- Banking sector remains vulnerable to FX shocks as it could take us longer to get over covid than the shock of the EM Zombie Apocalypse –Fitch. (Speed Round)

- Two-year installment plans, online access in gov’t consumer spending initiative. (Speed Round)

- TAQA Arabia inaugurates its first natgas fueling station, with plans to build 50 with the National Company for Roads. (Speed Round)

- No fatalities as pipeline explosion on Cairo-Ismailia road injures 17. (Last Night’s Talk Shows)

- The covid-19 economic crisis is far from over, warns El Erian. (What We’re Tracking Today)

- Middle-income nations have been missing from the covid-19 narrative. This needs to change, says the FT. (The Macro Picture)

- Orange tops regulator’s league table for data quality for the 11th straight month. (Speed Round)

- Could Egypt make better use of its position as a subsea internet cable hub? (Hardhat)

- The Market Yesterday

Wednesday, 15 July 2020

It’s going to take banks longer to get over covid than the EM Zombie Apocalypse –Fitch

TL;DR

What We’re Tracking Today

Good morning, friends, and welcome to the day we here like to think of as almost-THURSDAY. Three-day weekends are supplanting summer vacation for many of you, so how about we start this morning with a handful of stories to feed your soul as you look forward to unplugging for three days.

But first: Were you freaked out about the US government’s plan to pull the visas of foreign students who are being forced to take most of their courses online this fall? Whether you or your spawn were impacted, take a deep breath: The Trump administration backed down yesterday — for the moment. The requirement that foreign students take at least one in-person class (or leave the country / transfer schools) has been dropped, according to the judge hearing a case brought against the government by Harvard, MIT and other top-flight universities.

The problem is that it ain’t over until it’s over, as Yogi Berra (not Lenny Kravitz) said back in 1973. The presiding judge said the case isn’t yet closed, and at least one pundit is warning that US Immigration and Customs Enforcement is probably looking for other ways to deliver the same result. Start with this piece from Bloomberg (which takes a more pessimistic look), then flip over to the New York Times for more.

Remember that piece we suggested you read yesterday about midlife gap years? The notion started with college-aged kids…

Back to that long weekend. We’re not suggesting you go hang out in a restaurant — but placing an order for takeout from your favourite local joint is not a bad idea. Restauranteurs have been hammered the past four months, and it’s time folks started offering them support in between all of the baking of sourdough bread and finding of ways to stuff cake inside … stuff. You’re a regular somewhere, right?

Takeout in hand, head over to Billboard and remember that “music can help get us through some of the toughest moments in our lives.” Bands, orchestras and solo performers love recording albums — but they make their real money in live performances, which aren’t exactly on the menu at the moment. Some are streaming entire historic concerts online without charge (think: Metallica Mondays and Pink Floyd on Fridays), while everyone from the LA Philharmonic to Pink Sweat$ via Pearl Jam, Ice-T, Lil Wayne and Chuck D are doing at-home performances. Billboard has an exhaustive list of which of your favourite artists has (or will) live stream or release something awesome from their archive.

Settled into your favourite slot on the beach, with a full tummy and happy ears? Now start educating yourself about how contemporary art is changing in the of covid. Perhaps especially in times like this, “art can set you free,” The Conversation reminds us. One of our favourites right now: Up and coming Egyptian artist Alaa Abul Hamd, who draws inspiration from ancient Egyptian art without being hackneyed — or “obnoxiously orientalist,” as one of us recently remarked on our internal chat system. Abul Hamd is a native of Upper Egypt and professor in Luxor whose “subjects are recognizable by their strikingly Egyptian features, stillness, strength, proud postures, and silence.”

Go explore him via our friends at Cairo gallery TAM — or look at this awesome annual report we built for CIB back in 2011 that stands as a shining example of how your company can support the arts while buffing your bottom line. (TAM, by the way, made an appearance in season one of our podcast, Making It.)

REMINDER- We have a holiday long weekend next week as Thursday will be off in observance of the 23 July Revolution thanks to cabinet’s new policy of making Thursdays substitutes for midweek holidays. We’ll all be off again at the end of the following week for Eid Al Adha.

COVID-19 IN EGYPT-

The Health Ministry confirmed 73 new deaths from covid-19 yesterday, bringing the country’s total death toll to 4,008. Egypt has now disclosed a total of 83,930 confirmed cases of covid-19, after the ministry reported 929 new infections yesterday. We now have a total of 25,544 cases who have fully recovered.

The occupancy rates of quarantine facilities and ICU beds for covid-19 cases have both dropped to 60%, Health Ministry adviser Sherif Wadie said on Tuesday. Some 200 people are currently in intensive care while 111 patients are on ventilators, he said.

British Airways may resume regular flights to Egypt from the beginning of September, Youm7 reports, citing unnamed sources at Cairo International Airport. The carrier has been operating a limited number of flights between the UK and Cairo since Egypt reopened its airspace to international flights at the beginning of the month.

EgyptAir is still waiting on that EGP 3 bn loan: National flag carrier EgyptAir has yet to receive approval from the Finance Ministry for a credit guarantee that would allow it to draw down a EGP 3 bn loan from state-owned National Bank of Egypt, said Mohamed Roshdy Zakaria, the holding company’s chairman. The airline said in June it’s seeking the loan after having fallen into the red since the suspension of flights in March.

EgyptAir is notifying people travelling to Sharjah that they must have a PCR test certificate that shows they’ve been tested for covid-19 prior to departure.

ON THE GLOBAL FRONT-

Another hurdle cleared in the quest for a covid-19 vaccine: A vaccination for the novel coronavirus being developed by US pharma company Moderna has cleared an important hurdle after it succeeded in producing antibodies in all 45 volunteers during safety trials, Bloomberg reports. The catch? A number of patients experienced sometimes severe side effects from the vaccine. Moderna will move to large-scale testing later this month.

GLOBAL MACRO-

Indonesia is dramatically widening the Overton Window of what constitutes sensible monetary policy: The country’s central bank will start directly monetizing government debt when it soon purchases USD 40 bn in sovereign bonds, most of them directly from the state, Bloomberg reports. Direct monetization has long been taboo due to fears of out-of-control inflation caused by accelerated state spending, and a perceived threat to the independence of monetary policymakers.

In a sign of how topsy-turvy the world has become, investors have welcomed the move, anxious for aggressive measures to stabilize the economy. The bank’s governor has also sought to calm nerves about the policy, assuring that it would stop purchases if inflation began to surge.

And other emerging markets may soon follow if Indonesia doesn’t get burned. The business information service suggests that the Indian, Malaysian and Philippines central banks may be tempted to purchase government debt directly from the primary market, should Indonesia come out the other side intact.

If the exhilaration in the global stock markets has convinced you that it’s time to start partying like it’s January 2020, Mohamed El Erian is here to bring the sober analysis. “The financial stress caused by covid-19 is far from over,” reads the first sentence of El Erian’s latest opinion piece in the Financial Times, in which he warns us to prepare for non-payments to surge even among corporates and sovereigns with decent credit ratings. Investors, who are currently buying into a liquidity-fuelled rally producing valuations “stunningly decoupled” from the fundamentals, need to become more circumspect and pay attention to the signs of trouble ahead: record corporate bankruptcies, job cuts in large companies, delays in household and commercial rent payments, and a number of developing countries delaying debt payments.

US banks are preparing for the flood: The three biggest US banks put aside USD 28 bn in 2Q2020 to cover losses on personal and business loans in anticipation of a coming wave of defaults. This is a serious step up from the loan loss provisions made in the first quarter, demonstrating how thinking has changed about the longevity and severity of the economic crisis caused by the pandemic. Jamie Dimon, CEO of JPMorgan which has earmarked a record USD 10.5 bn to cover loan losses, said that the bank was “prepared for the worst-case scenario” and warned that things would likely get worse in the coming months. “This is not a normal recession … The recessionary part of this you’re going to see down the road.” The Wall Street Journal and the Financial Times have the story.

AND THE REST OF THE WORLD-

Derivatives trading is coming to Saudi Arabia: The Saudi stock exchange will allow futures trading starting 31 August, it said in a statement. The country’s first exchange-traded derivative contract — the Saudi Futures 30 (SF30) — will track the country’s MSCI Tadawul 30 Index.

We were supposed to be launching derivatives trading and a futures exchange here in Egypt during the first half of this year. We haven’t received any explanations for the delay, but we wouldn’t be surprised if something beginning with ‘C’ and ending in ‘ovid-19’ played a part.

The UK government decided yesterday to ban all new purchases of equipment from Chinese telecom giant Huawei and require mobile operators to remove its technology from the UK’s 5G infrastructure by 2027, the BBC reports. The announcement came after diplomatic pressure by the US to abandon cooperation with the now-sanctioned company and following British intelligence recommendations that could not verify the security of the company’s 5G technology.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: Egypt holds a unique position as far as global internet infrastructure is concerned. With 17 cables passing through the country, Egypt is second only to the US in terms of the number of submarine cables in its territory. But despite this, Egypt doesn’t rank among the strongest regional countries in terms of its internet speeds and cost effectiveness, due to our domestic infrastructure needing improvement. The answer? Open up domestic IT infrastructure development to the private sector, insiders and former officials tell us.

Enterprise+: Last Night’s Talk Shows

It was a mixed bag on the airwaves last night: Yesterday’s pipeline explosion understandably attracted the most attention, but we were also handed an interview with the International Labor Organization’s Cairo boss as well as the coverage of the latest goings on at the GERD negotiations.

No fatalities as pipeline explosion on Cairo-Ismailia road injures 17: Masaa DMC’s Ramy Radwan spoke with Health Ministry spokesman Khaled Megahed who discussed the incident in which the Shokeir-Mostorod oil pipeline caught fire near the Cairo-Ismailia road. He said some 17 people were injured but there were no fatalities (watch, runtime: 4:18). Oil Ministry spokesperson Hamdi Abdulaziz told Radwan that the accident was caused by a leak in the pipeline, and that a spark on the road caused the fire. He added that the fire services were able to swiftly extinguish the flames (watch, runtime: 8:09). Ala Mas’ouleety’s Ahmed Moussa spoke with the Public Prosecutor’s office regarding the incident, which said that an investigation had been launched, and the injured at the hospital were being questioned (watch, runtime: 2:53). Yahduth Fi Misr’s Sherif Amer also covered the accident (watch, runtime: 6:19), (watch, runtime: 5:29).

The story is getting plenty of attention in the international press: Associated Press | Reuters | XInhua | Arab News | Gulf News.

Call for Egyptian military intervention in Libya receives support: Radwan spoke with Khaled Al Mahjoub, the spokesman for Tripoli operations room of the Libyan National Army (LNA), who denied Turkish claims that there is a significant battle brewing in the town of Sirte. He accused Ankara of misinformation and said that there were no boots on the ground near the strategic town. Al Mahjoub welcomed the Tobruk-based House of Representatives’ call for Egyptian military intervention (watch, runtime: 8:05). Ala Mas’ouleety’s Ahmed Moussa spoke with Abd Elhamid Safi, an adviser at the Libyan parliament, who also said he welcomed the invitation for Egypt to intervene in the conflict (watch, runtime: 4:21).

ILO on covid-19 in Egypt: Amer spoke with Eric Oechslin, director of the International Labor Organization’s Cairo branch, who discussed the impact of covid-19 on employment. Oechslin said that covid-19 has pummelled labor markets in African and Arab countries, and that the organization has no idea when and how the crisis will end. He lauded Egypt for taking early measures to mitigate the impact of the outbreak on the country’s labor market and to support the private sector. He said that the organization is working closely with the government and private sector to ensure safety and security for workers. Oechslin also discussed the Women National Council's work with the United Nations Women Program to provide employment and training opportunities for women across Giza, Siwa, and Alexandria, as well as raise awareness about gendered violence (watch, runtime: 5:45), (watch, runtime: 3:23).

Speed Round

Speed Round is presented in association with

Egyptian banks’ FX liquidity “still vulnerable” — it’s going to take longer to recover from the covid-19 sell-off than from the 2018 EM Zombie Apocalypse -Fitch: The capital outflows Egypt sustained over the past several months as a result of the fallout from the covid-19 pandemic was “more severe” and the strain is likely to last longer than the emerging markets sell-off in 2018, Fitch Ratings said in a recent report. Egyptian banks’ net foreign assets (NFA) dropped to negative USD 5.3 bn to service these outflows, the report suggests. The ratings agency sees FX liquidity within the banking system as still being “vulnerable” to the swings of emerging market investor appetite and a general shortage of FX receipts because of the pandemic.

We’re getting back on our feet, but a full recovery will take time: While the USD 8 bn in funding Egypt has received from the IMF and the USD 5 bn eurobond issuance in May “have helped to ease pressure on foreign-currency (FC) liquidity in the short term … a sustainable improvement in [foreign currency] liquidity would require the return of FC receipts, which are contingent on external economic factors,” the report says. These external factors include lower international demand driving down Suez Canal receipts, as well as merchandise exports, in addition to lower remittances from Egyptian expats. The ratings agency sees Egypt’s current account deficit widening to 5.3% of GDP this year from 3.6% in 2019, “intensifying pressure on FC reserves.”

Foreign portfolio investment is starting to pick up again: Egypt has started to see a reversal of outflows as foreign central bank stimulus drives renewed risk appetite for high-yield EM debt. Foreign inflows have totalled around USD 3 bn in the past month, Al Masry Al Youm reported earlier this week, citing an unnamed banking source. Inflows have so far accelerated in July: last Thursday saw some USD 592 mn in new portfolio investment — the largest amount in a single day since the outbreak of the covid-19 pandemic in March — and Sunday saw USD 367 mn in inflows, the source said.

But a fresh wave of outflows is still a possibility: Fitch says Egypt could see a new wave of outflows if the EGP were to sustain a “sharp depreciation.” Another EM sell-off would also deliver a fresh blow to FX liquidity and banks’ NFA, as foreign holdings of t-bills represented some 20% of FX reserves at the end of April.

No cause for concern? “We are not worried as we believe the strain on foreign currency liquidity is relatively easing currently as reflected by the currency rate cooling off to around EGP 16.00 / USD from EGP 16.25 a few weeks ago,” HC Securities’ Monette Doss told Enterprise. ”We believe that at these levels Egyptian treasuries offer attractive risk-adjusted return coupled with low currency volatility which has possibly resulted in regained interest of foreign investors.”

On the upside, demand for FX has dropped considerably because of the pandemic, Suez Canal Bank board member Mohamed Abdel Aal tells us. While Egypt’s decision to close its airspace to commercial international flights caused tourism receipts to drop to zero, it also meant that Egyptians weren’t drawing FX to support international travel. The closure of the annual Hajj pilgrimage also saved the country substantial outflows, Abdel Aal says.

Two-year installment plans, e-commerce are part of gov’t consumer-spending initiative: Citizens will be offered two-year, low-interest installment plans to pay for consumer goods as part of new measures to encourage spending announced earlier this week, cabinet said in a statement yesterday. The government will create a dedicated online store that people can use to purchase products under the installment plans. The three-month program, which also includes discounts on selected consumer goods, will start from the end of July and aims to stimulate EGP 100 bn worth of consumer spending, the statement says.

Background: The government announced earlier this week a package of measures designed to support consumer spending and end the demand slump caused by the covid-19 pandemic. The government has made agreements with manufacturers and merchants to offer 15-25% discounts on as-yet unspecified consumer goods for all citizens, and will spend between EGP 10-12 bn to subsidize a 10% discount for ration card holders. In addition, a new holding fund will be used to guarantee up to EGP 2 bn in consumer loans and mortgages in an effort to encourage lending, and provide cheap financing for consumers to engage in government projects such as the installation of dual-fuel engines into cars.

TAQA Arabia inaugurates its first natgas fueling station with National Company for Roads as part of EGP 650 mn plan to build out 50 stations: Qalaa Holdings subsidiary TAQA Arabia and the National Company for Roads inaugurated yesterday the first natural gas fueling station under their three-year, EGP 650 mn plan to set up 50 stations, according to a press release (pdf). The station was set up in Rehab City in New Cairo. TAQA plans to close out the year with 13 natural gas stations under its belt in cooperation with the National Company for Roads. The partnership comes as the government continues to push citizens to install dual-fuel engines in a bid to increase fuel efficiency and protect the environment.

Orange Egypt tops the list of mobile operators in data services across the country for 11th straight month: Orange Egypt was ranked as the number-one data service provider out of the country’s four mobile network operators in May, placing the company as the top MNO in this category for eleven consecutive months, according to the latest service quality report (pdf) from the National Telecommunications Regulatory Authority (NTRA). The NTRA issues monthly quality of service (QoS) reports measuring Egypt’s four mobile networks’ performance in delivering voice and data services. According to the May QoS report, Orange Egypt’s average data speed across the 26k km surveyed was 32 Mbps, while the next best-performing competitor — Etisalat Misr — showed an average data speed of 28 Mbps. The company “developed a plan several years ago and this helped us achieve our objectives in obtaining the 4G license and the new frequencies in addition to making optimal use of these frequencies within Orange’s network,” Orange Egypt CTO Ayman Amiri said, according to a statement (pdf).

Egypt will allow inspectors to resume travel to check wheat shipments at their ports of origin, for countries that are accepting flights from Cairo, Reuters reports, citing Ahmed Al Attar, the head of the Agriculture Ministry’s Agricultural Quarantine Authority. The authority suspended the travel of inspectors in March during the covid-19 outbreak, recalling its inspectors in Russia and Ukraine. It had resumed the practice of sending inspectors to exporting countries in December of last year, after halting it in 2017.

In related news, state grain buyer GASC said on Tuesday that it had bought 114k tons of Russian wheat in an international tender, for shipment from August 16 to 26, according to Reuters. The Supply Ministry ended its local wheat procurement season yesterday after reaching its target of 3.5 mn tonnes of wheat purchased from farmers, according to a statement.

EARNINGS WATCH- CIB’s net profits dipped 4% y-o-y to EGP 2.6 bn in 2Q2020 on revenues of EGP 6.23 bn, which rose 20% y-o-y. The country’s largest private-sector bank decided to take on “the highest permissible provision band” during the quarter in a move that was “not only grounded by profound macroeconomic ambiguity but rather builds more on methodical assessments,” it said in its quarterly earnings release (pdf). CIB recorded a capital adequacy ratio of 26.3% by the end of the quarter, which is above the minimum regulatory requirement. Net income for the first half of the year dropped 7% y-o-y, coming in at EGP 12.7 bn. Commenting on the results, management said the bank “managed to upkeep its resilient performance in the second quarter of 2020, delivering singular top line growth while leaving its solvency untouched.”

The outlook remains “beset with challenges,” management said, but the bank does not expect it will need to “replicate the aggressive provisioning” it saw in 1H2020. CIB says it was well-positioned to absorb the shock from covid-19 — alongside a steep decline in interest rates — thanks to its balance sheet positioning over the past several years.

Orascom Investment Holding reported a net profit of EGP 51.64 mn in 1Q2020, compared to a net loss of EGP 78.86 mn in 1Q2019, the company said in a disclosure to the EGX.

CORRECTION- We incorrectly spelled e-payments platform Fatura’s name as Fatora in Sunday’s issue. The spelling has been amended on our website in a story reporting that the company has raised USD 1 mn in a funding round led by Disruptech along with EFG Hermes and Cairo Angels

The Macro Picture

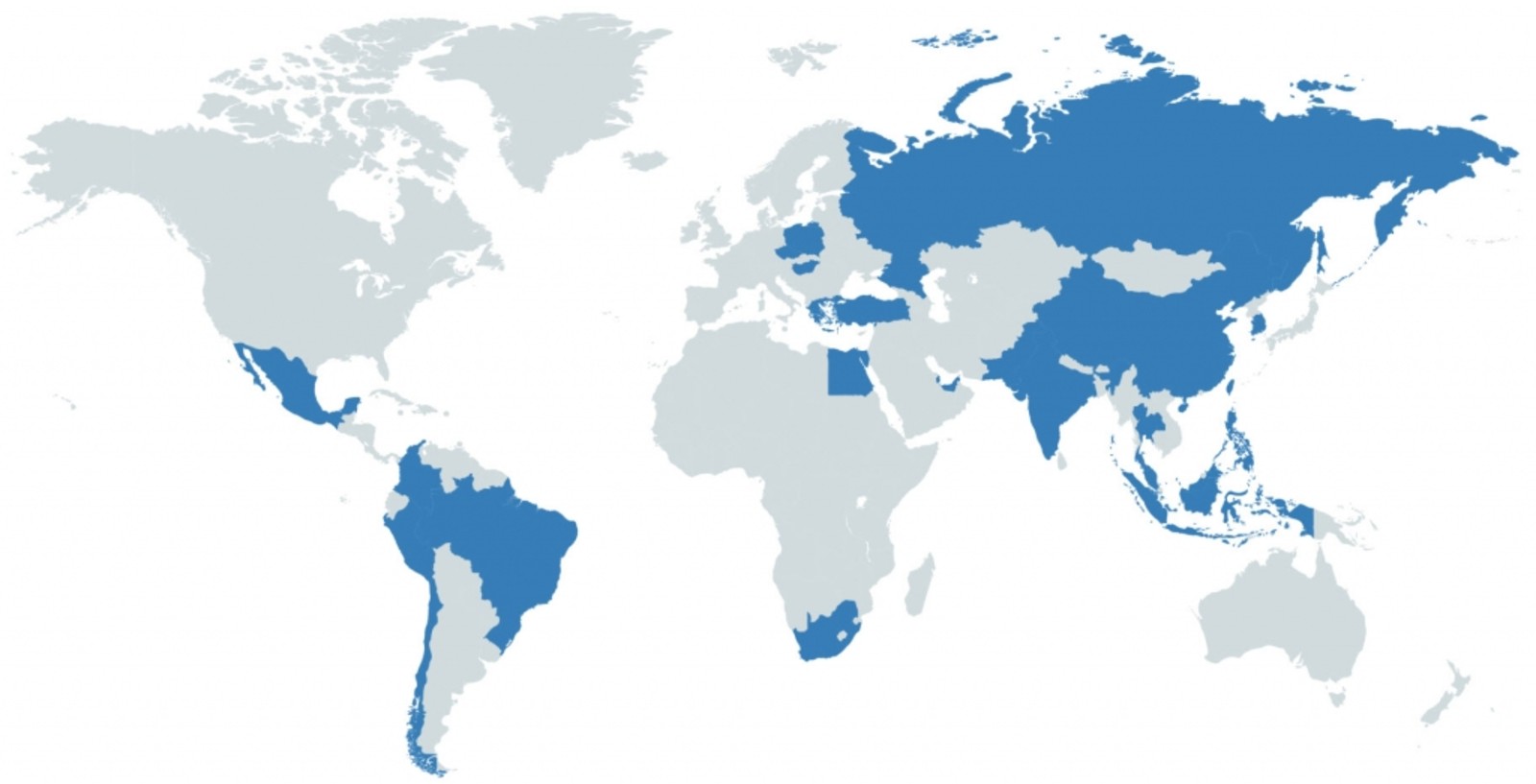

Why we now need to be talking more about EMs: Middle-income economies that stand halfway between the world’s richest and poorest “are uniquely vulnerable in the pandemic.” Despite this, those countries have largely been absent from the global narrative about the extraordinary steps needed to shield the global economy from the fallout, the Financial Times’ (paywall) editorial board writes in an op-ed.

Emerging economies have been tapping local debt markets or counting on central bank reserves, but unlike developed countries, they can’t depend on bn-USD stimulus programs and, unlike the poorest countries, aren’t in line for debt relief. This is made worse given the high debt levels, shaky healthcare systems, economic stagnation and serious inequality that characterized many EMs going into the crisis.

The risks are worthy of our attention: EM aren’t just shaky economies, they’re also often clogged with political unrest. The fallout from the outbreak, thus, not only threatens pushing mns into poverty but has the potential to give way to waves of internal unrest. And while many EM are still able to access international capital markets, “the calm is deceptive,” the FT writes. “As virus-induced recessions hit emerging markets with full force, budget deficits will blow out, triggering a wave of downgrades by ratings agencies and scaring away investors.”

One solution is to increase the IMF’s firepower: The IMF has so far lent out USD 25 bn to vulnerable countries, but this is far from the USD 2.5 tn in financial needs the fund has estimated for EMs. Rich countries have been considering making their IMF special drawing rights (SDRs) available to hard-hit countries including island nations in the Pacific or the Caribbean. This move could set a precedent, but much more should be done to increase the fund’s capacity as a lender of last resort.

Egypt in the News

The prospect of military intervention in Libya tops the conversation on Egypt in the international press this morning after the country’s eastern parliament invited the Egyptian military into the country: Reuters | AFP | Financial Times | Voice of America | Asharq Al Awsat | Arab News | Gulf News | Al Monitor.

Meanwhile: The Financial Times and Voice of America both look at the journalists, activists and critics who have been detained since protests last September and the New York Times reports that former military contractor-turned-critic in exile Mohamed Ali is fighting attempts by the government to extradite him from Spain to face charges of tax evasion and money laundering. Finally, Reuters has picked up the Supply Ministry’s decision to include reusable cloth face masks as part of its subsidy program.

Diplomacy + Foreign Trade

Ethiopia leaves door open for more GERD talks: Ethiopia is open to continuing talks with Egypt on the Grand Ethiopian Renaissance Dam (GERD), despite failing to reach an agreement in the latest round of African Union-sponsored talks, Bloomberg reports. The talks ended amid concerns Ethiopia would unilaterally fill the dam’s reservoir without first reaching an agreement, a move Egypt considers illegal. Ethiopia blamed the “unchanged stances and additional and excessive demands of Egypt and Sudan” for the lack of a breakthrough in the negotiations, according to a statement by its water and irrigation ministry on Tuesday, stressing that “Ethiopia is committed to show flexibility” to reach an outcome that’s acceptable to both sides.

Has Ethiopia already started filling the dam? New satellite photos show a swell of water in the GERD’s reservoir, seeming evidence that Addis Ababa has already begun to fill the dam. An analyst at the International Crisis Group tells the Associated Press that this is unlikely to be the case, and is instead probably a “natural backing-up of water” caused by the rainy season.

Sudan has submitted its final report following the latest round of talks on the Grand Ethiopian Renaissance Dam (GERD) from 3-13 July to the African Union, which sponsored the talks, state news agency SUNA reports. It included draft proposals for a “ balanced and fair agreement that is suitable to be the basis for a comprehensive and acceptable agreement between the three countries,” according to the report.

Deputy speaker welcomes east Libya parliament’s request for Egyptian military assistance: Deputy Speaker Soliman Wahdan has commended the statement by the Libyan House of Representatives, which on Monday invited the Egyptian military to intervene in the conflict to deter Turkey’s eastward advances, Youm7 reports.

How Egypt can make better use of its position as a sub-sea cable hub by opening up domestic infrastructure to the private sector: Egypt is a hub for internet submarine cables, with 17 cables transiting through the country. Egypt is second only to the US in terms of the number of submarine cables crossing the country, accounting for 17% of the world’s total, a Telecom Egypt (TE) official told Enterprise. But despite being a transit hub, private sector sources and former state officials we spoke with said that Egypt is still missing on major investments and has not been using these cables to the best of its ability.

The problem comes down to our local infrastructure not keeping up with the bandwidth potential from cables and other sources. Despite the investment and improvements we’ve made in bolstering our domestic capacity, Egypt’s internet prices and speeds still fall short of neighboring countries, according to independent reports and studies. Opening up more of Egypt’s IT infrastructure to the private sector and rethinking regulation are the best solutions to maximizing the use of our infrastructure.

Background: Egypt’s unique geographical linking Europe with Asia made us an ideal node in the global subsea cable internet. To exploit this advantage, TE has acquired additional stakes in submarine cables and embarked on building new cables from scratch. TE has already been a partner in several cables transiting the country and owns a few others. Back in 2018, TE gained full control over MENA Submarine Cable and signed an agreement to serve southern African neighbors, before it signed an MoU to expand and service submerged fiber optic cables in the region.

Most recently, TE became a partner in the 2Africa submarine cable project. TE, along with a consortium of global telecoms firms, partnered to lay a giant 37k-km subsea cable linking Europe, the Middle East and 16 countries in Africa. The new cable aims to provide a new crossing linking the Red Sea and the Mediterranean, the first in over a decade, and terrestrial routes parallel to the Suez Canal, using new technologies allowing the deployment of up to 16 fiber pairs instead of the eight. Once the new cable comes online within two years, it would be able to transmit up to 180 terabytes per second (Tbps), a TE official told us, which would allow Egypt to improve its internet service, the source added.

But are we benefiting from this capacity in our domestic usage? Not really: Although an exact figure is impossible to get, Egypt only uses a fraction of the capacity of these cables, former Communications Minister Khaled Negm told us. Egypt is already a member of the SEA-ME-WE 5 (SMW5) that delivers 38 Tbps as well as the Asia-Africa-Europe 1 (AAE-1) 25k km submarine cable from South East Asia to Europe, which delivers a capacity of 100 Gbps that is also projected to double. While TE raised Egypt’s domestic quota of bandwidth from these cables last year to 2.6 Tbps, Egypt used 1.9 Tbps last year. More importantly, the bandwidth per user from these cables has reached 9.3 kb/s in 2016, far below both the world and regional medians that hover over 30 kb/s.

One benefit appears to come from the transit fees for these cables to state coffers. TE made over EGP 2.9 bn in revenues from these transit fees in FY2019, according to a regulatory filing (pdf). These revenues accounted for 10% of the company’s profits in 1Q2020 (pdf). The cables transit fees have usually contributed 6.62%-17.39% of revenues between 2008 and 2019, according to a study by Submarine Cables Network.

With user bandwidth falling behind other countries, why are we not fully utilizing our quota from these cables? It boils down to our domestic infrastructure not being able to handle that added capacity, sources say. To use an analogy: It’s as if electricity generation capacity exceeded the capacity of the transmission infrastructure. Tapping into that bandwidth will need more investment into our telecommunications infrastructure, the Federation of Egyptian Industries IT division’s deputy head Hamdy El Leithy told us. He estimates that we need to invest around EGP 120 bn to expand the use of fiber optic cables locally and improve internet speeds.

That’s not to say that Egypt hasn’t gone a long way in installing fibre optics, since TE started replacing the traditional copper cables with fibre optic cables. The project — whose timeline had to be crunched to two years instead of four — required an investment of EGP 17 bn in 2019 and 2020, with EGP 26 bn having been spent in the last five years. Total investments reached EGP 43 bn since 2014, a TE official told us.

And that saved us during the lockdown and curfew. Users have experienced stable connections across multiple platforms during the curfew hours in the past few months, despite the increase in demand, as we noted in our feature on covid-19 IT actions taken by the government and private sector. These results were the fruit of a long-term strategy pursued by the Communications and Information Technology Ministry that has also succeeded in doubling the average broadband internet speed from 5 Mbps in 2018 to 17 Mbps in 2019, then 20 Mbps early this year, before scoring 30 Mbps in 2020, Communications Minister Amr Talaat told us.

But there is definite room for improvement: Egypt’s internet speed ranked fifth in Africa in June, according to Speedtest Global Index. Furthermore, our prices are higher than they should be. El Leithy and Negm told Enterprise that the internet prices in Egypt are still higher than they should be, especially given the quality of the service itself. Egypt’s fixed-broadband packages were found to be less affordable at an average of USD 7.06 per month when measured in terms of gross national income per capita (GNI pc). Egypt also ranked 48th globally in terms of affordability of USD 3.22 high-consumption mobile data and voice baskets, according to an International Telecommunication Union study.

Opening up Egypt’s IT infrastructure to the private sector offers a compelling solution: TE has the exclusive rights to establish communications infrastructure while the remaining operators have to lease capacities from it. This means that it is up to TE alone to improve the internet connection, one executive at a telecom company told Enterprise. El Leithy agrees, telling us that the private sector should be granted ways to participate in building their own infrastructure. Amr Badawy, former head of the National Telecommunications Regulatory Authority (NTRA), shares that sentiment. “The involvement of the private sector or at least a second company in the building of fibre optics infrastructure would almost definitely improve both the quality and the prices significantly,” he tells us.

Incentives and investment zones would go a long way toward unlocking new investment. Both Negm and Badawy said that the government needs to establish investment zones and offer gateways to international telecom companies, like in Alexandria and Zaafarana, to attract more investments and increase the added value the country can offer them.

And just about everyone we spoke with want to see the Data Protection Act signed into law, as it lays out the ground rules for how businesses use personal information collected online. The legislation has been approved by the House of Representatives but has not yet been passed. This legislation is crucial to attracting investments, El Leithy told us. He added that once passed, it could unlock investments worth over USD 100 bn as global companies would be able to benefit from skilled labor, good internet capacity, and a suitable business environment that protects the data of their clients.

Things could be heading in the right direction: TE is giving the private sector a shot at fiber optic infrastructure development, a TE official told us. Last year, the NTRA issued licenses to Vodafone and Etisalat to speed up the roll out of fibre optic cables to gated compounds. That said, while the license was granted, it only allows the companies to use the areas’ existing infrastructure to connect gated compounds on triple play technology, a high-end service that does not really qualify as investing in infrastructure, one telecoms exec told us.

And we may need to act soon, as our position as a cable internet hub is starting to face competition. Egypt is facing strong competition in submarine cables from Morocco due to their proximity to Europe, said Negm, while Israel is already giving us a run for our money, according to Badawy. The congested route that runs through Egypt, and several internet disruptions, has pushed stakeholders in the industry to explore alternative and cheaper routes, such as Google’s Blue-Raman cable that goes through Israel.

The top infrastructure stories of the week:

- The Electricity Ministry signed a EGP 4.6 bn agreement with Schneider Electric to build four electricity control centers, according to the local press. This comes as part of a larger EGP 8 bn plan.

- Cotton and Textile Industries Company signed a EGP 780 mn agreement with Gama Construction to develop a cotton spinning factory for its subsidiary Misr Spinning and Weaving Company.

- Damietta Port’s second container terminal is expected to be complete in January 2021 after renovation works were postponed due to covid-19. The terminal will cost EGP 500 mn.

- Egypt will invest more than EGP 45 bn to construct 47 seawater desalination plants over the next five years, in efforts to provide clean water to Sinai, the Red Sea, and Matrouh.

- Al Canal Sugar has contracted El Deiab for Land Reclamation to launch the largest agro-industrial project for sugar and strategic crops production by reclaiming 181k feddans in West Minya.

The Market Yesterday

EGP / USD CBE market average: Buy 15.90 | Sell 16.00

EGP / USD at CIB: Buy 15.89 | Sell 15.99

EGP / USD at NBE: Buy 15.92 | Sell 16.02

EGX30 (Tuesday): 10,874 (-1.2%)

Turnover: EGP 875 mn (2% below the 90-day average)

EGX 30 year-to-date: -22.1%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 1.2%. CIB, the index’s heaviest constituent, ended down 0.5%. EGX30’s top performing constituents were GB Auto up 5.7%, CIRA up 1.6%, and Orascom Construction up 0.1%. Yesterday’s worst performing stocks were KIMA down 4.5%, Egyptian Resorts down 4.2% and Orascom Investment Holding down 3.6%. The market turnover was EGP 875 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -31.3 mn

Regional: Net long | EGP +28.9 mn

Domestic: Net long | EGP +2.4 mn

Retail: 74.5% of total trades | 73.4% of buyers | 75.5% of sellers

Institutions: 25.5% of total trades | 26.6% of buyers | 24.5% of sellers

WTI: USD 40.44 (+0.85%)

Brent: USD 43.09 (+0.87%)

Natural Gas (Nymex, futures prices) USD 1.74 MMBtu, (+0.23%, August 2020 contract)

Gold: USD 1,812.90 / troy ounce (-0.07%)

TASI: 7,380 (-0.43%) (YTD: -12.03%)

ADX: 4,287 (-0.45%) (YTD: -15.52%)

DFM: 2,052 (-0.72%) (YTD: -25.76%)

KSE Premier Market: 5,552 (-1.91%)

QE: 9,319 (+0.23%) (YTD: -10.61%)

MSM: 3,504 (+0.19%) (YTD: -11.98%)

BB: 1,307 (-0.58%) (YTD: -18.80%)

Calendar

20-21 July (Sunday-Monday): Creative Industry Summit virtual edition.

23 July (Thursday): 23 July revolution anniversary, national holiday.

26 July (Sunday): Postponed court session for the lawsuit against Amer Group and Porto Group filed by Syria’s Antaradous for Touristic Development

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

5 August (Wednesday): IHS Markit PMI for Egypt released.

11-12 August (Tuesday-Wednesday): Senate elections take place.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-15 August (Thursday-Saturday): RiseUp from Home digital event. Pre-registration available here.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

12 September (Saturday): Court session for Egyptian Resorts Company lawsuit against The Tourism Development Authority

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

12-15 May (Wednesday-Saturday): Eid El Fitr (TBC).

10 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

22 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.