- Total covid-19 infections reach 1,173 as MoH reports 103 new cases. (What We’re Tracking Today)

- Stung by covid-19 outbreak, non-oil business activity falls to three-year lows on declining output and dearth of new orders. (Speed Round)

- Egypt is expediting approvals for international funding that backs our covid-19 response. (What We’re Tracking Today)

- Small companies can collect overdue export subsidies without proving they’re right with the Tax Authority. (Speed Round)

- Car dealerships want to issue car licenses for new buyers amid suspension of gov’t services. (Speed Round)

- GASC wants to change its wheat tender terms. (Speed Round)

- A deep dive into covid-19 testing in the US (with some surprising glimmers of good news). (Worth Listening)

- Students not likely to go back to in-person learning this academic year, minister says. (Last Night’s Talk Shows)

- The Market Yesterday

Monday, 6 April 2020

Covid cases up, PMI down and students are probably staying home ‘til the end of the year. (What, you expected good news this morning?)

TL;DR

What We’re Tracking Today

Egypt’s PMI figures for March are out and, well, they could have been worse. With output at three-year lows and exports falling to the lowest point in seven years, it doesn’t make particularly great reading. But a glance across the Mediterranean (more on this below) and a look to our neighbors in the Gulf, and our economic situation doesn’t quite look so bad. We have the full story in this morning’s Speed Round, below.

The EGX fell almost 2% in trading yesterday: Telecom Egypt was the biggest loser of the session, falling 9.2% on news that Saudi Telecom had postponed loan talks for its Vodafone Egypt acquisition. Trading volumes were low at EGP 365 mn, 39% below the 90-day trailing average.

Markets this morning: Markets to our east are mixed this morning. Up: Japan, Hong Kong, South Korea, Australia. Down: China, India, New Zealand. Futures suggest US markets will open the week in the green.

Things to keep an eye on this morning:

#1- Mixed signals out of America: Epidemiologists and health officials are warning that this could be a horrible week for covid-19 infections in the United States, with the surgeon general telling a TV interviewer that this could be “the hardest and the saddest week of most Americans’ lives, quite frankly. This is going to be our Pearl Harbor moment, our 9/11 moment.”

But The Donald and his VP say they see things stabilizing. Meanwhile, Bill Gates (who has given thought to these things more than most human beings) says that while a national lockdown would result in a “huge economic price,” it could see casualties fall “well short” of the 100k-240k deaths predicted by health officials. All of that is leading to (muted) optimism about the market as JP Morgan Chase said a “slowdown in the growth rate of new U.S. coronavirus cases may help put a floor under stocks and dampen volatility,” Bloomberg reports.

#2- What will oil do to global sentiment today? Brent crude was down 3.6% as we rushed toward dispatch on news that the Opec+ meeting has been tentatively rescheduled to Thursday, according to Bloomberg. It was originally scheduled to take place today. Saudi and Russia are trying to get the US, which has recently become the largest producer, to join or at least support what could be the biggest ever coordinated output cut to save plunging oil prices, which have fallen by 50% so far this year. Canada and the US are now both threatening tariffs on Saudi Arabia and Russia if they don’t agree on a production cut, the Financial Times reports.

COVID-19 IN EGYPT-

Egypt now has 1,173 confirmed cases of covid-19 after the Health Ministry reported 103 new infections yesterday. The ministry also said that another seven people had died from the virus, taking the death toll to 78. We now have a total of 346 people who have tested negative for the virus, of whom 247 have fully recovered.

The Health Ministry received 477,257 inquiries about the virus through its telephone hotlines last month, according to a ministry statement. Most callers inquired about prevention methods, common symptoms, complications, and what they should do when symptoms manifest. The hotline numbers are 105 on a landline and 15335 on mobile. The ministry’s covid website is here.

Egypt is expediting approvals for international funding that backs our covid-19 response: Egypt will fast-track approvals for international financing earmarked to help the nation respond to covid-19, International Cooper Minister Rania Al Mashat announced (pdf) on Sunday. Al Mashat outlined Egypt’s strategic priorities on the virus in an unprecedented video call with more than 100 representatives of international development partners including UN agencies, the World Bank, IMF, USAID, African Development Bank, European Bank for Reconstruction and Development, and others. Mashat’s (very solid) presentation is here (pdf).

Al Mashat also showcased Egypt’s improved results in the Global Partnership for Effective Development Cooperation survey (pdf), which measures the level of Egypt’s cooperation with development partners in things such as information sharing and transparency. The minister also outlined the narrative the ministry will use to communicate its covid-19 response strategy (pdf).

The bottom line: Mashat is taking the same systematic approach she took to helping rebuild the tourism industry when she ran that portfolio, sending a clear message that should resonate with donors not just now, but when we are lining up funding and assistance to help the country weather the economic fallout of the pandemic.

SMART POLICY- Egypt should issue “coronabonds” funded by international lenders to stave off a liquidity crisis in the private sector that could result in mass layoffs, former partner at private equity group Abraaj Ahmed Badreldin suggests, according to Al Mal. This initiative would be similar to that launched by the African Development Bank, which recently issued USD 3 bn-worth of three-year coronabonds to help cushion African economies. The proceeds from the issuance can then be used to pay for a three-month VAT and income tax holiday for businesses, a salary insurance scheme, and corporate loans to finance working capital, he said.

Former Libya premier Mahmoud Jibril has died in Cairo from covid-19 at age 68, Libya’s Al Arabiya reports. Jibril, who served as Libya’s prime minister following the ouster of longtime leader Muammar Gaddafi in 2011, had reportedly been in quarantine in Cairo since he was diagnosed with the illness on 26 March.

Some 77k government offices, places of worship, schools and public gathering spots have been disinfected by sanitation crews and over 7k cafes saw all their shisha gear confiscated before they were shut down as part of the government’s efforts to curb the spread of the covid-19 outbreak, a cabinet statement said. Another 7k schools and educational centers, more than 2k public markets and another 2k social clubs and wedding halls were closed, according to the statement.

Carrefour sees 6x increase in online sales: The Majid Al-Futtaim-owned supermarket has seen demand for online shopping skyrocket since the onset of covid-19, reports Al Mal.

Store owners at Cairo Festival City are complaining of inadequate financial relief: A number of small businesses have voiced concerns over financial obligations and rent payments due to Al Futtaim Group, which owns Cairo Festival City Mall, amid a significant reduction in sales, according to Al Mal. Al Futtaim (not to be confused with Majid Al Futtaim — a separate company that has given its tenants a rent holiday) has formed a committee to discuss the tenants’ requests for a rent holiday while covid-19 restrictions remain in place.

IN AND OUT- There are no direct flights to the US scheduled after the departure of an EgyptAir flight yesterday, the US embassy said. The Canadian embassy has arranged an EgyptAir flight to Toronto departing Cairo on Wednesday at 11am. Flights can only be booked directly with EgyptAir. On the inbound leg: An EgyptAir flight from Washington, DC, brought Egyptians home to quarantine in Marsa Alam, while media reports suggest 37 Egyptians have been repatriated from Nigeria.

DONATIONS-

Our friends at Sodic are redirecting all their marketing resources towards covid-19 awareness raising and are working in coordination with the Health Ministry to deliver community support programs, according to a statement (pdf). Sodic is donating ventilators and monitors to the Sheikh Zayed Specialized Hospital and is distributing protection packages with immunity boosters, sanitization material, and hygiene instructions in Ezbet Khairallah. The real estate company is also making use of all its outdoor billboards and digital platforms to raise awareness about the virus.

Our friends at Edita are donating EGP 2 mn to the Misr El Kheir foundation in support of the Breathe Campaign, which is raising funds to acquire ventilators from suppliers around the world, according to a statement (pdf). The donation, which will also be used to support the purchase of critically needed personal protection equipment (PPE) for medical personnel, will be disbursed from the EGP 5 mn Edita Foundation for Social Development, which was set up last month.

ON THE GLOBAL FRONT-

Making headlines this morning around the world: UK Prime Minister Boris Johnson has been hospitalized for tests following 10 days of “persistent symptoms” from his covid-19 infection. The story is getting front page treatment in the Financial Times as well as the Wall Street Journal and Reuters.

The news came after a rare televised address from the UK’s Queen Elizabeth II (watch, runtime: 4:31).

Covid deaths may have peaked in Italy, where the daily death toll fell on Saturday to its lowest level in two weeks and the number of people in intensive care dropped for the first time since the outbreak began, according to Reuters. Spain’s death toll eased for the third consecutive day yesterday, but the number of confirmed cases is still rising. Italy and Spain, together with China, are so far the three countries hardest-hit by the virus.

The latest from Stimulusland: The European Union is rolling out a USD 110 bn job support program — the fund would “lend directly to national governments to pay for short-term job programs,” the Wall Street Journal writes. Closer to home, the UAE has kicked it up a notch as the central bank said it will inject AED 61 bn (USD 16.6 bn) into the economy to support lending. The central bank has also cut banks’ reserve requirements, Bloomberg reports.

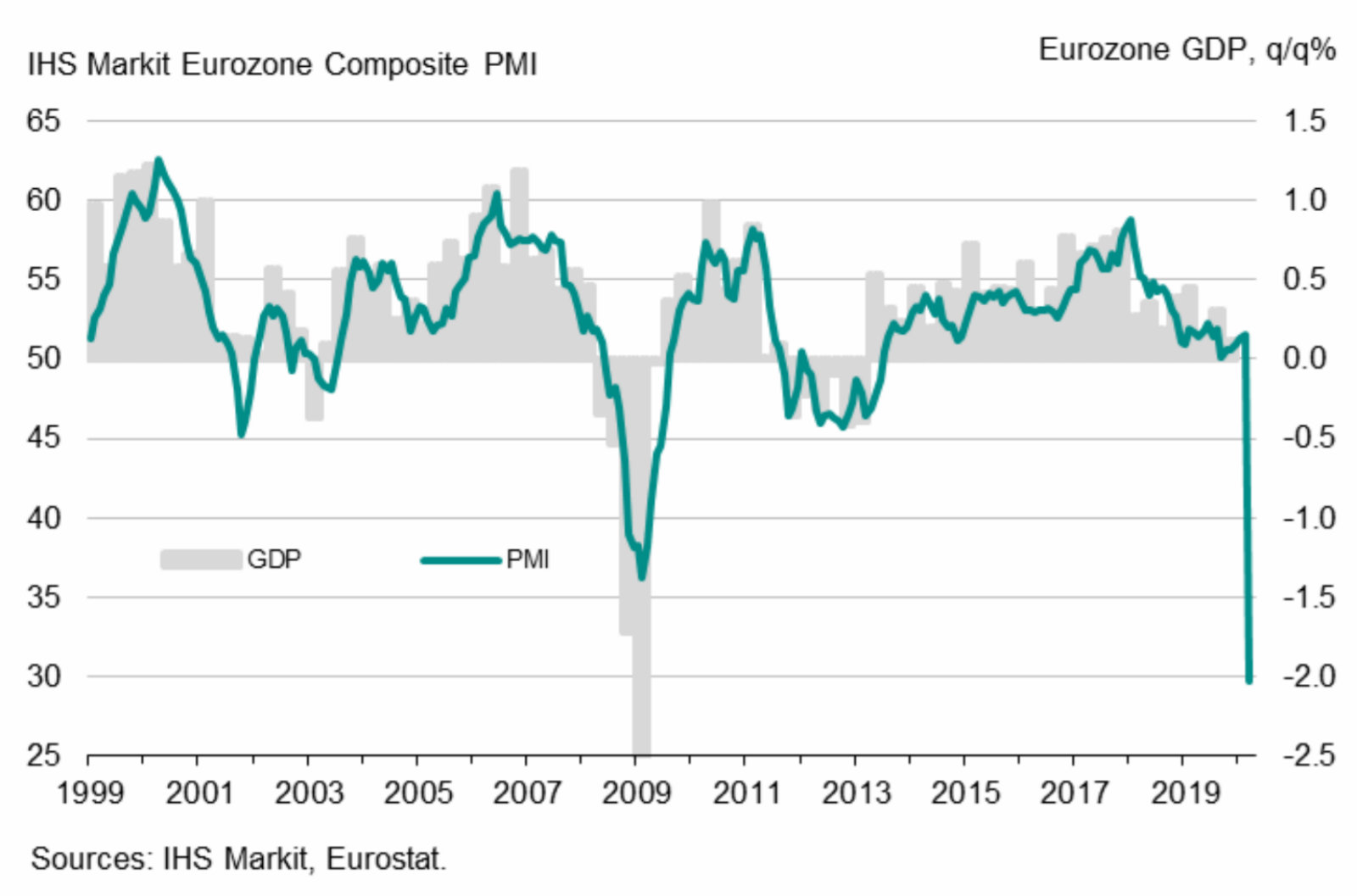

The euro composite PMI saw its biggest monthly drop ever to a low of 29.7 in March from 51.6 in February. The composite index measures activity in both the manufacturing and service sectors. The plunge was worse than the flash figures, which estimated the index would fall to 31.4. France, Spain, and Germany all saw business activity hit historic lows, but it was Italy which suffered the most, delivering a stunning PMI figure of just 20.2. Readings above 50 indicate expansion while figures below that mark show contraction.

Global data wasn’t that much better: Global manufacturing and services activity fell to 133-month lows of 39.4 last month as the services PMI fell to its lowest reading on record and the contraction in manufacturing easing marginally on better Chinese data, according to JPMorgan Global PMI figures (pdf).

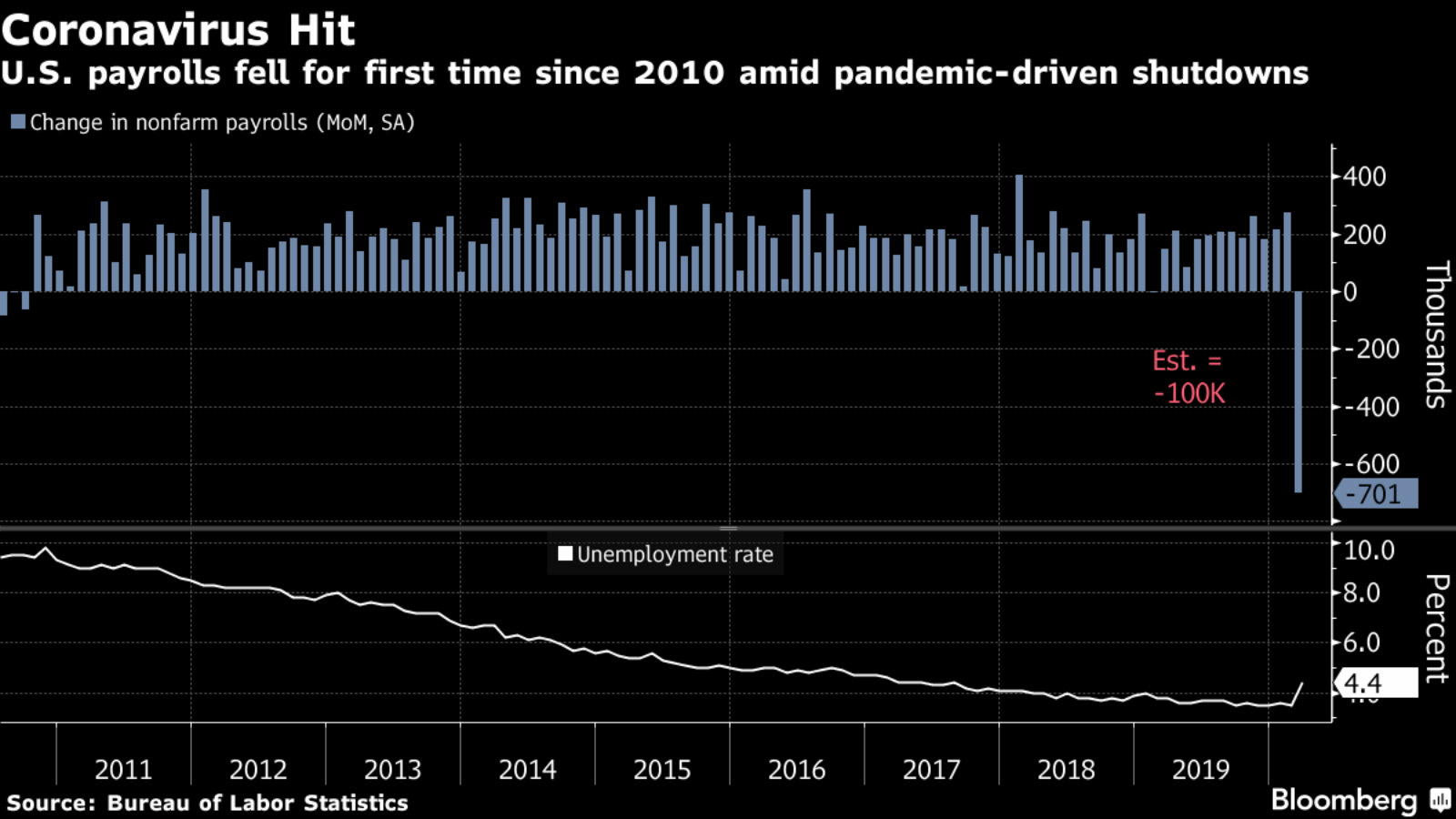

US delivers disastrous payroll data: Fresh US payroll data has shown that 10 mn new unemployment claims were filed in the past two weeks in what the Associated Press calls “the swiftest, most stunning collapse the US job market has ever witnessed.”

Unemployment forecasts “unprecedented since the Great Depression”: The US and Europe are expected to see unemployment rates “well up into the teens,” Peter Hooper, global head of economic research at Deutsche Bank, told Bloomberg. “Given the pain that we see near-term in the U.S. and Europe, this is unprecedented since the Great Depression, in terms of magnitudes.”

Africa faces economic breakdown as a result of covid-19, UNDP regional director Ahunna Eziakonwa tells the Associated Press. Mns could lose jobs across the continent with several sectors being battered by the global upheaval.

And emerging markets are looking at their first collective recession … ever? The warning on Africa comes as Capital Economics estimates that “economic output in emerging markets is forecast to fall 1.5% this year, the first decline since reliable records began in 1951,” the WSJ notes.

Covid-19 flight restrictions are delaying the delivery of pesticides needed to wipe out swarms of locusts attacking crops in east Africa, Reuters reports. Kenya, which is among the hardest-hit, could see some 4 mn more people struggling to feed their families as a result, says the FAO’s head of resilience for Eastern Africa.

Send in the ducks: China’s solution when Pakistan faced its own locust emergency in February was to mobilize an army of ducks, any one of which can apparently eat over 200 locusts a day.

The UAE’s largest healthcare provider could be heading into administration: Abu Dhabi Commercial Bank (ADCB) has applied to the UK High Court to place embattled healthcare company NMC into administration and investigate allegations of fraudulent accounting, Bloomberg reports. ADCB is one of the NMC’s largest creditors and said last week that it has USD 981 mn of exposure to the company, risking more than 80% of its projected 2020 profits. The chairman of NMC — the UAE’s largest healthcare provider — accused the bank of jeopardising the country’s ability to fight the covid-19 pandemic even as its debt load brings closer to insolvency and other creditors step up efforts to recover funds. Bloomberg has the full rundown on how the UAEs largest healthcare provider was brought to the brink.

Enterprise+: Last Night’s Talk Shows

The covid-19 outbreak at the National Cancer Institute was front and center in the talking heads’ coverage of the virus in Egypt.

Around 800 staff members and patients at the institute have been tested for covid-19 since 17 doctors and nurses tested positive for the virus over the weekend, Cairo University spokesman Mohamed Alam El Din told Al Hayah Al Youm’s Lobna Assal (watch, runtime: 4:46). President Abdel Fattah El Sisi had issued directives to the government to carry out contact tracing on patients who visited the institute over the past two weeks to curb the outbreak, El Hekaya’s Amr Adib noted (watch, runtime: 7:05).

Tracking down the patients who visited the institute over the past two weeks is a key focus since they came into contact with the infected medical staff, one of the infected doctors stressed to Al Kahera Alaan’s Lamees El Hadidi (watch, runtime: 10:52). Masaa DMC’s Eman El Hosary (watch, runtime: 0:45) and Min Masr’s Amr Khalil also covered the story (watch, runtime: 1:50).

El Hosary also recapped the Health Ministry’s daily tally of covid-19 cases, which we have in What We’re Tracking Today, above (watch, runtime: 1:12 and runtime: 1:07).

WHO’s Egypt rep weighs in on how we can put a lid on the outbreak: Egypt’s covid-19 outbreak is “not insignificant” but remains under control, and we still have several options for how to handle the situation, World Health Organization (WHO) Egypt representative John Jabbour told El Hekaya’s Amr Adib. Any policy will only be successful if the government and people work together, he said. Jabbour noted that the WHO is aware that there are likely more cases in the country that remain undetected, and told Adib that detecting and treating these cases is of the utmost importance at this stage (watch, runtime: 25:15).

Students are not likely to return to in-person learning before the end of the current academic year, Education Minister Tarek Shawky told Adib. The ministry has administered at-home exams to thousands of students in anticipation of resuming the academic year with distance learning, Shawky said (watch, runtime: 1:54).

The government’s commitment to its economic reform program over the past few years has put us in a relatively good position to contain the fallout from the covid-19 outbreak, UN special envoy on financing the 2030 development agenda and veteran economist Mahmoud Mohieldin said on Al Hayah Al Youm. Mohieldin noted that global growth will see a marked slowdown because of the outbreak (watch, runtime: 1:17).

Speed Round

Speed Round is presented in association with

Stung by covid-19 outbreak, non-oil business activity falls to three-year lows on declining output, dearth of new orders: Egypt’s non-oil business activity continued to shrink in March as the the covid-19 pandemic caused “sharp downturns” in output and new orders, according to IHS Markit’s purchasing managers’ index (PMI) (pdf). The PMI gauge fell to 44.2 in March from 47.1 in February, marking a sharp deterioration in business conditions at the end of the first quarter of the year and the lowest reading since January 2017. A reading above 50.0 indicates that activity is expanding, while a reading below means it is contracting.

Output fell at the fastest rate in more than three years as businesses struggled amid depressed demand. Domestic orders fell due to low employment, businesses said, while export volumes declined at the quickest pace in more than seven years.

Input purchases saw their biggest monthly decline in over three years, with some businesses reporting difficulty getting production inputs thanks to the shuttering of Chinese factories.

A hike in input costs was attributed to rising cost inflationary pressures, mainly due to the appreciation of the USD, and an uptick in the price of raw materials. It was tempered, however, by other price reductions — with oil prices being the most significant. This allowed businesses to reduce output prices albeit at a lower rate than seen in February.

Vendor performance fell for Egyptian businesses as well due to travel disruptions and Chinese factory closures. While the rate of deterioration was modest, it was also the swiftest for 19 months.

Employment fell for the fifth month in a row. Employees left businesses for other jobs and these roles were not replaced due to lower sales, causing a “solid drop” in workforces.

Firms were largely negative in their assessment of future prospects with no end in sight for covid-19. Confidence levels reached series lows as many feared an enduring impact on the domestic and global economy.

CABINET WATCH- Small companies can collect overdue export subsidies without proving they’re right with the Tax Authority: The Madbouly Cabinet will pay out export subsidy arrears to small companies owed less than EGP 5 mn without requiring official documents proving they have cleared their taxes, according to a cabinet statement. The government last month pledged to pay out EGP 1 bn in arrears by the end of April as part of its stimulus package to support the economy through covid-19, but had made the payouts contingent on tax clearance documentation.

Building materials companies want a slice of that pie: The Export Council for Building Materials is appealing to the Trade Ministry to make the same concession for building material firms, claiming that they are currently unable to get their hands on official documents because of the covid-19 outbreak, according to the local press.

Gov’t revises downward GDP growth expectations for current fiscal year (again): Based on its assessment of the economic impact of covid-19, the government has revised again its projections for Egypt’s GDP growth for FY2019-2020 to 4.2%, according to Planning Minister Hala El Said. This is the second revision in less than 10 days — the minister had cut the growth forecast for the fiscal year to 5.1%, from an original estimate of 5.6%, last month. El Said also now expects 3Q2019-2020 growth to come in at 4.5% (revised downward from 5.2%) and for the economy to expand only 1% during the current (fourth quarter) of the fiscal year (down from 4% previously). Egypt’s GDP grew 5.6% in 1H2019-2020, which was already slower than the 6% the government targeted in the state budget.

Speaking of the budget, the House Planning and Budgeting Committee has postponed its review of the FY2020-2021 draft budget over fears of spreading covid-19, committee deputy chair Yasser Omar tells Masrawy. The committee was scheduled to begin discussing the budget as of tomorrow, but has pushed it to a yet-to-be-determined later date. President Abdel Fattah El Sisi had reviewed the draft budget last month before it was shipped to the House.

What we know so far about next fiscal year’s budget: The government is ramping up spending on health, education, wages, and welfare. Revenues are expected to increase to EGP 1.3 tn, up almost EGP 200 bn from FY2019-2020, while the budget deficit should be shrinking to 6.3% of GDP compared to the 7.2% target in the current fiscal year’s budget. The government expects GDP to grow at a 3.3-3.5% clip next fiscal year, which Finance Minister Mohamed Maait had told us is based on its expectation that the covid-19 crisis will abate between July and December of this year.

The budget will also see the government spend EGP 5 bn on 13 new industrial zones in Assiut, Alexandria, Luxor, Beheira, Gharbia, Fayoum, and other governorates, according to a Planning Ministry statement. Another EGP 6.4 bn has been allocated to SME financing, as the government looks to fund 300k businesses in the upcoming fiscal year.

Car dealerships want to be able to arrange new car licenses for customers amid suspension of gov’t services: Auto manufacturers and car dealers are lobbying the government to allow them to arrange new car licenses issued from traffic units on behalf of their customers, according to Al Mal. Public-facing government services — including the issuance of car and driving licenses — have been suspended as of last month as part of the government’s measures to curb the spread of covid-19. Industry players, including GB Auto CEO Raouf Ghabbour and Egyptian Automotive and Trading Company Executive Director Karim Naggar, say this suspension is slowing down automotive sales and is creating a backlog of license requests that could be resolved by setting up a mechanism that allows dealers to get licenses issued for consumers. Prime Minister Moustafa Madbouly has set up a committee to look into the feasibility of the request.

Background: Local auto distributors have said that automotive sales significantly contracted in March after the government decided to halt issuance of new driving licenses as part of covid-19 precautionary restrictions to restrict large gatherings last month.

The General Authority for Supply Commodities (GASC) is looking to change its grain import process to include at-sight letters of credit (LCs) for upcoming tenders, assuring payments to suppliers as soon as they submit the necessary documents, Reuters reports, citing unnamed traders. The state grain buyer has been relying on deferred payments in its wheat tenders. The LCs would be paid through the Islamic Trade Finance Corporation, according to the traders.

GASC could also begin asking suppliers to offer their prices on a cost and freight basis, rather than the traditional free-on-board (FOB). The main difference between the two is who pays for the shipping or freight costs; cost and freight agreements make the seller responsible for arranging and paying for transportation, while under FOB agreements the seller owns and is responsible for the product only until it is loaded onto the shipping vessel. FOB agreements therefore put the responsibility and cost of any loss or damage to the goods from that point on the buyer. The potential changes come ahead of an anticipated tender to boost strategic reserves after GASC unexpectedly canceled a tender earlier this week. Previous reports indicated that Egypt is expected to import 12.85 mn tonnes of wheat in marketing year 2020-2021, inching up slightly by 0.4% from 12.8 mn this year.

More than EGP 53 bn has been invested into 15% certificates: National Bank of Egypt’s certificates have attracted EGP 36 bn since their launch two weeks ago, while investments in Banque Misr’s certificates now stand at EGP 17.2 bn. The two state-owned banks began offering the one-year high-interest certificates on 22 March to encourage people to maintain savings in EGP as local currencies around the world come under heavy selling pressure.

Egypt in the News

It’s all quiet on the foreign press front for Egypt this morning.

Worth Reading

Don’t blame the bats: It’s human environmental and social policies that pave the way for devastating pandemics. The prevalent narrative around microbes pits them as invaders that attack us, but it’s actually relentless human encroachment into new habitats that turns previously harmless organisms into devastating global pandemics, argues author Sonia Shah in an interview with Vox. In our ever-expanding search for land, we bring ourselves into closer proximity with creatures like bats — in whom microbes like Ebola or the new coronavirus exist without causing disease (because that’s where they’ve evolved). With our amazing global transport system, pathogens that emerge in the most remote locations can easily be transmitted to urban hubs. And with human environmental practices reducing biodiversity, we’re eliminating a natural mechanism of slowing the transmission of diseases that can make the jump from animal to human, or vice versa.

We need to shift our approach, or else covid-19 is just the start: Like it or not, human health is connected to that of animals — domestic and wild — and ecosystems in general, argues Shah. There needs to be a paradigm shift away from what she calls microbial xenophobia, or the idea of the germ invading from the outside. And with the likelihood being that the virus that causes covid-19 came from a wild-animal market in China, there should be a re-examining of our own meat production as well, she says. Crowded factory farms are the perfect breeding ground for highly drug-resistant forms of bacterial pathogens and virulent avian influenza — both of which have been scaring scientists long before covid-19 reared its ugly head.

Worth Listening

A deep dive into covid-19 testing in the US (with some surprising glimmers of good news): Health experts and business leaders have been working to meet growing demands for covid-19 testing, and preparing to run innovative trials using existing medications in the hope of alleviating some of its worst effects, according to this Goldman Sachs podcast (listen, runtime: 1:21:49). Interviews with leaders including the CEOs of Quest Diagnostics and Roche Diagnostics and the president of Massachusetts General Hospital highlight mass partnerships taking place across the US between private sector companies, the Federal Emergency Management Agency (FEMA), hospitals and other stakeholders to increase lab capacity for testing — widely acknowledged to be key in flattening the curve of covid-19 cases. Quest Diagnostics alone increased capacity from 0 to 20k tests per day between 1 and 20 March.

Could a pioneering approach to treating Ebola be adapted to protect people from covid-19 by the summer? It would involve manufacturing the antibodies that would normally be produced after a vaccine and administering them directly to patients, and could produce a 90% survival rate if given early, estimate the leaders of some pharma companies.

Diplomacy + Foreign Trade

Egypt will begin exporting citrus fruits to Brazil for the first time after the Agricultural Quarantine Authority (AQA) concluded negotiations with Brazilian authorities, according to a cabinet statement. The AQA has been in talks over opening citrus exports to Brazil since last September. Citrus fruits accounted for the largest share of Egypt’s agricultural exports in the first 11 months of 2019, which registered 5.1 mn tonnes.

Infrastructure

Egypt’s AOI to set up EGP 238 mn municipal waste recycling plant in Dakahlia

The Arab Organization for Industrialization has signed a EGP 238 mn agreement to construct a municipal waste recycling site in Dakahlia, according to a cabinet statement. The recycling facility, which is aimed to reduce waste at the Sandub landfill, is expected to be completed within six months.

Health + Education

Novo Nordisk to offer four new meds in Egypt

Danish pharma giant Novo Nordisk is in the process of registering four new meds in Egypt to introduce them by 2022, the company’s deputy chairman in Egypt Ayman Hassan told the local press, without providing further details on the products.

Real Estate + Housing

Madbouly orders “firm action” against building code violations

Prime Minister Moustafa Madbouly has ordered local authorities to tighten control over building permits and take “firm action” as permissible under emergency law, including military trials, against building code violations, according to a cabinet statement.

Automotive + Transportation

Egypt’s Railways Authority mulls buying 50 new locomotives from Siemens

The National Railway Authority is considering buying 50 new locomotives from Germany’s Siemens, the local press reports, citing an unnamed NRA source. No details were provided on the value or timeframe of the potential purchase. The pact would also include repair works for 50 other locomotives that have been running since the 1970s.

Other Business News of Note

State-backed, Africa-focused brokerage and investment promotion company to tap CEO “soon”

A new government-backed brokerage and investment promotion company has shortlisted three candidates for its CEO and will make a decision next month, said Mohamed Saad Eldin, a member of the company’s board of directors, according to the local press. The Africa-focused company is also working on finalizing other procedures, including choosing a name, Saad Eldin said. The company will be majority-owned by private investors, who will hold a 56% stake, while public sector companies will be allocated 24%. State-owned National Bank of Egypt, Banque Misr, and Banque du Caire will split the remaining 20% between them.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.7 | Sell 15.8

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Sunday): 9,273 (-1.9%)

Turnover: EGP 365 mn (39% below the 90-day average)

EGX 30 year-to-date: -33.6%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 1.9%. CIB, the index’s heaviest constituent, ended down 2.2%. EGX30’s top performing constituents were Dice up 2.3%, Credit Agricole up 2.1%, and Ibnsina Pharma up 0.1%. Yesterday’s worst performing stocks were Telecom Egypt down 9.2%, Egyptian Resorts down 7.7% and Kima down 6.1%. The market turnover was EGP 365 mn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -85.4 mn

Regional: Net Short | EGP -10.2 mn

Domestic: Net Long | EGP +95.5 mn

Retail: 59.4% of total trades | 63.1% of buyers | 55.6% of sellers

Institutions: 40.6% of total trades | 36.9% of buyers | 44.4% of sellers

WTI: USD 26.68 (-5.86%)

Brent: USD 32.90 (-3.55%)

Natural Gas (Nymex, futures prices) USD 1.64 MMBtu, (+1.42%, May 2020 contract)

Gold: USD 1,647.50 / troy ounce (+0.11%)

TASI: 6,752.19 (+0.04%) (YTD: -19.51%)

ADX: 3,676.46 (-2.18%) (YTD: -27.57%)

DFM: 1,682.08 (-2.37%) (YTD: -39.16%)

KSE Premier Market: 5,060.23 (+0.34%)

QE: 8,485.26 (+0.32%) (YTD: -18.61%)

MSM: 3,385.84 (+0.07%) (YTD: -14.95%)

BB: 1,322.38 (-0.56%) (YTD: -17.87%)

Calendar

12 April (Sunday): House of Representatives covid-19 recess ends.

12 April (Sunday): Western Easter Sunday.

12 April (Sunday): Court session for a lawsuit against Amer Group and Porto Group by Syria-based Antaradous for Touristic Development.

13 April (Monday): Earliest date on which suspension K-12 and university instruction is set to be lifted.

15 April (Wednesday): Suspension of international flights to / from Egypt expires.

15 April (Wednesday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

16 April (Thursday): New deadline for individuals to file their tax returns to the Egyptian Tax Authority.

17-19 April (Friday-Sunday): IMF, World Bank will hold virtual Spring Meetings.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 April (Sunday): Court session for a lawsuit against Amer Group and Porto Group by Syria-based Antaradous for Touristic Development.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.