- FinMin is closing an EGP 34 bn tax loophole that gives a break to some state institutions and insurers. (Speed Round)

- Beltone Financial Holding will set up three new non-banking financial companies in September as part of bid to return to profitability. (Speed Round)

- Vestas inks EGP 4.3 bn Gulf of Suez wind power plant agreement. (Speed Round)

- CIRA is building a new international school in New Sohag. (Spee Round)

- Fawry is officially Egypt’s first unicorn. (Speed Round)

- A bill offering investment incentives for waste management is making its way through the House. (Speed Round)

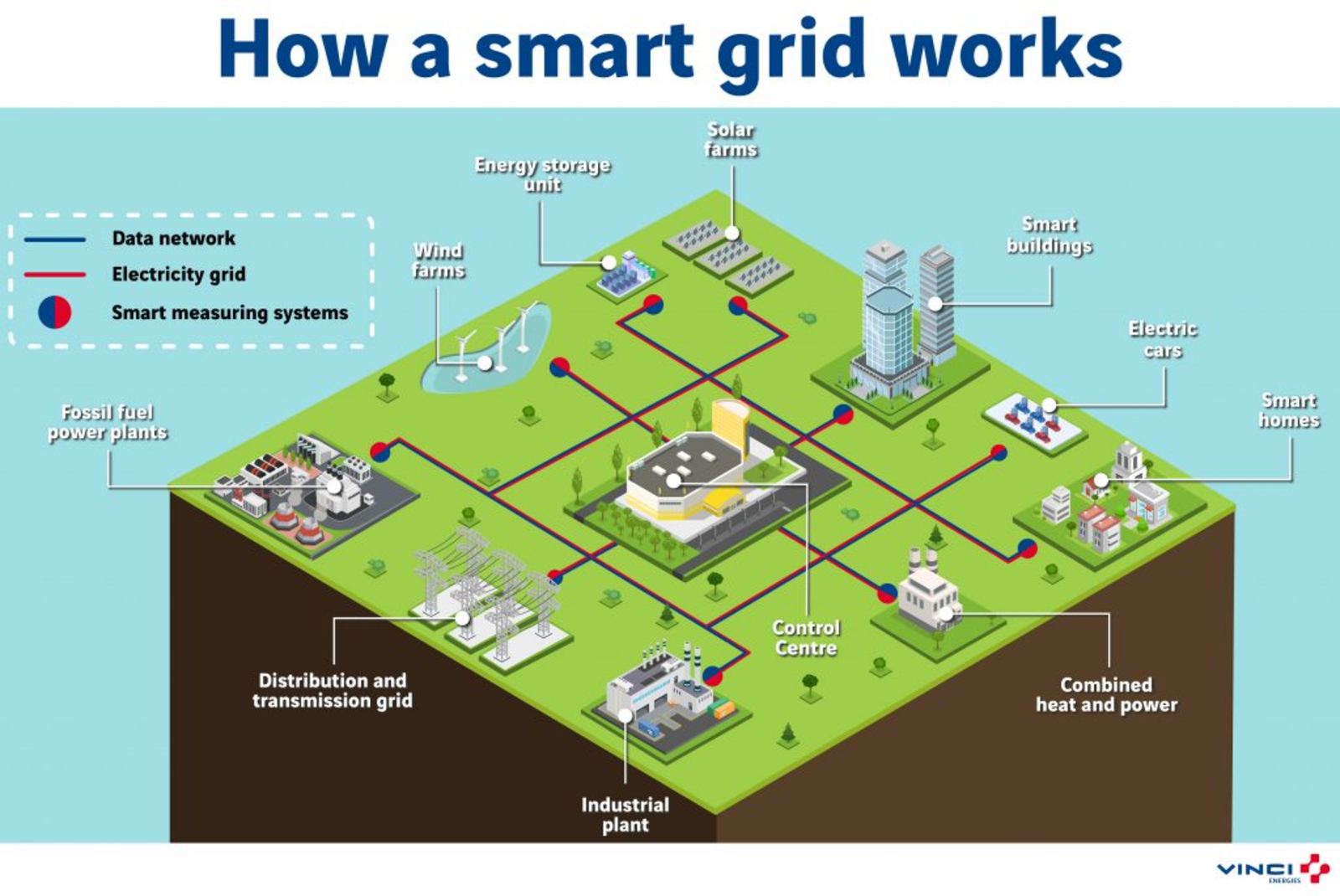

- How the smart grid can help stop power cuts and improve energy efficiency. (Hardhat)

- The Market Yesterday

Wednesday, 19 August 2020

FinMin looks to close EGP 34 bn tax loophole. Enjoy the long weekend and see you back here on Sunday.

TL;DR

What We’re Tracking Today

Welcome to the final workday of this abbreviated workweek. We hope you’ve all made plans for the long weekend — ideally ones that involve a modicum of social distancing?

The House of Representatives isn’t going on summer recess just yet: House Speaker Ali Abdel Aal adjourned parliament’s plenary sessions yesterday until next Sunday, 23 August. Parliament had a three-day legislative marathon this week as it pushed through a host of bills, which we had taken as the prelude to its summer recess. We have chapter and verse on yesterday’s legislative session in this morning’s Speed Round, below.

We’re getting the results of last week’s Senate elections today: National Elections Authority chief Lasheen Ibrahim is expected to announce the results of the vote later today. Runoffs are scheduled for 8-9 September in any districts where the results are inconclusive. Voters are electing 200 members to the newly reconstituted upper house of parliament, while the presidency will nominate another 100 members.

PSA- Stranger Things hasn’t resumed filming yet, but we now know there will be at least one season beyond the upcoming fourth installation, according to this Hollywood Reporter interview with showrunners the Duffer brothers. The interview is part of the outlet’s coverage in the run-up to the Emmys.

** We’re not publishing tomorrow in observance of the national holiday, but we’ll be back in your inboxes (and on the web) at the usual time on Sunday morning.

COVID-19-

The Health Ministry reported 163 new covid-19 infections yesterday, up from 115 the day before. Egypt has now disclosed a total of 96,753 confirmed cases of covid-19. The ministry also reported 11 new deaths, bringing the country’s total death toll to 5,184. We now have a total of 61,652 confirmed cases that have fully recovered.

The Federation of Egyptian Chambers of Commerce wants to standardize maximum business hours for retail outlets. A proposal currently with cabinet would see most stores allowed to open weekdays from 5am-11pm, while unspecified outlets whose activities are particularly noisy would not be permitted to open before 8am, the local press reports. Closing hours would extend to midnight on Thursdays and Fridays; all stores would need to close by 10pm in winter (please don’t ask us to sort through the logic there).

Red Sea hotel occupancy rates are still below the 50% cap set by the gov’t: Hotel occupancy in Hurghada is currently at 30-40%, making it the top performer in the country despite still falling short of the 50% capacity limit the government imposed as part of its covid-19 safety measures, Red Sea Tourism Investment Association Chairman Kamel Abou Aly told Reuters. Sharm El Sheikh lags behind with a 20-25% occupancy rate, which is still inching up as domestic tourists flock to the coastal city during the summer, Egyptian Hotel Association Board Member Hisham El Shaer said. Occupancy rates during the first half of the year averaged at 53% in Hurghada and 51% in Sharm.

FURTHER AFIELD- Renewed covid-19 outbreaks in some European countries are kneecapping their economic recovery, according to data measured by Bloomberg Economics. Italy, France and Spain saw a fall in activity in the first half of August, while the recovery in Germany, Sweden and Norway continued to be “sluggish.”

Joe Biden is officially the Democrats’ nominee for November’s US presidential election as the second night of the Dems’ virtual national convention comes to an end. Among the many speakers last night were former president Bill Clinton (addressing a party that has “left him behind,” but laying out a “stark choice” for voters) and Rep. Alexandria Ocasio-Cortez (making the case for progressive change). The convention continues through Thursday, when Biden is set to accept the nomination. The NYT liveblogged last night’s festivities, Politico has wall-to-wall coverage and you can visit the convention’s official website for more.

The S&P 500 closed at its highest level ever yesterday, erasing its corona-induced losses and “capping a remarkable rebound fueled by unprecedented government stimulus and optimism among investors about the world’s ability to manage the coronavirus pandemic,” the WSJ reports.

The latest worry over whether the US is losing its edge as the world’s reserve currency: Russia’s rising EUR inflows from its exports to China in 1Q2020, coupled with wide-reaching EU stimulus measures, are fueling the thus-far “historically unconsummated concern” that the USD’s standing as the world’s reserve currency is uncertain, Dion Rabouin writes for Axios. The moment of strength for the EUR is also coinciding with a “moment of weakness” for the US, with the hegemon facing the world’s most severe covid-19 outbreak and the Federal Reserve expanding its balance sheet by the tns.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: In part 2 of our series on why Egypt is still experiencing brownouts despite a large surplus in energy generation capacity, we look at how the smart grid can help stop power cuts and improve energy efficiency

Enterprise+: Last Night’s Talk Shows

The hiatus is back on: Our roundup of the top stories on the airwaves will be back next week.

Speed Round

Finance ministry is closing a tax loophole that gives a break to some state institutions and insurers that invest in state debt: The state treasury expects to net as much as EGP 34 bn in additional income from a bill currently making its way through the House of Representatives that would, if passed, tax previously-exempt institutions on returns from their investments in government treasury bonds and bills, a Tax Authority official who contributed to the bill’s drafting told Enterprise. The bill would cover specific state institutions as well as government-owned bodies such as the National Investment Bank and the Nasser Social Bank. It would also include private insurance firms and some civil society groups, the source said.

Leveling the playing field: These entities had previously not been taxed on interest income and capital gains they made on investments (or trading of) government bonds and bills — onshore investors in those instruments face taxes under the 2005 Income Tax Act.

One institution that’s still getting some special treatment: The National Organization for Social Insurance, which will only see 35% of the gains it makes from its investments in government debt be subject to income tax; the share of taxable income could rise every three years under the bill as it currently stands, according to Al Mal.

Why did the loophole exist in the first place? The source explained that the institutions that had been benefitting from the loophole have “social missions”: The loophole was an incentive for them to make better returns by investing in higher-yield state paper rather than leaving surplus liquidity parked in bank accounts.

Don’t expect the volume of investment in government debt to go down when the loophole closes given how attractive yields are today, the source argues: Institutions losing access to the loophole will still be able to generate returns as much as 400 bps higher than they would get by parking their liquidity with banks.

No foreign investors will be impacted by this change as only a handful of domestic investors presently have access to the loophole, Finance Minister Mohamed Maait said.

Keep this all in context: This is the second time the state has looked to recoup of a piece of the pie that investors make from investing in state debt instruments. A law passed in 2019 (executive regulations here) effectively hiked the tax rate on interest income banks and corporations make from investments in government bonds and bills.

Beltone Financial Holding will set up three new non-banking financial companies in September in a bid to return to profitability, CEO Ibrahim Karam said in an interview with Reuters on Tuesday. Beltone will set up a financial leasing company targeting a first-year portfolio of EGP 600 mn, a consumer finance company with a first-year portfolio of EGP 400 mn, and a venture capital subsidiary, he said. The investment bank has already locked down the licenses for these subsidiaries. Beltone had said in January it expects non-banking financial services to contribute 30-40% of its revenue over the next three years. “The new companies, along with strengthening existing activities, will help us return to profit in 2021,” Karam said.

Beltone is still waiting on US regulators to approve the sale of its 60% stake in New York-based brokerage Auerbach Grayson. “We are waiting for the regulatory authorities there to approve it, but we have concluded an agreement with a buyer and signed contracts,” Karam told the newswire without disclosing the identity of the buyers, adding only that they were not a GCC-based institution. The investment bank announced in April that it had completed the sale to a group of investors, pending regulatory approval.

Beltone has been on a loss-making streak that is on its way to last three years, last reporting a profit in 1Q2018. The company announced improved figures in 2Q2020, reporting a EGP 12 mn loss from the EGP 34 mn loss made in 2019.

INVESTMENT WATCH- Egypt, Vestas ink EGP 4.3 bn Gulf of Suez wind power plant agreement: The New and Renewable Energy Authority (NREA) signed yesterday a EGP 4.3 bn agreement with a consortium led by Denmark’s Vestas to construct a 250 MW wind farm in the Gulf of Suez, according to a cabinet statement. The consortium also includes unnamed Italian, French, and Chilean companies. The plant, which is expected to take 35 months to complete, will have an annual energy output of 840 GW once fully operational. The project will be jointly financed by the French Development Agency, the EU, the European Investment Bank, and the German Development Bank.

The NREA had awarded Vestas the tender earlier this year after both Siemens Gamesa and Germany’s Senvion retracted their bids late in 2019.

INVESTMENT WATCH- CIRA to build international school on 2.8 feddans in New Sohag: Cairo for Investment and Real Estate Development (CIRA) is earmarking 2.8 feddans in New Sohag to establish an international school complex, it said in an EGX disclosure (pdf) yesterday. We picked up a story from the press yesterday citing a source who incorrectly said the leading private sector education outfit had purchased a five-feddan plot of land in the area.

M&A WATCH- MNHD receives EGP 30 mn offer for its 98.4% stake in Nasr Utilities and Installations: Madinet Nasr for Housing and Development (MNHD) has received an offer from a unnamed strategic investor to purchase its 98.4% stake in construction company Nasr Utilities and Installations (NUI) for EGP 30 mn, it said in an EGX disclosure (pdf) yesterday. MNHD will likely come to a decision on the sale at its next board meeting on 23 August.

MNHD may also be exiting El Nasr Civil Works: News of the offer comes a week after MNHD agreed to allow Odin Investments to begin due diligence on El Nasr Civil Works ahead of a possible acquisition of the real estate developer’s 52.5% stake in the company.

M&A WATCH- A group of investors in state-owned Nile Cotton Ginning want to buy out the company’s workers’ union, offering EGP 183 mn for the entire 7.06% stake the union holds in the company, union head Khairy Marzouk tells Al Mal. The Financial Regulatory Authority has signed off on the potential sale, decreeing that the union would be treated as an individual investor and has the same ownership rights. The offer is up for discussion at the company’s next general assembly meet on 24 August.

REGULATION WATCH- Shares in companies that voluntarily delist from the EGX can still be traded for up to three months after the company announces its plans to leave the exchange, according to new regulations the Financial Regulatory Authority (FRA) issued yesterday. The decision is meant to give shareholders some measure of maneuverability during the delisting process.

Companies undergoing a mandatory delisting will be required to buy back their freefloating shares at a fair market value determined by an independent financial advisor. Shareholders who hold more than 20% of a company’s stock will not be permitted to trade in shares that face mandatory or voluntary delisting without giving the market regulator a heads up.

REGULATION WATCH- Consumers can now take out debt to finance sporting club memberships, insurance policies: The Financial Regulatory Authority (FRA) has authorized consumer finance companies to add the payment of insurance premiums and club membership fees and annual dues to their lists of products, according to a statement. The first part of the decision aims to stimulate the insurance market through consumer finance services, FRA boss Mohamed Omran said.

STARTUP WATCH- Fawry is officially Egypt’s first unicorn: EGX-listed e-payments firm Fawry became the first Egyptian tech company to hit a market cap of USD 1 bn on Monday after its share price reached intraday highs of EGP 22.69, former managing director Mohamed Okasha announced in a LinkedIn post. Fawry’s share price has increased by more than 300% since it debuted on the EGX last year, a rise that has accelerated in recent months as the use of its payment services skyrocketed during the lockdown. The company’s shares rose to EGP 23.74 at the close of play yesterday, giving it a market cap of USD 1.05 bn. The company’s success “will help the whole industry and will open more doors for fintechs to receive funds and make partial exits,” Okasha told Waya.

Gamers can now pay online without a credit card thanks to Paymob: Online payment processor Paymob has partnered with German company Holyo to allow gamers to pay international gaming merchants — including PlayStation, Xbox, or PUBG Mobile — online without a credit card, according to a press release (pdf). The MENA region is home to the world's fastest growing online gaming community, with 25% y-o-y growth, the release notes.

LEGISLATION WATCH- House gives early nod to draft law to regulate, encourage investment in waste management: The House of Representatives approved in principle yesterday a draft law to set up an authority to oversee and monitor waste management in Egypt, Al Mal reports. The authority would be in charge of monitoring the industry and encouraging its growth and would outline a national strategy for waste management as well as the regulations and guidelines for all contracts. The bill also includes investment incentives as well as other measures to encourage garbage collectors, small companies, private contractors, and recycling centers to join the formal economy. The legislation applies to all types of waste, including agricultural and industrial waste, as well as dangerous waste, we noted last year.

Why is this important? Private players in the waste management industry have been calling for the government to step in with incentives that would make the industry viable. This has the potential to revive a decades-old bid by the government to manage waste properly. But hurdles remain due to inherent structural problems, including the lack of a nationwide collection infrastructure and a market that is no longer conducive to the byproducts of recycling.

We recently took a deep dive into what makes Egypt’s waste management efforts challenging, asking whether a waste regulatory authority is really what’s needed.

Meanwhile: Final nod to amendments to protect the identity of harassment victims. Amendments to the country’s criminal code that ban the disclosure of the identities of [redacted] harassment and assault received final approval from the House yesterday. The changes, which will take effect as soon as President Abdel Fattah El Sisi signs them into law, would subject anyone who identifies victims to up to six months in prison, allowing the personal data of victims to only be known to their lawyers. Reuters took note of the story.

The House also signed off on 11 presidential decrees ratifying recent loans and agreements during a plenary session yesterday. The agreements include a USD 510 mn loan from First Abu Dhabi Bank to the government, a USD 50 mn emergency loan from the World Bank’s International Development Association, and a KWD 1 mn facility from the Arab Fund for Economic and Social Development to help fight covid-19.

Other bills that received final approval:

- A law to criminalize bullying — subjecting those who disparage another’s race, gender, religion, body, social status, or health or mental condition to up to six months of prison and fines of EGP 10-30k;

- A law to authorize the finance minister to guarantee a EGP 1 bn long-term loan to the Egyptian Holding Company for Airport and Air Navigation;

- A bill that divides Egypt’s electoral districts into 143 single-member constituencies and four in which MPs are elected through electoral lists;

- Amendments to the Civil and Commercial Judicial Procedures Law to expand the role of district courts to include lawsuits with lower claim values; and

- Amendments to the law regulating the National Authority For Tunnels to improve the authority’s performance.

ALSO AT THE HOUSE- An MP wants to question the supply minister over smaller loaves of subsidized bread. Rep. Abdel Hamid Kamal has tabled a request to summon Supply Minister Aly El Moselhy to a hearing into why his ministry is cutting the size of a loaf of subsidized bread by nearly a quarter, Al Mal reports. The decision to shrink the size of a loaf of bread comes despite recent CAPMAS data showing the country’s poverty rate edging up nearly 5%, argues Kamal.

Permits for building of Dabaa reactors coming in 2H2021: The Nuclear and Radiological Regulatory Authority (ENRRA) expects to issue the construction permit for the reactors of the Dabaa nuclear power plant during the second half of 2021, Nuclear Power Plants (NPPA) Authority boss Amgad El Wekeel told Youm7. Rosatom’s Atomstroyexport (ASE), the project’s main contractor, was previously set to break ground on the reactors around the second half of this year, with the first 1.2 GW nuclear reactor slated to begin operations in 2026. The delay in issuing the permit, which the NPPA needs to acquire from ENRRA, won’t affect other works at the site such as landscaping and setting up support buildings, El Wekeel said.

EARNINGS WATCH- EFG Hermes saw 8% y-o-y net profit growth in 2Q2020: EFG Hermes saw net profits grow to EGP 328 mn in 2Q2020, according to a company’s earnings release (pdf) as revenues rose 26% y-o-y to EGP 1.3 bn in 2Q2020. “Top line performance was primarily driven by revenue growth at the Group’s investment bank arm,” the company said, noting revenues there had risen 40% over the same period last year to EGP 1.0 billion as regional capital markets recovered and a “subsequent revaluation of seed capital and investments.” Group CEO Karim Awad said EFG has “shown resilience in the second quarter of 2020 as we continued to navigate a challenging external environment as a result of the covid-19 pandemic. EFG Hermes is ideally positioned to capture new opportunities when global markets and economic activity picks up.”

MOVES- EFG Hermes-owned microfinance player Tanmeyah has hired Ahmed Abed (Linkedin) as head of the information sector as well as Hatem Abouelenein (Linkedin) as human resources director, according to Al Mal. Abed was formerly the public sector account manager at Cisco Qatar while Abouelenein was the CIB’s head of compensation and benefits.

Egypt in the News

No single story is dominating the conversation on Egypt in the foreign press this morning. On the regional geopolitics side of things, the BBC likens Egypt’s potential military intervention in Libya to putting out a fire “in the house next door” in the absence of a fire brigade, while Foreign Policy looks at the EastMed showdown between Egypt, Greece, and Turkey. Meanwhile, lawyers leading a torture lawsuit filed against former caretaker prime minister and current IMF executive board member Hazem El Beblawi say that the fund should determine whether El Beblawi has diplomatic immunity, according to the Washington Post.

Diplomacy + Foreign Trade

Greek parliament to decide on Egypt-Greece maritime accord next week: Greece will submit the maritime demarcation accord signed with Egypt to its parliament for approval next week, reports the Greek local press. Egypt’s parliament ratified the joint economic zone agreement on Monday.

EastMed saga continues as Ankara deploys (yet another) drilling ship: Turkey yesterday dispatched another oil and gas drilling ship into an area to the southwest of Cyprus, reports Bloomberg. The move is the latest of a series of provocations by Turkey after statements by President Recep Tayyip Erdogan that his country “will not back down” from gas exploration efforts in the contested area despite an EU threat of sanctions. It also follows statements by the Turkish Foreign Ministry on Monday that countries in the region are forming an unholy alliance against Turkey. Turkey resumed oil and gas exploration in the contested territory last week after Greece and Egypt earlier this month signed their maritime demarcation pact.

Cyprus hints it’s open for reconciliation, taking cues from the EU: Nicosia is prepared for talks on maritime borders with its East Mediterranean neighbors, Cypriot Foreign Minister Nikos Christodoulides said yesterday, hinting that the island nation is looking to reach a pact with Turkey, according to Reuters. Turkey is the only neighboring country with whom Cyprus has no maritime demarcation pact. EU foreign ministers have also recently been trying to ease tensions between member states Greece and Cyprus and Turkey, and both the Greek and Cypriot foreign ministers have been reiterating their country’s willingness to engage in discussions.

Egypt, Ethiopia, Sudan sit down for second meeting of fresh AU-mediated GERD talks: Irrigation ministers from Egypt, Ethiopia, and Sudan held yesterday the second meeting of African Union-sponsored Grand Ethiopian Renaissance Dam (GERD) talks that resumed earlier this week after a seven-day suspension, Egypt’s ministry said. The ministers are still discussing proposals on filling and operating GERD and how to proceed with the negotiations until 28 August. Observers from the European Union, the US, and the African Union Commission also attended the meeting.

While the three countries have yet to sign an accord on the dam, a final agreement is currently “in the works,” Sudan’s acting Foreign Minister Omar Ismail Gamardin said, according to Voice of America. AU consultants are expected to facilitate the drafting process.

BRIEFLY NOTED-

- The Export Subsidy Fund is pushing printing, packaging, and paper exporters to submit the paperwork necessary to receive their export subsidy arrears from the last fiscal year, Vice President of the Printing, Packaging, Paper, Literary and Artistic Works Export Council Ahmed Gaber told the local press.

- Egyptian officials met with representatives from Hamas, the Palestinian Authority, and Israel in a bid to restore calm following Israeli airstrikes that targeted underground Hamas infrastructure in the Gaza strip, AFP reports.

How the smart grid can help stop power cuts and improve energy efficiency: We’ve been working to figure out why, in an era in which we have a surplus in electricity generation capacity, power cuts remain a persistent issue. Egypt has perhaps 58 GW of generation capacity, while peak consumption demand during the summer is in the range of 30-32 GW. In Part 1 of this series, we found that the issue is that our investment in generation capacity has far outpaced the rate at which we’ve added capacity to (and strengthened) the transmission networks that make up the national grid. We also explored what policymakers and private sector companies are doing to upgrade the grid, the costs of these plans, and the timeline laid out to get this all done.

Today, we ask: What would it take to make this grid “smart”?

How is a smart grid different from the current (traditional) one? A smart grid allows electricity distribution companies to analyze big data on the consumption of electricity using sophisticated servers and IT infrastructure embedded into control centers, former head of the New and Renewable Energy Authority (NREA) Mohamed El Sobky tells Enterprise. This also allows companies to anticipate problems with the grid or malfunctions in different parts, making the electrical system more reliable and efficient. The grid also helps to cut back on lost electricity, as engineers are able to keep a close eye on the performance, anticipate problems before they occur, and quickly maneuver to avoid interruptions, Mohamed El Hefnawy, power systems marketing director at Schneider Electric North-East Africa and the Levant told Enterprise. The new grid would also come with smart control units for street lights, which the ministry is piloting in Port Said before rolling them out to the rest of the country, sources have told Al Mal.

Control centers are the main ingredient in a smart grid: The plan includes the establishment of 47 smart control centers nationwide, some of which are already under construction. These centers will replace Egypt’s current six control centers and build some more to better control and oversee energy consumption in Egypt, Al Mal reported previously.

Smart grid design comes with energy storage in mind to maximize efficiency and allow us to better use renewables: Electricity that is produced isn’t always consumed due to the varying and often unpredictable behavior of consumers. In traditional grids, that energy would simply go to waste — partially because traditional grids are not designed to store electricity that is not used immediately. Meanwhile, renewable energy sources, such as solar and wind, aren’t always reliable, since clouds may block the sun for days or wind farms can stop spinning in the absence of strong wind, El Sobky tells us. As Egypt looks to increase its reliance on renewable energy, storage has become a priority to account for the days when the weather is not on our side, he added. But you can forget about opting for the battery route, as the investment required to allow for the storage of just 1 kWh of electricity in a battery is “major” and simply not feasible, El Sobky says. Storing electricity in a lithium-ion battery costs around USD 1k per 1 kWh, according to Vox.

That’s why Egypt is looking to incorporate methods such as pumped-storage hydroelectricity stations to its smart grid design. This method stores energy by using surplus electricity to pump water to a higher elevation, where it remains until the electricity is needed again. When the need arises, this water is then allowed to flow downstream towards turbines that generate roughly the same energy used to pump it upwards, says El Sobky. This is expected to bring down the cost of storage to around USD 18 per 1kWh, according to our in-house calculations. The Egyptian Electricity Holding Company was in talks last year with China’s Sinohydro to inaugurate a hydroelectricity station at Attaqa. The final contracts were scheduled to be signed earlier this year, but the timeline has been pushed back due to the outbreak of covid-19. Last we heard, the plant would be financed through an Export-Import Bank of China facility to the tune of USD 2.6 bn and is expected to store 2.4 GW of energy.

The grid’s reliability and efficiency are also getting a boost from digital power transformers, including 14 that Siemens has supplied for the Kafr El Sheikh and New Zagazig substations. Siemens is also engaged in a long-term plan with the Egyptian Electricity Transmission Company till 2025 to ensure safe and efficient transmission of the generated power, according to an emailed statement. The company has been extending lines and upgrading substations, especially in new cities, such as the new administrative capital and New Mansoura. It recently finalized the delivery and handover of two new “supervisory control and data acquisition systems” in Upper and Middle Egypt respectively, which includes the delivery of all software and related-hardware and all civil and electromechanical works, including the connection of 150 substations to the national grid as well as the installation works, commissioning, and training services.

Another component of a smart grid is prepaid meters, which are meant to put an end to electricity theft. Between June last year through April 2020 in Giza alone, the ministry has filed 317k lawsuits alleging households and commercial outlets had illegally connected to the grid, which costs the state over EGP 285 mn, Electricity Ministry spokesman Ayman Hamza told Enterprise. He expects the introduction of prepaid meters would put an end to this. The Electricity Ministry installed some 9.5 mn meters nationwide so far during that time period, Hamza told us.

Meanwhile, the Electricity Ministry is piloting a program to encourage households to install new smart meters that allow customers to track and regulate their own consumption, El Sobky notes. These meters would be connected to panels that will be smart enough to identify which unused appliances are connected to outlets and send alerts advising the customers to disconnect them, El Sobky explained. Better yet, even if a power cut is inevitable, these household smart systems will enable electricity distribution companies to notify customers, he added. So far, out of 250k meters targeted by the ministry, some 186k smart meters have been installed — mainly in Greater Cairo, but also in Alexandria, Upper Egypt, and the Delta, Al Mal reported, citing ministry sources.

The first phase of work to rebuild the grid has already begun: The Electricity Ministry is rolling out smart control centers in different areas around the country over five phases, which is expected to take around 10 years, Al Mal reported. Out of 15 control centers the Electricity Ministry has been planning to sign contracts for this year in Cairo, Alexandria, Upper Egypt, and the Canal region, Schneider Electric has already snapped up four of them at a cost of EGP 4.7 bn and would be ready within 30 months, El Hefnawy told Enterprise. To finance the project, EETC has sought loans worth EGP 37 bn from local banks, of which EGP 18 bn have already been approved back in 2017. The remaining 11 contracts will be signed this fiscal year on a turnkey basis, including 10 with Schneider Electric and one with General Electric in Alexandria, Hamza said. Siemens has also been awarded a contract by EETC to carry out a series of five-year grid studies to analyze and examine the country’s transmission network, to identify the feasibility of deploying different advanced energy technologies. The studies look at the potential role of smart technologies to transform the grid, as it continues to reflect the changes in the way energy is generated, distributed, managed and also stored. In this study, Siemens has used new software tools and modules to increase the capabilities of the EETC planning team.

Although covid-19 has slowed things down a bit, the ministry is still on track to completing the control center one step at a time, Hamza said. After completing the first phase, the ministry will offer more contracts for the remaining centers, which would depend on priorities and needs. The ministry is setting its priorities based on strategic needs — such as to fire up power plants in the Suez Canal Economic Zone and the new administrative capital — as well as development needs, like connecting the grid to poorer regions or areas that are outside the core grid’s current coverage — such as Marsa Alam. That said, Siemens has been working with the government to train engineers, using the region’s first virtual reality training program, which allows electricity companies to remotely test, validate and train employees.

Your top infrastructure stories of the week:

- Cairo Metro Line 3 inaugurated, ticket increase: President Abdel Fattah El Sisi inaugurated the fourth phase of the EGP 32 bn Cairo Metro Line 3 and metro price tickets all went up by at least EGP 2. Orascom Construction and Arab Contracts were the main contractors on phase four.

- The Suez Canal Authority is building four new tunnels in Port Said and Ismailia as part of its plans to invest EGP 16.9 bn this fiscal year, the local press reports.

- Tahrir Square renovations: The renovations of Tahrir Square cost the government EGP 150 mn, Assistant Housing Minister Abdel Khalek Ibrahim said (watch, runtime: 05:31).

- EGP 700 mn electricity line in North Sinai: The Electricity Ministry is planning to build a new 180 km, 500 KV power transmission line in North Sinai that will cost some EGP 700 mn, according to Al Mal. The Baghdad-Taba line is expected to be operational by the end of 2021.

- Benya Capital to build a EGP 1 bn fiber optic cable factory in SCZone: Benya Capital signed a final agreement with the Arab Organization for Industrialization to build an EGP 1 bn fiber optic cable factory in the Suez Canal Economic Zone.

- HA pens pact with AOI: Hassan Allam Holding has signed an agreement with the Arab Organization for Industrialization (AOI) to enhance cooperation in the implementation of national projects, Al Mal reports.

The Market Yesterday

EGP / USD CBE market average: Buy 15.88 | Sell 15.98

EGP / USD at CIB: Buy 15.87 | Sell 15.97

EGP / USD at NBE: Buy 15.88 | Sell 15.98

EGX30 (Tuesday): 11,077 (-0.6%)

Turnover: EGP 1.2 bn (18% above the 90-day average)

EGX 30 year-to-date: -20.7%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.6%. CIB, the index’s heaviest constituent, ended down 0.5%. EGX30’s top performing constituents were GB Auto up 3.2%, Qalaa Holding up 1.8%, and Egyptian Resorts up 1.5%. Yesterday’s worst performing stocks were Dice down 3.5%, Juhayna down 2.8% and CIRA down 2.5%. The market turnover was EGP 1.2 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +6.3 mn

Regional: Net Long | EGP +20.0 mn

Domestic: Net Short | EGP -26.3 mn

Retail: 71.7% of total trades | 73.0% of buyers | 70.3% of sellers

Institutions: 28.3% of total trades | 27.0% of buyers | 29.7% of sellers

WTI: USD 42.50 (-0.91%)

Brent: USD 45.01 (-0.79%)

Natural Gas (Nymex, futures prices) USD 2.41 MMBtu, (+3.21%, Sep 2020 contract)

Gold: USD 2,010.00 / troy ounce (+0.57%)

TASI: 7,853.57 (+1.24%) (YTD: -6.39%)

ADX: 4,445.48 (+0.32%) (YTD: -12.42%)

DFM: 2,224.61 (+0.85%) (YTD: -19.54%)

KSE Premier Market: 5,740.80 (-0.99%)

QE: 9,775.28 (+0.82%) (YTD: -6.24%)

MSM: 3,570.58 (+0.54%) (YTD: -10.31%)

BB: 1,348.96 (+0.03%) (YTD: -16.22%)

Calendar

19 August (Wednesday): Results of elections for the nation’s first Senate are due to be announced.

20 August (Thursday): Islamic New Year, national holiday.

September: The General Authority for Investment (GAFI) will host a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

12 September (Saturday): Court session for Egyptian Resorts Company lawsuit against The Tourism Development Authority

14-15 September (Monday-Tuesday) The Chemical Industries Export Council will organize a virtual conference to discuss export options for Egyptian chemical exporters in Kenya and Uganda

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

20 September (Sunday): A Cairo administrative court is due to issue a ruling in a third-party lawsuit demanding the government block YouTube in Egypt for carrying an allegedly sacreligious video. The case is an infamous 2012-vintage lawsuit still wending its way through the courts.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

16 September (Wednesday): The last day for the final results of the senate elections to be announced.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.