- Our Enterprise covid-19 poll found you’re not cutting staff — but you’re also not investing. (Speed Round)

- Lobbyist for private healthcare providers says the Health Ministry’s mandatory pricing scheme for covid-19 treatment is untenable. (Last Night’s Talk Shows)

- PMI reading suggests the private sector is weathering the storm. (Speed Round)

- Egypt’s daily count of new covid-19 cases and deaths are down this morning. (What We’re Tracking Today)

- Egypt could be getting a piece of EUR 670 mn worth of covid-19 support from EIB. (Speed Round)

- The government is waiving EGP 5.3 bn-worth of natural gas arrears owed by factories. (Speed Round)

- Making It is back with Tarek Assaad and Karim Hussein from Algebra Ventures. (What We’re Tracking Today)

- My WFH Routine: Khalil Abdel Khalek, co-founder and CEO of Tabibi 24/7.

- The Market Yesterday

Thursday, 4 June 2020

The Enterprise covid-19 poll: What you said about layoffs, salary cuts and investment

TL;DR

What We’re Tracking Today

We have a little bit of good news this morning for a change. Okay, okay, some of it only qualifies as neutral, but given the circumstances we’ll take it:

The covid-19 new case and death counts are down this morning. It’s too early to call it a trend, but this is the third day in a row that the new case number has dropped, and we’ll take it.

Job and salary cuts are not widespread — but you’re also not investing, and you definitely want more freedom to WFH in better times. Such are the results of our covid-19 reader poll, which leads this morning’s Speed Round.

The latest PMI reading suggests the private sector is weathering the worst of the storm: May figures show that while Egypt’s non-oil private sector remained in contraction territory, business activity mounted a solid rebound from last month’s record low. Saudi Arabia and the UAE were also largely in the same boat as lockdown restrictions began to ease, but companies there continued to cut staff and salaries. We have full coverage in our Speed Round below.

We won’t find out until next week when the Madbouly government plans to begin lifting some lockdown measures, including the ban on inbound and outbound international flights and the closure of restaurants and houses of worship, according to a statement. Cabinet’s covid-19 crisis management committee met yesterday to look over plans to prepare for the upcoming resumption of these activities, the statement says, without indicating an anticipated timeline. The most recent extension of lockdown measures is set to expire on Sunday, 14 June.

But we will see a phased reopening of tourist attractions and museums. The Tourism Ministry will “soon” reopen a total of six museums and tourist attractions including the National Museum of Egyptian Civilization and the Baron Palace after an almost three-month hiatus.

Markets today: Asian shares are mixed in early trading this morning, while futures point to European markets opening in the green later this morning. The same gauge suggests US shares will open in the red after the S&P, Dow and Nasdaq all posted gains yesterday despite ongoing nationwide protests against police brutality and racial inequality.

The EGX30 has so far closed in the green every day this week, adding to its streak by ending yesterday up 0.8% at the closing bell.

Oh, and Zoom? Definitely not interested in protecting your privacy: Only paid users will get access to an encrypted call feature now in development, the company’s CEO told investors, noting that “[unpaid] users for sure we don’t want to give that because we also want to work together with FBI, with local law enforcement in case some people use Zoom for a bad purpose.”

COVID-19 IN EGYPT-

The Health Ministry confirmed 36 new deaths from covid-19 yesterday, bringing the country’s total death toll to 1,088. Egypt has now disclosed a total of 28,615 confirmed cases of covid-19, with the ministry having reported 1,079 new infections yesterday — the third day in a row in which cases declined. We now have a total of 8,371 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 7,350 have fully recovered.

More than 5.4k coronavirus patients are being treated at home homes and another 5.9k patients from university hospitals, according to a Cabinet statement. Remote treatment for cases displaying mild symptoms of the virus has become the ministry’s standard protocol as it works to reduce the load on public healthcare infrastructure.

Citizens returning on repatriation flights are now being required to self-isolate at home, Hapi Journal reports. They had previously been sent to hotels serving as quarantine facilities.

Cabinet published yesterday an infographic of the geographic distribution of hospitals across the country that are currently treating covid-19 patients, as well as a list of the hospital names.

A handful of private sector labs have signaled they are prepared to provide PCR covid-19 testing if they get the go-ahead from the government, Al Mokhtabar Labs Chairman Moamena Kamel tells Al Mal. The Health Ministry has begun allowing private sector healthcare providers to treat patients infected with the virus but said that state-owned labs have enough testing capacity to cover the country’s needs for now.

A total of 99 hotels are now open nationwide after the government gave another 14 properties in Red Sea, Alexandria, Cairo, Suez and Aswan the green light.

We’re jumping on the drive-in cinema bandwagon: The Mall of Arabia plans to open what we think is Egypt’s first drive-in theatre since the 1990s. Drive-ins are making a comback globally in the age of covid, CNBC reports.

Canada has donated USD 500k to the UNDP in Egypt to purchase covid-19 diagnostic equipment, according to an embassy statement.

Somabay is naturally shifting its mindset to adapt to a new course of direction, paving the way for what’s yet to come. A new perspective is just over the horizon.

Somabay is naturally shifting its mindset to adapt to a new course of direction, paving the way for what’s yet to come. A new perspective is just over the horizon.

ON THE GLOBAL FRONT-

Italy has fully opened its international borders and scrapped its 14-day quarantine requirement for visitors, the Associated Press reports.

Iran is starting to see a second wave of virus infections, reporting 3,134 new cases on Wednesday, according to Bloomberg. The new outbreak marks the largest daily case count in the past two months and comes after the country began easing lockdown measures in April.

The United States plans to ban flights by Chinese airlines, complaining that Beijing hasn’t yet “approved requests by U.S. airlines to resume flights after they were suspended amid the pandemic,” the WSJ reports.

GLOBAL MACRO-

Russia, Saudi in look to extend oil production cuts: Saudi Arabia and Russia have reached a preliminary agreement to extend the record oil supply cuts agreed in April into next month, a source from OPEC+ said, according to Reuters. A final decision to keep the cuts in place depends on compliance from producers that haven’t been fully on board, the source said. Brent crude rallied to above USD 40 a barrel in recent days in response to the likely extension.

Things are looking much worse for natural gas, which unlike oil lacks a price-setting cartel. Bloomberg suggests that natgas futures, faced with the same conditions that led to the oil glut and price crash, could be changing hands at negative prices in Europe, “but only in the very short term” due to oversupply.

Meanwhile, Europe’s services PMI is signalling that the worst might be over, with the IHS Markit Eurozone Composite PMI (pdf) nearly doubling last month from April’s record low. But similar to the bloc’s manufacturing PMI figures that were out earlier this week, the EU’s services sector is still deep in contraction territory amid a sustained slump in demand.

AND THE REST OF THE WORLD-

The police officer accused of murdering George Floyd on video is being charged with a more serious offense and three other officers who stood by and watched will be charged with aiding and abetting the murder, Reuters reports. The new charge — an escalation to second degree from the initial third degree murder charge against the now-former officer — can carry a sentence of up to 40 years.

Widespread protests of racial ineqality and police violence sparked by Floyd’s murder are simmering in the US for a ninth day in New York City, San Francisco, Los Angeles, Washington, St. Louis and Portland. The gatherings were markedly less violent than in recent past, according to the NYT.

Former defense boss criticises uses of troops against protesters: Former US Defense Secretary Jim Mattis issued a statement earlier in the day condemning Trump for deploying the military against the protesters and helping foment divisions in the country.

The UK will give 3 mn Hong Kong residents the chance to seek refuge if China goes ahead with imposing a new security law on the island, said Prime Minister Boris Johnson, according to Bloomberg.

Warner Music raised USD 1.93 bn yesterday in the US’s largest IPO this year. The listing “signals the renewed strength of US offerings” (uhm, sure) Bloomberg reported, saying investors saw the appeal in the company's emphasis on streaming revenue after the covid-induced market turmoil.

US citizens vs. surveillance capitalism: Google’s California-based parent Alphabet is facing a potential USD 5 bn class action lawsuit in the US by claimants accusing the tech giant of illegally harvesting private data while users surf the web in ‘private’ mode, Reuters reports.

It’s Making It Day: The second season of our podcast on building a great business in Egypt resumes today.

Our guests today are Tarek Assaad and Karim Hussein, two of the three managing partners of Algebra Ventures, the USD 54 mn Cairo-based venture capital fund and one of a handful of pioneers who are writing the book on how VC is done in this corner of the world.

Together with their friend and partner Ziad Mokhtar (who was unable to attend our recording session and help us test whether we could fit three guests plus a host into our two-person studio…), they’ve led investments in industries ranging from fintech to e-commerce, transportation, online food ordering and more. Some of their portfolio companies are already household names (Elmenus, Halan, Orcas) or well known in the business community (Trella). The list has grown since we sat down with Assaad and Hussein in December with the addition of Khazna last month, their first fintech investment.

In an interview recorded before covid-19 swept the globe, Assaad and Hussein give us a peek into what VCs look for in startups — and the red flags that make them walk away.

Tap or click here to listen to the episode on our website | Apple Podcast | Google Podcast | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.

Enterprise+: Last Night’s Talk Shows

A industry lobbyist claims private healthcare providers are objecting to price caps the Health Ministry imposed earlier this week on covid-19 treatment, saying that the pricing scheme doesn’t match the cost of providing treatment. Khaled Samir, a member of the Federation of Egyptian Industries’ healthcare division, told Al Tase’a Masa’an’s Wael Ebrashy that healthcare providers want to sit down with Health Minister Hala Zayed to reach a compromise on a pricing scheme that would allow them to provide treatment to patients without running at a loss, Samir said (watch, runtime: 7:59).

Private hospitals want the ministry to set a three-tier pricing scheme that accounts for both the type of service and the quality of the hospital, and are due to meet next week to discuss the issue, the local press reports, citing an unnamed source from the division. The proposed pricing scheme from hospitals is as follows:

- Low-level isolation services- EGP 18k / day at a tier-one hospital, EGP 11k / day at a tier-two hospital, and EGP 7k at a tier-three hospital. The Health Ministry’s scheme priced these services at EGP 1.5k-3k / day.

- ICU treatment for patients who need ventilators- EGP 25k / day at a tier-one hospital, EGP 18k at a tier-two hospital, and EGP 10k / day at a tier-three hospital. The ministry had priced these services at EGP 7.5k-10k / day.

- ICU treatment with no ventilator- It remains unclear whether private providers have proposed a different price range for this treatment, which the ministry had set at EGP 5k-7k per day.

Elsewhere, political commentator Mostafa El Feky zeroed in on Egypt’s GERD negotiations with Sudan and Ethiopia, suggesting to Yahduth fi Misr’s Sherif Amer that Ethiopia’s approach to the talks is ruffling feathers and could help strengthen Egypt’s position (watch, runtime: 2:09).

Speed Round

Speed Round is presented in association with

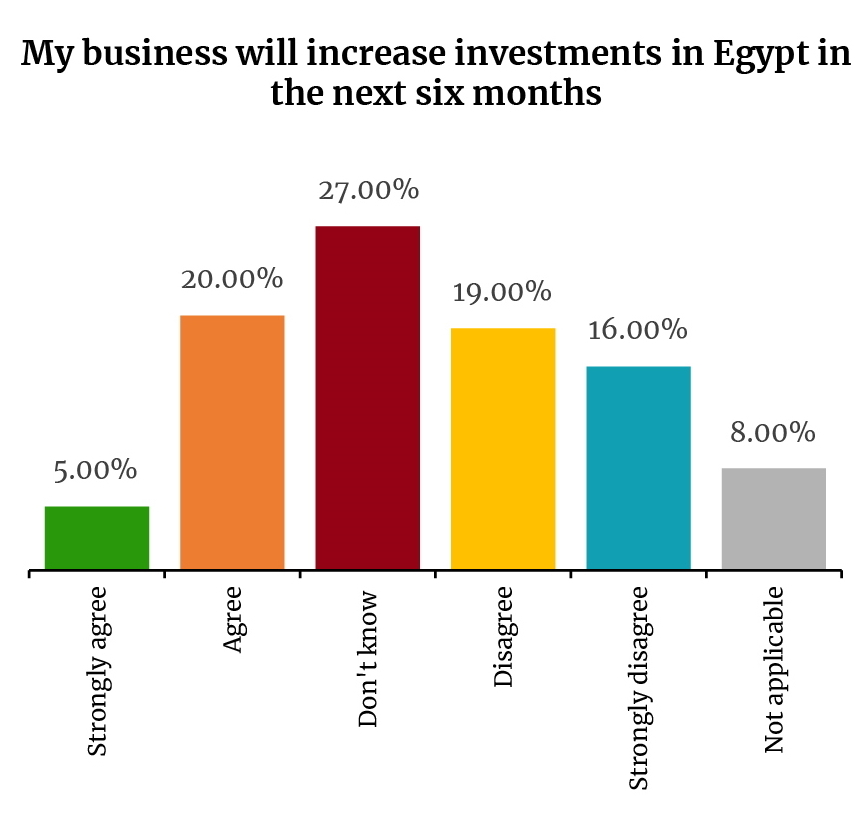

ENTERPRISE READER POLL- You’re not cutting staff — but you’re also not investing, and you definitely want more freedom to WFH in better times. A lot has changed since we last asked readers for their thoughts on the Egyptian economy and the outlook for business: At the start of the year, you told us of your optimism about 2020, predicting improved business conditions, a spate of new hiring and fresh foreign investment.

Fast-forward to June and the outlook for the Egyptian economy has radically changed: The unprecedented scale of the covid-19 pandemic has brought entire industries to a standstill, frozen supply chains at home and abroad, shaken capital markets, and forced hundreds of thousands (maybe mns?) of us to work from the confines of our own homes. We asked you in the days before the Eid El-Fitr holiday how you were coping. Here’s what you had to say:

HOW IS COVID-19 AFFECTING OUR COMMUNITY?

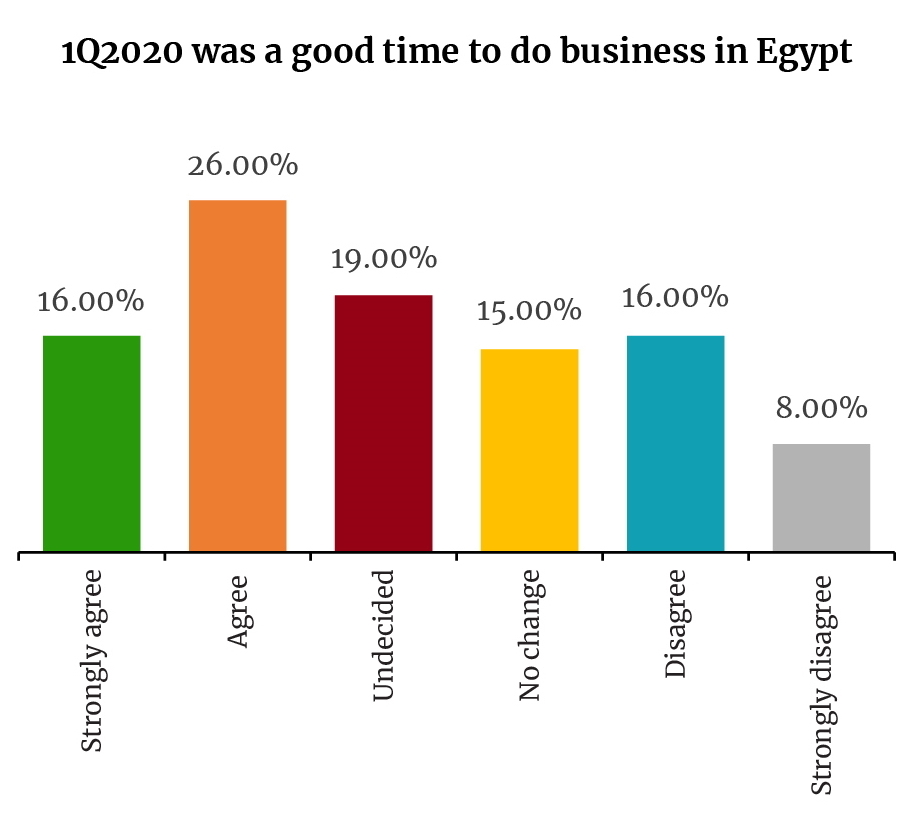

The halcyon days of the first quarter seem like a long time ago: Almost half of respondents said business conditions in the first quarter were good — while only 24% disagreed.

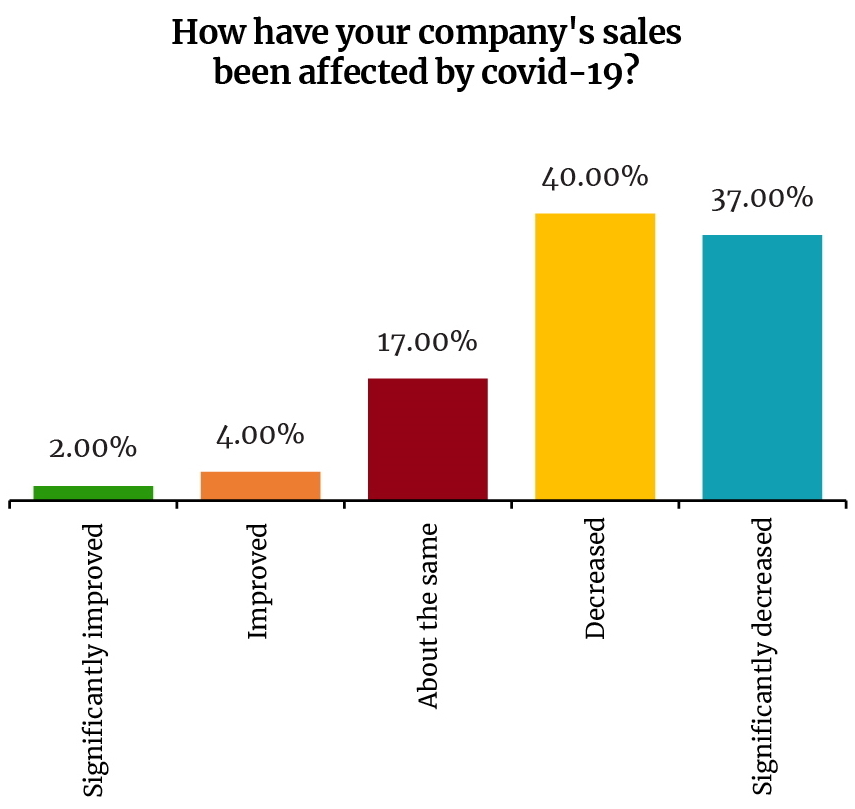

Sales have been hit hard: More than three-quarters (77%) of respondents reported a slowdown in sales as a result of the disruption, with 37% of them telling us that they had significantly decreased.

But critically, cashflows are still strong, with 70% of you saying that you have been able to keep up payments to vendors.

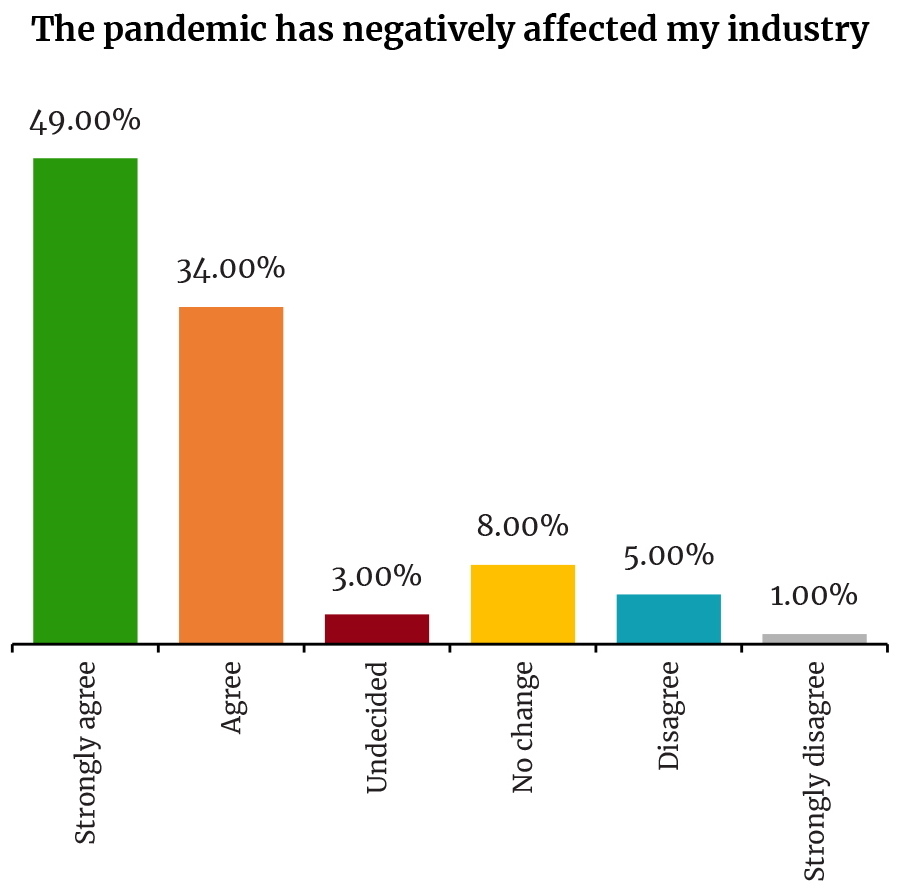

The vast majority of businesses are feeling the pain of the measures imposed to prevent the spread of covid-19. 83% of you told us that your industry had been negatively affected by the pandemic, with almost half of all respondents (49%) strongly agreeing with the statement.

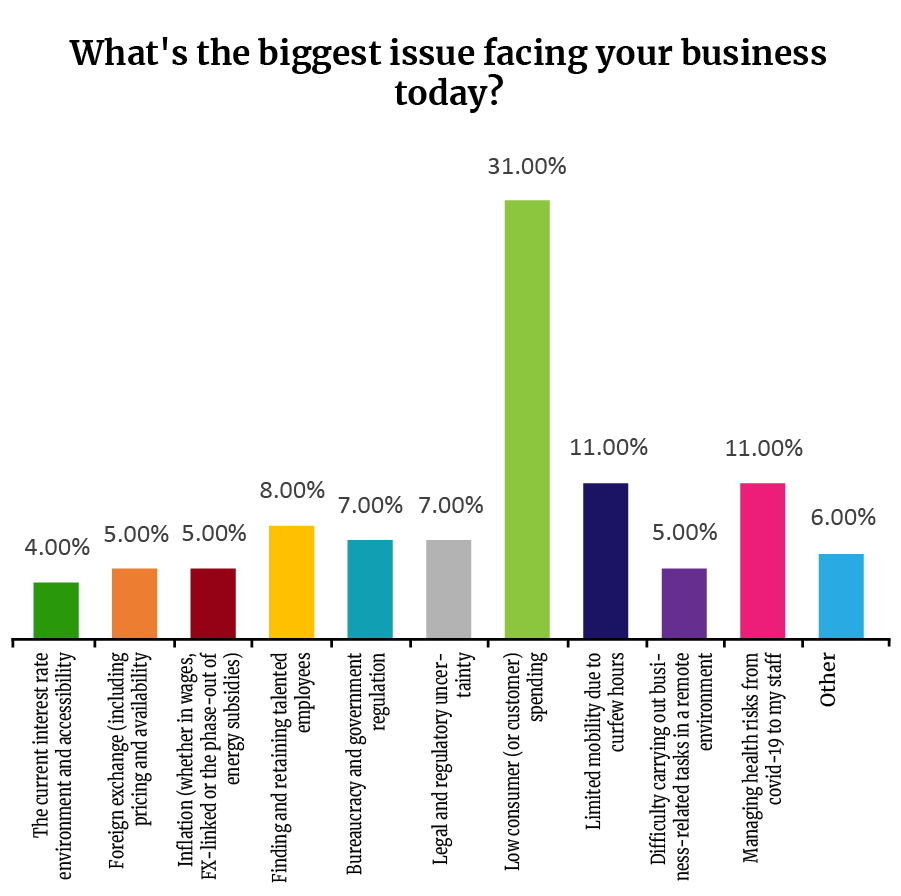

Unsurprisingly, the main issues faced by businesses have radically changed over the past three months: Almost a third of respondents (31%) said that low consumer demand is now the key challenge facing their business, while 11% cited protecting staff health and safety and difficulties associated with the curfew as the biggest issues. Only 7% cited finding talent (26% last time around) or bureaucracy (23% in our January poll).

HOW HAVE BUSINESSES RESPONDED?

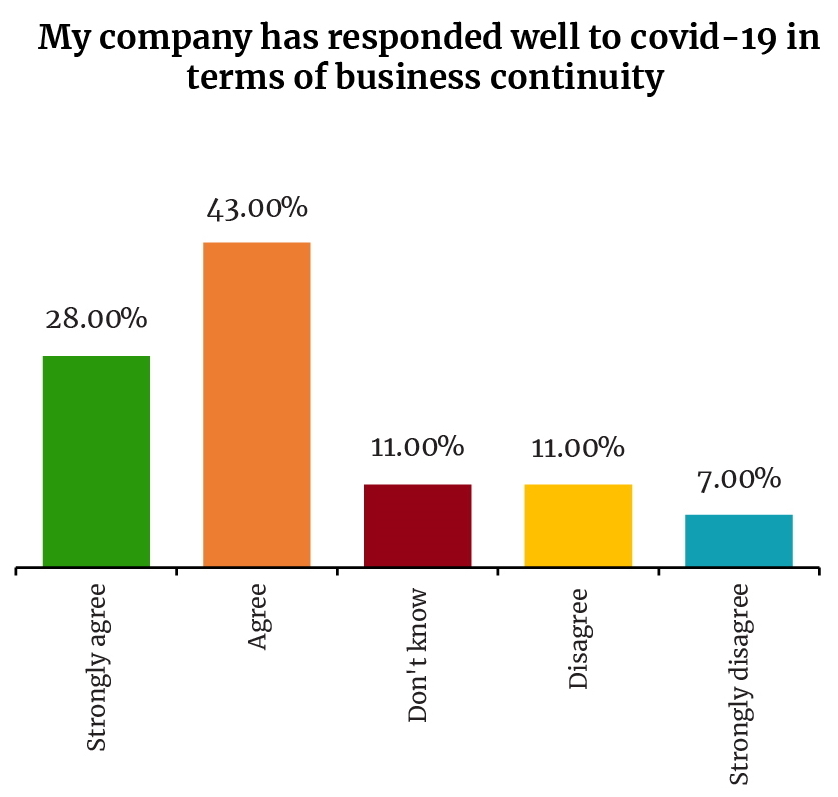

Overwhelmingly, you think your businesses have responded properly to adverse conditions: The vast majority (83%) have been happy with health and safety precautions put in place to protect employees, while 71% are satisfied with how they’ve responded in terms of business continuity.

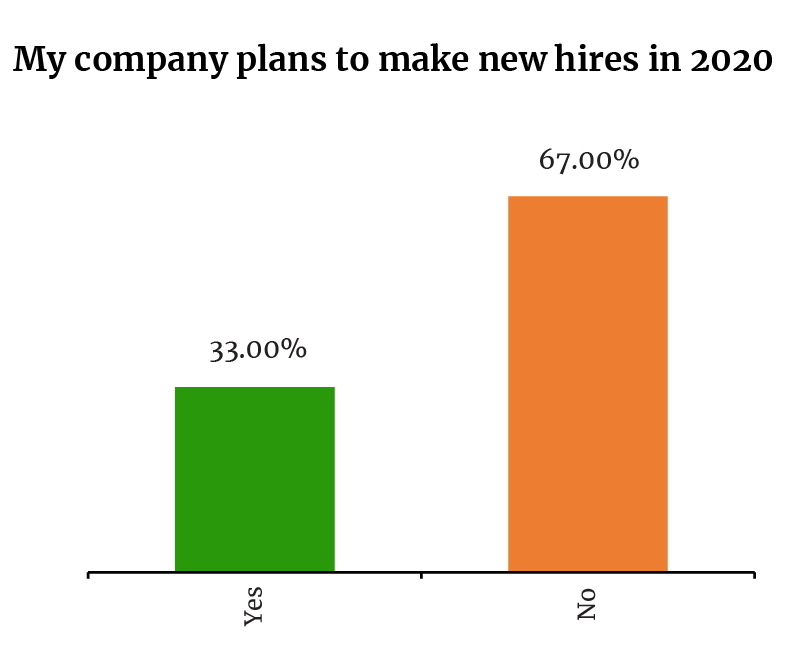

Only a third of you are still planning to hire new staff this year — down from 66% in our previous survey. Most of you (58%) have put in place a hiring freeze.

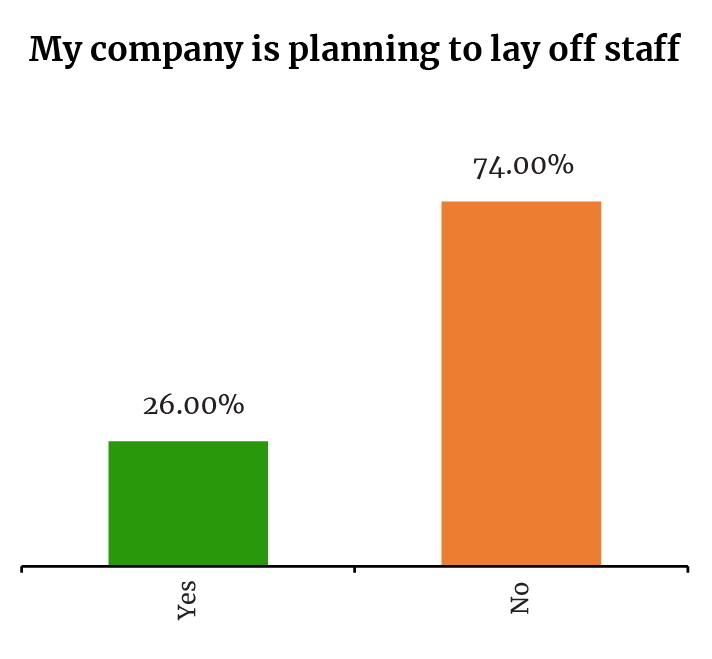

Less than a fifth (19%) of respondents have laid-off staff in response to the crisis, and 74% have no plans to do so in the future. Of the businesses that have cut back on staff, the majority (67%) have cut 1-10% of their workforce and 14% have cut 11-20%. A small minority have resorted to large-scale layoffs, with 5% shrinking their workforce by 50% or more.

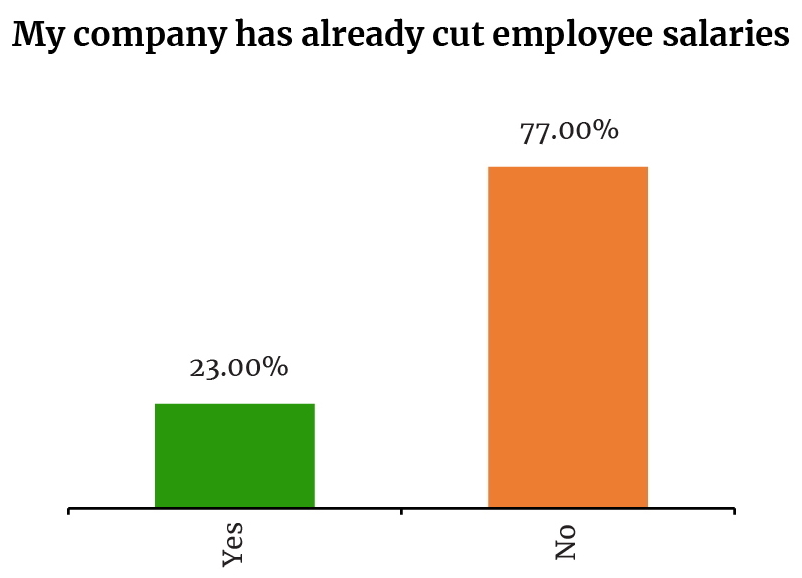

23% of you have made cuts to staff salaries and 67% have no plans to do so in the future.

Only a quarter of respondents plan to ramp up investment in the coming six months, down significantly from 58% from our last survey earlier this year. A bit more than one-third (35%) told us that they won’t be making new investments this year while a quarter remain undecided about their investment plans.

Most of you have rethought your budgets in response to the crisis with 56% of respondents saying they’ve had to re-calibrate revenue expectations and spending priorities.

Non-oil private sector slowdown eases in May: Egypt’s non-oil business activity fell at a slower rate in May, a month after the covid-19 pandemic caused the private sector to suffer its deepest contraction ever, according to IHS Markit’s purchasing managers’ index (PMI) (pdf). The PMI gauge rose 11 points to 40.7 in May, a significant recovery from the record low of 29.7 in April, but still the second fastest in a 10-month sequence of continuous declines. PMI readings above 50.0 suggest business activity is growing, while a reading below points to a slowdown.

Output, new orders in steady decline: Output levels dropped as many firms were still shut in May due to the government’s lockdown measures, though the decline was significantly less than that seen during April. New orders also suffered as stagnating demand continued through the month.

Unemployment accelerates at fastest rate in three years: Companies cut jobs at the fastest pace since January 2017, and for the seventh consecutive month. Reductions in salaries led to the highest drop in wage costs and first fall in input costs since 2011. “The remaining solace for Egyptian firms is that overall cost burdens eased for the first time in the series’ history,” IHS Markit economist David Owen noted.

Purchasing activity down, prices up: Lower input requirements from weaker sales led to reduced purchasing activity, but deliveries to companies slowed less in a slight recovery from the disruption to supply chains seen during March and April. Lower prices for plastic and other raw materials were offset by pricier food items and medical supplies. Output charges also dropped for the seventh consecutive month as firms offered discounts to boost sales.

Cautious optimism going forward: Firms were optimistic they would see the market recover once the pandemic subsides, “though concerns arose that the US/China relationship is worsening, which could affect any rebound in global demand," Owen noted.

Over in the Gulf: Saudi Arabia also saw slower, though sustained, reductions in output, new work and employment (pdf) while the UAE also stayed in contraction territory despite some signs of recovery (pdf) as the market remained weak and businesses cut jobs.

EGP WATCH- USD continues to rally: The EGP lost 11 piasters against the greenback yesterday to reach EGP 16.03 against the greenback, from 15.92 on Tuesday (pdf), according to data from the Central Bank of Egypt.

Egypt could be getting a piece of EUR 670 mn worth of covid-19 support from EIB: The European Investment Bank could lend public health authorities in Egypt and some of its developing neighbors a combined EUR 670 mn to help combat the pandemic, according to the bank’s project pipeline. The potential program — which also covers Jordan, Tunisia, Morocco, Moldova, Uzbekistan, and Belarus — aims to improve hospital provisions, ICU and testing capabilities, and support civil protection and prevention measures. Proceeds would also be used to support the medium-term capacity to co-exist with the pandemic. The European Union last month doled out EUR 89 mn to Egypt’s healthcare sector as part of a similar EUR 1.5 bn health aid program.

M&A WATCH- Prime Holdings is working on six transactions worth up to EGP 2.3 bn, all of which it expects to close this year despite market conditions, the local press reports, citing an unnamed company official. All of the companies are in industries that are more resilient and expected to better withstand fallout from covid-19, the report claims. Four of the six transactions, which it described as being in “advanced stages,” include the following:

- A cosmetics and food supplements business that will sell a EGP 350 mn stake within a month to an unnamed institutional buyer;

- An agricultural goods manufacturer marketing a EGP 50 mn stake and mulling capital increase of EGP 150 mn;

- A printing and packaging company to increase capital by EGP 140 mn and sell a EGP 60 mn stake; and

- A real estate developer working on a EGP 200-220 mn transaction.

Two more in earlier stages: The two other active transactions involve a food industry player that is selling a 25-35% stake worth between EGP 350-500 mn and an unnamed tobacco company that will be sold entirely to a “strategic investor,” the sources added. Prime is also currently in talks to sign on a new client which operates a hospital and several medical labs and is looking to sell EGP 600-800 mn controlling stake to a Saudi-based institutional investor.

CABINET WATCH- Cabinet greenlights Oil Ministry proposal to waive EGP 5.3 bn-worth of natural gas arrears owed by factories: Struggling state-owned and private sector factories will not have to pay EGP 5.3 bn in overdue bills for natural gas they bought from subsidiaries of the Oil Ministry on or before 31 December 2019, according to a ministry proposal approved by the Madbouly Cabinet in its weekly meeting yesterday. This will apply to late fees and penalties factories incurred for exceeding quantities specified in supply agreements with the government or failing to meet the minimum amount of natgas outlined in the agreements. The decision has not been linked directly to the covid-19 crisis and appears to be geared towards facilities that have been struggling or entirely stagnant for years.

Factories in Egypt currently pay on average USD 4.5/mmBtu of natural gas after the government slashed prices twice in the past six months, the statement notes. The first round of price cuts came last October after years of lobbying efforts by manufacturers who said high energy costs are affecting their product prices and thus sales which is causing them to work under their full production capacity.

Also approved in the cabinet meeting: France-backed agreement to improve food wholesale in Egypt: Cabinet ratified an agreement signed with France’s Semmaris and the French Development Agency (AFD) to improve the efficiency of Egypt wholesale markets in Egypt, according to a statement. Under the agreement, Semmaris — the company which administers France’s primary wholesale market Rungis — will provide recommendations to improve supply chain networks and food quality control, as well as work on studies that would help shape a national strategy for Egypt to develop fresh food wholesale markets. This so-called “technical support study” is funded by the AFD under the sponsorship of the French embassy in Cairo, the local press said in March. Eliminating waste from farm to consumer has actively been on Egypt’s agenda for 20 years now and has previously been the subject of funding from agencies including USAID.

Gov’t to resume trade talks with Eurasian Economic Union: Trade and Industry Minister Nevine Gamea will soon resume expert-level trade agreement talks with the Eurasian Economic Union (EAEU) with an eye on holding ministerial-level negotiations in 4Q2020, following a call with the union’s trade minister, Andrey Slepnev, according to a ministry statement. The potential trade agreement, first proposed in 2018, would see the creation of customs-exempt trade zones in Egypt. The EAEU is set to build infrastructure in Egypt’s Russian Industrial Zone the organization’s Industrial Policy Council announced late last year.

Wait, what’s the EAEU? Think “pals of Russia.” Members include Russia, Belarus, Kazakhstan, Kyrgyzstan and Armenia — with Mongolia, Syria, Tajikistan and Uzbekistan all having said at one time or another they’d like to join. EAEU has trade agreements with Vietnam, Iran, China, Serbia and Singapore.

Image of the Day

A vintage sunset view from the Great Pyramid: Maybe we’re feeling a little nostalgic about tourism amid the covid-19 lockdown. But we do like this lovely image of Egypt taken from the top of the Pyramid of Cheops in 1925 by prolific photographer George Rinhart. You can find more pyramid-clambering photos from between 1860 and 1930 here. Needless to say, don’t try this at home, folks.

Egypt in the News

A few stories to skim on an otherwise quiet morning for Egypt in the foreign press:

- Egyptians are looking to social media for information and answers to their questions on covid-19 in what plays out as a massive support group for the nation, according to the National.

- The Times of London picked up Mohammed Soltan’s federal lawsuit against former caretaker PM Hazem El Beblawi.

- The US State Department says it has “limited visibility” on Egypt’s anti-terrorism operations in Sinai, according to Foreign Policiy.

Telecoms + ICT

NACCUD to finalize ICT service agreements with Vodafone Egypt, Etisalat, Orange

The New Administrative Capital Company for Urban Development (NACCUD) will finalize this month contracts with Vodafone, Etisalat, and Orange to offer services in the city, NACCUD’s technology sector head Mahmoud Khalil said, according to Hapi Journal. The contracts will see state-owned Telecom Egypt sub-contract some of its duties to develop, operate, manage, lease, and maintain the new capital’s telecoms network to the private telecom companies.

Automotive + Transportation

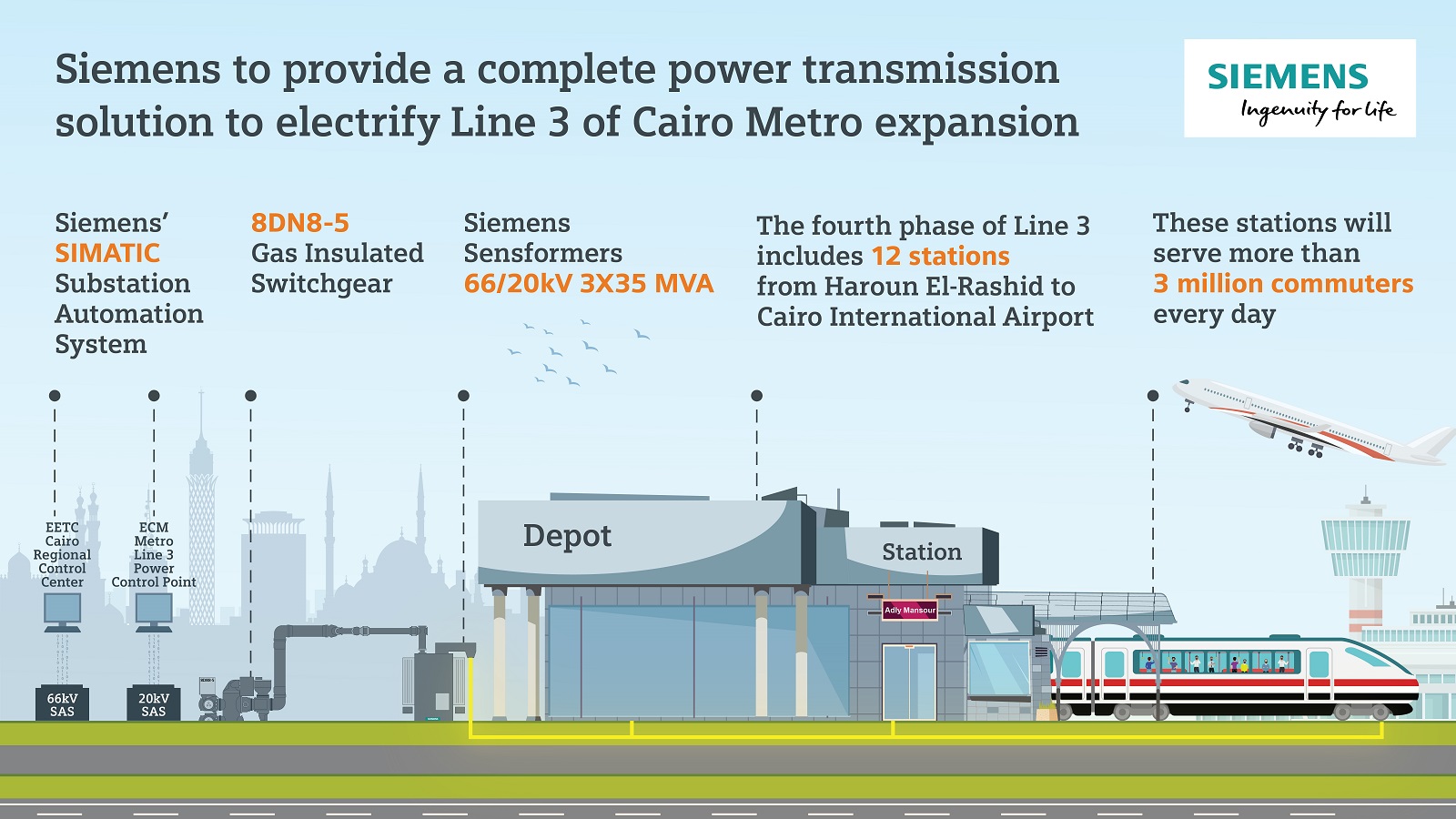

Siemens to supply electrification services for Cairo’s Metro Line 3

Siemens Energy will be providing the electrification services for Cairo’s Metro Line 3, which will link the capital city to Cairo International Airport, a company statement said. Colas Rail, Orascom Construction, and Arab Contractors are all working on the line.

Egyptian Competition Authority requires Careem to show Uber affiliation in its logo

Careem has changed its logo to show that the company is owned by Uber, following a request from the Egyptian Competition Authority to clearly indicate its affiliation with the ride-hailing giant, according to Al Mal.

Ride hailing app Dubci announced its soft launch.

Local ride-hailing app Dubci began a soft launch of its services earlier this week, with a 20% discount for all downloads of its app, according to Ahram Online. Dubci had said it would launch its services last year.

My Morning Routine

Khalil Abdel Khalek, co-founder and CEO of Tabibi 24/7: My Morning / WFH Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Khalil Abdel Khalik, co-founder and CEO of Tabibi 24/7, a homegrown primary healthcare practice that offers an integrated family healthcare system.

My name is Khalil Abdel Khalek and I’m what I call a “docpreneur” — a doctor-entrepreneur. I’m married to a beautiful psychologist, Mariam, and blessed with two great kids: Mohamed, 19, and Amina, 17. I run Tabibi, which provides help and healthcare to people and companies, whether at clinics, their workplace, or their homes. We have a team of around 75 full-time employees.

Since we’ve moved to working from home, I’ve tried to bring as much structure as possible to my daily routine. The first two weeks were quite different, but I’ve settled into a routine now. Once I wake up, I change my clothes and start my day with a bit of meditation, then read Enterprise with coffee and music — the earlier, the better. I used to get my day started with some physical activity at the club or in an outdoor space, but that’s no longer an option. I’ve set up designated areas within my home for the different parts of my routine — there’s a workspace, an area for my meditation and exercise, and a space for my breaks and time off. I stick to a specific schedule with my breaks as much as possible, but I have to allow a certain degree of flexibility to accommodate issues as they come up at work.

It’s tough to list what my job entails because there’s a lot that goes into it, and what it was pre-covid is very different from what it is now with the pandemic (also known as DC, or During Covid). The biggest challenge we’ve faced — which applies to the healthcare sector as a whole — is adapting to provide our services in a nonphysical way. We’ve shifted a lot of our services to the virtual space and it’s working for now, but I don’t see it as a viable long-term replacement for physically seeing patients.

The silver lining is that we’ve been able to lean more on having multidisciplinary teams managing our patient cases, because it’s easier to have a team of doctors with different specialties coordinating with each other online rather than having to meet in person to look over a case.

A major concern in the industry is that there’s currently a lot of unmanaged chronic cases because people are too afraid to visit clinics during the pandemic, and that we’re going to see a wave of these cases once we come out of lockdown. So we’re trying to accommodate these patients through Tabibi Telehealth services now to get ahead of the problem.

Running the business was a lot easier to move online; we don’t need to meet in person to manage the team and, if anything, we talk more as a staff and management team now than we did before. We have a daily virtual huddle for the whole team, and then we have what we’ve dubbed the Four at Four meeting every afternoon. That’s when the four managers all hop on a call to talk about whatever we need to.

At the beginning of the lockdown period, I began reading Man’s Search For Meaning, which in hindsight may not have been the best choice with everything happening, but it helped me think a lot about a long-term perspective for my business and industry. Now, I’m reading The Infinite Game. It’s a great book, especially because I’m in an infinite business: There will always be a need for healthcare.

Starting a business in Egypt and growing it requires you to wear different hats everyday, and the biggest challenge I’ve faced is finding a balance between the roles. What helps me is staying organized and relying heavily on a calendar. I log everything — even something as small as a quick call — on my calendar. And equally important is knowing when to take a step back and stop working; it’s critical to set time boundaries for your workday and I’ve learned that slowing down sometimes and really reflecting on everything is the best thing you can do for yourself and your business.

Once all of this ends, I’m looking forward to spending more time in nature. It’s already a little difficult to connect with nature when you live in a city like Cairo, and I think we all have a little bit of a Vitamin N deficiency — N being nature.

The Market Yesterday

EGP / USD CBE market average: Buy 16.03 | Sell 16.13

EGP / USD at CIB: Buy 16.03 | Sell 16.13

EGP / USD at NBE: Buy 16.01 | Sell 16.01

EGX30 (Wednesday): 10,424 (+0.8%)

Turnover: EGP 1.1 bn (52% above the 90-day average)

EGX 30 year-to-date: -25.3%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.8%. CIB, the index’s heaviest constituent, ended up 1.1%. EGX30’s top performing constituents were Dice up 5.0%, Qalaa Holdings up 4.3%, and Orascom Investment Holding up 3.3%. Yesterday’s worst performing stocks were Elsewedy Electricity down 1.8%, SODIC down 1.6% and EFG Hermes down 1.6%. The market turnover was EGP 1.1 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -246.7 mn

Regional: Net Long | EGP +13.9 mn

Domestic: Net Long | EGP +232.9 mn

Retail: 51.0% of total trades | 49.2% of buyers | 52.8% of sellers

Institutions: 49.0% of total trades | 50.8% of buyers | 47.2% of sellers

WTI: USD 36.75 (-1.45%)

Brent: USD 39.43 (-0.90%)

Natural Gas (Nymex, futures prices) USD 1.81 MMBtu, (-0.38%, July 2020 contract)

Gold: USD 1,703.30 / troy ounce (-0.09%)

TASI: 7,222.41 (-0.86%) (YTD: -13.91%)

ADX: 4,284.73 (+0.17%) (YTD: -15.58%)

DFM: 1,999.71 (+0.77%) (YTD: -27.67%)

KSE Premier Market: 5,453.79 (-0.15%)

QE: 9,213.10 (+1.61%) (YTD: -11.63%)

MSM: 3,535.01 (-0.15%) (YTD: -11.21%)

BB: 1,275.39 (+0.45%) (YTD: -20.79%)

Calendar

7 June (Sunday): House of Representatives' general assembly is due to reconvene for its last sitting before summer recess.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

13 June (Saturday): Earliest date on which suspension of international flights to / from Egypt expires.

13 June (Saturday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 June (Tuesday): Anniversary of the June 2013 protests, national holiday.

12 July (Sunday): North Cairo Court will hold a court session for the international arbitration case filed by Syrian Antrados against Porto Group for USD 176 mn after being pushed back from an initial 17 May court date.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.