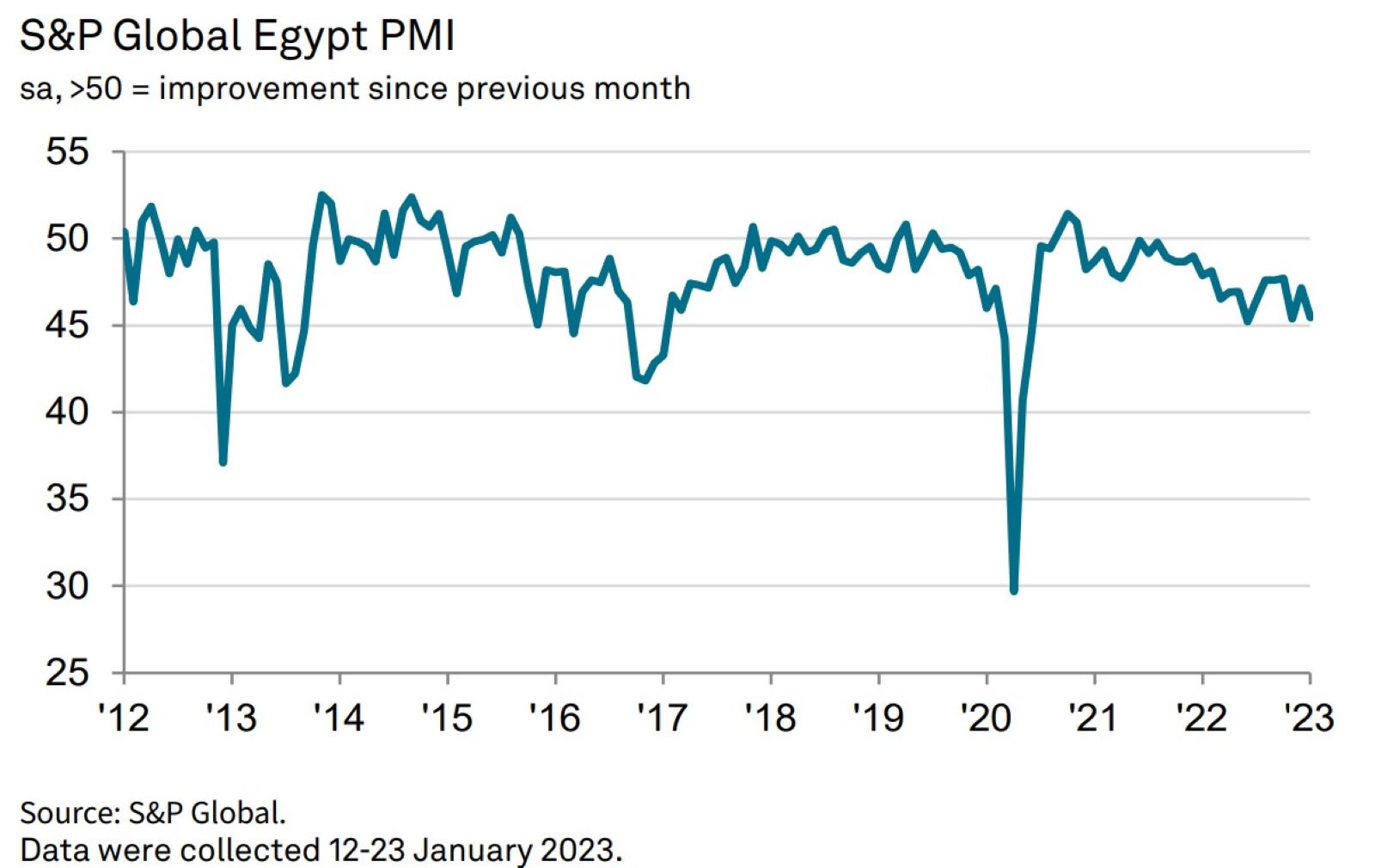

Private sector starts the year with sharper contraction: Activity in Egypt’s non-oil private sector contracted for the 26th consecutive month in January as high inflation continued to weigh on businesses, according to S&P Global’s purchasing managers’ index (pdf).The PMI reading fell to 45.5 in January from 47.2 a month before, dropping further below the 50.0 mark that separates growth from contraction. “The reading indicated a sharp deterioration in the health of the non-oil sector that was one of the quickest seen in the current 26-month sequence of decline,” S&P Global said.

EGP depreciation drives inflation: Purchasing costs rose at their fastest pace in 4.5 years as the January devaluation of the EGP added to inflationary pressures, with half of those surveyed reporting a rise in purchasing costs during the month. Output prices increased at their fastest in nearly six years, as businesses passed on rising costs to clients.

And inflation suppresses activity: “TheP build-up of inflationary pressures led to a marked and faster decline in new business inflows,” S&P wrote. The contraction in activity was exacerbated by ongoing supply issues at some firms thanks to import restrictions and a foreign-currency shortage. Amid this backdrop of high prices, falling demand, and supply shortages, managers cut purchasing at their steepest pace in the 12-year history of the PMI survey.

Employment fell for the third time in four months, though staff costs rose as employers hiked salaries amid high inflation.

Looking ahead: Confidence among purchasing managers hit its third-lowest level in the PMI’s history amid a “gloomy” outlook on inflation, S&P Global Senior Economist David Owen said. Sell-side price hikes suggest “inflation could climb further from December's 21.3% and remain elevated throughout much of the year,” he said, echoing the sentiment of all seven analysts we polled recently. “The USD shortage added significantly to Egypt's economic challenges in 2022 and will likely remain a major problem this year,” he said.

The story is getting ink in the foreign press: Reuters | Bloomberg.

FROM THE REGION-

Saudi Arabia’s non-oil private sector registered its second-fastest growth since September 2021 on the back of easing inflation and rising optimism, according to the country’s PMI (pdf).

Non-oil business activity in the UAE also remained strong in January, with output and new orders both rising sharply, according to the PMI (pdf). This was the lowest PMI reading in a year for the UAE, which has enjoyed a strong recovery from the pandemic since 2021.

TAXATION

A temporary capital gains tax waiver is on the table following the deval

EGX investors could be in line for a fresh capital gains tax break: Proposed amendments to the Income Tax Act have been pulled from the House while policymakers consider amending capital gains tax (CGT) rules in response to the current exchange-rate volatility, two government sources told Enterprise. Under the proposal, CGT on gains from stock trades made by resident investors in fiscal year 2022 would not be due until after the new tax legislation is passed. Policymakers are still mulling additional changes to how the CGT may be implemented, including timing.

The thinking: Keep the EGX attractive. Policymakers are considering setting aside the tax to mitigate the negative impact of the EGP’s devaluation on local investors. Their thinking: Local investors have been at a disadvantage (in EGP buying power terms) compared with foreign investors who were able to take larger positions for less (in USD terms). The currency has fallen sharply against the greenback over the past year on the back of global headwinds and a local FX shortage.

This has institutional backing: Among those pushing for the tax break are the Egyptian Stock Exchange, the Financial Regulatory Authority, and several undisclosed financial institutions.

There are no plans to scrap the tax entirely: The government isn’t planning on reversing its decision to re-introduce the capital gains tax, but policymakers are working on a new package of incentives to drive foreign investment in the market, one source said.

This isn’t the first time we’ve seen CGT breaks since its reintroduction: The Madbouly government in March slashed the capital gains tax on gains made from IPOs on the EGX by 50% for a two-year period and created a tax exemption for share-swaps between listed and unlisted companies, as part of an EGP 130 bn stimulus package that followed the March devaluation.

More tax incentives to come: The state is looking into introducing more incentives to draw investments in securities and investment funds, taking into account exchange rate changes and interest levels.

The current rules: A 10% capital gains tax on EGX transactions was reintroduced last January for resident investors (foreign investors in the bourse are exempt). Investors pay the tax on net portfolio earnings calculated at the end of the tax year, minus brokerage fees. Policymakers first said they were going ahead with a CGT in 2015, delayed, then set it aside in favour of a 0.125% stamp tax in 2017 and shelved the CGT for a three-year period. They then put on hold again until the start of last year thanks to the pandemic.

LOOKING AHEAD- We are bracing for more tax changes in the coming weeks: The Madbouly government is set to unveil its tax policy document in the coming few weeks.

The EGX has been on a tear on the back of the devaluation: The benchmark EGX30 index has risen 11.4% since the start of the year; it was up nearly 20% at the start of last week being hit by a wave of profit-taking. The index has almost doubled since falling to six-year lows last June.

M&A WATCH

AAIB could exit Palm Hills in stake sale to Emirati investor

Yesterday in M&A: Palm Hills’ second-largest shareholder could be about to sell its entire stake to an Emirati investor. Also yesterday, International Company for Medical Industries shareholders greenlit proposals to acquire a majority stake in a Mansoura-based textiles company.

AAIB ON ITS WAY OUT OF PALM HILLS?

Palm Hills could get new UAE shareholders: Arab African International Bank (AAIB) is looking to sell its entire 12.7% stake in EGX-listed Palm Hills Developments to Emirati investment company Al Ain Holding, sources familiar with the matter reportedly told Asharq Business. Palm Hills representatives were not available for a comment when Enterprise reached out yesterday.

AAIB is Palm Hills’ second-largest shareholder after the company’s founding Mansour family, which collectively owns around 49%. The remaining stake is divided among minority shareholders and freefloat shares on the EGX.

About Al Ain Holding: Founded by UAE royal Sheikh Hamdan Bin Zayed Al Nahyan, the Abu Dhabi-based investment company’s portfolio spans residential, commercial and industrial properties, hotels, and schools. Most of the company’s portfolio is located in the UAE, but it also owns commercial properties in London.

Palm Hills is growing fast: The company posted record-high net income of EGP 911 mn in 9M 2022, up 43% y-o-y, as well as all-time high revenues of EGP 9.5 bn, up 62% y-o-y. New sales rose 36% in the nine-month period.

The market welcomed the news: Palm Hills shares gained 10.3% yesterday to close at EGP 2.24.

Gulf investors are eyeing our real estate sector: The state-owned parent of Heliopolis Housing is in talks with Gulf investors to sell off land and other assets, according to local media. The government is fielding several offers from Arab investors to buy land in hard currency. The UAE’s Aldar and ADQ together acquired more than 85% of upmarket real estate developer SODIC in late 2021. Our Gulf neighbors last year pledged over USD 22 bn in total to support the economy amid the fallout from the crisis in Ukraine, with Abu Dhabi’s ADQ and Saudi’s Public Investment Fund investing a combined USD 3.1 bn in government-owned shares in EGX-listed companies.

ICMI TO PROCEED WITH BANFF ACQUISITION-

ICMI shareholders greenlight Banff acquisition: Shareholders of the International Company for Medical Industries (ICMI) approved plans to acquire a 72% stake in Mansoura-based textiles company Banff Non Wovens after approving the results of a fair value study valuing the company at some EGP 39.2 mn, according to an EGX disclosure (pdf).

INVESTMENT WATCH

Concord to invest USD 40 mn in Egypt’s healthcare sector

Concord to target Egypt’s healthcare sector: US-based, Egypt-focused asset manager Concord International Investments plans to establish a USD 40 mn company to invest in the country’s healthcare sector, Chairman Mohamed Younes told Asharq Business in an interview. The company will deploy funds in feeder industries for the healthcare sector, such as the production of medical equipment and supplies, he said, adding that it will begin raising capital from local and global investors starting the second half of the year.

The company has been involved in Egypt’s healthcare sector for years: Concord was part of a consortium that acquired 98% of Amoun Pharma for USD 500 mn back in 2007, a transaction which the company describes as one of the largest private-equity transactions ever in Egypt.

Concord is the second private-equity player to signal healthcare investment in recent weeks: B Investments and the Sovereign Fund of Egypt announced a partnership last month that could channel more than EGP 2 bn into the local healthcare and pharma sectors. Concord and the SFE had signed a MoU of their own back in 2020 to manage a USD 300 mn healthcare fund though nothing has been heard since.

And that’s not all, folks: Concord plans to establish a new stock fund and another to invest in bonds this year to capitalize on the current bull run on the EGX and higher interest rates, Younes said.

A MESSAGE FROM HSBC

Middle East executives are among the world’s most optimistic on growth

Executives in the Middle East are some of the world’s most optimistic when it comes to new business growth in the year ahead, with expansion overseas a key priority for many of them.

Our latest survey of leaders in companies with revenues of between USD 10 mn and USD 500 mn shows clearly that the preferred strategy to deal with the economic uncertainties created by central banks raising interest rates to fight inflation is to double down on investing for growth.

And it is executives in the Middle East who have the highest expectations of the success of those growth plans.

Of the 1.7k chief executives and chief financial officers we polled across 14 markets, 77% of them were targeting at least 10% revenue growth in 2023. Confidence in achieving that goal is highest in the UAE (93%), followed by India (88%), Mexico (86%), Australia (84%), and Indonesia (80%).

Meanwhile, nearly half (46%) of all respondents say expansion into at least one new foreign market is an investment priority for the year to meet their revenue growth goals. And 40% will seek external investment to support their growth plans.

Those intentions of international expansion align with the reality of the business flows that we see as the world’s leading trade bank.

Middle East trade flows continue to gain pace despite the uncertainty elsewhere, with the strategic location of the region proving to be a particular advantage enabling internationally-minded businesses to expand along the substantial trade and investment corridors that exist with Asia, Europe and the US.

New business verticals, new products, and new supply chains are being formed.

LOOKING AHEAD WITH CONFIDENCE

The focus on growth is the key to how executives plan to address the challenges they see.

Inflation and the cost of living is cited as the top risk by business leaders in the region (38%). Increased interest rates comes next (32%), followed by political uncertainty (27%).

Putting growth in the spotlight is leading to substantial revisions of business plans and deeper analysis of supply chains to see where revenue can be grown or costs can be cut.

Those revisions have also led to re-prioritisations for many companies, with nearly half (48%) of UAE respondents highlighting sustainability as becoming a key business driver. With COP27 in Egypt last year and COP28 being hosted in the UAE at the end of 2023, the focus on sustainability as a growth enabler is likely only to get sharper.

The key takeaway from the research for me is that even in a difficult environment, ambitious, forward-looking businesses will put together a plan to deliver growth, manage supply chains, pay bills, and manage liquidity.

This op-ed was written by Chaker Zeraiki (LinkedIn), HSBC UAE head of global trade & receivables finance and regional head of business origination for MENAT. HSBC’s column in Enterprise appears every second Monday.

LEGISLATION WATCH

Senate committee greenlights bill allowing informal industrial projects to get temp licenses

Senate committee approves bill handing temporary licenses to informal industrial projects: The Senate Industrial Committee approved a new government-drafted bill that would enable unlicensed industrial projects to temporarily go legit. The two-article bill would grant the Industrial Development Authority (IDA) the power for three years to allow unlicensed industrial projects to operate for a temporary one-year period. The period could be extended for an additional two years by the trade and industry minister upon the recommendations of the IDA.

Hundreds of thousands of industrial projects operate without licenses: The new bill aims to facilitate licensing measures for small-scale industrial projects to join the formal economy. “This bill is important for the Egyptian industry as building and expanding industrial projects can never be possible without first meeting all legal licensing requirements,” said committee head Mohamed Halawa. There are “hundreds of thousands of small-scale industrial projects in different governorates that are operating without having a license and as a result they are considered a part of the informal economy.”

TOUGHER PENALTIES FOR FGM?

Egypt is set to toughen penalties on female genital mutilation (FGM) and child marriage, Social Solidarity Minister Nevine El Qabbaj told the Senate yesterday. “We are currently in the process of drafting a new bill that will toughen penalties on FGM and early marriage crimes,” the minister said on the sidelines of a discussion of a study on family violence.

Still widespread: FGM is still widespread in rural areas, El Qabbaj said, describing the practice as still one of the worst crimes in the country. She said some in rural areas resort to early marriage without official documentation, referring to child marriage as a form of “human trafficking.”

REMEMBER– The House of Representatives approved amendments to the penal code in 2021 that hand jail terms of 5-20 years to people found guilty of committing FGM. Doctors carrying out FGM are subject to harsher penalties of up to ten-year prison terms if they cause permanent disability and between 15-20 years in case of death.

MOVES

Sameh Qattah was named chairman of satellite operator NileSat by the company’s board of directors yesterday, state-run MENA agency reported.

LAST NIGHT’S TALK SHOWS

It was a rather quiet night on the airwaves yesterday: Getting coverage almost across the board was the funeral of former prime minister Sherif Ismail. Ismail, who served as the country’s premier during 2015 to mid 2018, passed away on Saturday at age 67 after a battle with illness. Al Hayah Al Youm (watch, runtime: 6:11), Masaa DMC (watch, runtime: 3:01) and Kelma Akhira (watch, runtime: 1:47) all covered yesterday’s military funeral, which was led by President El Sisi and top state officials.

The mechanism in which the state will facilitate obtaining industrial licenses for investors will be announced soon, Federation of Egyptian Industries (FEI) head Mohamed El Sewedy told El Hekaya (watch, runtime: 18:20). He described obtaining industrial licenses for factories as time-consuming, estimating it at three to six months. “Yet the past period … saw the process accelerating if requirements are met,” he said. His statements came following a meeting with the government where Prime Minister Madbouly expressed keenness to accelerate approvals related to the industrial sector and investment promotion.

Zamalek FC’s ongoing heat with the Egyptian FA received attention: The football club has been blocked by the Egyptian FA from registering new signings due to having unpaid debts. In an interview on Ala Mas’ouleety, former sports minister Khaled Abdel Aziz speculated that there is a “missing link that no one knows” in the conflict but rejected the conspiratorial claims made by the club’s pugnacious head Mortada Mansour (watch, runtime: 3:23). Zamalek is reportedly considering submitting a complaint to FIFA, which could forecast the EFA to register the players, sports pundit Ahmed Darwish told Kelma Akhira. (watch, runtime: 9:57)

ALSO ON OUR RADAR

INFRASTRUCTURE-

Gov’t denies ADP-Suez Port talks: The Transport Ministry has denied that it’s in talks to sell development and management rights at Suez Port to Abu Dhabi Ports. Asharq Business had reported last month that the ADQ-owned company was in advanced talks to take over management of the port under a usufruct contract, citing sources it said had knowledge of the matter. In a statement yesterday, the ministry denied talks were taking place and called the report “completely false and baseless.”

PHARMA-

Ibnsina Pharma signs second distribution agreement with an int’l drugmaker in as many weeks: Ibnsina Pharma will distribute treatments by German pharma giant Boehringer Ingelheim — including for diabetes, hypertension, respiratory diseases, and stroke — under a new agreement between the two firms, it said in a press release (pdf) yesterday. Ibnsina last week inked an agreement with Swiss pharma giant Sandoz to distribute its OTC medications in Egypt.

REAL ESTATE-

NUCA approves support for real estate players: The New Urban Communities Authority (NUCA) has approved measures announced last week by the Madbouly government to help developers weather a tough economy, according to a statement. The measures grant developers a 20% deadline extension on their projects, allow them to mark projects as complete earlier in the construction timeline, and reduce the interest rate they pay on installments for state-owned land.

TELECOMS-

Telecoms regulator reportedly paving the way for WiFi calling services: The National Telecom Regulatory Authority is working to make WiFi calling services available at some point this year, Al Borsa reports, citing unnamed sources. The regulator is in talks with the country’s mobile network operators on how to implement the service, which would allow mobile phone owners to make calls using their WiFi connection.

PLANET FINANCE

KSA warns of energy shortages on back of oil sanctions, lack of investment: EU sanctions imposed against Russian oil and under-investment in upstream assets will trigger an energy shortage, Saudi Energy Minister Prince Abdulaziz bin Salman suggested over the weekend, according to Reuters. “All of those so-called sanctions, embargoes, lack of investments, they will convolute into one thing and one thing only, a lack of energy supplies of all kinds when they are most needed,” he said.

A return to USD 100 oil this year? The introduction yesterday of fresh G7 and EU sanctions against Russian oil products amid China’s reopening have some predicting a tighter market this year. Goldman Sachs’ lead commodities analyst is now expecting oil to rise back above USD 100 a barrel later this year due to dwindling spare production capacity, Bloomberg reports. Lower investment will also play a big role in the supply shortfall, which by 2024 could pose a major problem for the industry.

Growing demand in China could force OPEC+ to up its output, International Energy Agency Executive Director Fatih Birol said yesterday. The oil cartel and its allies last week decided to keep its output steady, sticking to an agreed plan to cut production by 2 mn barrels per day through the end of 2023.

The 2023 rally in emerging-market assets may already be starting to peter out as investor sentiment shifts in response to last week’s market rout of Adani Group companies and uncertainty about the trajectory of US interest rates, according to Bloomberg. The MSCI gauge of EM currencies saw its biggest one-day loss since early December on Friday while a similar index of EM equities suffered its first weekly loss of the year on the back of the Adani selloff.

Big calls: The EM rally prompted Morgan Stanley Investment Management to declare less than a month into the year that the decade of emerging markets has begun. EM stocks and bonds saw near-record inflows in January on building risk-on sentiment driven by falling inflation and China’s re-opening from covid-19 curbs.

Not so fast: “We aren’t in the environment just yet where can indiscriminately buy,” said Angus Bell, a managing director at Goldman Sachs Asset Management. “For countries that faced acute stress last year, it’s not really as though the macro environment has shifted so dramatically that all of the problems that they were facing have now totally evaporated.”

ALSO WORTH NOTING- Hong Kong eyes Aramco listing: Hong Kong leader John Lee is attempting to persuade Saudi authorities to consider listing Saudi Aramco on the Hong Kong Stock Exchange during talks in Riyadh. In what is his first official trip to the Middle East, Lee will tomorrow head to Abu Dhabi and Dubai to hold talks with local business leaders. (Statement | South China Morning Post)

|

|

EGX30 |

16,266 |

+0.1% (YTD: +11.4%) |

|

|

USD (CBE) |

Buy 30.24 |

Sell 30.33 |

|

|

USD at CIB |

Buy 30.23 |

Sell 30.33 |

|

|

Interest rates CBE |

16.25% deposit |

17.25% lending |

|

|

Tadawul |

10,559 |

-1.3% (YTD: +0.8%) |

|

|

ADX |

9,931 |

+0.7% (YTD: -2.7%) |

|

|

DFM |

3,383 |

+0.5% (YTD: +1.4%) |

|

|

S&P 500 |

4,136 |

-1.0% (YTD: +7.7%) |

|

|

FTSE 100 |

7,902 |

+1.0% (YTD: +6.0%) |

|

|

Euro Stoxx 50 |

4,258 |

+0.4% (YTD: +12.2%) |

|

|

Brent crude |

USD 79.94 |

-2.7% |

|

|

Natural gas (Nymex) |

USD 2.41 |

-1.9% |

|

|

Gold |

USD 1,876.60 |

-2.8% |

|

|

BTC |

USD 22,892 |

-2.3% (YTD: +38.3%) |

THE CLOSING BELL-

The EGX30 rose 0.1% at yesterday’s close on turnover of EGP 1.77 bn (2% below the 90-day average). Local investors were net sellers. The index is up 11.4% YTD.

In the green: Palm Hills Development (+10.3%), GB Auto (+9.2%) and Talaat Moustafa Group (+3.1%).

In the red: Taaleem (-4.1%), Qalaa Holdings (-4.0%) and Ibnsina Pharma (-3.1%).

Shares in much of Asia are in the red this morning: China and Hong Kong are leading losses (both down almost 2.0%) while the Nikkei is bucking the trend, rising 1.0%. Meanwhile, the late-week sell-off in the US and Europe is poised to continue later today, according to stock futures.

DIPLOMACY

Energy, food and fertilizer were among the topics of discussion between El Sisi + Romanian PM: Romanian Prime Minister Nicolae Ciucă agreed to increase exports of Romanian wheat to Egypt during talks with President Abdel Fattah El Sisi yesterday, according to a statement from the Romanian PM’s office. The two also discussed upping Egyptian fertilizer exports to Romania, the statement said. El Sisi and Ciucă talked about strengthening energy ties in light of the impact of the Russia-Ukraine war on global energy supplies, according to Ittihadiya.

Exporting natural gas to Romania? State-owned gas company EGAS signed an MoU with Romanian state-owned gas pipeline operator Transgaz on natural gas transportation, according to a cabinet statement. The agreement will see the two sides work on developing infrastructure for transporting natural gas, the statement said, without providing further details.

Madbouly calls for more Romanian investment: Prime Minister Moustafa Madbouly invited Romanian investors to step up involvement in Egypt’s health, renewable energy and industrial sectors during the Egyptian-Romanian business forum yesterday, according to a statement by the Cabinet. More than 100 Romanian companies are currently operating in Egypt and have invested a combined USD 104 mn, he said.

Edtech could be just the fix for some of the more significant issues in the education sector: Education technology (edtech) is well-positioned to address several challenges in Egypt’s education space, including issues of access and infrastructure, as well as a lack of diverse content and quality teaching. Although edtech players that are either looking to enter Egypt or are already here face hurdles in getting their products to market or expanding their footprint — including cost barriers and skill and training gaps — many still see massive potential in the Egyptian market. For edtech to be successfully applied in Egyptian schools, providers need to ensure adequate training for teaching staff and provide solutions that are tailored for the regional and national context, according to government officials and nearly a dozen UK-based edtech companies speaking at a showcase hosted by the British embassy last month.

REFRESHER- In part one of this Blackboard two-parter, we looked at the lay of the land of the current edtech adoption in Egypt and why British companies are interested.

The big initial hurdle: Tight budgets amid rising costs: For educational resource suppliers, like CES Holdings, Egypt presents a market with huge growth potential — but the challenge lies in getting their products to us, MENA head Ceri Henderson told Enterprise. “Budgets are tight everywhere,” Henderson said. Schools are facing cost pressures from restrictions on raising tuition fees, while also having to answer to parents, who want to know that schools are spending on the best materials, from books to pens, for their children. Providers like CES are attempting to provide well-priced products, but between a weakening EGP and certain levies like import taxes, these providers find themselves faced with mounting costs, Henderson added.

Once these products are in the market, there’s also the issue of skills and capacity training: Some edtech players, including the Tes Institute and Innovera — in collaboration with global education company Promethean — have already been active in offering teacher training programs to schools in Egypt. Innovera and Promethean have together trained over 135k teachers in the country to date, Promethean’s head of education strategy John Collick told Enterprise. Most institutions looking to adopt edtech have their tech partner conduct “a workshop or two,” Innovera said, but comprehensive training that teaches day-to-day integration of edtech in teaching — both to educators and school leadership — is the only way to adopt a sustainable approach. The Tes Institute has also been offering teaching training programs to schools in Egypt for more than four years, with a focus on training or upskilling local educators as opposed to bringing expat teachers to the market, MENA head of regional development Ryan Jones told Enterprise.

But again, affordability is a roadblock: Tes offers six courses on international teaching practices, including the International Postgraduate Certificate in Education, a fully online master’s level course for individuals looking to teach internationally. Courses start from a costly GBP 3k (over EGP 111k) — and these are some of the cheapest in the market, Jones said. To attract teachers, Tes is looking to provide workarounds to help tamp down the costs. If a school pays for the course for one of its teachers, value-added taxes are waived, for example. The company is also looking at incorporating an installment method for payments, and currently several of the courses can be studied online and alongside a full-time job.

A key point in the approach to edtech is using it as a support tool, rather than a replacement for human teachers: “Tech needs to support teachers not take their place,” Education Minister Reda Hegazy said at the showcase. By adopting edtech that supports pedagogical methods, schools can focus on providing student centric learning. The government has been pushing education reform since former minister Tarek Shawki’s 2018 launch of Education 2.0 — a broad overhaul of the K-12 education system — and is looking to the private sector to provide integrated tools that bolster education quality and content. Allowing teachers to focus on innovative learning that engages students is key to the government’s education reform strategy, Deputy Education Minister for Information Technology Ahmed Daher said during a roundtable at the showcase.

Edtech players can help create transformation strategies that streamline activity in the classroom: Schools should seek a “long-term edtech partner” to help develop an edtech strategy that relies more on “transformation rather than trends,” Innovera’s Middle East program manager Ashraf Magd told Enterprise. Some companies, such as advanced machine learning platform Century Tech, can help streamline teachers’ work by relaying data on their students’ learning needs and building personalized paths that parents can have access to. These types of solutions reduce the burden on teachers and avail time and resources to allow them to focus on developing relationships with students and focusing content on their needs.

Importantly, these solutions need to take a region-specific approach: Most edtech solutions are “built with global perspectives,” ignoring the specific needs of a developing country — like poor internet connectivity inside classrooms, or tech infrastructure within schools, Magd said. When edtech partners enter the Egyptian market they need to to understand the needs and limitations facing schools, Magd told us. International companies need to develop long-standing relationships with local school leaders, which will help to shape the solutions they provide, Deputy Director General of the British Educational Suppliers Association Julia Garvey agreed.

Communication is key to understanding: The showcase served as the first step, to allow the British schools to identify edtech advocates within Egyptian schools that will champion the incorporation of edtech and be a part of the onboarding process, Garvey said. Edtech partners must maintain productive relationships for schools to be convinced in the value of an edtech solution and remain in a continued dialogue with their edtech partners.

Your top education stories for the week:

- The Education Ministry will launch an in-school tutoring scheme across all governorates at the start of the second semester of the academic year as it moves to crack down on the private tutoring industry.

- MP calls for action on soaring private university fees: Rep. Ayman Mehasseb has called on the Education Ministry to help parents shoulder the burden of rising tuition fees at private universities amid high inflation. (Al Mal)

CALENDAR

FEBRUARY

26 January-6 February (Thursday-Monday): Cairo International Book Fair, Egypt International Exhibition Center.

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

12 February (Sunday): The House reconvenes.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH

March: 4Q2022 earnings season.

6-9 March (Monday-Thursday): EFG Hermes One-on-One conference, Atlantis, Dubai.

21-22 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

23 March (Thursday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

APRIL

April: GAFI to launch the country’s first integrated electronic platform to facilitate setting up a business.

1 April (Saturday): Deadline for banks to establish sustainability units.

10-16 April (Monday-Sunday): IMF / World Bank Spring Meetings, Marrakesh, Morocco.

16 April (Sunday): Coptic Easter

17 April (Monday): Sham El Nessim.

21 April (Friday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

30 April (Sunday): Deadline for self-employed to register for e-invoicing.

30 April (Sunday): End of Mediterranean, Nile Delta oil + gas exploration tender.

Late April – 15 May: 1Q2023 earnings season.

MAY

1 May (Monday): Labor Day.

2-3 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Thursday): National holiday in observance of Labor Day (TBC).

4 May (Thursday): IEF-IGU Ministerial Gas Forum, Cairo.

18 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

20-21 May (Saturday-Sunday): eGlob Expo, St. Regis Almasa Hotel, Cairo.

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE

7-10 (Wednesday-Saturday): The second edition of Africa Health Excon.

10 June (Saturday): Thanaweya Amma examinations begin.

13-14 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

19-21 June (Monday-Wednesday): Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

22 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

25-26 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

AUGUST

3 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

19-20 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

31 October – 1 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

NOVEMBER

2 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

DECEMBER

12-13 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

EVENTS WITH NO SET DATE

2023: The inauguration of the Grand Egyptian Museum.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q 2023: Egypt + Qatar to launch joint business forum.

1Q 2023: FRA to introduce new rules for short selling.

1Q 2023: Internal trade database to launch.

1Q 2023: The Madbouly government will choose which state-owned hotels will be merged into a new hotels company ahead of an offering to foreign and Gulf investors.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.