- With “no end in sight” to the outbreak, gov’t plans to “coexist” with covid-19 in the long term. (Speed Round)

- CBE cuts interest on soft loans for tourism industry to 5% from 8%. (Speed Round)

- Egypt has now disclosed a total of 5,268 confirmed cases of covid-19 (+226). (What We’re Tracking Today)

- Egyptian companies will be among the beneficiaries of USD 500 mn in covid-19 recovery funding from Apicorp. (Speed Round)

- What’s a private equity investor to do in the time of covid-19? The IFC has ideas. (Spotlight)

- US economy contracted at its fastest rate in over a decade, and Powell doesn’t see a fast rebound in the cards. (What We’re Tracking Today)

- Do we have enough graph literacy to understand all these covid-19 charts? (Worth Watching)

- My WFH Routine: Mohamed Aboul Naga, co-founder and CCO of Halan.

- The Market Yesterday

Thursday, 30 April 2020

With “no end in sight” to the outbreak, gov’t plans to “coexist” with covid-19 in the long term

TL;DR

What We’re Tracking Today

Sign of the times: Finance nerds are getting “creative.” Happy Thursday, everyone, and welcome to what we think is (almost) the slowest news morning in recorded history. Or at least in the five or so years that we’ve been around.

On the plus side: The first week of Ramadan is now drawing to an end, and with it the workweek. We hope you’re all looking forward to a restful weekend.

Don’t miss: This morning’s very honest WFH Routine column, wherein Halan CCO Mohamed Aboul Naga talks about what we all know, but are too-often reticent to admit in public: [redacted] is hard right now.

It’s that time of the month again: Here are the key news triggers to keep your eye on as we kick off the month of May:

- PMI figures for Egypt, Saudi Arabia and the UAE will land on Tuesday, 5 May;

- Foreign reserves figures for April will be released during the first week of May;

- Inflation figures for April are out on Sunday, 10 May;

- Amendments to the Banking Act are expected to come up for discussion by the House of Representatives’ general assembly next week.

The Central Bank of Egypt’s Monetary Policy Committee next meets on Thursday, 14 May to review key interest rates. The committee left rates unchanged at its last meeting on 2 April.

Not that most of us will feel it, but Saturday is a national holiday for both private- and public-sector employees in observance of Labour Day, which this year falls on Friday, according to a cabinet statement.

The markets today: Asian markets are comfortably in the green this morning at the opening bell, while futures point to similar starts to the day in Europe and the United States later today. The benchmark EGX30 was up 1.3% yesterday in heavy trading, leaving the exchange down 24.5% since the start of the cursed year that is 2020.

So, when do we eat? Maghrib prayers are at 6:32pm and you’ll have until 3:37am to finish caffeinating. Fajr is coming one minute earlier every day through the end of the Holy Month.

COVID-19 IN EGYPT-

Egypt has now disclosed a total of 5,268 confirmed cases of covid-19 after the Health Ministry reported 226 new infections yesterday. The ministry also said that another 21 people had died from the virus, taking the death toll to 380. We now have a total of 1,712 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 1,335 have fully recovered.

The new IMF loans Egypt is seeking won’t have the same reform strings attached as our last facility, Prime Minister Moustafa El Madbouly said yesterday, according to a cabinet statement. Madbouly stressed that the one-year rapid financing instrument and a separate stand-by arrangement for which the government is currently in talks will not drive inflation up or any carry other downsides for the average citizen.

The Medical Syndicate is raising flags about over-reliance on what it called “very low accuracy” covid-19 rapid testing kits, according to a statement. The syndicate noted that the World Health Organization recommends the use of PCR as the most accurate tool at hand to diagnose the virus. Medical staff should only be allowed to leave quarantine hospitals after two negative RT-PCR tests administered 48-hours apart, the syndicate said, and instead the Health Ministry is overly-reliant on rapid antibody tests that it said have high false-positive / false-negative rates. The story is getting wide play in the domestic press: Youm7 | Ahram Gate | Masrawy | Ahram Online.

WFP to provide food support to Egyptians most at risk: The Local Development Ministry will sign an agreement with the UN’s World Food Programme to support day laborers whose livelihood was threatened by measures to contain the virus and other vulnerable individuals in rural areas, Minister Mahmoud Shaarawy said. Shaarawy did not say when the agreement would be signed, or the value of the agreement.

Egypt’s Premier League season could get back on track as early as mid-July under a proposal the Egyptian Football Association (EFA) sent to the Sports Ministry, EFA Vice President Gamal Mohamed Ali said on ONTime Sports (watch, runtime: 3:57). The EFA is now waiting for the ministry’s decision on the proposal.

DONATIONS-

6th of October University donated EGP 10 mn to the government, according to a cabinet statement.

Real estate developer Castle Development donated EGP 1 mn, including 500k to support day laborers and EGP 500k to the Tahya Misr fund, according to a cabinet statement.

ON THE GLOBAL FRONT-

The US’ longest growth run on record just screeched to a halt, with real GDP contracting by a 4.8% annualized rate in the first quarter of the year, the Commerce Department said. Consumer spending, the biggest component of the economy’s broadest gauge, was dragged down 7.6% during the quarter thanks to shuttered malls, bars, and restaurants. “Today’s GDP numbers are weak, but in line with expectations as a result of the COVID-19-driven disruptions,” US Commerce Secretary Wilbur Ross said.

PSA- The worst is yet to come for the US economy. Let’s keep this brief, shall we? The US economy contracted in 1Q2020 at a faster rate than at the peak of the global financial crisis — and the worst recession “in our lifetime” is still to come, pundits suggest. Enter US Federal Reserve boss Jay Powell, who Reuters said “dashed lingering hopes for a fast rebound from the coronavirus pandemic, saying the U.S. economy could feel the weight of consumer fear and social distancing for a year or more in a prolonged climb from a deepening hole.” Powell was speaking at the end of a two-day Fed meeting at which its open markets committee left interest rates on hold.

Powell warned of lasting “medium-term” economic fallout, the Financial Times added.

How bad could it get? Economists polled by the Wall Street Journal agree we are staring down the barrel of a recession of “unprecedented” proportions. The prognosticators at IHS Janes expect the US economy to contract “at a 37% annual rate from April to June, which would represent the biggest drop since quarterly records began in 1947.” The chief economist at Credit Suisse suggests “we are heading for the largest contraction in GDP since the Great Depression.”

Patients given remdisivir recovered 31% faster than those given a placebo, prompting Anthony Fauci, the top US infectious diseases official, to declare that “this will be the standard of care.” Fauci likened the results of clinical trials to a watershed moment in 1986 when “when we were struggling for [meds] for HIV and we had nothing.” Reuters and Bloomberg have the story and you can read drugmaker Gilead’s statement here.

Tech won earnings season this quarter, handily kicking the [redacted] of companies that traffic in real-world goods and services.

Losers in yesterday’s tourney: Old-economy giants including PepsiCo, Coca Cola, and Starbucks have reported their first quarterly drop in same-store sales in almost 11 years — and worse is probably still to come in 2Q. BP’s first quarter profits were down by 67% as the virus slashed oil demand globally, while carmaker Ford reported a net loss of USD 2 bn in the first quarter as most operations were grounded to a halt by the pandemic.

The winners: Facebook’s net income more than doubled to USD 4.9 bn in 1Q2020. El Face saw a decline in demand for advertising but witnessed increased engagement as people in isolation rely heavier on its products to connect with others. Microsoft saw its net profits rise 22% to USD 10.8 bn, mainly driven by higher demand on its cloud services. And unexpectedly, next-gen carmaker Tesla turned in a net profit of USD 16 mn in the first quarter with a stable outlook.

High-rollers are waiting for equities to fall another 5-20% before they re-enter the market, according to UBS research cited by Bloomberg. Less than one quarter of the ultra-wealthy folks polled think it’s time to buy back into equities.

With the US discussing how to “exit” lockdown, the usual suspects think demand for oil will recover, driving WTI June contracts to USD 16 / bbl yesterday from USD 12 / bbl, the Financial Times notes. Still: Expect volatility in the coming period, folks.

The Abu Dhabi Investment Authority has delayed the sale of USD 2 bn-worth of private-equity fund stakes from its portfolio after failing to reach consensus on the sale value with investors, Bloomberg reported. The world’s third largest sovereign wealth fund will give the transaction another shot in 2H2020.

GCC fiscal support insufficient, says Oxford Economics: Gulf countries’ fiscal response to the economic fallout from the pandemic falls short of those from comparable economies in Europe and Asia, with policies “too small and narrow,” say experts at Oxford Economics according to Bloomberg.

BEYOND COVID-

NMC founder BR Shetty claims he was victim of fraud by other execs: The founder of London-listed Emirati healthcare company NMC, Bavaguthu Raghuram Shetty, claims a preliminary investigation into the company found that he was a victim of “serious fraud and wrongdoing” by other executives, according to a statement picked up by Bloomberg and the Financial Times. Fraudulent accounts, powers of attorney, loans, personal guarantees, and companies were all used or created under Shetty’s name to facilitate fraud, the Indian entrepreneur alleges. The company has revealed more than USD 4 bn of previously undisclosed debt and claimed to have found evidence of fraud after US short seller Muddy Waters questioned its finances last December. The company was forced into administration earlier this month by Abu Dhabi Commercial Bank, one of its major lenders.

Shetty also faces accusations of financial wrongdoing on his watch at high-profile fintech startup Finablr, which last month announced it was investigating charges of impropriety and lined up bankruptcy advisors. Key subsidiary Travelex has since put itself up for sale.

It’s Making It Day: The latest episode of season two of our podcast on building a great business in Egypt is out today. Look for new episodes dropping every Thursday this Ramadan.

Laila and Adel Sedky, co-founders of Nola: Our second episode follows the story of two siblings transforming a small teal-colored cupcake shop in 2010 into a fast-growing purveyor of whimsical sweet treats spanning seven cities and 25 stores. We are, of course, talking about Laila and Adel Sedky, the founder and CEO respectively, behind the household name Nola.

How to survive the end of a trend: While a sharp pivot can be difficult and costly, it is sometimes necessary to make sure your business survives — especially when it was originally built on a trend whose shelf life is approaching its end. Laila and Adel spoke with us on repositioning their brand and experimenting with new products.

Tap or click here to listen to the episode on: Our website | Apple Podcast | Google Podcast | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It here.

Enterprise+: Last Night’s Talk Shows

Nothing to see here today, ladies and gentlemen. With television power couple Lamees El Hadidi and Amr Adib off air last night, and the vast majority of other talk shows on their annual Ramadan hiatus, the airwaves gave us nothing to work with.

Speed Round

Speed Round is presented in association with

The government is drawing up plans to “coexist” with covid-19 in the long term, saying there is currently “no end in sight” to the outbreak, according to a cabinet statement. Health Minister Hala Zayed presented to cabinet yesterday her ministry’s proposal that would see the government significantly ease restrictions and gradually reopen the economy while still adhering to “precautionary medical guidelines.”

The plan wouldn’t see a complete return to normalcy, but is meant to give businesses and government services space to operate and fire up the economy again. Zayed said the government would push for an increased reliance on electronic payments and services to avoid physical crowding, while places labeled as "high risk" for the spread of the virus — which were not specified in the statement — will remain closed.

Zayed didn’t say when this plan would come into effect, but our guess is the government is shooting for right after Ramadan. Prime Minister Moustafa Madbouly has relaxed some covid-19 restrictions for the duration of the holy month, including shortening the nighttime curfew, and suggested at the time we could see a “gradual” return to normal life after Ramadan.

Nothing is set in stone: The government will review the plan and amend it as needed every two weeks based on how the situation progresses, the statement notes.

REGULATION WATCH- CBE cuts interest on soft loans for tourism industry to 5% from 8%: The central bank is subsidizing loans from banks to tourism companies to help them cover wages, commitments to suppliers and maintenance expenses, the Tourism and Antiquities Ministry said in a statement. CBE had extended its EGP 50 bn tourism support initiative to provide soft loans to tourism companies to help them mitigate the impact of the covid-19 on their business. The loans originally carried an interest rate of 8% tenor of two years, and provide a six-month grace period. Egypt expected tourism revenues to hit USD 15 bn this year, up from a record USD 13 bn in 2019, before the pandemic hit.

The Tax Authority has pushed the 60-day window for businesses to file February VAT returns until 10 May, according to Masrawy. The postponement only applies to the tax filings as businesses are still required to remit VAT by today, Tax Authority Chairman Reda Abdel Kader said. Finance Ministry sources had told us as much earlier this month.That said, companies have recently been allowed to claim 65% of their VAT drawbacks before an assessment is made to fast-track refunds.

Egyptian companies will be among the beneficiaries of USD 500 mn in covid-19 recovery funding from Apicorp: The Arab Petroleum Investments Corporation (Apicorp) has announced a USD 500 mn funding package to help its clients in the energy sector cover shortfalls caused by the covid-19 pandemic and the collapse in oil prices, the multilateral development bank said in a statement (pdf). The funds “will be deployed to support sustainable impact-driven projects … within the areas of utilities, renewables, petrochemicals, amongst other energy sub-sectors,” the statement said. It will come in addition to the USD 2 bn allocated to the sector by the lender each year, CEO Ahmed Ali Attiga said in an interview.

Egypt in focus: Egypt is among a list of “worst hit” countries named by Attiga that are destined to receive the bulk of the funding. “It is a covid-19 recovery intervention which will concentrate on the worst hit sectors and countries like Bahrain, Oman, Iraq, Egypt and other countries in the region,” he said. Apicorp has investments of more than USD 210 mn in Egypt and over the past five years has provided financing of more than USD 530 mn to energy projects in the country, an Apicorp official told us.

Capital increase gives lender more room for manoeuvre: Apicorp shareholders last week gave the go-ahead for a substantial capital increase to support its investments in the sector. The lender now has USD 8.5 bn in callable capital, up from USD 1 bn. Authorized capital has risen to USD 20 bn and subscribed capital to USD 10 bn.

CABINET WATCH- Egypt okays fresh financing from World Bank loan for healthcare: The Madbouly Cabinet agreed in its meeting yesterday to move ahead with a USD 400 mn loan from the World Bank to support the new universal healthcare scheme, according to a statement. The loan, which the bank recently agreed to increase from USD 250 mn, will be used to help the needy afford paying membership fees for the scheme, complete several infrastructure projects in the cities where the scheme will be early implemented, and provide “institutional support” for the new system. The scheme is currently up and running in Port Said, where the new system was piloted in September.

Egypt probes alleged dumping of aluminum, rolled steel products: The Trade Ministry began earlier this month a “safeguard investigation” into potential dumping of raw aluminum in the domestic market, according to the World Trade Organization (WTO). The investigation comes after state-owned Egypt Aluminium began reporting losses because the market is being “flooded” with imported aluminum products, according to a ministry statement.

An aluminum dumping frenzy: News of the investigation comes as Egypt is among 18 countries being investigated by the US for dumping aluminium in the US market according to a US Commerce department report earlier this month. Although the report doesn’t mention Egypt by name, last month a petition filed by the US aluminium industry named Egypt among the list of 18 countries accused of dumping alloy aluminium sheet.

The ministry is also looking to impose anti-dumping measures on rolled steel rods sourced from China, Turkey, and Tunisia, the statement says, without providing further details.

MOVES- BP North Africa Regional President Hesham Mekawi (LinkedIn) is stepping down from his position as of 1 July and will act as a senior advisor to the company for a six-month transition period thereafter, according to a release (pdf). The high-profile oil energy executive plans to retire after leaving BP and is pursuing opportunities as a non-executive director. Mekawi spent 30 years at BP in Cairo, Houston, Chicago, and London.

CORRECTION- In yesterday’s edition of Hardhat, we incorrectly stated that roadside assistance app Mayday’s 1Q2020 revenue is EGP 500k. The correct figure is EGP 1.2 mn. The story has since been corrected on our website.

Spotlight

What’s a private equity investor to do in the time of covid-19? The International Finance Corporation has ideas. Earlier this month, the International Finance Corporation (IFC) announced a USD 20 mn investment in SPE AIF I, an Egypt and North Africa-focused PE fund managed by SPE Capital Partners. In SPE, the corporation has channeled investment into an ambitious fund looking to “significantly ramp up” its involvement in Egypt’s private sector.

With just 15% of its current USD 65 mn portfolio invested in Egypt, SPE is looking to hike AUM to USD 200 mn or more by 3Q2020 and has earmarked 40% of for investment in Egyptian opportunities, Managing Partner and CEO of SPE Capital Nabil Triki tells us. Having already raised 90% of its target, the fund is looking at other companies in the Egyptian healthcare sector (Future Pharma Industries being its sole portfolio company in the country so far) as well as firms operating in the manufacturing, education and B2B services sectors, he says.

With companies looking for growth capital and lifelines alike amid fallout from covid, we spoke with Walid Labadi, the IFC’s country manager for Egypt, to discuss the corporation’s plans.

Enterprise: What sectors is the IFC looking at in Egypt and regionally?

Walid Labadi: Our strategy in Egypt focuses on three pillars: Employment, integration, and inclusion. We are keen to develop and invest in job-generating sectors, such as manufacturing, agribusiness, and tourism. We also seek projects in sectors that enhance integration and connectivity, such as digital technology, telecoms, and infrastructure. We also focus on inclusion, where we look at improving access to healthcare services, investing in education, promoting financial inclusion, and facilitating access to finance for small businesses, youth, and women.

Countries in the MENA region face a host of long-standing challenges like unemployment, infrastructure gaps, lack of financing and gender inequality. In Egypt, our investments and advisory programs are geared towards tackling those challenges through increasing private sector participation in the economy. We believe that the private sector can play a critical role in generating jobs and promoting economic growth.

E: How is the IFC prioritizing investments in Egypt through the pandemic? Is it focused on supporting the most vulnerable sectors or those most likely to succeed?

WL: As a global response to the covid-19 outbreak, IFC announced a fast-track financing facility of USD 8 bn to support impacted businesses, especially in the tourism and manufacturing sectors.

The financing is part of a USD 14 bn relief package announced recently by the World Bank. IFC’s support will focus on three areas: First, we’re providing USD 2 bn to support our existing clients in sectors like manufacturing, agribusiness, and healthcare. The financing will help them preserve jobs and weather the covid-19 storm. Secondly, we’re earmarking USD 6 bn to emerging-market banks, allowing them to ramp up lending to businesses and support cross-border trade, which will keep essential goods flowing between countries.

In Egypt, we will focus on investments that support employment and help reduce risks associated with disruptions to supply chains and consumer demand. We will also continue to address long-standing challenges, like unemployment, infrastructure shortfalls and a lack of financial inclusion.

Finally, we are proceeding full speed ahead with projects that arose pre-covid-19. This work will play a key role in driving a strong economic recovery in Egypt.

E: Which sectors do you think will be hardest hit by the current crisis, and which could emerge stronger?

WL: In addition to structurally resilient sectors such as education and healthcare, we believe export-centric manufacturing, logistics, and businesses which could substitute imports, could emerge stronger.

Sectors that will be hard hit include tourism, with the impacts of travel and movement restrictions, and oil and gas due to lower global demand. Manufacturing will also be affected due to global supply chain disruptions.

It’s clear that the healthcare system is currently under pressure, and this has illustrated tremendous need for enhanced healthcare services. The private sector can play a critical role in meeting this demand. Testing and preventative measures are becoming increasingly important and we are looking at projects across the healthcare value chain to support that.

We are witnessing an acceleration in the move towards more online and digital services. Although it is early to predict who will emerge the strongest, it is evident that sectors such as fintech, digital infrastructure and solutions, and e-learning will grow. By developing these sectors Egypt can drive economic growth and we would like to work with the government to enable that.

E: Is the IFC planning further investments in Egypt-focused PE funds in the near future?

WL: Well, as you are aware, we recently invested USD 20 mn into a newly-independent private equity fund to help extend necessary financing to small and mid-cap companies in countries where access to equity is constrained, like Egypt, Morocco and Tunisia. Such investments can play a critical role in development, helping to build the dynamic, job-creating companies that drive prosperity, provide essential goods and services, and strengthen the middle class. We will also maintain an active pipeline in private equity, considering both single-country and regional funds for investment.

E: How much of the USD 40.5 mn invested by the IFC in MENA-based private equity and VC funds has been directed to Egypt, and in which sectors?

WL: In FY20, the IFC invested a total of USD 40.5 mn in private equity and venture capital funds to support businesses in the MENA region. Most of these funds have regional coverage, meaning they invest across the region and across a variety of sectors. The funds, including SPE, are expected to invest a significant portion in Egypt. These numbers do not include direct investments by IFC.

Egypt in the News

We have been blessed with yet another relatively quiet morning for Egypt in the foreign press.

…full of sound and fury, signifying nothing: Businessman Mohamed Bahgat got a boost from the Financial Times in his long-running dispute with the government of Egypt thanks to what feels like clever legal counsel and a dash of PR juju. The news trigger? Bahgat’s lawyers convinced a Dutch bailiff to seize an unused Egyptian embassy building in The Hague as part of a global search for assets to attach to a USD 115 mn arbitral award. Egypt is appealing to have the award set aside. The salmon-coloured paper would have you believe that the dispute “provides a rare insight into the challenges that investors, domestic and foreign, can face in doing business in the Middle East,” etc, etc. Nothing like a little bit of orientalism to spice up the last day of the first week of Ramadan, no?

A couple of headlines to skim, however briefly: Cairo-based tech company Giza Systems is 3D-printing protective face masks for healthcare workers and distributing some 2k of the plastic shields daily to 25 Egyptian medical facilities, AFP reports. Meanwhile, Human Rights Watch alleged that two women were forcibly disappeared from their homes after criticizing the government’s covid-19 response.

Worth Watching

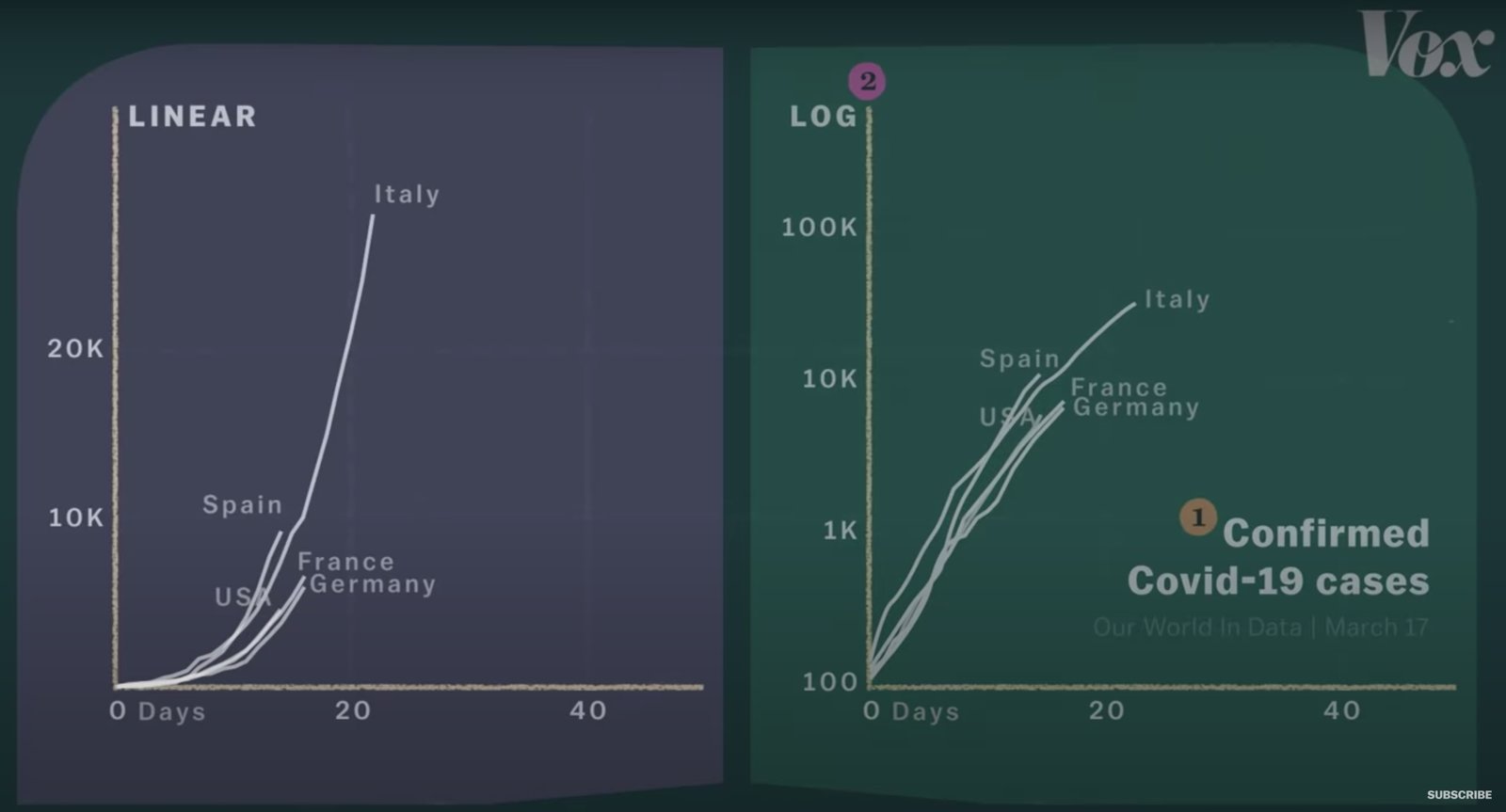

We’re being flooded with charts almost daily, but do we really know what we’re looking at? Covid-19 graphs showing infection and mortality rates might not give us the whole picture without a little graph literacy. This Vox explainer breaks down all you need to know when taking a look at your next covid-19 chart, like how a rising number of cases may be more indicative of a country’s robust testing effort than at showing us the severity of an outbreak.

Read carefully: It's also worth taking note of what your x and y axes represent on any given chart — are they linear or logarithmic? What are the units? There’s a lot to learn here and definitely worth checking out before forwarding any more graphs over WhatsApp. (watch, runtime 4:57)

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi discussed proposed measures to address the covid-19 outbreak in African countries with several of the continent’s heads of state, according to an Ittihadiya statement.

Energy

SDX Energy’s Sobhi well set to produce 10-12 mcf / d of natural gas

SDX Energy is expected to produce 10-12 mcf / d of natural gas from its Sobhi well, the company said in a statement. The discovery has grown the South Disouq concession’s production capabilities by 50%, putting SDX on track to extract up to 50 mcf / d by 2023. Earlier this month SDX discovered 24 bcf of natural gas at the Sobhi well, marking a “low-cost, highly-cash generative" expansion to the field.

Legislation + Policy

Egypt’s House Economic Committee recommends streamlining CBE appeals

The House Economic Committee has added a provision to the proposed Banking and Central Bank Act that would streamline the process to appeal regulatory decisions by the Central Bank of Egypt (CBE) after the House Economic Committee added an article to an original 241-article draft, MENA reports, citing unnamed sources. The new article would require appellants to file appeals to the central bank’s board no later than 30 days after a given decision. The board would also be required to give its decision within 30 days of filing. The committee submitted its recommendations on the draft to the House of Representatives general assembly earlier this week. The assembly is due to begin its own round of discussions next week ahead of a final approval.

My Morning Routine

Mohamed Aboul Naga, co-founder and CCO of Halan: My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Mohamed Aboul Naga, co-founder and CCO of Halan. Best known for their adverts promoting tuktuk and motorcycle ridesharing, Halan is an international on-demand delivery startup operating in Egypt, Sudan, and Ethiopia.

I am the co-founder and chief commercial officer of Halan. I mainly work with the sales, business development, and operations departments, with a team of seven people, managing about 230 overall. Halan’s services fall under five verticals: Ride hailing, bill payment, B2B delivery (restaurants to home), peer-to-peer delivery, and commerce (product financing).

I start my workday from home at around 10am, with 10-15 minute calls with each of my team members. From 12:30-2:30pm, we hold vertical calls to analyze the performance of a different vertical each day. Tuesdays are dedicated to discussing how the five verticals are functioning together. I usually take a 30-minute break afterwards. As of last week, I started heading back to the office at around 3:30pm, where I stay until 6pm.

Our business supports other people staying at home, so it’s impossible for us to fully shut down, but we’ve reduced our [in-office] operations as much as we can and implemented health safety and hygiene measures.

We take social distancing seriously. Halan implemented hygiene and sanitization measures and told our teams to work from home before the government announced restrictions. WFH is very hard though, especially for our sales teams, for whom work is target- and commission-based. Sales and business development really needs to be done on the ground with some form of personal interaction. WFH is much easier for our engineering, tech, data science, and business intelligence teams, but we do hope to have 30% of our people back in the office in a month.

I find WFH personally challenging. I prefer meeting and speaking to new people over remaining home all the time. I’m a salesman by nature and I feel a little restricted at the moment. I also find I have sharper fluctuations in productivity.

It’s not easy to tune out noise and distractions at home, but I’m adapting. I’ve isolated a part of my house and made it my home office, with my computer and documents. I recently bought noise canceling software called Krisp. And I’ve been using Halan for errands, paying some bills with it the other day, and relying on it for grocery and pharmacy orders. I try to use our services often to make sure they’re working well.

Within the company, we’re optimistic about the future. Some of our products have been hit much harder than others. Our B2B services, for example, are performing far better than before the covid-19 crisis and we’ve managed to launch our P2P services amid the turmoil. I’ve been working a lot on upselling — selling new services to existing clients — because it's difficult to make new agreements. Budgets are on hold right now, and so it's hard to get clients to make new financial commitments. Generally, people are feeling the strain of this difficult time and they need a lot of reassurance and support.

Our recently-launched automated reporting system is helping us understand what’s working well and what isn’t. This is a digitized system that measures KPIs and target goals, and automatically notifies owners when targets are not met. It gives us more data on our operations, which has been particularly valuable since we started social distancing.

What am I doing for myself in this period? I would usually go to the gym at night, so now I exercise for 30 minutes every night before going to bed.

I’ve just rewatched House of Cards, I liked it a lot the first time around and I just feel like it's very politically relevant. I’m also watching two Ramadan comedies, El Le3ba and Rijalat Al-Bayt. The Brave Ones on YouTube, which profiles the lives of entrepreneurs, is a recent find that I’m learning a lot from.

I like to read about a different entrepreneur every week, and this week it’s Reid Hoffman.

My previous work as Careem’s regional director helped with my WFH transition. Having offices in four countries made online communications over Zoom and Slack essential, so the transition to managing teams from a distance has been straightforward.

I really miss praying taraweeh in Ramadan and I miss traveling. I want to eat with older family members without the fear of potentially harming them.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Wednesday): 10,545 (+1.3%)

Turnover: EGP 1.1 bn (63% above the 90-day average)

EGX 30 year-to-date: -24.5%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 1.3%. CIB, the index’s heaviest constituent, ended up 3.2%. EGX30’s top performing constituents were AMOC up 3.3%, CIB up 3.2%, and SODIC up 2.7%. Yesterday’s worst performing stocks were Juhayna down 3.8%, EFG Hermes down 3.4% and Pioneers Holding down 2.4%. The market turnover was EGP 1.1 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +33.2 mn

Regional: Net Short | EGP -10.5 mn

Domestic: Net Short | EGP -22.6 mn

Retail: 70.4% of total trades | 67.9% of buyers | 72.8% of sellers

Institutions: 29.6% of total trades | 32.1% of buyers | 27.2% of sellers

WTI: USD 15.91 (+5.64%)

Brent: USD 23.30 (+3.37%)

Natural Gas (Nymex, futures prices) USD 1.87 MMBtu, (-0.21%, June 2020 contract)

Gold: USD 1,728.70 / troy ounce (+0.89%)

TASI: 6,985.33 (+1.46%) (YTD: -16.73%)

ADX: 4,221.98 (+0.03%) (YTD: -16.82%)

DFM: 2,004.09 (+0.32%) (YTD: -27.52%)

KSE Premier Market: 5,265.69 (+1.08%)

QE: 8,701.06 (+1.17%) (YTD: -16.54%)

MSM: 3,538.87 (0.00%) (YTD: -11.11%)

BB: 1,308.65 (+0.06%) (YTD: -18.73%)

Calendar

1 May (Friday): National holiday in observance of Labour Day.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): Earliest date on which suspension of international flights to / from Egypt expires.

23 May (Saturday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

31 May (Sunday): A postponed court session for the lawsuit filed by Cairo Development and Auto Industry, a subsidiary of Arabia Investment Holding, against Peugeot Automotive to demand EUR 150 mn compensation.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 June (Sunday): Anniversary of the June 2013 protests, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.