- Gov’t cuts EGX taxes, energy prices to support businesses through covid-19 outbreak. (Speed Round)

- 30 new covid-19 cases brought the total to 196 yesterday. (What We’re Tracking Today)

- CBE issues new debt relief initiative for individuals. (Speed Round)

- EGX sell-off slows following CBE’s surprise rate cut. (Speed Round)

- Eni is investing USD 60 mn more in Egypt. (Speed Round)

- How viruses jump from animals to humans. (Worth Watching)

- Can Egypt be ready for the next ‘dragon storm’? (Hardhat)

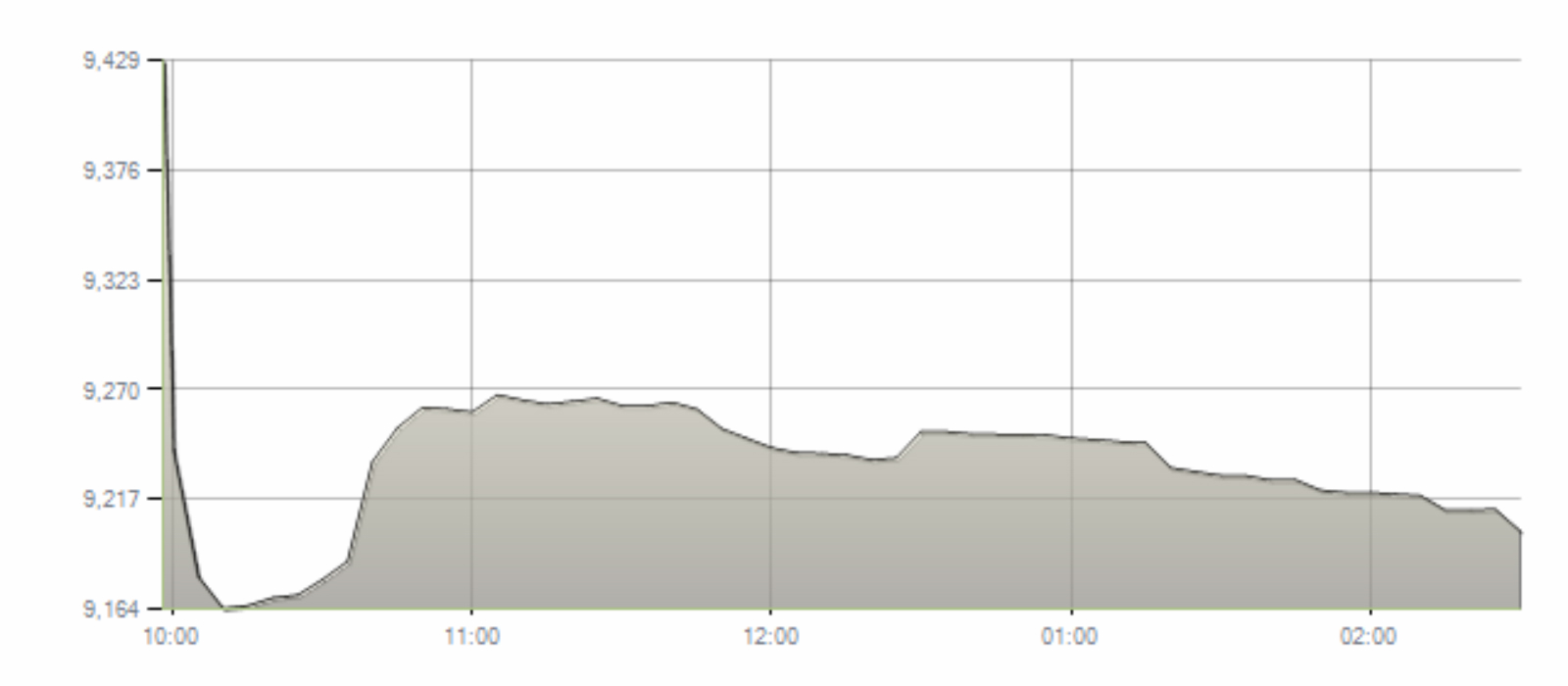

- The Market Yesterday

Wednesday, 18 March 2020

Gov’t announces new measures to support industry, investors through the covid-19 crisis

TL;DR

What We’re Tracking Today

Would anyone care to explain how it is not yet Thursday? Time moves simultaneously in slow motion and at the speed of light during weeks like this.

Some (not so) random notes to get us started this morning:

SMART POLICYMAKING #1- The Madbouly government’s initial fiscal response to the threat of covid-19 includes tax breaks to support interest in the EGX, real estate tax relief for businesses, and cuts to energy prices for factories. It’s a good start, and we look forward to hearing more in the days ahead about measures to support the rest of the business community — support that may be coming as the government says it will fast-track legislation through the House of Representatives. A good start: Cut dividend taxes for privately owned businesses, too.

SMART POLICYMAKING #2- The central bank said on Monday that it will waive interest for private citizens at risk of defaulting on debt of less than EGP 1 mn each.

(We have more on points 1 and 2 in this morning’s Speed Round, below.)

SMART POLICYMAKING #3- Domestic tourism is suspended on the Red Sea and workers in the tourism industry there will be quarantined for 14 days before being allowed to travel home. The decision, handed down by the governor of the Red Sea, applies to workers at hotels, restaurants and bazaars, among others. More here (including a copy of the decision) and here.

WE WANT TO SEE MORE OF THIS: Grocery chain Oscar has dedicated its first hour of business (8am-9am) exclusively to senior citizens so they can shop comfortably and safely. Older people face the highest risk of death from covid-19 if infected. Oscar’s move mirrors steps taken by US grocers H.E.B. and Dollar Stores as well as Iceland in the UK and Ireland.

Similarly: Mobile network operators are allowing just one client to enter each branch at any time and are directing clients to (a) reserve their time online or (b) move their transaction entirely online.

Egypt now has 196 covid-19 cases after 30 more were confirmed yesterday, according to the Health Ministry. All new cases yesterday are Egyptians who came into contact with previously infected people, the ministry said. Of the 196 total cases, 26 have now fully recovered and been discharged from hospital. Eight others have had a first negative PCR test and are still in hospital under observation.

The MoH also announced two more deaths, both of them people over the age of 70, bringing the total loss of life to six.

Businesses around the country have put in place procedures for what to do when / if a customer or client tests positive, including notification to staff and other clients, deep cleaning of facilities, etc. We think the business community has generally stepped up to the plate and shown responsibility this past week by enacting policies to curb the spread of the virus and reporting these policies to the wider public via email and on their websites. We’re not going to get into the tick-tock of who does / doesn’t have a case on hand.

The government is actively helping Egyptians get on flights to ensure they’re back home before planes are grounded for two weeks starting at noon this coming Thursday, according to a Cabinet statement. National flag carrier EgyptAir will put on additional flights until then to accommodate demand.

Egypt won’t be completely sealing off its airspace once it enacts the flight ban, the civil and aviation ministers said yesterday. Cargo flights will continue and the government has signalled it will evacuate foreign visitors to Egypt who choose to finish their trips rather than leave by Thursday’s deadline.

MARKETS TODAY- Mixed. Stocks are up in Japan and China, down in Korea and Hong Kong at dispatch time this morning. Futures point to a mixed open for European markets when they ring the bell later this morning, while the Dow, the Nasdaq and the S&P all look set to open in the red later today. The EGX30 closed down 2.4% yesterday and mercifully failed to trip circuit breakers as the sell-off cooled for a day.

The Finance Ministry and Tax Authority want private citizens to complete their tax filings online before the tax season ends this month, according to Youm7. Individuals will be joining companies, who began online tax filings at the start of the year as part of Egypt’s new unified digital tax payment system.

Other covid-19 news of note here in Egypt:

The CBE wants banks to minimize in-person meetings: The Central Bank of Egypt (CBE) has issued directives that allow for more meetings by conference call or video — including meetings by bank boards of directors, Al Shorouk reports.

Cinemas and theatres have been ordered closed until further notice, according to a cabinet statement.

The Environment Ministry is curbing visits to national parks, according to a cabinet statement. Zoos, meanwhile, are shutting down.

Government agencies are telling staff to stay home in line with a decree earlier this week to limit the number of employees who show up each day at ministries, government agencies and state-owned companies. Among those announcing measures to keep some of their people home yesterday were the ministries of social solidarity, electricity, labour, the Suez Canal Authority, CAPMAS and Al-Azhar.

Compensation for seasonal workers: The Manpower Ministry has announced it will pay EGP 500 to each seasonal worker as compensation for income lost as a result of covid-19.

The Tourism Ministry has ordered a deep cleaning of all hotels during the two-week period starting Thursday that air traffic will be suspended, Al Shorouk reports. It will also run an awareness campaign for the industry.

The Trade and Ministry will halt exports of rubbing alcohol, its derivative products, and surgical masks for three months to ensure that domestic needs are covered, a cabinet statement said.

A covid-19 test co-created by an Egyptian doctor will be used to test up to 1k people every day, CBS reports. Dr. Heba Mostafa, who helped to develop the test with a fellow doctor at Hopkins University, said they are working to shorten the results time to just three hours, filling a vital gap in the US which has struggled to test widely for the virus.

*** PSA: Our webinar on how to work remotely, which was scheduled to take place tomorrow, 19 March at 2 pm CLT, has been postponed. We’re all fine here, just completely overloaded at both Enterprise and Inktank at the moment. We’ll have a new date for all of you very soon. Those who had registered should have received an email from us yesterday.

WHAT’S HAPPENING AROUND THE WORLD: With pundits declaring a global recession a certainty (the issue is, for how long?), the task at hand now is to ward off a depression: Markets have yet to price in a full-on depression, but investors and economists appear to see the “D-word” as increasingly likely as the fallout from the covid-19 outbreak continues to widen, Reuters says.

Fortress Europe: EU leaders yesterday banned foreign nationals from entering the bloc for 30 days as covid-19 cases continued to rise, Bloomberg reports.

Fortress America: Canada and the US are expected to announce an agreement today to close their border to non-essential travel, the Globe & Mail reports.

Iran has warned that mns of its citizens may die from covid-19 “if people keep traveling and ignore health guidance, the Associated Press reports. The country has reported 988 deaths and some 16,000 cases since the outbreak began.

The US is looking at handing out cash to every citizen: The Trump administration is proposing an unprecedented USD 1 tn stimulus plan, half of which would either be handed directly to individuals or given out as tax cuts, CNBC reports. An official said the rescue package would see USD 500-550 bn dispersed in direct payments or tax cuts, USD 200-300 bn given to small businesses and USD 50-100 bn allocated to help bail out airlines and industry.

The Fed announced a facility to purchase commercial paper: In a bid to supply much-needed liquidity to businesses, the Federal Reserve has relaunched a 2008-era facility that will see it purchase short-term unsecured and asset-backed debt.

Italy, Spain, France have placed restrictions on short selling in a bid to reduce market volatility, CNBC reports.

The UK announced a new GBP 350 bn support package for businesses and individuals in financial difficulty. Loans worth GBP 330 bn will be extended to businesses and individuals, GBP 20 bn will be given to businesses making losses because of the virus, and mortgage payments will be suspended for people facing financial difficulties, the BBC says.

Chinese authorities have greenlit the start of clinical trials on its first vaccine to combat covid-19, Reuters reports/

The Euro 2020 football championship has been postponed to 2021, the Associated Press reports.

Hotel group Marriott will be placing tens of thousands of staffers on unpaid leave, as the covid-19 outbreak continues to devastate bookings, the Financial Times reports.

The IMF needs to help emerging markets weather the storm: With emerging markets in a more vulnerable position, the IMF should expand its allocation of special drawing rights (SDRs) to member countries, allowing them to receive more of an artificial currency that can be exchanged for the basket of currencies it represents, Marcos Buscaglia writes in an opinion piece for the Financial Times. While not currencies in themselves, SDRs are held by the fund’s member countries as a way to hedge against their reliance on costly debt to build up stocks of foreign reserves. They are made of unequal parts USD, EUR, RMB, JPY, and GBP. An SDR expansion similar to that of 2008 is essential to help economies less able to boost asset purchases and liquidity funding to do so, Buscaglia says.

Is covid-19 going to re-shape the global economy for years to come? Renewable energy will be set back by a decade by having to compete with cheaper fossil fuels, universities may face an existential challenge, China’s dominance in manufacturing is likely to dissipate while Africa’s star may ascend, predicts Andy Kessler in the Wall Street Journal. Tech will of course continue to be a transformative force, he believes, with all kinds of businesses being shaped by AI systems and the developing world poised to benefit from productivity improvements to attract increasing levels of investment.

COVID TIP OF THE DAY: How to ride out the financial crisis. This round-up of thoughts seasoned investors by the New York Times has some advice for newbies. The highlights? Don’t be too driven by emotion, make rash decisions, or stay glued to every single new development. Remember that businesses are still running and the world is still operating, but do start preparing calmly for an uncertain job market and possible future job search.

Egypt’s GERD tour continues: Foreign Minister Sameh Shoukry is resuming his tour to rally support from African leaders in light of the Grand Ethiopian Renaissance Dam (GERD) dispute, according to Ahram Online. Shoukry landed in Burundi yesterday and is planning to head to South Africa, Tanzania, DR Congo, South Sudan, Niger, and Rwanda next. This came as Kenyan President Uhuru Kenyatta signalled support for Egypt during a meeting with President Abdel Fattah El Sisi in Cairo yesterday. Foreign ministry officials this week visited Algeria, Tunisia and Mauritania after Shoukry toured several European and Arab capitals in search of diplomatic backing.

Amidst all the craziness, it’s easy to forget that primary season is still underway in the US of A: Joe Biden looks to be building up an insurmountable delegate lead in the Democratic primary race after sweeping the three primaries yesterday. The former vice president looks to have taken the lion’s share of the delegates in Florida, Illinois and Arizona, leaving progressive rival Bernie Sanders with the increasingly impossible task of acquiring a delegate majority.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and even social infrastructure such as health and education.

In today’s issue: We look at Egypt’s rainwater infrastructure after the damage wreaked by last week’s “dragon storm,” what it would take to get our infrastructure in shape to handle future weather events caused by climate change — and how economically feasible this all is.

Enterprise+: Last Night’s Talk Shows

The talking heads were back last night with the daily covid-19 update: Min Masr’s Amr Khalil covered the Health Ministry's announcement of 30 new cases yesterday, which we re-cap in this morning’s What We’re Tracking Today, above (watch, runtime: 1:51), Masaa DMC’s Ramy Radwan ran a more detailed report, covering the two latest deaths (watch, runtime: 11:32).

Fresh government stimulus to bolster economy amid virus outbreak: Al Hayah Al Youm's Lobna Assal covered the government’s latest efforts to soften the blow of the virus on the Egyptian economy by cutting energy costs for industry and reducing the tax burden for EGX investors (watch, runtime: 2:22). Min Masr’s Reham Ibrahim, speaking by phone with Federation of Industries board member Mohamed El Bahei, carried the same report (watch, runtime: 9:24). We go into detail on the announcement in this morning's Speed Round, below.

New preventative measures against the spread of the covid-19 virus: Assal also covered the new measures taken by the government to contain the spread of the virus, including reducing staff at government agencies for the next 15 days (watch, runtime: 2:43).

Three-month export ban on rubbing alcohol, surgical masks: Assal mentioned the trade and industry minister’s decision to stop exporting all rubbing alcohol products and surgical masks for three months from the date of their production to ensure there is sufficient supply for domestic needs (watch, runtime: 4:07).

No more cinema, theatre outings: Min Masr’s Reham Ibrahim covered the cabinet’s decision to suspend all shows in cinemas, theatres and festivals until further notice (watch, runtime: 0:57). Assal had the same report (watch, runtime: 3:41).

Relief for inclement weather: Yahduth Fi Misr’s Sherif Amer spoke by phone with presidential spokesman Bassam Rady to cover the presidential initiatives to compensate those adversely affected by the severe weather conditions of last weekend’s ‘dragon storm.’ Rady confirmed that the weather cost the power sector around EGP 400 mn and the transport sector some EGP 100 mn (watch, runtime: 4:41).

Speed Round

Speed Round is presented in association with

Gov’t cuts EGX taxes, energy prices to support businesses through covid-19 outbreak: The government has announced a package of fiscal measures to help support the economy and financial markets as it braces against the impact of the covid-19 outbreak. Industrial companies will receive relief in the form of lower energy and tax costs, and equity investors will be granted generous breaks to taxes on dividend and stamp duty.

Taxes on EGX transactions slashed to support equity investors: The government has moved to sharply cut the tax burden on EGX investors in a bid to shore up demand in the equity markets, which have fallen precipitously in the wake of the virus outbreak. The moves include:

- Stamp tax cuts: Foreign investors will pay stamp tax on EGX transactions at a reduced rate of 0.125%, instead of 0.15%. Residents will pay just 0.05% stamp tax, down from 0.15%. All spot transactions on the EGX will also be made exempt from stamp tax.

- Capital gains tax postponed for two years: Capital gains tax on EGX transactions will be reintroduced on 1 January 2022, and foreign investors will be made permanently exempt.

- Tax on dividends cut in half: Investors will now pay a withholding tax of 5% on dividend payouts from listed companies, down from 10% previously.

Real estate tax relief: Companies operating in the industrial and tourism sectors will receive a three-month real estate tax holiday and will be permitted to repay existing real estate tax liabilities in monthly installments over the next six months.

Lower energy costs for factories: The government has lowered the price of natural gas for the entire industrial sector to USD 4.50 / mmBtu. This will mean a 25% price cut for cement companies which were paying USD 6.00 / mmBtu, and an 18% cut for metallurgy and ceramic manufacturers which were paying USD 5.50 / mmBtu. The price of electricity per kWh was also lowered by 10 piasters for medium, high and ultra-high voltages, and will be frozen for the next 3-5 years. Government sources said the electricity price cuts could cost around EGP 6 bn alone.

Government to pay out EGP 1 bn in arrears by the end of April: The Export Subsidy Fund will pay out the entire EGP 1 bn in arrears during March and April and the 10% in cash payments during June. The fund began paying out the arrears at the beginning of this month.

Legislation on the fast track: The government and the House of Representatives will work to fast-track the SMEs Act and the amendments to the Real Estate Tax Act, as well as the auto incentives strategy. The House SMEs committee is currently expected to finish its review of the SMEs Act this month, and the real estate tax amendments were approved by the cabinet in January. The cabinet last week greenlit the auto strategy although we remain none the wiser about what it entails.

The business community broadly welcomed the measures, but industry associations and other lobby groups are asking for more.

Lower gas prices to boost exports? Mohamed Saad El Din, chairman of the Gas Investors Association, said the decision to cut gas prices will increase the competitiveness of Egyptian products and increase exports. Other industry association figures said the price cuts, while welcome, were a necessity even in the absence of covid-19. Hassan El Marakby, chairman of El Marakby Steel, said prices need ot hit USD 2.50-3.00 / mmBtu if companies are to withstand the crisis.

Industry associations want the government to permanently scrap real estate taxes for factories. Mohamed Khamis Shaaban, head of the Sixth of October Investors Association, said the announcement was “not encouraging” and urged the government to abolish the tax for factories. Magd El Manzalawi, head of the industry committee at the Egyptian Businessmen’s Association, also called for its removal.

Companies in the tourism sector have welcomed the temporary real estate tax suspension and are lobbying for a VAT holiday. Elhamy El Zayat, former president of the Federation of Egyptian Chambers of Commerce, said the state should consider bringing back its industry support fund to provide liquidity to struggling companies.

Exporters want more than just subsidy arrears: Former Export Council for Agricultural Crops head Sherif El Beltagy says payment of arrears by its will not help exporters overcome headwinds that include spiraling shipping costs.

CBE offers new debt relief initiative for individual borrowers: The Central Bank of Egypt (CBE) on Monday launched a new debt relief initiative for individuals at risk of default that will waive marginal interest on debt under EGP 1 mn, according to an official statement. Eligible customers will have to make a 50% payment of the original debt in cash or in-kind and arrange a payment plan with the creditor bank. The customers will have their names removed from the CBE and i-Score’s blacklist and will restrictions on their assets lifted.

The initiative comes one day after the CBE moved to enact an emergency 300 bps rate cut and extended the tenor of all bank loans to businesses for a period of six months. The extension applies whether the facility is held by an SME, a large corporation, or an individual borrower, CBE Governor Tarek Amer said.

EGX sell-off slows following CBE’s surprise rate cut: The benchmark EGX30 index dipped again yesterday, but at a slower pace Sunday and Monday as concern over the covid-19 outbreak continued to rattle the markets. The EGX30 fell 2.64% in the first minutes of the trading session and went on to close down 2.41%. The EGX30 has shaved off 17% this week and is down 34% from its peak in early February. Yesterday’s session came after the Central Bank of Egypt announced an emergency 300 bps rate cut late on Monday.

On the EGX30, index heavyweight CIB and Eastern Company were the best performers, closing up 0.9%, while Egyptian Resorts Company and EFG Hermes were each down 10%.

Yesterday was the first session this week that the index’s circuit breakers were left untriggered, but 40 companies saw their shares suspended after falling more than 5%. Ezz Steel (down 8.4%) and Madinet Nasr for Housing and Development (down 9.6%) were among the companies that saw trading on their shares halted for 10 minutes.

Buybacks continue to help falling shares: Egypt Kuwait Holding bought some 433k treasury stocks, Arabia Investments Holding bought back 1.4 mn stocks, and Odin Investments approved the purchase of close to 10 mn shares, according to regulatory filings (here, here, and here — pdfs). A growing number of listed companies have been buying back stock after the Financial Regulatory Authority eased rules to allow companies to complete same-day buybacks in a bid to prop up share prices.

INVESTMENT WATCH- Eni is tacking on an additional USD 60 mn for its planned investments in Egypt’s Agiba: Italy’s Eni is planning to invest USD 60 mn more than was initially planned this year in its JV Agiba to increase exploration and development operations in the Western Desert and the Gulf of Suez this year, the local press reported, citing unnamed sources. The JV's budget was USD 370 mn but will be increasing to USD 430 mn.

Egypt holds the second highest number of ultra-rich individuals in Africa: There are currently 764 ultra-high net worth individuals (UHNWI)—those with a net worth above USD 30 mn—in Egypt, only second to South Africa and just ahead of Nigeria, according to a Knight Frank Wealth report. The number of UNHWIs in Egypt grew some 3% between 2014-2019 and the number of high net worth individuals (HNWI)—those with a net worth of USD 1 mn or more—grew 29% over the same period, making Egypt the country with the second largest concentration of both HNWIs and UHNWIs in Africa.

This stands in sharp contrast with Egypt's rising poverty rate. Capmas figures showed last year that the country’s poverty rate had risen to 32.5% in FY2017-2018, up from an estimated 27.8% in 2015. The reported rate estimated the number of individuals living at or below the now-adjusted poverty line for an income of EGP 735.5 per month. The survey also found that the average Egyptian household makes just EGP 58.9k a year, up from EGP 44.2k in 2015.

EARNINGS WATCH- Beltone Financial continues loss-making streak, reporting a net loss of EGP 91.5 mn in 2019, compared to a EGP 82.4 mn loss in 2018, according to a bourse filing (pdf). Revenues fell 30% to around EGP 243 mn from EGP 342.7 mn a year earlier. The company’s board approved a support loan from its majority shareholder Orascom Investments worth USD 1.5 mn.

Egypt in the News

Covid-19 is — unsurprisingly — once again making an appearance in the foreign press: This morning it’s Foreign Policy, which has a particularly ominous prognosis on how Egypt may handle a full-blown outbreak. Of all the countries in the Middle East “Egypt is the most worrisome in a coronavirus crisis,” Steven Cook writes, noting Cairo’s densely populated conurbations, the country’s “fragile” public healthcare system (and the private sector’s poor positioning to plug the gaps), and the broad distrust of government policy among Egyptian citizens.

Also getting attention in the foreign press:

- Interim GERD agreement to resolve deadlock? Egypt, Ethiopia and Sudan should establish an interim GERD agreement spanning the first two years of filling the dam’s reservoir, to allow time for the more protracted negotiations needed to reach a comprehensive settlement, International Crisis Group argues.

- Human Rights Watch has called for conditional releases of “unfairly detained” inmates in Egypt to prevent an outbreak of covid-19 in overcrowded prisons.

- Egypt’s reopening of the 4,700-year-old Djoser pyramid in Saqqara could hardly have come at a worse time, with tourist numbers at a low thanks to the covid-19 pandemic, Al Monitor reports.

Worth Watching

Are you losing perspective as alarms — some more valid than others — continue to sound over the global covid-19 outbreak? This Vox video (watch, runtime: 8:48) takes you back to the beginning late last year, reminding you of how and where it all began, contrasting the speed of its dissemination and scale of its impact with previous iterations of covid (like SARS) and crucially, investigating why these viruses originated in wet markets such as those in China. It looks at how these pathogens jump from one animal host to another, and eventually humans. Lax hygiene measures and policies on wildlife farming and trade are key triggers. Watch and weep.

Can Egypt be ready for the next ‘dragon storm’? Even if you were living under a rock, chances are you were impacted by the rain, wind, sand, and lightning that pummeled the country last Thursday and Friday. The so-called ‘dragon storm’ reportedly resulted in 21 people being killed, caused widespread power outages, travel disruption, passenger train collisions and infrastructure damage as roads flooded and several buildings collapsed. Prime Minister Moustafa Madbouly described the level of rainfall as unprecedented in recent decades. Complicating matters: The storm hit as Egypt was on the ramp to the covid-19 epidemic — itself an unprecedented crisis.

The scale of the flooding (which was well-documented on social media) we’ve seen is an indicator of how unprecedented the storm was. Clearly our infrastructure was not built to handle that much rainfall in that short amount of time. But with climate change a reality here and globally, a few questions come to mind. Can our infrastructure handle another dragon storm? What would it take for us to get our infrastructure to handle another one? And is it worth the upgrade?

Counting the costs of the dragon storm: President Abdel Fattah El Sisi met with the Madbouly Cabinet yesterday to discuss the impact the storm has had on Egypt’s infrastructure, with a preliminary figure of EGP 1.2 bn bn given as the cost of damages, according to an Ittihadiya statement. The president instructed them to conduct a comprehensive review of the nation’s readiness to handle these unstable weather conditions. The breakdown of the damages, according to the statement is as follows:

- EGP 650 mn will the be cost to repair and maintain residences in the Zarayeb neighborhood in Helwan, which suffered “extensive damage” during the storm;

- Electricity infrastructure suffered damages worth EGP 400 mn;

- Roads and highways suffered damages to the tune of EGP 100 mn.

A new rainwater drainage system sounds nice, but is it worth the immense price tag? Talk of building a new rainwater drainage system that would run parallel to Egypt’s sewage and wastewater systems has increased since the storm. But while everyone we’ve spoken to agrees that would be ideal, all agree that building such a network is simply not feasible. “A lack of a rainwater drainage system in Egypt is a crucial problem, but building such a system in Greater Cairo would cost between EGP 200-300 bn,” Cabinet Spokesperson Nader Saad said in a call-in to Sada El Balad (watch, runtime: 6:08). Is it worth such a price tag for a few days in a year, he asks.

Al Ahly Sabbour for Real Estate Developments founder Hussein Sabbour concurs with this assessment, telling Enterprise that developing rainwater infrastructure is one of the most expensive infrastructure development projects out there. He questions their merit in the face of heavy rains that fall only around seven days out of the year. There have been proposals for a drainage system that would harvest rainwater and then use it to generate electricity, he tells Enterprise. However, these plans were put to bed as they were deemed highly impractical. He noted that his company, which is working on the utilities in the new capital, will not be developing one there.

Both Saad and Sabbour suggest that Egypt’s current wastewater system could be adequate despite not being able to handle a massive influx of rain in a short span of time. Cairo’s wastewater system can handle around 5 mn cubic meters of water per day, which is a significant amount of water under normal circumstances, Saad had said. Sabbour notes that the amount of water that fell during the dragon storm was indeed absorbed by the current wastewater and sewer systems — it just took longer for them to do so.

Why focus on new rainwater drainage systems, when many in Egypt still need basic wastewater systems? Focusing on developing a parallel rainwater drainage system is not tenable, when only 65% of Egypt’s population has access to them, Assistant Housing and Utilities Minister Tarek El Rifai tells Enterprise. The government is currently focused on increasing the wastewater and drinking water coverage for those Egyptians that don’t have it. That should be the priority, he says.

And even those systems are in need of funding: Egypt’s current FY2019-20 budget has allocated EGP 1.5 bn in funding towards wastewater, even though our wastewater management systems need between EGP 3-4 bn annually to be maintained at operational level, El Rifai tells Enterprise. He noted that the government does provide additional funding when required. In FY2018-19, the government raised the ministry’s allocation to EGP 2 bn from an initial EGP 1.5 bn, he says.

Our high birth rates are not helping either: El Rifai also noted that Egypt’s wastewater systems are built to last around 30 years, but changes in demographics and high population density affects the quality of these systems, necessitating increased maintenance.

Even upgrading our existing network to accommodate increased rainfall appears to not be practical. Upgrading the current system throughout Egypt to handle more rainfall would cost EGP 300-400 bn, says Khaled Seddik, who heads the government’s informal housing redevelopment project.

So is all hope lost? Depends on your geographic location. Communities located on the high ground have found workarounds between the new requirements of water drainage and the high costs of developing them, Seddik suggests. The Asmarat neighborhood redevelopment project in Muqattam had utilized the area's geography to build a highly efficient wastewater system that kept it dry. The neighborhood’s elevated area was used to funnel out much of the rainfall. That wastewater system cost only around EGP 750 mn, said Seddik. The Madbouly Cabinet’s report on the damages suffered during last weekend’s dragon storm had particularly noted extensive damages to lowland residential areas, where water had accumulated.

Certain neighborhoods were hit harder than others, so the problem would only need to be fundamentally looked at in certain wet zones. The cities of 6 October and Sheikh Zayed were largely spared the deluge of New Cairo because they were built on a more solid and rocky bedrock than the sandy one of New Cairo, said Mohamed El Bustani, who heads the New Cairo Real Estate Developers Association. This would make a comprehensive, nationwide system of rainwater drains in all areas highly impractical.

Others are proposing local funding solutions, including El Bustani. He proposes using the neighborhood's affluence to spur funding for such a crucial infrastructure project, especially considering that New Cairo was among the hardest hit by last weekend’s storm. Real estate developers in New Cairo already pay fees of 1-3% of the value of their land to the city’s municipalities. Considering that land prices in New Cairo cost between 6.5-24k per sqm in the compounds, the neighborhood could cover the costs of developing a separate drainage network if they repurposed those fees, he suggests.

Perhaps it’s time to raise those fees or taxes: El Bustani falls short of advocating for raising those fees or taxes. But in light of how many municipalities are strapped for cash and are barely able to cover the costs of the services they do provide, it may behoove them to increase these fees or taxes.

Ultimately, there is no immediate magic pill for an unprecedented crisis. Disruptive weather patterns resulting from climate change are a problem that most cities who have been hit by them are still struggling to figure out. Take the US for instance, where even after the 2005 hurricane Katrina (whose damages are estimated to be in the USD 117-125 bn range), there followed Sandy (USD 74 bn in damages) in 2012, and Irma (USD 77 bn), Maria (USD 90 bn), and Harvey (USD 125 bn), all in 2017. Unless climate change as a whole is addressed, we will constantly be dealing with ever increasing irregular weather and any major attempts to resolve it, risks simply being today’s band aid solution.

Your top five infrastructure news of the week:

- The government will complete 13 industrial complexes, including nine in Upper Egypt, by the end of this year, Trade and Industry Minister Nevine Gamea said at a conference on Monday.

- First new capital skyscraper complete: China State Construction Engineering Company completed the capping of the first skyscraper in the new administrative capital.

- Funding to develop desert into residential, industrial zones: President Abdel Fattah El Sisi ratified a EUR 53.2 mn financing agreement with the International Fund for Agricultural Development (IFAD) for the development of desert areas into fully connected residential and industrial zones.

- More funding for railway rehab: Cabinet approved a EUR 1.5 mn grant from the European Investment Bank to fund railway upgrades to the Tanta-Mansoura-Damietta line.

- Egypt has launched a tender for advisory services for the new administrative capital – Nasr City and 6th of October – Giza monorail project, with the deadline for technical and financial bids set for 17 March.

The Market Yesterday

EGP / USD CBE market average: Buy 15.68 | Sell 15.81

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Tuesday): 9,202 (-2.4%)

Turnover: EGP 552 mn (7% below the 90-day average)

EGX 30 year-to-date: -34.1%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 2.4%. CIB, the index’s heaviest constituent, ended up 0.9%. EGX30’s top performing constituents were CIB up 0.9%, Eastern Company up 0.9%, and Credit Agricole up 0.8%. Yesterday’s worst performing stocks were Egyptian Resorts down 10.0%, EFG Hermes down 10.0% and Sidi Kerir Petrochemicals down 9.8%. The market turnover was EGP 552 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -20.3 mn

Regional: Net short | EGP -34.4 mn

Domestic: Net long | EGP +54.7 mn

Retail: 54.1% of total trades | 54.1% of buyers | 54.1% of sellers

Institutions: 45.9% of total trades | 45.9% of buyers | 45.9% of sellers

WTI: USD 29.96 (+0.04%)

Brent: USD 28.96 (+0.80%)

Natural Gas (Nymex, futures prices) USD 1.70 MMBtu, (-1.62%, April 2020 contract)

Gold: USD 1,534.50 / troy ounce (+0.57%)

TASI: 6,107 (+2.47%) (YTD: -27.20%)

ADX: 3,323 (-6.33%) (YTD: -34.53%)

DFM: 1,750 (-4.98%) (YTD: -36.68%)

KSE Premier Market: 4,707 (+0.99%)

QE: 8,521 (+1.06%) (YTD: -18.27%)

MSM: 3,660 (-0.58%) (YTD: -8.06%)

BB: 1,379 (-1.13%) (YTD: -14.33%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist-sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action”, new administrative capital, Egypt.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

17-19 April (Friday-Sunday): IMF, World Bank hold Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.